In this glossary, we define every term we could think of associated with decentralized finance (DeFi).

Written by: Mike Martin | Updated June 26, 2024

Reviewed by: Ryan Grace

Fact checked by: Laurence Willows

🍒 New to DeFi? Master the concepts with our Learn Center.

Aave is a decentralized finance (DeFi) protocol built on the Ethereum blockchain network. This decentralized app (dApp) allows users to lend, borrow, and earn interest on cryptocurrency assets. Like all dApps, Aave accomplishes this without the use of intermediaries.

The native token of the Aave network is AAVE.

Ankr is a Web3 platform that makes running a node (which validates transactions) for a proof-of-stake (PoS) blockchain more accessible.

This protocol has eliminated the need for significant hardware investments and technical proficiency, which has simplified the process greatly.

The native token for this network is ANKR.

APR stands for annual percentage rate. APR communicates to borrowers the amount of interest they must pay for loans taken out on a yearly basis.

Arbitrage in DeFi refers to the process of buying a token/coin at a lower price on one decentralized crypto exchange (DEX) and then selling that same asset quickly for a higher price on another DEX to turn a profit.

The ability for traders to profit from price discrepancies on DEXs also helps to stabilize crypto prices, which helps to build trust and liquidity. Arbitrage is the reason that most crypto prices are relatively the same on all exchanges, give or take a little.

Automated market makers (AMMs) are smart contracts powering all decentralized crypto exchanges (DEXs) and other decentralized finance (DeFi) protocols.

Becoming a market maker on an AMM requires you to simply add two or more cryptocurrencies into a liquidity pool. You earn the fees that traders pay a DEX when they trade from your pool.

Bitcoin was the first successful blockchain network to launch. Since Bitcoin is not able to store smart contracts, its DeFi presence is limited.

Nevertheless, Bitcoin’s presence in DeFi has been increasing since late 2023 thanks to layer 2 solutions like Stacks and Merlin, as well as protocols like Ordinals and Runes.

Blockchain is a digital ledger that is distributed across all participants in a network. Blockchain has many advantages over traditional ledgers, such as being immutable, public, decentralized, and secure. Every transaction on a blockchain is public, and they have to be confirmed by a network of computers called miners, which are rewarded with cryptocurrency for their work.

Ethereum is the most popular blockchain network for DeFi.

A bonding curve is a mathematical curve that determines the price of a digital asset on a (DeFi) platform. These curves are used to create and manage a liquidity pool for a specific cryptocurrency pair.

Bridges facilitate the transfer of crypto assets from one chain to another, ensuring interoperability within the DeFi sector.

CeFi is short for centralized finance. CeFi companies operate through traditional central intermediaries, like banks and stock exchanges.

CeFi is in contrast to DeFi, which does not employ intermediaries.

Read: CeFi vs TradFi vs DeFI

The native token for Convex is CVX.

Ctokens are associated with the Compound protocol. These tokens represent a deposited position and can be used as collateral in various liquidity pools or traded for other digital assets.

A cold wallet is a type of self-custody wallet that is not connected to the internet. Cold wallets include:

• Paper Wallets

• USB Wallets, also called hardware wallets (Ledger)

To borrow in DeFi, users must deposit collateral in the form of crypto. Most often the value of the collateral is worth more than the value of the loan itself.

A crypto wallet, also known as a digital wallet, is a software program, hardware device, or a simple sheet of paper that stores a user’s private keys.

Crypto wallets enable users to securely store, manage, and transact with digital assets, DeFi, and non-fungible tokens (NFTs).

Crypto wallets can be either custodial wallets or self-custody wallets.

Compound Finance is a decentralized finance (DeFi) lending protocol that enables users to lend or borrow cryptocurrencies without the need for a centralized intermediary.

The native token for Compound is COMP.

Curve Finance is a decentralized crypto exchange (DEX) that operates as an automated market maker (AMM), similar to Uniswap.

The native token for Curve Finance is CRV.

A custodial crypto wallet is a type of crypto wallet where a centralized entity, such as Coinbase, maintains control over users’ private keys.

For the most part, custodial wallets offer less security than self-custody wallets, which give users direct access to and control over their private keys.

A DAO, or decentralized autonomous organization, is an organization that operates without any intermediaries through smart contracts.

In a DAO, decisions are made through a decentralized voting system, where very member has voting power proportional to their stake in the organization.

In crypto, digital signatures are a cryptographic tool used for message authentication that binds a crypto user to digital data.

Digital signatures are created by hashing data, encrypting this data with a private key, and verifying the data using the corresponding public key.

A dApp (decentralized application) is an autonomous application comprised of smart contacts that operates under a decentralized blockchain (distributed ledger).

DeFi, short for decentralized finance, is a blockchain-based financial system that allows users to become stakeholders, lenders, borrowers, traders, and even market makers without the need for intermediaries.

DeFi protocols rely on smart contracts to operate.

Live stock quotes are an example of the value that an oracle adds.

DeFiLlama is a website that provides free real-time data and analytics around all things DeFI. I use it everyday!

A derivative is a financial instrument that derives its value from a different underlying asset. The value of a derivative is contingent upon the future value of the underlying to which it is attached.

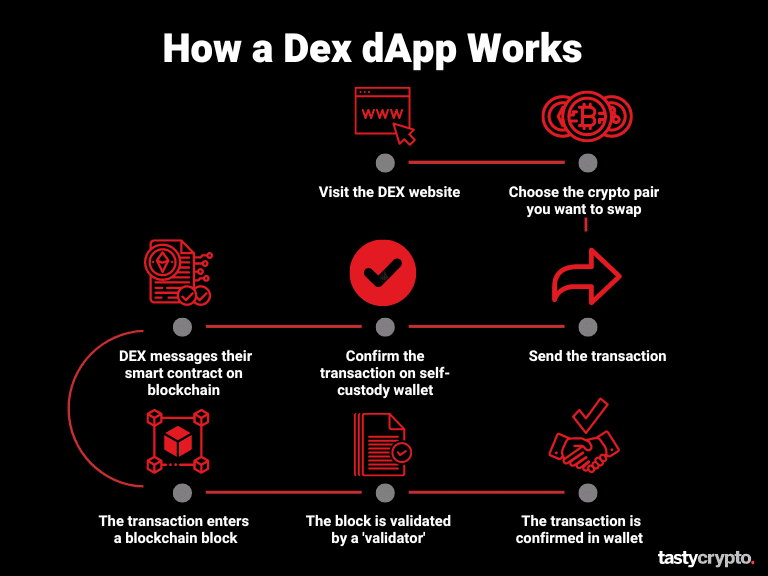

A DEX (decentralized exchange) is a cryptocurrency exchange that operates on a peer-to-peer system and therefore does not require any intermediaries.

All users of self-custody wallets need to connect to DEXs in order to swap crypto. Uniswap is the most popular DEX.

EigenLayer is a restaking protocol that allows users to boost their staking rewards by repurposing their staked ETH to secure other services besides the mainnet.

ERC-20 tokens are fungible tokens associated with the Ethereum blockchain network. All ERC-20 tokens are interoperable, which means they can be traded freely for one another.

The Ethereum blockchain is the most robust and popular blockchain for DeFi. Unlike Bitcoin, Ethereum allows for the storage of smart contracts, which represent the backbones of Web3.

Even Layer 2 solutions like Polygon and Arbitrum rely upon the Ethereum ecosystem.

Fair launch refers to a transparent way of issuing a new cryptocurrency (ICO) so that all market participants have an equal opportunity to participate.

Fiat currency refers to any type of currency that is issued by a government. The US Dollar, for example, is a fiat currency. Fiat currencies are typically backed only by the good faith of a government.

Primitives are the building blocks and lifeblood of DeFi. Primitives generally perform one specific function, such as hashing. They are implemented by a smart contract.

In DeFi, flash loans refer to a multi-step transaction: a user takes out an uncollateralized loan and repays the same loan immediately. Flash loans are usually used to exploit arbitrage opportunities.

Read: What Are Flash Loans?

In crypto, a flash swap is a type of transaction that allows traders to borrow any crypto for a short duration. Flash swaps are growing in popularity because they do not require any collateral.

Like flash loans, flash swaps are executed in the same transaction. These swaps help to increase liquidity in the cryptocurrency ecosystem.

Read: Flash Swaps Explained

In DeFI, forced liquidations occur when a loan or any transaction type goes undercollateralized.

These liquidations are performed by ‘keepers’, and are common in highly leveraged transactions.

In DeFi, game theory refers to the study of crypto market participants in order to increase returns.

Two categories that game theory followers pay close attention to are incentives and market coordination.

On the Ethereum network, ‘gas’ refers to the fees that users must pay validators in order to validate their transactions and add them to the blockchain. Gas fees are denominated in “gwei’.

Read: What are ETH gas fees and how do they work?

In crypto, a governance token refers to a cryptocurrency that gives its owners the right to ‘govern’ a crypto project. Voting rights allow these token holders to play a role in a protocol’s future and present, kind of like how stock owners can vote on changes to board members.

GWEI represents a denomination of ether (ETH) – one-billionth of one ETH.

Ethereum gas fees (network fees) are denominated in GWEI.

Hierarchical-deterministic (HD) wallets simplify self-custody by allowing wallet owners to generate multiple addresses from one seed phrase.

A hot wallet is a type of self-custody cryptocurrency wallet that is always connected to the internet (and therefore always at risk of being hacked!).

Software wallets, such as mobile wallets and desktop wallets, are hot wallets.

HODL stands for ‘hold on for dear life’. Hodlers are long-term crypto investors that weather any storm.

In blockchain and DeFi, immutability means that once a transaction enters a blockchain, it can never be altered or changed. Immutable is another way of saying set in stone.

In DeFI, impermanent loss is a risk that liquidity pool participants face.

The value of the cryptocurrency staked by liquidity pool providers in a pool fluctuates as traders buy and sell from the pool.

Impermanent loss can be thought of as opportunity cost – how much would that liquidity provider have made if they simply owned the crypto outright and didn’t participate in the pool at all?

Impermanent loss insurance is a service offered to liquidity pool providers (LPs) to hedge risk. Like any insurance, LPs have to pay a premium for impermanent loss insurance.

Keepers are programs that ensure protocols run properly. For example, if a loan goes undercollateralized on a lending dApp, a keeper may trigger its automatic liquidation.

KYC refers to ‘know your customer’. KYC is popular in traditional finance but has yet to be implemented in DeFi and self-custody products.

In DeFi, lending aggregators are protocols that pool together the lending and borrowing rates of many lending dApps into a single interface.

Layer 2 networks rely upon preexisting blockchains (mostly Ethereum) for validation.

Layer 2’s use technology like sharding to dramatically decrease network fees and increase transaction throughput.

Polygon, Optimism and Arbitrum are popular layer 2’s.

Leverage refers to the process of borrowing funds in order to increase exposure. Leverage is very popular in DeFi. Leverage ratios of 10x – 20x are not uncommon.

Lido is a DeFi crypto-staking peer-to-peer protocol. In 2023, Lido is the most popular dApp in existence.

Lido offers staking for Ethereum (ETH), Polygon (MATIC), and Solana (SOL).

Lightening Network is a bitcoin-based layer 2 protocol. Lightening is powered by smart contracts and is helping to scale Bitcoin.

BRC-20 tokens are run on this network.

In crypto, liquidity refers to the ease with which a digital asset can be bought or sold without having a material effect on price.

When you swap crypto on a decentralized exchange (DEX), you want to make sure the bid-ask spreads are tight, as this implies high liquidity.

Liquidity pools are the lifeblood of all decentralized crypto exchanges as they permit the buying and selling of cryptocurrency. Anyone can join a liquidity pool and become a market marker by depositing two (or more) cryptocurrencies into a liquidity pool.

As traders buy and sell from these pools, liquidity providers of the pools earn a portion of their fees as rewards.

Protocols that allow users access to their staked crypto through liquidity tokens.

Read: What is Liquid Staking?

LP tokens (liquidity provider tokens) are the tokens that decentralized exchanges (DEXs) issue to liquidity providers in return for staking crypto into a liquidity pool.

Liquidity providers (LPs) can later redeem these tokens to receive their stake in the liquidity pool (plus the fees they earned!).

Additionally, LP tokens can be used for collateral on many different DeFi protocols.

MakerDAO is a CDP (collateralized debt position) DeFi protocol. Here is how it works:

User connects self-custody wallet to MakerDao

User chooses crypto to use as collateral

MakerDAO issues stablecoin ‘DAI’ at 150%+ collateralization ratio

Users does with this DAI what they wish

User redeems DAI for their original crypt

In crypto, market cap (capitalization) refers to the total market value of a blockchain network or protocol.

Market cap = coin value x total coins issued

F2Pool is currently Bitcoins largest mining pool.

Money legos, or DeFi legos, refers to the process of bringing together the concepts behind already existent simple DeFi protocols in order to build more comprehensive protocols.

A multisig (multi-signature) wallet is a type of elevated security cryptocurrency wallet that requires at least two signatures in order to send a transaction.

A non-fungible token (NFT) represents a unique digital asset, such as digital art. Most NFTs reside on the Ethereum blockchain. Ethereum NFTs are called ERC-721 tokens.

Optimistic rollups are layer 2 scaling solutions for Ethereum that make the network more efficient.

According to Ethereum.org, optimistic rollups involve “moving computation and state storage offline”

Arbitrum and Optimism are optimistic rollup-up-based layer 2s.

Options are derivative financial instruments that derive their price from a seperate underlying asset.

All options have a strike price and expiration.

For example, you could buy an ether 2,000 call option for September 15 expiration. If you paid $100 for this option, ether would have to be trading at or above $2,100 in order for you to break even.

Read: DeFi Options Explained

The native token for PancakeSwap is CAKE.

In decentralized finance, perpetuals are a type of derivative that allows users to speculate on the price of a cryptocurrency without having to actually own the underlying crypto.

Perpetuals are similar to traditional futures contracts, but perpetual do not have an expiration date.

In cryptocurrency, a private key is a long string of digits that gives owners direct access to their cryptocurrency on a blockchain.

Private keys are used in tandem with public keys via encryption and decryption to help maintain the secrecy of the private key.

In DeFi, a protocol represents a series of rules that govern the interactions between an application and a blockchain via smart contracts saved and executed on a blockchain.

DeFi protocols, like Uniswap, are built on smart contracts.

Polygon is an Ethereum-based layer 2 scaling solution that was created to grow Ethereum-compatible projects faster and more effeciently.

The native token for Polygon is MATIC.

Polymarket is an events based gambling platform in DeFi.

Public keys are mathematically linked to private keys. Their function is to both encrypt crypto blockchain messages and verify digital signatures

Public keys can be compared to a mailbox: anyone can send mail to any address. However, the private key acts as the mailbox key, which can only be opened by the possessor of this key.

In DeFi, rebalancing refers to the process of adjusting a position in order to mitigate risk and increase diversification.

Rebalancing is frequently performed in liquidity pools (automated market markers) in order to assure the proportions of all cryptos in the pool stay in line.

Rocket Pool is one of the largest crypto-staking protocols in existence. Rocket Pool only allows staking in ETH.

RPL is the native token of Rocket Pool.

ROI (return on investment) simply tells you the anticipated return for a particular investment expressed as a percentage of your initial investment.

Some ROI opportunities in DeFi include:

•Staking

•Liquidity pool participation

•Lending

RWA (real world assets) protocols enable DeFi users to tokenize traditional assets, such as stocks or real estate, as well as crypto assets.

Popular DeFi RWA protocols include Maker RWA, Ondo Finance, and Solv Protocol.

In blockchain technology, a sidechain represents a blockchain network that operates under a pre-existing blockchain network.

Sidechains are thereby able to leverage the power of a larger blockchain but offer lower fees and higher throughput than the main chain. Most sidechains are built around Ethereum as gas fees can run high on Ethereum.

Polygon is an example of a sidechain.

A smart contract is code that is stored on a public blockchain which automatically executes when certain conditions are met.

All DeFi protocols are run by smart contracts.

In DeFi, a spread refers to the width of the bid-ask spread. The tighter the spread, the better liquidity a market has.

A stablecoin is a cryptocurrency that pegs its price to that of another asset on a 1×1 basis. Most stablecoins peg their price to the US dollar. Many, but not all stablecoins, are backed by reserves.

Stablecoin Types:

· Fiat-backed

· Cryptocurrency-backed

· Algorithmic stablecoins

· Commodity-backed

Stablecoins are an intricate component of the DeFi ecosystem as they allow for a low volatility haven.

Read: How do Stablecoins Work?

Staking in DeFi refers to locking up crypto in order to receive rewards and earn yield.

Popular staking activities include:

· Liquid staking

· Staking pools

· Validator staking (Ethereum)

SushiSwap is an Ethereum-based decentralized crypto exchange (DEX). Like all DEXs, any crypto participant can become a liquidity provide on SushiSwap.

The native token for SushiSwap is SWAP.

In crypto, synthetic tokens can be used to replicate the price of many assets, including stocks and gold.

Crypto synthetics are created through the process of minting.

Synthetix is a decentralized finance protocol that specialize in minting synthetic tokens (above).

These tokens are called ‘synths’. Synths can can track a wide array of real-world assets, such as stocks.

The native token for Synthetix is SNX.

Popular Testnets include:

· Goerli

· Rinkeby

· Ropsten

In cryptocurrency, tokens represent the native currency of a protocol that operates under a blockchain. Crypto coins are the medium of exchange for a blockchain (BTC is Bitcoin’s) while tokens operate under a blockchain ecosystem. There can only be one coin per blockchain, but a single blockchain network can support an infinite number of protocols/tokens.

Tokenomics refers to any and all studies around a cryptocurrency project in order to determine its value.

Tornado Cash is an Ethereum-based decentralized finance protocol that allows for anonymous transactions. Tornado Cash has come under scrutiny lately because of its pseudonymous nature.

One of the best platforms for DeFi fundamental research.

TradFi is short for traditional finance, and represent all traditional, centralized financial businesses, such as banks and insurance companies.

In DeFi, total value locked (TVL) refers to the total amount of cryptocurrency locked in a project.

Read: TVL vs Market Cap

TVL ratios gauge the overall health of a DeFi protocol. The higher the TVL, the more promising a protocol may be.

TVL Ratio Calculation: Market Cap / TVL

In DeFi, underlying assets are used to describe the assets to which the price of derivatives (perpetuals, synthetics and options) are contingent.

Uniswap is the largest decentralized crypto exchange (DEX) in existence.

The owners of self-custody wallets connect their wallets to Uniswap in order to swap crypto via Uniswaps liquidity pools.

Utility tokens represent any cryptocurrency token that gives its owner the right to perform a specific function on a DeFi protocol.

This is in contract to governance tokens, which give owners the right to vote on changes to a protocol.

Validators do the math required to verify and add proof-of-stake (PoS) transactions to a blockchain. Validators get paid in crypto for their work.

In cryptocurrency, volatility refers to the rate at which the price of a digital asset(s) move over a given duration of time.

High volatility cryptos move a lot in price over a short duration of time, and therefore have higher risks than low volatility cryptos.

Whales are crypto participants who hold very, very large amounts of crypto.

For example, if a bitcoin whale were to sell their coins all at once, this would lead to bitcoin falling in value.

Wrapped tokens allow for cryptocurrencies native on one chain to be traded on another chain that doesn’t support that crypto.

For example, wrapped bitcoin (wBTC) is an ERC-20 token that tracks the price of bitcoin within the Ethereum network.

All tokens within the Ethereum ecosystem are ERC-20 tokens, and therefore interoperable.

Ironically, ether (ETH), the native coin to Ethereum, is not ERC-20, and therefore not interoperable. The wrapped ETH (wETH) token was created to solve this problem.

Yearn Finance is a yield aggregator on the Ethereum blockchain. Yearn makes it easier for yield farmers to earn interest on staking cryptos.

The native token to Yearn is YFI.

In DeFi, a yield aggregator is a protocol that consolidates many different staking protocol offerings into a single interface.

A yield curve is a line that plots the various yields of debt instruments with different expirations. Yield curves can be indicative of many things, such as a recession.

A zero-knowledge (ZK) rollup is a Layer 2 scaling solution that performs computations and storage off-chain while digital assets are held in an on-chain smart contract.

Mike Martin

Mike Martin formerly served as the Head of Content for tastycrypto. Before joining tastycrypto, Michael worked in the active trader divisions of thinkorswim, TD Ameritrade, and Charles Schwab. He also served as a writer and editor for projectfinance.

Michael has been active in the crypto community since 2017. He holds certifications from Duke University in decentralized finance (DeFi) and blockchain technology.

What Is Ether.fi? Liquid Staking Reinvented

What Is Wrapped Ether? Complete wETH Guide

Impermanent Loss in DeFi: The Complete Guide

What is GMX? DeFi Perpetual Exchange 2024 Guide

What Is Defi Liquidity Mining and How Does It Work?