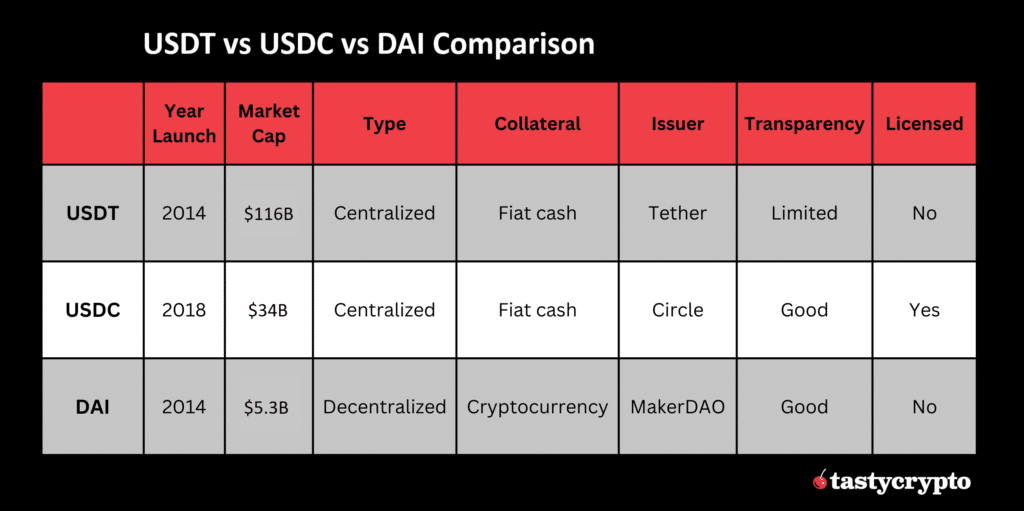

USDT (Tether), USDC (USD Coin), and DAI are all stablecoins which peg their price to the US dollar. USDT and USDC are centralized stablecoins backed by physical reserves of US Dollars; DAI is a decentralized stablecoin that is over-collateralized by various cryptocurrencies.

Written by: Anatol Antonovici | Updated August 6, 2024

Reviewed by: Mike Martin

Fact checked by: Ryan Grace

USDT, USDC, and DAI are currently the three most popular stablecoins, but deciding which of these is best depends on context. Let’s dive in!

🍒 tasty takeaways

-

USDT, USDC, and DAI are all USD stablecoins that aim to peg their price to $1 in US fiat currency.

-

USDT and USDC are centralized collateralized stablecoins; DAI is a decentralized stablecoin. The latter is overcollateralized to maintain the price peg in a decentralized manner.

-

As of today, USDT, USDC, and DAI are the third, sixth, and twelfth-largest cryptocurrencies, respectively..

What Are Stablecoins?

Stablecoins are blockchain-based digital currencies designed to strictly follow the price of an underlying asset, usually a fiat currency like the USD. As a rule, these tokens are pegged to their underlying assets based on a 1:1 ratio, enabling cryptocurrency holders to have easy access to TradFi assets, especially fiat money.

The main goal of stablecoins is to avoid fluctuations and thus address one of the most ardent problems in crypto: extreme volatility. They combine the benefits of traditional money – like stability and liquidity – with the unique features of blockchain technology, such as decentralization, transparency, security, speed, and programmability.

🍒 7 Best Stablecoins in Crypto

Stablecoins can be purchased on exchanges in centralized finance and decentralzied exchanges (DEXs) in DeFi with self-custody wallets.

The Role of Stablecoins

Stablecoins have had a tremendous role in making digital assets more accessible to everyone, bridging the gap between the crypto space and traditional finance. They are also essential to decentralized finance (DeFi) – one of the biggest blockchain trends, forming many trading pairs listed on decentralized exchanges.

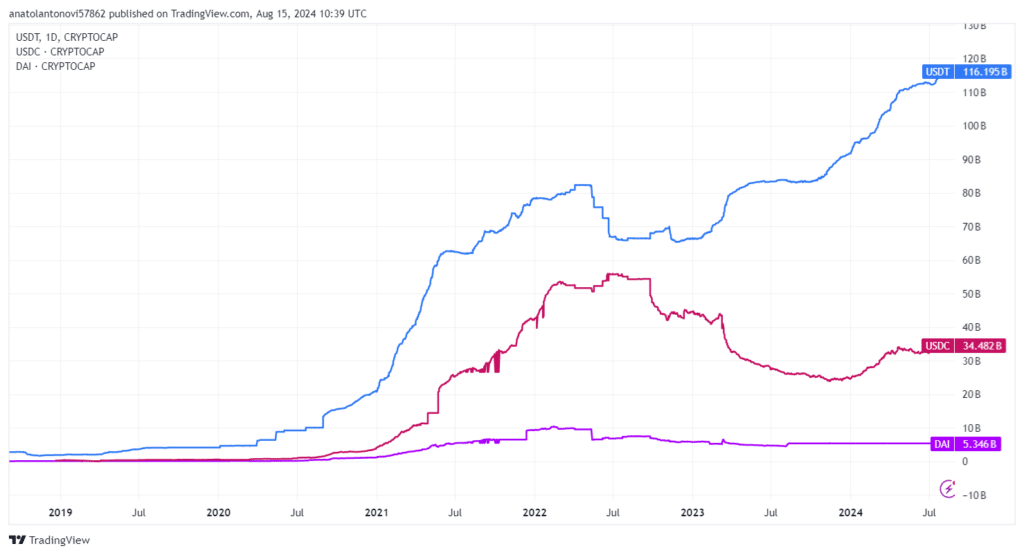

As of mid-August 2024, USDT, USDC, and DAI are the three largest stablecoins by market cap. All of them are pegged to the USD. Together, they account for 7.5% of the entire crypto market.

Source: TradingView

USDT vs USDC vs DAI – Quick Comparison

| Stablecoin | Type | Collateral | Notes |

|---|---|---|---|

| USDT (Tether) | Centralized | Physical US Dollar Reserves | Most popular, faced controversies |

| USDC (USD Coin) | Centralized | Physical US Dollar Reserves | Transparent, compliant with US regulations |

| DAI | Decentralized | Over-collateralized by various cryptocurrencies | Run on the Maker Protocol, Ethereum-based |

| BUSD (Binance USD) | Centralized | Physical US Dollar Reserves | Launched by Binance, one of the largest crypto exchanges |

| TUSD (TrueUSD) | Centralized | Physical US Dollar Reserves | Transparent, known for regular audits |

While all three tokens try to maintain the price peg with the US dollar, they achieve this in different ways.

USDT and USDC are centralized stablecoins, with the token supply and price-peg mechanism being implemented by centralized entities. Elsewhere, DAI is completely decentralized and is governed by a DAO.

All of the three tokens are backed by collateral. USDT and USDC are fiat-backed stablecoins based on a 1:1 ratio, while DAI relies on an overcollateralized system implemented by Ethereum-based algorithms.

While USDT and USDC tokens use similar methods, the latter is regarded as a more reliable option, with Circle complying with US regulations and being more transparent. The monthly attestation from Deloitte reflects USD Coin’s transparency.

🍒 Though referred to as stable ‘coins’, these cryptocurrencies are actually tokens. Coins vs Tokens

USDT vs USDC vs DAI: Which is Best?

It depends on the context. USDT is the most popular option, but holding large values in this token is not recommended due to doubts regarding its true reserves and frequent un-pegging. USDC is a more reliable token. Also, USDC is more suitable for business use cases, with Circle offering API products that can be integrated easily.

If you don’t want to deal with centralized entities and are an ardent fan of absolute decentralization, then DAI is the right stablecoin for you.

🍒 In 2023, PayPay launched PYUSD. Learn how the latest stablecoin works here!

What is Tether USDT?

USDT, also known as Tether, is a stablecoin issued by Tether Limited. It was launched in 2014 and is the oldest major stablecoin in existence. Today, USDT is by far the largest stablecoin by market cap, with over $83 billion as of August 24. It follows right after BTC and ETH.

USDT initially launched on the Bitcoin blockchain through a dedicated software layer called Omni. Eventually, the stablecoin moved to other chains, including Ethereum, Tron, and EOS. Ethereum and Tron are currently the largest markets for Tether.

How does USDT work?

USDT falls under the category of centralized collateralized stablecoins, meaning that the company behind it, Tether Limited, holds traditional cash and equivalents in reserves to back the value of the coin. It mints new USDT tokens when users deposit fiat dollars and burns tokens when users sell them, maintaining the parity between the value of tokens and reserves.

However, Tether has been surrounded by controversy for years, with market participants and regulators scrutinizing the company’s claims that the tokens are fully backed by USD reserves. In 2014, the US Commodity Futures Trading Commission (CFTC) fined Tether after it had found that it held less than 30% in cash reserves to back the token. The company now offers a ‘Transparency’ page to demonstrate its commitment.

What Is USD Coin USDC?

USD Coin (USDC) is another major collateralized dollar stablecoin. It was launched in 2018 by the Centre Consortium, a joint venture between fintech company Circle and US-based crypto exchange Coinbase. Circle acts as the issuer and is responsible for implementing and maintaining the price-pegging mechanism.

Circle is registered with the Financial Crimes Enforcement Network (FinCEN) – a bureau of the US Department of Treasury – as a Money Services Business. Also, it is licensed as a money transmitter in several US states.

USD Coin, currently a $35 billion market, launched on Ethereum, but it eventually became a multi-chain asset after moving to Solana, Avalanche, Algorand, Tron, Stellar, Hedera, Flow, and, Arbitrum and Polygon.

How Does USDC Work?

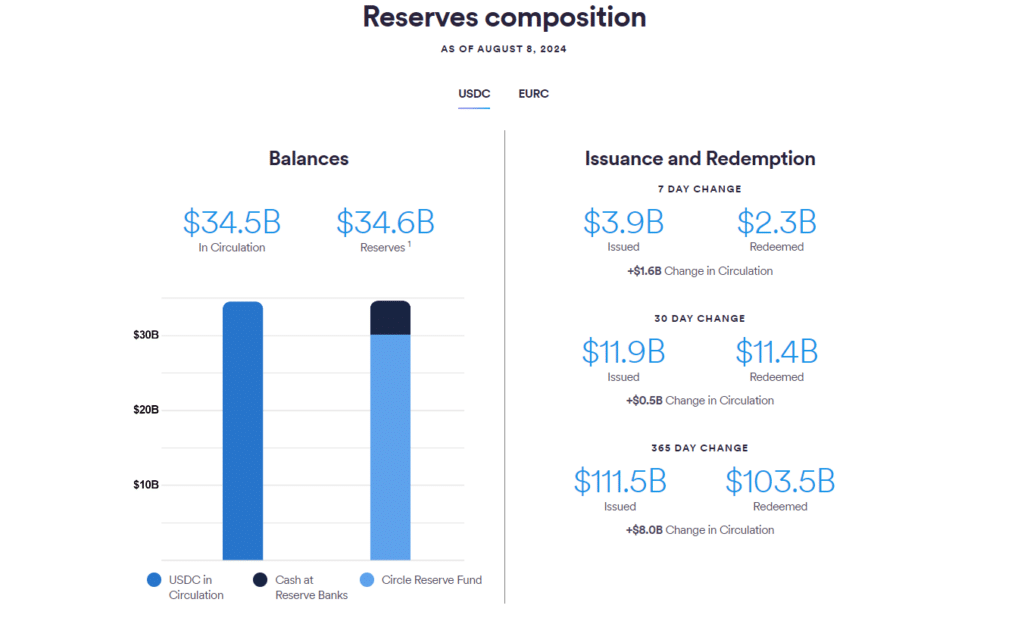

As a centralized collateralized stablecoin, USDC relies on the same principles as Tether: it holds traditional assets in reserves, making sure that their value must coincide with its stablecoin market. Still, Circle is regarded as being more transparent and reliable. USDC reserves, which include 80% of short-term US Treasuries and 20% of cash, are attested by Deloitte, one of the Big Four accounting firms. It performs audits on a monthly basis.

Source: Circle

Despite its transparency and methodical approach, Circle couldn’t avoid some painful moments. In March 2023, USDC briefly depegged after dropping below $0.87 per token amid concerns over Circle’s exposure to Silicon Valley Bank (SVB), which collapsed at the time. Nevertheless, the price quickly recovered after the US government intervened to help SVB clients.

It’s worth noting that USDC is a great choice for enterprises, as Circle offers several business-oriented products, which makes its token suitable for various use cases, including payments, payouts, corporate treasury management, etc.

What Is MakerDAO DAI?

DAI is the largest decentralized stablecoin, with a market capitalization of about $5.3 billion. Unlike the previous two tokens, DAI is not managed by a centralized entity. Instead, it is run on the Maker Protocol, an Ethereum-based decentralized application (dapp).

Maker is a lending protocol governed by MakerDAO, a decentralized autonomous organization (DAO) in which users vote to decide the updates and roadmap collectively. It holds about $7 billion in total value locked (TVL), making it the fourth-largest Web3 app in DeFi.

DAI, launched in 2014, is an ERC-20 token that is part of the Maker ecosystem, acting as a decentralized money system used for lending, borrowing, and transacting.

How Does DAI Work?

Since there is no central entity like Circle or Tether to maintain the peg, DAI relies on smart contracts and algorithms to adjust the token supply based on market dynamics.

The system uses collateralized debt positions (CDPs) to maintain a stable value. New DAI is minted when users deposit ETH or other supported crypto assets into a vault. In return, they get a certain amount of DAI, but the key thing to know is that DAI is overcollateralized, meaning that the value of the locked crypto should always be higher than DAI in circulation. If the value of the collateral drops below a certain threshold, it may be liquidated to maintain the price peg.

Overcollateralization is what helps DAI avoid the faith of algorithmic stablecoins like Terra USD (UST), which saw its $18 billion market vanishing in a matter of days after a dramatic depeg.

Stablecoin FAQs

Crypto holders looking for stability should consider a diversified approach, but USDC seems to be the better option for long-term investors due to its transparent approach and the profile of Circle’s partners.

These stablecoins maintain a price as close to $1 as possible, so they are not used for price speculation. USDC does perhaps the best job of maintaining its peg to the US Dollar.

DAI is a decentralized stablecoin that is not managed by a centralized entity, unlike popular tokens like USDT and USDC. It runs on the Ethereum blockchain and relies on smart contracts and algorithms.

USDC stablecoin has grown as a USDT alternative. It is known for its transparency and regulatory compliance.

Anatol Antonovici

6+ years of experience writing for crypto brands and blockchain firms, including Coindesk, Cointelegraph, Bitcoinist, CryptoPotato, Algorand, and OTCTrade.com

🍒 tasty reads

The Core Blockchain and DeFi Ecosystem: What You Need to Know

7 Best DePIN Crypto Projects

What Is Symbiotic and How Does It Work in 2024?

Ethereum vs Ethereum ETFs – 5 Major Differences