📕 Decentralized Application (dApp): A dApp is a decentralization application that runs on a public blockchain network like Ethereum with no controlling entity.

Written by: Mike Martin | Updated June 26, 2024

Reviewed by: Ryan Grace

Fact checked by: Laurence Willows

Web3 wouldn’t exist without decentralized applications. In this guide, we’ll show you how dApps are reshaping the digital ecosystem.

🍒 tasty takeaways

dApp stands for decentralized application.

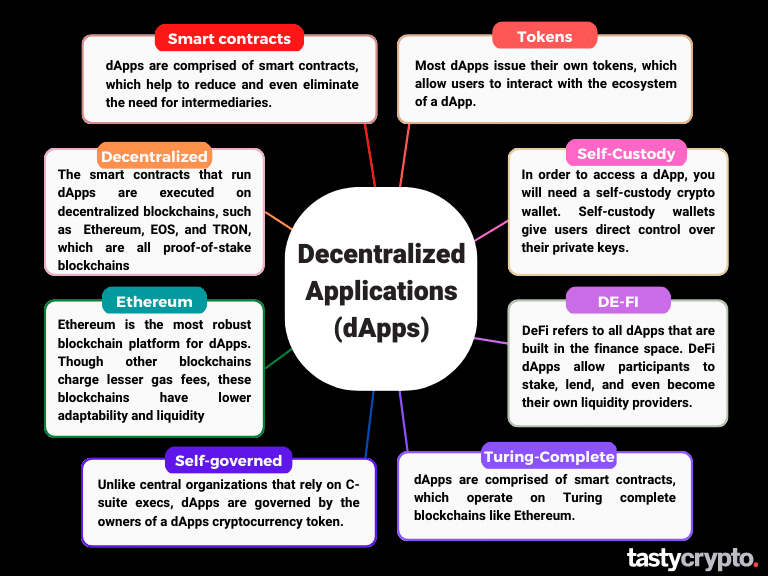

dApps are comprised of smart contracts, which are stored and executed on decentralized blockchains.

Most dApps issue tokens, which both secure dApp protocols and allow users to interact with an interface.

DeFi and gaming are the two most popular categories of dApps.

Though dApps are traditionally open-source, an increasing quantity of dApps are close-source.

Summary

| Description | |

|---|---|

| dApp Overview | Programs running on decentralized blockchains, forming the foundation of Web3. |

| History | Originated with Bitcoin in 2009; Ethereum in 2015 expanded their potential. |

| Smart Contracts | Code units on blockchains, enabling dApps' functionalities. |

| dApp Use Cases | From decentralized finance (DeFi) to gaming, dApps cover a wide range of sectors. |

| Tokens | Issued by most dApps for interaction and securing their protocols. |

| Web3 Wallets | Tools for users to interact with dApps, maintaining private key access. |

| Risks | dApps present smart contract, gas fee, and other associated risks. |

What Are dApps (Decentralized Applications)?

Decentralized applications are the programs that are powering Web3, the latest iteration of the world wide web.

Outwardly, dApps (also called Web3 apps) can appear almost identical to the centralized applications we know and use on a daily basis. The mechanics of dApps, however, are very different than that of traditional applications.

Unlike Web2 apps, which store and run code on centralized servers, Web3 dApps execute code in the form of ‘smart contracts’ on decentralized blockchains, such as Ethereum.

The vast majority of dApps issue cryptocurrency tokens. In addition to giving the owners of these tokens the ability to interact with and govern an application, tokens help a dApp to secure its ecosystem.

dApps are accessed through self-custody Web3 wallets, which give users direct access to their private keys via a web browser.

📕 Read! What Is a Self-Custody Crypto Wallet and How Does It Work?

Though many dApps are completely decentralized, some dApps, like OpenSea, are run by a central authority. dApps that are completely autonomous are called Decentralized Autonomous Organizations (DAOs). One example is LooksRare, a decentralized NFT marketplace.

💡 Learn how to connect to dApps using tastycrypto with WalletConnect!

History of dApps

The first dApp was the Bitcoin network, which was launched in 2009 by ‘Satoshi Nakamoto’.

Though Bitcoin is technically a ‘decentralized application’, the full utility of dApps did not come until 2015 when Vitalik Buterin launched the Ethereum network.

Unlike Bitcoin, Ethereum is a “Turing complete” blockchain network, which means that this peer-to-peer blockchain-based technology can execute code that is uploaded to it by developers.

Code simply tells computers what to do. Ethereum developers write code on Solidity and then send this code to the Ethereum Virtual Machine (EVM) in order to have it carried out.

This is in contrast to centralized organizations, which run and execute their code on centralized servers.

Though smart contracts were originally invented in the 1990s by Nick Szabo, their true potential wasn’t realized until Ethereum’s launch in 2015.

In 2024, there are thousands of dApps in existence. Although most dApps are in the gaming and decentralized finance (DeFi) space, dApps exist for almost all market segments. Although in theory dApps are open-source, today an increasing number of dApps are closed-source, which means their code is private.

dApp Use Cases: 5 Popular DeFi dApps

Investors and traders will be most interested in dApps that operate in the decentralized finance (DeFi) space. Let’s explore a few DeFi dApps and their relative use cases!

1. Aave: Borrowing/lending

Aave is crypto borrowing and lending DeFi dApp. In contrast to traditional banking, you can lend or borrow crypto instantaneously on Aave. There is no pre-approval or paperwork required. In order to borrow crypto on Aave, you must deposit crypto as collateral. The amount you deposit must be greater in value than the amount you are able to borrow. This ‘over-collateralization’ help to make the protocol secure. Aave employers ‘keepers’ whose job is to liquidate undercollateralized loans.

📚 Read: AAVE vs Compound vs JustLend: Which Lending dApp is Best?

2. Lido: Staking

Lido is a liquid staking dApp. Proof-of-stake networks, like Ethereum, Polygon, and Solana, use validators to secure their networks. Validators are rewarded for their work in cryptocurrency. In order to be in this pool, you must ‘stake’ crypto. Lido is a dApp that does this staking for you. Lido pays stakers in the form of APR. For example, if you were to stake Ethereum (ETH) on Lido right now, you could receive an APR of 5.2%. On top of that, Lido provides a liquid staking token (LST) in exchange for staked funds to be used in DeFi.

3. 1inch: DEX aggregator

1inch is a DEX agggregiator. Aggregators look at the prices from multiple DEXs and connect you with the ones that offer the best prices for your selected pair. 1inch has affiliations with many DEXs, including Uniswap, Sushiswap, Kyber Network, Bancor, Balancer, and Oasis.

4. OpenSea: NFT Marketplace

Though technically not a dApp (OpenSea is run by a centralized organization), OpenSea is one of the largest marketplaces for buying, selling, and minting non-fungible tokens (NFTs). Like with most dApps, you must connect your self-custody crypto wallet in order to interact with OpenSea.

5. Ribbon Finance: Options dApp

Ribbon is a derivative dApp that leverages products much like options. Though you can not trade options directly on Ribbon, you can invest in their ‘vaults’ that mimic popular options trading strategies, such as the covered call.

📕 Read! DeFi Options Explained

Most dApps are in their early stages, but frontend user experience is constantly improving.

How Do dApps Work?

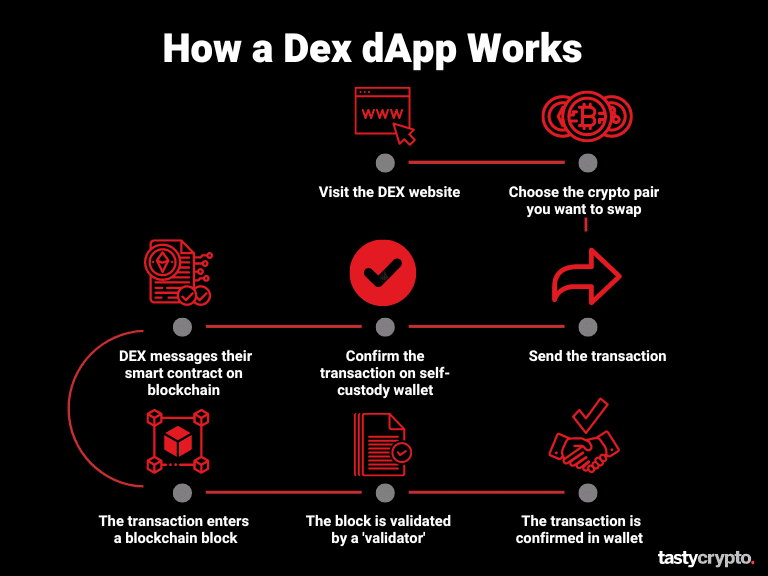

In order to understand how a dApp works, let’s walk through how the Uniswap DeFi dApp works.

Uniswap is a decentralized crypto exchange that allows users to swap digital assets without a central intermediary. Like most dApps, Uniswap is operated by holders of its token, ‘UNI”.

In this example, a user is trying to swap some of their ether (ETH) for Uniswap (UNI). Let’s see what happens on the backend!

A user logins into the dApp user interface, which in this case is the Uniswap website, uniswap.org.

The user chooses the crypto they want to both buy and sell (ETH for UNI)

The user confirms and sends this transaction.

The user connects their self-custody crypto wallet to confirm the transaction.

After confirmation, the dApp messages a smart contract stored on a blockchain to access the ETH/UNI liquidity pool stored on it.

The transaction enters a block and is validated by a node.

The transaction is broadcast to the entire Ethereum blockchain network for verification.

The block that the transactions reside in is added to the blockchain, making it immutable and final.

As we can see, the triggering event here is Uniswap interacting with its smart contract saved on a blockchain. Put simply, dApps are interfaces that allow the public to interact with an organization’s smart contracts.

📕 Read: What Is a DEX? How Decentralized Crypto Exchanges Work

Different Types of dApps

dApps exist for almost every type of business imaginable. Let’s run through a few more popular dApp categories now.

Decentralized Exchanges

Decentralized exchanges (DEXs) are the most popular dApps in DeFi. These P2P exchanges operate on blockchains devoid of intermediaries, which makes them transparent and cost-effective.

Read! Uniswap vs. SushiSwap vs. PancakeSwap: Which DEX Is Best?

Gaming

Since 2023, gaming dApps have been exploding in popularity. It has been estimated that gaming dApps make up more than half of blockchain usage. This popularity may be due in part to their free-to-play nature; some ‘play-to-earn’ games even reward participants by paying them in crypto and/or non-fungible tokens (NFTs) to play!

Gambling

dApp casinos are run on public blockchains, which makes them inherently transparent. This is in contrast to traditional casinos, which are often opaque when it comes to odds. You can also bet on the outcomes of events such as elections on the Polymarket platform.

Social Media

Social media dApps are growing in popularity. Unlike traditional social media applications, social media dApps do not sell or store your personal data. Steemit, for example, is a dApp that operates much like Twitter on decentralized technology.

Oracles

Oracles are used to store and receive information. Many dApps rely upon live data in order to operate (e.g., crypto exchanges). Decentralized oracles, like Chainlink, provide this data on a decentralized platform.

5 dApps Risks

dApps are not risk-free. Let’s explore the top five risks associated with decentralized apps.

1. Smart Contract risk

dApps are comprised of smart contracts. If a smart contract is written with faulty code, that dApp could be vulnerable to attacks. In order to mitigate these risks, it is wise to: 1) interact only with dApps that are widely used and 2) assure at least two independent audits have been conducted on a dApp before you connect your wallet to it. There is also the risk that a dApp’s software is laggy, which could result in downtime.

2. Counterparty Risk

Counterparty pertains to the risk of a borrower defaulting on their loan obligations. This risk is present in all types of lending, including DeFi lending dApps. Unlike traditional banks, however, DeFi dApps use overcollateralize ratios. This system makes the default of crypto loans a rare occurrence.

3. Gas Fees

In order to interact with the Ethereum network (which is the most robust blockchain for dApps), you will need to attach a gas fee to your transactions. Gas fees pay validators for adding your transaction to the immutable blockchain. Gas fees can vary widely in value as prices are dictated by supply and demand as well as network congestion. It is therefore best to check the current gas fees before sending a transaction. Though gas fees for simple transactions usually equate to a few dollars, gas fees for smart contracts can cost thousands of dollars.

4. Seed Phrase Risk

In order to interact with a dApp, you will need a self-custody crypto wallet. Self-custody wallet users are responsible for maintaining a record of their private keys, AKA ‘seed phrase’. If you lose this seed phrase, there is no central intermediary to recover your digital assets. Therefore, it is very important to write down your seed phrase in a secure location.

5. Impermanent Loss

We mentioned earlier that users of self-custody wallets are able to buy and sell crypto on decentralized exchanges. This liquidity is provided by liquidity pools and automated market makers. Anybody can choose to become a liquidity provider in DeFi (and earn the fees that come with it!) by contributing two cryptocurrencies to a liquidity pool. As users buy and sell from your liquidity pool, the value of the two cryptocurrencies added may fluctuate in value. For example, if you added crypto to the USD Stablecoin/ETH liquidity pool, your proportion of ETH will fall as more users buy ETH from the pool and sell USD. Impermanent loss can also be thought of as opportunity risk; how much would you have made on your crypto (ETH) if it wasn’t in a liquidity pool?

dApp FAQs

An app is a product of Web2, in which centralized organizations collect and store data on centralized servers. A dApp is a component of Web3, where applications are community lead. On dApps, code is stored and carried out via smart contracts on decentralized platforms.

Smart contracts are the on-chain feature of dApps. dApps provide users with an interface in order to access a smart contract, which is saved and executed on a blockchain like Ethereum.

There are thousands of dApps in existence, many of which you can make money from. In DeFi, dApps allow participants to earn yield through staking, lending, and liquidity pools. Even some ‘play-to-earn’ dApp games allow users to monetize from interactions.

🍒 tasty reads

What Is Ether.fi? Liquid Staking Reinvented

What Is Wrapped Ether? Complete wETH Guide

Impermanent Loss in DeFi: The Complete Guide

What is GMX? DeFi Perpetual Exchange 2024 Guide

What Is Defi Liquidity Mining and How Does It Work?

Wrapped Crypto Tokens: A Beginner’s Guide

Mike Martin

Mike Martin formerly served as the Head of Content for tastycrypto. Before joining tastycrypto, Michael worked in the active trader divisions of thinkorswim, TD Ameritrade, and Charles Schwab. He also served as a writer and editor for projectfinance.

Michael has been active in the crypto community since 2017. He holds certifications from Duke University in decentralized finance (DeFi) and blockchain technology.