Definition: In decentralized finance, liquidity pools are comprised of two or more cryptocurrencies. These pools allow for peer-to-peer crypto trading on decentralized exchanges.

Written by: Andrey Sergeenkov | Updated June 28, 2024

Reviewed by: Mike Martin

Fact checked by: Ryan Grace

A liquidity pool represents cryptocurrency locked in a smart contract on a DEX (decentralized exchange). Liquidity pools offer a decentralized solution to liquidity.

🍒 tasty takeaways

-

Liquidity pools are crypto smart contracts in DEXs that replace traditional order book trading.

-

They’re funded by users (liquidity providers) who earn fees and LP tokens.

-

LP tokens represent a provider’s share in the pool and can be used for additional earnings through liquidity mining.

-

Notable examples of liquidity pool-based DEXs include Uniswap, Balancer, and Bancor.

-

While they offer numerous benefits, liquidity pools also carry risks like impermanent loss and smart contract vulnerabilities, particularly in illiquid markets.

Liquidity Pools Summary

| Summary | |

|---|---|

| Liquidity Pool Introduction | Liquidity pools are crypto smart contracts in DEXs that facilitate peer-to-peer trading, replacing traditional order books. |

| Liquidity Pools vs Order Books | Unlike centralized exchanges' order books, liquidity pools use a formula to determine prices, allowing efficient trading with low volumes. |

| How Do Liquidity Pools Work? | Liquidity providers deposit assets in pools and receive liquidity tokens. Traders buy or sell tokens, changing the pool's balance and price. |

| Why Are Liquidity Pools Important? | They are crucial for decentralized trading, lending, and yield farming, allowing users to trade directly and earn passive income. |

| Pros and Cons of Liquidity Pools | They are open to everyone and offer earning opportunities but come with risks like impermanent loss and smart contract vulnerabilities. |

| Liquidity Pool Tokens | LP tokens represent providers' shares in the pool and can be staked, traded, or used as collateral, exposing holders to impermanent loss. |

| Liquidity Pool Examples | Uniswap uses a simple formula for prices. Balancer offers more flexibility, and Bancor addresses the impermanent loss issue. |

| Conclusion | Liquidity pools are revolutionary in DeFi, allowing efficient, decentralized trading and earning opportunities with associated risks. |

Liquidity Pool Introduction

Liquidity pools are the backbone of many decentralized exchanges (DEXs), representing a paradigm shift in how trades are made and orders are filled. At their core, they are blockchain smart contracts that lock up funds, creating a pool of tokens that users can trade against.

These funds are supplied by users known as cryptocurrency liquidity providers, who deposit an equal value of two tokens (or sometimes more) to create a market.

Unlike traditional centralized exchanges, where an order book matches buyers and sellers to create liquidity, DEXs like Uniswap, PancakeSwap, and Sushiswap rely on these liquidity pools to provide liquidity in the crypto market.

Liquidity Pool Benefits

This model offers numerous benefits, including:

LPs allow users to trade directly from their self-custody crypto wallets, which eliminates the need for a central party to oversee transactions.

LPs make it possible to earn passive income by collecting fees as users trade from pools that crypto participants stake in.

In this context, liquidity refers to the availability of a particular asset in the pool, allowing trades to occur without significant price slippage. The larger the liquidity pool, the less impact large trades will have on the asset’s price, contributing to a more stable and efficient market.

Liquidity Pools vs Order Books

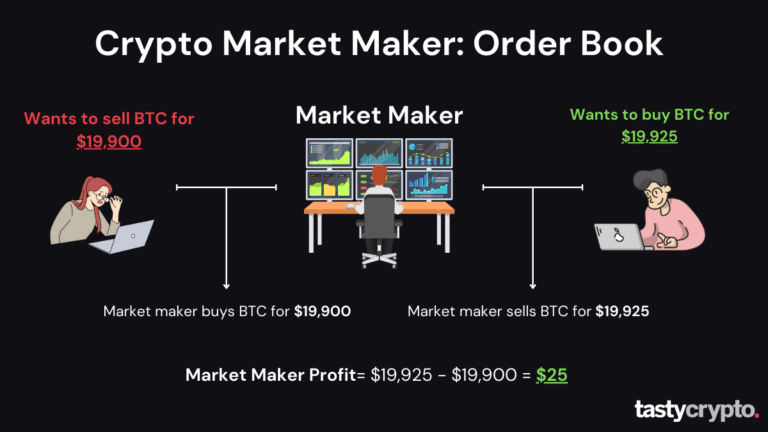

In a centralized exchange, the order book model is used. In this traditional model, a market maker creates markets by buying and selling crypto directly from crypto traders.

The below visual illustrates how a traditional order book-based market maker functions.

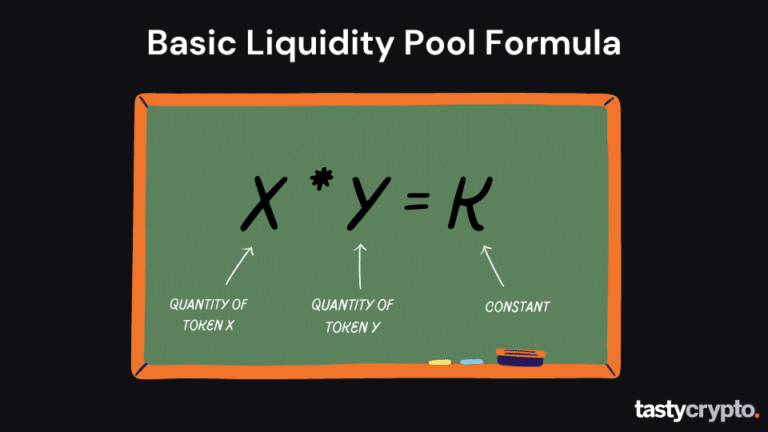

Liquidity pools replace this order book with a simple mathematical formula that automatically determines the price based on the ratio of assets in the pool. This eliminates the need for traditional market makers and allows for efficient trading even with relatively low trading volumes.

📚 Read: CEX vs DEX – Crypto Exchange Fees Comparison

How Do Liquidity Pools Work?

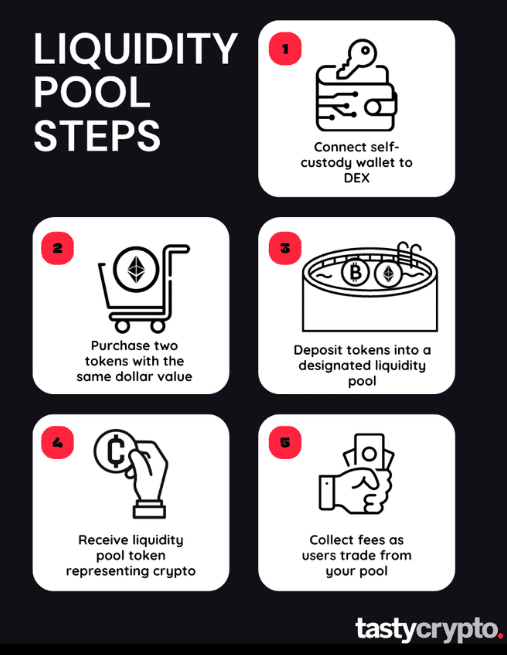

The below visual shows the steps involved in joining a liquidity pool.

A liquidity pool is typically created for a specific trading pair (e.g., ETH/DAI or any ERC-20 token pair). Users, known as liquidity providers, deposit their assets into these pools and in return receive liquidity tokens, which represent their share of the total liquidity pool.

Traders can then buy or sell tokens from these pools, which changes the balance of tokens in the pool and therefore, the price. Each trade incurs a small fee, which is added to the pool, rewarding liquidity providers.

However, expected price changes and flash loan attacks can also impact the value of assets in a liquidity pool.

Liquidity providers can later redeem their share of the pool by burning their liquidity tokens.

Why Are Liquidity Pools Important?

Liquidity pools are the backbone of DeFi (decentralized finance), allowing for decentralized finance trading, DeFi lending, and yield farming. They offer several advantages such as enabling traders to trade directly from their wallets, promoting financial inclusion by allowing anyone to provide liquidity and earn fees, and creating opportunities for earning passive yield income through yield farming.

Pros and Cons of Liquidity Pools

Pros:

Open to everyone: Any user can become a liquidity provider, making DeFi a more inclusive financial system.

Earning opportunities: Liquidity providers earn fees from trades, providing an additional income stream.

No need for large volumes: Liquidity pools facilitate price discovery and efficient trading without requiring high trading volumes.

Cons:

Impermanent loss: Liquidity providers can face impermanent losses if the price of tokens in the pool deviates significantly from the market price.

Smart contract risk: As liquidity pools are based on smart contracts, they are exposed to potential bugs and hacking.

Liquidity Pool Tokens

Liquidity tokens, also known as LP tokens, are an essential part of the mechanism of liquidity pools. These tokens are given to liquidity providers as proof of their contribution when they deposit their assets into the liquidity pool. Essentially, these tokens are a claim on the assets deposited into the pool.

The number of liquidity tokens received by a liquidity provider is proportional to their contribution to the pool. For instance, if you contribute 1% of the pool’s total liquidity, you would receive LP tokens that represent 1% of the total issued LP tokens.

What Can I Do With A Liquidity Pool Token?

Liquidity pool tokens have 3 primary uses.

LP tokens represent a liquidity provider’s share of the pool and can be redeemed to reclaim their share of the assets in the pool. This includes any trading fees that have been earned by their share of the pool since they deposited their assets.

In many DeFi protocols, LP tokens can also be staked or farmed to earn additional rewards. This is a common mechanic in yield farming strategies, where users provide liquidity to earn LP tokens, which are then staked to earn other tokens as rewards.

LP tokens are transferable, just like other tokens in the Ethereum ecosystem. This means they can be traded, sold, or used as collateral for loans in other DeFi platforms. Some protocols have even created secondary markets for LP tokens.

It’s important to note that while LP tokens have the potential to earn returns, they also expose the holder to certain risks. The most significant of these is impermanent loss, which can occur if the price of the underlying assets in the liquidity pool changes significantly compared to when they were deposited.

Liquidity Pool Examples

Uniswap

Uniswap is one of the most popular DEXs that uses liquidity pools. It uses a simple x*y=k formula to determine prices.

Balancer

Balancer allows for the creation of liquidity pools with up to eight assets with adjustable weights, providing more flexibility than Uniswap.

Bancor

Bancor introduced a solution to the impermanent loss problem by using an innovative v2 pool, which uses Chainlink oracles to maintain the balance of assets in the pool.

Conclusion

Liquidity pools are a revolutionary concept in the DeFi space, allowing for efficient, decentralized trading while offering lucrative earning opportunities for liquidity providers. However, they also come with their own set of risks, and potential users should thoroughly understand these before participating. As the DeFi ecosystem continues to evolve, we’re likely to see more innovation and improvements in liquidity pool technology.

🍒 Read next! What are Automated Market Makers and How Do They Work?

Liquidity Pools FAQs

Impermanent loss is the loss incurred by liquidity providers when the price of their staked tokens changes in a liquidity pool – how much could the staker have made if they simply owned the tokens outright? Impermanent loss can be thought of as opportunity loss.

Yes, anyone can become a liquidity provider by depositing crypto assets into a liquidity pool. These assets could be any pair of tokens, including stablecoins, which are cryptocurrencies designed to minimize price volatility.

The main risks include impermanent loss, smart contract risk which includes potential bugs and hacking, and the possibility of falling victim to a scam. Scams in DeFi can take various forms, including fraudulent projects or tokens

Fees are distributed according to the proportion of liquidity that each provider has contributed to the pool. The more liquidity a provider contributes, the larger the proportion of the fees they receive.

When you’re ready to withdraw your assets, your liquidity tokens are burned (or destroyed), and in return, you receive a portion of the liquidity pool’s assets based on your share.

An AMM (automated market maker) is a type of decentralized exchange protocol that uses a specific algorithm to price tokens. AMMs incorporate liquidity pools instead of order books.

Staking in a liquidity pool involves depositing or locking up your digital assets in a pool to earn incentives. These incentives can include transaction fees from the pool or additional tokens from the protocol, often enhancing the return for liquidity providers.

Andrey Sergeenkov

Expertise: DAOs, NFTs. Blockchain. Cryptocurrency

Summary: 6 years of experience in the blockchain and cryptocurrency industry. Content Manager at DAO Time. Published in Cointelegraph, Coindesk, and Coinmarketcap.

🍒 tasty reads

What Is Ether.fi? Liquid Staking Reinvented

What Is Wrapped Ether? Complete wETH Guide

Impermanent Loss in DeFi: The Complete Guide

What is GMX? DeFi Perpetual Exchange 2024 Guide

What Is Defi Liquidity Mining and How Does It Work?