Wrapped crypto tokens represent tokenized versions of crypto assets from different blockchain networks. They are pegged to the value of the underlying, representative cryptocurrency based on a 1:1 ratio.

Written by: Anatol Antonovici | Updated August 25, 2024

Reviewed by: Mike Martin

Fact checked by: Ryan Grace

🍒 tasty takeaways

- Wrapped crypto tokens are tokenized versions of different blockchain assets, pegged 1:1 to their original value.

- They enhance interoperability in DeFi, primarily using Ethereum-based tokens.

- Example: Wrapped Bitcoin (WBTC) mirrors Bitcoin’s value on Ethereum.

- Custodians facilitate the wrapping process, with options for centralization or decentralization.

- Redeeming wrapped tokens involves custodians burning them and sending the original crypto to the user’s wallet.

- Wrapped tokens support cross-chain communication, liquidity, and efficiency but rely on custodians and may have centralization risks.

What Are Wrapped Tokens?

A wrapped token is a digital asset pegged to the value of an original cryptocurrency or token, usually mirroring the price of that digital asset on a 1:1 ratio. As a rule, wrapped tokens reside on different blockchains than the underlying asset.

‘Wrapping’ is the figurative term to describe the creation of a new token on a blockchain network that follows the price of an underlying crypto.

Wrapped tokens are quite similar to stablecoins as they use the same mechanisms to maintain the price peg. However, stablecoins like USDT and USDC derive their value from traditional finance (TradFi) assets like fiat currencies, while wrapped tokens are usually pegged to other cryptocurrencies.

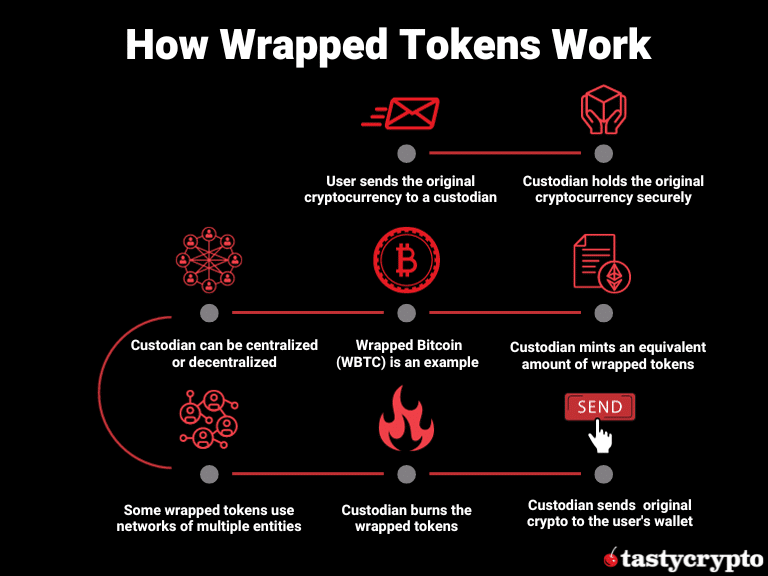

How Do Wrapped Tokens Work?

The crypto wrapping process happens with the help of a custodian – an entity that holds an equivalent amount of the original token or coin. When users deposit the underlying cryptocurrency with the custodian, the custodian mints the wrapped version on the targeted chain. For example, Wrapped Bitcoin (WBTC) is an ERC-20 token hosted on Ethereum and backed by Bitcoin.

A custodian can be either a centralized or a decentralized entity. Here are a few examples of custodians:

- Merchant

- Multisig crypto wallet

- Decentralized autonomous organization (DAO)

- Smart contracts

Some wrapped tokens are managed by networks of multiple entities to ensure some level of decentralization.

When a user wants to exchange or redeem their wrapped tokens for the original coin, the custodian burns the former and sends the cryptocurrency to the user’s Web3 wallet, keeping the balance intact.

How Does WBTC Work?

WBTC is operated by a larger network of stakeholders that include merchants, a custodian, and a DAO.

The wrapping process involves the following steps:

- Merchants lock BTC with the custodian and mint WBTC on Ethereum.

- Burn WBTC to free up the locked BTC and send it back to users.

The proof of reserves can be viewed on-chain at any time.

Today, the network of merchants mostly includes decentralized finance (DeFi) protocols and a few centralized crypto services. There are over 20 merchants in total, including CoinList, Maker, Aave, Loopring, Kyber, Dexwallet, 0x, and Nexo, among other decentralized apps. The only custodian as of today is BitGo.

The entire system is operated by a DAO that includes merchants, the custodians, and other stakeholders.

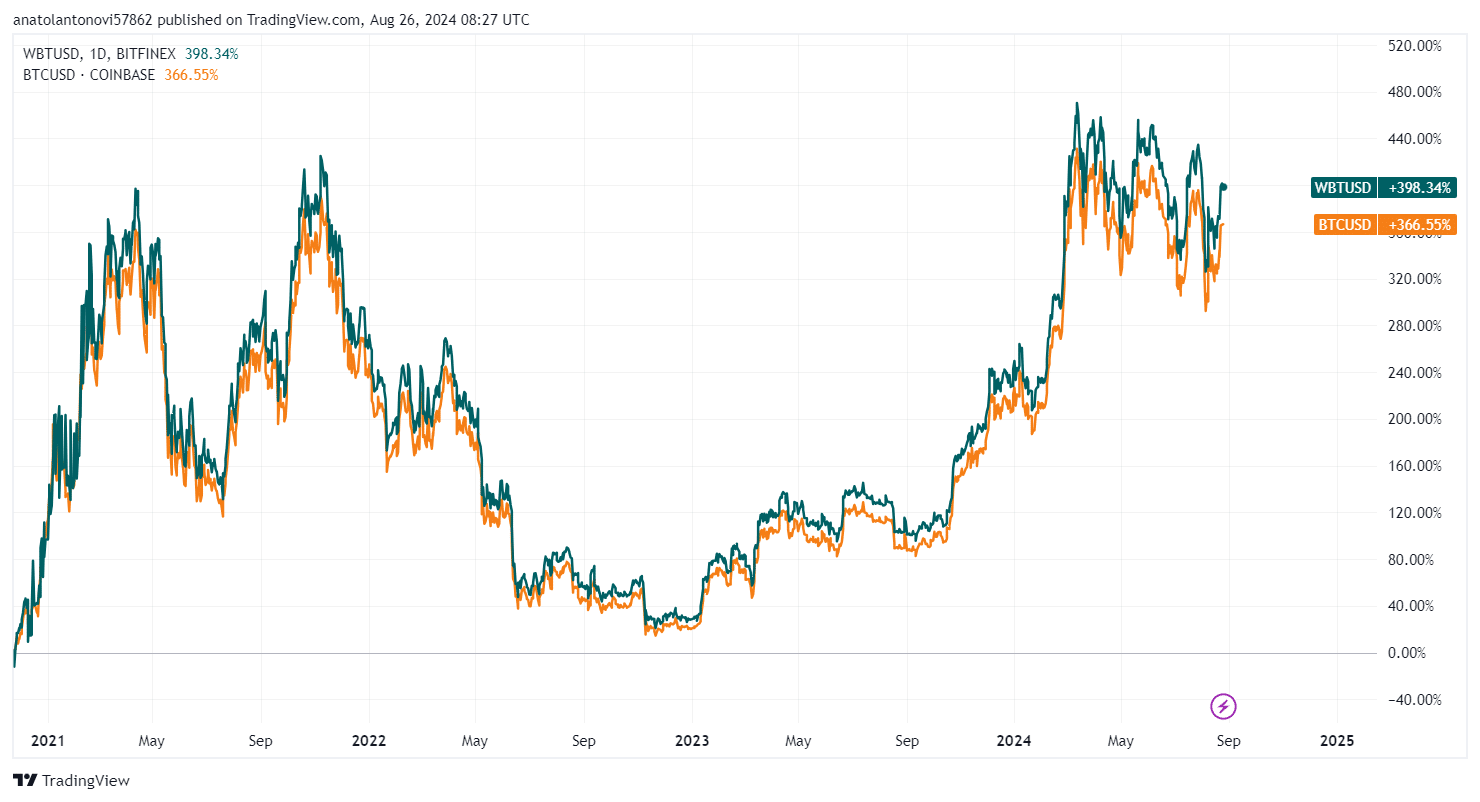

While WBTC mirrors the price of BTC, some deviations might show up on larger timeframes.

WBTC vs BTC Price Deviations

Source: TradingView

Why Are Wrapped Tokens Needed?

Stablecoins bridge the gap between fiat currencies and digital assets, but what’s the purpose of creating a derivative for another crypto?

Wrapped tokens play a major role in bringing interoperability to the blockchain industry. They are a big thing, especially with the emergence of the DeFi trend.

Blockchain is a fragmented market. Independent chains don’t communicate between themselves unless they use the same computation engine like the Ethereum Virtual Machine (EVM). The problem is that Bitcoin – the largest, oldest, and most secure cryptocurrency – doesn’t support the smart contract feature and can’t be used in DeFi apps like decentralized exchanges (DEXs).

In DeFi, financial services are powered by decentralized code. While this market currently exceeds $40 billion, it once peaked at over $210 billion in late 2021, indicating potential for recovery. Over half of DeFi applications rely on Ethereum-based tokens, emphasizing the importance of having assets within the Ethereum ecosystem.

Wrapped Tokens on Ethereum

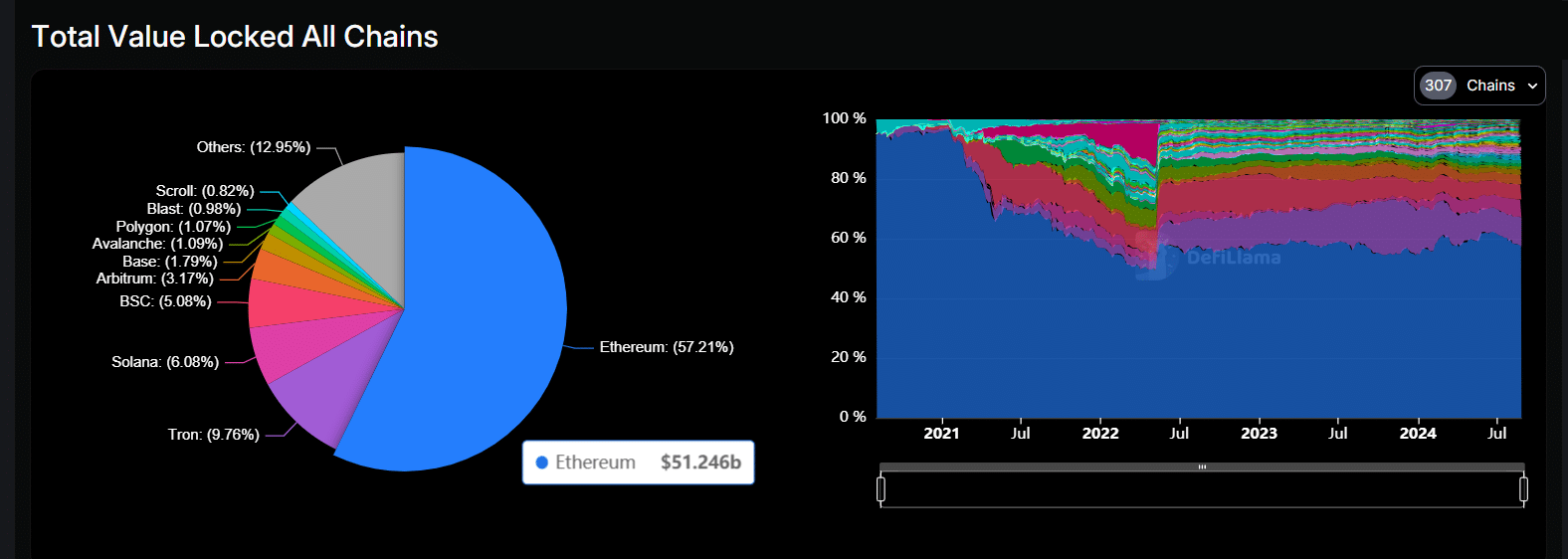

Today, Ethereum accounts for about 57% of the total value locked (TVL) in DeFi.

While these numbers today are close to the lowest on record, Ethereum still dominates the DeFi ecosystem, which is why many wrapped tokens are created on this chain. They support DeFi platforms, provide liquidity, and contribute to cross-chain communication.

For example, if you hold USDT on Ethereum, you can get exposure to Bitcoin by purchasing WBTC directly through a DEX, such as Uniswap or Curve. You can access the coins of other chains without having to leave Ethereum at all.

Wrapped Tokens on BNB Chain

Another blockchain network gaining traction in DeFi is BNB Chain (formerly known as Binance Smart Chain), which accounts for 5% of the total TVL.

Binance offers a tool called Binance Bridge, which enables users to wrap cryptocurrencies and convert them to its BEP-20 token standard. Once you wrap your coins – be it BTC, ETH, or USDT – you can use them in various DEXs and yield farming apps on BNB Chain, such as PancakeSwap, Venus, or Coinwind.

Wrapped tokens on Binance would have other symbols. For example, for Bitcoin, it would be Bitcoin BEP-20 (BTCB).

Benefits of Wrapped Tokens

- Interoperability – the most important achievement of wrapped tokens is that they address the fragmentation of the crypto industry. You can use assets like Bitcoin on other networks, such as Ethereum. You can put your Bitcoin to work by exploring yield farming opportunities or lending it.

- Liquidity – wrapped tokens boost liquidity and increase the diversification of assets on smart contract chains.

- Transaction speed – wrapped tokens can be more rapid and efficient compared to original tokens. For example, the transaction speed of WBTC is higher than that of BTC itself since Ethereum is a faster network than the Bitcoin blockchain.

- Transaction fees – often, buying and selling wrapped tokens incurs lower gas fees compared to trading the underlying assets.

Limitations of Wrapped Tokens

While wrapped tokens address challenges related to blockchain fragmentation and lack of liquidity, they’re not ideal.

Here are some drawbacks you should be aware of:

- Reliance on custodians – wrapped tokens depend on custodians, as they hold the original coins. While major wrapped tokens, such as WBTC, use trusted services, custodians may show dishonest behavior. For example, they could affect the unwrapping process.

- Centralization – wrapped tokens are often issued by centralized entities, such as merchants or custodians, and this goes against the promise of decentralization. This risk was also stressed by Ethereum co-founder Vitalik Buterin himself. He said:

“I'm worried about the trust models of some of these tokens. It would be sad if there ends up being $5b of BTC on Ethereum and the keys are held by a single institution.”

— Vitalik Buterin

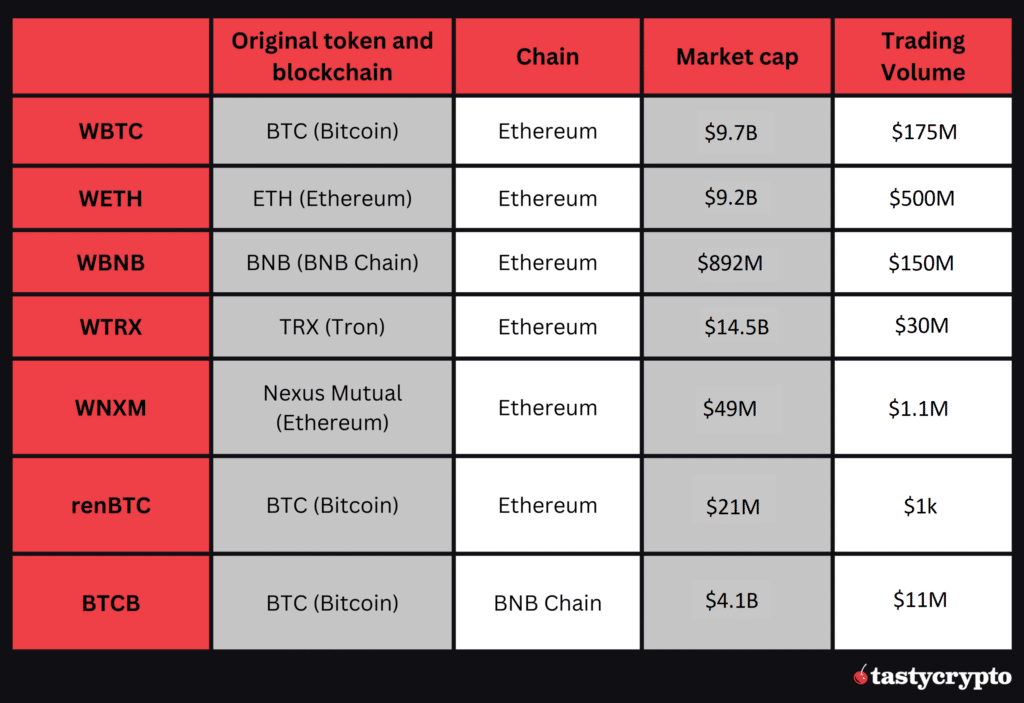

Popular Wrapped Tokens

Here are some of the largest wrapped tokens as of August 2024:

Data compiled from Coinmarketcap, Coinranking, and CryptoSlate

FAQs

You can use wrapped tokens if you want to benefit from DeFi services with cryptocurrencies that aren’t necessarily compatible with DeFi, e.g., Bitcoin.

Wrapped tokens can be considered pegged tokens, although they are very specific, as they are tokenized versions of other crypto coins. Pegged tokens can represent anything from fiat currencies (like stablecoins) to company stocks and other assets (synths).

WETH represents an alternative version of Ethereum (ETH) on the Ethereum blockchain. This development arose from the fact that ETH was introduced prior to the existence of the ERC-20 standard, which has become the predominant standard for tokens in the decentralized finance (DeFi) space. Consequently, to enable the practical utilization of ETH within DeFi applications, an ERC-20 variant, known as WETH, was introduced.

You can obtain wrapped tokens either by purchasing them via DEXs or by depositing your original tokens with a vetted merchant, smart contract, or a specialized platform.

Anatol Antonovici

6+ years of experience writing for crypto brands and blockchain firms, including Coindesk, Cointelegraph, Bitcoinist, CryptoPotato, Algorand, and OTCTrade.com

🍒 tasty reads

What Is Ether.fi? Liquid Staking Reinvented

What Is Wrapped Ether? Complete wETH Guide

Impermanent Loss in DeFi: The Complete Guide

What is GMX? DeFi Perpetual Exchange 2024 Guide

What Is Defi Liquidity Mining and How Does It Work?