Definition: In cryptocurrency trading a DEX (decentralized exchange) is a peer-to-peer exchange that operates with no middlemen.

Written by: Mike Martin | Updated August 18, 2023

Reviewed by: Ryan Grace

Fact checked by: Laurence Willows

In this post, we answer all of your questions about decentralized cryptocurrency exchanges (DEXs).

🍒 tasty takeaways

DEXs are peer-to-peer crypto-swapping marketplaces without intermediaries

They are transparent, cost-efficient, and immutable

DEXs are a subcategory of DeFi and use self-custody crypto wallets to connect to liquidity pools

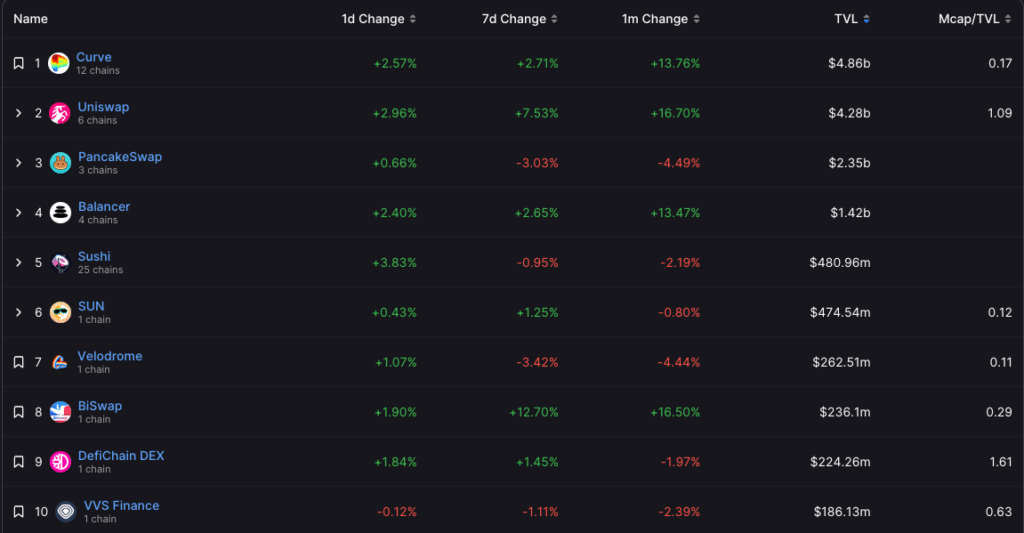

Examples of popular DEXs include Uniswap, PancakeSwap, SushiSwap, and Balancer

The safety of DEXs depends on their smart contract and users should research them before connecting a self-custody wallet

DEXs charge fees to swap crypto on their protocols

Uniswap is considered the best DEX due to its high liquidity, minimal transaction fees, and ability to connect with numerous blockchains

In cryptocurrency, a decentralized exchange (DEX) is a peer-to-peer crypto-swapping marketplace that connects buyers and sellers to liquidity pools. Unlike traditional exchanges, DEXs operate without intermediaries. Additionally, DEXs are transparent, cost-efficient, and immutable. Transactions on DEXs can not be changed – which can be viewed both positively and negatively.

DEXs are in contrast to centralized crypto exchanges (CEXs) like Coinbase, which fill orders using traditional order books.

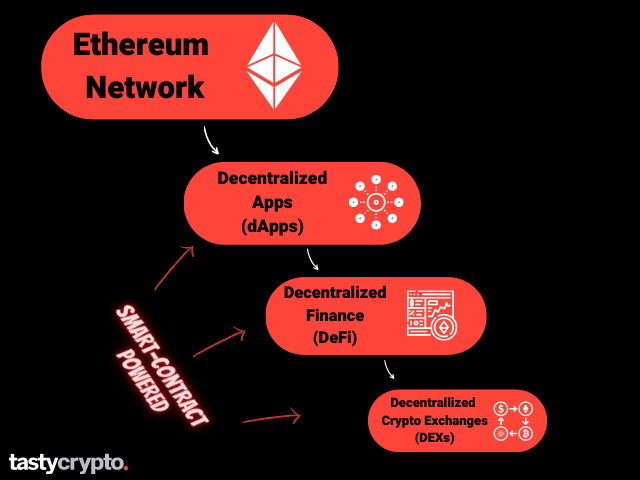

What is the difference between DeFi and DEX?

DeFi stands for decentralized finance. DeFi encompasses all decentralized financial platforms.

DEXs (decentralized exchanges) are a subcategory of DeFi, as they represent only the decentralized exchange category of DeFi.

📚 Read: What are decentralized applications (dApps) and how do they work?

What are examples of crypto DEXs?

Examples of popular decentralized exchanges (DEXs) include Uniswap, PancakeSwap, SushiSwap, and Balancer.

To engage with DEXs, individuals link their self-custody crypto wallets. After connecting, users can trade cryptocurrencies using the DEX interface, which communicates with a smart contract stored on a decentralized blockchain network that the DEX has access to.

📚 Read: Top 5 DEXs in 2023

What is the biggest DEX?

In 2023, the biggest DEX by total value locked (TVL) is Curve Finance. The second largest DEX in 2023 is the Uniswap protocol.

What is the oldest DEX crypto?

The oldest DEX (decentralized crypto exchange) in crypto is BitShares, which was launched in 2014. Other early DEXs also include:

2015 Counterparty DEX

2016-2017: IDEX, ForDelta, EthereDelta

📚 Read: The Evolution of Decentralized Exchanges – CoinMarketCap

How many DEX are there in crypto?

According to DeFiLlama, there are over 700 DEXs in operation in 2023.

Are DEXs safe?

DEXs are as safe as the smart contract that run them. Hacks are common on DEXs. Before connecting a self-custody wallet to a DEX, it is important to thoroughly research a DEX for its history of hacks and the extent of its auditing.

How do DEXs make money?

DEXs (decentralized exchanges) make money by charging users fees to swap crypto on their protocols. The majority of DEXs charge about 0.25% to 0.3% of the trade price to swap crypto on their platforms. Some of this fee goes to pay liquidity providers while a portion of it is returned to the protocol.

📚 Read How do DeFi Protocols Make Money?

Is Cardano a DEX?

Cardano is a decentralized public blockchain network and not a DEX (decentralized exchange).

Is Coinbase a DEX?

Coinbase is a centralized cryptocurrency exchange and not a DEX. However, you can connect to a DEX using the Coinbase self-custody wallet.

📚 Read: Trade on decentralized exchanges – Coinbase

What is the main DEX of Ethereum?

The most popular DEX (decentralized crypto exchange) on the Ethereum blockchain network is Uniswap.

What is the main DEX of Cardano?

According to DeFiLlama, the main DEX for the Cardano blockchain is Minswap.

What is the main DEX for Solana?

According to DeFiLlama, the main DEXs for the Solana blockchain are Orca and Raydium.

What is the main DEX for Avalanche?

According to DeFiLlama, the main DEX for the Avalanche blockchain is Trader Joe DEX.

What is the main DEX of Arbitrum?

According to DeFiLlama, the main DEX for the Arbitrum blockchain is Uniswap V4.

What is the main DEX of Polygon?

According to DeFiLlama, the main DEX for the Polygon (MATIC) blockchain is Quickswap.

What is the main DEX of Bitcoin?

The main DEX for wrapped bitcoin is Uniswap.

Why is Uniswap the best DEX?

Uniswap is considered the best DEX because of its capacity to connect with numerous blockchains, its minimal transaction fees, and its high liquidity. Because of its wide usage, Uniswap has also dramatically reduced counterparty risks.

Is Uniswap better than SushiSwap?

Uniswap is typically viewed as a better option than SushiSwap due to its superior liquidity, user-friendly interface, and lower transaction fees.

What is the downside of Uniswap?

One disadvantage of Uniswap, as well as all other DEXs, is the inherent security risk. If your self-custody crypto wallet is connected to Uniswap when a hack occurs, you could be at risk of losing your digital assets. This is of particular concern for liquidity providers leveraging automated market maker (AMM) technology.

Why is Uniswap so cheap?

Unlike traditional exchanges, Uniswap does not need to pay intermediaries or follow know-your-customer (KYC) procedures, which results in the transaction fees on Uniswap being cheap.

Remember, in addition to paying transaction fees, Uniswap users also need to pay gas fees (network fees) in order to have their trades confirmed and added to a blockchain.

Interested in investing in DeFi? Check out our top 11 DeFi coins for 2023!

Does Uniswap report to IRS?

While Uniswap doesn’t directly report to the IRS, it’s important to note that any profits, losses, earned fees, and interest in cryptocurrency gained through Uniswap must be reported to the IRS on forms such as the 1040 Schedule D form.

Can IRS track crypto from Dex?

Yes. The IRS (like anyone) can view the entire transactional history of any public blockchain network.

What are DEX aggregiators?

Dex aggregators are decentralized finance (DeFi) protocols that enable users to trade cryptocurrencies on multiple decentralized exchanges (DEXs) through a single platform. DEXs accomplish this by aggregating the liquidity pools of different DEXs and displaying the prices for those pools on one interface.

1nch is an example of a DEX aggregator.

What is Bancor?

Bancor is a DeFi protocol that allows for the conversion of tokens that reside on different blockchains.

What is slippage on a DEX?

On a DEX, crypto slippage refers to the actual fill price of a crypto swap vs the anticipated fill price. In volatile markets, crypto assets within liquidity pools can change dramatically, which often leads to slippage.

Mike Martin

Mike Martin formerly served as the Head of Content for tastycrypto. Before joining tastycrypto, Michael worked in the active trader divisions of thinkorswim, TD Ameritrade, and Charles Schwab. He also served as a writer and editor for projectfinance.

Michael has been active in the crypto community since 2017. He holds certifications from Duke University in decentralized finance (DeFi) and blockchain technology.

🍒 tasty reads

The Core Blockchain and DeFi Ecosystem: What You Need to Know

7 Best DePIN Crypto Projects

What Is Symbiotic and How Does It Work in 2024?

Ethereum vs Ethereum ETFs – 5 Major Differences