Arbitrum is a Layer 2 scaling solution for the Ethereum blockchain that processes fast transactions while reducing network costs.

Written by: Mike Martin | Updated June 29, 2024

Reviewed by: Ryan Grace

Fact checked by: Laurence Willows

Following the release of its native token (ARB) in 2023, the Arbitrum blockchain network has exploded onto the DeFi scene. In these FAQs, we’ll teach you all the basics about this Level 2 network.

🍒 tasty takeaways

Arbitrum is a Layer 2 Ethereum scaling solution that increases throughput by bundling multiple transactions into one, allowing developers to create decentralized applications more cost-effectively than on the Ethereum mainnet.

Unlike other Layer 2 solutions, Arbitrum employs ‘rollups with fraud proof’ which ensures high security and keeps transaction fees minimal.

By leveraging ‘rollups’, Arbitrum offers reduced gas fees, processing more transactions off-chain before they’re grouped and sent to the Ethereum mainnet.

While Arbitrum is fundamentally a blockchain network with a native cryptocurrency named ‘ARB’, it’s on its way to full decentralization, having originally been developed by Offchain Labs.

Users can tap into decentralized exchanges like Uniswap via Arbitrum and purchase its native token, ARB, from popular centralized and decentralized crypto exchanges.

What is Arbitrum used for?

Arbitrum is a Layer 2 Ethereum scaling solution that uses Optimistic Rollup technology (which bundles many transactions into one) to increase throughput. Arbitrum is used by developers to build decentralized applications in a more cost-efficient environment than the Ethereum mainnet.

How is Arbitrum different from other Layer 2s?

Arbitrum differs from other Layer 2 scaling solutions because this blockchain uses ‘rollups with fraud proof’. Fraud proofs allow Arbitrum to have extremely high security while at the same time keeping transaction fees low.

📚 Read: Fraud Proofs: How Validators Keep Arbitrum Honest

How does Arbitrum offer lower gas fees than Ethereum?

Arbitrum uses ‘rollups’ to offer lower gas fees. Rollups allow many transactions to be processed together off-chain before being sent to the Ethereum mainnet as a single, yet bundled, transaction. This method is much more cost-efficient than validating orders one at a time, as they are done on Ethereum.

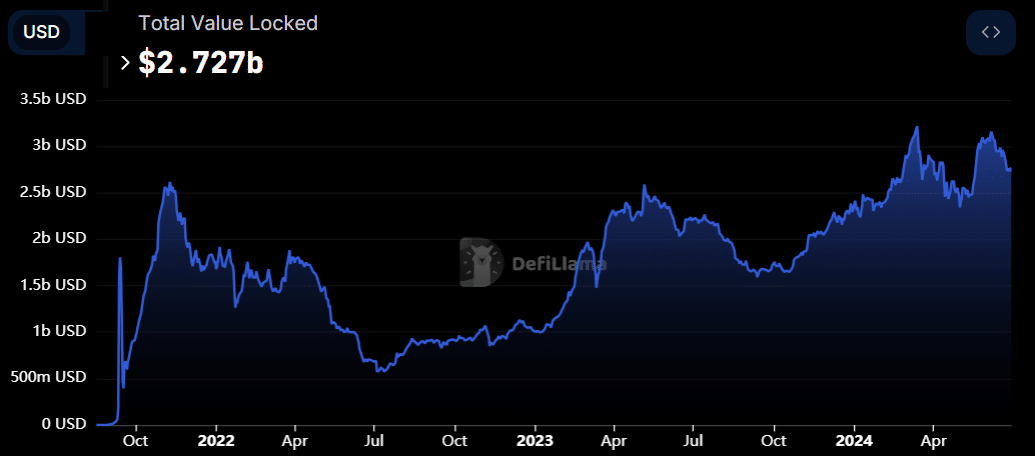

What is the TVL of Arbitrum?

Source: DefiLlama

In June 2024, the total value locked (TVL) in decentralized finance (DeFi) applications built on Arbitrum is about $2.7 billion, according to data from DefiLlama.

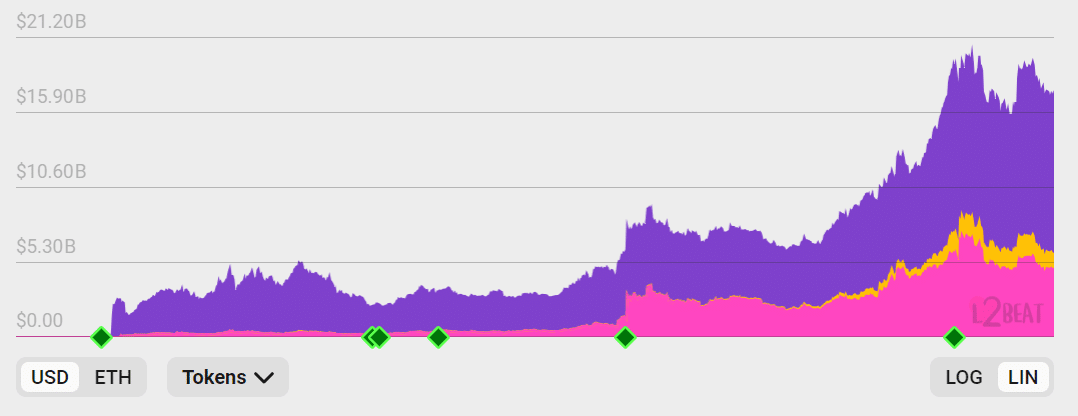

A broader TVL metric tracked by L2Beat, which includes all crypto assets bridged to Arbitrum, suggests that the Layer 2 hosts $16.8 billion in TVL, which makes by far the largest Layer 2 solution.

Source: L2Beat

How do I buy Arbitrum?

You can buy Arbitrum (ARB) on many different centralized and decentralized crypto exchanges. In order to interact with a decentralized crypto exchange (DEX), you’ll need to connect a self-custody crypto wallet.

Is Arbitrum a cryptocurrency?

Arbitrum is a blockchain network; the native cryptocurrency for Arbitrum is ‘ARB.’

Who owns Arbitrum?

Though Offchain Labs was Arbitrum’s initial developer, Arbitrum is in the process of becoming a completely decentralized network.

The core element of the network’s decentralized model is Arbitrum DAO (from decentralized autonomous organization), which enables ARB holders to vote on major changes in the ecosystem.

Is Arbitrum built on Ethereum?

Yes, Arbitrum is built on the Ethereum blockchain as a Layer 2 network.

Is Arbitrum an exchange?

Arbitrum is a blockchain network and not an exchange. However, you can access decentralized exchanges (like Uniswap) through the Arbitrum network.

Can you buy ETH on Arbitrum?

Though you can not directly purchase ETH (ether) on Arbitrum, you can purchase Wrapped ETH (WETH) as this crypto is an ERC-20 token.

How do you convert Ethereum to Arbitrum?

Ether can be converted to Arbitrum by using the Arbitrum Token Bridge.

What is the max supply of Arbitrum?

The max supply of Arbitrum is 10,000,000,000 ARB coins.

What exchanges is Arbitrum listed on?

Arbitrum (ARB) is listed on most major centralized crypto exchanges, including Binance and Coinbase. It is also offered on decentralized exchanges (DEXs), such as Sushi, Slingshot, and Uniswap.

🍒 Read Next: DeFi Self-Custody Wallet FAQs

Mike Martin

Mike Martin formerly served as the Head of Content for tastycrypto. Before joining tastycrypto, Michael worked in the active trader divisions of thinkorswim, TD Ameritrade, and Charles Schwab. He also served as a writer and editor for projectfinance.

Michael has been active in the crypto community since 2017. He holds certifications from Duke University in decentralized finance (DeFi) and blockchain technology.

The Core Blockchain and DeFi Ecosystem: What You Need to Know

7 Best DePIN Crypto Projects

What Is Symbiotic and How Does It Work in 2024?

Ethereum vs Ethereum ETFs – 5 Major Differences