Self-custody crypto wallets give users direct access to their private keys via seed phrases. In this article, we will answer all of the questions you have on DeFi self-custody crypto wallets.

Written by: Mike Martin | Updated September 5, 2024

Reviewed by: Ryan Grace

Fact checked by: Laurence Willows

What is a self-custody wallet in DeFi?

In DeFi (decentralized finance), a self-custody wallet is a type of wallet that gives users control over and direct access to their private keys. This allows users to connect their self-custody wallet to decentralized protocols. In DeFi, these protocols include:

Borrowing and lending protocols

Staking protocols

Derivative trading protocols

Is DeFi wallet and crypto wallet different?

A DeFi wallet and a crypto wallet are essentially the same things. DeFi wallets (like the tastycrypto wallet) are crypto wallets that specialize in making it easier for their user to connect and interact with DeFi dApps.

📚 Read: Crypto vs DeFi – How They Differ

What are self-custody wallets?

Self-custody crypto wallets (non-custodial crypto wallets) are a type of crypto wallet that allows users to maintain ownership over their private keys without involving intermediaries. Self-custody wallets are accessed through a seed phrase.

Self-custody wallets are mostly associated with the Ethereum network as the Bitcoin ecosystem does not support smart contracts.

There are two kinds of self-custody wallets: hot wallets (connected to the internet) and cold wallets (not connected to the internet).

📚 Read! Hot Wallet vs Cold Wallet

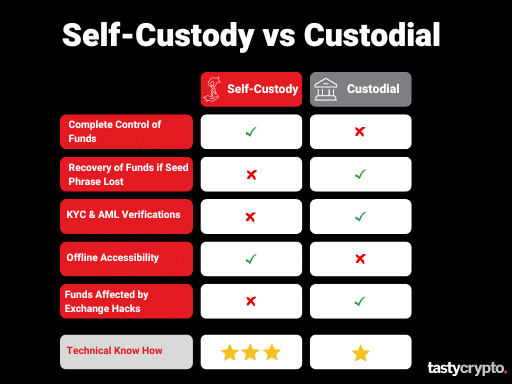

What is the difference between a custodial wallet and a self-custody wallet?

With custodial wallets, crypto exchanges, like Coinbase, maintain control over their user’s private keys. In custodial wallets, users must trust that a central entity is holding their crypto 1×1 as they can not track their crypto assets on a blockchain.

Self-custody wallets give users the ability to control and manage their private keys. To assure a self-custody wallet does not get hacked, users must make sure security measures are in place.

Is DeFi wallet custodial?

A DeFi wallet is a self-custody wallet, not a custodial wallet. In order to access DeFi, users must be able to access their private keys, which is impossible with custodial wallets as exchanges hold these keys for their customers.

Can IRS track DeFi wallets?

Since all transactions on public blockchains are recorded publicly, it is possible for the IRS to track DeFi wallets. However, since DeFi wallets are pseudonymous, it may be difficult for the IRS to trace an address to an actual person.

📚 Read! Can the IRS Track Cryptocurrency? – The Risks of Tax Evasion

Does DeFi wallet report to IRS?

DeFi wallets do not directly report their user’s activity to the IRS. It is the responsibility of the individual to report gains, losses, and interest earned to the IRS. For this reason, crypto participants need to keep an accurate record of their DeFi transactions to report on their Schedule D and Form 8949.

How do I protect my DeFi wallet?

Some measures to protect a DeFi wallet include:

Keep seed phrase/private key stored in a secure location.

Enable two-factor authentication for wallet access.

Use reputable DeFi protocols that have had at least 2 audits done.

Use a dedicated device when accessing your DeFi wallet.

Keep the device your DeFi wallet is stored on secure.

Use a strong password for your DeFi crypto wallet.

Be on the lookout for phishing scams.

📚 Read! tastycrypto Wallet: Safety And Security Tips

Is DeFi wallet safe from bankruptcies?

No business is immune from bankruptcies, including DeFi wallets. However, since the issuer of a DeFi wallet does not have access to their user’s seed phrases/private keys, crypto held on DeFi wallets will be safe even in the event of bankruptcy. As long as you have the seed phrase for a DeFi wallet, you can access the crypto within the wallet using any DeFi self-custody wallet.

Does the IRS know I own crypto?

If you hold crypto on a centralized exchange, such as Coinbase or Gemini, the IRS can easily determine whether or not you own crypto. If you own crypto in a self-custody wallet, it will be more difficult for the IRS to determine if you own crypto. However, since all blockchain transactions are viewable publicly, the IRS can indeed trace crypto transactions back to you.

What happens if you don’t pay a DeFi loan?

If you do not pay a loan that you took in DeFi, a few things could happen. In most cases, DeFi lending protocols will take ownership over some or all of the crypto you put up for collateral to receive the loan. Since crypto loans are over-collateralized, this assures the parties that lent you the crypto do not lose funds.

What happens if my crypto wallet goes out of business?

Since self-custody crypto wallet issuers do not have access to their user’s private keys, any crypto held on a wallet will be safe in the event of the issuer shutting down. To regain access to these funds, users simply open another self-custody wallet using the seed phrase generated by the out-of-business wallet.

Will I lose my crypto if Coinbase shuts down?

If Coinbase shuts down, they will most likely return crypto to their users. However, if Coinbase is hacked, you may lose all of your cryptocurrency held with Coinbase. Since there is no FDIC insurance in crypto, this would be a complete loss.

Can your crypto still grow in a wallet?

Yes, your crypto can still grow in a self-custody wallet.

How do I get my money out of a crypto DeFi wallet?

To get digital assets out of a DeFi wallet, a user must send that crypto to an exchange. After the crypto is on an exchange (like Coinbase or Kraken), it can be converted to fiat currency like US Dollars and then withdrawn.

Is Coinbase a DeFi wallet?

Coinbase offers both self-custody and custodial crypto wallets. Their self-custody wallet can be used to access DeFi, so could be considered a DeFi Wallet.

What are the cons of DeFi wallets?

Some cons of DeFi wallets include lost seed phrases, phishing scams, protocol hacks, complexity, and limited customer support (but not at tastycrypto!).

🍒 Want to learn more DeFi terms? Check out our DeFi glossary!

Mike Martin

Mike Martin formerly served as the Head of Content for tastycrypto. Before joining tastycrypto, Michael worked in the active trader divisions of thinkorswim, TD Ameritrade, and Charles Schwab. He also served as a writer and editor for projectfinance.

Michael has been active in the crypto community since 2017. He holds certifications from Duke University in decentralized finance (DeFi) and blockchain technology.

🍒 tasty reads

The Core Blockchain and DeFi Ecosystem: What You Need to Know

7 Best DePIN Crypto Projects

What Is Symbiotic and How Does It Work in 2024?

Ethereum vs Ethereum ETFs – 5 Major Differences