In cryptocurrency, DeFi lending refers to the process of lending digital assets to borrowers on peer-to-peer platforms. No centralized intermediaries are required.

Written by: Mike Martin | Updated July 26, 2024

Video by: Ryan Grace

Fact checked by: Laurence Willows

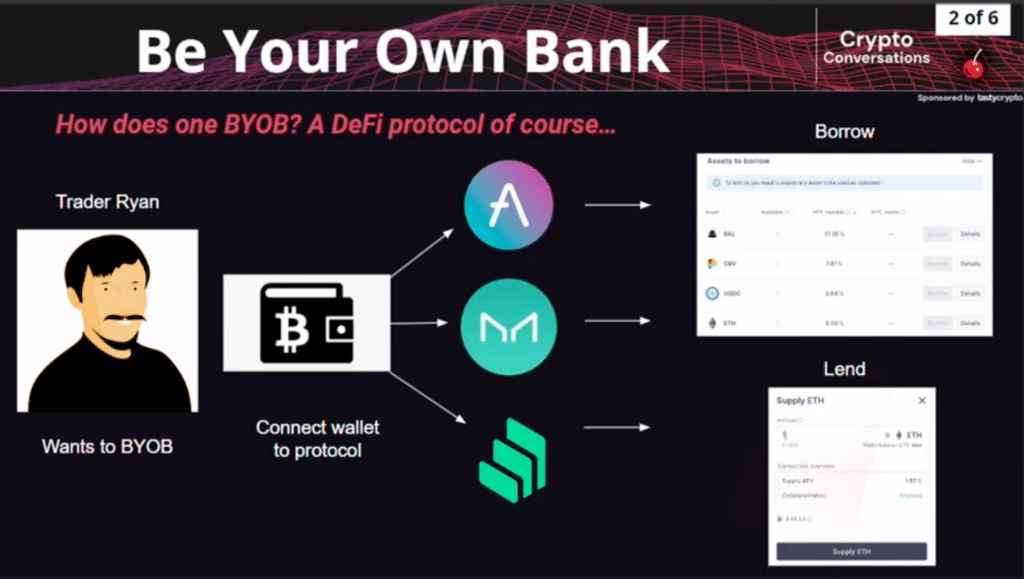

In this video, we will explore how blockchain technology and cryptocurrencies have revolutionized lending.

🍒 tasty takeaways

DeFi lending revolutionizes finance through crypto, smart contracts, and blockchain technology.

It eliminates intermediaries, offering higher interest rates and increased accessibility.

Prominent platforms like Aave and Compound facilitate decentralized lending and borrowing.

Use cases include collateralized loans, yield farming, and stablecoin liquidity.

Challenges include volatility risks, regulatory considerations, and smart contract vulnerabilities, but the future outlook for DeFi lending is promising

DeFi Lending Summary

| Details | |

|---|---|

| Definition | DeFi lending refers to peer-to-peer lending of digital assets on decentralized platforms, eliminating the need for centralized intermediaries. |

| Benefits | Offers liquidity, higher interest rates, decentralization, security, flexible loan terms, and accessibility to new lending and borrowing opportunities. |

| Platforms | Aave and Compound are notable platforms that facilitate decentralized lending and borrowing. |

| Use Cases | Includes collateralized loans, yield farming, leveraged trading, and providing liquidity to stablecoin pools. |

| Challenges | Faces issues like volatility risks, regulatory considerations, and smart contract vulnerabilities. |

| Outlook | The future of DeFi lending is promising with potential to reshape the global financial system, offering more diversity and inclusion. |

Understanding DeFi Lending

In recent years, the world of finance has witnessed a paradigm shift with the emergence of decentralized finance (DeFi). At the forefront of this revolution is DeFi lending, which leverages the power of cryptocurrencies, smart contracts, and blockchain technology to provide individuals with new opportunities to lend and borrow funds.

In this comprehensive guide, we will delve into the intricacies of DeFi lending, explore its benefits, discuss the role of smart contracts and blockchain, explore popular platforms such as Aave and Compound, analyze its use cases, and shed light on the challenges and future prospects of this groundbreaking financial ecosystem.

Read: How Does DeFi Work?

The Rise of DeFi Lending

In order to access DeFi, you’ll first need a self-custody crypto wallet to connect, like the tastycrypto wallet!

DeFi lending is a disruptive force that offers a decentralized alternative to traditional lending facilitated by banks and financial intermediaries. It enables participants to engage in lending and borrowing activities directly, eliminating the need for intermediaries and enabling seamless peer-to-peer transactions. This emerging ecosystem is powered by blockchain technology, particularly the Ethereum network, which facilitates the execution of smart contracts.

The Role of Smart Contracts and Blockchain in DeFi Lending

At the heart of DeFi lending are smart contracts, which are self-executing contracts with the terms of the agreement directly written into code. These contracts automatically enforce lending conditions, collateral requirements, and interest rates, ensuring a transparent and tamper-proof process. Blockchain technology serves as the underlying infrastructure, providing a distributed ledger where all transactions are recorded immutable.

📚 Read: What Are Smart Contracts And How Do They Work?

Advantages of DeFi Lending

DeFi lending offers several compelling advantages that have contributed to its rapid growth and popularity:

Liquidity and Accessibility: DeFi lending platforms enable individuals to access liquidity by leveraging their crypto assets as collateral. This accessibility empowers users to unlock the value of their holdings without undergoing the lengthy and cumbersome processes associated with traditional banks.

Higher Interest Rates: Compared to traditional savings accounts, DeFi lending platforms often offer higher interest rates on deposited assets. Lenders can earn attractive yields by lending their crypto assets to borrowers, thereby generating passive income on their crypto.

Decentralization and Security: DeFi lending operates in a decentralized manner, removing the need for intermediaries and minimizing counterparty risks. Smart contracts execute lending agreements with predefined conditions, ensuring transparency, security, and trustlessness.

Flexible Loan Terms: DeFi lending platforms offer borrowers the flexibility to choose their loan terms, including the loan amount, duration, and interest rate. This customization allows individuals to tailor their borrowing experience according to their specific needs.

Top DeFi Lending Platforms

In crypto, TVL stands for ‘total value-locked’, which means the total amount of crypto currently in use on the platform.

📕 Read: TVL vs Market Cap

Several prominent decentralized applications (dApps) have emerged as leaders in the DeFi lending landscape. Let’s explore two notable platforms:

Aave: Aave is a decentralized lending platform that allows users to deposit their crypto assets into liquidity pools. These funds are then available for borrowers to borrow against by providing sufficient collateral. Aave offers various features, such as flash loans, which provide instant and uncollateralized loans for arbitrage or other time-sensitive purposes.

Compound: Compound is another popular DeFi lending protocol built on the Ethereum blockchain. It enables users to lend or borrow assets directly from the protocol. The interest rates are algorithmically determined based on the demand and supply dynamics within the lending pools.

Use Cases of DeFi Lending

DeFi lending has a broad range of use cases that extend beyond traditional borrowing and lending scenarios. Some notable examples include:

Collateralized Loans: Borrowers can utilize their crypto assets as collateral to secure loans, avoiding the need for credit checks or traditional collateral such as real estate.

Yield Farming: Yield farming involves leveraging various DeFi protocols to optimize returns on deposited assets. Users can deposit their crypto assets into liquidity pools and earn additional tokens or interest by participating in different farming strategies.

Leveraged Trading: Traders can use borrowed funds to amplify their trading positions, potentially increasing their profits. DeFi lending platforms enable traders to access leverage without the need for intermediaries.

Stablecoin Liquidity: Stablecoins, such as DAI, are a popular choice for lending and borrowing in DeFi. Lenders can earn interest by providing liquidity to stablecoin liquidity pools, while borrowers can access stablecoin loans to mitigate price volatility.

📕 Read: How Do Liquidity Pools Work?

Challenges and Future Outlook

While DeFi lending presents exciting opportunities, it is not without its challenges. Some key considerations include:

Volatility Risks: The crypto market is highly volatile, and sudden price fluctuations can impact the value of collateral. Proper risk management strategies are essential to mitigate potential losses.

Regulatory Environment: As DeFi lending gains mainstream attention, regulatory frameworks are likely to be established. Adhering to regulatory guidelines and ensuring compliance will be crucial for the long-term growth and stability of the ecosystem.

Smart Contract Risks: Smart contracts, while robust, are not immune to vulnerabilities. Thorough code audits and security measures are necessary to safeguard users’ funds and protect against potential exploits.

Looking ahead, the future of DeFi lending appears promising. The ecosystem is expected to continue evolving, offering more diverse lending opportunities, improved user experiences, and enhanced security measures. Continued innovation in dApps, interoperability, and scalability will pave the way for broader adoption and integration with traditional financial systems.

Embracing the Potential of DeFi Lending

DeFi lending represents a paradigm shift in the financial landscape, empowering individuals with greater control over their assets and financial futures. By harnessing the power of crypto, smart contracts, and blockchain technology, DeFi lending offers liquidity, higher interest rates, and a decentralized alternative to traditional lending. As the ecosystem matures and overcomes challenges, it holds the potential to reshape the global financial system, making it more inclusive, transparent, and accessible to all.

In conclusion, DeFi lending is revolutionizing finance by leveraging the advancements in blockchain technology and providing individuals with innovative financial services. By eliminating intermediaries, offering higher interest rates, and unlocking new opportunities, DeFi lending opens doors to a decentralized and permissionless financial ecosystem. While challenges and risks exist, proper risk management, regulatory compliance, and user education are key to unlocking the full potential of DeFi lending. As the ecosystem continues to evolve, it will play an increasingly vital role in shaping the future of finance.

DeFi Lending Takeaways

DeFi lending leverages cryptocurrencies, smart contracts, and blockchain to provide decentralized lending and borrowing opportunities.

Smart contracts enforce lending conditions, collateral requirements, and interest rates in a transparent and tamper-proof manner.

Advantages of DeFi lending include liquidity and accessibility, higher interest rates, decentralization, security, and flexible loan terms.

Aave and Compound are leading DeFi lending platforms that offer features like flash loans and algorithmically determined interest rates.

DeFi lending has use cases such as collateralized loans, yield farming, leveraged trading, and stablecoin liquidity, but it also faces challenges like volatility risks, regulatory considerations, and smart contract vulnerabilities.

Additional Reading:

- Decrypt: What Is Aave? Inside the DeFi Lending Protocol

- The Defiant: What is DeFi Lending?

- tastycrypto: USDT vs USDC vs DAI: Which Stablecoin is Best?

Mike Martin

Mike Martin formerly served as the Head of Content for tastycrypto. Before joining tastycrypto, Michael worked in the active trader divisions of thinkorswim, TD Ameritrade, and Charles Schwab. He also served as a writer and editor for projectfinance.

Michael has been active in the crypto community since 2017. He holds certifications from Duke University in decentralized finance (DeFi) and blockchain technology.

🍒 tasty reads

What Is Ether.fi? Liquid Staking Reinvented

What Is Wrapped Ether? Complete wETH Guide

Impermanent Loss in DeFi: The Complete Guide

What is GMX? DeFi Perpetual Exchange 2024 Guide

What Is Defi Liquidity Mining and How Does It Work?