Ether.fi is a decentralized staking protocol that maximizes Ethereum staking rewards by using EigenLayer technology for restaking and providing liquid staking tokens.

Written by: Anatol Antonovici | Updated May 29, 2024

Reviewed by: Mike Martin

Fact checked by: Ryan Grace

Ether.fi is reinventing Ethereum staking by offering maximum returns thanks to EigenLayer restaking and DeFi yields.

Table of Contents

🍒 tasty takeaways

Ether.fi is a liquid restaking protocol that automatically restakes ETH through EigenLayer and offers a liquid restaking token (LRT) for use in DeFi.

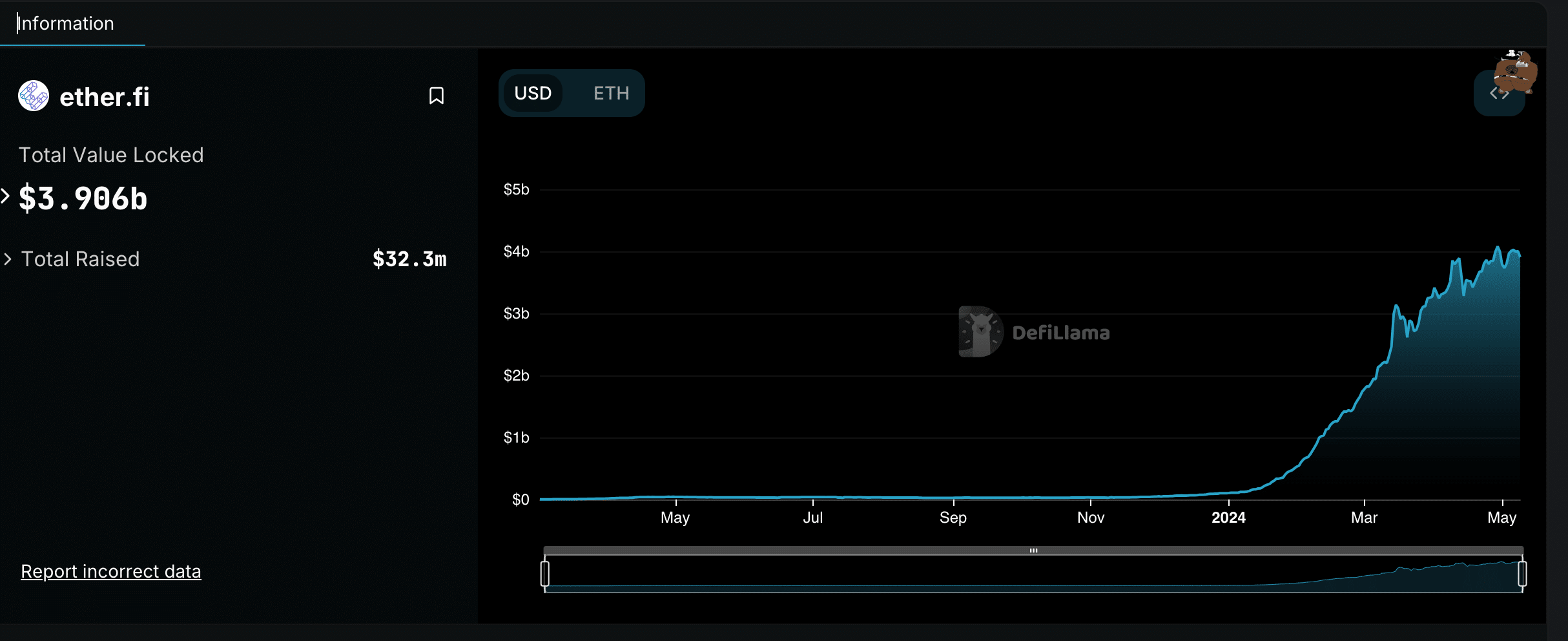

Ether.fi’s TVL has surged by over 3,600% since the beginning of 2024.

ETHFI is Ether.fi’s governance token that launched in March 2024.

Ether.fi Summary

| Feature | Details |

|---|---|

| Protocol | Decentralized Ethereum staking with EigenLayer restaking and liquid tokens for DeFi. |

| TVL Growth | Increased over 3,600% since early 2024, reaching almost $4 billion. |

| Ether.fi Token (ETHFI) | Launched March 2024, governance token with a current market cap around $440 million. |

| Liquid Product | Offers automated DeFi strategy, aiming for 20% APY using staked and restaked ETH. |

| Accessibility | Reduces entry barriers, offers staking for any ETH amount, enhancing DeFi accessibility. |

| Risks | Exposed to centralization and slashing risks inherent in EigenLayer technology. |

What Is Ether.fi?

Ether.fi is a decentralized staking protocol that enables Ethereum stakers to maximize their potential rewards.

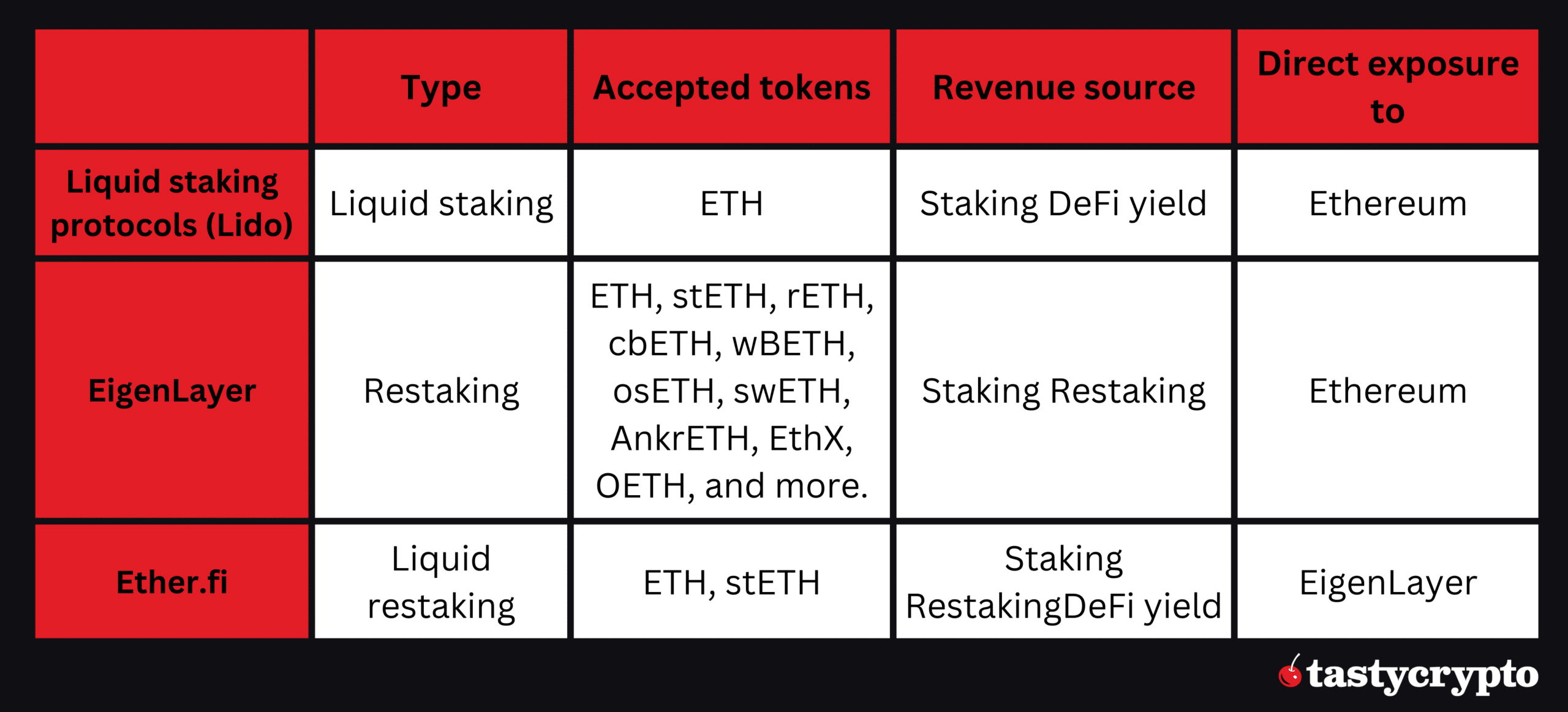

The platform works similarly to liquid staking protocols like Lido. It enables users to deposit ETH or liquid staking tokens (LSTs) for staking and receive an equivalent asset, eETH, which can be used in decentralized finance (DeFi) for yield opportunities.

However, unlike standard liquid staking protocols, Ether.fi offers native restaking by leveraging EigenLayer technology. This feature ensures an additional reward stream that can boost the stakers’ returns.

The goal of Ether.fi is to make staking more accessible, profitable, and genuinely decentralized.

The protocol raised over $30 million in two rounds, with Series A led by Bullish and CoinFund.

Source: X Post

Ethereum Staking Today

Following the Ethereum Merge upgrade, which is part of the blockchain’s transition from Proof of Work (PoW) to Proof of Stake (PoS), ETH holders can participate in the block validation process by staking their coins and running a node.

Validators must lock at least 32 ETH to help secure the network and earn rewards, with annual rates ranging from 3.5% to 7%. As of this writing, the minimum requirement means spending about $100,000, which is prohibitive for most retail users. On top of that, validators have to lock their ETH during staking, potentially losing many opportunities in DeFi.

Liquid Staking Protocols Transform Staking

Retail users can become delegators by staking any ETH amount with specialized services pooling capital, reducing entry barriers, and maintaining a high degree of decentralization.

A popular option is decentralized staking solutions, which provide liquid staking tokens (LSTs) on a 1:1 basis for locked ETH, allowing stakers to explore DeFi opportunities while their funds are staked.

Over $40 billion worth of ETH is locked with liquid staking protocols.

Source: DeFiLlama

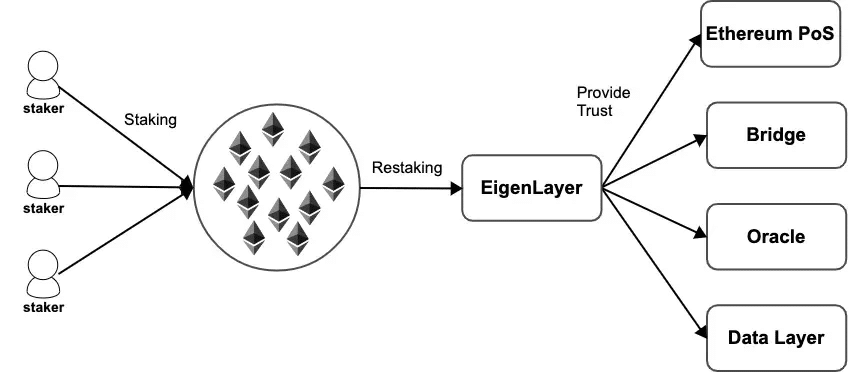

EigenLayer triggered another major trend in Ethereum staking: restaking. This new strategy enables retail ETH holders to increase potential rewards by repurposing the staked ETH to share mainnet security to so-called Actively Validated Services (AVSs). These include layer 2s, data layers, bridges, or decentralized applications (dapps).

You can go to our in-depth guide on EigenLayer to learn more about it.

EigenLayer unlocks additional yield by extending Ethereum mainnet’s security to dapps.

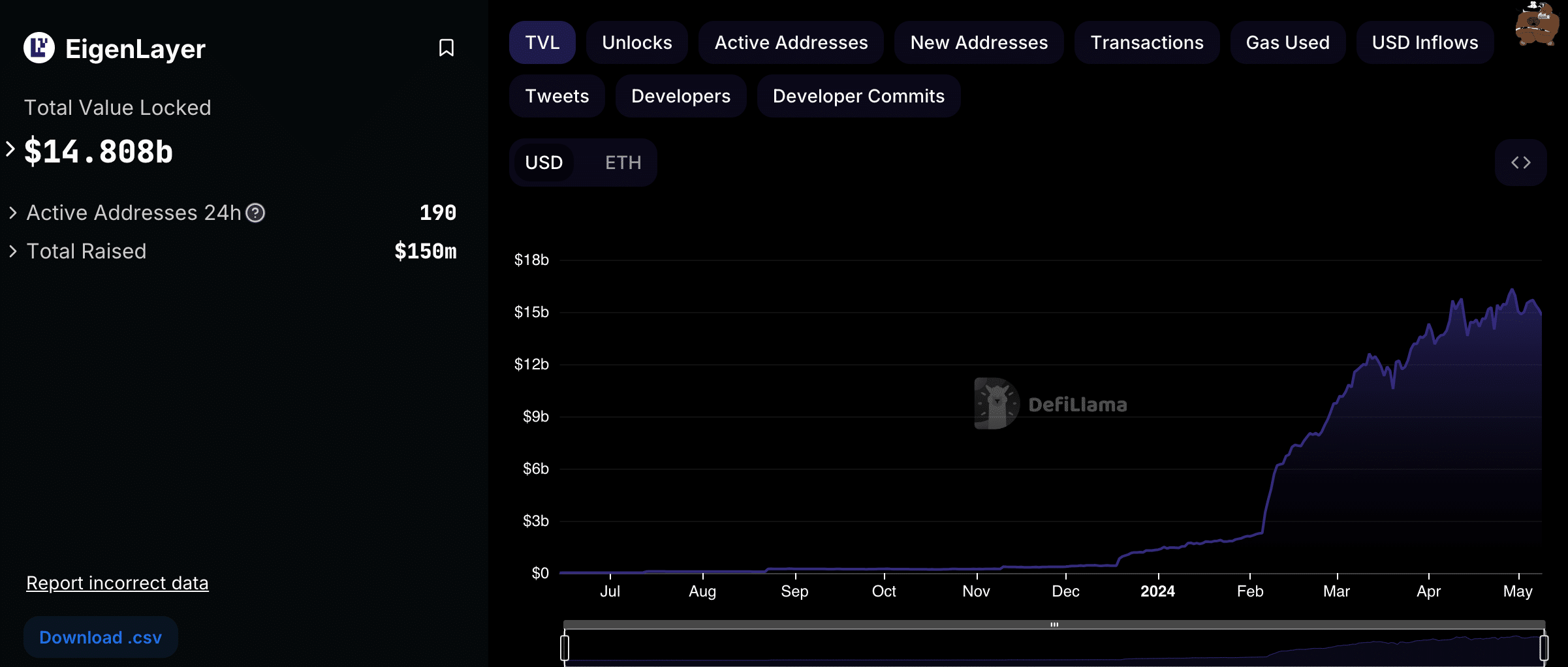

Since its launch in 2023, the total value locked (TVL) through EigenLayer has surged to about $15 billion.

Source: DeFiLlama – EigenLayer

EigenLayer enables users to deposit ETH and LSTs, but the drawback is that restaked LSTs are non-usable in DeFi. The protocol imposes a 7-day withdrawal period for redemption.

How Does Ether.fi Work?

Ether.fi is a liquid restaking protocol acting as a Lido-like service for EigenLayer: instead of staking ETH through Ethereum, the protocol automatically restakes via EigenLayer.

Ether.Fi users can stake ETH or LSTs and receive eETH on a 1:1 basis. While ETH and LST deposits are automatically restaked through EigenLayer for higher staking rewards, eETH can be used to explore DeFi opportunities for maximum profits. Therefore, Ether.Fi stakers benefit from three streams of income:

- Pure ETH staking

- Additional rewards are generated by restaking through EigenLayer (via EigenLayer points)

- DeFi yield

Source: Ether.fi

Ether.fi vs Liquid Staking Protocols

Ether.fi Adoption

Ether.fi’s TVL has skyrocketed from $100 million at the beginning of 2024 to almost $4 billion as of mid-May 2024.

Source: DeFiLlama – ether.fi Growth

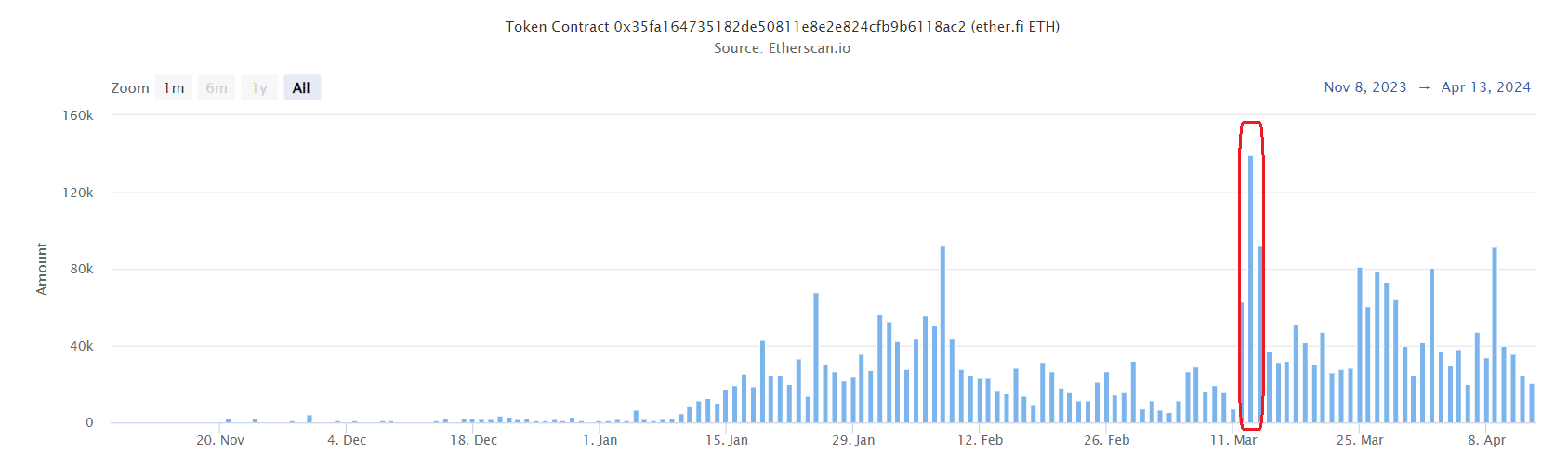

Interestingly, a good chunk of the TVL came from Tron’s Justin Sun, who deposited 120,000 ETH or about $480 million on March 13. That day still holds the record for the most considerable transfer amount.

Source: etherscan.io

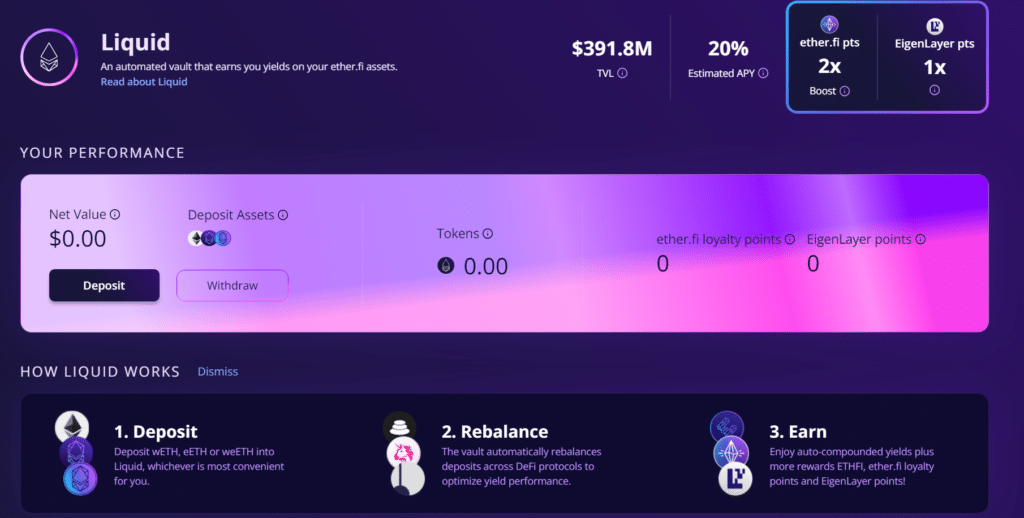

The liquid product has a TVL of almost $400 million.

Ether.fi may experience even greater adoption after it launches its Cash product, enabling users to borrow funds, including fiat money like USD, against their Ether.fi balance.

Source: Medium

Ether.fi also offers additional staking products for institutional investors, including non-fungible tokens (NFTs) backed by ETH deposits.

What Is ETHFI?

ETHFI is Ether.fi’s governance token launched in March 2024 through Binance’s launchpad.

The ETHFI token has a total supply of 1 billion, and its circulating supply accounts for about 11.5%.

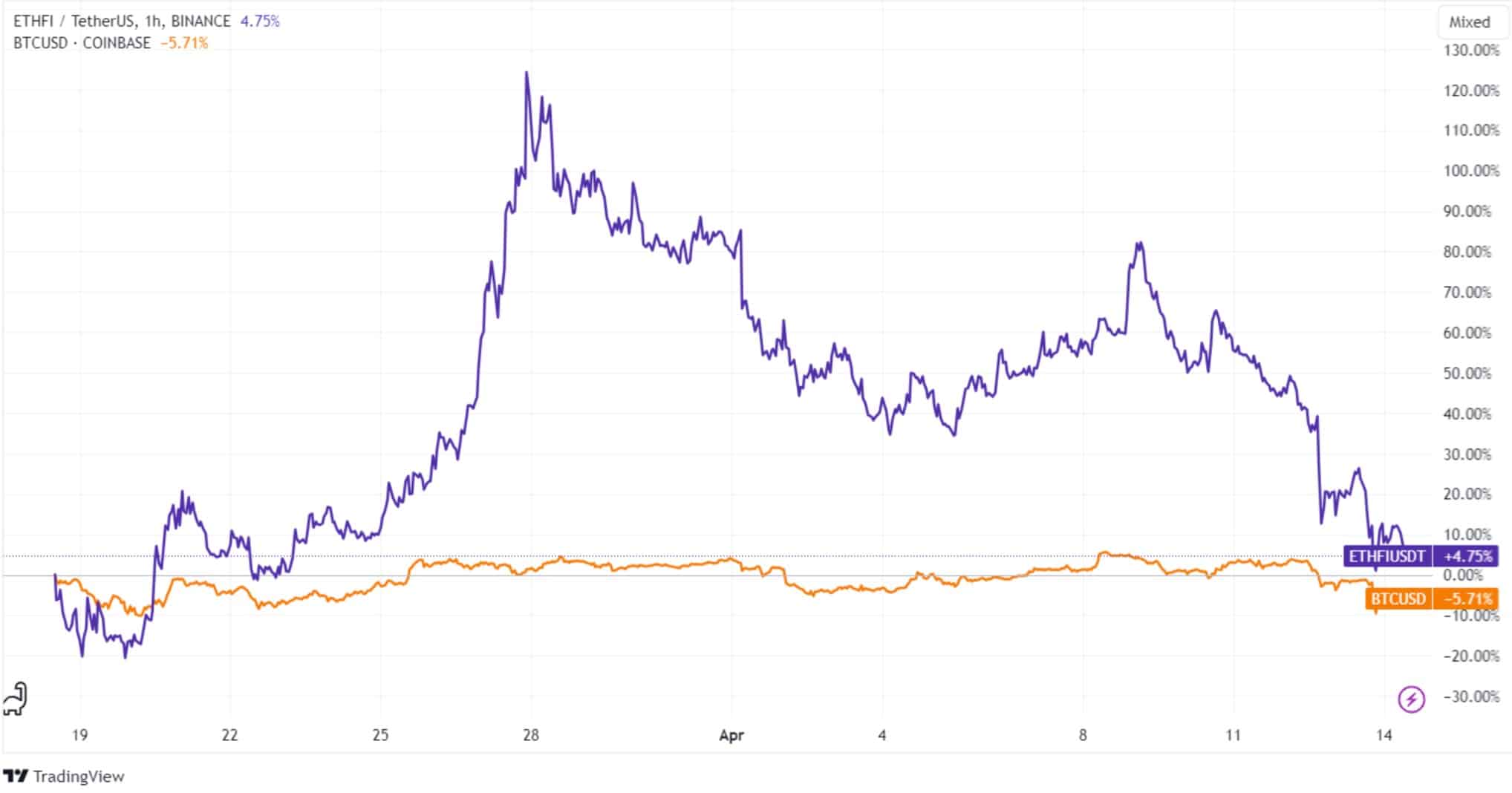

The new crypto asset launched with a market cap of about $500 million, which almost doubled within a week before correcting to the current $440 million as of mid–May. The pullback was caused by a massive airdrop of about 60 million ETHFI, which pushed the Ether.fi price below $4.

Despite the correction, the token has outperformed Bitcoin (BTC).

Source: TradingView

Ether.fi Pros

- Ether.fi offers maximum rewards for ETH stakers based on three income streams: staking, restaking and DeFi yield farming.

- The Liquid product offers an automated DeFi strategy that targets an APY of 20%.

- Ether.fi lowers entry barriers for ETH stakers and offers a decentralized and transparent environment.

- Users can deposit both ETH and LSTs.

Ether.fi Cons

- Ether.fi inherits the risks of EigenLayer, such as centralization risk and slashing.

- The Liquid strategy is not guaranteed to generate the stipulated APY.

- Restaking may lower the reward rate of pure ETH staking.

FAQs

What is Ether.fi?

Ether.fi is a decentralized staking protocol that enables users to maximize Ethereum staking rewards. Users can deposit ETH or liquid staking tokens (LSTs), receive eETH in return, and use it for DeFi yield farming. The platform automatically restakes the deposited funds using EigenLayer technology.

Why stake with Ether.fi?

Ether.fi offers maximum staking rewards by restaking with EigenLayer while offering a liquid restaking token for use in DeFi.

What is the ETHFI token?

ETHFI is Ether.fi’s governance token that enables holders to influence the ecosystem’s progress.

Is Ether.fi safe?

Ether.fi is decentralized and transparent, but it is exposed to EigenLayer risks, and like any other Ethereum service, its smart contract may have loopholes.

🍒 tasty reads

The Core Blockchain and DeFi Ecosystem: What You Need to Know

7 Best DePIN Crypto Projects

What Is Symbiotic and How Does It Work in 2024?

Ethereum vs Ethereum ETFs – 5 Major Differences

Anatol Antonovici

6+ years of experience writing for crypto brands and blockchain firms, including Coindesk, Cointelegraph, Bitcoinist, CryptoPotato, Algorand, and OTCTrade.com