EigenLayer introduces “restaking” to Ethereum. Restaking involves deploying the same ETH for staking on both Ethereum and other platforms, thereby broadening trust across these ecosystems and increasing the utility and rewards of staked tokens.

Written by: Anatol Antonovici | Updated February 15, 2024

Reviewed by: Mike Martin

Fact checked by: Ryan Grace

EigenLayer has quickly become one of the leading players in decentralized finance (DeFi). It introduces the concept of restaking. Read on to find out how this fast-growing platform works!

Table of Contents

🍒 tasty takeaways

EigenLayer is a decentralized protocol that enables users to restake their ETH and aim for higher rewards.

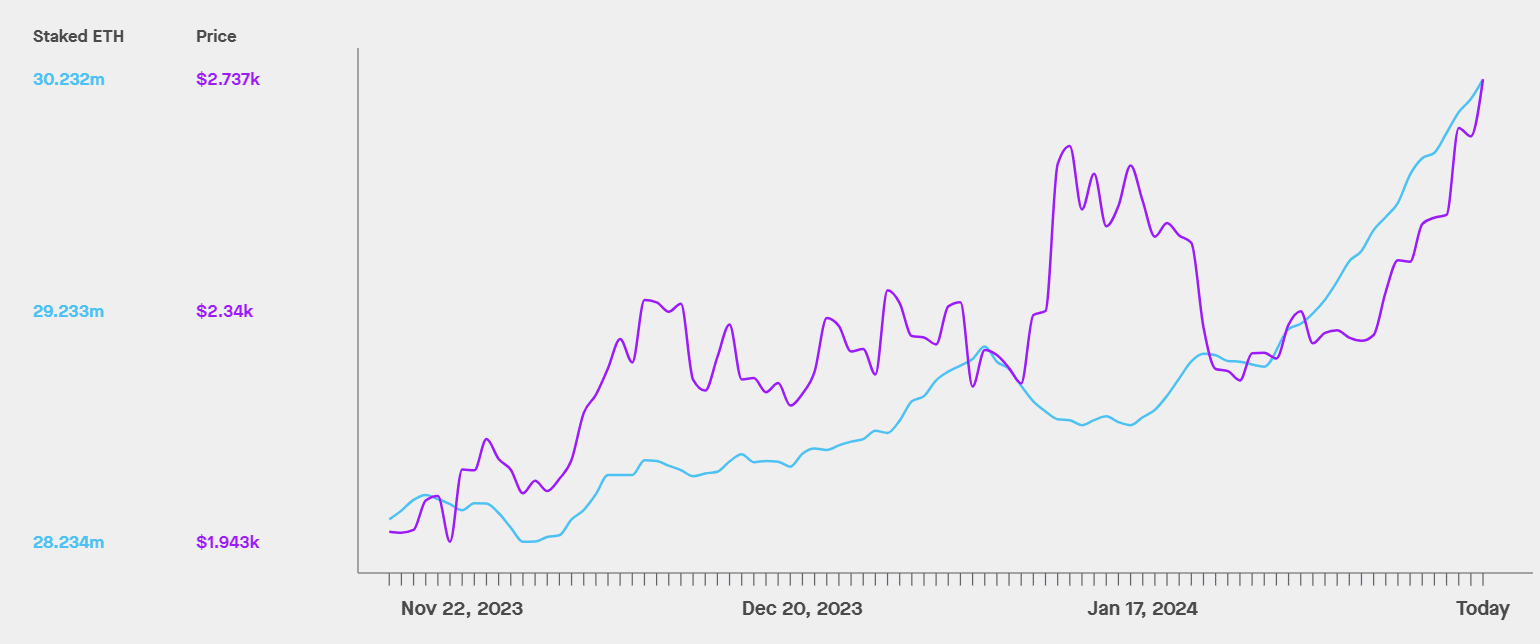

Its TVL has surged over 2,000% in less than two months and in 2024 is the fifth-largest DeFi protocol.

Thanks to restaking, non-EVM protocols and other blockchain apps can benefit from mainnet security.

EigenLayer Summary

| Topic | Summary |

|---|---|

| What Is EigenLayer? | Introduces "restaking" on Ethereum, allowing ETH to be staked on multiple platforms, increasing utility and rewards. |

| Impact on DeFi | As a leading DeFi player, EigenLayer's restaking significantly enhances protocol security and yield opportunities. |

| TVL Growth | TVL surged over 2,000% in under two months, ranking EigenLayer fifth in DeFi protocols. |

| Ethereum Staking Overview | Post-PoS, Ethereum enables ETH staking for block validation, with a 32 ETH minimum, equating to about $87,000. |

| Ethereum Restaking | EigenLayer's unique offering allows ETH stakers to secure other protocols for additional rewards without unstaking. |

| How EigenLayer Works | Facilitates non-EVM dApps to leverage mainnet security, optimizing costs and reliability through outsourced validation. |

| Restaking Strategies | Options include native staking and restaking LSTs or LP tokens from liquid staking protocols for enhanced yields. |

| Risks | Includes potential slashing, centralization risk, and yield fluctuations, despite offering significant benefits. |

What Is Ethereum Staking?

Following Ethereum’s transition from a Bitcoin-style Proof of Work (PoW) consensus mechanism to Proof of Stake (PoS), it now allows users to stake ETH for block validation purposes.

🍒What Is Crypto Staking and How Does It Work?

Staking involves locking an amount of ETH to help secure the network. Crypto participants stake ETH to earn rewards. The Ethereum protocol has a minimum deposit requirement of 32 ETH, which is the equivalent of about $87,000 as of this writing.

Alternatively, retail users can leverage specialized services that pool staking capital from ETH holders all over the globe, reducing entry barriers.

On top of that, there are DeFi staking services that offer liquid staking tokens (LST) in exchange for locked ETH, enabling users to explore DeFi opportunities while staking.

Currently, approximately 25% of all ETH is staked through liquid staking services such as Lido or Rocket Pool, in pools, or by individual holders.

Source: Staking Rewards

What Is Ethereum Restaking?

Ethereum restaking is a concept proposed by EigenLayer. It enables stakers on the Ethereum network to use their staked ETH to secure other protocols and earn additional rewards without having to unstake their tokens.

EigenLayer is currently the only decentralized service to offer restaking. It acts as a middleman for ETH stakers.

EigenLayer restaking works both with ETH and LSTs, such as those provided by Lido or RocketPool, e.g., stETH and rETH.

How Does EigenLayer Work?

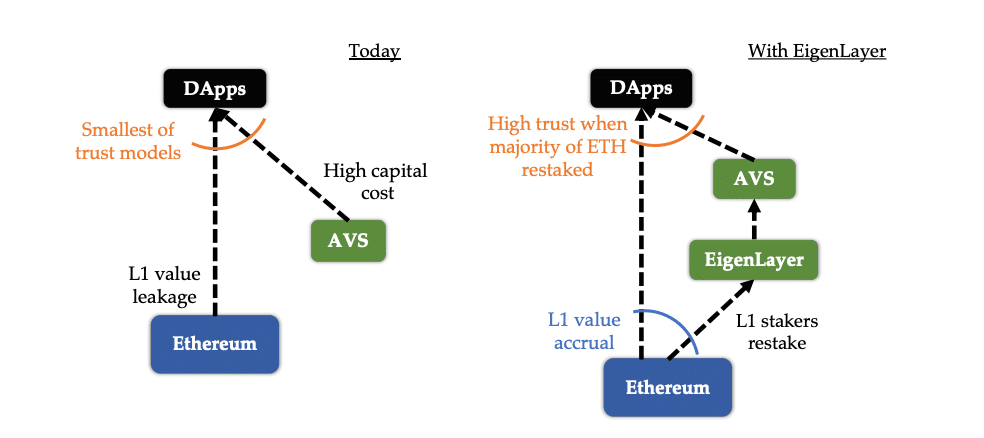

The Ethereum Virtual Machine (EVM) enables dapps to leverage the mainnet security. However, not all dapps can be deployed through the EVM. Many applications, such as bridges, oracles, decentralized exchanges (DEXs), and data availability protocols, must operate as actively validated systems (AVS) by running full nodes.

Thanks to EigenLayer, these AVS can benefit from the same level of security without having to set their validators, which greatly reduces costs and improves the reliability of these dapps. It’s as if EigenLayer outsources Ethereum’s security to non-EVM protocols, thus strengthening the Ethereum ecosystem.

Source: EigenLayer Whitepaper

The staked ETH is repurposed to offer validation services to other dapps. EigenLayer achieves this through an opt-in process in which users approve new slashing conditions on top of the consensus layer in return for greater rewards.

EigenLayer Ecosystem

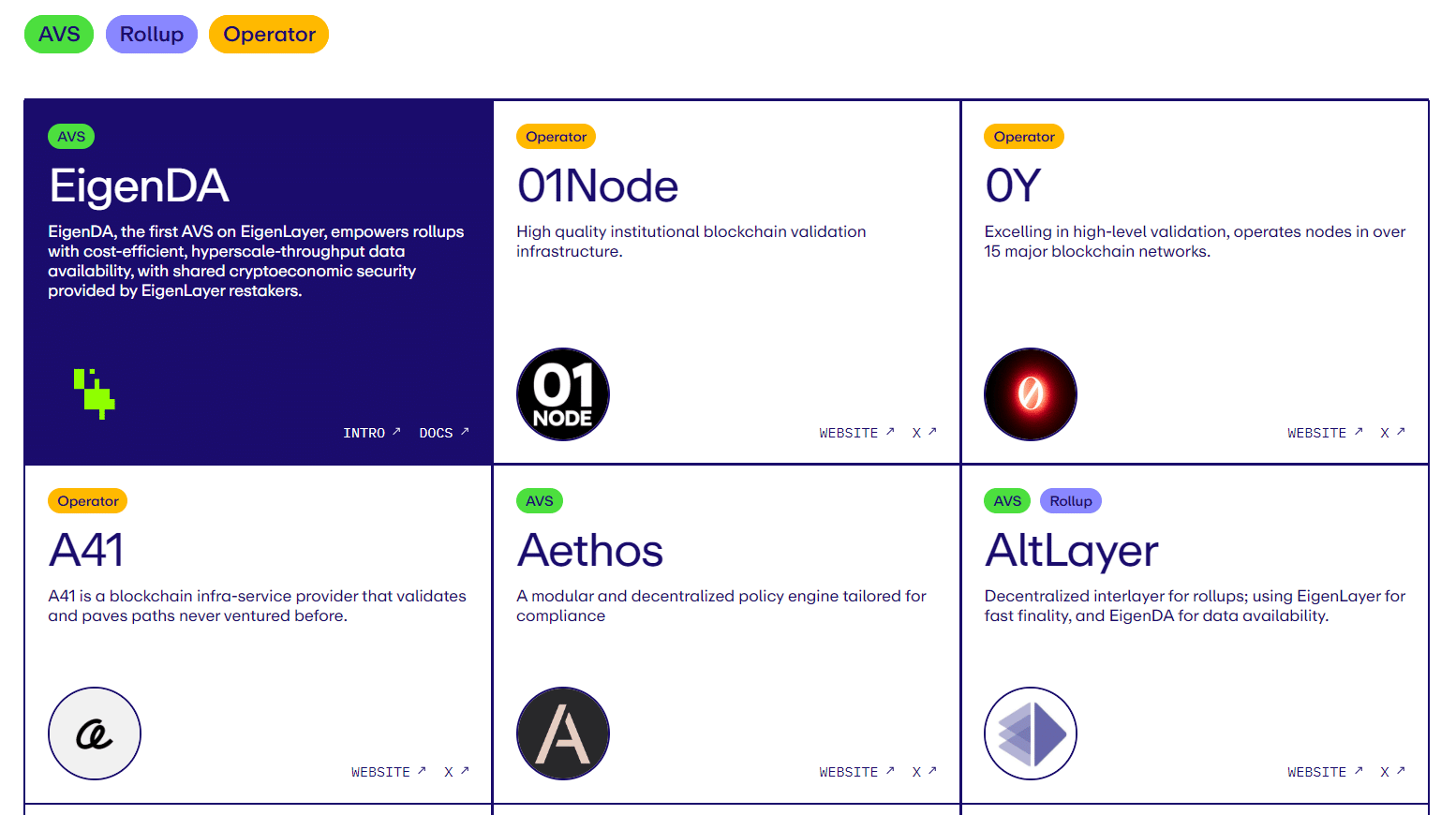

EigenLayer’s architecture comprises four key components as follows:

- Restakers – provide pooled security through Ethereum and play a key role on EigenLayer.

- AVS services – use the restaked ETH to improve their security while cutting costs.

- Rollups – leverage the services rendered by the AVS, including the so-called hyperscale data availability offered by the EigenLayer ecosystem.

- Operators – provide validation, which is essential for the AVS.

The full list of AVS, rollups, and operators is available on EigenLayer’s ecosystem page.

Source: EigenLayer

Restaking Strategies

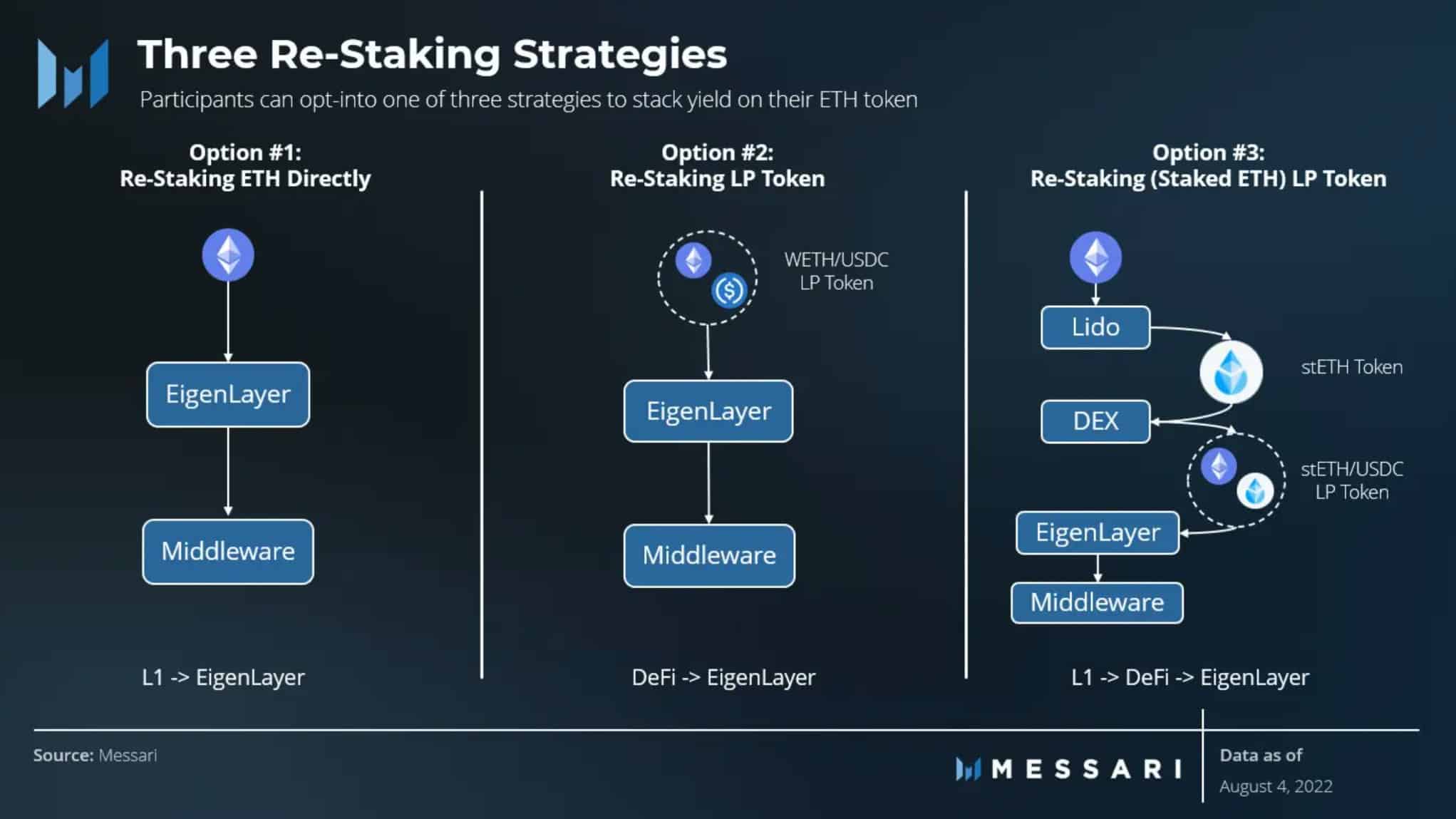

Users can choose from several restaking strategies, including:

- Native staking – users restake their staked ETH.

- LSD restaking – users restake the LSTs offered by liquid staking protocols like Lido.

- LSD LP restaking – users restake the liquidity provider (LP) tokens of a pair comprising an LST.

- ETH LP restaking – users restake the LP tokens of a pair comprising ETH.

Here, Messari visualized three of these strategies:

Source: Messari – Twitter

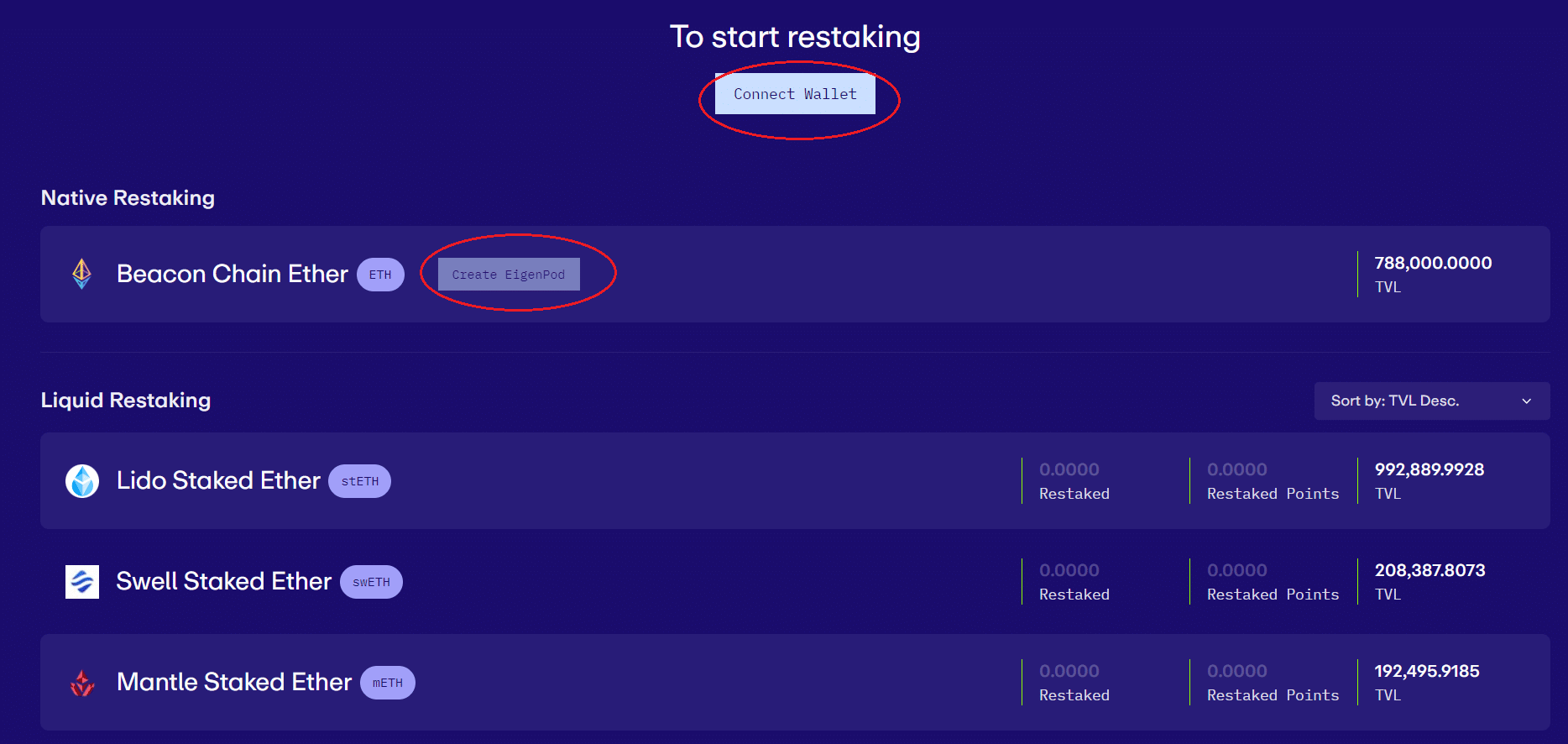

How Do I Restake on EigenLayer?

Here are the main steps to restake with EigenLayer:

- Choose your assets to restake. First, you should prepare the LST tokens of your choice. You can deposit with a liquid staking platform like Lido to receive LSTs.

- Go to the EigenLayer app and connect the self-custody wallet where you hold the LSTs.

- Complete the deposit. Input the amount you want to deposit and confirm the transaction.

You will be able to see the staking rewards and restaked ratio on the homepage.

If you are a validator and run a node on Ethereum, you can choose Native Restaking, which will require you to create an EigenPod through the app and then deposit ETH.

Source: EigenLayer

It is worth noting that EignLayer imposes a seven-day delay on withdrawals to add an extra security layer.

EigenLayer Risks

EigenLayer offers some key benefits to Ethereum-based Web3 apps, such as enhanced security and capital efficiency. It also allows stakeholders to secure higher rewards.

However, the new restaking concept comes with several risks. Ethereum co-founder Vitalik Buterin has also warned about these risks, some of which are:

- Slashing – when you stake your ETH or LSTs, you are exposed to slashing if you engage in malicious activity on a dapp. Up to 100% of your ETH can be slashed, although this shouldn’t happen with honest behavior.

- Centralization risk – if EigenLayer attracts a high proportion of staked ETH, it can become a systemic risk for the Ethereum ecosystem in the case it’s exploited. Users can move their withdrawal credentials to EigenLayer, which adds to the risk of centralization.

- Yield risks – if more stakers are chasing the higher yield of AVS, the resulting yield for actual protocol users may decline.

Despite risks, EigenLayer is growing rapidly, expanding its ecosystem by attracting TVL and developing new features and use cases.

FAQs

EigenLayer is an Ethereum-based protocol that lets ETH stakers target higher yields by letting their locked coins be restaked to improve the security of decentralized applications.

Restaking is a new concept in which users restake locked ETH or related liquid staking tokens (LSTs) to outsource the Ethereum security to secondary decentralized applications in return for higher rewards.

At the moment, EigenLayer doesn’t have its own crypto coin, but it may launch a native token as the ecosystem grows.

Yes, EigenLayer acts as a decentralized Ethereum restaking protocol.

🍒 tasty reads

The Core Blockchain and DeFi Ecosystem: What You Need to Know

7 Best DePIN Crypto Projects

What Is Symbiotic and How Does It Work in 2024?

Ethereum vs Ethereum ETFs – 5 Major Differences

Anatol Antonovici

6+ years of experience writing for crypto brands and blockchain firms, including Coindesk, Cointelegraph, Bitcoinist, CryptoPotato, Algorand, and OTCTrade.com