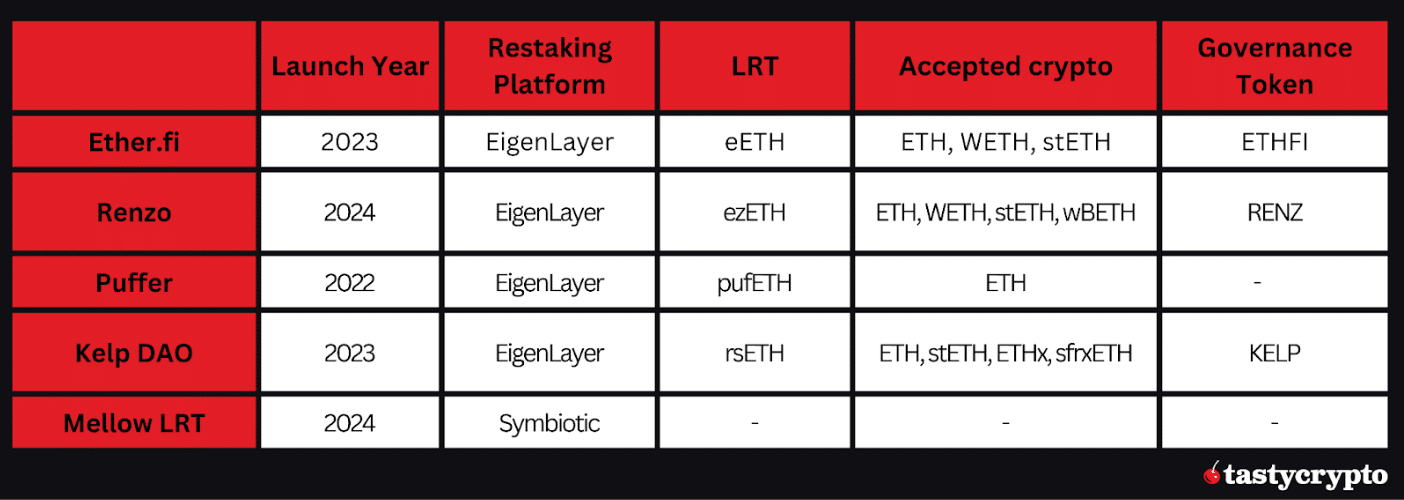

In 2024, the best liquid restacking protocols for increasing yields from staking Ethereum are Ether.fi, Renzo, Puffer Finance, Kelp DAO, and Mellow LRT.

Written by: Anatol Antonovici | Updated June 13, 2024

Reviewed by: Mike Martin

Fact checked by: Ryan Grace

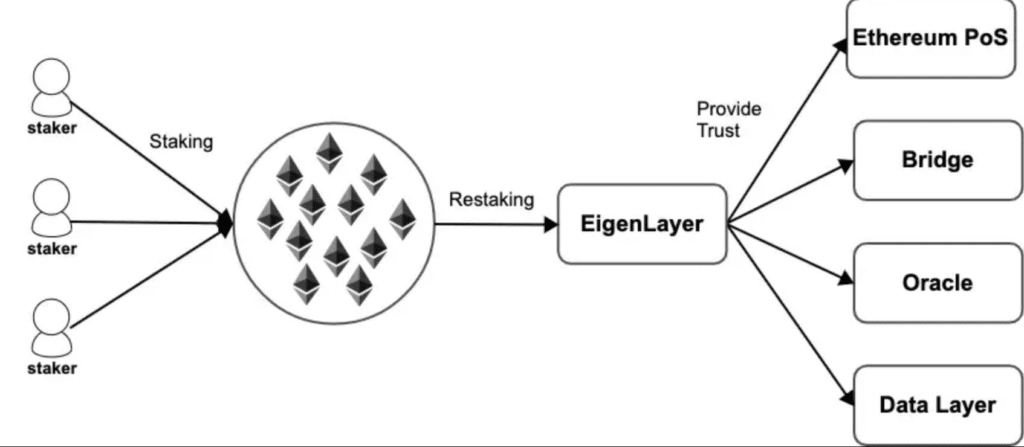

Restaking protocols leverage technologies like EigenLayer and Symbiotic to offer significant returns and enhanced DeFi opportunities. In this article, we discuss the top 5. Let’s go!

Table of Contents

🍒 tasty takeaways

Liquid restaking is a passive income mechanism for ETH stakers to increase returns by restaking and exploring DeFi opportunities.

Ether.fi, Renzo, Puffer Finance, and Kelp DAO are the best liquid restacking protocols that leverage EigenLayer.

Mellow LRT, a newly launched liquid restaking platform, is based on the Symbiotic protocol, which competes with EigenLayer.

Summary

| Protocol | Details |

|---|---|

| Ether.fi | Oldest and largest liquid restaking platform with $6.5 billion TVL, offers eETH and governance token ETHFI. |

| Renzo | Connects to EigenLayer, $3.8 billion TVL, offers ezETH and native token RENZ. |

| Puffer Finance | Third-largest on EigenLayer, $1.7 billion TVL, offers pufETH and eliminates slashing risk. |

| Kelp DAO | Launched in January, crossed $1 billion TVL, offers rsETH using EigenLayer. |

| Mellow LRT | Newly launched, $116 million TVL, uses Symbiotic protocol for modular LRT creation. |

Liquid restaking is a decentralized finance (DeFi) passive income opportunity for staking Ethereum.

After adopting the Proof of Stake (PoS) algorithm at the end of 2022, consensus on the Ethereum blockchain is reached through staking instead of mining.

Ethereum staking has quickly expanded into a large and diverse market that comprises various techniques to increase potential returns.

Restaking and Liquid Restaking Boost Rewards

One of these methods is staking, which we previously explained in a dedicated post about EigenLayer. In June 2023, this protocol introduced the concept, offering Ethereum holders the chance to earn higher staking rewards by repurposing deposited coins.

Liquid restaking protocols unlock even more yield by offering liquid restaking tokens (LRTs) representing deposit values to be freely used in DeFi. They operate similarly to liquid staking platforms like Lido but are built on top of restaking platforms like EigenLayer.

The Liquid Restaking Market Is Growing Fast

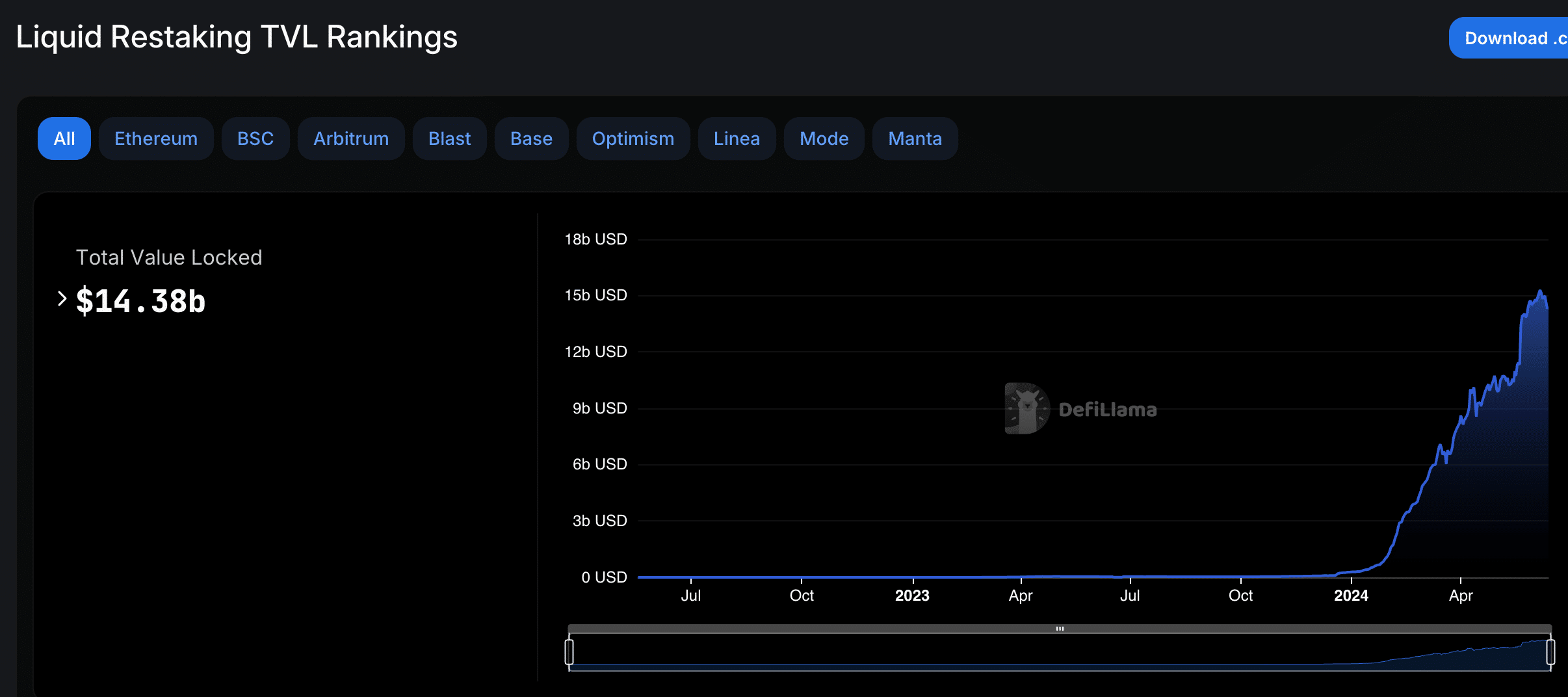

Liquid restaking has been a fast-growing market in 2024. The total value locked (TVL) in liquid restaking protocols surged from less than $300 million to a record $15 billion as of mid-June.

Source: DeFiLlama

Overall, Ethereum staking has been the main driver of the reviving DeFi sector, whose TVL recently crossed the $100 billion mark for the first time since May 2022.

Staking services account for almost half of the entire DeFi TVL as of this writing. They come in three main categories:

- Liquid staking protocols ($55 billion in TVL)

- Restaking protocols ($20 billion in TVL)

- Liquid restaking protocols ($15 billion in TVL)

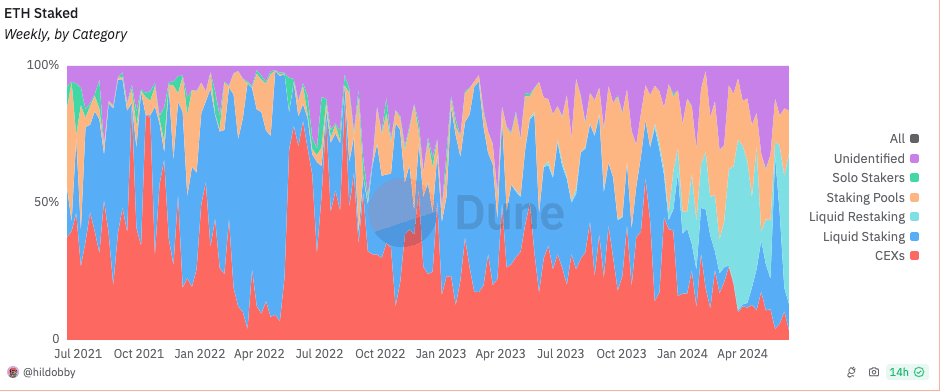

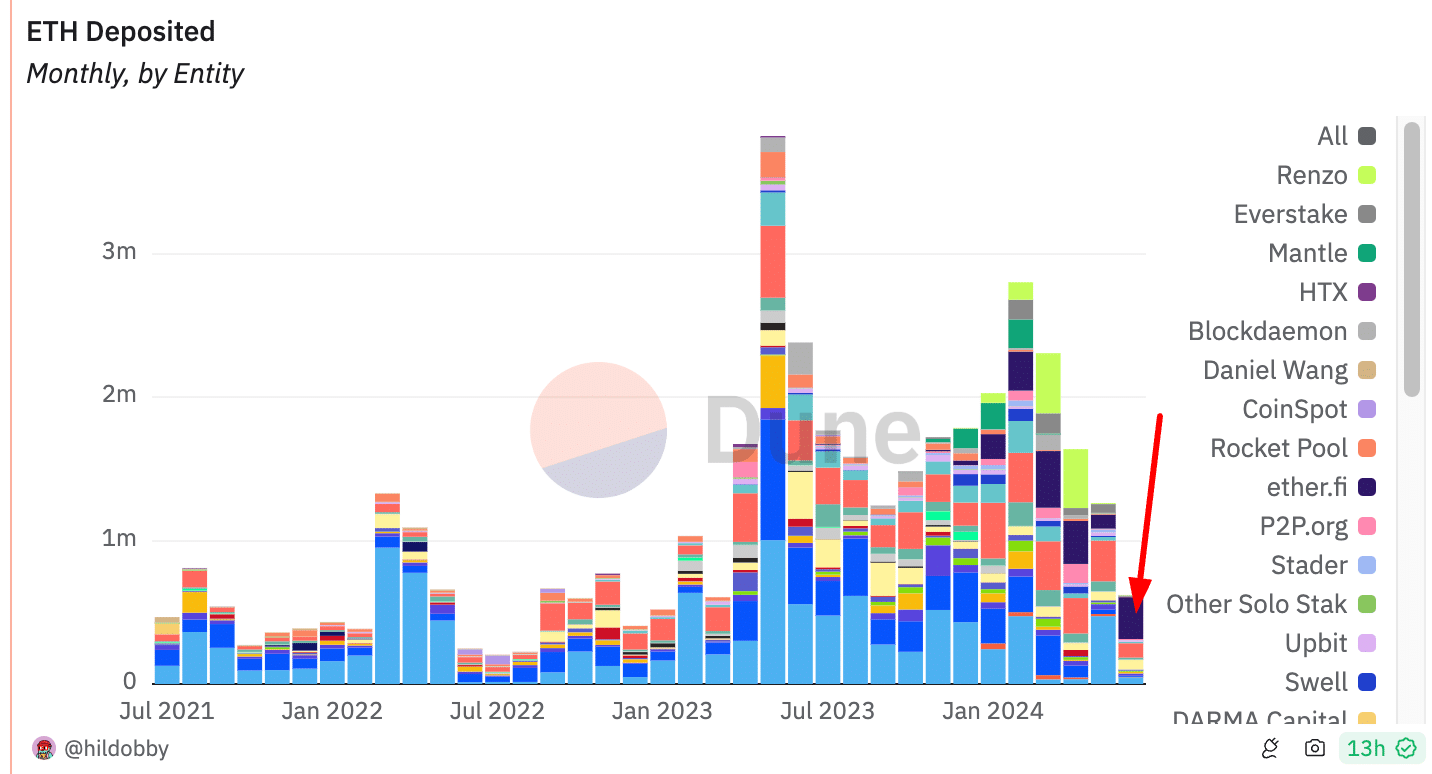

Despite the dominance of liquid staking tokens like Lido and Rocket Pool, liquid restaking platforms currently have the highest inflows, attracting over 50% of staked ETH.

Source: Dune Analytics

Here are the top 5 liquid restaking protocols to watch in 2024:

1. Ether.fi

Ether.fi is the oldest and currently the largest liquid restaking platform in DeFi. Its TVL reached a new record on June 6 at $6.5 billion.

Users can stake ETH or Lido’s stETH and receive eETH, a LRT with the same value as ETH that can be used in DeFi. The platform automatically restakes deposited ETH through EigenLayer.

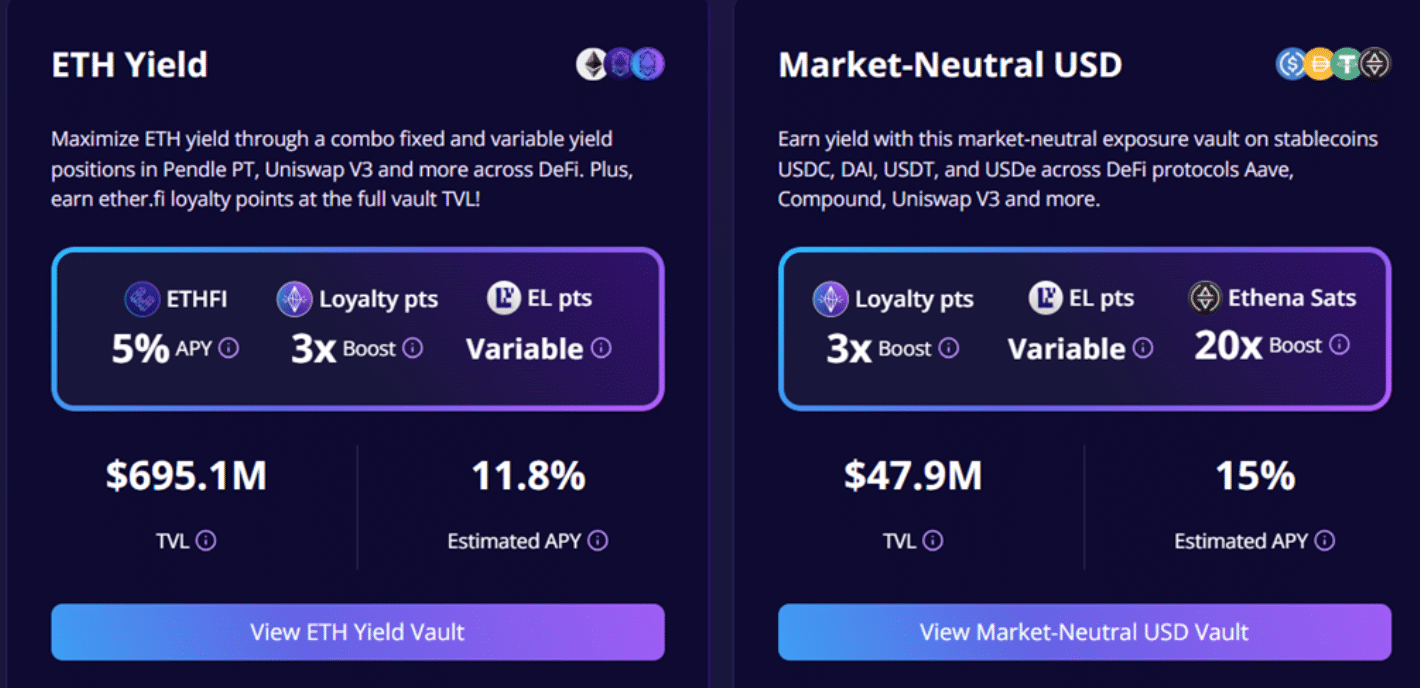

Ether.fi offers its own crypto yield farming product called Liquid, where users can put their eETH to the work by targeting an annual percentage yield (APY) between 11% and 15%.

Source: ether.fi

This, coupled with restaking rewards of up to 4%, can increase total annual returns to 20%.

Ether.fi Token

In March 2024, Ether.fi launched its governance token, ETHFI, valued at $440 million as of this writing.

In the first two weeks of June 2024, Ether.fi has accounted for about half of all ETH deposited for staking.

Source: Dune Analytics

2. Renzo

Renzo is another leading liquid staking protocol that connects to EigenLayer technology. Its TVL is $3.8 billion.

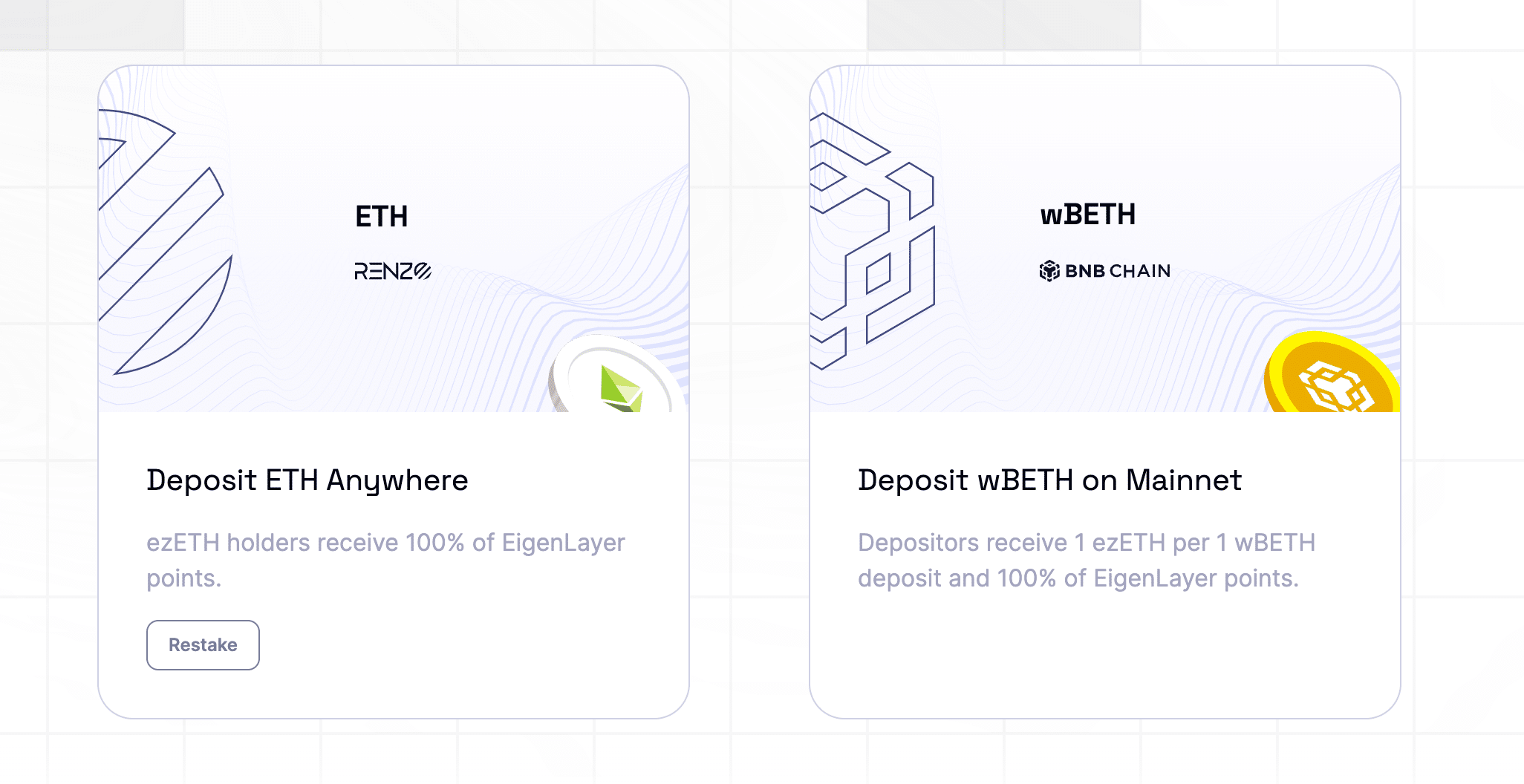

The protocol offers an LRT, ezETH, and acts as a strategy manager on EigenLayer to target higher restaking rewards and promote restaking.

Users can deposit ETH, WETH, stETH, or wBETH, and receive ezETH. Holding ezETH generates 1 ezPoint per hour, making it a reward-bearing token. On top of that, it can be used in DeFi.

ezPoints determines the number of REZ tokens a user will receive following the token generation event, which brings us to the next point.

Unlike Ether.fi, Renzo extends to six other chains besides Ethereum, including Arbitrum, Blast, Linea, BNB Chain, and Base.

In April 2024, Renzo launched its native token, RENZ. The number of earned points determined how much RENZ each user received.

3. Puffer Finance

Puffer is the third-largest liquid restaking protocol on EigenLayer, with a TVL of $1.7 billion.

Users can deposit ETH to be restaked via EigenLayer and mint pufETH, which can be used in DeFi.

Puffer eliminates slashing risk and has introduced so-called validator tickets, guaranteeing rewards regardless of validator performance.

The protocol is officially part of the EigenLayer ecosystem.

4. Kelp DAO

Kelp DAO launched in January of this year and crossed the $1 billion mark at the end of May.

The EigenLayer-based liquid restaking protocol allows users to deposit ETH, stETH, ETHx, and Frax’s sfrxETH, offering rsETH in exchange.

The protocol secured $9 million in a private round in May

5. Mellow LRT

Mellow LRT is a fresh liquid staking protocol that was launched on June 11 and has over $116 million in TVL.

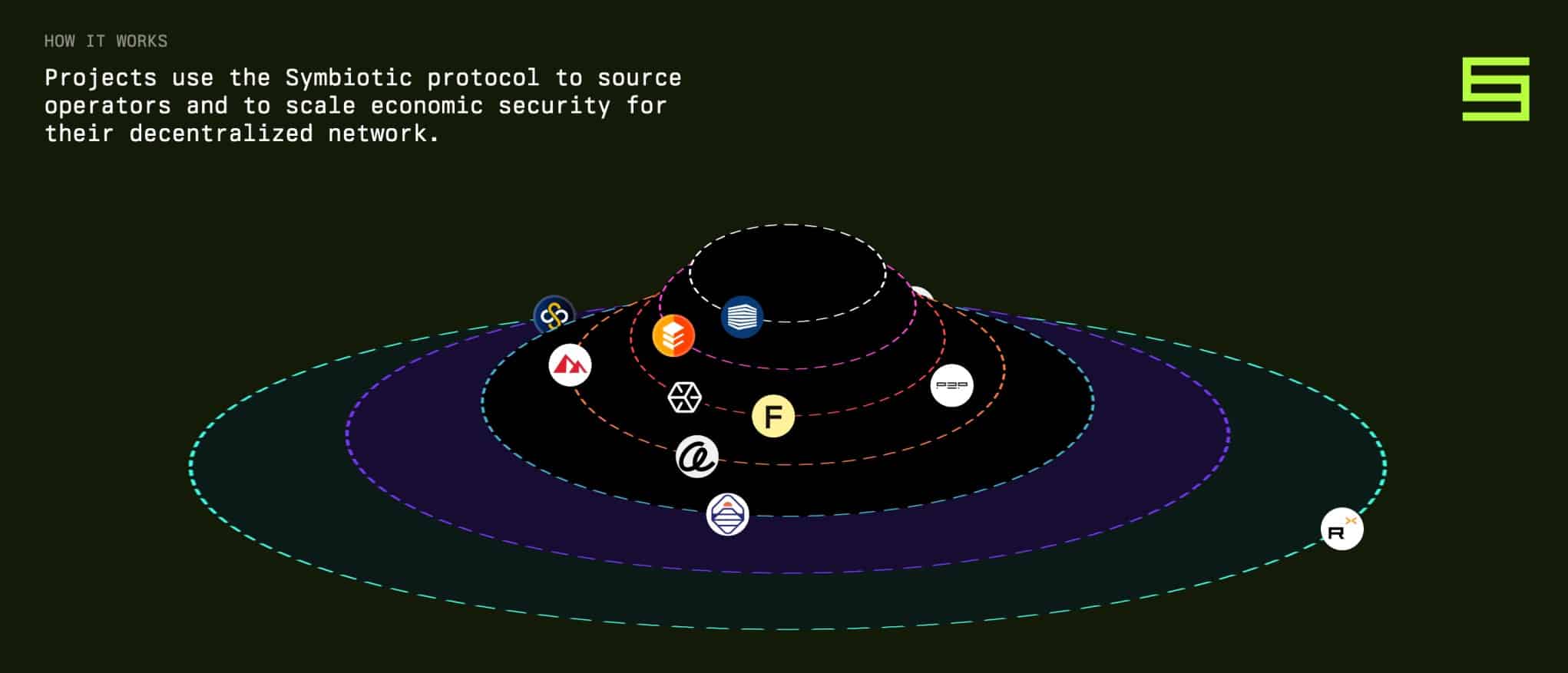

Unlike most liquid restaking platforms that leverage EigenLayer, Mellow LRT is built for a new restaking protocol known as Symbiotic. The latter also launched on June 11 and aims to compete with EigenLayer.

Source: Symbiotic

According to Mellow, it represents a modular infrastructure for creating LRTs, providing permissionless vault smart contracts that enable stakers to select their risk exposure when restaking. The documents read:

“Mellow enables depositors more flexibility regarding their desired level of exposure to risk, while still benefiting from the liquidity of staked assets. This is achieved by dynamically adjusting strategies within each vault based on real-time risk assessments and market conditions.”

— Mellow

Lido partnered with Mellow to develop restaking vaults to challenge the increasing influence of EigenLayer.

Restaking Protocols Overview

FAQs

What is restaking?

Restaking in DeFi is a method where Ethereum or liquid staking token holders can earn higher staking rewards via platforms like EigenLayer, which repurposes deposited ETH to power decentralized applications (dapps) and entities operating on Ethereum.

What are liquid restaking protocols?

Liquid restacking protocols offer liquid restacking tokens (LRTs), representing the value of locked ETH-related deposits restated on platforms like EigenLayer. The LRTs can be used freely in DeFi to explore additional yield opportunities.

What are the best liquid restaking protocols?

Ether.fi, Renzo, Puffer Finance, Kelp DAO, and the newly launched Mellow LRT are the top liquid restacking protocols in 2024.

How much can you earn on liquid restaking protocols?

Some platforms, such as Ether.fi, offer total annual returns of up to 20% through yield farming and restaking rewards. However, LRT holders can use the tokens as they wish. For example, they can trade them on decentralized exchanges for stablecoins to reduce volatility risks.

🍒 tasty reads

The Core Blockchain and DeFi Ecosystem: What You Need to Know

7 Best DePIN Crypto Projects

What Is Symbiotic and How Does It Work in 2024?

Ethereum vs Ethereum ETFs – 5 Major Differences

Anatol Antonovici

6+ years of experience writing for crypto brands and blockchain firms, including Coindesk, Cointelegraph, Bitcoinist, CryptoPotato, Algorand, and OTCTrade.com