Written by: Mike Martin | Updated March 14, 2024

Reviewed by: Ryan Grace

Fact checked by: Laurence Willows

In this guide, we explore the top DeFi applications across popular categories:

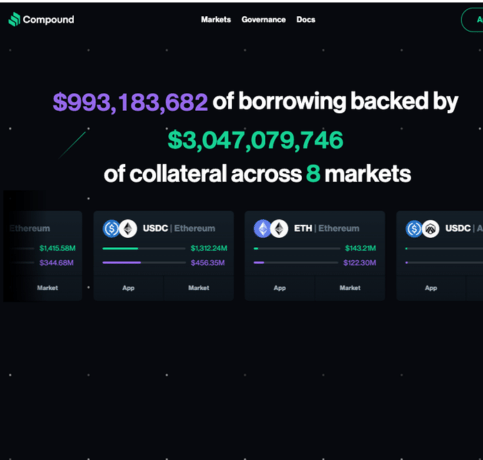

- Borrowing/lending

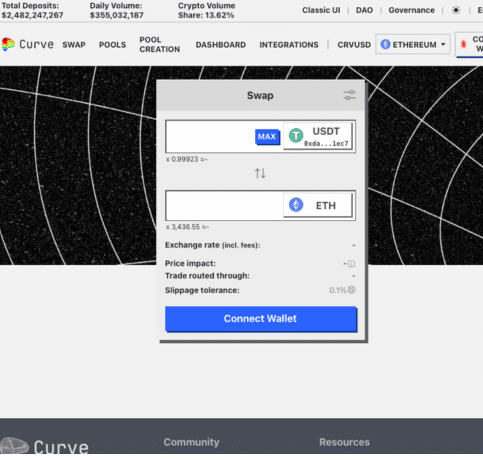

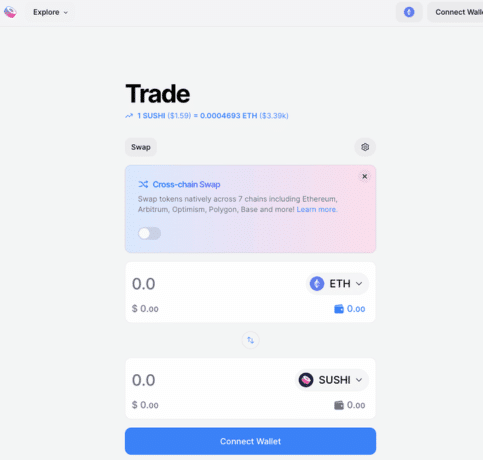

- Decentralized exchanges (DEXs)

- Staking

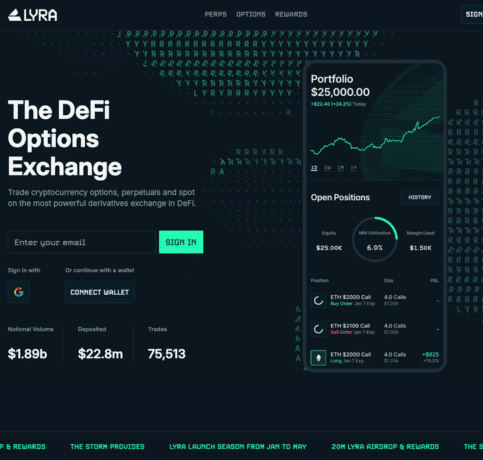

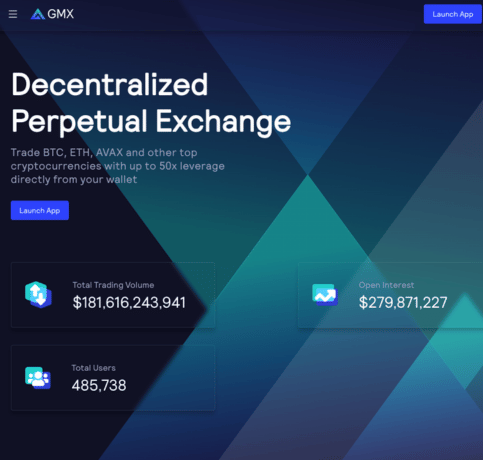

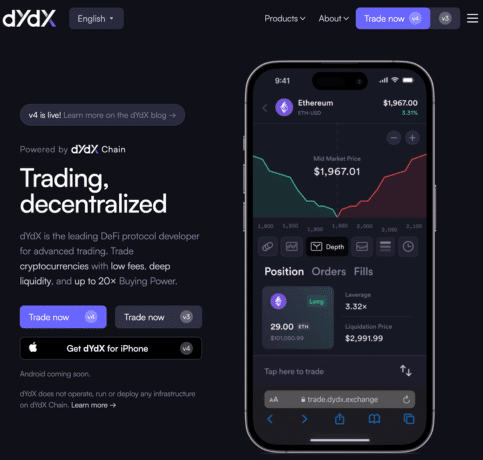

- Derivatives and yield farming!

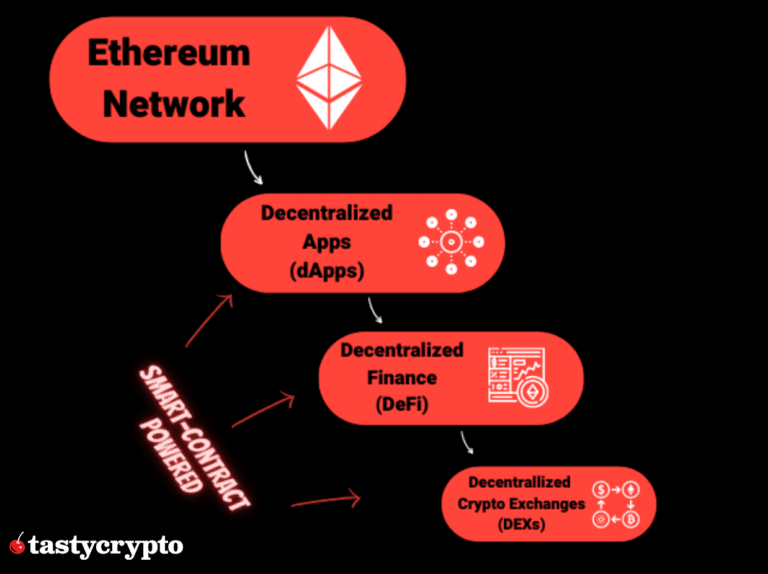

What is a DeFi Dapp?

DeFi stands for decentralized finance. “Dapps” are short for decentralized applications. Dapps are often referred to as ‘protocols’ or simply ‘platforms’

A DeFi Dapp is any application that operates atop an existing blockchain network.

Uniswap, for example, is a Dapp that operates atop the Ethereum blockchain. Uniswap falls under the category of decentralized exchange (DEX) Dapp.

Dapps and Smart Contracts

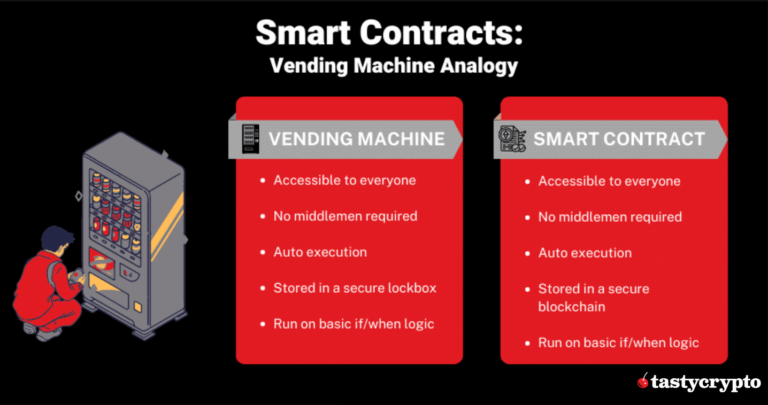

Dapps are simply the interface for a smart contract. Smart contracts perform all the heavy lifting done in DeFi.

Smart contracts are self-executing contracts written in code and stored on a blockchain network.

Let’s say, for example, you initiate a swap on the Uniswap DEX. After you send the order, the smart contract representing Uniswap interacts with the Ethereum blockchain.

If you’re purchasing ether (ETH) while selling bitcoin (BTC), the smart contract will access the liquidity pool held on the decentralized exchange (DEX), facilitating the swap. This action decreases the ETH available in the pool while simultaneously increasing the quantity of BTC.

No work is actually done by Uniswap – it is all automated by the Uniswap smart contract.

Because of their automated nature, smart contracts can be thought of as digital vending machines.

🍒 tasty reads

The Core Blockchain and DeFi Ecosystem: What You Need to Know

7 Best DePIN Crypto Projects

What Is Symbiotic and How Does It Work in 2024?

Ethereum vs Ethereum ETFs – 5 Major Differences

Mike Martin

Mike Martin formerly served as the Head of Content for tastycrypto. Before joining tastycrypto, Michael worked in the active trader divisions of thinkorswim, TD Ameritrade, and Charles Schwab. He also served as a writer and editor for projectfinance.

Michael has been active in the crypto community since 2017. He holds certifications from Duke University in decentralized finance (DeFi) and blockchain technology.