A crypto coin is the native cryptocurrency of a blockchain while a crypto token is the digital currency used for applications that are built on top of blockchains.

Written by: Anatol Antonovici | Updated August 9, 2024

Reviewed by: Mike Martin

Fact checked by: Ryan Grace

There are far more crypto tokens than crypto coins. This is because tokens are the product of decentralized applications, which are built atop blockchains. The Ethereum blockchain, for example, has thousands of applications, all with their own unique cryptocurrency token.

Table of Contents

🍒 tasty takeaways

- Coins are digital currencies that have their own blockchain network which they are intrinsic to.

- Tokens are digital assets built on top of an existing blockchain supporting the smart contract feature. They have specific functions within an ecosystem or certain circumstances.

- The main difference between coins and tokens has to do with their infrastructure and issuance process. It’s more accurate to associate cryptocurrencies with coins rather than tokens.

Summary

| Features | Crypto Coin | Crypto Token |

|---|---|---|

| Definition | Native cryptocurrency of a blockchain. | Digital currency for applications built on existing blockchains. |

| Infrastructure | Has its own blockchain network. | Built on top of existing blockchains. |

| Main Purpose | Act as a medium of exchange and store of value. | Specific functions within an ecosystem or certain circumstances. |

| Creation | Mined or earned through staking by intrinsic blockchain rules (e.g., PoW, PoS). | Pre-mined by developers using smart contracts. |

| Examples | BTC, ETH, BNB, DOGE, ADA, SOL. | UNI, AAVE, LINK, SHIB, MATIC, etc. |

| Quantity | Fewer in number. | Significantly more due to decentralized apps built on blockchains. |

| Variety | Generally, similar functions (though some may offer staking, governance, etc.). | Ranges from utility, governance, security, synthetic assets, to NFTs. |

| Price Dynamics | Volatile prices influenced by supply/demand. | Varies based on utility, demand, and specific use-case. |

| Key Use Cases | Medium of exchange, store of value. | Fee payments, trading, discounts, bonuses, governance, etc. |

What Is a Coin?

Crypto coins are digital assets that are hosted on their own blockchain networks, which makes them independent of other networks. The best example is obviously Bitcoin – this cryptocurrency is a coin because it has its own blockchain. Like Bitcoin, many coins share the name of their native blockchains.

Crypto coins are mainly designed to work as a medium of exchange and store value, similar to traditional fiat currencies. Crypto coins are the first digital assets to leverage blockchain technology. Their similarities with traditional currencies earned them the name “cryptocurrencies,” which later became a broader term.

Crypto coins have volatile prices dictated by the supply/demand dynamic. While Bitcoin started with the intention to become a decentralized peer-to-peer (P2P) money system, it ended up being used for price speculation due to its volatility and store of value (SOV) deflationary model.

How Are Crypto Coins Created?

Crypto coins are intrinsic to their native blockchains, and the way they’re created is dictated by rules that are built-in the blockchain algorithm itself. For example, Bitcoin is mined through the so-called Proof of Work (PoW) consensus mechanism, while Ethereum is earned via a Proof of Stake (PoS) mechanism following the network’s transition from PoW to PoS.

Popular Crypto Coins

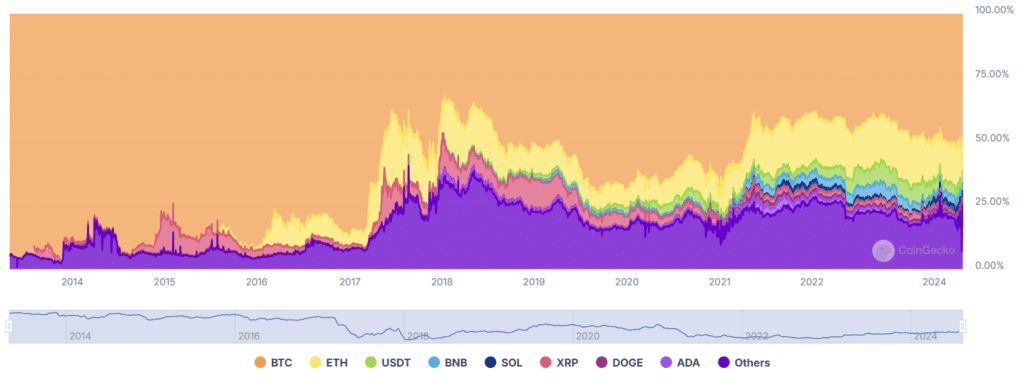

The cryptocurrency market is dominated by coins in terms of market cap. There are far fewer coins than tokens. Here are some popular coins with their native chain and their market cap as of mid-August 2024:

- BTC (Bitcoin) – $1.16 trillion;

- ETH (Ethereum) – $318 billion;

- BNB (BNB Chain) – $76 billion;

- DOGE (Dogecoin) – $15 billion;

- ADA (Cardano) – $12 billion;

- SOL (Solana) – $67.2 billion.

The six mentioned crypto coins account for 78% of the entire crypto market, with Bitcoin dominance hovering above 55%.

What Is a Token?

Unlike crypto coins, tokens are hosted on existing blockchains and technically represent secondary assets on their respective chains. It’s worth noting that tokens can only reside on blockchains supporting the smart contract feature, which refers to self-executing programs that settle when predetermined conditions are met.

While crypto coins are designed as a means of exchange, tokens have utility and functionality within a certain ecosystem or niche. For example, a platform can issue tokens to be used for fee payments, trading within a proprietary marketplace, discounts and bonuses, or participating in the governance process.

Often, tokens fuel decentralized applications (dapps), being the key element of their economic model.

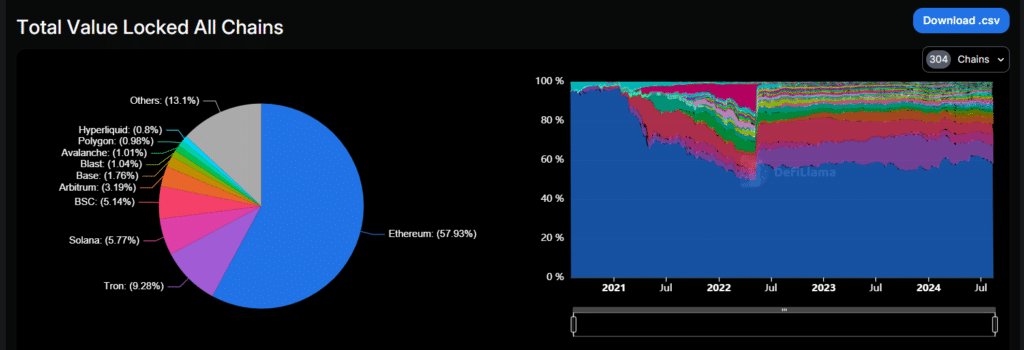

Today, the Ethereum blockchain acts as the host network for the largest portion of tokens, providing the main piece of infrastructure for the decentralized finance (DeFi) sector – a $86 billion market.

Types of Tokens

There are several types of tokens with unique use cases:

- Utility tokens – these offer access to certain products or services within an ecosystem.

- Security tokens – these are legal securities built on blockchain and can represent anything from company shares to bonds or real estate assets.

- Governance tokens – these tokens enable holders to participate in the governance process of a decentralized project.

- Synthetic assets – these tokens mimic the price of real-world assets, such as commodities or company stocks, although they are not legal securities.

- Non-fungible tokens (NFTs) – NFTs are not interchangeable and can represent something unique, such as artworks, collectibles, real estate, etc.

How Are Tokens Created?

Unlike crypto coins, tokens are pre-mined, with developers being able to create any economic model they like. Through a smart contract, the total supply is established from inception, while the dynamic of the circulating supply is dictated by the chosen model.

Blockchains with the smart contract feature have special standards for tokens. The most popular one is Ethereum’s ERC-20 standard, which is used by many utility tokens. NFTs have a dedicated standard to avoid fungibility.

Popular Crypto Tokens

Some examples of tokens are UNI (Uniswap), AAVE (Aave), LINK (Chainlink), Shiba Inu (SHIB), and MATIC (Polygon). There are hundreds of thousands of tokens on Ethereum alone.

Coin vs. Token: What Is the Difference?

The main difference between coins and tokens has to do with the underlying infrastructure: coins have their own blockchains, while tokens don’t. Instead, tokens leverage existing decentralized networks and may even have a multi-chain presence.

The underlying infrastructure impacts the way digital assets are issued. Coins can be mined or earned through staking by anyone, while tokens are issued by developers, organizations, and other creators that can mint the entire supply at once.

Despite being fewer than tokens, crypto coins account for the largest share of the blockchain industry. Coins generally trade in large volumes and having deeper liquidity than tokens. Anyone can create a token, but the trading volume tends to be lower. Nevertheless, tokens play a major role in DeFi and Web3.

On a side note, the crypto community may also use the term ‘altcoins,’ which refers to all digital assets other than Bitcoin, irrespective of their type.

Are Stablecoins Coins or Tokens?

Stablecoins play a major role in the crypto space, accounting for over 12% of the industry’s total market cap. The prices of these digital currencies are pegged to fiat currencies and other real-world assets, most often the US dollar. Although their name implies that they are coins, stablecoins are technically tokens. For example, Tether (USDT) and USD Coin (USDC), the two largest stablecoins by market cap, started as ERC-20 tokens. USDC later expanded to other chains.

The coin suffix hints at the tokens’ design to act as a medium of exchange.

FAQs

Crypto coins are intrinsic to native blockchains, acting as a means of exchange.

Crypto tokens are digital assets created on top of an existing blockchain. They have utility within a certain decentralized ecosystem.

Crypto coins have their own blockchain; tokens do not. Also, tokens can have multiple use cases and are more versatile. On the other hand, crypto coins are more secure due to the underlying infrastructure and are less prone to price manipulation.

In theory, tokens are more unpredictable and volatile, but that’s not always the case. Also, tokens are prone to price manipulations that are difficult to achieve with crypto coins. As a rule, tokens are more suitable for trading, while crypto coins can be used for investment.

Anatol Antonovici

6+ years of experience writing for crypto brands and blockchain firms, including Coindesk, Cointelegraph, Bitcoinist, CryptoPotato, Algorand, and OTCTrade.com

🍒 tasty reads

The Core Blockchain and DeFi Ecosystem: What You Need to Know

7 Best DePIN Crypto Projects

What Is Symbiotic and How Does It Work in 2024?

Ethereum vs Ethereum ETFs – 5 Major Differences