Wrapped Ether (wETH) is an ERC-20 compatible version of Ethereum’s native cryptocurrency, enabling interoperability within the DeFi ecosystem.

Written by: Anatol Antonovici | Updated August 25, 2024

Reviewed by: Mike Martin

Fact checked by: Ryan Grace

Ether, ironically, does not abide by the ERC-20 standard token, set forth by the Ethereum network. Wrapped ether, or wETH, allows for transactions and interactions across decentralized applications by adhering to the widely-used ERC-20 token standard, which is not natively supported by ether (ETH).

🍒 tasty takeaways

Ether (ETH) is incompatible with ERC-20 tokens because the token standard emerged months after the launch of the Ethereum mainnet and its native coin ETH.

DeFi applications use wETH instead of ETH because wrapped ether is interoperable with other ERC-20 tokens.

Ether can easily be converted to wrapped ether and vice versa via decentralized Web3 apps like Uniswap, MetaMask, or OpenSea.

- You can buy wETH in the tastycrypto wallet by using the in-app swap feature.

Wrapped Ether (wETH) Summary

| What is wETH? | Tokenized ether (ETH), using ERC-20 standard. |

| Ethereum | Blockchain with smart contract capability. |

| Wrapped Tokens | Crypto assets for interoperability between blockchains. |

| Working of wETH | Used in DEXs, DeFi protocols, and for NFTs; not for gas fees. |

| How to Wrap/Unwrap | Through DEXs like Uniswap, MetaMask, OpenSea. |

| wETH Advantages | Interoperability, liquidity, DeFi opportunities. |

| wETH Cons | Centralization risk, minting fees, risk of unpegging. |

| Current Value | Pegged to ETH, currently $1,877. |

What Is Ethereum?

Ethereum is a public blockchain network that supports the smart contract feature. Smart contracts allow anyone to create decentralized applications (dApps) that run on top of the Ethereum mainnet.

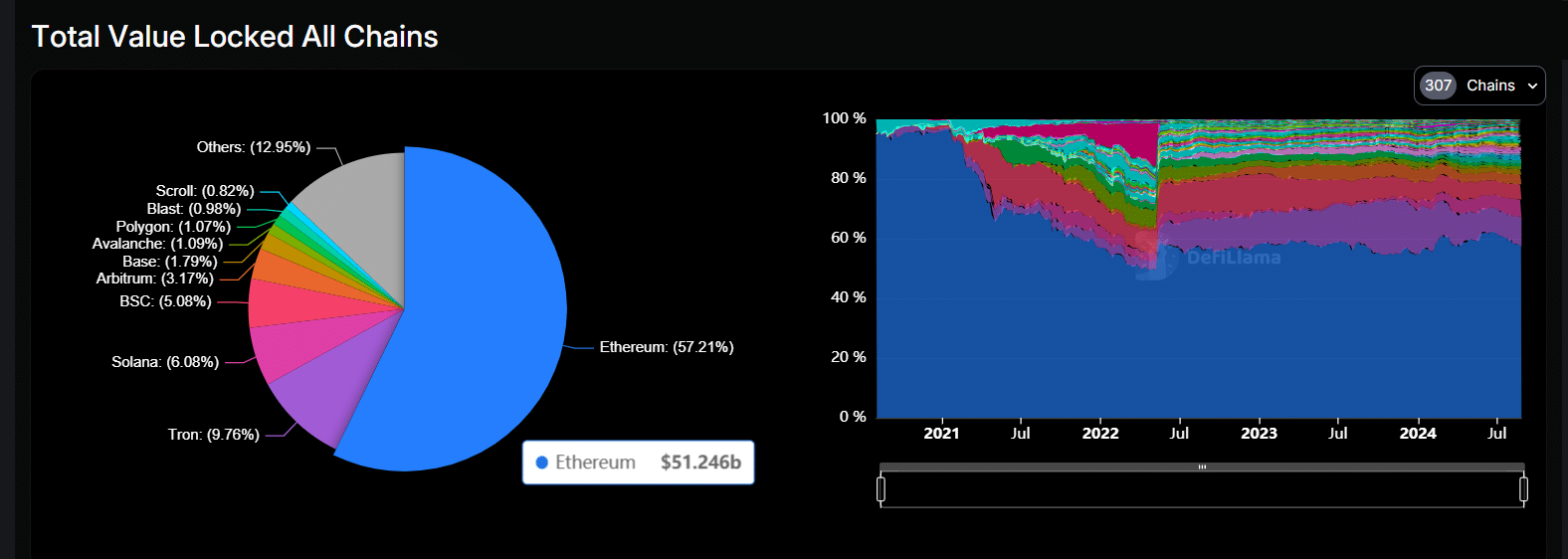

Ethereum’s ability to execute smart contracts (which Bitcoin can’t) and maintain robust decentralization through a widespread node network has solidified Ethereum as the frontrunner in decentralized finance (DeFi) – the most important and popular blockchain sector.

Source: DeFiLlama

The Ethereum blockchain has a native cryptocurrency, Ether (ETH). Ether is used to pay for transaction fees and computational resources. The network also supports several token standards to create cryptocurrency tokens on top of it. The most popular standard is ERC-20. Ether, coincidentally, does not abide by the ERC-20 standard, which is reserved for tokens, not coins.

🍒 Crypto Coin vs Token: Here’s How They Differ

Today, there are hundreds of thousands of ERC-20 tokens. ERC-20 tokens are fungible, or interchangeable, sort of like fiat currency – any US Dollar is as good as the next just like any bitcoin is as good as the next.

ERC-721 tokens, however, are non-interchangeable. ERC-721s can be thought of as digital art in that they are not interchangeable. NFTs (non-fungible tokens) on Ethereum use the ERC-721 standard.

What Are Wrapped Tokens?

Wrapped tokens are crypto assets pegged to the value of an original cryptocurrency or token from another blockchain ecosystem. Wrapped ether is backed 1:1 with ether (ETH). Since wETH can be redeemed for ETH, the price of these two cryptos mirror each other. wETH maintains its peg to ether through the same mechanisms that stablecoins like USDT and USDC use.

The purpose of wrapped tokens is to bring interoperability between different blockchain ecosystems or token standards. Since many DeFi apps operate exclusively with ERC-20 tokens, making non-Ethereum assets compatible with this token standard would improve diversification and liquidity on these apps.

For example, one can get exposure to Bitcoin (BTC) without leaving the DeFi ecosystem by purchasing Wrapped Bitcoin (WBTC) on Ethereum.

What Is Wrapped Ethereum?

Wrapped Ethereum (wETH) is an ERC-20 token pegged to the price of Ether. What’s the point of it, considering that wETH stays on the Ethereum network as well?

Since Ethereum dominates the DeFi space, most wrapped tokens are created on this network by leveraging the ERC-20 standard. However, Ether itself cannot be used on Web3 apps because it’s not compatible with ERC-20, which was developed after Ether.

Therefore, wETH is designed to bring interoperability and enable DeFi and dApps users to get easy exposure to ETH without leaving their ecosystem.

There are different versions of wETH on other blockchain networks, including Tron and Avalanche (with the ticker wETH.e). Most people, however, refer to wrapped ether as wETH, which is an ERC-20 token.

Ether (ETH) vs Wrapped Ether (wETH)

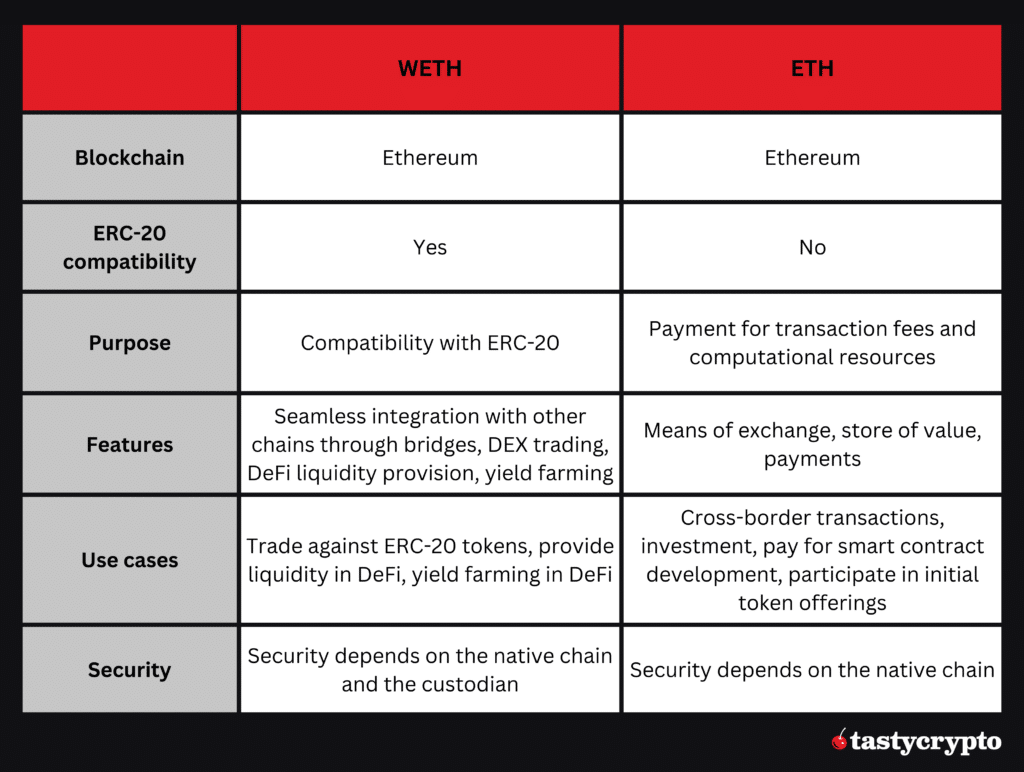

Here is a brief comparison between wETH and the original ETH:

How Does wETH Work?

wETH has the same attributes as all other ERC-20 tokens. However, wETH can not be used to pay for Ethereum gas fees. wETH is primarily used to trade against other tokens on decentralized exchanges (DEXs), provide liquidity on DeFi protocols, or buy non-fungible tokens (NFTs) through marketplaces like OpenSea and LooksRare.

To obtain wETH tokens, ETH holders send their cryptocurrency to a custodian. The custodian in turn mints new wETH. Custodians can be:

- Merchants

- Multi-sig crypto wallets

- Smart contracts

If you want to unwrap or get ETH back, you can send wETH back to the custodian, who will then burn the wETH and return your original ETH. This mechanism ensures that the wrapped version maintains parity with ETH.

Wrapped Ethereum: Facts and Figures

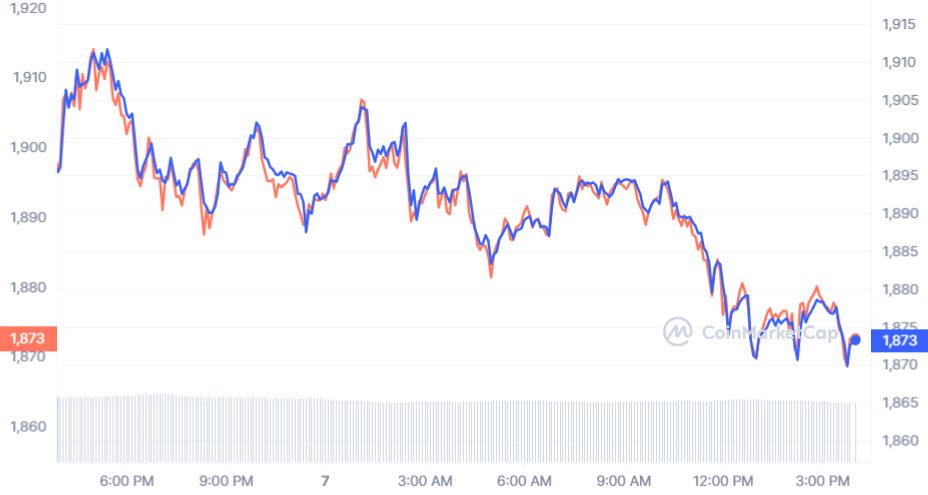

wETH mirrors the price of ETH. Minor deviations, however, do occur. Below is a daily chart comparing the price of wETH vs ETH.

Source: CoinMarketCap

At the time of writing, wETH has a market cap of $9.1 billion, meaning that almost 3% of all Ethereum is locked as collateral to mint wETH.

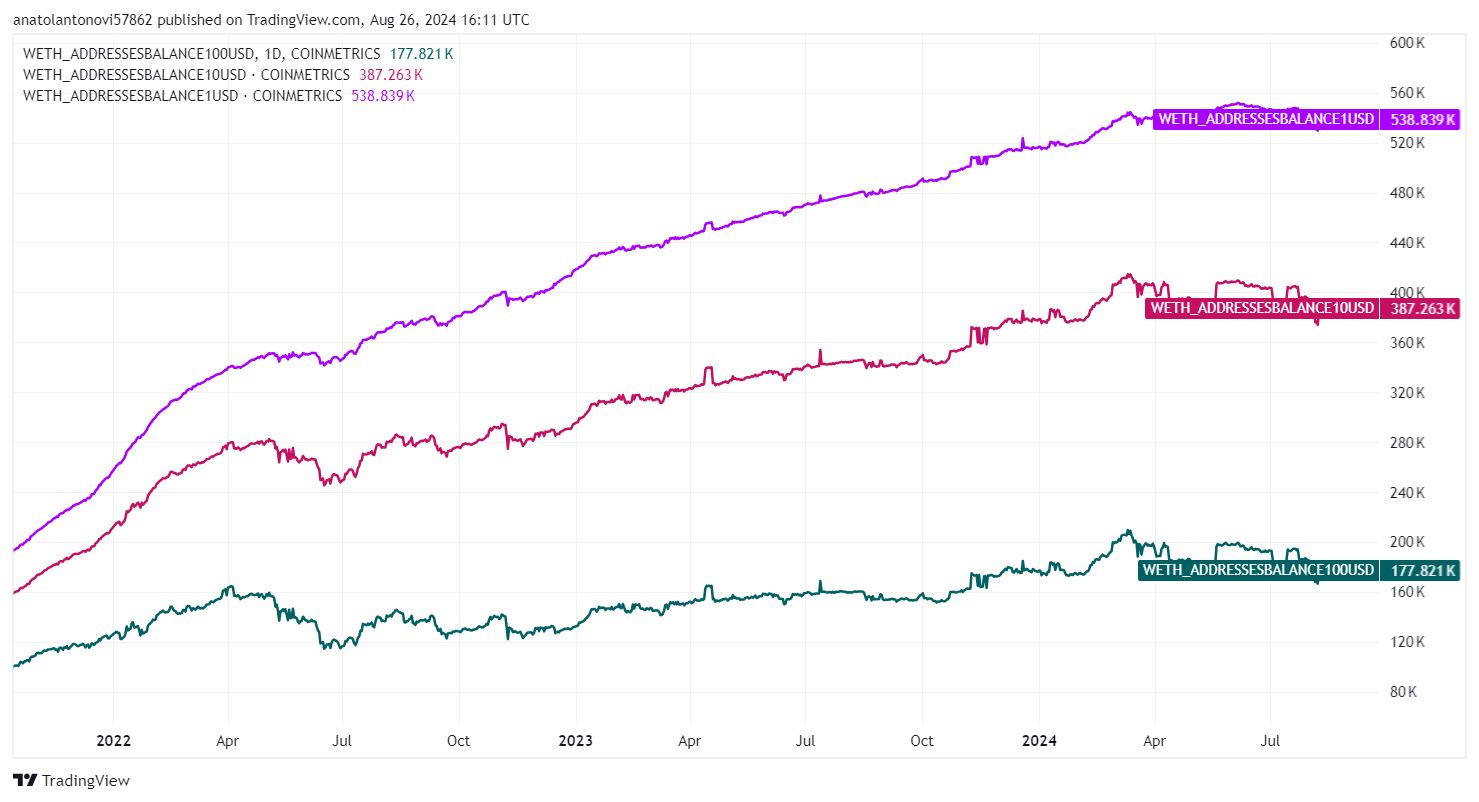

While DeFi activity has been declining since 2022, the number of wETH holders keeps increasing, with more than 500,000 addresses holding at least $1. The addresses holding at least $10 and $100 are also increasing, as seen below.

Source: TradingView

How to Wrap and Unwrap Ethereum

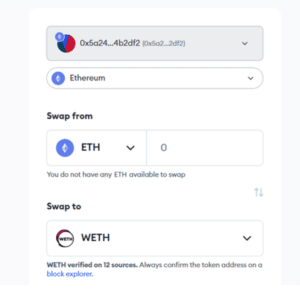

You can acquire Wrapped Ethereum (wETH) via Decentralized Exchanges (DEXs) by trading it for other ERC-20 tokens. If you own Ethereum (ETH) and wish to convert it into wETH, you can do so by interacting with a dedicated smart contract found on widely used platforms like:

- Uniswap – this is the largest DEX by trading volume and total value locked (TVL). Uniswap enables users to wrap ETH directly on the app by connecting their non-custodial wallet.

- OpenSea – the largest NFT marketplace by trading volume also supports an ETH wrapping interface that is easy to use, as seen below.

Source: OpenSea

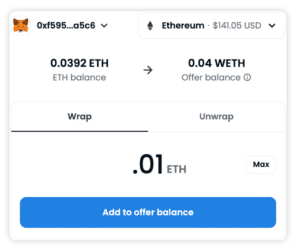

- MetaMask – the most straightforward way to wrap ETH is to do so directly in a Web3 wallet. On MetaMask, you can wrap ETH by connecting your crypto wallet to the Ethereum Mainnet and performing an ETH to wETH swap, as displayed below.

wETH can be unwrapped on the same platforms by clicking “unwrap” or swapping back to ETH.

wETH Advantages

Here are a few advantages of Wrapped Ethereum:

- wETH is pegged to the value of ETH and (almost) always maintains the peg.

- wETH can be used in DeFi apps supporting Ethereum-based tokens, including DEXs, DeFi lending apps, staking and liquid staking platforms, etc.

- wETH brings interoperability to the blockchain world and streamlines the exchange of tokens.

- wETH brings more liquidity and diversification to the DeFi space.

- wETH opens the door to many yield generating opportunities in DeFi.

wETH Cons

Here are a few disadvantages to wrapped ether:

- Increased centralization due to reliance on custodians is a significant challenge for Wrapped Ethereum (wETH) and similar tokens.

- Centralized custodians’ technical or financial problems can disrupt the minting and burning of wrapped tokens.

- Vitalik Buterin, Ethereum’s co-founder, has emphasized the concern over the centralization of wrapped assets.

- Minting wETH incurs a small fee.

- There is a risk of unpegging with wETH, meaning its value could diverge from that of Ether, posing a potential financial risk for holders.

Secure Your Crypto With Self-Custody

When you store your wETH and other cryptos in a self-custody wallet, you don’t have to trust that an exchange is acting in your best interest. This is because you are the only party privy to your private key, or seed phrase.

Here are some additional benefits you get when you choose to self-custody your digital assets with tastycrypto:

- In-App Swap: Trade BTC, ETH, and 1,000+ tokens

- Generate Yield in DeFi: Stake, lend, and become your own market maker

- NFTs: Buy, sell, and view NFTs in-app

tastycrypto offers both iOS and Android self-custody wallets – download yours today! 👇

FAQs

Wrapped ETH (wETH) is a tokenized version of Ethereum that mirrors the price of ether (ETH). Unlike Ethereum, wETH uses the ERC-20 standard, which makes it compatible with many DeFi apps, such as DEXs, lending apps, and yield protocols.

wETH is worth the same as ETH or very close to it.

You can buy wETH on DEXs with other ERC-20 tokens or wrap ETH through apps like Uniswap, MetaMask, or OpenSea.

You can unwrap wETH and receive the equivalent amount of ETH using the same platforms facilitating the wrapping process.

🍒 tasty reads

What Is Ether.fi? Liquid Staking Reinvented

What Is Wrapped Ether? Complete wETH Guide

Impermanent Loss in DeFi: The Complete Guide

What is GMX? DeFi Perpetual Exchange 2024 Guide

What Is Defi Liquidity Mining and How Does It Work?

Wrapped Crypto Tokens: A Beginner’s Guide

Anatol Antonovici

6+ years of experience writing for crypto brands and blockchain firms, including Coindesk, Cointelegraph, Bitcoinist, CryptoPotato, Algorand, and OTCTrade.com