Cryptocurrency coin burning is a deflationary and typically bullish practice that decreases the circulating supply of a coin or token.

Written by: Anatol Antonovici | Updated November 20, 2023

Reviewed by: Mike Martin

Fact checked by: Ryan Grace

Coin burning is used across various contexts in the crypto world, including Proof of Burn networks, stablecoins, and wrapped tokens. It serves to maintain balance, protect against spam, and support token value while offering both benefits and potential downsides for crypto projects and investors.

Table of Contents

🍒 tasty takeaways

Crypto burns serve as a key mechanism in Proof of Burn networks, stablecoins, and wrapped tokens, contributing to their functionality and ecosystem.

Crypto projects can burn a portion of their supply, either as a one-time event or periodically, as a strategy to attract investors and stabilize token value.

The practice of burning crypto, which reduces circulating supply, often results in a bullish effect on price, benefiting token holders and project sustainability..

- Crypto Burning Definition: “Burning” in crypto refers to completely removing a portion of a cryptocurrency’s circulating token supply.

- Burning for Value: Burning crypto reduces supply, akin to stock buybacks, supporting crypto asset value, and occasionally complemented by buybacks for price enhancemen

“Burning” is a term used to describe the complete removal of a portion of a cryptocurrency’s token supply.

There are many contexts where crypto burning is used, and we’ll discuss the most relevant ones below. By default, burning crypto serves as a deflationary measure that supports the value of the crypto asset. If you burn crypto, you reduce its supply. As a result, the price of the crypto asset typically increases amid the same level of demand.

Crypto burning is akin to stock buybacks, and at times, it is complemented by crypto buybacks to decrease the supply and bolster prices.

Individuals can burn tokens for a wide variety of reasons. For example, in 2021, Vitalik Buterin burned $6 billion of Shiba Inu (SHIB) tokens he had previously received as a gift. The amount destroyed represented about 50% of the SHIB token supply.

How Does Burning Work?

Crypto burning involves the transfer of the tokens or coins to a burn address (eater address), which represents a crypto wallet from which they cannot be retrieved anymore. Technically, this wallet has no known private keys, and it can only receive tokens while always displaying a zero balance. Sending tokens to such wallets means permanently destroying them.

Crypto Burning Process

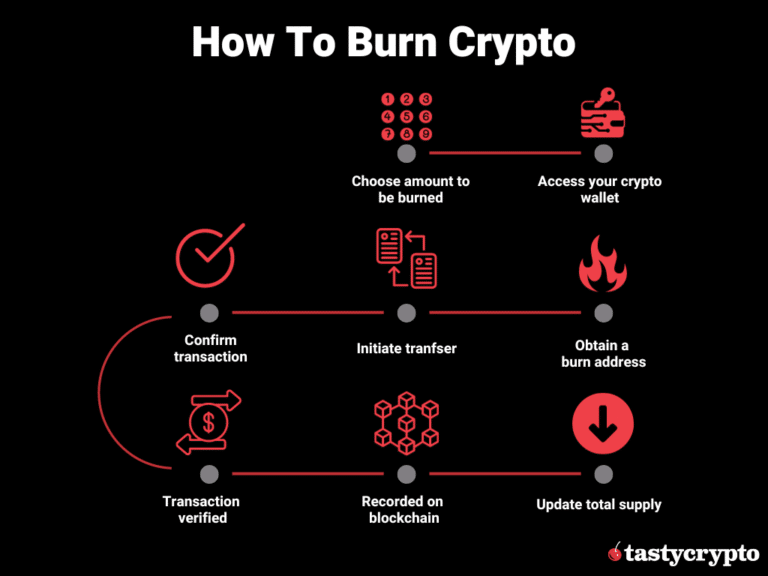

The below visual shows the process of burning crypto.

Why Burn Crypto?

Blockchain projects and communities can engage in crypto burning in various situations. Here are some examples:

Proof of Burn

Some cryptocurrencies rely on burning at the infrastructure level. They employ the so-called Proof of Burn (PoB) consensus mechanism, which requires nodes to burn a portion of their holdings to become eligible to validate new blocks.

PoB combines elements from Proof of Work (PoW) and Proof of Stake (PoS), and is regarded as an experimental algorithm to achieve energy efficiency. Some examples of cryptocurrencies using PoB are Namecoin and Slimcoin.

The PoB mechanism comes in various versions:

- In a PoB-based chain, miners have to burn the native coin to add new blocks. Eventually, the losses are offset by rewards.

- Some networks require the burning of a cryptocurrency different than the native one, e.g., Bitcoin (BTC).

- There are more complex PoB mechanisms in which miners burn native coins in exchange for credits that can eventually be used to perform certain functions on the network.

In this context, burning is not necessarily used as a deflationary mechanism, and it doesn’t affect the supply.

Stablecoins, Synthetic Assets, and Wrapped Tokens

Burning is a key mechanism used by most stablecoins, wrapped tokens, and synthetic assets (synths). All of these are blockchain-based tokens backed by underlying assets. For example, stablecoins like USDT and USDC are predominantly backed by fiat currencies; wrapped tokens like wrapped eth are backed by other cryptocurrencies, and synths mirror the price of real-world assets like stocks or commodities.

These tokens try to maintain parity with the underlying assets by balancing against reserve assets held in custody. This balance is maintained by minting new tokens or burning them based on the supply of reserve assets.

When people sell these tokens to redeem the underlying assets, the tokens are automatically burned.

Support Token Value in the Long Term

Certain volatile cryptocurrencies and tokens undergo the burning of a portion of their supply to help stabilize their price in terms of USD. These burns can take the form of either one-time processes or recurring events that are programmed from the outset.

This deflationary strategy is meant to reduce the supply or the inflation rate, thereby improving investor confidence.

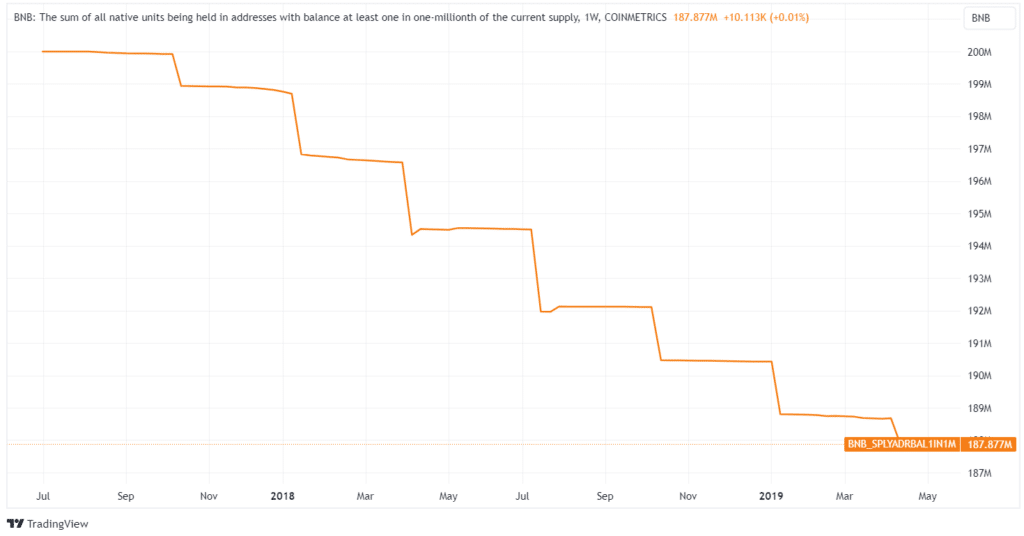

Some crypto projects buy back crypto from the open market and burn it to support the price, similar to stock buybacks. For example, Binance uses a portion of its profits to buy back and burn Binance Coin (BNB). Thanks to these regular buybacks, BNB’s supply is gradually declining, supporting the price in the long term.

Source: TradingView

In 2019, the Stellar Development Foundation (SDF) conducted a one-off token burn, reducing the XLM supply from 105 billion to 50 billion. The move was meant to improve the ecosystem and attract investors.

Protection Against Spam

Burning coins can safeguard a network against Distributed Denial-of-Service (DDoS) attacks and deter spam transactions from congesting the system. Akin to how Bitcoin users face nominal fees for transactions or Ethereum participants pay gas fees for smart contract operations, certain blockchain networks mandate that block validators burn the transaction fees they earn.

With this approach, a portion of every transaction processed is burned. One of the blockchains using this mechanism is Ripple (XRP).

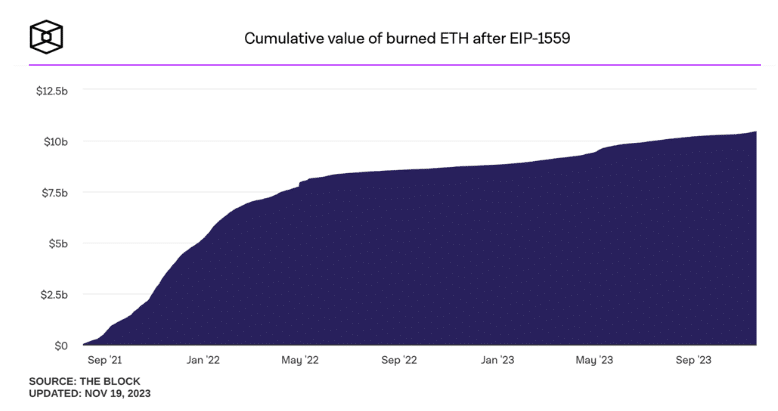

Ethereum uses a fee-burning mechanism after implementing the proposal EIP-1559, also referred to as the London upgrade. Over $10 billion worth of ETH has been burned already.

Source: The Block

Balancing Mining Incentives

Some PoW chains may use burning as a way to encourage new miners. For example, in a typical PoW network, such as Bitcoin, early adopters have an advantage over newcomers, as the halving event reduces the reward per block to cut the inflation rate.

Token burning contributes to maintaining a balance in mining by incentivizing new miners. In this model, miners are required to burn early coins and mine new coins, making it harder for early adopters to hold the cryptocurrency.

Crypto Burning Effect on Price

Crypto burning is regarded as a bullish event for non-stablecoin cryptocurrencies.

However, don’t expect the price to increase immediately after the burn. Price can be affected only when a sizeable portion of the supply is taken out of circulation. Even if/when that happens, other news or market conditions can offset the bullish effect and put pressure on the price.

Moreover, if the burn is substantial and information about it is known beforehand, the market might factor it in well in advance, potentially causing an uptrend before the actual burn.

With that said, the key takeaway is that crypto burning tends to have a bullish impact on the price.

Benefits of Crypto Burning

Here are some pros of burning crypto:

- Reduced inflation – coin burning reduces crypto supply, combating inflation and raising token value.

- Creating scarcity – by creating a sense of scarcity, a crypto project can attract more investors.

- Improving tokenomics – token burns can be used to adjust project tokenomics, such as better token distribution or eliminating unsold tokens.

- Rewarding holders – by reducing the circulating supply, crypto projects can indirectly reward crypto owners, as they end up with a higher share.

- Control supply – by burning crypto, crypto projects can maintain the supply to a certain threshold. For example, stablecoins and wrapped tokens use minting and burning to control supply.

Cons of Crypto Burning

Here are a few potential downsides of burning crypto.

- Irreversibility – once burned, the coins are permanently gone, making errors in this process irreversible.

- Speculation and volatility – news of coin burning often leads to speculation, causing short-term price surges that might not reflect the project’s long-term vision and lead to price instability.

- Limited impact – for projects with a large total supply, coin burning might have an unnoticeable impact on the token’s value, as the supply reduction may fall short of expectations.

Secure Your Crypto With Self-Custody

When you store your crypto in a self-custody wallet, you don’t have to trust that an exchange is acting in your best interest. This is because you are the only party privy to your private key, or seed phrase.

Here are some additional benefits you get when you choose to self-custody your digital assets with tastycrypto:

- In-App Swap: Trade BTC, ETH, and 1,000+ tokens

- Generate Yield in DeFi: Stake, lend, and become your own market maker

- NFTs: Buy, sell, and view NFTs in-app

tastycrypto offers both iOS and Android self-custody wallets – download yours today! 👇

FAQs

Burning crypto means permanently removing a portion of the circulating supply by sending it to a special burn address from which it can never be recovered.

Crypto burning can be beneficial as it acts as a deflationary measure, supporting the token’s price by reducing its supply. Burning is also used by stablecoins and wrapped tokens to maintain parity with their underlying assets.

Burning crypto generally has a bullish effect on price, as reducing supply amid constant demand can increase the token’s value.

Buying after a crypto burn event requires caution. While it can suggest a bullish trend, the impact on price can be influenced by market conditions and the size of the burn.

🍒 tasty reads

Crypto Burning Guide: What It Means and How It Works

Crypto Coin vs Token: What’s The Difference?

Leverage in Crypto Trading: 6 Key Examples

What Is Slippage in Crypto? Beginners Guide

Anatol Antonovici

6+ years of experience writing for crypto brands and blockchain firms, including Coindesk, Cointelegraph, Bitcoinist, CryptoPotato, Algorand, and OTCTrade.com