In cryptocurrency, leverage refers to the process of amplifying both returns and losses by borrowing funds.

Written by: Mike Martin | Updated July 26, 2024

Reviewed by: Ryan Grace

Fact checked by: Laurence Willows

In cryptocurrency, leverage trading refers to the process of borrowing funds in order to increase long or short exposure to a digital asset. In this article, we’ll explore leverage in the decentralized finance (DeFi) space.

🍒 tasty takeaways

Leverage crypto with DeFi borrowing.

Leverage crypto with margin trading platforms like dYdX.

Perpetual futures offer various leverage ratios.

Options contracts allow for custom-tailored leverage strategies.

Leveraged tokens offer a hassle-free approach to leverage.

Gain leverage through liquid staking protocols like Lido.

In crypto trading, leverage refers to the process of increasing exposure to a digital asset(s) using funds that you do not own.

Many centralized crypto exchanges like Kraken, Bybit, and Binance offer leverage in the form of margin trading. DeFi (decentralized finance), however, presents far more options to leverage your crypto.

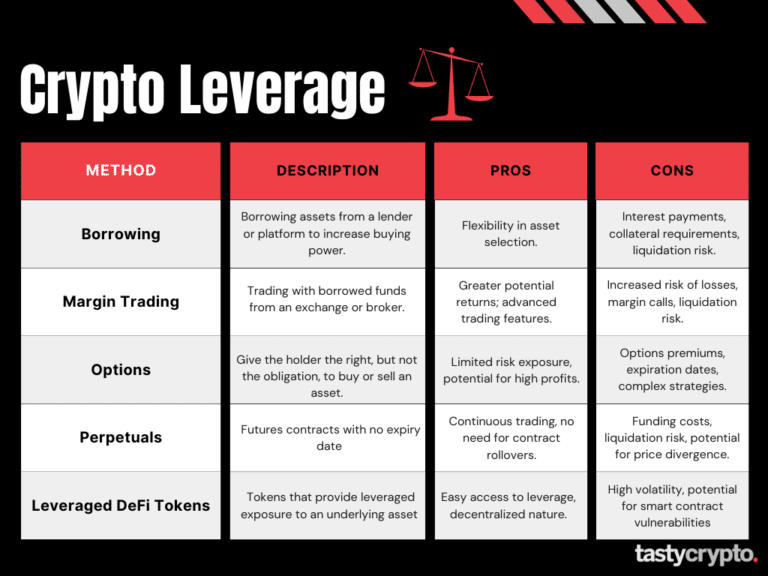

There are 6 primary ways to achieve leverage in DeFi:

Borrowing

Margin

Perpetual futures

Options

Leveraged tokens

Liquid staking

Let’s now dive deeper into these strategies!

⚠️ Warning: Using leverage in crypto comes with high risks.

1. Leverage With DeFi Borrowing

One of the most popular ways of leveraging cryptocurrency in decentralized finance, or ‘DeFi’, is through borrowing protocols.

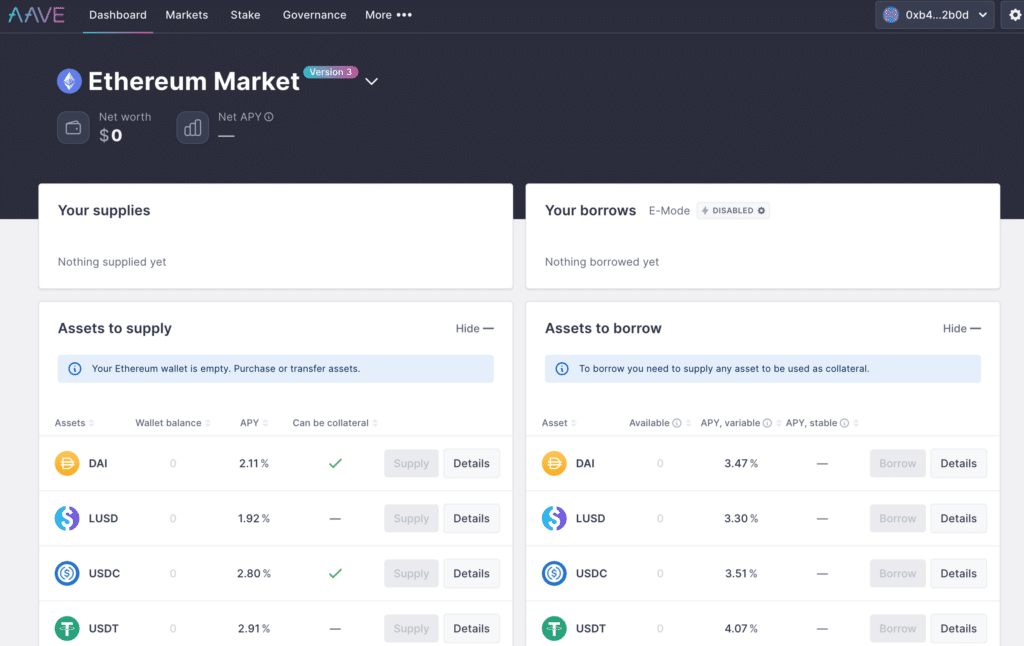

In borrowing/lending protocols like Aave, users leverage their cryptocurrency without traditional financial intermediaries using blockchain technology and smart contracts.

Let’s walk through the steps of how this works:

Connect self-custody crypto wallet to a DeFi borrowing/lending platform

Provide collateral to the protocol by depositing crypto into a smart contract

Borrow any cryptocurrency that the protocol offers by tapping into a lending pool

Pay interest to the protocol on any crypto borrowed

Repayment of the original loan

If a loan goes undercollateralized, lending platforms employ ‘keepers’ to automatically liquidate your loans and return your collateral, minus any liquidation fees. Generally speaking, collateralization ratios are very high in DeFi.

For example, the average collateralization ratio on Aave is about 150%. This means that if you want to borrow $100 worth of crypto, you’ll need to put up $150.

Top DeFi Lending Platforms

Aave

Compound

JustLend

📚 Read: AAVE vs Compound vs JustLend: Which is Best?

2. Leverage With DeFi Margin

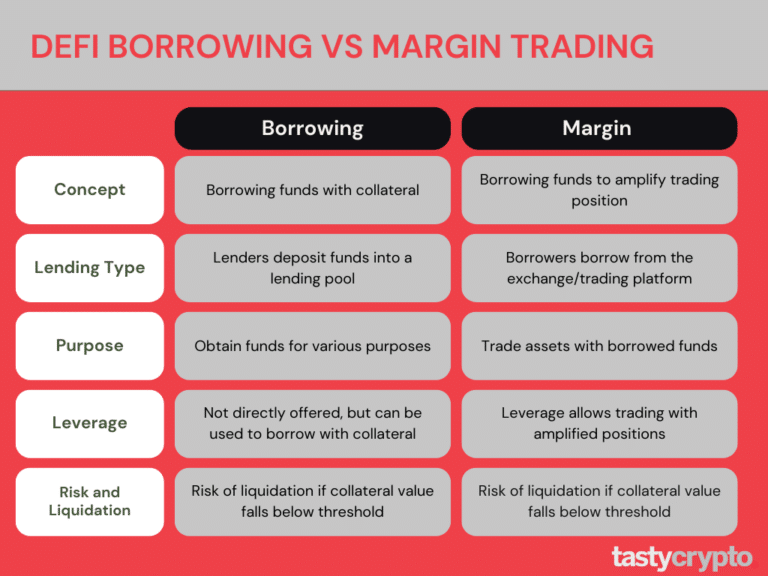

In margin trading, users borrow funds from a DeFi platform in order to invest more crypto than the funds currently available in their trading accounts (self-custody wallets).

This sounds a lot like DeFi borrowing, but there are a few differences.

For one, DeFi margin trading is much more limited in scope. With a DeFi loan, you can do what you please with those digital assets. DeFi margin trading focuses more on increasing a position size (increasing buying power) and is considered a true ‘leveraged’ position.

DeFi margin trading also offers far greater leverage than DeFi borrowing. Additionally, many DeFi margin trading platforms allow users to take long positions and short positions, the latter of which profit when a crypto price drops in value.

Some DeFi trading platforms, like dYdX, offer leverage ratios of up to 20x!

DeFi Margin Trading Steps

Own an initial balance of crypto

Connect self-custody wallet to DeFi margin platform that supports your crypto

Choose the amount of leverage you want (most platforms offer 5x)

Confirm the transaction in your wallet

Monitor your position to assure it does not go under collateralized

Some platforms offer risk management tools such as ‘stop-loss’ orders, which liquidate your position at the market price when the stop price is breached. Alternatively, limit orders (take-profit orders) can be used to lock in gains.

DeFi Margin Trading Risks

Trading crypto on margin comes with risks. The greater the leverage you use, the greater risk your position has. Here are a few different risks to keep in mind when trading on margin:

Price volatility: when you trade on margin, you must remember that both profits and losses to the underlying are greater.

Liquidation risk: if your position becomes undercollateralized, it will be liquidated. Liquidation can also come with high fees that are taken from your principal.

Smart contract risk: if the protocol that is holding your collateral is hacked, you could lose all your initial crypto. The same is true here for borrowing platforms.

Too much leverage: if you leverage your positions high (20x plus), a very small market movement can force a liquidation.

Margin call: If you don’t meet the maintenance margin requirement, you may enter a margin call, which can lead to forced liquidation.

DeFi Lending vs Margin Trading

The below table shows the difference between margin trading and borrowing.

3. Leverage with Perpetuals

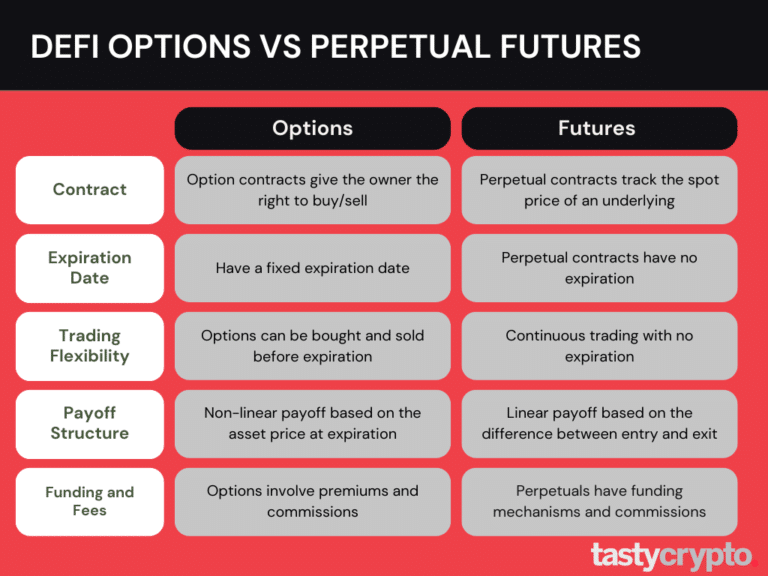

Perpetuals differ from margin trading in that these financial instruments are derivatives. This means that their price is ‘derived’ from another source, such as bitcoin (BTC). Options contracts (coming up next) are also derivatives.

Perpetuals allow crypto participants to speculate on the price of a digital asset without actually owning it. Leverage is typically maxed out at 5x on perpetual futures. This means that $5k of margin can control $25k worth of exposure.

Perpetuals differ from traditional futures contracts in that they have no expiration date. Automated funding mechanisms are employed to assure the price of the perpetual stays in line with that underlying asset. Traders of perpetuals must pay a ‘funding rate’ which contributes to assuring this peg.

The most popular perpetuals track the prices of Ethereum and Bitcoin.

Perpetual Trade Example

Trader A is bullish on bitcoin (BTC) when it is trading at $60k

Trader A connects their crypto wallet to a perpetuals platform (like GMX)

Trader A enters a 5x leveraged BTC perpetual contract with a notional value of $50,000 and pays $10,000 upfront to get into this position.

Bitcoin rises to $65,000

Since the price increased by $5,000, Trader A’s profit would be $5,000 x 5 (leverage) = $25,000.

📚 Go In-Depth: Perpetual Futures for Beginners

4. Leverage With DeFi Options

Another popular way of getting crypto leverage exposure is with options contracts.

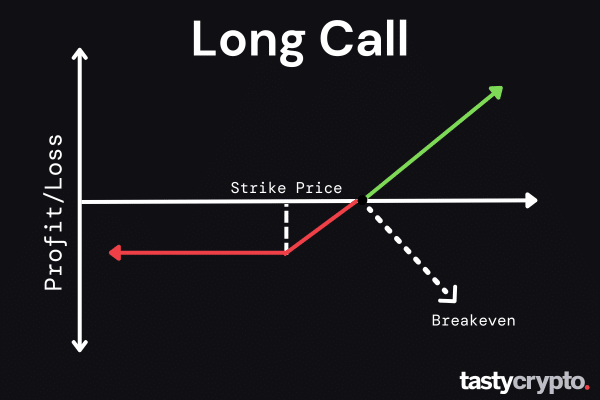

There are two types of options contracts; calls and puts. Calls are bullish market bets while puts are bearish market bets. Calls and puts can be combined to form numerous types of options strategies.

Like perpetuals, options are derivatives. There are, however, some big differences between options and futures:

Options have an expiration date

Options have a strike price

The owner of an option contract has the right to buy (calls) or sell (puts) the underlying crypto at the strike price before (American style) or at the time of expiration (European style)

Options can be combined to create many kinds of options trading strategies

📚 Read: A Beginners Guide to DeFi Options

DeFi Options Trade Example

Let’s now look at an example of an ether options trade on the Derive DeFi options protocol (formerly known as Lyra).

Trader A is bullish on ether (ETH)

Trader A connects their crypto wallet to the Derive protocol

Trader A selects a call option strike price from the options chain

A debit is paid to purchase this option

If the price of ETH is greater than the strike price + premium paid at expiration, the trader will make a profit.

On Derive, traders do not have to wait for expiration to sell a position. Derive uses automated market maker technology that lets traders buy and sell options whenever they want.

📚 Read more about how Derive works here!

DeFi Options vs Perpetuals

Let’s conclude by comparing DeFi perpetuals vs DeFi options:

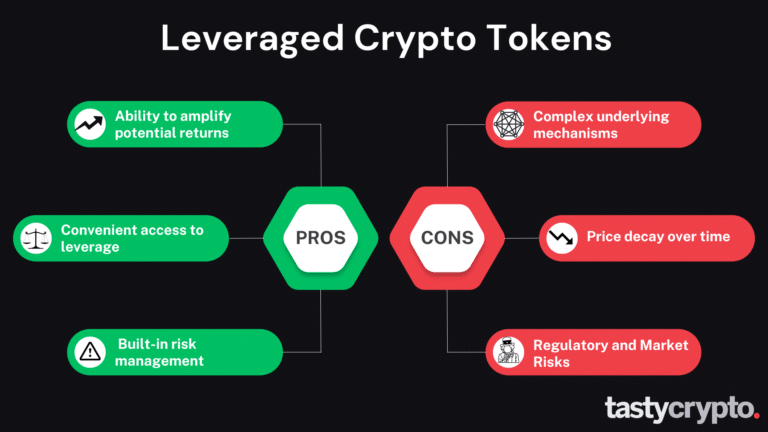

5. Leverage with DeFi Tokens

Perhaps the easiest way to get leverage in crypto is by simply purchasing a token that is inherently leveraged. With tokens, you don’t have to worry about collateralization issues, funding rates, or assignments.

Leveraged tokens are similar in nature to leveraged ETFs like SPUU, which provides for 2x exposure to the S&P 500.

Though rebalancing does indeed occur in DeFi tokens (and these fees are implicit in the token’s price) this happens behind the scenes.

Let’s now explore some of the most liquid leveraged tokens in crypto according to CoinGecko.

BTC 2x Flexible Leverage Index (BTC2X-FLI)

ETH 2x flexible leverage index (ETH2X-FLI) Index Coop

MATIC 2x flexible leverage index (MATIC2X-FLI-P) Index Coop

Pros and Con of DeFi Leverage Tokens

6. Leverage with Liquid Staking

Some liquid staking DeFi protocols allow users to borrow against their staked crypto. For example, you can stake your crypto on the Lido protocol, and then use these staked digital assets as collateral to obtain a loan. You can use these loans to open other crypto positions, thus creating a leveraged position in the process.

Liquid staking leverage typically involves interacting with numerous smart contracts, which can be very risky.

⚠️ Before putting on a leveraged trade, it is vital to research your crypto investment.

FAQs

Many popular cryptocurrency exchanges, like Binance, offer leverage in the form of margin trading. Margin traders must pay interest on their borrowed funds.

Yes. The more leverage you take on in the crypto market, the greater your risk. In addition to price risk, leverage traders in DeFi are exposed to smart contract risk.

$100 leveraged 20x would give you $2,000 worth of exposure. Liquidation risks are high with this much leverage.

If the market moves in your favor, crypto leverage trading can be very profitable. However, over the long run, crypto leverage trading is generally unprofitable. This is due to price divergence, fees, interest payments, and having to pay a funding rate for perpetual futures.

The maximum leverage in crypto on DeFi protocols is generally 100x.

A leverage ratio in crypto compares the amount of borrowed crypto to the amount of crypto owned.

Additional Reading

Mike Martin

Mike Martin formerly served as the Head of Content for tastycrypto. Before joining tastycrypto, Michael worked in the active trader divisions of thinkorswim, TD Ameritrade, and Charles Schwab. He also served as a writer and editor for projectfinance.

Michael has been active in the crypto community since 2017. He holds certifications from Duke University in decentralized finance (DeFi) and blockchain technology.

🍒 tasty reads

Crypto Burning Guide: What It Means and How It Works

Crypto Coin vs Token: What’s The Difference?

Leverage in Crypto Trading: 6 Key Examples

What Is Slippage in Crypto? Beginners Guide