🍒 Cryptocurrency Definition: Cryptocurrency represents any form of digital currency that is secured by cryptography and based on blockchain technology.

Written by: Mike Martin | Updated September 5, 2024

Reviewed by: Ryan Grace

Fact checked by: Laurence Willows

In this beginner’s guide to cryptocurrency, we’ll teach you everything you need to know to get started on your crypto-investing journey!

🍒 tasty takeaways

Cryptocurrency is a digital currency where transactions are recorded and maintained on a peer-to-peer ledger.

Cryptocurrency coins are created by consensus mechanisms like proof-of-work and proof-of-stake.

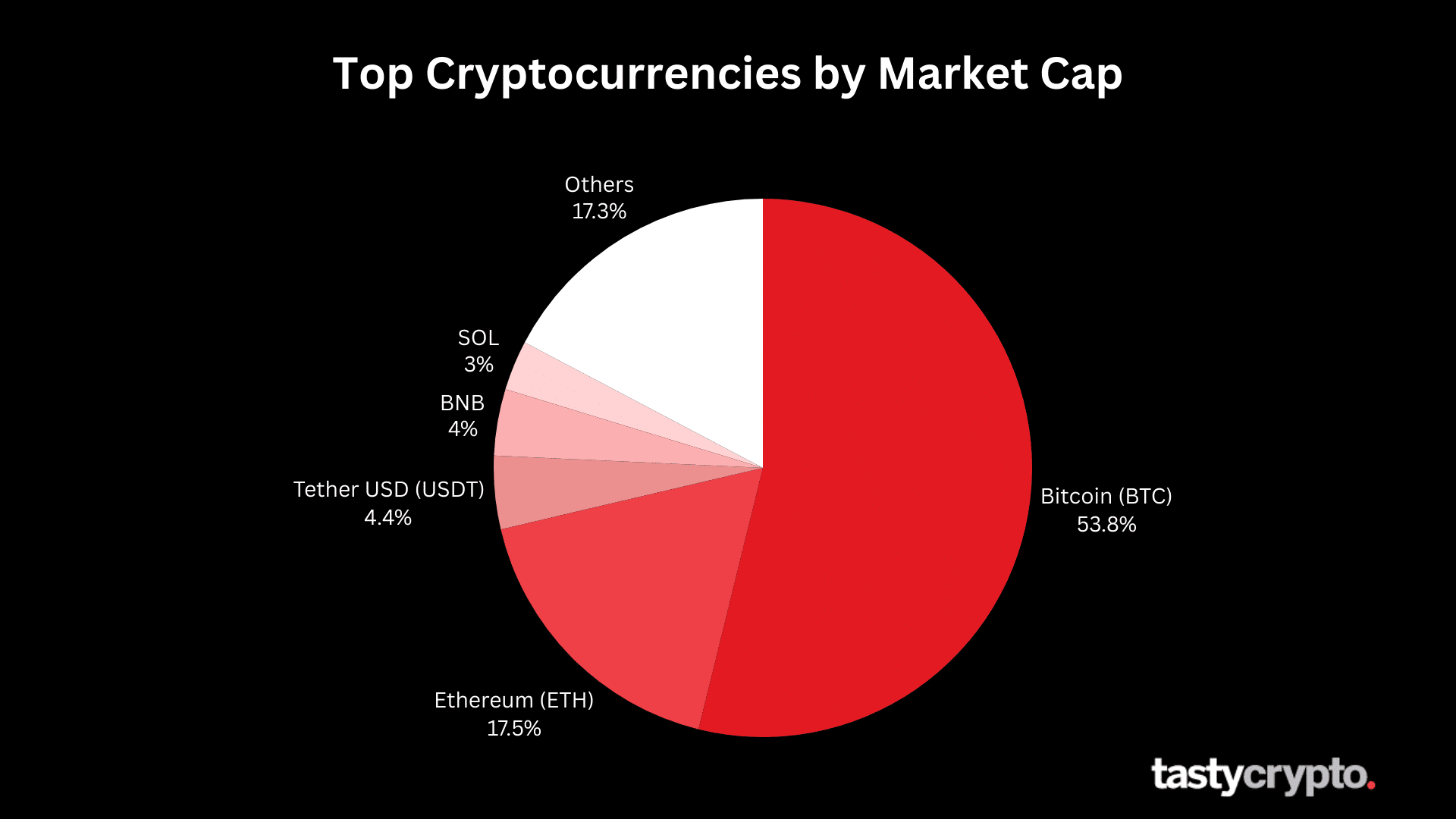

Bitcoin (BTC) and ether (ETH) are the two largest cryptocurrencies in the world.

Altcoins represent all cryptocurrencies that are not bitcoin.

There is only one crypto coin per network, but each crypto network can produce multiple crypto tokens.

Cryptocurrency can be traded on both centralized exchanges and decentralized exchanges (DEXs).

NFTs are digital assets that are unique and are valued independently.

What is Cryptocurrency?

Cryptocurrencies like Bitcoin (BTC) and Ethereum (ETH) represent a form of digital currency that does not rely upon intermediaries like banks to verify transactions. Instead, cryptocurrencies are created and maintained on distributed ledgers, or blockchains.

This democratization of control allows blockchain networks to act far more efficiently than traditional organizations and governments, which employ expensive and time-consuming top-down leadership models.

The greatest advantage of cryptocurrencies is that their transactions are stored on ‘immutable’ blockchains.

Immutable means that something can never be altered. The transactions that enter a blockchain, therefore, can never be altered or tampered with. This makes both double-spending and counterfeiting almost impossible – a regular problem with fiat currencies such as the US dollar.

📚 Read: 23 Best Crypto Research Tools

Cryptocurrency/Blockchain Features

In addition to this immutability, some paramount features of blockchain and cryptocurrency include:

Trustless

Blockchains do not have to be trusted in order to work; they act in the best interest of the majority.

Security

Encryption algorithms make larger blockchains like Bitcoin (BTC) and Ethereum (ETH) almost impossible to hack.

Consensus

Blockchains employ consensus methods like proof-of-work, which means that the majority of a blockchain community must agree on changes to the blockchain before they are enacted.

Transparency

All cryptocurrency transactions are recorded and can be viewed by anyone, anytime.

Efficient

Since cryptocurrencies operate without the need for central authority approval, transacting in crypto is both cheaper and faster when compared to transacting with a bank.

Global

Unlike traditional fiat currency, cryptocurrency is borderless. This allows anyone in the world to participate in crypto (local government permitting).

In order to truly understand cryptocurrencies, we must first understand how blockchain technology works.

Let’s go!

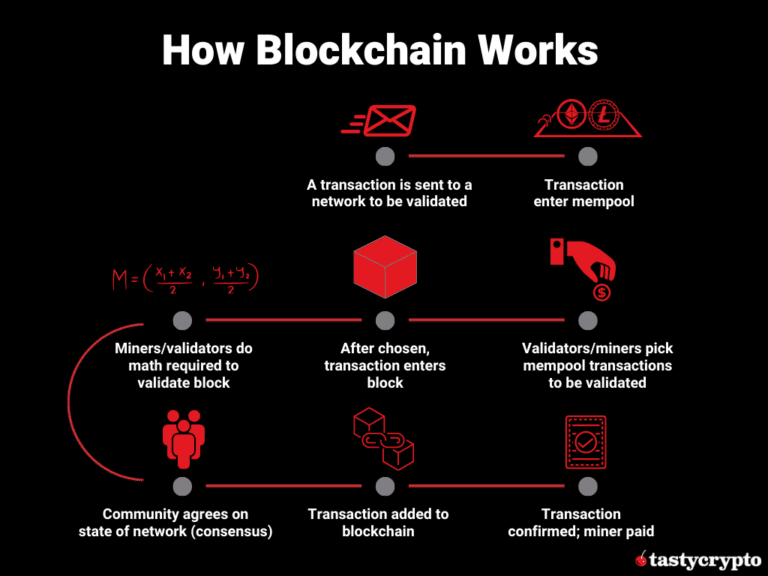

How Does Blockchain Work?

If you understand how a basic ledger works, you can understand how distributed networks like blockchain operate.

At its core, a blockchain is a ledger. Another name for blockchain, after all, is ‘distributed ledger.’

Blockchains are distributed in that they are stored on the computers of every single participant in the network (peer-to-peer). This is in contrast to centralized organizations, which store their ledgers and code on centralized servers inaccessible to the public.

The entire history of every single blockchain transaction can be viewed by anyone at any time through ‘block explorers’.

This transparency provides great security. In most large blockchain networks, it is impossible to ‘cook the books’. If a bad actor were indeed to try, they would be stopped by a network’s ‘consensus mechanism’.

A consensus mechanism is a way in which a blockchain community comes to an agreement on the current state of a network.

If in the latest block, a bad actor were to try and introduce something malicious, the community would see it, and prevent it from entering and infecting the rest of the blockchain.

Consensus mechanisms are also how all cryptocurrency coins are created. Let’s learn about this next!

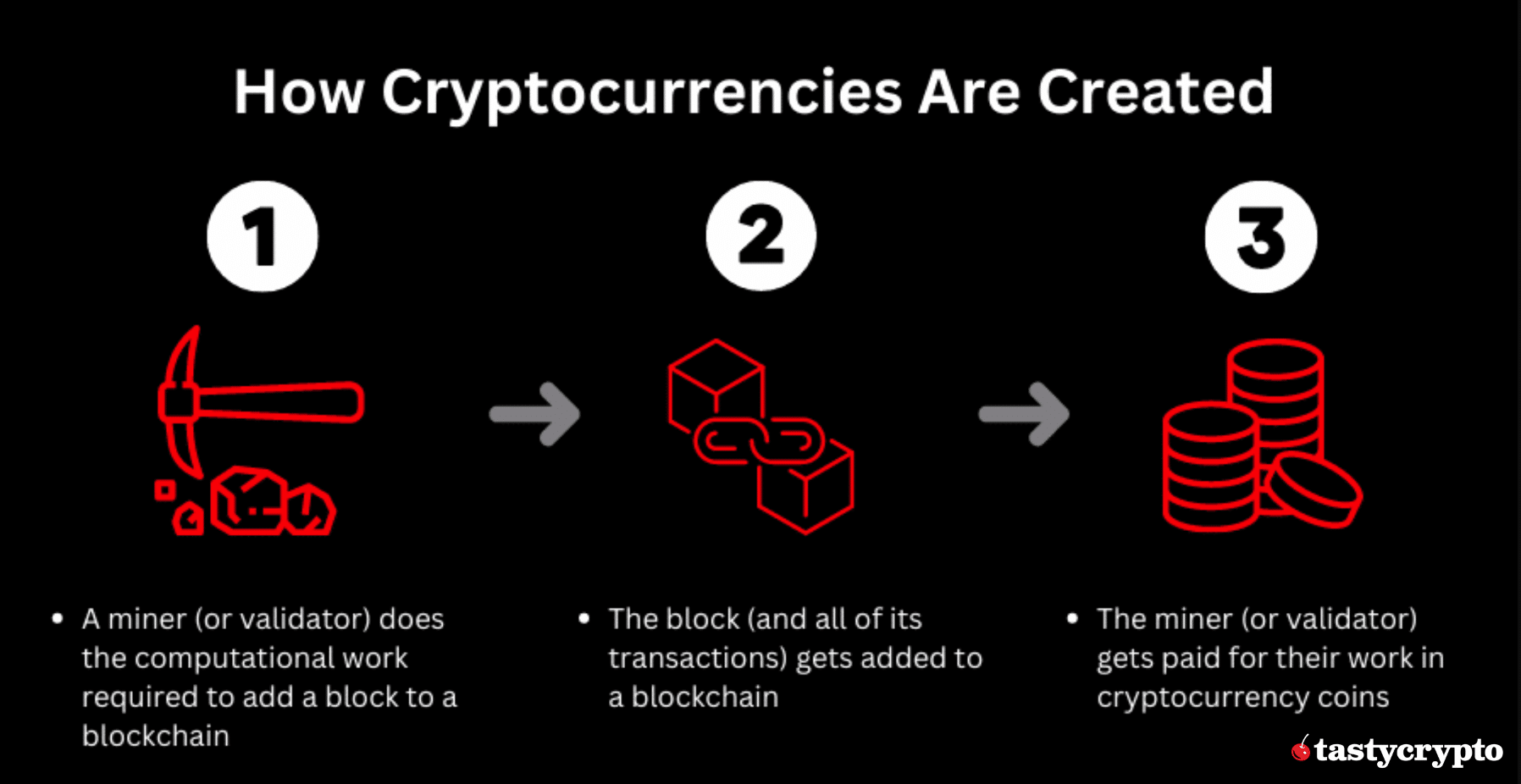

How Are Cryptocurrencies Created?

All cryptocurrency coins (not tokens- more on these later) are created through a network’s consensus mechanism. Here are 3 popular consensus mechanisms modern blockchains are using in 2024.

Proof-of-Work (PoW) – Bitcoin

Proof-of-Stake (PoS) – Ethereum

Delegated PoS (DPoS) – Tron

Proof-of-Work (PoW) vs Proof-of-Stake (PoS)

Let’s explore PoW and PoS next as they are the most popular.

Proof-of-Work (Bitcoin)

In proof-of-work (PoW) networks, crypto ‘miners’ from around the world race to solve a mathematical equation. This math problem helps to secure a blockchain network. The miner that solves this math problem first is able to validate and verify all the transactions within the latest block. They are rewarded in the ‘fees’ that users attach to their orders to have their transaction validated (it is not free!), and a network reward.

For the Bitcoin network, this ‘block reward’ currently sits at 3.125 bitcoins (BTC). That’s equivalent to about $209k USD at Bitcoin’s current price of $67k/coin in 2024. And remember, these ‘miners’ also get fees on top of this block reward!

🚨 If you’re trading crypto on a CEX, you don’t pay gas fees – you pay maker/taker fees. Read how these fees work here!

Proof-of-Stake (Ethereum)

Proof-of-stake (PoS) is different from PoW.

In this consensus mechanism, validators are chosen via a lottery system. In order to be in this lottery, you must stake that network’s native coins. Your staked coins are like lottery tickets – the more you have staked, the greater the chance you have of being selected by a network to validate the latest block.

📕 Read: What is Crypto Staking and How Can I Use It?

The network assigns a math problem to your computer (node) if you are selected. After validation is done, your work is broadcasted to the entire network. If the network comes to a consensus, this block is added to the blockchain and you are rewarded in fees. Ethereum does not currently have a block reward; it is therefore a deflationary digital asset in 2023.

Block Reward = Crypto Origination

This ‘block reward’ paid to miners is the origin of all cryptocurrency coins (again, not tokens!). After miners (or validators for PoS networks) are given their reward, these parties can sell their coins on popular cryptocurrency exchanges like Coinbase.

Cryptocurrency Coins vs Tokens

All cryptocurrencies (not including NFTs) can be broken down into coins and tokens.

Cryptocurrency Coins

A cryptocurrency coin represents a blockchain network’s native asset. Cryptocurrency coins are primarily used as a medium of exchange. There is only one cryptocurrency coin per blockchain network.

Cryptocurrency Coins Examples

Ethereum: ether (ETH)

Bitcoin: bitcoin (ETH)

Cardano: ada (ADA)

Solana: sol (SOL)

Polygon: matic (MATIC)

Binance: bnb (BNB)

Cryptocurrency Tokens

A cryptocurrency token, on the other hand, operates under a native blockchain. For this reason, there can be an infinite number of crypto tokens per blockchain.

The Ethereum network is Turing complete, which makes it a popular choice for developers to build decentralized applications (dApps) atop. On Ethereum, these tokens are interoperable as they are all built with the ERC-20 token standard.

Ethereum Token Examples

Uniswap (UNI)

Aave (AAVE)

ChainLink (LINK)

MakerDAO (DAI)

Types of Ethereum Tokens:

There are many different types of cryptocurrency tokens. Here are two of the most popular ones.

Stablecoins

USDC, USDT, BUSD

Stablecoins track the price of a different asset class, such as the US Dollar. Many (not all) stablecoins are backed 1X1 with reserves of the underlying native currency.

Utility Tokens

LINK, UNI, LIDO

Utility tokens allow users to perform a specific action within a protocol.

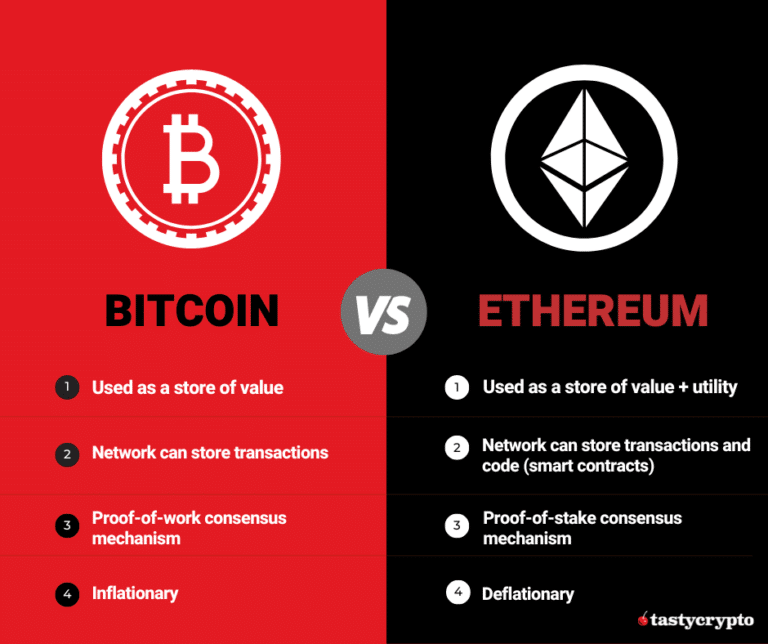

Bitcoin vs Ethereum

Bitcoin and Ethereum are the two juggernauts in the crypto ‘coin’ world. We learned earlier how both of these coins are created; let’s now learn what they actually do!

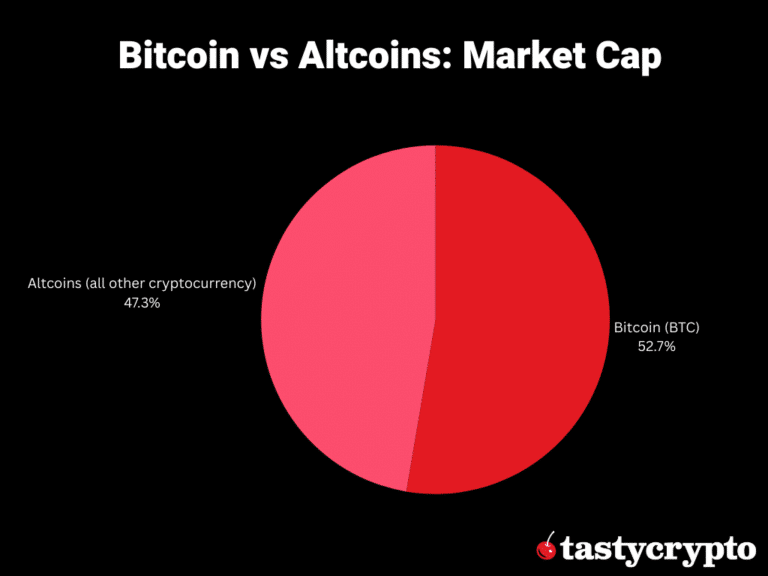

As we can see from the below image, Bitcoin is the largest cryptocurrency by market capitalization in the world. Let’s look at bitcoin (BTC) first!

What Is Bitcoin?

The bitcoin (BTC) cryptocurrency (spelled with a lowercase ‘b’ is the native digital asset of the Bitcoin (uppercase ‘B’) blockchain network.

Satoshi Nakamoto introduced the world to Bitcoin in 2008 with his famous whitepaper. The Bitcoin network was officially launched in 2009.

📚 Read! Here’s what to look for in a whitepaper

Before Bitcoin, all previous attempts at blockchain failed because they could not solve the ‘double-spending’ problem. Satoshi was the first successful blockchain developer to crack this riddle.

Today, bitcoin cryptocurrency is mainly used as a store of value, kind of like digital gold. Relative to other blockchains, bitcoin is quite expensive to use as an everyday payment system.

📚 Read! Bitcoin is a Legit Store of Value. Here’s Why.

What is Ethereum and How Does It Work?

Bitcoin is not Turing-complete. This means that it is limited in its functionalities. The Bitcoin blockchain can only store basic transactions in the blockchain.

Ethereum (ETH), on the other hand, can store both transactions and code in its blocks.

This code comes in the form of ‘smart contracts’.

Smart Contract Definition: A smart contract is code that is stored on a public blockchain that automatically executes when certain conditions are met.

Smart contracts can be used to build apps that mirror any centralized application in existence today, including Twitter and Facebook. Smart contracts are most popular today in gaming and DeFi (decentralized finance), which is mirroring our current financial system in decentralized blockchains.

🍒 Want to read more about smart contracts? Smart Contracts for Beginners: Definition and Use-Cases

What Are Altcoins?

Altcoin Definition: An ‘altcoin’ represents any form of cryptocurrency that is not bitcoin (BTC).

As we can see, the definition of altcoin is pretty straightforward. If it’s not bitcoin, it’s an altcoin. Even ether (ETH) is considered an altcoin.

As blockchain technology explodes, many crypto investors are diversifying their digital assets across numerous crypto projects. As we can see from the above image, bitcoin today represents 53% of the total crypto market cap.

Watch! How To Pick a Winning Crypto Trade

How Much Should I Invest in Crypto?

At tastycrypto, we believe that 1% of an investor’s portfolio should be invested in cryptocurrencies.

For sure, this number varies depending on who you ask.

The consensus was 3-5%, but this was formed when crypto was trading at values 3x higher than where it’s at today.

Given this reduction in market cap, modern portfolio theory suggests a 1% crypto allocation may be more appropriate.

🍒 Want to see how we came up with this number? Crypto: Here’s Why to Invest and How Much

How Much Money Do I Need to Start Investing in Cryptocurrency?

You can start investing in crypto with any amount of money you desire. However, you should bear in mind that most blockchains charge network fees to transact. On Ethereum, gas fees are usually a couple of dollars per transaction. Therefore, it would not make sense to invest or trade crypto if you wanted to start with $10 or so. You’d be down 20-30% because of the fees out of the gate!

How Do I Buy Crypto?

There are two primary ways to buy cryptocurrencies:

Centralized exchanges

Decentralized exchanges

Buying Crypto on Centralized Exchanges

On centralized exchanges, like Coinbase or Binance, you buy crypto with a ‘custodial cryptocurrency wallet’.

In these types of wallets, the exchange holds your private keys. This means that you can never be 100% sure that an exchange is holding your funds 1×1 (FTX!) since you can’t track it on a blockchain.

📕 Read: Best Defi Coins To Buy on DEXs in 2023

Buying Crypto on Decentralized Exchanges

Self-custody wallet users buy and sell crypto on DEXs, or decentralized crypto exchanges, like Uniswap.

If you want to maintain control over your private keys and trade on DEXs, you will need to open a self-custody crypto wallet, like the one tastycrypto offers.

With self-custody wallets, you are the sole party responsible for maintaining a record of your private keys, which are associated with a ‘seed phrase’. If you lose this seed phrase, there is no password recovery method to retrieve it.

In addition to giving crypto investors complete control over their private keys, self-custody wallets allow users to interact with decentralized applications (dApps).

In order to initially get crypto into a self-custody wallet, however, you may need to first purchase it on a centralized exchange, and then send this crypto to your self-custody wallet address.

📕 Read: DEXs vs CEXs: Which Offer Lower Fees?

What Are NFTS?

Non-fungible tokens, or NFTs, are digital assets that are not fungible.

Fungible is another word for replaceable. For example, US currency is fungible because one US Dollar is as good as the next.

Non-fungible tokens, therefore, are unique crypto assets. Like art or baseball cards, NFTs are valued independently.

Popular NFT collections include:

Bored Ape Yacht Club

CryptoPunks

Otherdeed for Otherside

Mutant Ape Yacht Club

CLONE X

In order to purchase NFTs you will need to connect a self-custody crypto wallet to an NFT marketplace, such as OpenSea.

📕 Read More: NFTs: The Beginners Guide

😊Ready to begin investing? Start here! Best cryptos of 2024

Before investing in crypto, it may be wise to read this article from the U.S. Securities and Exchange Commission, which highlights some of the risks related to cryptocurrency.

FAQs

Bitcoin is the most popular crypto to invest in. The ‘best’ cryptocurrency will depend on the market. During crypto bull markets, altcoins tend to outperform bitcoin. However, during bearish times, most altcoins underperform bitcoin.

Bitcoin (BTC) is used primarily as a store of value while Ethereum (ETH) is used both as a store of value and as a way to store and execute code on blockchains.

You can indeed $1 in cryptocurrency, but on most blockchains, the fees would exceed $1, making a $1 investment in crypto non-sensical.

Dogecoin (DOGE) is a meme-inspired coin that was launched in 2013. Dogecoin skyrocketed in value in 2021 when celebrities like Elon Musk promoted the coin. Compared to other blockchain networks, Dogecoin offers little utility.

Litecoin (LTC) was launched in 2011 by Charles Lee. Like Bitcoin, Litecoin employs the proof-of-work consensus mechanism. Though Litecoin is both faster and cheaper than Bitcoin, it has not been as widely adopted as Bitcoin and therefore has less value.

The main difference between stocks and crypto is that stock gives you ownership in a company (equity) while cryptocurrencies offer no direct intrinsic value. Additionally, cryptocurrencies are much more volatile than the stock market.

🍒 tasty reads

Crypto Burning Guide: What It Means and How It Works

Crypto Coin vs Token: What’s The Difference?

Leverage in Crypto Trading: 6 Key Examples

What Is Slippage in Crypto? Beginners Guide

Mike Martin

Mike Martin formerly served as the Head of Content for tastycrypto. Before joining tastycrypto, Michael worked in the active trader divisions of thinkorswim, TD Ameritrade, and Charles Schwab. He also served as a writer and editor for projectfinance.

Michael has been active in the crypto community since 2017. He holds certifications from Duke University in decentralized finance (DeFi) and blockchain technology.