Whitepaper Definition: In cryptocurrency, a whitepaper is a document that communicates important information related to a blockchain project.

Written by: Siyu Ren Heinrich | Updated August 9, 2024

Reviewed by: Mike Martin

Fact checked by: Ryan Grace

Cryptocurrency whitepapers are crucial documents that present essential details about a specific cryptocurrency project. In this article, we’ll tell you what to look for in a crypto whitepaper.

Table of Contents

🍒 tasty takeaways

-

Whitepapers deal with the most important components of a crypto project and answer questions related to a project.

-

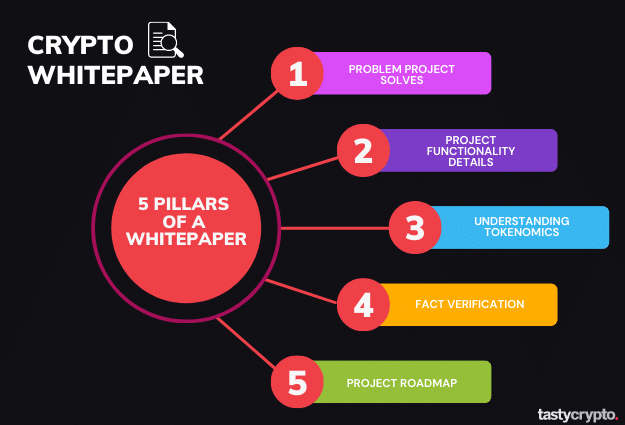

The five key elements of a whitepaper consist of the project’s use case, its operational details, tokenomics, the ability to substantiate the information presented through facts, and the depth and comprehensiveness of the information included.

-

A whitepaper is only part of a successful crypto project. A good or bad whitepaper alone says little about subsequent success or failure.

What Is a Whitepaper?

The aim of a crypto whitepaper is to enable potential users, crypto investors, and other interested parties to gain a comprehensive understanding of the key details of the project.

Specifically, a whitepaper answers the following questions:

What is the project’s purpose and what kind of problems does it solve?

How does the project work?

How are blockchain technology and smart contracts used?

In many cases, a crypto project issues a whitepaper before it tries to raise funding. This is done to attract potential investors to join the initial coin offering (ICO) or initial exchange offering (IEO). For this reason, whitepapers usually talk in detail about a project’s tokenomics.

What Are the Main Components of a Whitepaper?

Many digital assets whitepapers follow the structure of a typical scientific research paper. A good example is the Bitcoin whitepaper written by Satoshi Nakamoto, which is the most well-known whitepaper in the crypto sphere. Although there is no strict format to be followed, here is a list of the main components of many whitepapers:

Extract – a short summary of the whitepaper.

Introduction/ history – in this section, the problem the project is trying to solve is described, including the history and current status of the industry.

A detailed description of the project – this is usually the main part of the whitepaper. In a typical crypto whitepaper, you’ll find multiple subsections. These often include the project’s architecture, detailed explanations of its operations, often accompanied by charts and mathematical equations, as well as how various theories apply to the project. The whitepaper also outlines potential use cases and applications, along with the project’s tokenomics and governance structure.

Conclusion – a wrap-up of what the project is trying to achieve and a summary of the key takeaways for the readers.

A whitepaper could also cover other information such as:

Who are the founders and important team members?

The roadmap, the goals, risks, potentials, and regulatory facts.

Relevant points if the project is to be embedded in an existing ecosystem.

Is the project a DAO (a decentralized autonomous organization) that allows tokenholders to participate in the management and decision-making?

Responsible projects update their whitepaper regularly. For example, the Ethereum whitepaper was written by Vitalik Buterin in 2014, and the latest version was updated in June of 2023.

Watch! tasty interviews Vitalik Buterin

What to Look For in a Whitepaper

A well-written whitepaper offers a lot of useful information. Here are the 5 most important points it should cover:

1. What problem does the crypto project solve exactly?

Usually, this is outlined in the introduction section. This point helps you to understand the project’s market as well as its main target groups. While certain projects provide data regarding the market size, user base, and industry forecasts they aim to engage in, others highlight the existing challenges within that industry and articulate the necessity for a solution. Gaining a deep understanding of the problem the project aims to address can enhance your ability to accurately evaluate its potential.

2. How does the project work?

This is an important part that allows you to understand the project’s strengths and weaknesses, as well as illustrate how this particular project is better (or worse) than its competitors.

To give an example, here are some points you’d want to learn about when reading a Layer 1 network’s whitepaper:

What is the consensus mechanism (e.g. proof of work, proof of stake)?

What are the criteria to run the network’s nodes (this plays a role in how crypto assets are secured)?

What are the fees for using the platform?

Which decentralized applications (dApps) and use cases does the network have?

If the project is building a DeFi (decentralized finance) platform such as a decentralized exchange (DEX), you’d want to read detailed information about which automated market makers (AMM) it is implementing, and how its liquidity pools are created and maintained.

If the project aims to solve blockchain scalability, there should be a section in the whitepaper explaining whether it is a layer 1 or layer 2 solution.

As these examples show, what makes a good white paper depends very much on the project at hand.

3. Tokenomics – where does the value of the cryptocurrency lie?

Another significant incentive for people to investigate crypto projects is their aim to spot the next project that could produce 100x or even 1000x returns. Grasping a project’s tokenomics is essential for this. In a whitepaper, this section should answer several crucial questions, among others:

What digital currency (coin/token) does the project issue?

Is there a hard cap on the total amount?

Is it inflationary or deflationary?

What is the amount that will be available for sale to institutional and retail investors respectively?

What is the use of the token? Does it actually have any utility or use case once the project is live?

Will there be a lockup period once the crypto token is bought? If so, what is the vesting schedule?

Will the token/coin be listed on any crypto exchanges? Is there any cooperation between the project and crypto exchanges?

4. Facts or opinions?

A comprehensive whitepaper is one thing. But how much can you trust the information it contains? In short, don’t trust any white paper blindly. Always do your own research. For example, if the whitepaper lists out the current market size of a particular industry, google it again to see if it is consistent with other reliable sources. When the whitepaper uses a lot of phrases such as “we think”, and “in our opinion”, always take it with a grain of salt. After all, you want to see that the project is built based on scientific research, not the founder’s opinions.

📚 Read! Best Free Tools to Research Crypto

5. Vague or detailed information?

A lot of terms in blockchain are difficult to understand for people with little knowledge of tech. However, this does not mean that a project should be vague and try to avoid thorough explanations. On the contrary, a solid project always explains ideas that an average reader or beginner can understand. They use charts, graphs, and equations to visualize and simplify things. A whitepaper that refuses to give in-depth information and only talks about key points briefly gives a sketchy impression.

Crypto Whitepaper Sumamry

| Title | Content |

|---|---|

| Whitepaper Definition | A document that communicates crucial information related to a blockchain project. |

| Key Elements in a Whitepaper | Use case, operational details, tokenomics, substantiation of information, depth and comprehensiveness of information included. |

| Main Components of a Whitepaper | Extract, introduction/history, detailed description of the project, conclusion, and information about the founders and team members. |

| What to Look for in a Whitepaper | The problem the project solves, how the project works, tokenomics, facts or opinions, vague or detailed information. |

| Whitepaper Importance | Provides transparency, helps in better understanding and assessment of the project, and serves as a benchmark for future progress. |

FAQs

Even though publishing a whitepaper is not a must for a crypto project, and there are no standards for how a whitepaper for a cryptocurrency or decentralized application should be written, a whitepaper is still considered to be important for the following reasons:

It is an important document for the project team to introduce their ideas, innovations, and all the relevant details to the public in a formal way.

It provides transparency so that all interested parties can have a better understanding of the project.

It helps researchers, developers, potential users, and community members make better assessments and decisions about the project.

It can be used as a benchmark in the future to check if the project is actually implementing its plan, reaching its goals.

There are many projects that published good quality whitepapers, such as Ethereum, Polksdot, Uniswap, to name a few. Two things distinguish a good white paper: it lists the author’s names at the very beginning and it includes a reference section at the very end. Usually, the author(s) are the founders and/or responsible for the design and building of the project. With the references, one can know the previous academic research that the project is based on, and what improvements or new features the people behind it are building. In many cases, innovative projects offer better opportunities than projects that simply make changes to forked code.

No. While a good whitepaper gives readers a good overview of the important aspects of a project, it does not guarantee the project will succeed. A good quality whitepaper does show that the team is serious about the project. However, many other factors also contribute to the success of a project. For example, the management, the team who is actually building the project, funding, marketing, etc. When a whitepaper is published, many projects are still in the startup phase or at the very beginning of the building stage. That means that many things could still go wrong. Even a solid project with a dedicated team could fail due to poor marketing and the inability to generate enough users.

In short, a litepaper is usually shorter and not as detailed as a whitepaper. Usually, the technical part is kept very short. It is like a teaser of a whitepaper. A whitepaper is more comprehensive and describes the fundamental and technical details of the crypto project. A yellow paper focuses on the technical and mathematical part of the crypto project. It contains a lot of complex equations, scientific analysis, and proofs which are not covered in extensive depth in a whitepaper.

Yes, NFT (non-fungible tokens) projects have whitepapers. Here is a list of popular NFT whitepapers.

Additional Reading:

Siyu Ren Heinrich

5 years of experience in crypto research of writing practical blockchain and crypto analysis on Medium.

MSc in Computer Science, BSc in Smart Engineering, and BSc in Economics and Statistics.

Michael has been active in the crypto community since 2017. He holds certifications from Duke University in decentralized finance (DeFi) and blockchain technology.

🍒 tasty reads

What Is a Crypto Whitepaper? 5 Things to Look For

Crypto Fundamentals to Pick Winning Trades

Here’s How to Diversify a Crypto Portfolio