In this video, we’ll review some basic fundamental research principles to help you in your cryptocurrency investment journey.

Cryptocurrencies have become a significant part of the financial landscape, with Bitcoin dominating the market. In this article, we will go beyond the price action and explore the fundamentals of crypto tokens.

By analyzing blockchain networks and their underlying metrics, we can gain valuable insights into their potential and market dynamics. This article aims to provide a comprehensive understanding of crypto fundamentals, including financial metrics and on-chain data points. So let’s dive in!

Table of Contents

🍒 tasty takeaways

When analyzing crypto fundamentals, it is essential to consider financial metrics such as trading volume, market cap, and liquidity.

On-chain activity, including active addresses, transaction count, and transaction throughput, provides insights into the adoption and viability of blockchain networks.

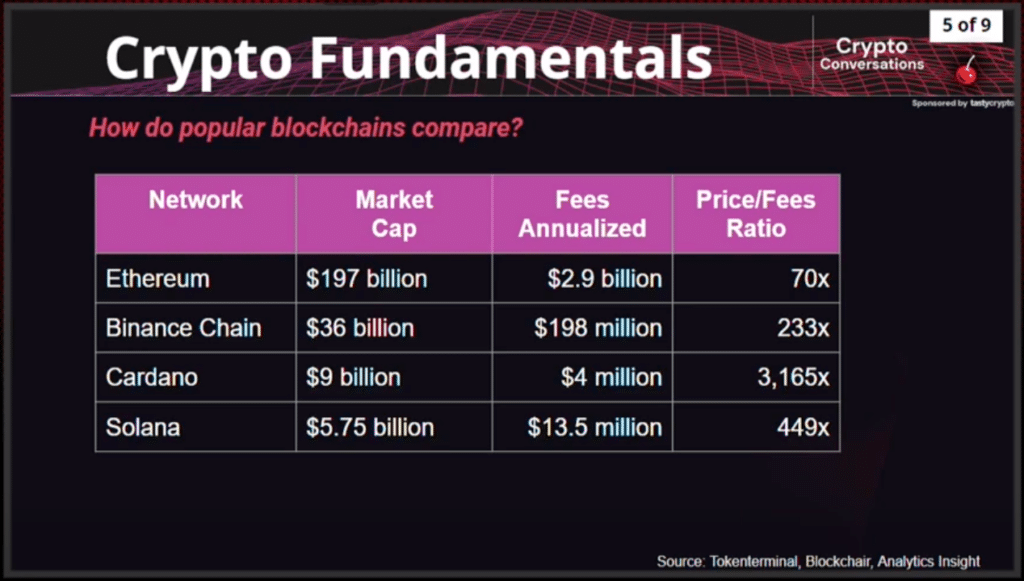

A comparison of popular networks like Binance Chain, Ethereum, Cardano, and Solana reveals variations in on-chain activity levels, indicating differences in network usage and potential use cases.

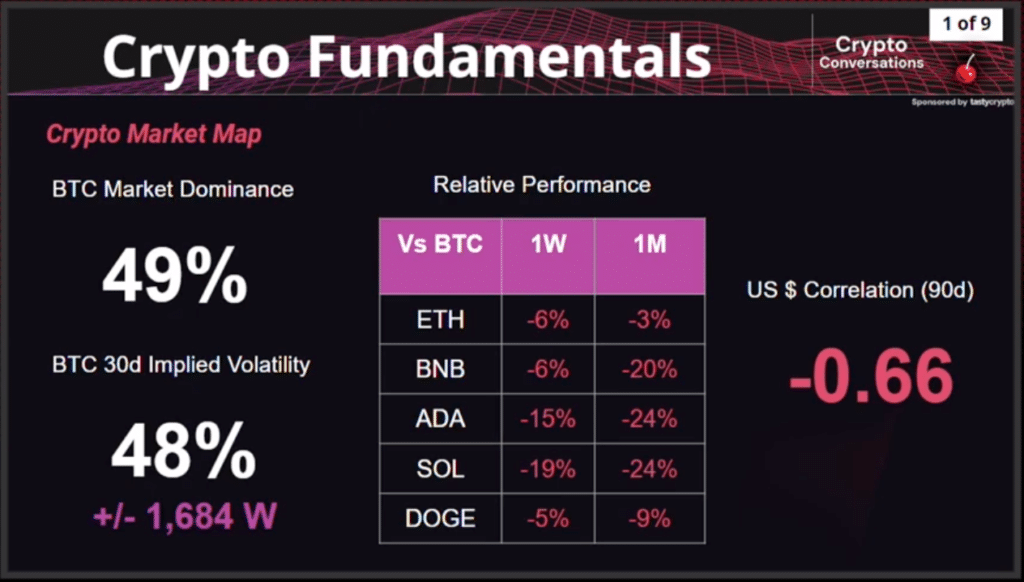

To gain a clear perspective on the crypto market, we must first examine its current state. Bitcoin, with its market dominance approaching 50%, serves as a reliable proxy for the entire crypto market.

This dominance indicates that altcoins and other tokens might not be the best investment choice at present. Additionally, the implied volatility of Bitcoin is relatively low, which suggests a lack of market volatility. However, it is essential to consider external factors such as the correlation with the dollar and interest rates, as they significantly impact the crypto market’s performance.

Exploring Financial Metrics

Financial metrics provide valuable insights into the health and potential of blockchain networks. Two main categories of financial metrics can help us evaluate tokens: market data and financial ratios.

Market data includes trading volume, market capitalization, and liquidity, which play a crucial role in determining a token’s investment value. Higher liquidity ensures fair pricing and ease of trade. Financial ratios, such as price-to-earnings (P/E) ratios in traditional markets, can be used to assess whether a token is relatively cheap or expensive.

📚 Read! 23 Free Crypto Research and Analysis Tools

Analyzing On-Chain Data Points

On-chain data points are critical indicators of a blockchain network’s activity and adoption. By examining on-chain activity, such as the number of active addresses, transaction count, and transaction throughput, we can gauge the network’s vitality.

A blockchain with a higher number of active addresses and transactions suggests a more active and engaged user base. Additionally, transaction throughput and associated network fees provide insights into the network’s scalability and cost-effectiveness for various use cases.

Comparative Analysis of Popular Networks

To better understand the differences between blockchain networks, let’s compare some of the popular ones: Ethereum, Cardano, Solana, and Binance Chain. By examining their active addresses, we can gain insights into user adoption and network activity.

For example, Binance Chain exhibits higher activity compared to Ethereum, Cardano, and Solana, indicating a more active user base. However, it’s crucial to note that these metrics are not the sole determinants of a network’s quality but offer contextual information for evaluating its potential.

Conclusion

As the crypto market continues to evolve, it is crucial to understand the fundamentals of blockchain networks. By analyzing financial metrics and on-chain data points, investors can gain valuable insights into a token’s potential and make informed investment decisions. It is essential to consider market dominance, liquidity, active addresses, transaction count, and network scalability when evaluating blockchain networks. Armed with this knowledge, investors can navigate the crypto market with a deeper understanding and seize opportunities for growth.

Mike Martin

Mike Martin formerly served as the Head of Content for tastycrypto. Before joining tastycrypto, Michael worked in the active trader divisions of thinkorswim, TD Ameritrade, and Charles Schwab. He also served as a writer and editor for projectfinance.

Michael has been active in the crypto community since 2017. He holds certifications from Duke University in decentralized finance (DeFi) and blockchain technology.

🍒 tasty reads

What Is a Crypto Whitepaper? 5 Things to Look For

Crypto Fundamentals to Pick Winning Trades

Here’s How to Diversify a Crypto Portfolio