Crypto fundamental analysis assesses a digital asset’s intrinsic value by examining external events, financial statements, and industry trends that can influence its future price.

Written by: Anatol Antonovici | Updated December 20, 2023

Reviewed by: Mike Martin

Fact checked by: Ryan Grace

To make well-informed investment choices, it’s crucial to utilize cryptocurrency fundamental analysis to gauge market sentiment. Fundamental analysis focuses on the underlying factors impacting the value of a crypto asset, including demand and supply, adoption rate, features, roadmap, regulation, and investor sentiment, among others.

In this article, we explore the top 5 crypto analysis tools for 2024.

Table of Contents

🍒 tasty takeaways

- Fundamental analysis focuses on the underlying factors impacting the value of a crypto asset, including demand and supply, adoption rate, features, roadmap, regulation, and investor sentiment, among others.

- The best free crypto analysis tools are

- Coinmarketcap

- Token Terminal

- TradingView

- DappRadar

- DefiLlama

- More advanced paid crypto analysis tools include Messari, CryptoQuant, IntoTheBlock, and Glassnode.

Summary

| Tools | Description |

|---|---|

| Coinmarketcap | Tracks crypto prices, market caps, and volumes. |

| Token Terminal | Provides metrics for blockchain projects. |

| TradingView | Charting tools for crypto analysis. |

| DappRadar | Analyzes decentralized applications. |

| DefiLlama | Data on DeFi projects and protocols. |

What Is Fundamental Analysis in Crypto?

Traders and investors typically employ two primary methods for evaluating financial assets: fundamental analysis and technical analysis.

- Technical analysis concentrates on price movements and employs intricate indicators like moving averages, the Relative Strength Index (RSI), and the Stochastic Oscillator.

- Fundamental analysis seeks to determine an asset’s intrinsic value by examining market sentiment and overall health.

These methodologies, long-standing in traditional finance, are equally applicable to digital assets. In conducting fundamental analysis of cryptocurrencies, investors assess whether a crypto’s price is overvalued or undervalued by considering factors such as supply/demand dynamics, adoption rates, regulatory changes, tokenomics, key news updates, and broader macroeconomic events that could influence the crypto market.

Free Fundamental Analysis Crypto Tools

Several free tools are available to assist in conducting quality fundamental analysis.

It’s important to mention that top crypto analysis platforms such as Messari, Glassnode, Dune, Nansen, IntoTheBlock, and CryptoQuant offer comprehensive tools. However, this article focuses elsewhere, as their most advanced analytics are primarily behind a paywall. Yet, it’s worth checking out their free indicators, which can be quite helpful.

🍒 5 Best Crypto Portfolio Trackers

That being said, here are the top free crypto analysis tools to watch in 2024:

1. CoinMarketCap

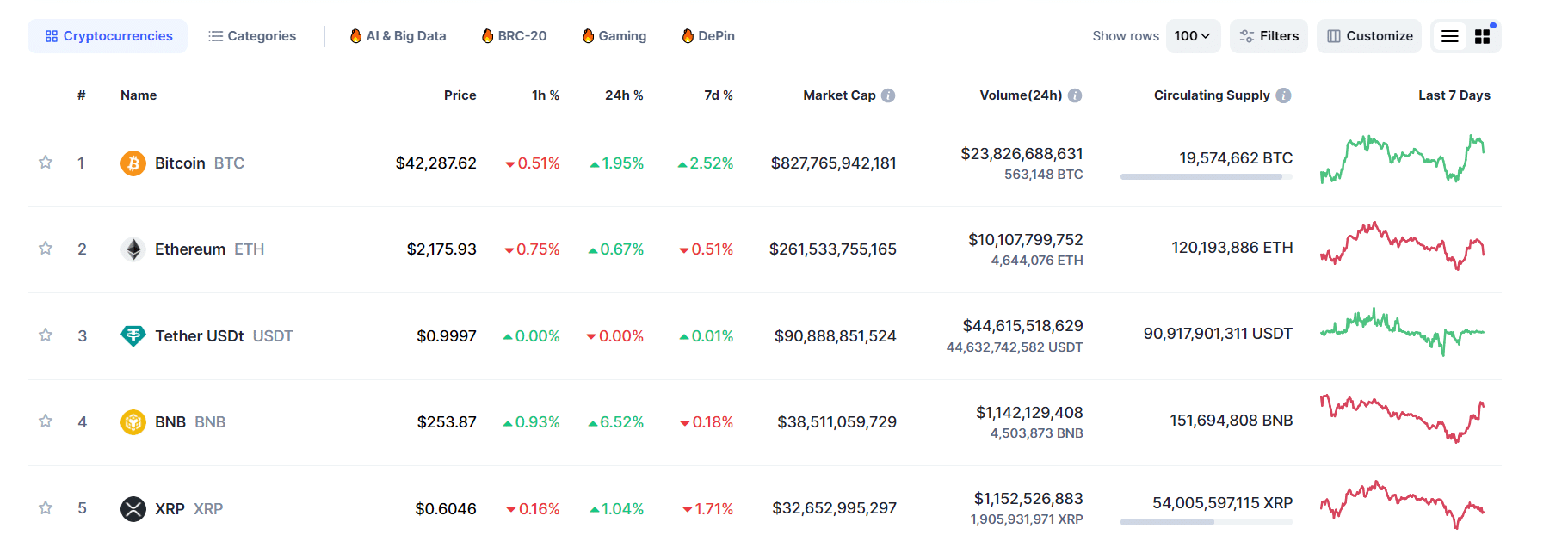

CoinMarketCap is the go-to platform to check the current price of all crypto assets, plus some basic but valuable indicators, such as market capitalization, trading volume, and circulating supply, among others.

By default, the platform ranks cryptocurrencies by market cap, listing the price of each crypto coin and its main indicators on the home page.

Source: CoinMarketCap

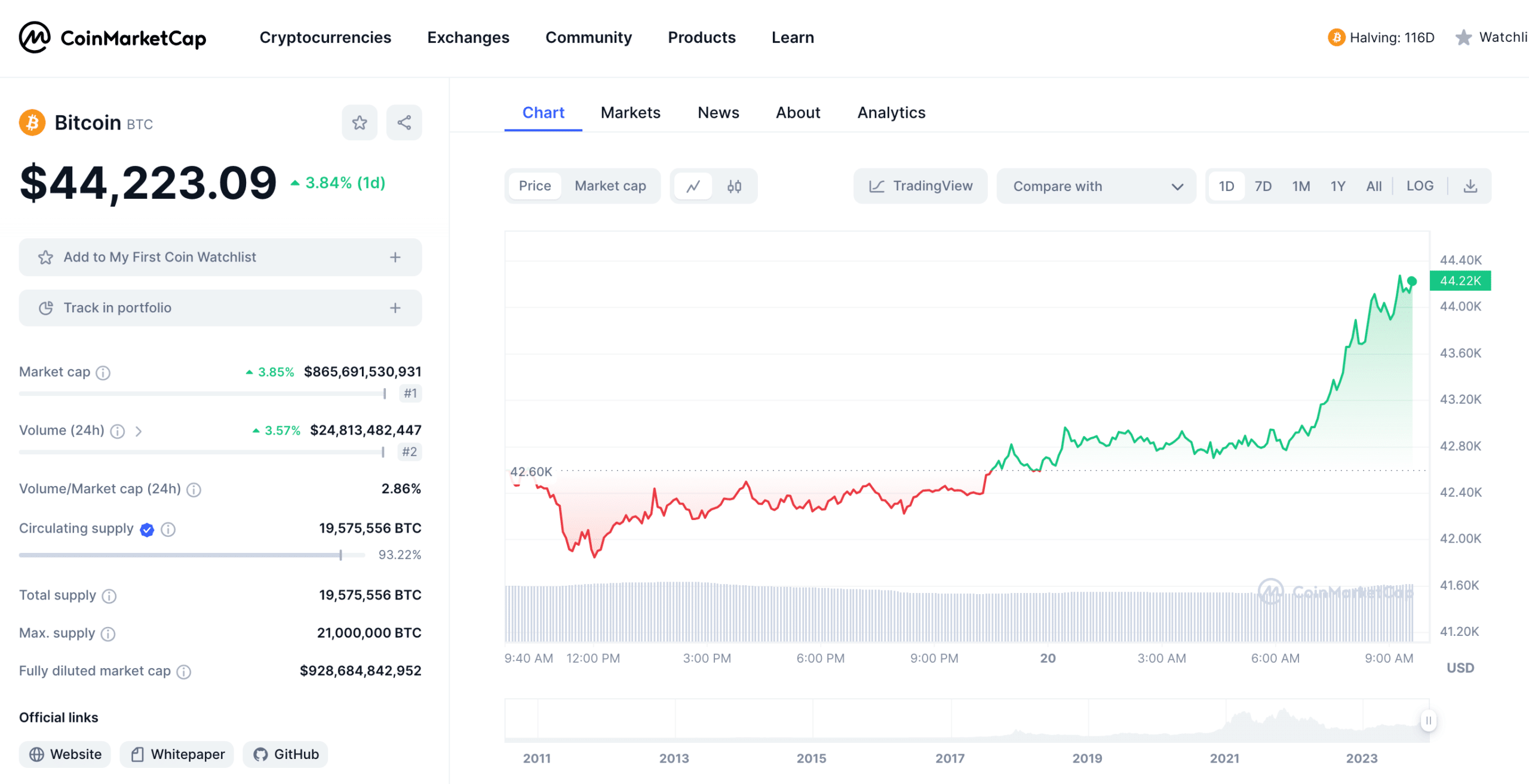

By clicking on each coin, you can access a more detailed analysis. This includes:

- Price chart across various timeframes

- Market cap dynamics

- List of exchanges where the coin is traded.

You’ll also find the latest relevant news, a brief overview of the crypto project, along with several analytical tools such as the number of addresses, the share of whales (large investors), transaction fees, and others. Additionally, there are links to the project’s official website, social media pages, and whitepaper.

Source: CoinMarketCap

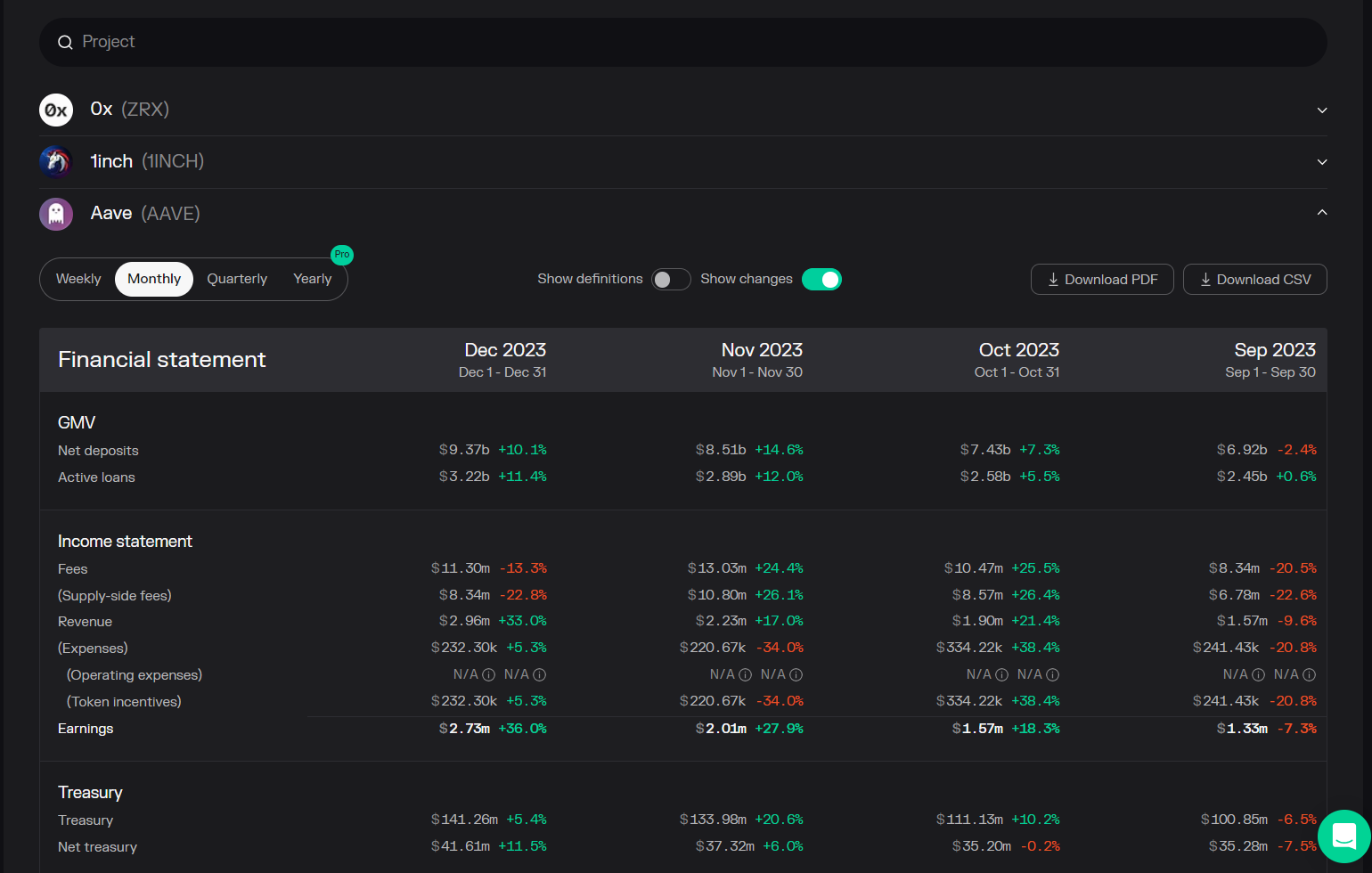

2. Token Terminal

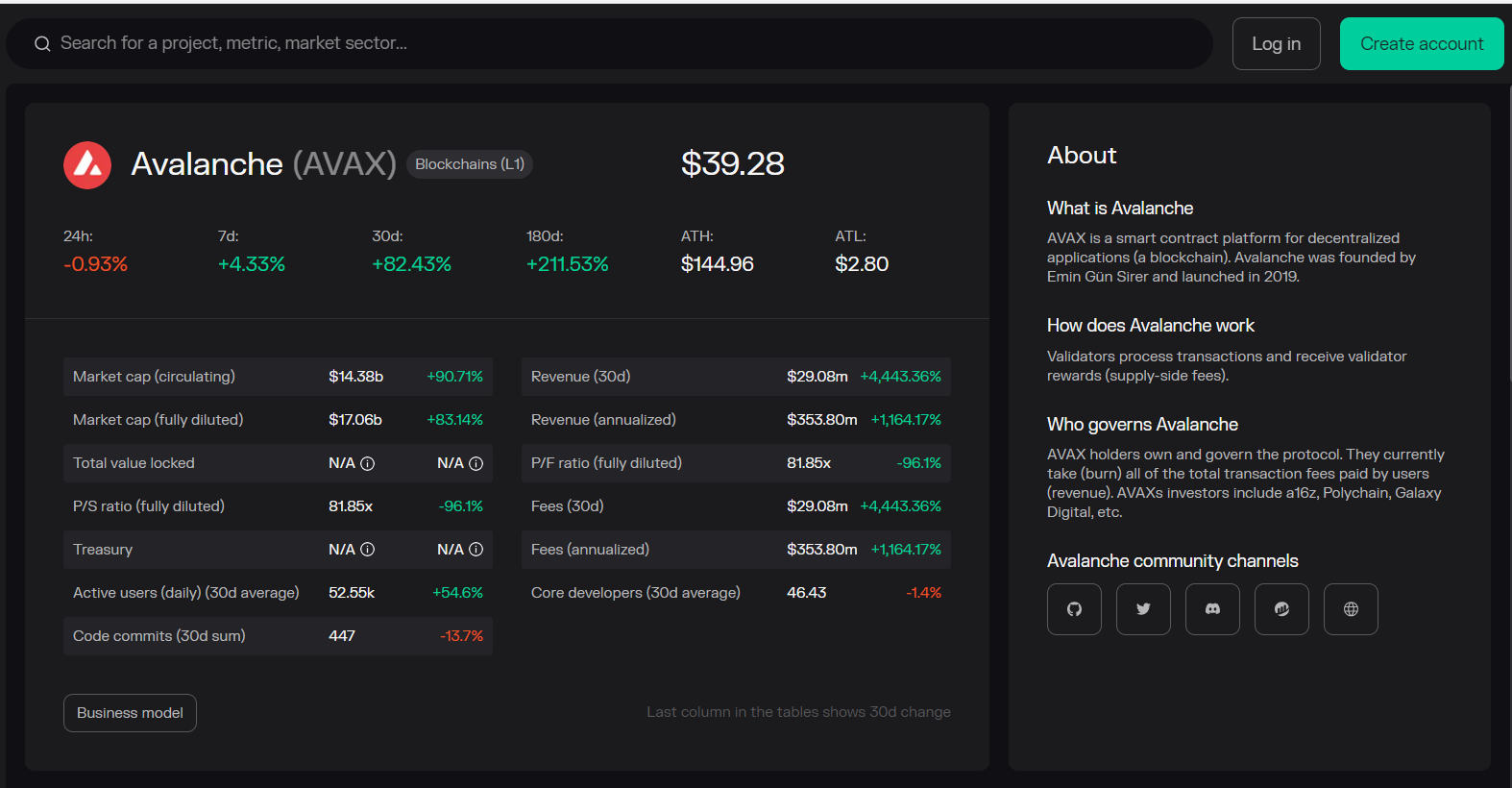

Token Terminal is a blockchain data platform that offers key metrics across major chains, including Bitcoin, Ethereum, Avalanche, Solana, Cardano, and others.

There is a search bar at the top of the terminal page where you can type any blockchain or crypto project you’re interested in. This will lead you to a dedicated page that includes a short description of the project on the right side and a list of key metrics, including the price, market cap, trading volume, total value locked (TVL), active users, fees, revenue, and more.

Source: TokenTerminal

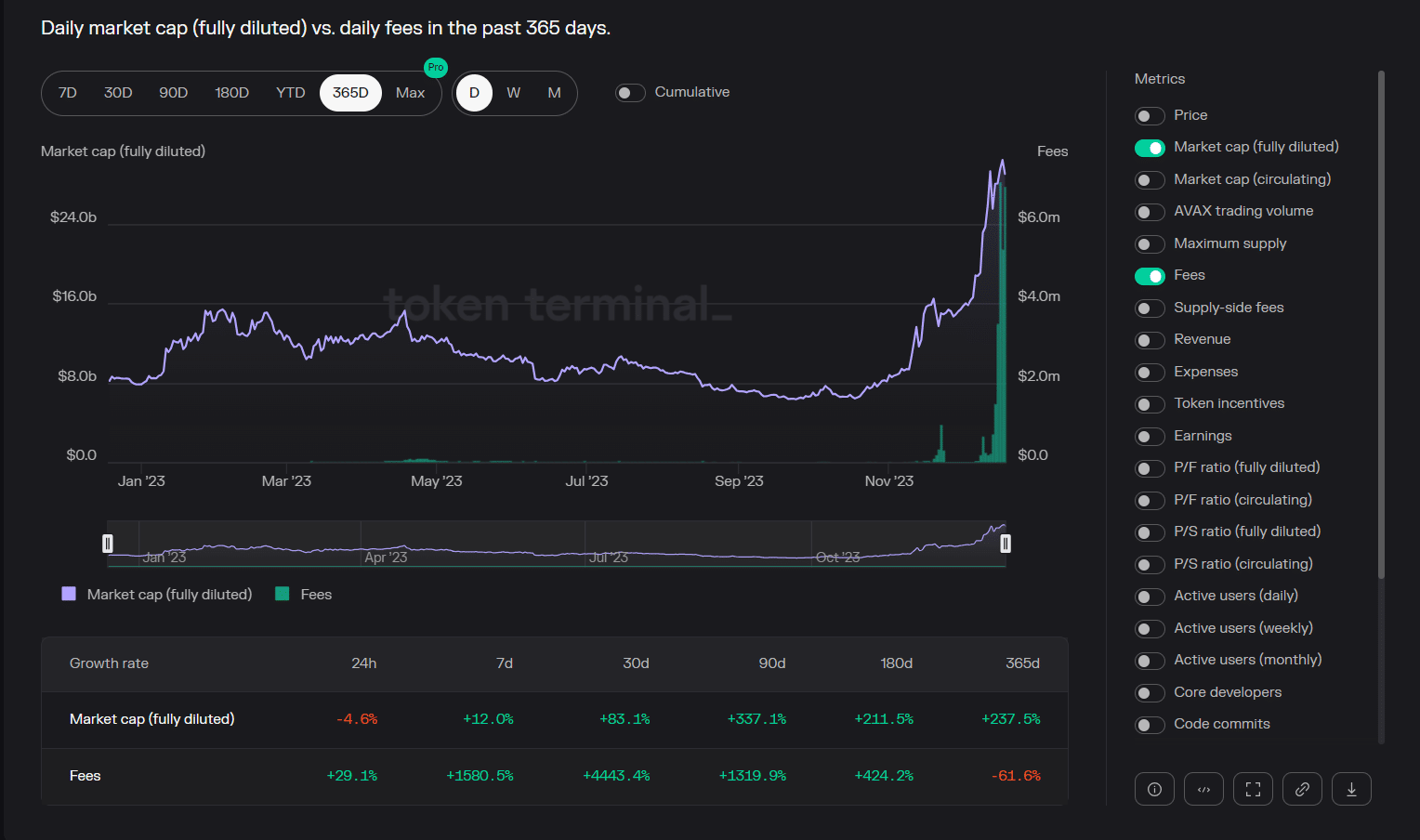

What I like about Token Terminal is that you can access multiple charts by scrolling down on a project’s page. The charts can display all the key on-chain metrics, which can be switched on and off on the right side.

Source: TokenTerminal

Token Terminal has many interesting tools available only for pro users, but you can do some great analysis without any subscription as well.

A great tool is the financial statements of multiple projects, which shows the dynamics of fees, revenue, token prices, and more.

Source: TokenTerminal

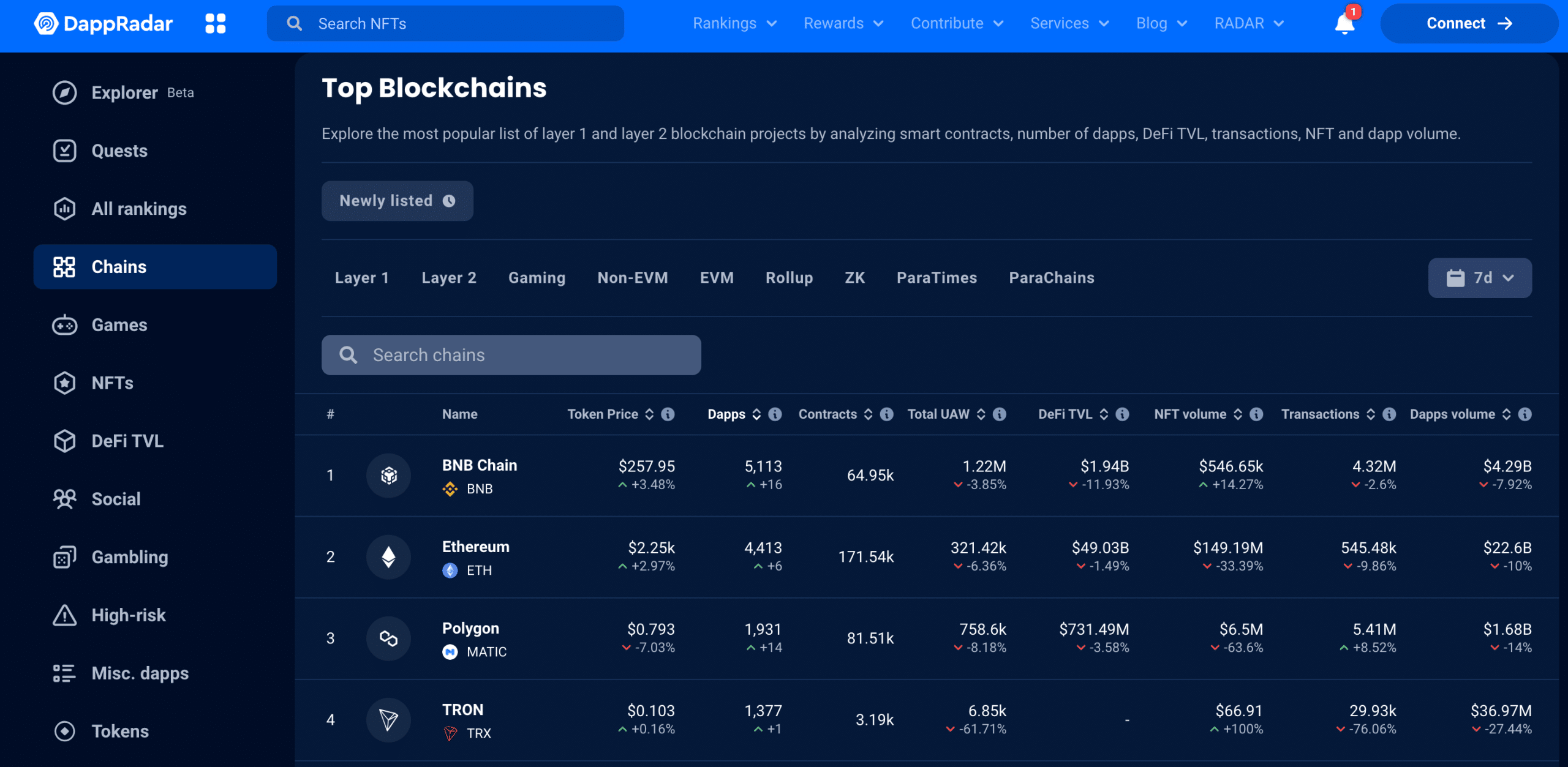

3. DappRadar

DappRadar is the best analytics tool for decentralized applications (dapps), which are built on blockchains offering the smart contract feature. The platform ranks all dapps and provides many great tools for different categories, including decentralized finance (DeFi), non-fungible tokens (NFTs), games, chains, and tokens.

As with Token Terminal, there is a search bar at the top to look for any dapp or token you’re interested in. Every dapp profile displays basic info and key metrics, including TVL, market cap, token price, pools, etc.

DappRadar is especially popular for its rankings, such as the top smart contract blockchains, top DeFi protocols, top NFT collections, and top NFT marketplaces, among others.

Source: dapp Radar

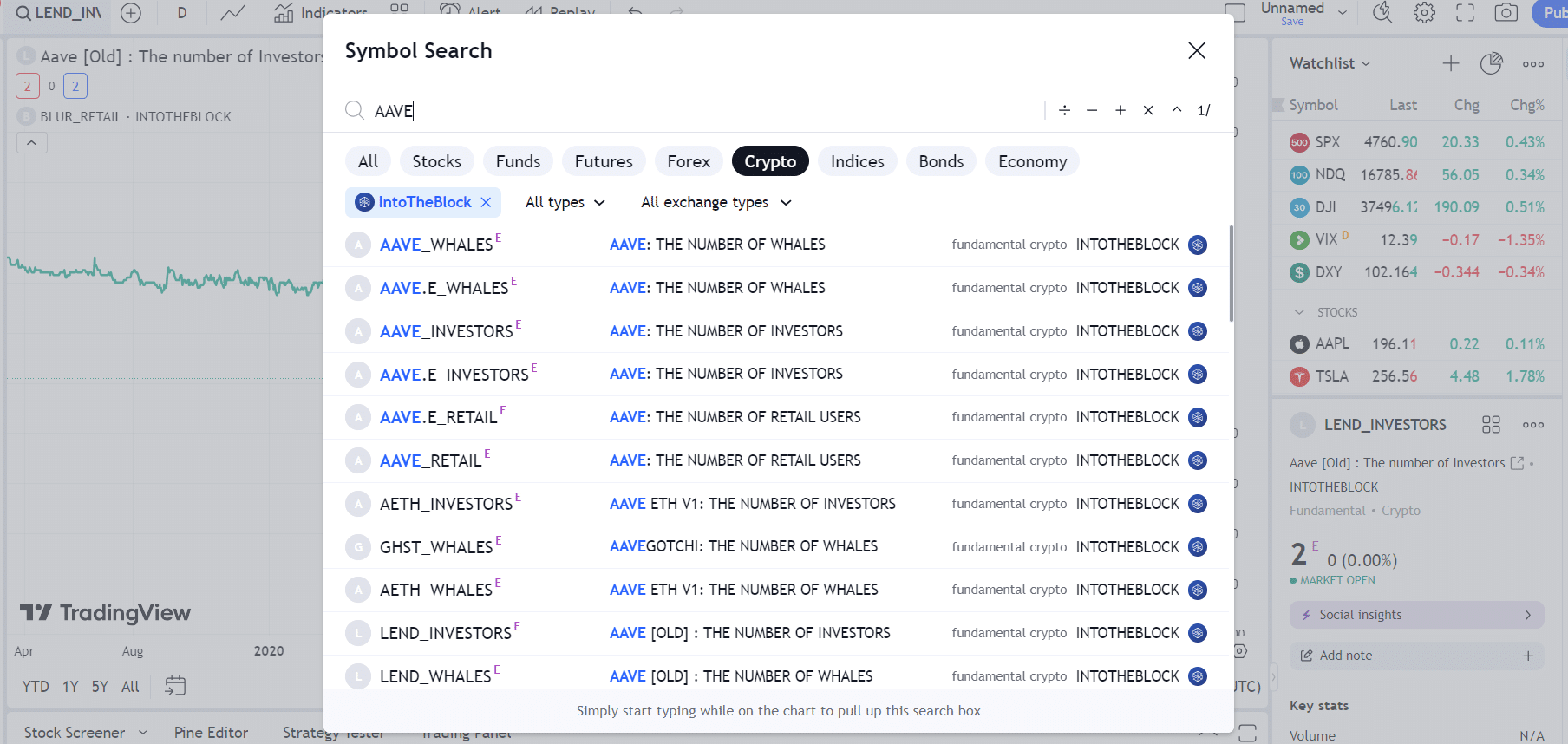

4. TradingView

TradingView is a charting platform used by over 50 million traders and investors to monitor price movements and financial metrics. It was originally created for traditional instruments, including stocks, commodities, and foreign exchange pairs. Today, it supports hundreds of cryptocurrencies as well.

As a charting platform, TradingView is mostly used for technical analysis, as you can detect special patterns on the candlestick charts, add all types of indicators, and test trading strategies.

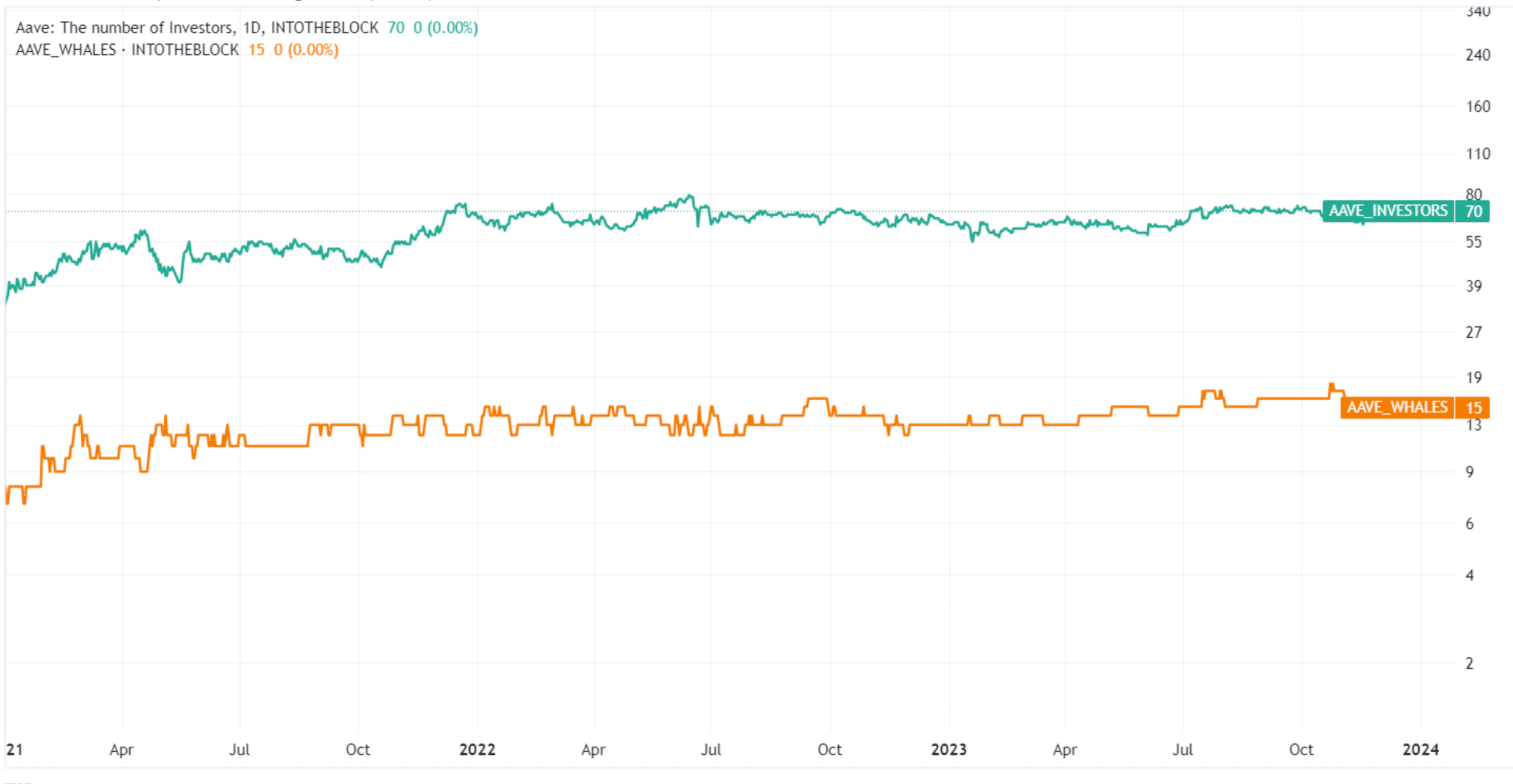

However, you can still use it as a fundamental analysis tool by analyzing multiple crypto metrics on its charts. There is a little secret you should know about – with TradingView, you can visualize metrics that are available only for subscribed members on other sources. For example, you can see a lot of metrics from IntoTheBlock, like active addresses, which are actually for paid subscribers on their platform. Here is an example of AAVE:

Source: TradingView

We can also compare the evolution of the number of investors and the number of whales on TradingView:

Source: TradingView

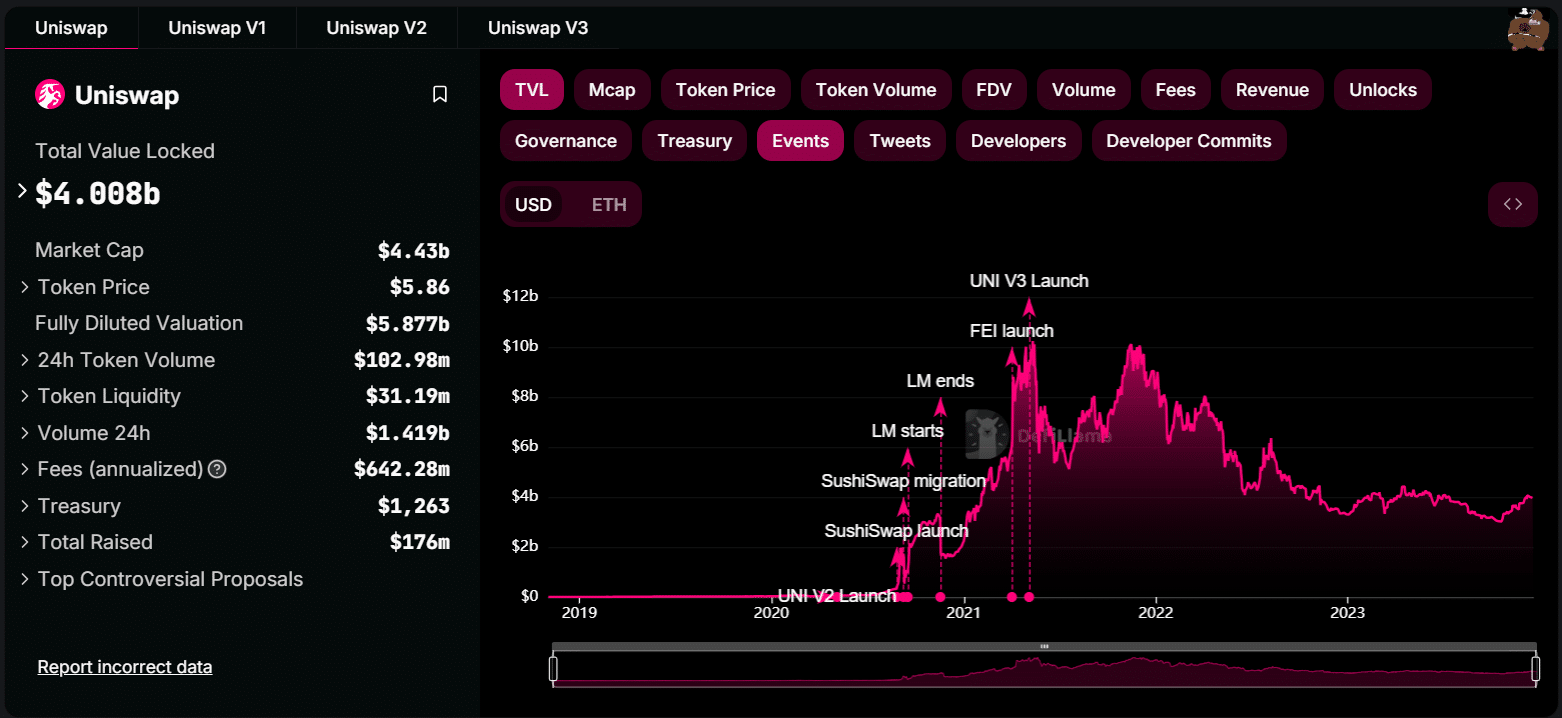

5. DefiLlama

DeFiLlama is the go-to analysis platform for DeFi investors. It displays all DeFi protocols, chains, categories, and liquidity pools. It lists data on thousands of different coins and tokens.

Previously, DeFi Pulse was the main platform to monitor the DeFi space, but the resource shut down a few years ago, with DefiLlama replacing it as the leading DeFi analytics platform.

DeFiLlama lists over 3,000 DeFi projects, providing key metrics and stats for each protocol.

Source: DeFiLlama

DeFiLlama also displays the main DeFi categories, oracles, liquidity pools, and blockchains. It is the most comprehensive DeFi analysis tool at the moment, and it’s free to use.

Secure Your Crypto With Self-Custody

When you store your crypto in a self-custody wallet, you don’t have to trust that an exchange is acting in your best interest. This is because you are the only party privy to your private key, or seed phrase.

Here are some additional benefits you get when you choose to self-custody your digital assets with tastycrypto:

- In-App Swap: Trade BTC, ETH, and 1,000+ tokens

- Generate Yield in DeFi: Stake, lend, and become your own market maker

- NFTs: Buy, sell, and view NFTs in-app

tastycrypto offers both iOS and Android self-custody wallets – download yours today! 👇

FAQs

Fundamental analysis is a method of analysis to determine the intrinsic value of a crypto by evaluating its underlying factors, such as market sentiment, adoption, ecosystem health, and regulatory environment.

The best free crypto analysis tools include Coinmarketcap, Token Terminal, DappRadar, TradingView, and DeFiLlama, each offering unique insights into various aspects of the crypto market.

Monitoring the latest news is an important aspect of fundamental analysis. Besides the mentioned crypto analysis tools, you can keep an eye on leading crypto news sites, such as CoinDesk and Cointelegraph. You can also check tastycrypto’s blog for unique insights and guides.

Some crypto analysis platforms, such as Messari, Glassnode, and CryptoQuant, offer advanced tools for subscribers only. Their in-depth market insights can improve your strategies and decision-making.

🍒 tasty reads

The Core Blockchain and DeFi Ecosystem: What You Need to Know

7 Best DePIN Crypto Projects

What Is Symbiotic and How Does It Work in 2024?

Ethereum vs Ethereum ETFs – 5 Major Differences

Anatol Antonovici

6+ years of experience writing for crypto brands and blockchain firms, including Coindesk, Cointelegraph, Bitcoinist, CryptoPotato, Algorand, and OTCTrade.com