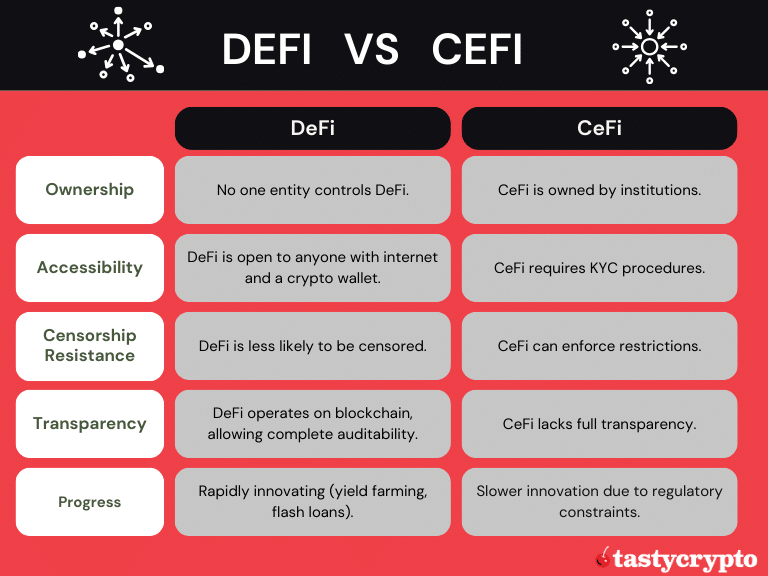

Decentralized finance, or DeFi, is a financial system that operates on blockchain technology, allowing for secure, peer-to-peer transactions and services like lending or trading without traditional centralized intermediaries like banks or brokers.

Written by: Anatol Antonovici | Updated September 14, 2024

Reviewed by: Mike Martin

Fact checked by: Ryan Grace

In this article, we explore the 11 best DeFi projects for 2024. We will span across numerous categories, including DEXs, staking protocols, lending protocols, and derivative protocols. Top DeFi projects include LIDO, UNI, BAL, AAVE, MKR and COMP.

🍒 tasty takeaways

- DeFi is a $80 billion market that comprises thousands of applications.

- The most popular use cases in DeFi are liquid staking, decentralized exchanges, and lending platforms.

- Popular DeFi projects include Lido, Aave, Uniswap, Maker, Curve, Balancer, and Yearn Finance.

- To invest in many of the tokens on our list, you’ll need a self-custody crypto wallet. tastycrypto offers self-custody wallets in the form of mobile apps and a browser extension 🍒

Summary

| Name | Symbol | Category | Market Cap | TVL |

|---|---|---|---|---|

| Uniswap | UNI | DEX | $6.3b | $5.9b |

| Curve | CRV | DEX | $356.3m | $2.2b |

| Balancer | BAL | DEX | $196.8m | $1b |

| Aave | AAVE | Borrowing/Lending | $1.2b | $12.4b |

| MakerDAO | MKR | Borrowing/Lending | $2.1b | $6.1b |

| Compound | COMP | Borrowing/Lending | $433.1m | $2.4b |

| Lido | LDO | Staking | $1.7b | $33.5b |

| Synthetix | SNX | Derivatives | $712m | $462.5m |

| Stargate | STG | Cross-Chain | $108.4m | $282.3m |

| Convex Finance | CVX | Yield | $193.3m | $1.3b |

| Yearn Finance | YFI | Yield | $206m | $291m |

DeFi is an ecosystem consisting of financial services built on blockchain infrastructure. Bank of America and ING consider it to be more disruptive than Bitcoin itself.

DeFi projects, built on decentralized networks with smart contract functionality, offer community-focused financial services that enable peer-to-peer transactions. In DeFi, operations are conducted autonomously by smart contracts, removing intermediaries from the process.

Decentralized applications (dapps) aim to democratize finance, enhance financial freedom and privacy, and circumvent censorship. Most dapps issue a cryptocurrency.

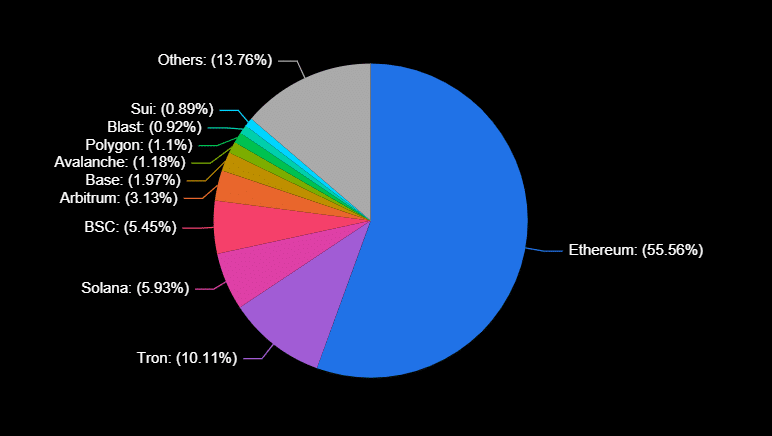

Today, DeFi is a $50+ billion market, with the Ethereum blockchain dominating the space as the most widely used underlying infrastructure.

Top DeFi Chains

Source: DeFiLlama

What Can You Do in DeFi?

The DeFi space aims to transpose all kinds of financial services to trustless systems, ideally run by community-driven decentralized autonomous organizations (DAOs). Think about trading, lending, and asset management. DeFi offers services that are not possible in traditional finance, e.g., staking and cross-chain protocols.

Here is what you can do in DeFi:

- Buy and sell tokens on decentralized exchanges (DEXs). There are decentralized marketplaces for non-fungible tokens (NFTs) as well.

- Borrow and lend digital assets on lending platforms like Compound and Aave.

- Earn passive income through yield farming strategies by providing liquidity on DEXs, lending protocols, and other DeFi services.

- By holding governance tokens, you can participate in the governance processes by voting for proposals.

- Stake crypto through liquid staking, which allows users to use their collateral on other dapps.

Additionally, some DeFi platforms offer services like insurance, betting, gambling, and more.

Here are the top DeFi platforms for 2024:

Secure Your DeFi Tokens With Self-Custody

When you store your crypto in a self-custody wallet, you don’t have to trust that an exchange is acting in your best interest. This is because you are the only party privy to your private key, or seed phrase.

Here are some additional benefits you get when you choose to self-custody your digital assets with tastycrypto:

- In-App Swap: Trade BTC, ETH, and 1,000+ tokens

- Generate Yield in DeFi: Stake, lend, and become your own market maker

- NFTs: Buy, sell, and view NFTs in-app

tastycrypto offers both iOS and Android self-custody wallets – download yours today! 👇

Best Decentralized Exchanges

DEXs are blockchain-based trading platforms where you can swap one token for another by simply connecting your self-custody wallet. Unlike centralized exchange platforms like Binance, DEXs don’t operate order books. Instead, they act as automated market makers (AMMs), hosting liquidity pools to trade against.

Here are the best DEXs as of today:

1. Uniswap (UNI)

Total Value-Locked Over Time – DeFiLlama

- Token: UNI

- Category: DEX

- Market cap: $3.9b

- TVL: $4.3b

Uniswap (UNI) is the largest DEX by trading volume and total value locked (TVL), with $3.9 billion worth of cryptocurrency being held in its pools. It hosts pools made of pairs of two tokens, e.g., USDC/ETH. Many pools have a stablecoin, which helps to reduce impermanent loss risk.

Liquidity providers (LPs) deposit funds into these pools and receive rewards from trading fees paid by traders.

Uniswap launched in 2018 on Ethereum, but the latest version is available on ten other chains, including Polygon, Arbitrum, Avalanche, and BNB Chain.

2. Curve (CRV)

Total Value-Locked Over Time – DeFiLlama

- Token: CRV

- Category: DEX

- Market cap: $317m

- TVL: $1.8b

Curve (CRV) is a DEX that focuses on stablecoins – tokens pegged to traditional assets like fiat currencies. It added support for Wrapped Bitcoin (WBTC) and Wrapped Ethereum (WETH) as well. The DEX hosts pools made of two, three, or four crypto assets.

Curve was once the largest DEX by TVL, but the recent $70 million hack led to a massive outflow.

3. Balancer (BAL)

Total Value-Locked Over Time – DeFiLlama

- Token: BAL

- Category: DEX

- Market cap: $108m

- TVL: $676m

Balancer (BAL) is one of the oldest DeFi platforms. Unlike other DEXs, it acts as an index fund, hosting pools made up of multiple tokens – as many as eight. The pools automatically adjust asset allocations to keep a desired balance amid price fluctuations.

The protocol, which operates on Ethereum and six other chains, offers public, private, and smart pools to match different preferences and risk levels.

Best DeFi Lending Projects

DeFi lending platforms connect lenders and borrowers, who interact in a non-custodial manner. Lenders can provide liquidity to earn interest, with the APY ranging from 0.1% to 15% and more. Elsewhere, borrowers can access crypto funds with no credit history and KYC requirements.

Here are the best DeFi lending protocols:

4. Aave (AAVE)

Total Value-Locked Over Time – DeFiLlama

- Token: AAVE

- Category: Borrowing/Lending

- Market cap: $2.1b

- TVL: $11.1b

Aave (AAVE) competes with Maker as the largest lending platform by TVL. As of today, it has over $11 billion worth of crypto as collateral.

The latest version, V3, is available on 10 different chains, including Ethereum, which lets users lend and borrow dozens of tokens.

5. MakerDAO (MKR)

Total Value-Locked Over Time – DeFiLlama

- Token: MKR

- Category: Borrowing/Lending

- Market cap: $1.4b

- TVL: $5b

Maker (MKR) is a broader ecosystem that comprises a lending platform, a decentralized USD-backed stablecoin called DAI, and a DAO that runs the network.

The Ethereum-based platform enables users to deposit different crypto assets as collateral to borrow DAI.

Total Value-Locked Over Time – DeFiLlama

- Token: COMP

- Category: Borrowing/Lending

- Market cap: $379m

- TVL: $2.3b

Compound (COMP) is a lending platform that lets users lend and borrow a variety of crypto tokens. Compound triggered the DeFi craze back in 2020 when it launched COMP, its governance token. Following its launch, the TVL in DeFi surged from $1 billion to over $10 billion in less than 3 months.

Best Liquid Staking Project

Liquid staking protocols became popular after Ethereum switched its consensus algorithm from Proof of Work (PoW) to Proof of Stake (PoS), which requires block validators to deposit 32 Ether that has to be locked during the staking process.

Liquid staking platforms take the task of Ethereum block validators by pooling user deposits with no minimum threshold. On top of that, they offer so-called liquid staking tokens (LSTs) in exchange for the staked ETH, letting users put their ETH value to work and explore yield farming opportunities while staking.

7. Lido (LDO)

Total Value-Locked Over Time – DeFiLlama

- Token: LDO

- Category: Staking

- Market cap: $891m

- TVL: $22.5b

Lido is the largest liquid staking platform, with over $22 billion worth of ETH locked with it. It is also the largest DeFi project, accounting for a third of the entire sector. Lido is the go-to platform for staking ether.

Best Derivative Trading Platform

DeFi derivative trading platforms enable users to trade tokenized derivatives that can represent traditional assets – fiat currencies, commodities, or bonds – as well as other cryptocurrencies. Some platforms, such as dYdX, offer perpetual futures, while others, such as Synthetix, support tokenized versions of other assets. Derive (formerly known as Lyra) is the best DeFi derivative protocol for DeFi options.

8. Synthetix (SNX)

Total Value-Locked Over Time – DeFiLlama

- Token: SNX

- Category: Derivatives

- Market cap: $450m

- TVL: $238m

Synthetix (SNX) is a trading platform on Ethereum and Optimism. It allows users to mint and trade synthetic assets (synths), which mimic the price of real-world and digital assets. By using the native SNX as collateral, users can generate synths like sBTC and sUSD, which track the price of Bitcoin and the USD, respectively.

Best Cross-Chain Protocol

Cross-chain protocols facilitate the movement of tokens from one chain to another, bringing interoperability to blockchain and helping the crypto market become less fragmented.

9. Stargate (STG)

Total Value-Locked Over Time – DeFiLlama

- Token: STG

- Category: Cross-Chain

- Market cap: $60m

- TVL: $450m

Stargate Finance (STG) is a cross-chain liquidity protocol that allows users and dapps to transfer tokens between different chains, acting as a bridge. It can move native assets between 13 chains, including Ethereum.

Best Yield Protocols

DEXs and lending protocols enable users to earn passive income, but yield farming projects are specialized in finding the most rewarding opportunities in DeFi.

10. Convex Finance (CVX)

Total Value-Locked Over Time – DeFiLlama

- Token: CVX

- Category: Yield

- Market cap: $195m

- TVL: $957m

Convex Finance (CVX) is a DeFi protocol that offers boosted rewards for Curve LPs. It uses pooled control of voting power and incentives to maximize profits for CRV stakers and LPs.

11. Yearn Finance (YFI)

Total Value-Locked Over Time – DeFiLlama

- Token: YFI

- Category: Yield

- Market cap: $162m

- TVL: $204m

Yearn Finance (YFI) is a yield aggregator that scans passive income opportunities across all of DeFi, including Curve, Aave, Maker, and Compound.

Users deposit cryptocurrency and seek the best interest rates, with the rewards being paid in the native token, YFI, which also acts as a governance token.

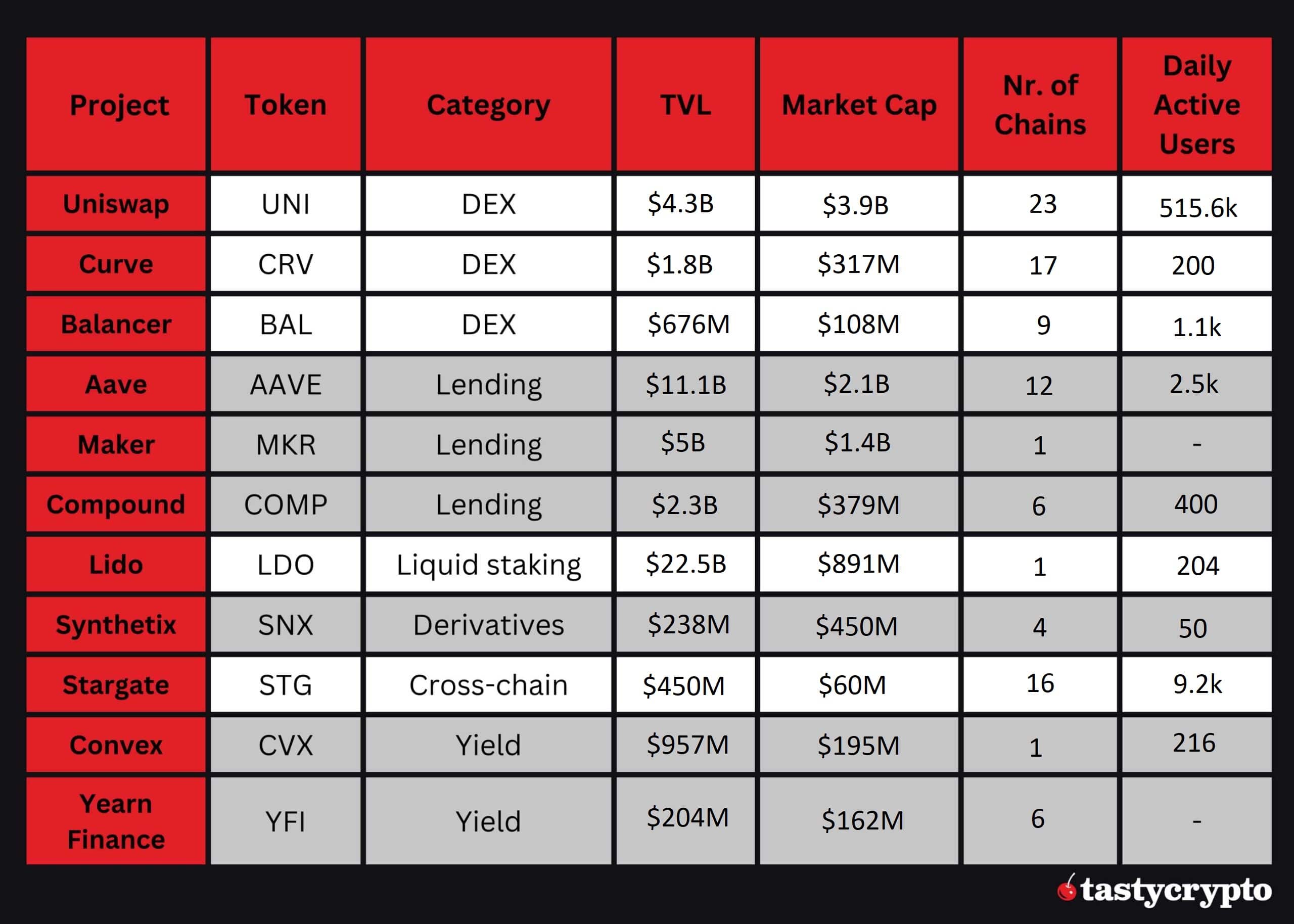

Best DeFi Projects

Here is a brief comparison of the best DeFi projects discussed in this article:

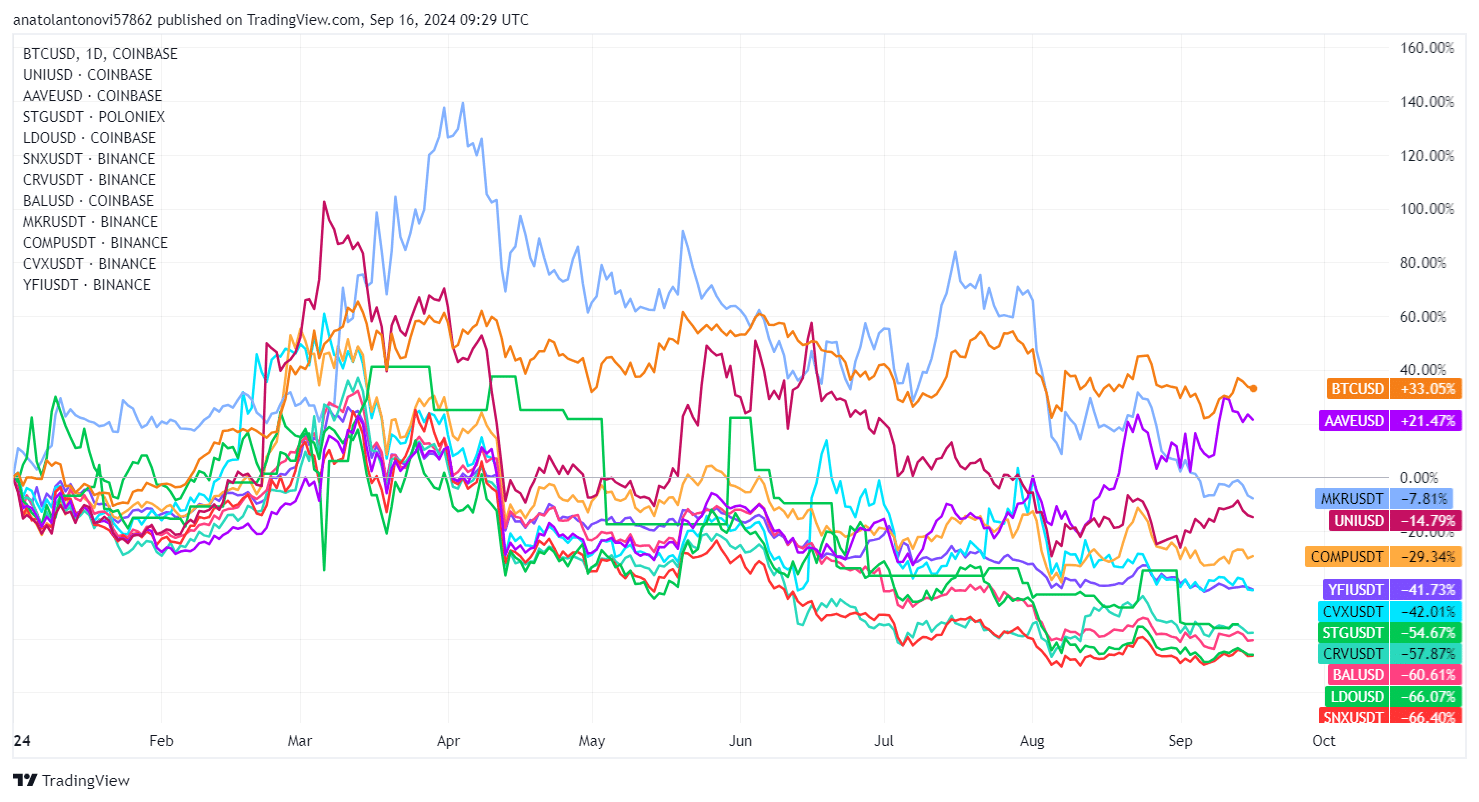

Best DeFi Projects Price Comparison

Here is the year-to-date performance of the governance tokens on our list in relation to bitcoin (BTC):

Source: TradingView

FAQs

DeFi projects are decentralized financial services leveraging blockchain technology. They use smart contracts for peer-to-peer interactions without intermediaries.

The main goal of the DeFi ecosystem is to offer financial services, such as trading and lending, by giving you full control over your crypto funds without sharing personal data.

The DeFi sector comprises projects that offer different use cases, which makes it difficult to pick the best one. Uniswap is a leader among DEXs, Aave is a popular lending platform, while Yearn Finance is the best yield farming aggregator.

Yes, you can generate returns in DeFi through activities like yield farming, staking, and lending, although you should be aware of the risks, such as high volatility or impermanent loss. Read more about DeFi risks here.

🍒 tasty reads

The Core Blockchain and DeFi Ecosystem: What You Need to Know

7 Best DePIN Crypto Projects

What Is Symbiotic and How Does It Work in 2024?

Ethereum vs Ethereum ETFs – 5 Major Differences

Anatol Antonovici

6+ years of experience writing for crypto brands and blockchain firms, including Coindesk, Cointelegraph, Bitcoinist, CryptoPotato, Algorand, and OTCTrade.com