Definition: In cryptocurrency, perpetual futures are a type of derivative product. Unlike traditional futures, perpetual futures never expire.

Written by: Andrey Sergeenkov | Updated June 28, 2024

Reviewed by: Mike Martin

Fact checked by: Ryan Grace

In this article, we will explain what perpetual futures in crypto are and illustrate their use cases with trade examples.

🍒 tasty takeaways

Perpetual futures contracts are a continuous betting and hedging mechanism for predicting the change in a cryptocurrency’s value without any predetermined expiration date.

Perpetual futures contracts work by adjusting the “funding rate” based on the distance between the contract price and the spot price.

Margin requirements are a crucial aspect of perpetual trading as they serve as collateral to safeguard against potential losses.

Summary

| Explanation | |

|---|---|

| What are Perpetual Futures? | A type of derivative in cryptocurrency that doesn't have an expiration date. |

| Main Function | Allows continuous betting and hedging on cryptocurrency value changes. |

| Working Mechanism | Adjusts the “funding rate” based on the distance between the contract price and the spot price. |

| Key Advantage | Provides flexibility to traders as there's no need to roll over into a new contract. |

| Popular Use Case | Commonly used in the cryptocurrency market to speculate or hedge against future price movements. |

Beginner’s Guide on Perpetual Futures in Crypto

The cryptocurrency industry has seen a significant rise in the popularity of various crypto derivatives products like perpetual futures, options, futures markets, and contracts. In fact, in 2024, monthly futures trading volumes on centralized exchanges hasn’t declined below the $1 trillion mark, often exceeding the total crypto spot trading volume.

Broadly, these cryptocurrency derivatives products enable investors to engage in speculation or hedging on the upward or downward price movements of cryptocurrencies, all without actually possessing them. Compared to the more conventional spot trading, these products offer enhanced adaptability and the potential for superior returns.

Perpetuals can be traded both on centralized exchanges and decentralized exchanges (DEXs) with self-custody crypto wallets.

Perpetuals are a form of leverage. Read other ways you can leverage your crypto here.

In this beginner’s guide, we delve into the world of perpetual futures, focusing on their definition, functionality, and the advantages and disadvantages associated with them in the realm of cryptocurrency futures trading.

What Are Perpetual Futures Contracts?

Perpetual futures contracts are a type of derivative product in the cryptocurrency market that allows traders to speculate on the price movements of cryptocurrencies without actually owning the underlying asset. These contracts have no expiration date, which means positions can be held indefinitely, as long as traders maintain the required margin and pay the funding rate.

Here’s an example of a perpetual futures contract:

Asset: Bitcoin (BTC)

Type of contract: Perpetual future

Position: Long (expecting the price of BTC to increase)

Entry price: $60,000

Leverage: 5x (trader’s position is magnified by a factor of 5)

Margin requirement: 20% (trader must maintain at least 20% of the notional value of the position as collateral)

Funding rate: 0.01% (fee paid by traders every 8 hours, based on the difference between the contract price and the spot market price).

In this example, a trader enters a long position in a perpetual Bitcoin futures contract, expecting the price of Bitcoin to rise. They enter at a price of $60,000, using 5x leverage, which magnifies their position’s potential profits and losses. To maintain the position, they must have at least 20% of the notional value of the position in their account as collateral. Additionally, they pay a funding rate of 0.01% every 8 hours, based on the difference between the contract price and the spot price of Bitcoin.

How Do Perpetual Futures Contracts Work?

Perpetuals are unique in that they don’t have an expiration date, which means they can be held indefinitely or until the trader decides to close the position.

Here’s a simple explanation of how perpetual futures contracts work, using a hypothetical trade:

Choose a trading pair: A trading pair consists of two crypto assets, usually a cryptocurrency (like Bitcoin) and a stablecoin or fiat currency (like USD). For example, let’s use the BTC/USD trading pair.

Long or short: A trader needs to decide whether they believe the price of Bitcoin will increase (go long) or decrease (go short). In this example, let’s say the trader believes the price of Bitcoin will increase. Read: 7 Ways To Short Crypto

Margin and leverage: The trader deposits a fraction of the total value of the contract as collateral, called the margin. This allows them to use leverage, which essentially means borrowing funds to increase the size of their trade. For example, if the trader deposits $100 and uses 10x leverage, they can control a position worth $1,000.

Opening the trade: The trader enters a long position on the BTC/USD perpetual at a price of, say, $60,000. Since they’re using 10x leverage, they control $1,000 worth of Bitcoin.

Funding rate: To keep the perpetual futures price close to the spot price of the underlying asset, a funding rate is applied periodically (usually every 8 hours). If the funding rate is positive, long positions pay short positions. If it’s negative, short positions pay long positions. This mechanism incentivizes traders to maintain a balance between long and short positions.

Closing the trade: Let’s say the market price of Bitcoin increases 8.3% to $65,000 on Binance. The trader decides to close their position, realizing a profit. Since the position size was $1,000, it increased 8.3% to $1,083, the profit is $83.

Keep in mind that trading crypto perpetual futures contracts carries risks, such as potential liquidation if the price moves against the trader’s position and the margin isn’t enough to cover the losses. It’s essential to understand these risks and have a solid margin trading strategy before engaging in any form of leveraged trading.

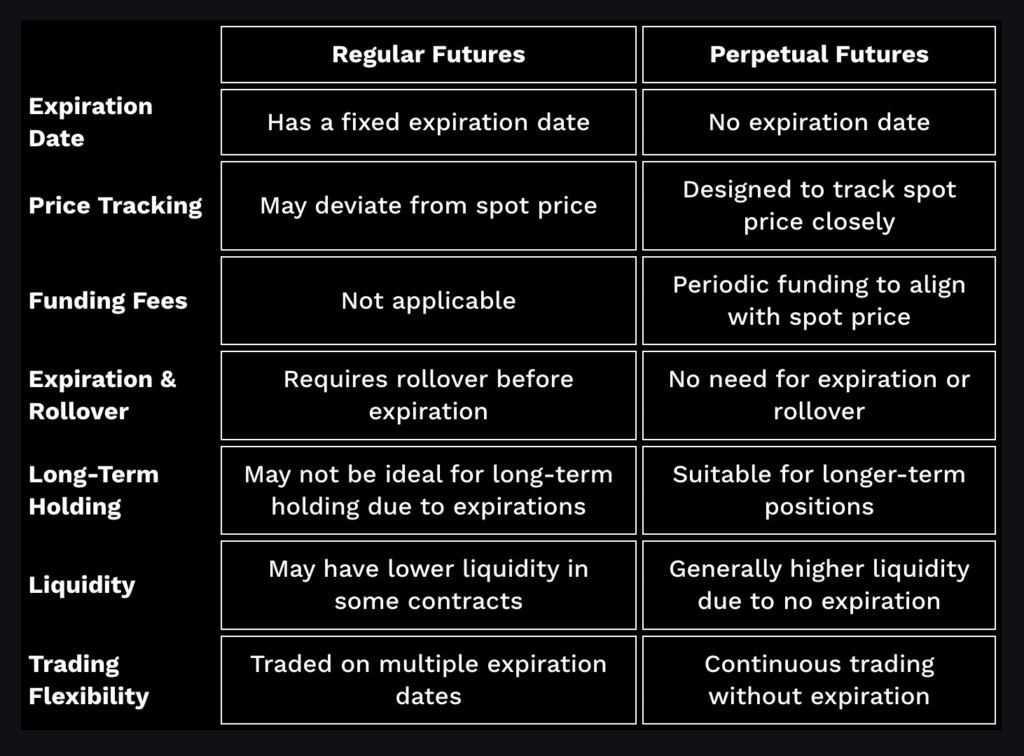

Traditional vs Perpetual Futures

Traditional futures and perpetual futures are both financial instruments for speculating on an asset’s future price, but they differ in key ways:

Expiration: Traditional futures have a predetermined expiration date, while perpetual futures don’t expire.

Settlement: Traditional futures can be cash or physically settled, whereas perpetual futures are continuously settled through a funding rate.

Assets: Traditional futures cover various digital assets, including commodities and financial instruments. Perpetual futures mainly focus on cryptocurrencies.

Trading venue: Traditional futures trade on regulated crypto exchanges, while perpetual futures are traded on cryptocurrency trading platforms.

The choice between the two depends on the trader’s preferences, risk tolerance, and desired assets.

Perpetual Futures Formula

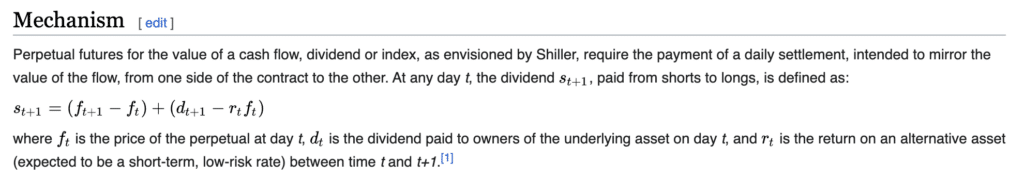

Perpetual futures were introduced by Robert Shiller in 1992.

According to Wikipedia, here is the mathematical formula that perpetual futures follow, which has been altered slightly for cryptocurrency:

Margin Requirements for Perpetual Futures

Margin requirements for perpetual futures refer to the minimum amount of collateral a trader must deposit to open and maintain a leveraged position. The margin serves as a safety net for the trader and the exchange in case the market moves against the trader’s position.

Here’s a simple example of margin requirements:

Choose a trading pair: Let’s use the ETH/USD trading pair.

Long or short: The trader believes the price of Ethereum will increase (goes long).

Margin and leverage: The trader deposits $200 as collateral (margin) and uses 5x leverage, allowing them to control a position worth $1,000 (5 times their margin).

Opening the Perpetual Trade

The trader enters a long position on ETH/USDT perpetual at a price of $3,000. With 5x leverage, they control 0.33 ETH, or $1,000 worth of Ethereum.

Margin requirements:

To maintain the position, the trader needs to keep a minimum balance in their margin account. If the market moves against their position and their margin balance falls below the maintenance margin requirement, they risk liquidation.

For example, if the maintenance margin requirement is 3%, the trader needs to maintain at least $30 (3% of $1,000) in their margin account. If the asset price of Ethereum drops and the trader’s margin balance falls below $30, their position will be liquidated to prevent further losses.

It’s crucial for traders to understand margin requirements and manage their risk when trading perpetual futures, as leverage can amplify both profits and losses.

Example of a Bitcoin Perpetual Future

Imagine a trader who wants to speculate on Bitcoin’s price through a perpetual futures contract. The trader opts to go long, meaning they buy one Bitcoin perpetual futures contract currently valued at $30,000. Although the notional value of the crypto futures contract is one Bitcoin, the trader uses 5x leverage, resulting in a total position size of $150,000 ($30,000 x 5).

With a 5% margin requirement, the trader must maintain $7,500 (5% of $150,000) as collateral in their trading cryptocurrency account to open positions. The funding rate for this Bitcoin perpetual futures contract is approximately 0.03% for each eight-hour funding period.

If Bitcoin’s price increases to $35,000, the trader earns $25,000 on their position. However, they will also incur a 0.03% funding fee every eight hours, deducted from their trading account. Conversely, if Bitcoin’s price changes to $25,000, the trader faces a $5,000 loss on their position, which will also be subtracted from their day trading account.

Pros and Cons of Perpetual Futures Contracts

Pros

No expiration date: As long as you meet the margin requirements, your position will remain open.

High liquidity and leverage: Perpetual future contracts typically involve highly-liquid assets and the option to use leverage.

Accessibility: Unlike traditional futures contracts, perpetual futures are open to retail investors.

Cons

High risk and volatility: Along with the potential to make a huge profit, there is the risk of losing a significant portion of your assets because of price fluctuations.

Counterparty risks: When traded on centralized cryptocurrency exchanges, traders could lose their funds if the platform is hacked or goes bankrupt.

Not ideal for new traders due to the risks involved.

Perpetuals in DeFi (decentralized finance) introduce hacking risks.

Conclusion

Perpetual futures, devoid of any expiration date, have piqued the interest of traders looking to establish long-standing positions in crypto markets without the need to acquire the underlying assets themselves. Despite the allure of these contracts, they also carry an elevated level of risk. Consequently, those who venture into this realm should tread carefully, meticulously assessing their crypto futures trading strategies and risk management protocols.

Perpetual Futures FAQs

in theory, you can hold perpetual futures forever. However, you must pay a small ‘funding rate’ daily to keep your perpetual future open. Over time, these funding rates can add up significantly.

Perpetual futures have no expiration whereas all regular futures do have an expiration date. Additionally, perpetual futures holders must pay a periodic ‘funding rate’.

Although perpetual futures are not illegal in the US, many perpetual exchanges are restricting access to US customers until clearer government regulation becomes available.

Andrey Sergeenkov

Expertise: DAOs, NFTs. Blockchain. Cryptocurrency

Summary: 6 years of experience in the blockchain and cryptocurrency industry. Content Manager at DAO Time. Published in Cointelegraph, Coindesk, and Coinmarketcap.

🍒 tasty reads

What Is Ether.fi? Liquid Staking Reinvented

What Is Wrapped Ether? Complete wETH Guide

Impermanent Loss in DeFi: The Complete Guide

What is GMX? DeFi Perpetual Exchange 2024 Guide

What Is Defi Liquidity Mining and How Does It Work?