GMX is the largest decentralized perpetual trading platform in DeFi, offering exposure to cryptocurrencies with up to 100x leverage, no registration, and unique benefits for traders and liquidity providers.

Written by: Anatol Antonovici | Updated August 25, 2024

Reviewed by: Mike Martin

Fact checked by: Ryan Grace

GMX allows anyone in the world to trade perpetual futures, which are similar to traditional futures with one exception – they never expire.

🍒 tasty takeaways

GMX enables users to get exposure to crypto assets without owning them.

GMX traders can use up to 100x leverage to boost potential profits while taking additional risk.

Unlike decentralized crypto exchanges, GMX relies on a unified pool of multiple assets to ensure liquidity.

As a DeFi protocol, users don’t need to register or pass KYC verification. All you need is a wallet.

| Explanation | |

|---|---|

| What are Perpetual Futures? | A type of derivative in cryptocurrency that doesn't have an expiration date. |

| Main Function | Allows continuous betting and hedging on cryptocurrency value changes. |

| Working Mechanism | Adjusts the “funding rate” based on the distance between the contract price and the spot price. |

| Key Advantage | Provides flexibility to traders as there's no need to roll over into a new contract. |

| Popular Use Case | Commonly used in the cryptocurrency market to speculate or hedge against future price movements. |

What Are Perpetual Contracts?

Perpetual contracts are financial derivatives that allow traders to gain exposure to underlying assets without actually owning them. Think of them as a betting tools where you attempt to predict the future price movements of an asset.

Perpetual contracts belong to the category of futures contracts, which are financial derivatives where two parties agree to buy or sell an underlying asset at a predetermined price and time in the future.

Futures contracts are very popular in the world of commodities such as oil or agricultural products, where buyers often secure prices in advance before taking possession of the physical commodities. Unlike these traditional futures, perpetual futures center around cryptocurrencies and never expire.

Perpetual futures are well-suited for margin trading, also known as leverage trading, in which traders utilize borrowed funds to amplify potential profits while also assuming greater risk.

How Are Perpetual Contracts Different from Futures?

Crypto perpetuals allow traders to profit from fluctuations in the price of digital assets without actually owning cryptocurrency.

Unlike regular futures contracts, perpetual contracts don’t have an expiration date. Traders are able to hold perpetuals for any duration without having to worry about rolling them, as is the case with traditional futures.

Since perpetual contracts never expire, a funding rate is typically paid. These rates go towards assuring the price of the perpetual stays in line with the underlying crypto a perpetual is tracking. They are typically very minimal fees, averaging about 0.01% of the contract value over a duration of 8 hours.

GMX is an exception to this rule as this platform has borrowing fees instead of funding rates.

Funding Fee = Premium x Funding Rate

What Is GMX?

GMX is a decentralized spot and perpetual exchange that allows traders to open long or short positions on major cryptocurrencies, such as Bitcoin (BTC) or Ethereum (ETH).

The goal of the platform was to make perpetual contracts accessible to decentralized finance (DeFi), a blockchain ecosystem comprising financial services built on a decentralized, trustless infrastructure where the rules are enforced by code alone.

GMX is different from decentralized exchanges (DEXs) thanks to its perpetual contract feature, which enables traders to open positions using up to 100x leverage. Unlike using a centralized platform, GMX users maintain custody of their collateral by connecting a self-custodial wallet.

GMX Infrastructure

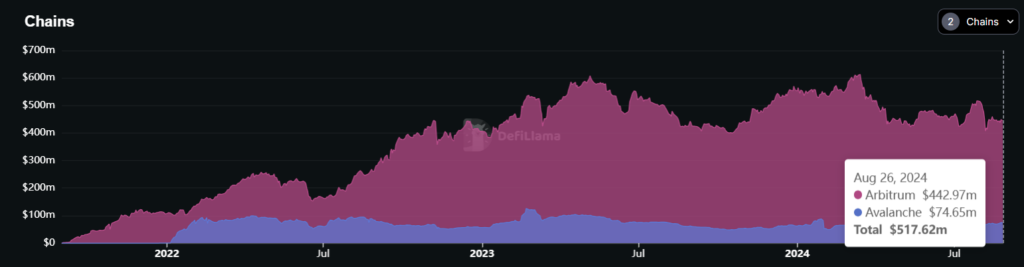

GMX launched in September 2021 on Arbitrum, a layer 2 network meant to scale the Ethereum blockchain. At the beginning of 2022, GMX deployed on Avalanche, a high-speed layer 1 compatible with the Ethereum Virtual Machine (EVM).

At the time of writing, over $517 million worth of crypto is locked on GMX, making it one of the top 50 largest DeFi protocols in terms of total value locked (TVL). Arbitrum accounts for 85% of TVL.

Source: DeFiLlama

GMX uses Chainlink oracles to access fluctuating crypto prices based on the real-time data of high-volume crypto exchanges.

How Does GMX Work?

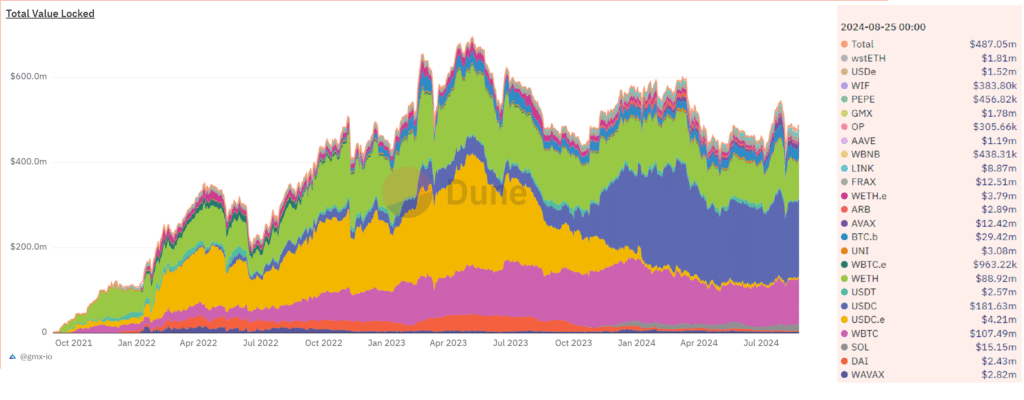

Most DEXs have trading pools for each token pair or larger pools consisting of up to eight assets, as it in the case of Balancer. Trading on GMX is facilitated by a single multi-asset pool called GLP.

At the time of writing, more than a third of these pools consist of stablecoins (USDC 29%, USDT 4%), another third is allocated to Wrapped Bitcoin (WBTC), and 25% to Wrapped Ethereum (WETH). The rest includes altcoins like UNI (Uniswap) and LINK (Chainlink).

There are two separate liquidity pools for Arbitrum and Avalanche. Here is the token allocation on both pools:

Source: Dune

Spot trading and perpetual trading are conducted against these pools, which hold over $480 million in assets.

Who Provides Liquidity On GMX?

Anyone can become a liquidity provider (LP) on GMX by adding supported tokens to a GMX pool after connecting a non-custodial decentralized crypto wallet.

LPs mint GMX Liquidity Provider (GLP) tokens. By adding liquidity and minting GLP tokens, LPs become eligible to earn 70% of all fees either on Arbitrum or on Avalanche paid in escrowed GMX (esGMX).

GLP‘s price, rewards, and index composition may differ between the two chains (Arbitrum and Avalanche). Unlike other DEX pools, GLP is not affected by impermanent loss.

GLP tokens can be minted using any of the assets supported by the pool, and they can also be redeemed to obtain any index asset. It’s important to note that the protocol automatically stakes these tokens. Also, they cannot be transferred to other users.

Thanks to this approach, GMX aims to offer a better spot and perpetual trading experience with low swap fees and zero-price impact trades, which enable traders to open large positions without affecting the price.

GMX Token Overview

In addition to the GLP token, which is non-tradable, there is the GMX token, which acts as the governance token for the GMX platform. GMX can be staked to receive three steams of rewards:

- 30% of all protocol fees are distributed to GMX stakers (we mentioned that 70% of fees go to LPs). The fees are paid in ETH on Arbitrum and AVAX on Avalanche.

- GMX stakers earn esGMX, which can be further staked for rewards or vested. If vested for 12 months, esGMX is converted into GMX. Thus, esGMX is a mechanism to prevent inflation and encourage GMX holding.

- GMX stakers earn Multiplier Points (MPs) that increase their reward rate. MPs are distributed at a rate of 100% APR. For instance, 200 GMX staked for a year can earn holders 200 MPs.

Due to these incentives, almost 85% of GMX is currently staked.

The GMX token has a total supply of 13.25 million, with over 9.6 million in circulating supply. The current GMX price is $28.5, with a market capitalization of $275 million. The all-time high of the GMX coin was set in April 2023 at over $90.

What Can You Do on GMX?

Here is what you can do on GMX:

- Spot trading – you can use GMX as a DEX and swap the supported tokens for fees that range between 0.2% to 0.8%.

- Perpetual trading – this is a more popular use case because it gives traders the opportunity to use up to 100x leverage. Traders can go long or short on any offered pair, paying a 0.1% fee for opening or closing a position. Market, limit, take-profit, and stop-loss orders are available to customize the trading experience.

- Staking – staking GMX can generate rewards that can be compounded and boosted with Multiplier Points.

- Liquidity provision – you can become an LP by locking tokens in the GLP pool to mint GLP tokens and earn rewards.

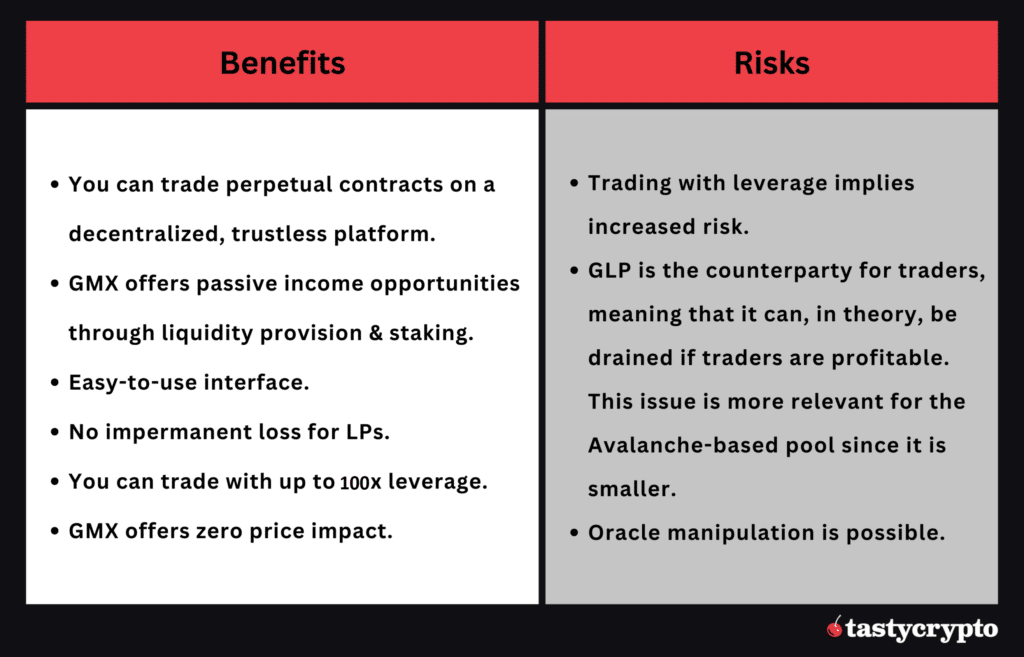

GMX Benefits and Risks

Here are the main pros and cons of the GMX protocol:

🍒 Interested in learning about more derivative DeFi platforms? Check out Derive (formerly known as Lyra), the most widely-used DeFi application for options trading.

GMX FAQs

GMX is not operated by a centralized entity like Binance, BitMEX, or OKX. Instead, it is a decentralized platform run by a community that requires no registration and KYC verification.

On the GMX protocol, you can swap tokens, trade crypto with up to 50x leverage, and earn passive income by providing liquidity or staking the native GMX token, which also gives you voting power.

GMX is the native token on the GMX protocol, which provides voting rights and can be staked for rewards.

GMX might be a solid investment compared to other altcoins with lower market caps. GMX has few competitors, being the largest derivative trading protocol in DeFi.

Anatol Antonovici

6+ years of experience writing for crypto brands and blockchain firms, including Coindesk, Cointelegraph, Bitcoinist, CryptoPotato, Algorand, and OTCTrade.com

🍒 tasty reads

What Is Ether.fi? Liquid Staking Reinvented

What Is Wrapped Ether? Complete wETH Guide

Impermanent Loss in DeFi: The Complete Guide

What is GMX? DeFi Perpetual Exchange 2024 Guide

What Is Defi Liquidity Mining and How Does It Work?