Short crypto strategies profit when the underlying digital assets falls in value. You can short crypto with ETFs, futures, options, synthetic tokens and more.

Written by: Mike Martin | Updated September 5, 2024

Reviewed by: Ryan Grace

Fact checked by: Laurence Willows

Bearish on crypto? There are numerous ways for you to profit. In this article, we’ll review the 7 most popular ways to short cryptocurrencies like bitcoin (BTC) and ether (ETH).

Table of Contents

🍒 tasty takeaways

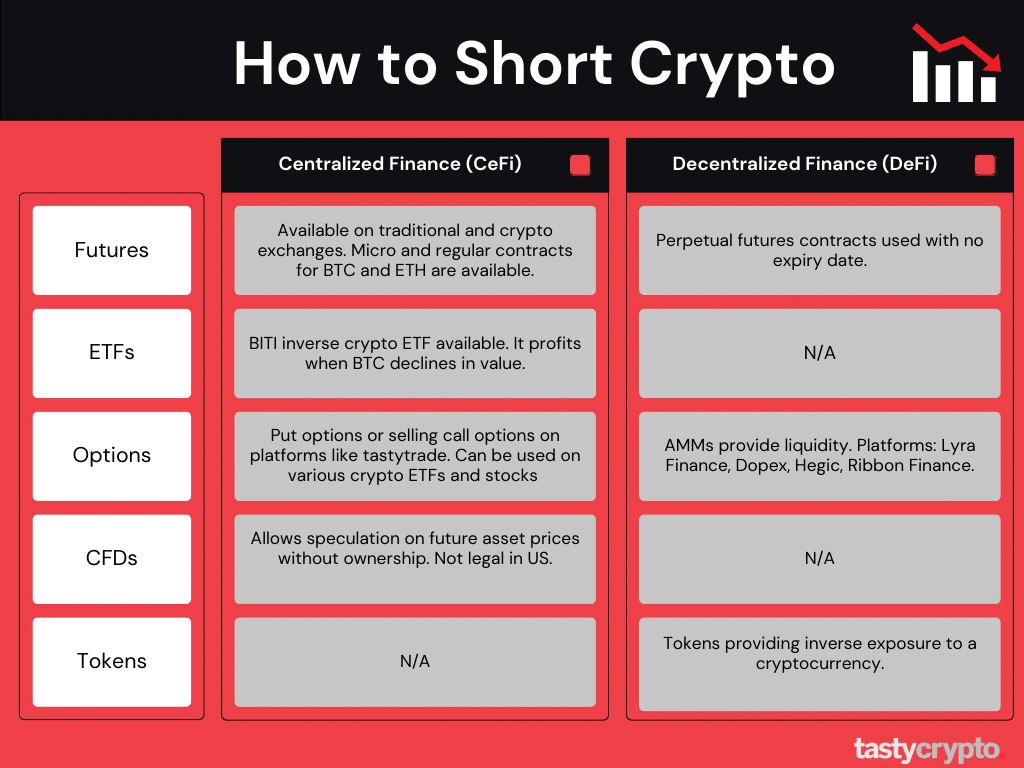

In centralized finance, you can short crypto with futures, options, ETFs, and CFDs.

In decentralized finance, you can short crypto with perpetuals, synthetic tokens, and DeFi options.

Some short crypto strategies involve unlimited risk, so make sure you understand the strategy before placing a trade.

7 Ways to Short Crypto

| Method | Description |

|---|---|

| 1. Short Crypto With Futures | Futures contracts are financial agreements between two parties who agree to buy or sell an asset, like crypto, at a specific price on a specific future date. |

| 2. Short Crypto With ETFs (BITI) | Another trading strategy to short sell crypto in traditional finance (TradFi) is with inverse exchange-traded products. These ETFs profit when the underlying declines in value. |

| 3. Short Crypto With Options | Another way to short cryptocurrency is with options contacts. Put options, for example, profit when the underlying declines in value. |

| 4. Short Crypto With CFDs | Contract for Difference (CFD) is a method of trading that allows individuals to speculate on the future price of an asset without having to actually own the underlying. |

| 5. Short Crypto With DeFi Perpetual Futures | One of the most popular ways to sell short cryptos like bitcoin and ether in DeFi is with perpetual futures. |

| 6. Short Crypto With DeFi Options | You can trade options in DeFi as well, though the mechanics here are a little different. |

| 7. Short Crypto With Tokens (Synthetic Assets) | When you have a self-custody wallet, you can trade thousands of crypto tokens. Some of these tokens provide inverse exposure to a cryptocurrency, thereby mimicking a short position. |

What is Shorting Crypto?

The crypto market is very volatile. It is common for 100%+ bull runs to be proceeded immediately by 50% crashes.

Shorting cryptocurrency allows traders to profit from this volatility. Traditional short selling (usually associated with the stock market) involves a trader borrowing an asset, and then immediately selling that asset on the market.

In order to turn a profit, this trader must buy back that asset at a lower price than what they sold it for. This is how basic short selling in margin trading works.

There are, however, many different ways to profit from a digital asset falling in value. In this article, we’ll explore the 7 different ways to ‘short’ bitcoin, ethereum (ether), and other cryptocurrencies.

🍒 Curious What Cryptos To Short? Read: 11 Best Crypto to Day Trade

Shorting Crypto in CeFi/TradFi

In this first section, we’ll show you different ways you can profit from cryptocurrency falling in price in centralized finance (CeFi) and traditional finance (TradFi).

📖 Read: CeFi vs DeFi vs TradFi

1. Short Crypto With Futures

Futures contracts are financial agreements between two parties who agree to buy or sell an asset, like crypto, at a specific price on a specific future date. When you sell to open a futures contract, you are effectively betting that the underlying asset will decline in value.

Be cautious when trading in the futures market; these contracts are leveraged, which can amplify both losses and gains.

You can trade futures contracts in traditional finance (CME) and on centralized crypto exchanges.

CME FUTURES

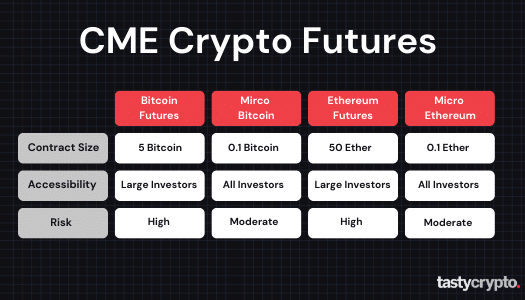

Many retail trading platforms (including tastytrade) offer access to Chicago Mercantile Exchange (CME) products.

CME currently offers both bitcoin and ether futures trading. Here is a breakdown of their products in these categories.

Bitcoin Futures

Mirco Bitcoin Futures

Ether Futures

Micro Ether Futures

Placing stop-loss order on crypto futures can help to mitigate risk.

Crypto Exchange Futures

If you want access to additional cryptocurrency futures, you must open an account with a centralized cryptocurrency exchange (CEX). Kraken, for example, offers futures on more than 40 cryptocurrencies. These futures, however, are ‘perpetuals’, which, unlike CME futures, do not expire (more on this later).

⚠️ Binance does not offer futures to its US customers

2. Short Crypto With ETFs (BITI)

Another trading strategy to short sell crypto in traditional finance (TradFi) is with inverse exchange-traded products. These bitcoin ETFs profit when the underlying declines in value.

Currently, the only inverse crypto ETF on the US stock market is BITI, which profits when bitcoin (BTC) declines in value.

The BITI short bitcoin Strategy ETF is offered by ProShares. It is worth noting that this product is a futures-based ETF. This means that in order to keep the ETF alive, the short futures comprising this fund must be rolled. This can sometimes cost extra money and lead to contango, which causes an ETF to shed value. Therefore, this ETF is best for traders who are bearish on bitcoin in the short term only.

3. Short Crypto With Options

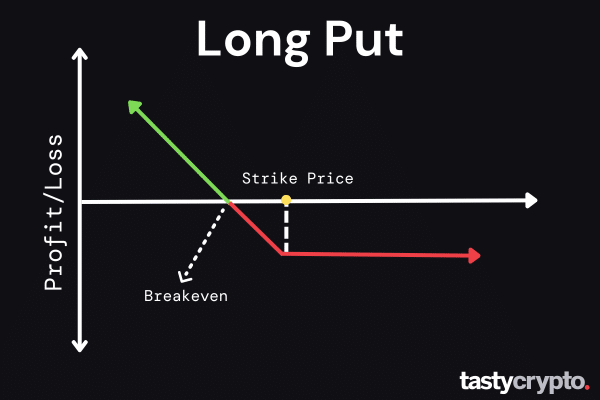

Another way to short cryptocurrency is with options contacts. Put options, for example, profit when the underlying declines in value.

Like futures contracts, options contracts are derivatives. This means that the value of an option contract is derived from a separate, underlying source. There is also leverage in options – typically, one options contract represents 100 shares of the underlying stock.

In addition to buying puts, you can also short crypto with options by buying put spreads or selling call spreads. You can also take a neutral/short position in crypto by selling calls naked, but this is a very high-risk strategy.

If you are bearish on crypto, you can buy put options on many different crypto ETFs and stocks.

Crypto ETFs with Options

BITO – futures-based bitcoin ETF

BLCN – Invests in companies involved with blockchain

BLOK – Invests in companies involved with blockchain

Crypto Stocks with Options

Coinbase (COIN)

Riot (RIOT)

MicroStrategy Inc (MSTR)

🍒 tastytrade was recently ranked as the #1 options trading platform by Investopedia. Check out tastytrade here!

You can also trade binary crypto options on offshore exchanges like Deribit and OKEx.

4. Short Crypto With CFDs

Contract for Difference (CFD) is a method of trading that allows individuals to speculate on the future price of an asset without having to actually own the underlying. In the US, CFDs are not legal. However, if you reside outside the US, you can go short crypto with CFDs on popular platforms like IG.

📖 Read More: What are IG’s cryptocurrencies CFD product details?

Shorting Crypto in DeFi

Let’s now explore a few ways to sell short crypto in decentralized finance.

📢 In order to interact with DeFi, you’ll need a self-custody crypto wallet. Check out our wallets here!

5. Short Crypto With DeFi Perpetual Futures

One of the most popular ways to sell short cryptos like bitcoin and ether in DeFi is with perpetual futures.

Unlike the traditional futures we learned about earlier, perpetual futures have no expiration date. Perpetual futures also use what is called a ‘funding rate’. Since these contracts never expire, they must be adjusted, usually a few times a day, so the perpetual price matches that of the underlying crypto asset. These adjustments cost money. Traders of perpetual futures incur these fees by paying a nominal ‘funding rate’.

Let’s now look at a perpetual trade example.

Perpetual Trade Example

Underlying: Bitcoin (BTC)

Position: Short (anticipating that the BTC price will fall)

Entry Price: $30,000

Leverage: 5x

Funding Rate: 0.01%

In this example, a trader enters a short position in a perpetual Bitcoin futures contract, expecting the price of Bitcoin to fall.

The trade is entered at a price of $30,000, using 5x leverage, which magnifies the position’s potential profits and losses.

To maintain the position, the trader must have at least 5% of the position’s notional value in their account as collateral. Additionally, they must pay a funding rate of 0.01% every 8 hours, based on the difference between the contract price and the spot price of Bitcoin.

Despite the fact that the face value of the cryptocurrency futures contract is based on one Bitcoin, the trader has a leverage of 5x. This magnifies the total value of the trader’s position to $150,000, which is the result of multiplying the entry price of $30,000 by the leverage factor of 5.

Now let’s say that in a week bitcoin falls by 2k. Since this trader is short, they will profit by $2,000. However, since we are leveraged 5x, the true profit here would be $2,000 x 5, or $10,000. We must subtract the funding rate from this profit, but the figure is very small.

📖 Read More: Perpetual Futures for Beginners

Popular DeFi Perpetual Exchanges

dYdX

6. Short Crypto With DeFi Options

You can trade options in DeFi as well, though the mechanics here are a little different.

In traditional options markets, market makers create markets by buying and selling options from traders. Their responsibility is to provide liquidity. They profit on the ‘spread’, or the difference between the bid and ask price.

DeFi employs automated market markers (AMMs) in order to provide liquidity.

In TradFi, there are huge barriers to entry. In DeFi anybody can be a market maker on DeFi options platforms like Derive (formerly known as Lyra) and earn the fees that come with it.

Additionally, anybody can trade options in DeFi. No paperwork, KYC, or advanced learning is required. Here are a few popular DeFi protocols for options:

Derive

Dopex

Hegic

Ribbon Finance

📖 Read More: DeFi Options In Depth

7. Short Crypto With Tokens (Synthetic Assets)

When you have a self-custody wallet, you can trade thousands of crypto tokens. Some of these tokens provide inverse exposure to a cryptocurrency, thereby mimicking a short position. Most popular inverse tokens are leveraged at ratios of 1x, 2x, and 3x.

Additional Reading

CoinTelegraph: A beginner’s guide on how to short Bitcoin and other cryptocurrencies

FAQs

In crypto, a ‘short’ refers to a position that profits when an underlying such as bitcoin (BTC) drops in value.

In crypto, you can buy short positions by purchasing inverse ETFs (BITI), purchasing put options, purchasing put spreads, and buying synthetic tokens in DeFi.

A long position profits when a cryptocurrency such as ether (ETH) rises in value while a short position profits when a cryptocurrency declines in value.

A downside to shorting crypto is risk. In many short positions, such as selling futures contracts, there is unlimited risk. Some risk-defined strategies, such as long puts, can help to mitigate this risk.

Mike Martin

Mike Martin formerly served as the Head of Content for tastycrypto. Before joining tastycrypto, Michael worked in the active trader divisions of thinkorswim, TD Ameritrade, and Charles Schwab. He also served as a writer and editor for projectfinance.

Michael has been active in the crypto community since 2017. He holds certifications from Duke University in decentralized finance (DeFi) and blockchain technology.

🍒 tasty reads

The Core Blockchain and DeFi Ecosystem: What You Need to Know

7 Best DePIN Crypto Projects

What Is Symbiotic and How Does It Work in 2024?

Ethereum vs Ethereum ETFs – 5 Major Differences