Like traditional options, DeFi options give the owner the right, but not the obligation, to buy (calls) or sell (puts) the underlying at a set price (strike price) at a future time. Defi options, however, operate on decentralized exchanges and require no intermediary.

Written by: Siyu Ren Heinrich | Updated June 26, 2024

Reviewed by: Mike Martin

Fact checked by: Ryan Grace

With an estimated 137 billion options contracts traded in 2023, options are among the most popular financial instruments in the world. At the same time, traditional options trading is not transparent and far from accessible to everyone – decentralized finance (DeFi) is changing that.

In this article, we will teach you what DeFi options are all about.

🍒 tasty takeaways

DeFi options offer advantages over traditional options as these derivatives are trustless, accessible to all, and transparent.

DeFi options are created with smart contracts. These contracts offer users programmable possibilities that go far beyond traditional options trading.

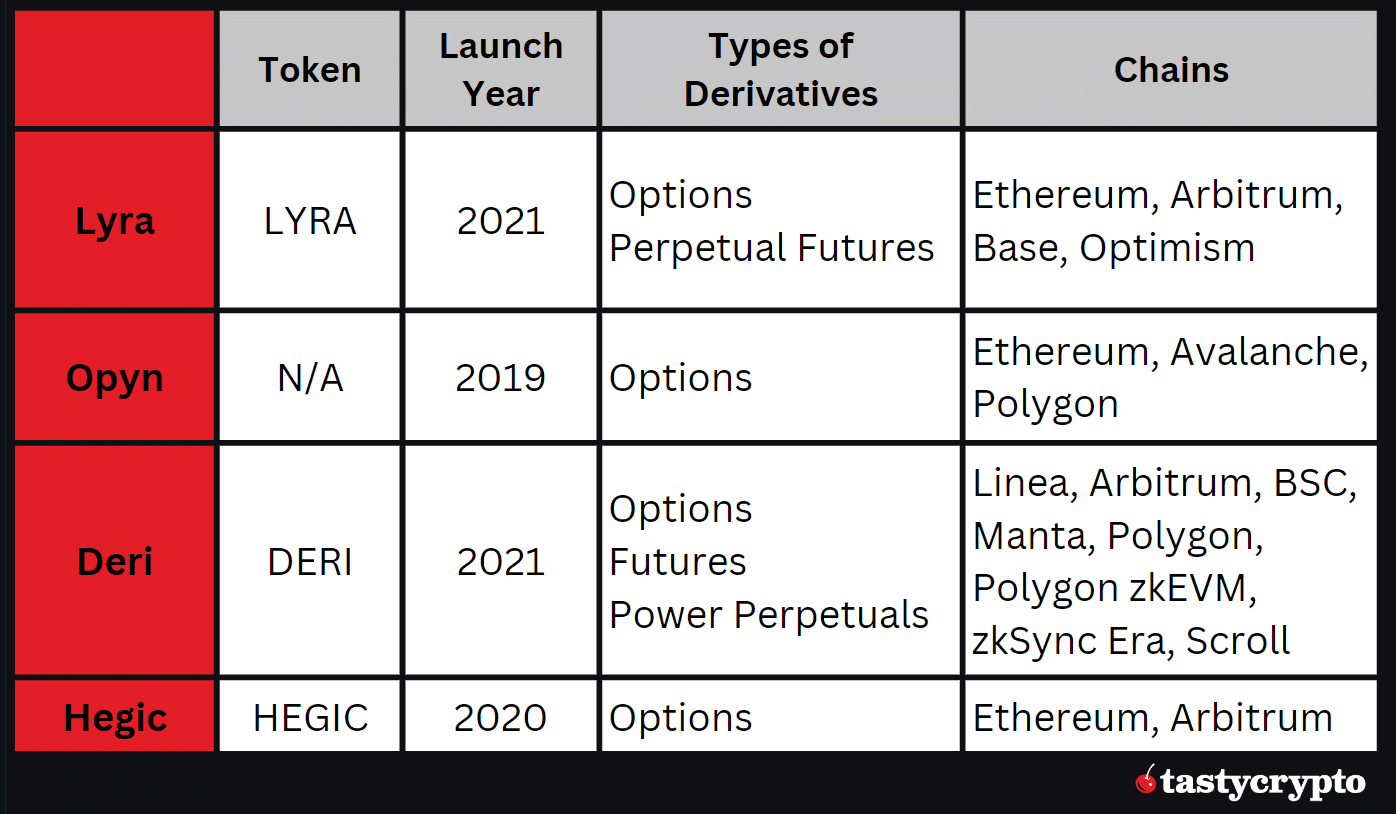

The best DeFi protocols for options trading include Derive (formerly known as Lyra), Opyn, Deri, and Hegic.

📚 Read more about Derive, the most popular DeFi options protocol here!

What Are Options?

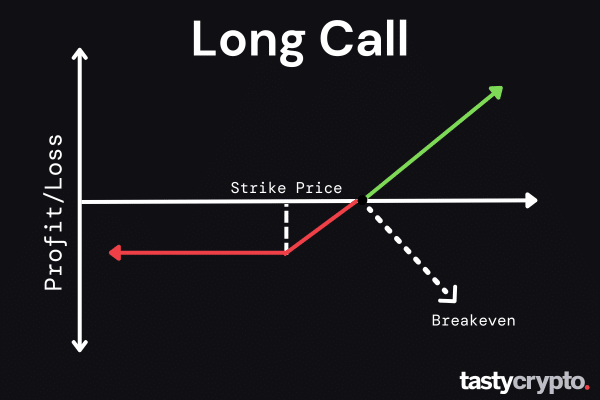

An option is a financial contract that gives the owner the right but not the obligation to buy (a call option) or sell (a put option) an underlying asset at a specific price on or before an expiration date.

Options are known as derivatives because they derive their value from a different underlying asset. This asset could be a stock, a cryptocurrency, or a commodity.

Options contracts all contain:

An underlying asset

An expiration date

Type (call vs put)

Premium (how much an option is sold/bought for)

Strike price (the price at which an option is exercised/assigned)

Put options profit when the underlying falls in value while call options profit when the underlying rises in value. However, just because the underlying moves are in your favor does not necessarily mean your option will be profitable. Remember, you have to factor in the premium you paid for that option.

What Are The Advantages of Options Trading?

Options offer traders two main advantages:

The flexibility of investment: A major advantage of options is their versatility. Unlike traditional securities, options provide the opportunity to profit in any market, including when it moves down or trades sideways (market neutral).

Hedging: Options can serve as an insurance policy to protect traders from potential losses in downturns (or upturns for short sellers). Traders can buy or sell options to minimize the impact of adverse market movements.

Leverage: One options contract typically represents 100 shares of stock.

What Are DeFi Options?

Traditional options trading is not very transparent and accessible only to those who have been pre-approved (which requires experience and a minimum net worth). DeFi introduces many advantages over traditional options trading:

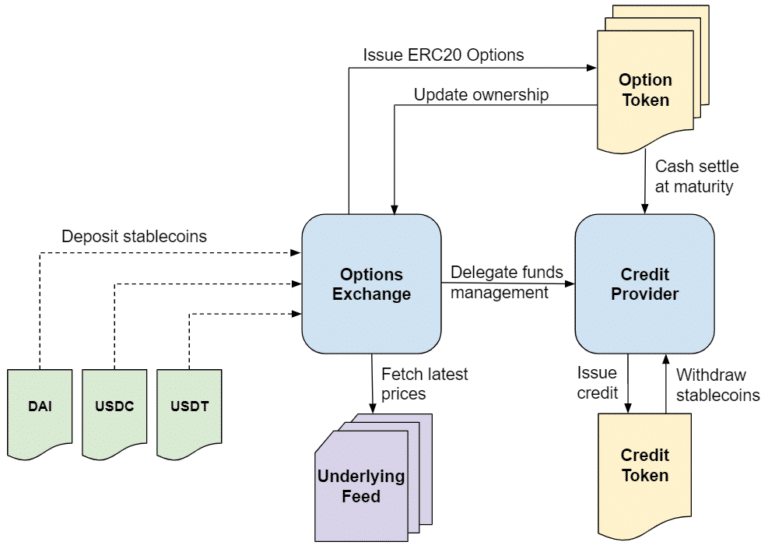

Trustless: DeFi options do not rely on intermediaries – smart contracts handle the transactions as well as the clearing of transactions. Trading is non-custodial (self-custodial), meaning that no party takes custody of assets.

Open: DeFi options trading is available 24/7 with prices being updated algorithmically. Trading is often possible without a KYC (know-your-customer) process, making it accessible to anyone globally with a crypto wallet, regardless of their status as an approved options trader or institutional investor.

Flexibility: DeFi option contracts are exercisable at any time, kind of like American options in TradFi. Exercise is guaranteed by liquidity locked within smart contracts.

The Risks Of DeFi Options Trading

There are also some risks associated with DeFi options trading.

High volatility: A key element of options trading is that users speculate on the future price of an asset in order to turn a profit. However, the volatility of crypto markets can pose a challenge, especially for inexperienced traders. A single large movement of the underlying can prove disastrous to a portfolio.

Risky leverage: Some DeFi platforms allow traders to use very high leverage. This increases the potential for gains, but also for losses.

Sometimes holding is better than trading: In bullish crypto markets, simply holding a cryptocurrency is often more profitable than options trading due to time decay (theta).

Errors in programming: Faulty DeFi protocol smart contracts can have financial consequences for those involved.

No FDIC Insurance: Unlike traditional brokers, there is no FDIC insurance in DeFi.

How Do DeFi Options Work?

Here are the steps demonstrating how options trading in DeFi works:

The user provides a cryptocurrency like bitcoin (BTC) or a stablecoin.

The required amount is locked by a smart contract.

Based on user input, the smart contract creates an options contract with the following information:

amount

expiration date

type of option (call vs put)

fees

The smart contract refers to price data and calculates the profit from it.

On the key date, the smart contract transmits the profit/loss to the user.

DeFi Option Protocols

According to DeFiLlamma, the Ethereum blockchain is the most popular network for option protocols, followed by Arbitrum, a layer 2 scaling solution for Ethereum.

Leading blockchain-based option decentralized applications (dApps) with high total value locked (TVL) figures include:

Derive: Derive is an Automated Market Maker (AMM) for options that enable users to buy and sell options against a liquidity pool. Derive has two key user groups: liquidity providers and options traders. Liquidity providers deposit funds into one of Derive’s Market Maker Vaults. Traders can buy or sell options to the Vaults, paying liquidity providers a fee as compensation.

Opyn: Opyn aims to be a capital-efficient DeFi options trading protocol that uses an on-chain settlement architecture to offer free limit orders to its users. This platform created one of the first DeFi options trading protocols and introduced the world’s first perpetual option, called Opyn Squeeth.

Deri: Deri is a derivatives trading platform that supports futures, options, and power perpetuals, which are a type of leveraged futures. The protocol is compatible with multiple networks, including Arbitrum, Linea, BSC, Polygon, and Manta.

Hegic: Hegic is an AMM for trading options on Arbitrum. It utilizes a so-called Stake & Cover pool to provide liquidity in which LP participants share the profit or loss accrued by the protocol users.

📚 Read! 11 Best DeFi Tokens for 2023

Challenges Faced by Decentralized Option Markets

At present, DeFi options markets are in their nascent stages. Many protocols only offer basic call-and-put options. This is due to three main factors:

Current DeFi options trading protocols require 100% collateralization, making them less capital-efficient than centralized platforms.

It’s difficult to price options on AMMs; protocols do not account well for time dimension (time decay) in the asset. Improved AMM protocol designs are needed.

For efficient price discovery, options trading requires a high level of liquidity. This problem is related to the two previously mentioned challenges. However, it can be expected that the innovative crypto space will solve them soon.

DeFi Options FAQs

Decentralized options are like traditional options, but they operate in an ecosystem devoid of a central authority and government regulations.

The top DeFi options protocols are Lyra, Opyn, and Dopex.

Decentralized options run on decentralized blockchains. This makes them far more transparent than traditional options. Additionally, DeFi options are cheaper to trade, more accessible, and programmable.

To trade DeFi options, you need to open a self-custody crypto wallet, fund that wallet with crypto and connect to a DeFi options protocol, like Lyra.

Siyu Ren Heinrich

5 years of experience in crypto research of writing practical blockchain and crypto analysis on Medium.

MSc in Computer Science, BSc in Smart Engineering, and BSc in Economics and Statistics.

Michael has been active in the crypto community since 2017. He holds certifications from Duke University in decentralized finance (DeFi) and blockchain technology.

🍒 tasty reads

What Is Ether.fi? Liquid Staking Reinvented

What Is Wrapped Ether? Complete wETH Guide

Impermanent Loss in DeFi: The Complete Guide

What is GMX? DeFi Perpetual Exchange 2024 Guide

What Is Defi Liquidity Mining and How Does It Work?