Polymarket is a decentralized prediction marketplace where crypto holders bet on the outcome of events related to politics, sports, entertainment, crypto assets, and other industries.

Written by: Anatol Antonovici | Updated February 26, 2024

Reviewed by: Mike Martin

Fact checked by: Ryan Grace

Source: Polymarket

Polymarket allows crypto participants to bet on anything – from political outcomes to the extraterrestrial, this marketplace has it all. In this article, we’ll show you how it works.

Table of Contents

🍒 tasty takeaways

About Polymarket: A decentralized betting platform on the Ethereum blockchain, allowing users to wager on events ranging from politics to entertainment using the Polygon Layer-2 scaling solution.

User Interaction: Participants register, deposit USDC, choose events, and buy or trade outcome shares, with the platform operating without KYC checks, providing self-custody of wallets.

Technological Backbone: Utilizes Polygon to enhance scalability and reduce costs on Ethereum, competing with similar platforms like Augur and Gnosis.

Regulatory Status: Faced a $1.4 million fine by the CFTC and is currently not available to U.S. residents, continuing its operations internationally with robust trading volumes.

What Is Polymarket?

Polymarket is one of the largest decentralized prediction platforms. It operates on the Ethereum blockchain through a Layer-2 scaling solution called Polygon.

The platform was founded in 2020 by US entrepreneur and crypto investor Shayne Coplan. It managed to raise $4 million in a seed round funding the same year from investors like Polychain and ParaFi Capital.

Despite having a team working on the project, the prediction market operates as a decentralized Web3 app, and that’s its most important feature. Polymarket users can interact with it in a self-custodial fashion, i.e., they simply have to connect their self-custody crypto wallets without depositing funds to the platform or going through KYC verification.

Real-Time Betting

Polymarket enables users to speculate on the outcomes of current and future events related to politics, entertainment, sports, and other events using cryptocurrency. Participants purchase outcome shares for under $1, which can be traded at any time and become worth $1 if the predicted outcome is correct. Otherwise, they become worthless.

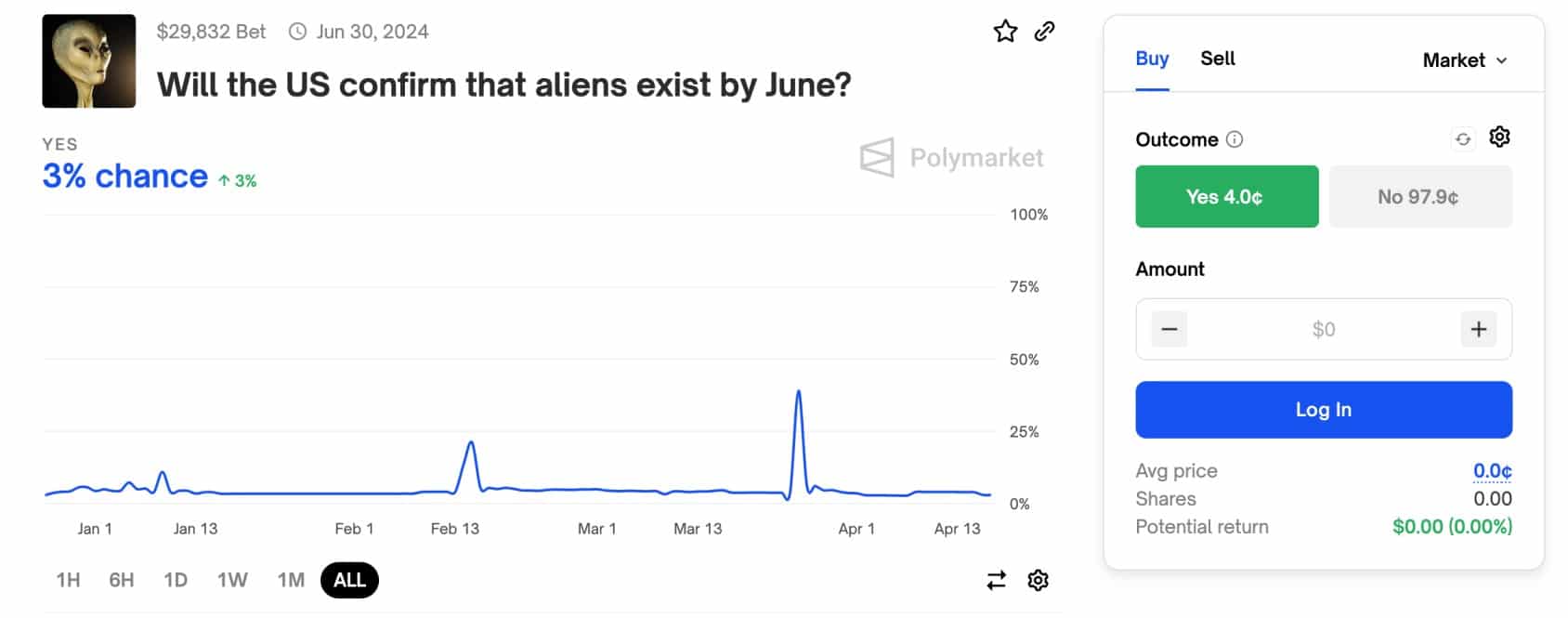

Will Donald Trump win the next Presidential election? Will there be a fight between Elon Musk and Mark Zuckerberg? Will the US government admit the existence of aliens? These are some of the questions representing events that you can bet on today.

The platform provides a user-friendly dashboard where you can see all the markets and filter them by category, liquidity, status, etc.

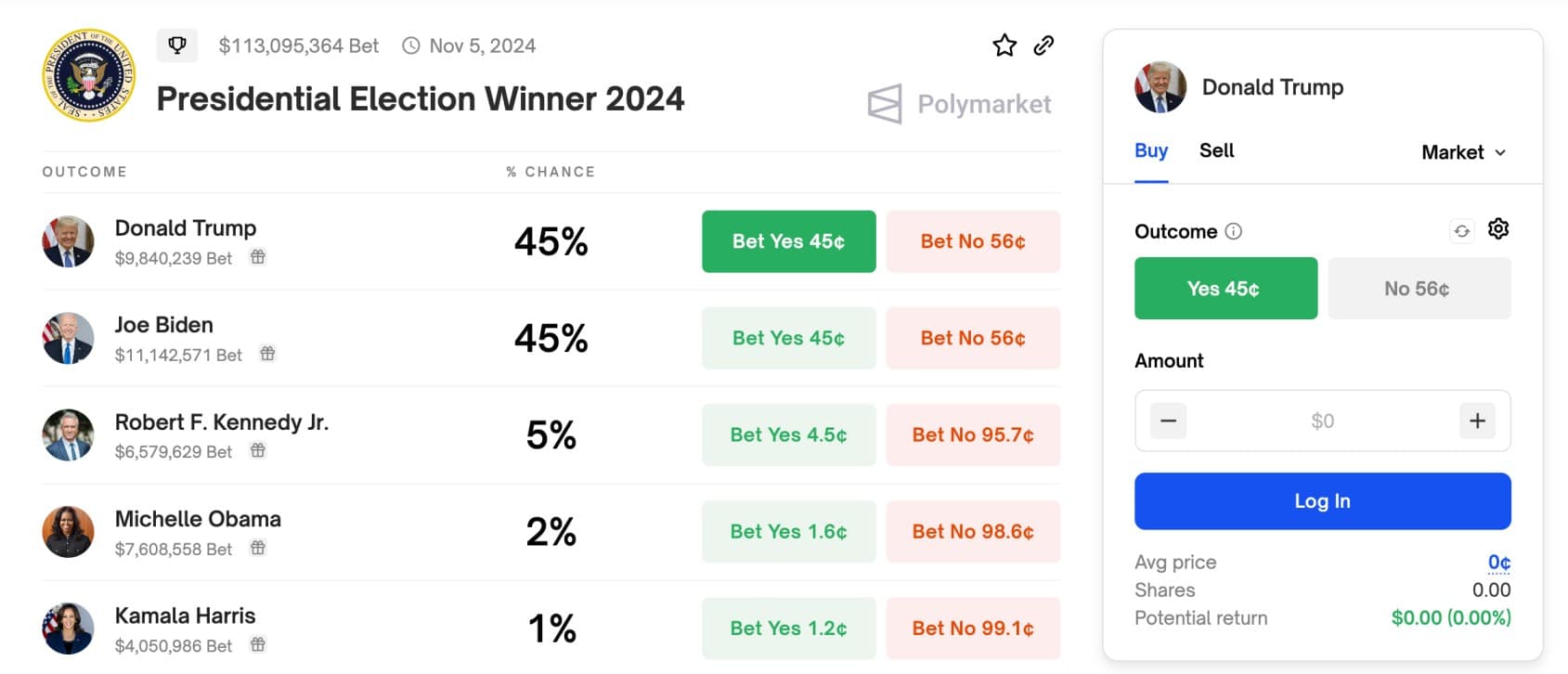

For example, here are the current bets on the 2024 presidential election as of April 2024.

Source: Polymarket

How Does Polymarket Work?

Polymarket features a wide range of events for users to select from. To access the platform, users navigate through a browser and connect using an Ethereum-compatible wallet that holds the USDC stablecoin.

If you want to bet on Polymarket, here are the steps you should follow:

- Sign up – you should sign up with your email address, after which Polymarket creates an Ethereum-based wallet for you. You hold the private keys, ensuring full control over your funds.

- Deposit funds – you have to deposit USDC into your Polymarket wallet. For those unfamiliar, USDC is a stablecoin pegged to the price of the US dollar, meaning that it’s designed to cost $1 at any time. The stablecoin helps the platform value events and payouts in USD terms. You can easily buy USDC through a centralized exchange like Coinbase, Binance or a decentralized exchange (DEX).

- Pick a market – you can choose a market to speculate on. Most markets present a binary (yes/no), verifiable outcome. However, some of them may be categorical, i.e., have multiple options that will resolve either $1 or $0, and scalar, which is a market that resolves to where the final value ends up between a lower and upper bound. You can use filters to pick the markets that suit your interests.

- Purchase outcome shares – if you like a particular market, you can speculate on an outcome by purchasing ‘outcome shares’ with USDC. Each share is priced between $0.01 and $1.00 and reflects the aggregated probability of expected outcomes. For example, if the Yes outcome of a binary market costs only a few cents, it means it’s less probable to happen.

- Trade shares – shares can be sold at any time before the market resolves. There are no fees charged by Polymarket. Once resolved, they end up costing either $1 or $0 each, depending on the final result.

- Market resolution – markets close when the outcome has been unambiguously determined. If you predicted correctly, you can cash out your shares at $1.00 each. If outcomes are ambiguous, Polymarket’s Market Integrity Committee (MIC) determines the outcome.

Source: Polymarket

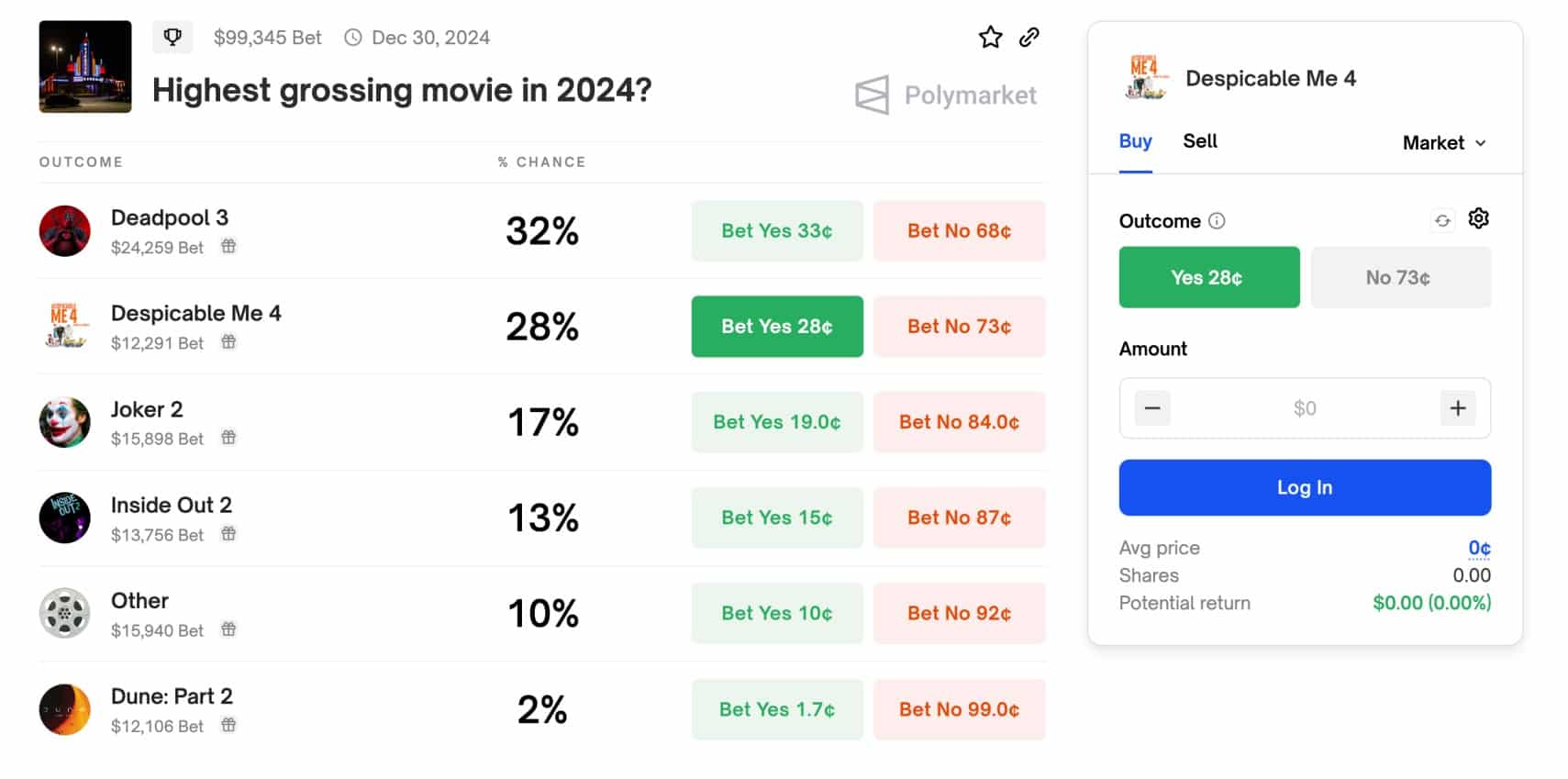

Unlike in the example above, the outcome shares of some markets can fluctuate greatly as the probability changes. Here is a more even market predicting the highest grossing movie of 2024:

Source: Polymarket

Technology Behind Polymarket

Polymarket leverages a Layer-2 network called Polygon, a $6.6 billion market. The goal of Polygon is to improve Ethereum’s scalability. Layer-2 solutions aim to cut transaction costs and boost the throughput of the main blockchain by processing transactions off-chain, typically on a related sidechain. This ensures that Polygon applications like Polymarket can handle high transaction volumes without causing congestion on Ethereum.

Thanks to its underlying decentralized infrastructure powered by Polygon, Polymarket offers great advantages over traditional online prediction markets, such as minimal fees, more privacy, and the flexibility to trade shares prior to resolution.

Polymarket Alternatives

| Platform | Market Cap | TVL | Daily Active Users | Blockchains | Launch | Types of Markets |

|---|---|---|---|---|---|---|

| Polymarket | N/A | $9.18M | 326 | Polygon | 2020 | Binary, Categorical, Scalar |

| Augur | $6.52M | $2.43M | N/A | Ethereum | 2018 | Binary, Categorical, Scalar |

| Gnosis | $855M | $6.38M | 16.3K | Ethereum, Gnosis Chain | 2015 | Binary, Categorical, Scalar |

Polymarket is one of several decentralized prediction markets out there. On a side note, most betting markets are based on Ethereum, and some of them leverage the Polygon network as well for more efficiency.

The most popular Polymarket competitors are Augur and Gnosis.

What is Augur?

Augur is one of the oldest blockchain-based prediction markets. The Ethereum-based platform was founded in 2014 and fully launched in 2018. Besides betting on event outcomes, users can create markets themselves. The platform has its native token, REP, which is used for rewards, creating new markets, and disputing an outcome, among others.

Augur has a ‘sportsbook’ platform dedicated to sports betting. Other than that, it supports many categories, including crypto. Like Polymarket, Augur supports binary, categorical, and scalar markets. Recently, Augur launched its ‘Turbo’ version that leverages Polygon.

What is Gnosis?

Gnosis is another Ethereum-based prediction market. It was founded in 2015 and has added other features besides betting, including decentralized trading, wallet services, and infrastructure tools.

Gnosis has a more complex architecture and has broader use cases besides predictions. Its native token, GNO, is used for governance and staking.

Gnosis even built its own Layer-2 chain with smart contract capability, Gnosis Chain, which is also used by another competitor known as Azuro.

Polymarket Availability in US

Polymarket relies on a decentralized infrastructure, and that’s not accepted in some jurisdictions. Last year, the US Commodity Futures Trading Commission (CFTC), which rules over commodity derivatives and other financial products, fined Polymarket $1.4 million and required it to shut down its markets for US residents.

The CFTC treated Polymarket’s markets as binary options and penalized the platform for not seeking a Designated Contract Market (DCM) or Swap Execution Facility (SEF) registration, which is required for binary options providers in the US.

Polymarket managed to reduce the fine, but it hasn’t offer its services to US residents since then.

FAQs

Polymarket is a decentralized prediction platform where users speculate on outcomes of various events related to politics, entertainment, sports, and others by purchasing and trading outcome shares with cryptocurrency.

You can bet on Polymarket by signing up, depositing USDC into your wallet, selecting a market, and purchasing outcome shares with USDC. Shares can be sold anytime before the market resolution, and the positive result is worth a maximum of $1 per share. Besides USDC, users should hold some MATIC, the native token of Polygon, to pay for gas fees.

While Polymarket operates globally, its services are currently not available to US residents due to a ruling by the US Commodity Futures Trading Commission treating Polymarket’s markets as an unregistered binary options provider.

Anatol Antonovici

6+ years of experience writing for crypto brands and blockchain firms, including Coindesk, Cointelegraph, Bitcoinist, CryptoPotato, Algorand, and OTCTrade.com

The Core Blockchain and DeFi Ecosystem: What You Need to Know

7 Best DePIN Crypto Projects

What Is Symbiotic and How Does It Work in 2024?

Ethereum vs Ethereum ETFs – 5 Major Differences