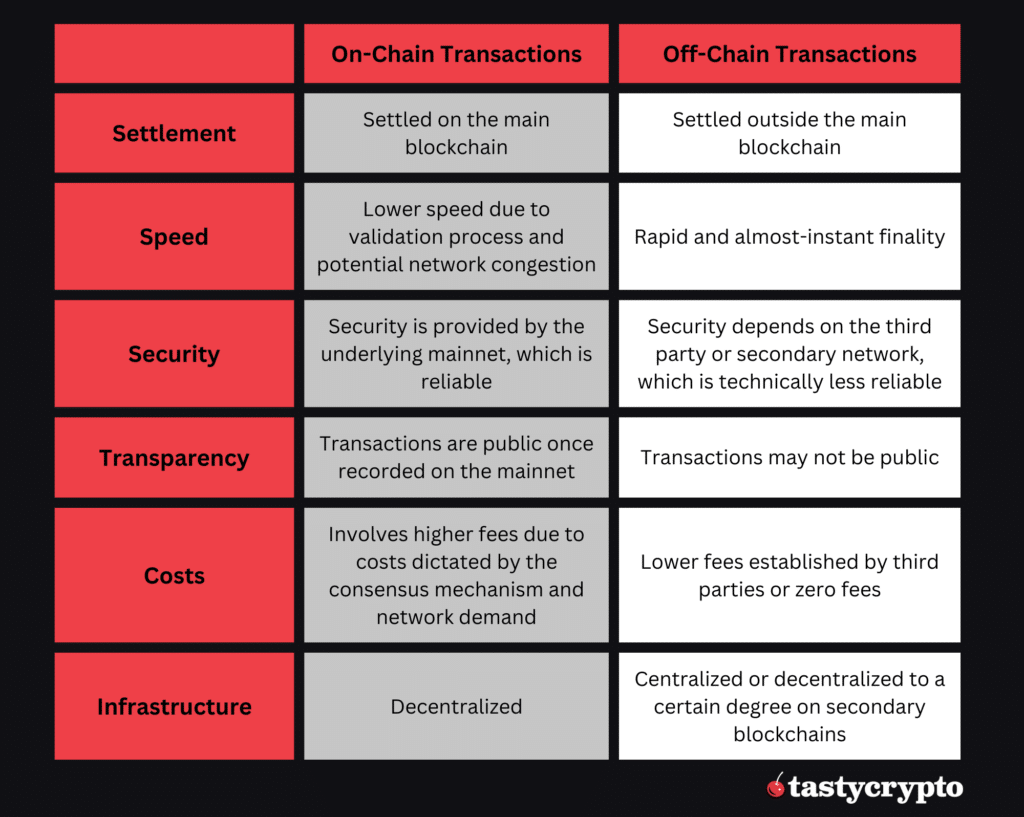

‘On-chain’ crypto transactions are validated and stored directly on a decentralized blockchain network while ‘off-chain’ transactions occur outside a decentralized blockchain. The former is more secure while the latter is generally faster and cheaper.

Written by: Anatol Antonovici | Updated August 9, 2024

Reviewed by: Mike Martin

Fact checked by: Ryan Grace

‘On-chain’ transactions provide the best security; ‘off-chain’ transactions are faster and cheaper but at the expense of security.

🍒 tasty takeaways

On-chain transactions are conducted on a blockchain – they are validated by a decentralized network of nodes and recorded permanently on the public ledger.

Off-chain transactions are settled outside a blockchain to achieve greater scalability and efficiency.

- The need for scalability gave rise to layer 2 solutions, which are centralized platforms or decentralized networks built on top of an existing blockchain.

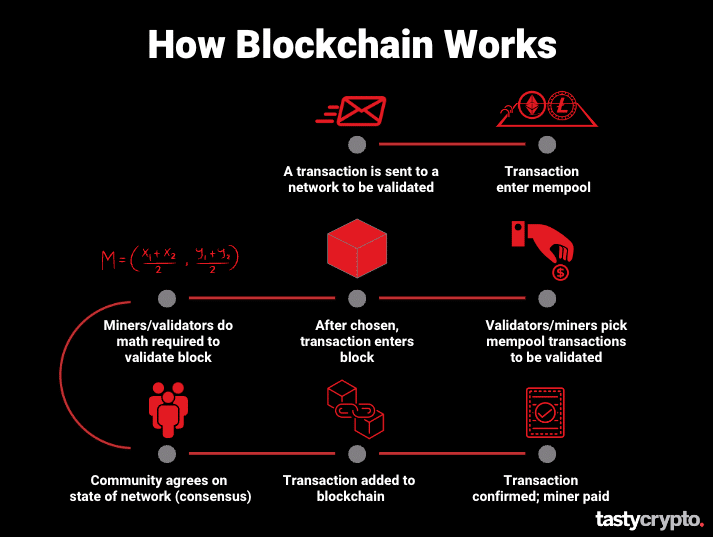

Blockchains are decentralized networks that facilitate transactions without the involvement of intermediaries like banks, regulators, or government. However, validating these transactions in a decentralized fashion requires some effort from network participants, which is an impediment to scalability.

Off-chain transactions are a great solution to increase the speed and accessibility of crypto interactions, but they’re less secure. Here’s how the two compare.

| Attributes | On-Chain | Off-Chain |

|---|---|---|

| Description | Transactions occur exclusively within a blockchain network and are recorded permanently on the public ledger. | Transactions occur outside a native blockchain. Specialized platforms can facilitate these transactions for faster settlements. |

| Security | More secure; transactions are encrypted and cannot be tampered with unless a majority agrees. | Less secure than on-chain; can be vulnerable to risks like hacking and theft. |

| Speed | Transactions require time for node verification and reach finality; e.g., Bitcoin takes about 10 minutes per transaction. | Near-instant settlement since no validation is required from the mainnet. |

| Cost | Can have higher fees especially during times of high demand. | Much lower or even zero fees due to lack of mainnet validation costs. |

| Centralization | Public blockchains are managed in a decentralized manner; they are censorship-resistant and borderless. | Handled by centralized entities or decentralized layer 2 networks with fewer nodes. Trust is placed in these entities/systems. |

| Transparency | High transparency; all transactions are recorded on a shared public ledger. | Lower transparency; transactions are settled off-chain and users have less visibility of behind-the-scenes operations. |

| Anonymity | Public blockchains offer some anonymity but all transactions are recorded for public view. | Off-chain transactions offer greater anonymity than on-chain. |

What Are On-Chain Transactions?

On-chain transactions are transactions that occur exclusively within a blockchain network, being recorded permanently on the public ledger that is operated in a decentralized manner.

Once these transactions are initiated – for example, person A sends crypto to person B – they are bundled together into blocks and await validation to be added chronologically to the public ledger. Nodes, which are computer servers hosting a version of the distributed ledger, take part in the verification process depending on the consensus mechanism, which differs from network to network.

On-Chain Transaction Examples

For example, Bitcoin (BTC), the largest cryptocurrency by market cap, uses a Proof of Work (PoW) algorithm that involves competition between nodes that use enormous computing power to win the right to become the next block validator.

Elsewhere, Proof of Stake (PoS) blockchains, such as Ethereum, Solana, Cardano, or Avalanche, rely on block validator candidates who stake a portion of the native coin, an approach that provides more scalability.

The decentralized nature of blockchain technology ensures that on-chain transactions are simultaneously added across multiple nodes, ensuring transparency and mitigating fraudulent alterations.

Pros and Cons of On-Chain Transactions

Pros

- Decentralization – public blockchains are managed in a decentralized manner, meaning that they’re censorship-resistant and borderless.

- Transparency – blockchains are the epitome of transparency, as they record transactions on a ledger that is shared among all network participants.

- Security – transactions recorded on a public blockchain are encrypted and cannot be tampered with unless the majority of participants agree to do so.

Cons

- Speed – while real-time blockchain transactions would be ideal, they actually require some time to be verified by nodes and reach finality. For example, Bitcoin can handle only about 7 transactions per second (tps), with each transaction settling in about 10 minutes. PoS are more rapid, though.

- Fees – during times of high demand, transaction fees can skyrocket.

What Are Off-Chain Transactions?

Off-chain refers to all transactions occurring outside blockchain technology, e.g., all banking operations, stock market operations, and other TradFi transfers are off-chain. However, in this article we refer to off-chain transactions in the context of blockchain.

In short, off-chain transactions in blockchain are operations with crypto coins and tokens that occur outside a native blockchain.

How Off-Chain Transactions Work

There are multiple methods to facilitate off-chain transactions. In more complex setups, a third party or guarantor can mediate and ensure the transactions’ integrity, akin to platforms like PayPal.

There are specialized platforms that facilitate transactions off-chain to reach faster settlements. Eventually, these transactions can be integrated back into the primary decentralized network, which we call the mainnet.

For example, the Lightning Network and Liquid Network are layer 2 solutions for the Bitcoin blockchain. They can settle hundreds of thousands of Bitcoin transactions per second before sending these to the mainnet.

Pros and Cons of Off-Chain Transactions

Here are a few pros and cons of off-chain transactions.

Pros

- Speed – off-chain transactions can reach near-instant settlement since no validation is required from the mainnet.

- Cost – off-chain transactions require much lower gas fees or even zero fees because there is no cost to be paid for validators or stakers. This makes a huge difference for both large transactions and micro-transactions.

- Greater anonymity – while public blockchains offer some anonymity, it is less relevant since all transactions are recorded permanently for public view. Off-chain transactions offer more anonymity.

Cons

- Centralization – off-chain transactions are usually handled by third-party centralized entities like Coinbase/Binance or decentralized layer 2 networks with fewer nodes. Users have to trust these entities or systems instead of benefiting from the trustless primary blockchain.

- Transparency – since these transactions are settled off-chain, users have less knowledge of what’s happening behind the scenes.

- Security – off-chain transactions are settled by centralized entities, which makes them more vulnerable to risks like hacking and theft (FTX).

On-Chain vs. Off-Chain: Which Is Best?

The fundamental difference between on-chain and off-chain transactions is that the former are conducted exclusively on the main blockchain while the latter are settled outside the main network with the possibility to be added at a later time.

Here is how the two differ:

Which of the Two Is Better?

Which type of transactions you should consider? It depends on your needs.

On-chain transactions are suitable for those looking for security and reliability. If you want to reduce risks to a minimum, on-chain transactions are best, although you should be ready for higher fees and sluggish settlements. Self-custody crypto wallets (like tastycrypto) are required to transact on-chain.

If you’re looking for scalability and speed, off-chain platforms are the better option. For example, many Web3 applications require high volumes of transactions conducted almost in real-time at a low cost, and this is currently possible because of off-chain solutions.

What Is a Layer 2 Network?

One popular off-chain transaction approach is to leverage layer 2 blockchains, which are secondary decentralized networks built on top of a primary blockchain – the mainnet.

For example, Ethereum is one of the most used blockchains for decentralized finance (DeFi) and Web3 applications. To achieve greater scalability and better performance, layer 2 blockchains use methods like rollups which are built on top of Ethereum to take the burden off it.

Technically, these secondary blockchains are decentralized to a certain degree, but transactions on them are off-chain because they involve ETH, which is part of the mainnet. Some examples of layer 2s are Arbitrum, Optimistic, and Polygon.

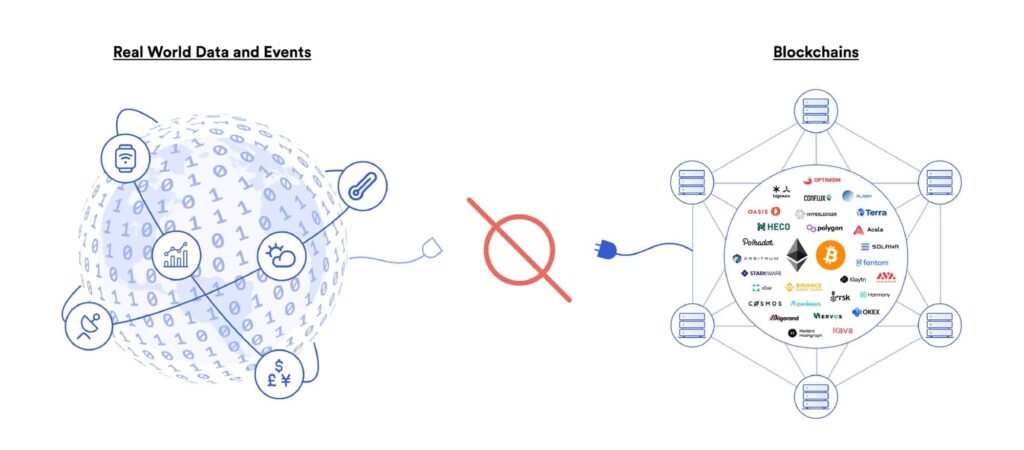

What Are Blockchain Oracles?

I’d like to quickly mention a special solution that connects off-chain data with on-chain networks – it’s called an oracle. The truth is that blockchains have no way to directly access external real-world data and events.

Source: Chain.Link

The goal of blockchain oracles is to ensure that blockchain smart contracts, which involve if/then statements often dependent on off-chain data, use reliable external information.

For example, if a smart contract triggers on-chain transactions based on events like fiat price fluctuations, weather, etc., oracles must ensure the external data that enters on-chain is accurate.

FAQs

On-chain transactions occur directly on a blockchain, with all the information being recorded permanently on the public network. Off-chain transactions are settled outside a blockchain.

Off-chain transactions are faster and cheaper, being suitable for Web3 and DeFi use cases.

Layer 2 chains are public or private networks built on top of existing blockchains, such as Ethereum or Bitcoin, with the goal of bringing scalability and efficiency to the main chain.

Off-chain interactions don’t provide the same security level as the mainnet. Users have to trust the off-chain platform. However, reputable layer 2 solutions are usually reliable. If you have no problem trusting a bank or online wallet, you can trust a well-established off-chain platform. Just know that FDIC insurance does not yet exist in crypto.

Additional Reading

- Blockchain Council: Crypto Off-Chain vs. On-Chain Transactions

- Investopedia: Off-Chain Transactions

Anatol Antonovici

6+ years of experience writing for crypto brands and blockchain firms, including Coindesk, Cointelegraph, Bitcoinist, CryptoPotato, Algorand, and OTCTrade.com

The Core Blockchain and DeFi Ecosystem: What You Need to Know

7 Best DePIN Crypto Projects

What Is Symbiotic and How Does It Work in 2024?

Ethereum vs Ethereum ETFs – 5 Major Differences