Bitcoin’s adoption peaked in 2021 with over 41 million BTC addresses holding at least $1 worth of BTC. 2024 is pivotal for Bitcoin adoption because of the upcoming halving event and potential spot Bitcoin ETF approvals from the SEC.

Written by: Anatol Antonovici | Updated December 28, 2023

Reviewed by:Mike Martin

Fact checked by: Ryan Grace

Bitcoin has been around for more than a decade, solidifying its position as a legitimate financial instrument. BTC’s adoption reached its highest in 2021 and awaits the next bull run for further expansion.

🍒 tasty takeaways

- Bitcoin’s adoption saw a peak in 2021 with over 41 million BTC addresses each holding at least $1 worth of Bitcoin.

- 2024 is set to be a significant year for Bitcoin, with events like the halving and potential SEC approvals of Bitcoin ETFs.

- Factors driving Bitcoin’s global adoption include its status as a store of value, interest from institutional investors, layer 2 scaling solutions, and the anticipation of Bitcoin ETFs.

- Challenges to widespread adoption include high price volatility, centralized exchange risk, regulatory uncertainty, and the complexities of blockchain technology.

Bitcoin Adoption Summary

| Topic | Summary |

|---|---|

| Bitcoin Adoption in 2021 | Peaked with over 41 million BTC addresses holding at least $1 worth of BTC. |

| Significance of 2024 | Halving event and potential SEC approvals of Bitcoin ETFs. |

| Facts and Figures | Bitcoin adopters categories include early enthusiasts, tech-savvy investors, retail, and institutional. Active addresses around 1 million. |

| Factors Driving Adoption | Store of value status, institutional interest, layer 2 scaling solutions, anticipation of ETFs. |

| Obstacles | Price volatility, centralized exchange risks, regulatory uncertainty, tech complexities. |

| Outlook for 2024 | Bitcoin halving in May and potential ETF approvals. Predicted to reach $100,000. |

Bitcoin Adoption: Facts and Figures

Bitcoinadopters can be broken down into four overlapping categories:

- Early adopters andcryptoenthusiasts

- Tech-savvy investors who understand the value of decentralization

- Retail investors

- Institutional investors

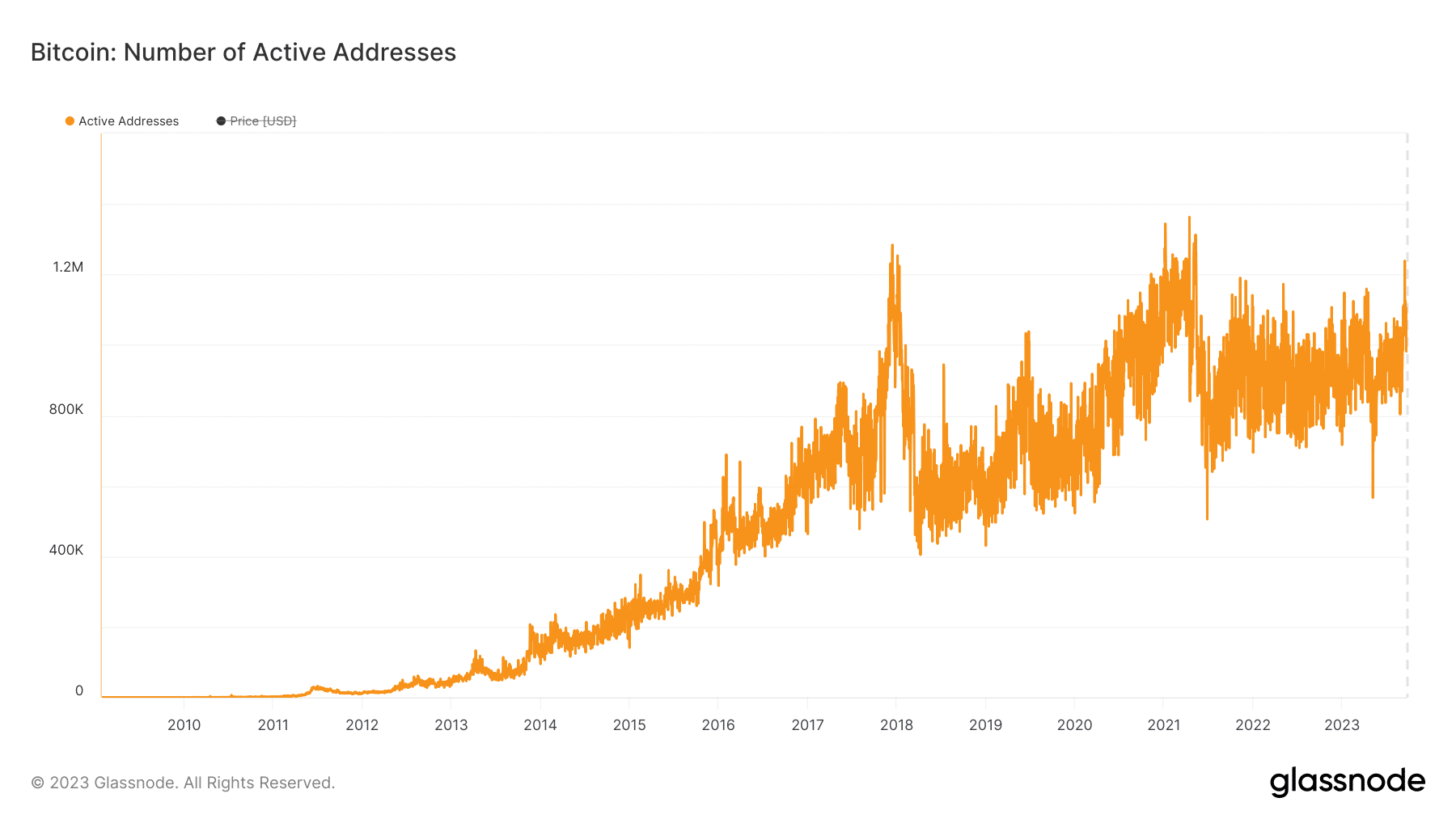

To get a clear picture of Bitcoin’s adoption rate, we can monitor the count of active Bitcoin addresses. This number saw a consistent increase leading up to 2021 and, as of now, seems to have stabilized with an average of around 1 million active addresses.

Source: Glassnode

These active addresses represent a small percentage of Bitcoin addresses holding at least $1 worth of BTC. As perBitInfoCharts, over 41 million BTC crypto wallets hold more than $1 today, up from 35 million a year ago.

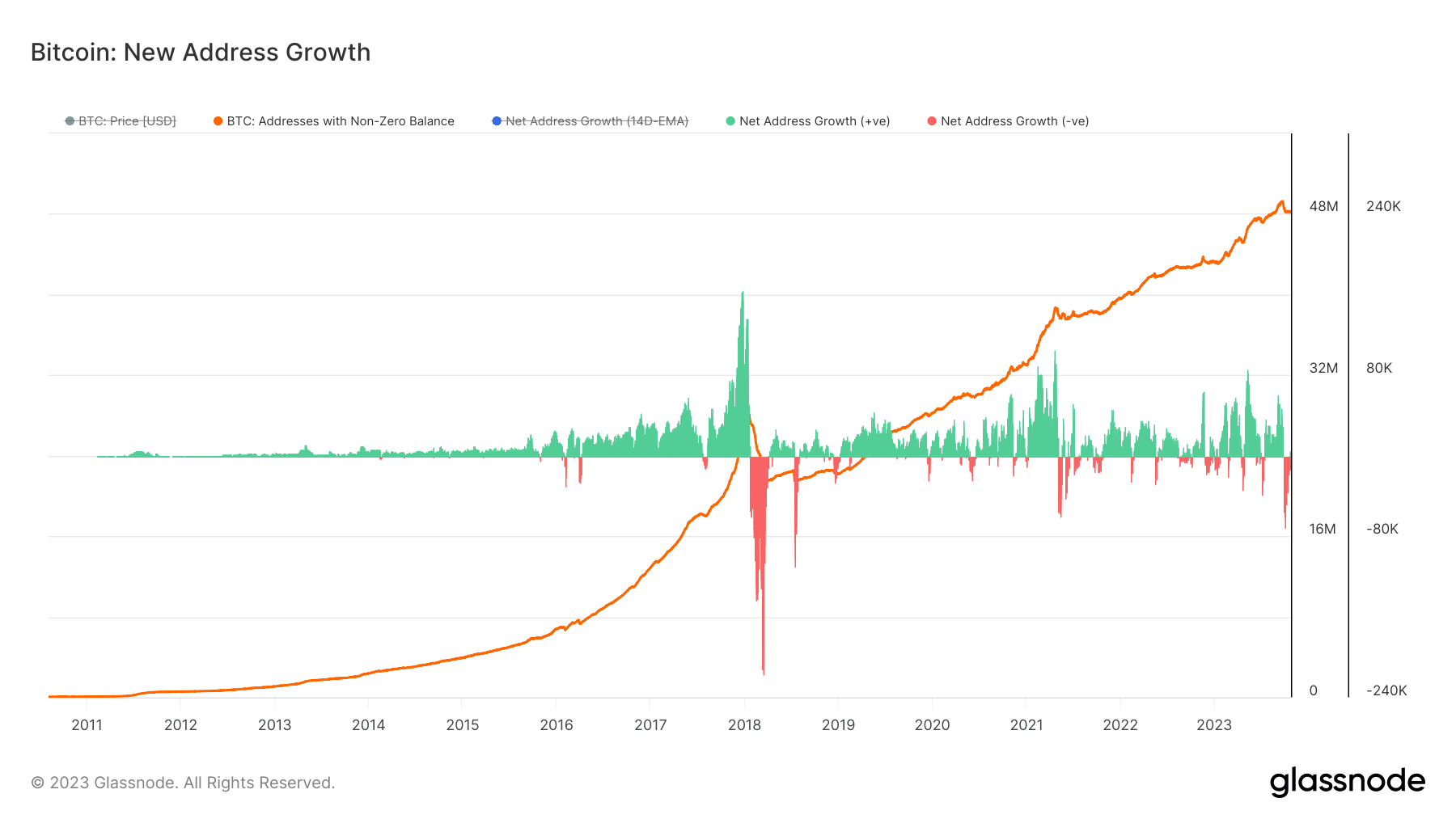

Glassnode data shows that the number of BTC addresses with non-zero balances is close to 50 million, and the most active periods for new address creation were in 2017, 2021, and 2023.

Source: Glassnode

Bitcoin Exchange Activity Peaked in 2021

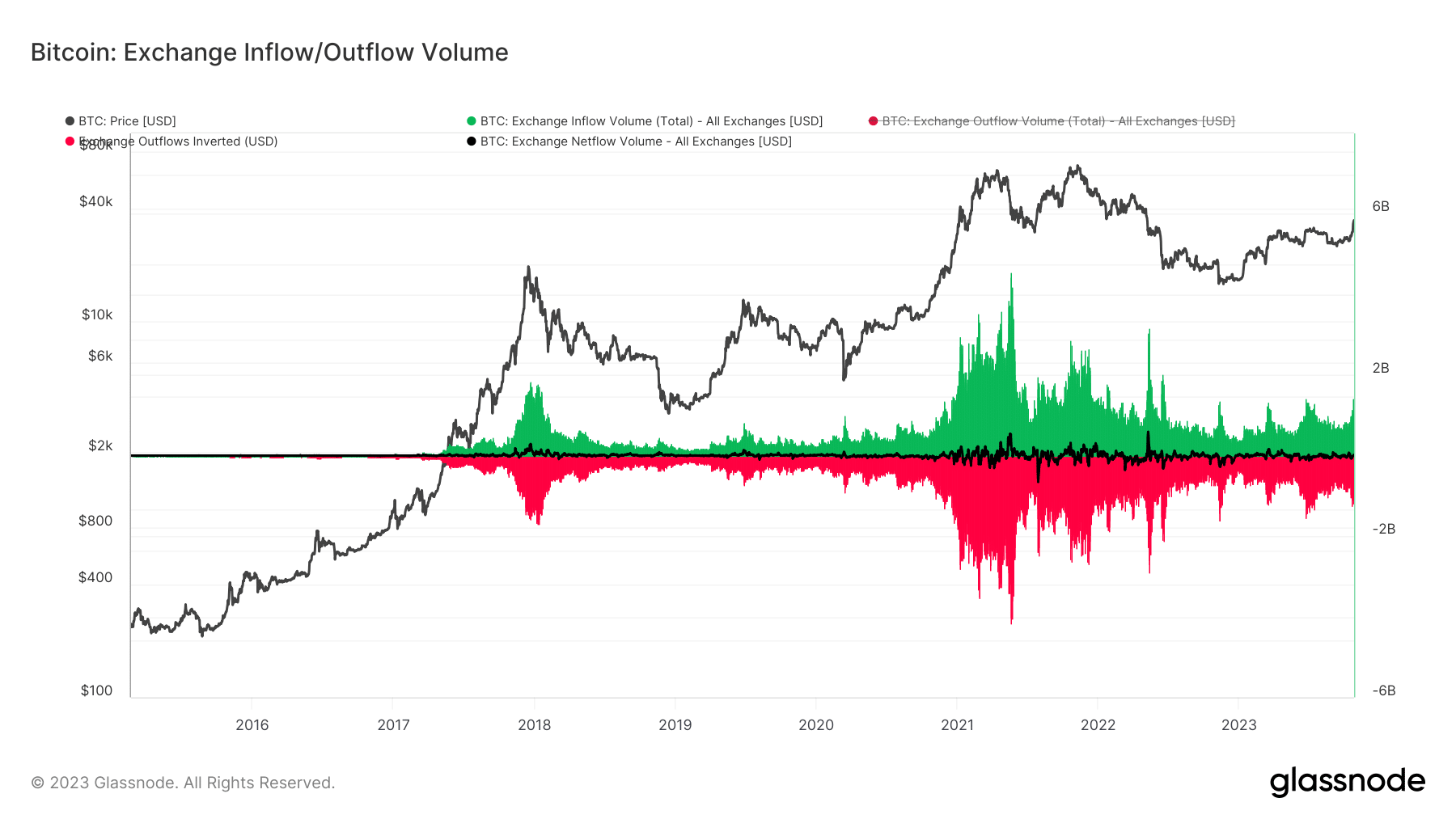

Another way to assess the adoption level of the oldest cryptocurrency is to monitor the amount of BTC inflows and outflows from crypto exchanges in USD terms.

Starting with the active participation of retail users, crypto exchanges like Coinbase or Binance have become essential for making crypto popular and bridging the gap withtraditional finance (TradFi).

Similar to active addresses, activity on crypto exchanges reached its highest in 2021 and has adjusted downwards since.

Source: Glassnode

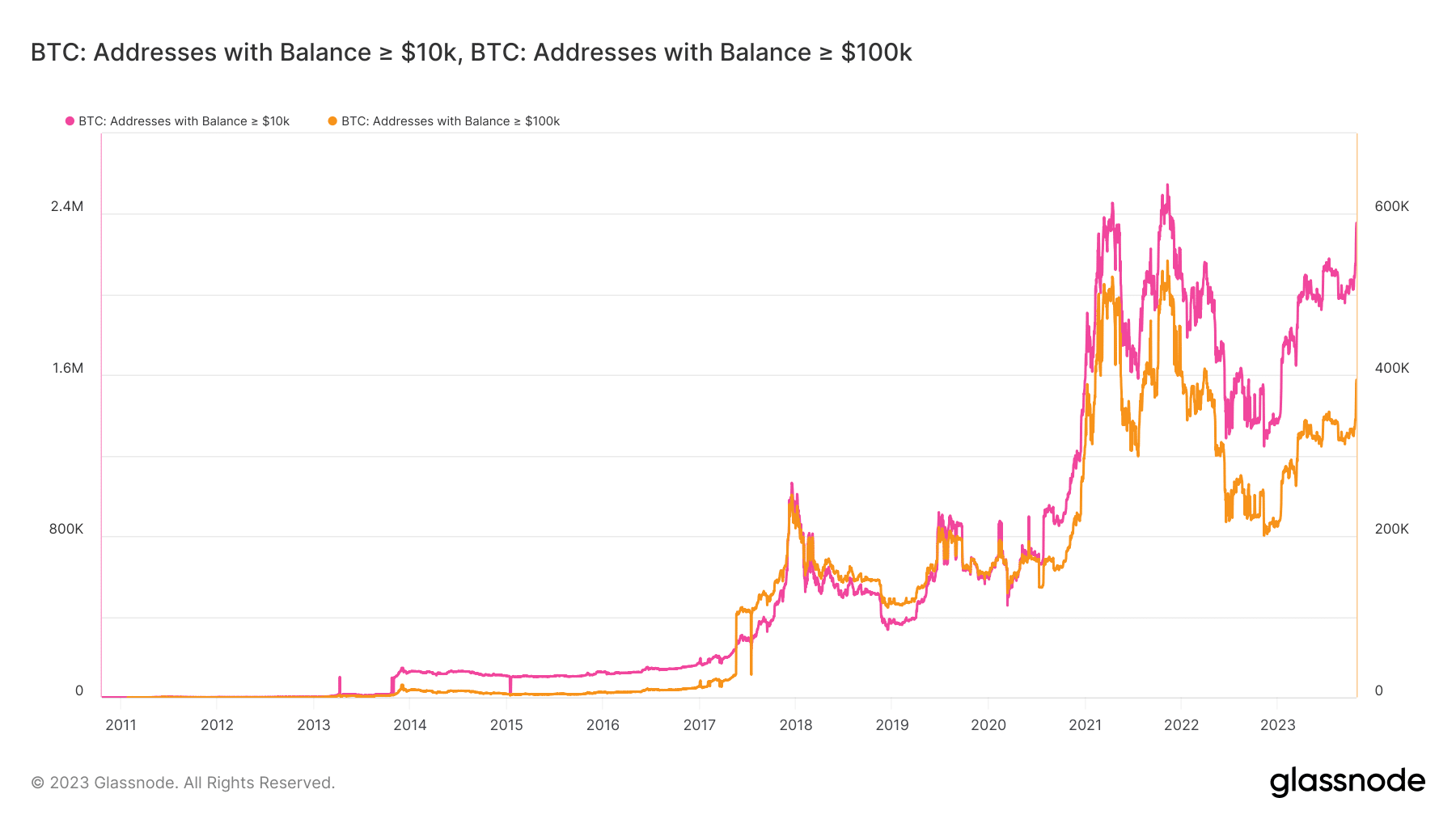

In 2021, the participation of institutional investors exploded, as shown below by the number of addresses holding $10,000+ and $100,000+ worth of bitcoin.

Source: Glassnode

Bitcoin Adoption by Region

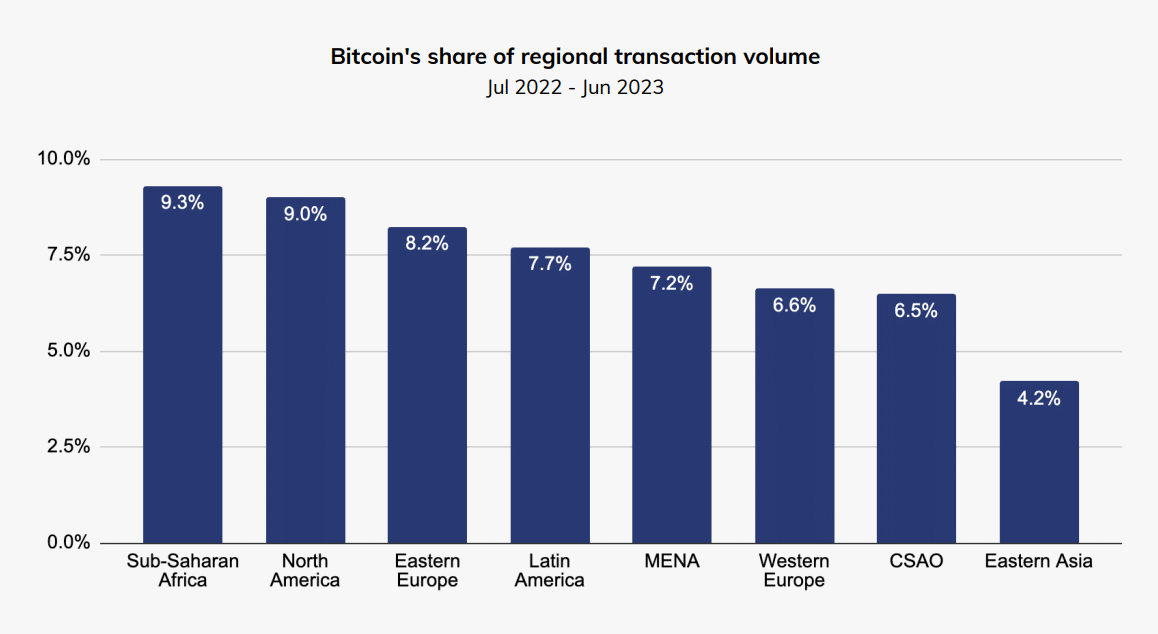

The latest “Geography of Cryptocurrency” report by Chainalysis indicates that Sub-Saharan Africa leads in Bitcoin activity, accounting for 9.3% of total digital currency transactions. North America follows closely with 9.0%.

Source: Chainalysis

Bitcoin is preferred due to its status as astore of value(SOV), which is relevant in African regions that struggle with high inflation and debt. Nevertheless,stablecoinslikeUSDT, USDC, and DAIstill dominate crypto transaction volume in all regions.

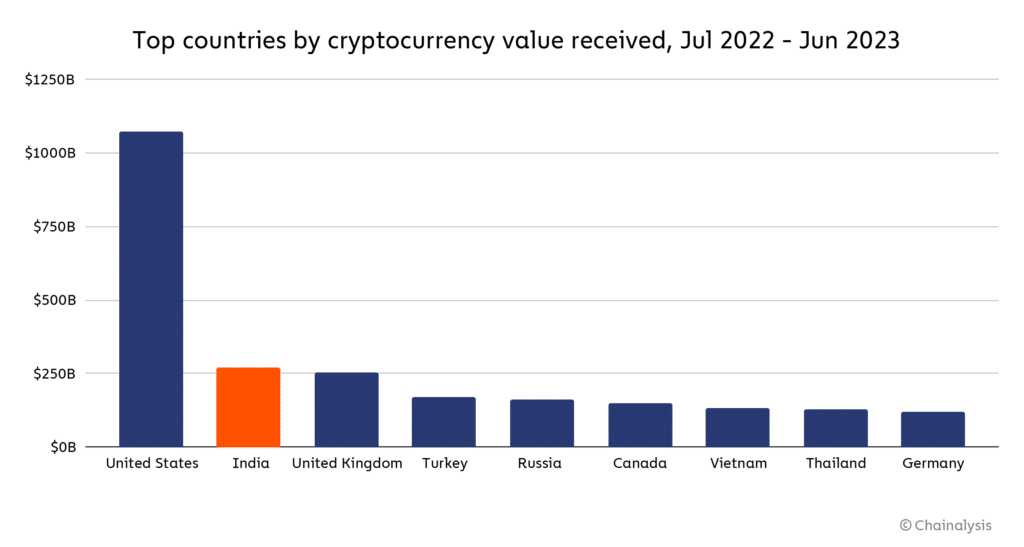

In terms of overall crypto adoption, the highest-ranked countries are India, Nigeria, Vietnam, the US, and Ukraine. The US stands out for having the highest crypto volume received in the twelve-month period leading up to June 2023.

Source: Chainalysis

Countries That Recognize Bitcoin As a Legal Tender

Some countries recognize Bitcoin as a legal tender along with their native fiat currencies. There are only two of these countries today:

- 🇸🇻 El Salvador

- 🇨🇫 The Central African Republic

In June 2021, El Salvador made headlines by officially approving Bitcoin as a legal tender, meaning that citizens can use it to pay for goods, services, and taxes.

President Nayib Bukele stated that the nation heavily depends on remittances, constitutinga quarter of its GDP, so equating BTC with the USD was a logical decision.

Factors Driving Bitcoin Adoption

Here are a few factors that have been driving Bitcoin adoption across the world:

- Store of value status – Bitcoin is regarded as a safe haven asset due to its deflationary model. With a maximum supply of 21 million coins, its halving process steadily decreases the cryptocurrency’s inflation rate. This model attracts many large investors looking to hedge against skyrocketing inflation, which continues to surge into 2024.

- Institutional investors – the interest from institutional investors turned the image of Bitcoin from a virtual currency for criminal activity to a viable investment opportunity. Grayscale, Tesla, Microstrategy, and the Block are a few major companies with considerable exposure to BTC.

- Scaling solutions – Bitcoin is a rigidblockchain network, but thanks tolayer 2 solutionslike the Lightning Network or Stacks, Bitcoin can be integrated intoWeb3 appsanddecentralized finance (DeFi) use cases along with stablecoins andEthereum-basedtokens.Ordinalsalso allow for the creation ofNFTson the Bitcoin platform.

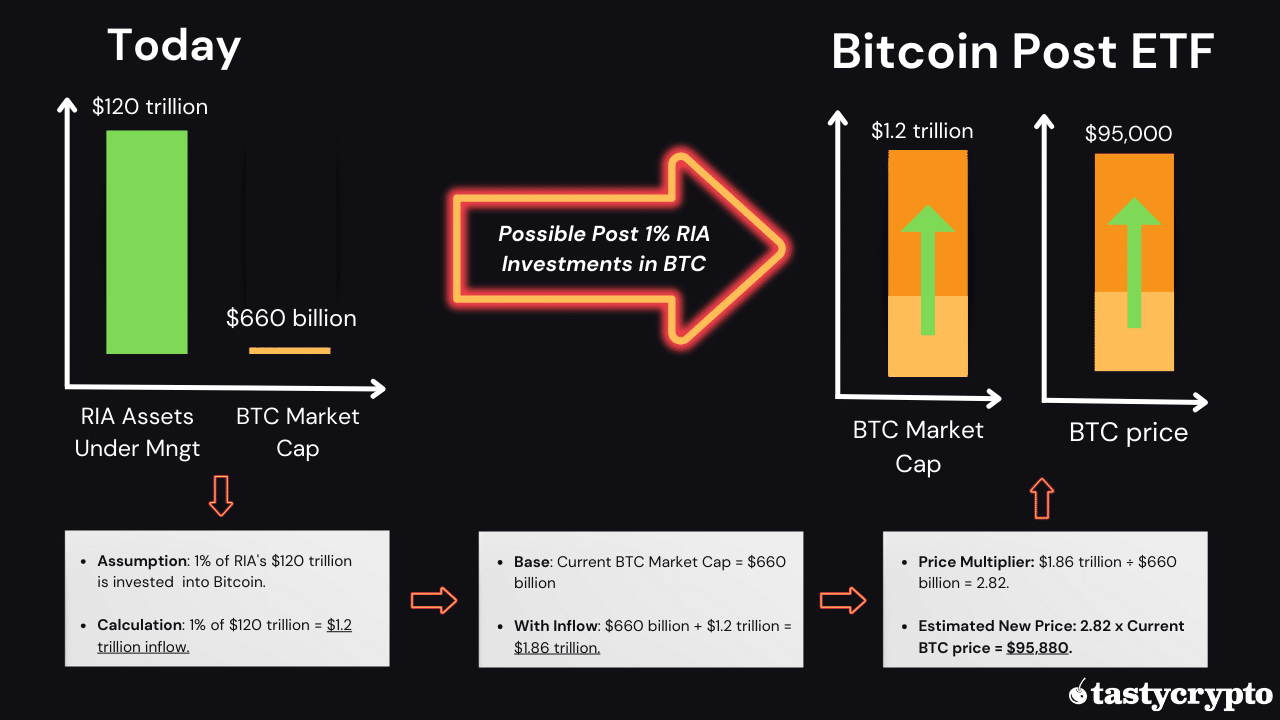

- Bitcoin ETFs – the crypto community is waiting for the approval of a spot Bitcoin exchange-traded fund (ETF) by the US Securities and Exchange Commission (SEC). Financial behemoths like Blackrock, Fidelity, VanEck, ARK Invest, and Galaxy Digital are all waiting for their ETF applications to get the green light from the SEC. Such a decision could propel the price of Bitcoin to new highs thanks to additional inflows from institutional investors.

Buy Bitcoin with Self-Custody

You can buy bitcoin with tastycrypto. When you store your crypto in a self-custody wallet, you don’t have to trust that an exchange is acting in your best interest. This is because you are the only party privy to your private key, or seed phrase.

Here are some additional benefits you get when you choose to self-custody your digital assets with tastycrypto:

- In-App Swap: Trade BTC, ETH, and 1,000+ tokens

- Generate Yield in DeFi: Stake, lend, and become your own market maker

- NFTs: Buy, sell, and view NFTs in-app

tastycrypto offers both iOS and Android self-custody wallets – download yours today! 👇

Obstacles to Bitcoin Adoption

While Bitcoin is poised for widespread adoption, it must overcome significant obstacles:

- Volatility – Bitcoin is highly volatile, which makes it less suitable for use cases like payments. This volatility, however, has fallen dramatically as we enter 2024.

- CeFi vulnerability – centralized exchanges have played a major role in promoting crypto adoption, but they have consistently faced threats from hacking attacks and manipulations. The collapse of FTX showed that even the largest CeFi platforms can disappoint users.

- Legal uncertainty – there are many countries still hesitant on Bitcoin. China banned crypto altogether, while the regulatory uncertainty in the US puts much pressure on major companies like Coinbase and Gemini. The European Union is the first primary jurisdiction to establish a clear legal framework for digital assets.

- Complexity – while Bitcoin can increase scalability thanks tolayer 2s, using them can be daunting for non-tech-savvy users.

Bitcoin Outlook for 2024

Bitcoin halving and the launch of bitcoin SPOT ETFs are two major events scheduled for 2024, and both of them are bullish.

Bitcoin Halving

The nextBitcoin halvingis expected to occur in May 2024, when the miner reward will decrease from the current 6.25 BTC to approximately 3 BTC. This will reduce the future supply of bitcoins and therefore likely be a bullish event for existing coins.

Bitcoin SPOT ETF

The SEC has delayed its decision on Bitcoin SPOT ETF filings, but 2024 could be the year when it approves some ETFs, potentially boosting adoption and driving the Bitcoin price upwards.

Bitcoin specialists agree that the cryptocurrency could surpass its previous peak and potentially reach the $100,000 milestone in the upcoming year.

- Galaxy DigitalexpectsBTC to surge 74% after an ETF approval, which equates to about $60,000 per coin.

- Standard Charteredincreased its 2024 bitcoin outlook to $120,000 in July 2023.

Bitcoin Adoption FAQs

Multiple methods exist to measure Bitcoin adoption. One can examine on-chain data to track the trend in the number of BTC-holding addresses and active addresses. Conducting comprehensive surveys across various regions is another approach.

According to the latest data from Chainalysis, North America and the European Union account for the largest share of crypto transaction value received while Bitcoin dominance is highest in Sub-Saharan Africa and North America.

Bitcoin’s path to widespread adoption has been obstructed by various challenges, including high volatility, regulatory ambiguities, security issues with centralized finance (CeFi), and its inherent complexity.

Bitcoin could see a major bull run in 2024 if the US SEC approves at least some of the SPOT ETF applications. Also, the upcoming Bitcoin halving might produce a subsequent bullish effect.

Anatol Antonovici

6+ years of experience writing for crypto brands and blockchain firms, including Coindesk, Cointelegraph, Bitcoinist, CryptoPotato, Algorand, and OTCTrade.com

🍒 tasty reads

The Core Blockchain and DeFi Ecosystem: What You Need to Know

7 Best DePIN Crypto Projects

What Is Symbiotic and How Does It Work in 2024?

Ethereum vs Ethereum ETFs – 5 Major Differences