DefiLlama, currently the largest DeFi TVL aggregator, is dedicated to delivering accurate and comprehensive data on all known Layer 1 and Layer 2 blockchains. The platform presents this data in user-friendly charts and graphs.

Written by: Andrey Sergeenkov | Updated January 31, 2024

Reviewed by: Mike Martin

Fact checked by: Ryan Grace

DeFiLlama is the leading resource for monitoring the decentralized finance (DeFi) ecosystem and exploring the fundamentals of DeFi projects. Here’s how to use it! 👇

Table of Contents

🍒 tasty takeaways

DeFiLlama is the go-to DeFi analysis platform to track the total value locked (TVL) and other metrics.

The platform offers multiple features to analyze the DeFi and blockchain market from different perspectives.

DeFiLlama supports over 3,000 DeFi projects, 242 layer 1 and layer 2 chains, and almost 11,000 pools.

DeFiLlama Summary

| Feature | Details |

|---|---|

| TVL Aggregator | Tracks over 3,000 projects |

| Chains Supported | 242 Layer 1/2 blockchains |

| Protocols Monitored | 11,000 pools |

| Analytics | Comprehensive charts & graphs |

| Dashboard | Interactive DeFi TVL and metrics |

| Tools | Yields, NFTs, Bridges, and more |

| Utilities | Swap and Borrow Aggregator |

| Users | Over 10 million monthly |

What Is DeFiLlama?

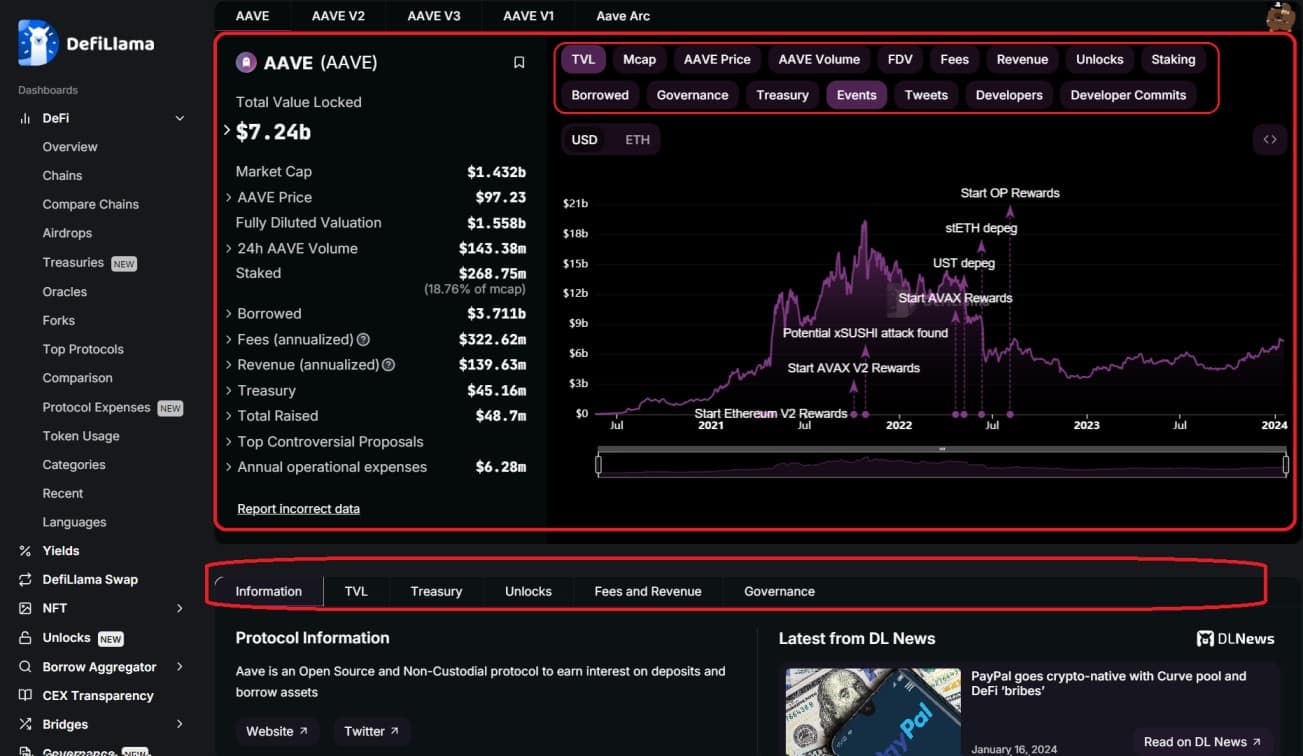

DeFi Llama, or DeFiLlama, is a leading blockchain data analytics platform that focuses on the DeFi ecosystem. It aggregates data from multiple sources and offers a wide range of tools to perform in-depth fundamental analysis of the wider DeFi sector and individual decentralized applications (dapps).

DeFiLlama is the go-to platform to track the total value locked (TVL) on DeFi projects – the most important metric in the DeFi sector. It also offers many other metrics such as market cap and token prices, which are powered by CoinGecko APIs.

The TVL aggregator is part of LlamaCORP, which comprises a node infrastructure, a crypto news site, and a cryptocurrency payment tool, among others. It has over 10 million monthly users 😮.

How Does DeFiLlama Work?

DeFiLlama collects data from thousands of DeFi protocols and hundreds of Proof of Stake (PoS) networks like Ethereum to provide an accurate picture of the sector.

All data is available for free through its website, which has a user-friendly design inspired by Uniswap.

DeFiLlama Pros

- DeFiLlama is the most popular and reputable DeFi data aggregator, offering a multitude of features.

- All features are free to use – no registration required.

- It has an intuitive interface and offers interactive charts.

Secure Your Crypto With Self-Custody

When you store your crypto in a self-custody wallet, you don’t have to trust that an exchange is acting in your best interest. This is because you are the only party privy to your private key, or seed phrase.

Here are some additional benefits you get when you choose to self-custody your digital assets with tastycrypto:

- In-App Swap: Trade BTC, ETH, and 1,000+ tokens

- Generate Yield in DeFi: Stake, lend, and become your own market maker

- NFTs: Buy, sell, and view NFTs in-app

tastycrypto offers both iOS and Android self-custody wallets – download yours today! 👇

How Do I Use DeFiLlama?

DeFiLlama features a straightforward structure where all dashboards can be accessed from the left menu while the charts, rankings, and tools related to each selected dashboard show up on the main screen.

DeFi Dashboard

To provide a comprehensive understanding of the platform’s capabilities, here’s a breakdown of its key features:

- The DeFi dashboard is the most critical aspect.

- From the home page, users are led directly to the Overview section of the DeFi dashboard.

- Just below this, the DeFi TVL chart is prominently displayed.

- This chart facilitates the visualization of TVL data for each blockchain.

- It also offers options to include additional metrics like trading volume and stablecoin market cap.

- Beneath the chart, a detailed rankings table presents thousands of DeFi applications, complete with their key metrics.

Source: DeFiLlama

The DeFi dashboard includes additional features to explore the DeFi sector from all angles, such as:

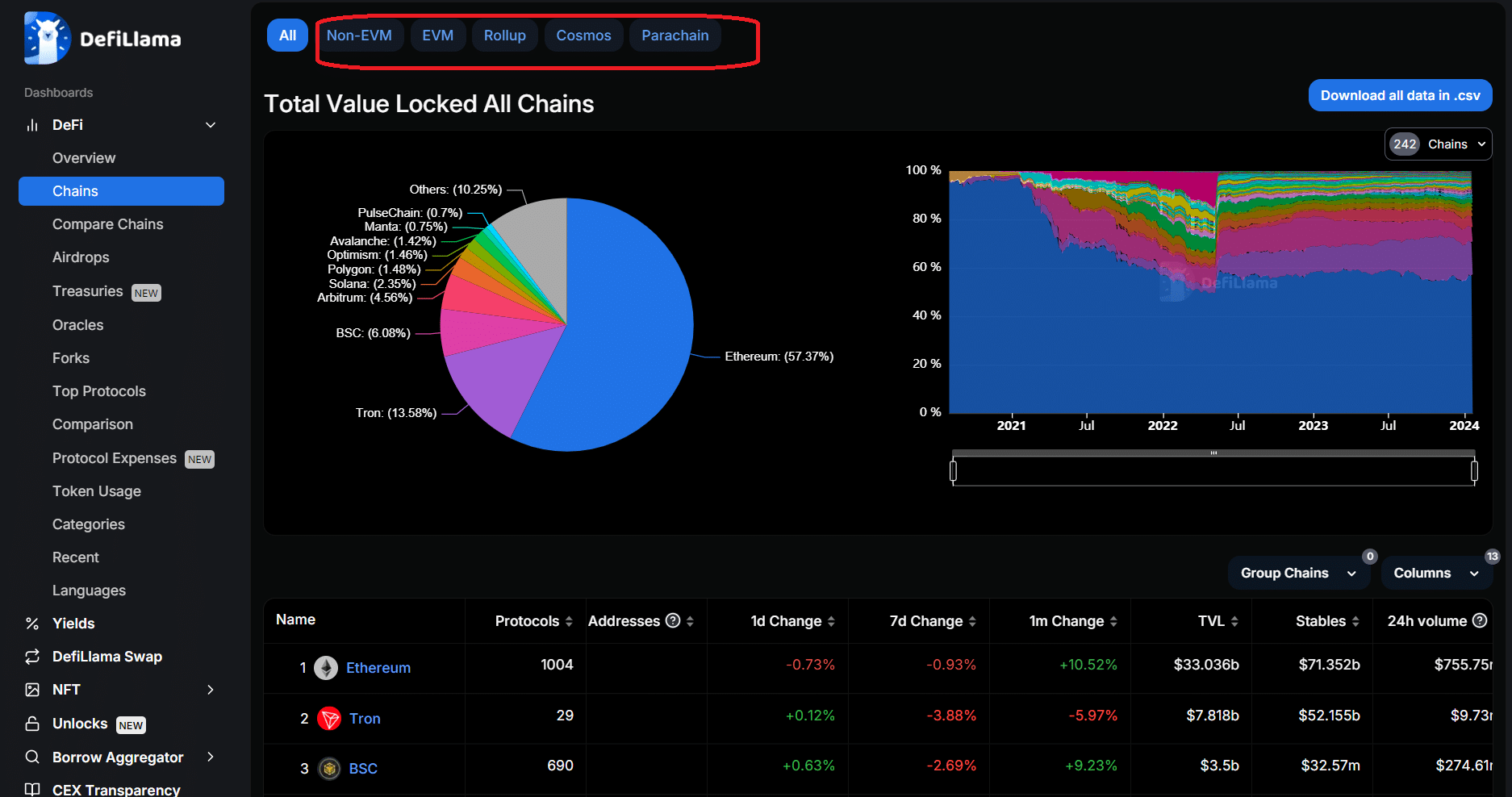

- Chains – this is a TVL overview of all DeFi chains hosting dapps, including Ethereum, Solana, Tron Polygon, and BSC. You can customize the chart to show EVM-compatible chains, Rollups, or Cosmos chains.

Source: DeFiLlama

- Compare Chains – you can compare the TVL, fees, or revenue of two or more chains.

- Airdrops – early investors can explore tokenless DeFi protocols scheduled to airdrop.

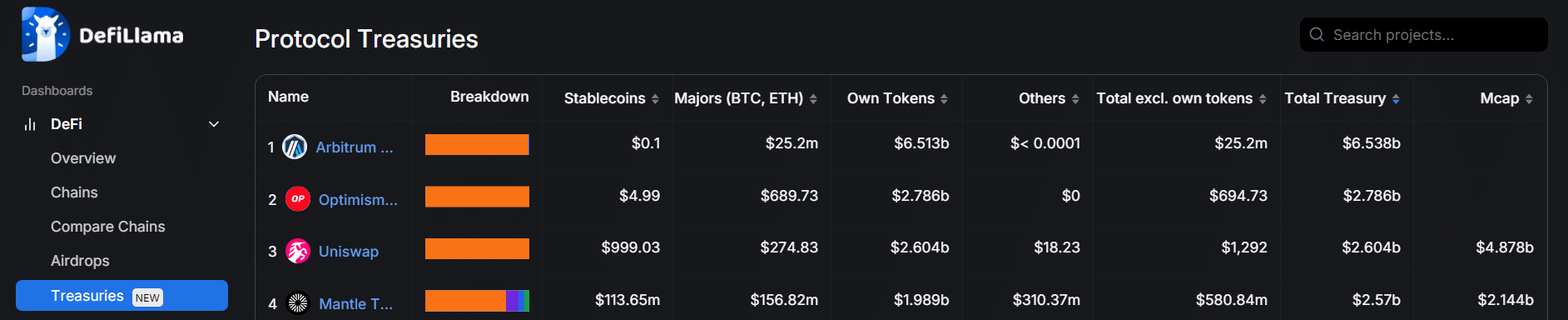

- Treasuries – this new feature shows the treasury components of certain protocols. Check it out below 👀.

Source: DeFiLlama

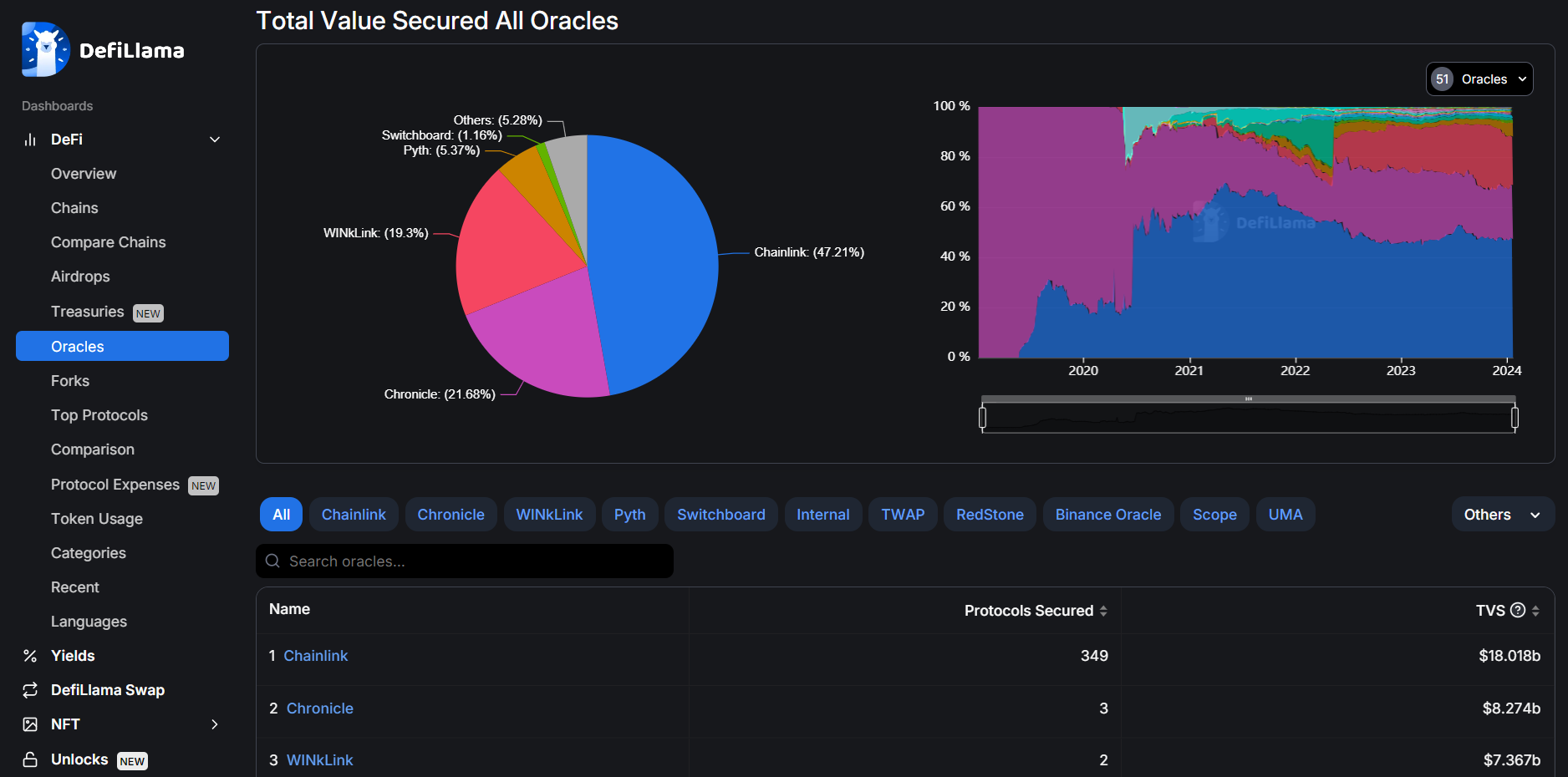

- Oracles – this is an overview of oracle networks, which help blockchains and dapps communicate with the off-chain world or between themselves.👇

Source: DeFiLlama

- Comparison – you can compare two or more DeFi protocols on a chart.

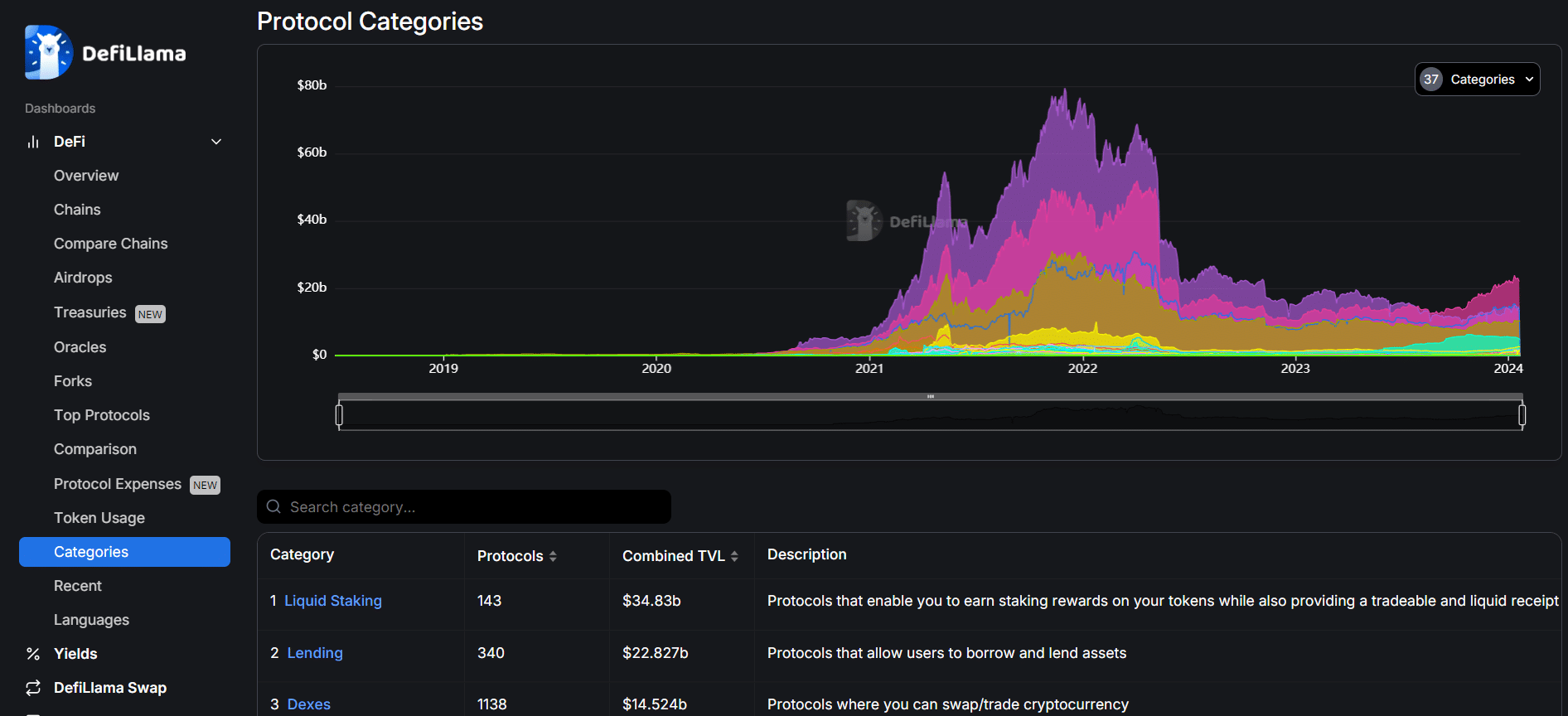

- Categories – this tool displays the main DeFi subsectors, including liquid staking, decentralized exchanges (DEXs), and lending.👇

Source: DeFiLlama

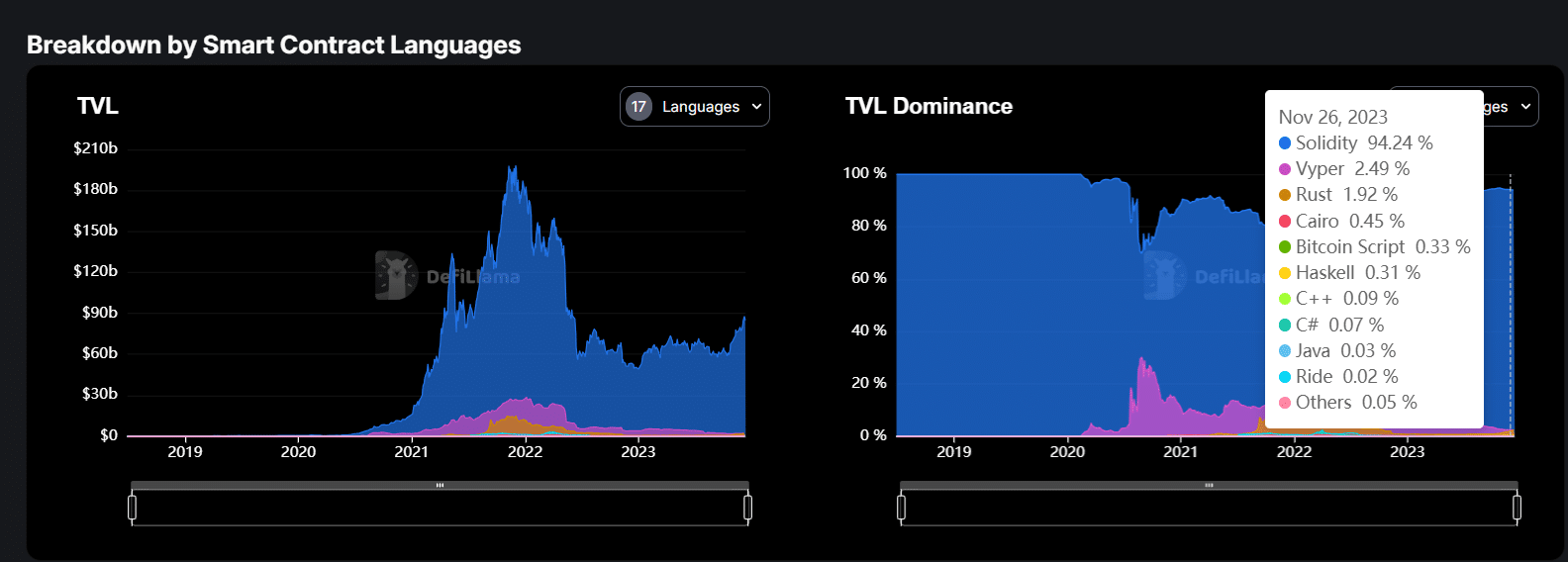

- Languages – developers can visualize the most popular programming languages (smart contracts) used to build dapps, with Ethereum’s Solidity dominating the space. 👇

Source: DeFiLlama

DeFiLlama Additional Features

Aside from the DeFi dashboard, you can explore other interesting tools, some of which go beyond DeFi:

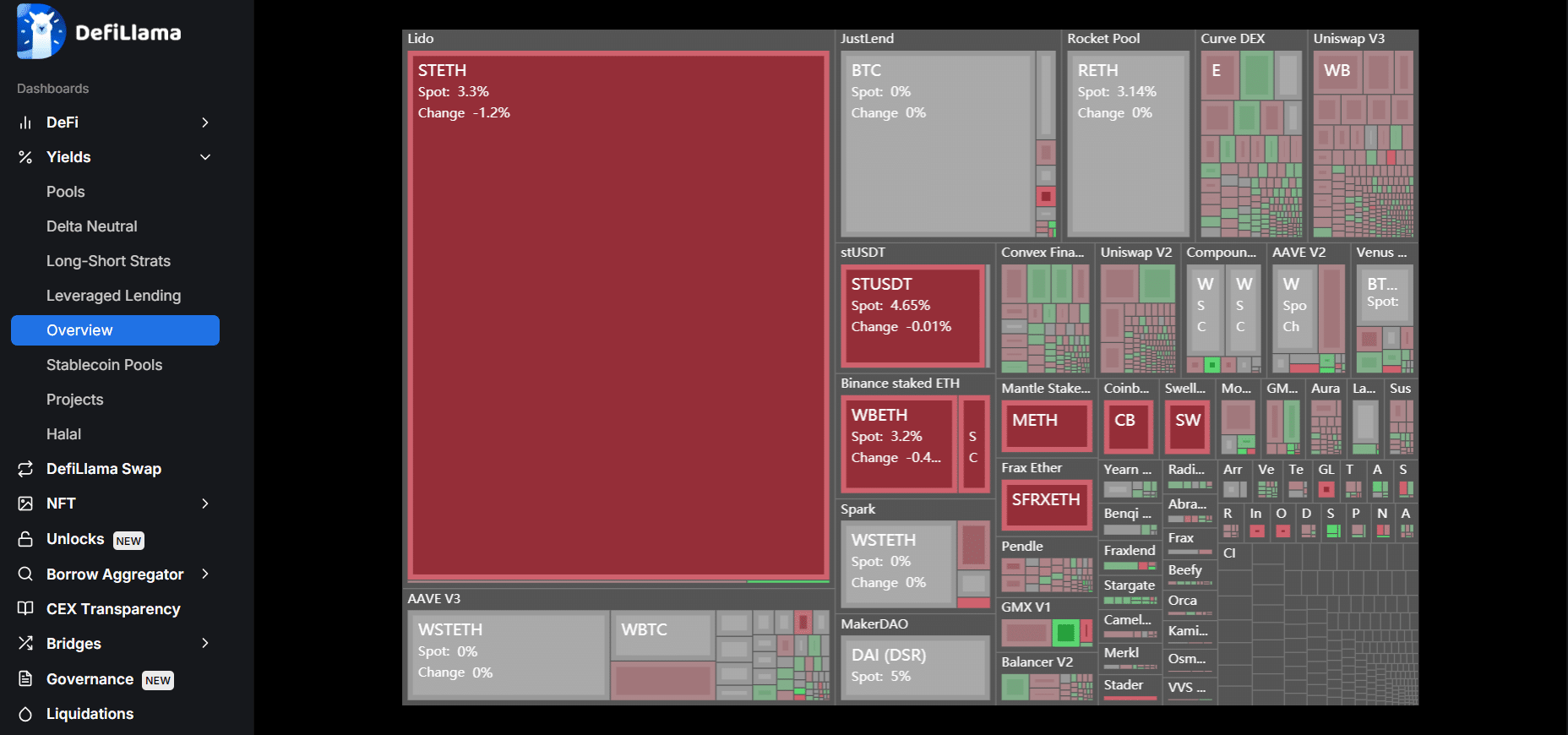

- Yields – this tool displays different types of pools in DeFi, including their TVL and annual percentage yields (APY), which may help with your yield farming strategies. You can also find insightful yield charts, like this treemap that displays pools by market share👇.

Source: DeFiLlama

- NFTs – here, you can analyze the top non-fungible token (NFT) collections and marketplaces.

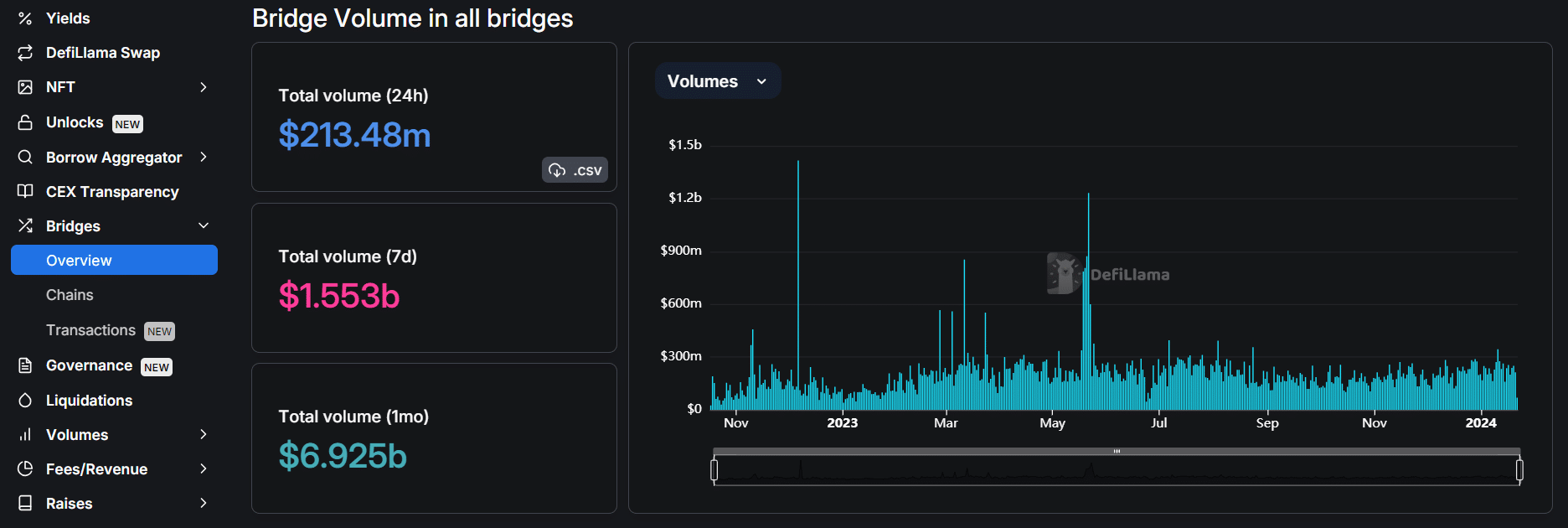

- Bridges – this dashboard displays bridge volume data and inflows by chain. Bridges play an essential role in cross-chain interoperability despite being the Achilles’ heel of DeFi due to security weakness 👇.

Source: DeFiLlama

- Governance – this feature shows the number of proposals by app.

- Liquidations – in this section, you can explore liquidation levels in DeFi and view the total assets that are subject to liquidation.

- Volumes – this dashboard displays volume data on DEXs, DEX aggregators, derivatives platforms, and options trading protocols.

- Fees/revenue – you can analyze the fees of blockchain networks and DeFi projects.

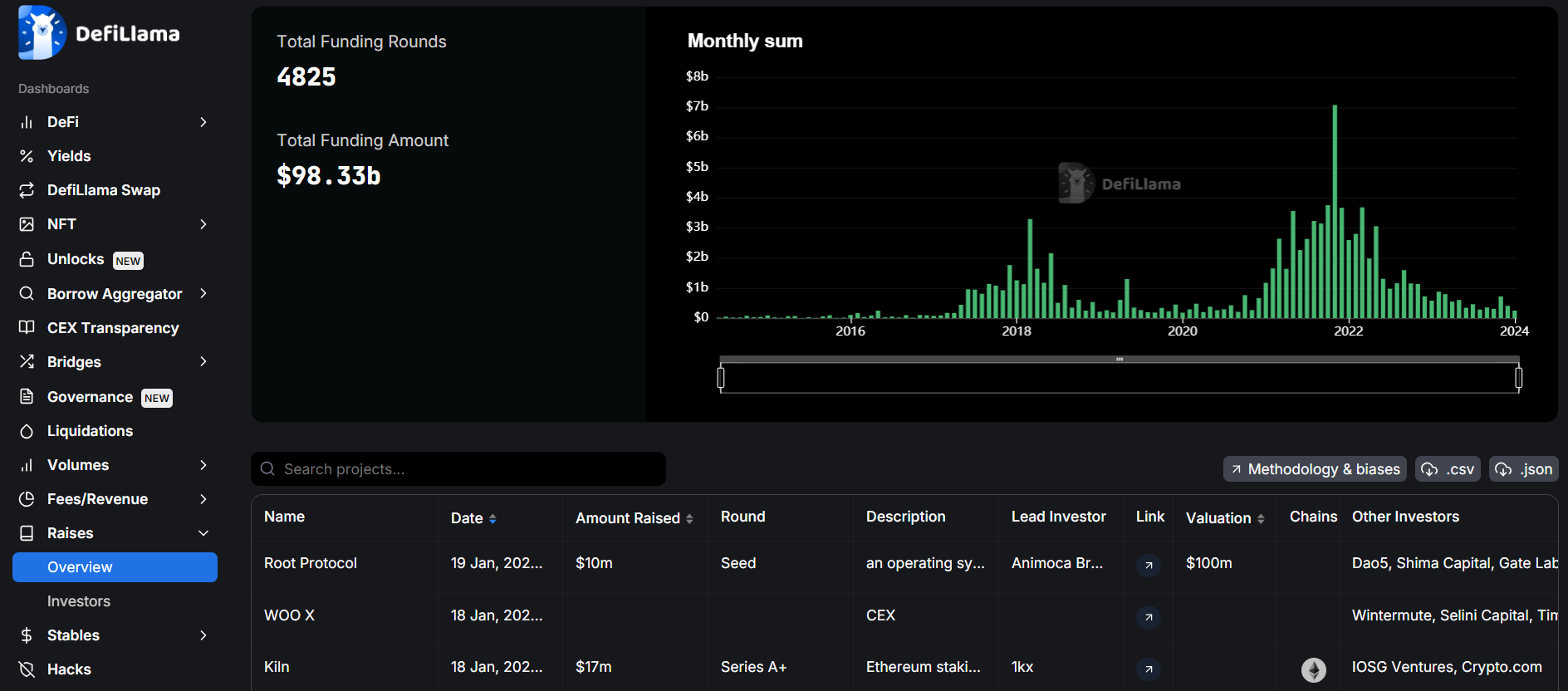

- Raises – this is an overview of funding rounds held by DeFi protocols. 👇

Source: DeFiLlama

- Stables – stablecoins account for a good chunk of DeFi pools. This tool helps you track the performance of 150 stablecoins, including USD-backed tokens USDT and USDC.

- Hacks – this tool shows the history of DeFi hacking attacks and the amount stolen each month. Interestingly, bridges have a dedicated data card.

- ETH Liquid Staking – liquid staking has become one of the biggest use cases in DeFi after Ethereum transitioned to PoS. This tool tracks liquid staking platforms, with Lido dominating the market.

DeFiLlama Swap and Borrow Aggregator

Aside from conducting fundamental analysis on DeFi dapps, you can swap tokens and explore lending rates directly on the DeFiLlama platform.

The platform’s swap feature, which is currently in beta mode, is an aggregator of DEX aggregators like 1inch. You can exchange any token from any supported chain. DeFiLlama doesn’t charge any fee.

With the borrow aggregator feature, you can explore the interest rates on Bitcoin (BTC) and other digital assets that you may want to borrow. The platform connects you to several lending protocols, such as Aave or Compound.

🍒 Read Next: What Is Token Terminal and How Does it Work?

FAQs

DeFiLlama, also written as DeFiLlama, is a data analysis resource for the decentralized finance (DeFi) market – one of the most important sectors in blockchain.

You can explore the fundamentals of the DeFi sector and individual DeFi projects. The key metric tracked by DeFiLlama is the total value locked (TVL) in DeFi pools.

The total value locked represents the value of crypto assets that users deposit in DeFi pools, providing liquidity to DeFi apps.

No, DeFi Pulse used to be the primary platform for monitoring the DeFi market, but it ceased operations a few years ago. DeFiLlama is a different resource that has replaced it and currently provides even more features.

🍒 tasty reads

The Core Blockchain and DeFi Ecosystem: What You Need to Know

7 Best DePIN Crypto Projects

What Is Symbiotic and How Does It Work in 2024?

Ethereum vs Ethereum ETFs – 5 Major Differences

Anatol Antonovici

6+ years of experience writing for crypto brands and blockchain firms, including Coindesk, Cointelegraph, Bitcoinist, CryptoPotato, Algorand, and OTCTrade.com