📕 Staking Definition: When you stake crypto, you help with a blockchain’s operations. Stakers are paid out in crypto rewards for their work.

Written by: Mike Martin | Updated September 5, 2024

Reviewed by: Ryan Grace

Fact checked by: Laurence Willows

Staking crypto is a great way to earn passive income from your coins. When delegating your coins to a protocol like Lido, you earn rewards through APR.

🍒 tasty takeaways

Staking is the process of using one’s crypto coins to help secure a network.

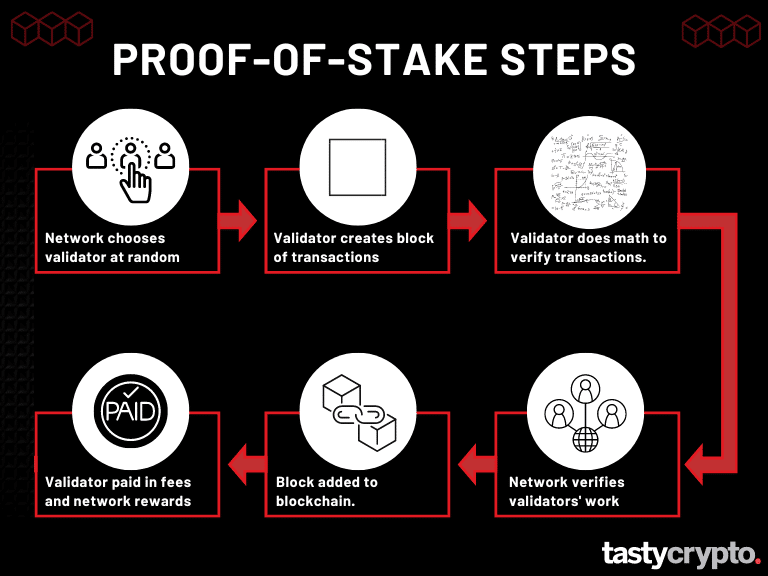

Proof-of-stake networks choose validators to validate new blocks in a lottery system.

Stakers (validators) are paid for their work in cryptocurrency.

Only proof-of-stake coins are eligible for staking.

You can either delegate your crypto to a service to stake for you or run your own staking node.

What Is Staking in Crypto?

Staking crypto, which can be part of ‘liquidity mining‘, offers investors a great way to earn passive income on otherwise idle proof-of-stake (PoS) cryptocurrency coins. Staking represents just one of many ways crypto participants can earn a yield on their digital assets.

Staking refers to the process of a crypto participant staking, or locking up, cryptocurrency on a network in order to validate and verify transactions on a blockchain. In return for doing this work, a staker gets paid rewards by the network.

However, not all cryptocurrencies can be staked. Only coins (not tokens) that employ the proof-of-stake (PoS) consensus mechanism are eligible for staking (sorry bitcoin!).

Stakers are often referred to as validators. A validator simply represents the actual computer a staker uses to validate transactions. Once/if a staked coin is chosen by a network, the validation process begins.

New to crypto? Check out our Guide: What is Cryptocurrency and How Does it Work?

🎥 Watch! Crypto Staking by Ryan Grace 🎥

Validators in Staking

If you were to send ether (ETH) to a party, that transaction must first go through the validation process before it is finalized and added to the Ethereum blockchain.

Among other things, validators check for:

Double-spending: Does the sender indeed have that ether to send?

Signature: Did the sender actually sign the transaction?

Format: Is the transaction (message) formatted properly?

If all of these conditions are met, a transaction will get added to the blockchain, and the validator will be paid for its work in crypto rewards.

The vast majority of crypto participants choose to delegate their coins to an exchange or protocol to stake their coins on their behalf (myself included). Therefore, these participants do not need to understand the intricacies of staking in order to participate. But it’s always good to know how things work!

📕 Read! 5 Best Ways to Stake Your Ethereum

How Is a Validator Chosen?

Validators are chosen at random by proof-of-stake networks in a lottery system.

In order to be in this lottery pool, you must both own and ‘stake’ the coins native to that network. The more coins you stake, the greater the odds you have of being chosen to validate the next block and receive the block rewards.

What Coins can I stake?

Only coins that participate in the PoS consensus mechanism (more on this next!) are eligible for staking. Popular PoS networks include:

Ethereum (ETH)

Tezos (XTZ)

Cosmos (ATOM)

Solana (SOL)

Cardano (ADA)

Polkadot (DOT)

Algorand (ALGO)

Polygon (MATIC)

Binance Coin (BNB)

Avalanche (AVAX)

TRON (TRX)

Proof of Work vs Proof of Stake

All decentralized blockchain networks incorporate at least one consensus mechanism. A consensus mechanism is a way by which all nodes on a blockchain come to an agreement on the state of the network.

Popular consensus mechanisms include:

POW (Proof of Work)

POS (Proof of Stake)

DPOS (Delegated proof-of-stake)

POH (Proof of History)

The most popular means of consensus are proof-of-work and proof-of-stake.

Proof of Work

In proof-of-work (PoW) networks, like Bitcoin, blocks (and the transactions within them) are validated by miners. Miners use highly specialized computers to solve difficult math problems.

Before a proof-of-work block can be added to a network, math must be done. This math secures the network.

The miner who solves a new block’s math problem first is able to add that block to the blockchain. For their work, proof-of-work miners receive rewards in the form of crypto assets. For the Bitcoin network, these rewards are received in bitcoin (BTC).

Proof of Stake

In proof-of-stake networks (PoS) like Ethereum, this competition to validate is replaced by a lottery system.

In PoS, a network chooses at random a computer to do the math required to validate a block. If a network chooses one of your staked coins from the staking pool, the network will assign to you the math problem required to validate the block.

📚 Read: 3 Ways to Stake Cardano (ADA)

Staking: Run a Node or Delegate?

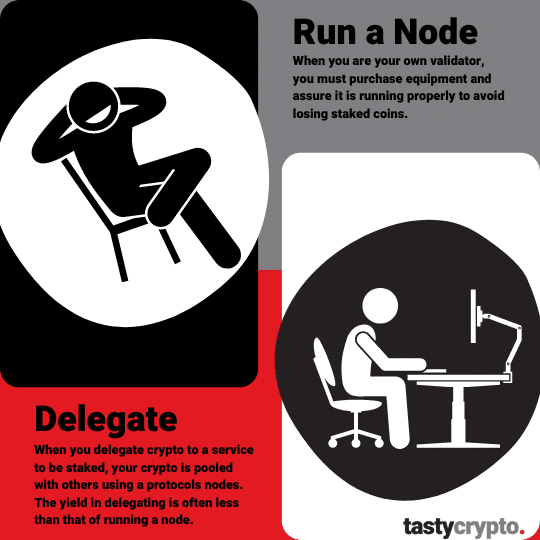

The vast majority of staking participants choose to delegate their coins to either a cryptocurrency exchange or decentralized finance (DeFi) protocol to do this validation work for them. You’ll need a self-custody crypto wallet when you stake through a DeFi protocol.

For example, you could choose to have a crypto exchange like Coinbase stake your coins for you on their ‘nodes’. Since there are many other stakers with you in this pool, Coinbase can determine their odds of ‘winning’ future blocks and calculate an APY for your staked assets.

When you delegate your coins to a party to do this work for you, you will usually earn less yield than if you were to be your own validator.

Here are the current rates for staking ETH through these two different methods:

Validator-as-a-Service: 3.65% (ETH)

Run a Validator: 4.07% (ETH)

Read! Want access to your staked crypto? Learn about ‘Liquid Staking’ here!

How Can I Stake Crypto in a Self-Custody Wallet?

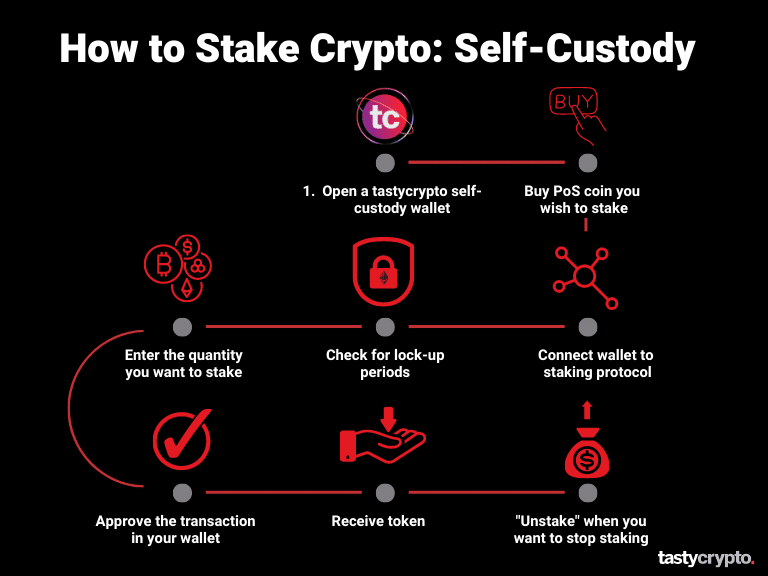

If you want to stake crypto using your tastycrypto wallet, you’ll need to delegate proof-of-stake coins to a DeFi protocol. Here are the steps to do this.

Open a tastycrypto self-custody wallet.

Buy the proof-of-stake coins you want to stake on a DEX (decentralized exchange).

Connect your wallet to a staking protocol, such as Lido.

Check for lock-up periods.

Enter the amount of the proof-of-stake coin you wish to stake.

Approve the transaction in your wallet.

A token representing your share of staked coins will appear in your wallet.

To terminate the staking process, choose ‘unstake’ on the protocol.

Where Can I Stake Crypto Using A Self-Custody Wallet?

If you want to stake crypto using a self-custody wallet, you have a few choices. The below 4 staking protocols are the most popular according to DeFiLlama.

TVL (total value locked): $33.4B

Supported networks: Ethereum, Solana, Moonbeam, MoonRiver, Terra Classic

TVL: $4.3B

Supported networks: Ethereum

Binance Staked ETH

TVL: $3.1B

Supported networks: Ethereum, BSC

Mantle Staked ETH

TVL: $1.6B

Supported networks: Ethereum

The mentioned platforms are referred to as liquid staking protocols because they offer a liquid staking token (LST) in exchange for the staked ETH, enabling stakers to explore decentralized finance (DeFi) opportunities.

Ethereum stakers can seek even higher returns by restaking on EigenLayer or locking funds with liquid restaking protocols built on top of it.

What Are the Risks of Staking Crypto?

Since there are two different methods of staking crypto, there are two different sets of risks.

Staking Risks for Validators

Hardware risks

When you ‘stake’ coins as a validator, you are at risk of losing those coins. A network may penalize you if there is a problem with your computer hardware during the validation process.

Connectivity risks

If you’re running your own node, that computer must be up and running 24/7. If you are chosen to be a validator and lose connectivity halfway through, a network may penalize you by keeping a portion of your staked coins.

Expenses

Running validation rigs is not cheap. In addition to the costs of connectivity, you need to stay competitive by always running the most modern rigs, the costs of which can add up. Generally speaking, you must have a very large quantity of coins eligible for staking in order to turn a profit running your own node.

Volatility risks

In order to stake crypto, you must own crypto, which is a very volatile asset class.

Staking Risks for Delegating

Centralized risks

If you are staking through a centralized organization, such as Kraken, Coinbase, Binance, or Gemini, there is a risk that your broker could be compromised. If your exchange gets hacked (or becomes insolvent), the FDIC does not currently protect you.

Lock-up period risks

Some staking services require that your staked coins be ‘locked up’ for a certain period of time. This could prevent you from selling coins in adverse markets. Additionally, this introduces opportunity costs: what else could you have been doing with those coins if there were not locked up?

Protocol risks

Staking through decentralized finance (DeFi) protocols often offers higher returns than staking through centralized exchanges. However, protocols are not without risks. Some staking protocol risks include smart contract risks, technical risks, and ‘slashing’ risks. Slashing risks refers to a protocol not being about to validate properly due to hardware or connectivity issues. These risks are shared with running your own node.

Volatility risks

Staking: ETH vs ETH2

In late 2022, the Ethereum network switched from a proof-of-work network to a proof-of-stake network. This shift was called the Ethereum Merge.

The Merge created two different Ethereum coins: ETH and ETH2.

ETH (or ETH1) represents the network’s execution layer. This layer handles transactions and executions.

ETH2 is the network’s current consensus layer, which incorporates proof-of-stake consensus.

Therefore, in order to stake Ethereum, you must own and stake the so-called “ETH2” coins.

For a more thorough understanding of the Merge, read this article from ethereum.org.

📕 Read Next: Staking Pools: Lido vs Rocket Pool vs StakeWise

Staking FAQs

Ethereum is currently the most popular network for staking. However, other networks pay more staking rewards. For example, Polkadot currently pays 12.7% APR in staking rewards on Lido while Ethereum pays 4.4% APR.

Generally speaking, crypto coins with higher price volatility pay greater staking rewards.

Although staking crypto is a moderately safe way of earning interest on crypto owned, it does come with downsides. Some downsides of staking crypto include price volatility, protocol risk, centralized risk, and hardware risks (for nodes).

The frequency of getting paid for staking crypto will depend upon who you choose to stake with. For example, if you stake on a DeFi protocol like Lido, you will start earning rewards within 24 hours of staking. Some protocols require a bonding period before you are paid. Most protocols pay staking rewards on a daily basis.

Stablecoins are tokens, not coins. Therefore, stablecoins are not eligible for staking.

🍒 tasty reads

What Is Ether.fi? Liquid Staking Reinvented

What Is Wrapped Ether? Complete wETH Guide

Impermanent Loss in DeFi: The Complete Guide

What is GMX? DeFi Perpetual Exchange 2024 Guide

What Is Defi Liquidity Mining and How Does It Work?

Wrapped Crypto Tokens: A Beginner’s Guide

Mike Martin

Mike Martin formerly served as the Head of Content for tastycrypto. Before joining tastycrypto, Michael worked in the active trader divisions of thinkorswim, TD Ameritrade, and Charles Schwab. He also served as a writer and editor for projectfinance.

Michael has been active in the crypto community since 2017. He holds certifications from Duke University in decentralized finance (DeFi) and blockchain technology.