You can stake Cardano ADA on centralized exchanges, through staking pools and directly within a self-custody crypto wallet.

Written by: Anatol Antonovici | Updated August 9, 2024

Reviewed by: Mike Martin

Fact checked by: Ryan Grace

ADA staking lets you earn rewards ranging from 2% to 4% per year. In this article, we will show you three of the best ways to stake your Cardano coins

🍒 tasty takeaways

Unlike other blockchains, Cardano doesn’t require stakers to lock up coins, and there are no penalties involved.

You can stake Cardano ADA with a cryptocurrency exchange, a specialized staking pool, or directly through a self-custody wallet.

- 22.7 billion ADA is staked, which accounts for 65% of Cardano’s circulating supply.

What is Cardano Staking?

Cardano staking is a process during which ADA holders contribute to the network’s security, decentralization, and block creation process by delegating their tokens to the Cardano blockchain. For their contribution, stakers receive a percentage of their staked amount in ADA as a reward.

In general, staking is the mechanism through which Proof-of-Stake (PoS) blockchains make sure that consensus is reached on their networks. These networks reward stakers for their effort. This is completely different from Bitcoin (BTC) mining dictated by the Proof of Work (PoW) mechanism, which requires computing power to win the competition of cracking complex puzzles.

Cardano blockchain has a PoS version called Ouroboros, which came out as a result of peer-reviewed research. It incentivizes block validators and keeps the network secure.

How Does Cardano Staking Work?

The goal of staking ADA is to contribute to the security of the blockchain network and support the validation of new blocks comprising token transaction data. The Cardano network relies on a staking mechanism that uses game theory rather than slashing, a method used by other PoS chains to punish validators for failing with their duties.

The Ouroboros whitepaper explains more in detail how the consensus mechanism works, but the key thing to know is that stakers don’t have to lock ADA for any vesting period, as they do with other PoS chains.

Cardano Staking Pools

The first line of block validators is made up of the approved stake pools, to which anyone can delegate ADA. Note that stakers who delegate to a stake pool don’t transfer token ownership as they remain in full control over their digital assets.

We won’t mention the creation of a pool (running your own node) as a staking method in this article because it is a relatively complex process that requires technical knowledge. Businesses and individuals seeking to run a pool on their own have to set it up. They may then choose to promote it to attract delegators.

Cardano distributes rewards to stake pools, which eventually redistribute proportionally to delegators after successfully being selected as block validators.

Now let’s find out how we can stake Cardano! 🏃

#1 Stake Cardano ADA Through a Centralized Exchange

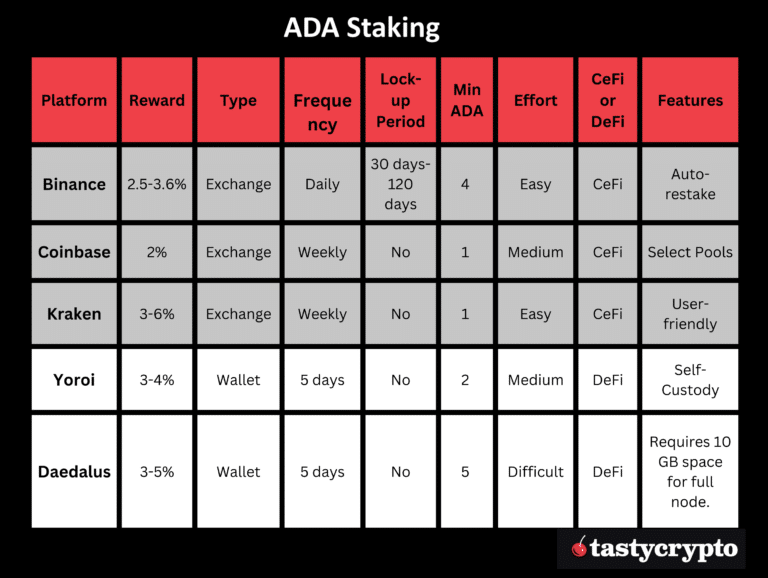

The easiest way to stake ADA is through a centralized exchange. Many such crypto exchanges offer this option, including Binance, Coinbase, Kraken, Poloniex, and KuCoin, among others.

This approach is suitable for crypto beginners who are already using one of these exchanges for buying and selling crypto.

Usually, users have to follow these simple steps to stake on a CEX:

- Register with a crypto exchange.

- Buy or deposit ADA in their account.

- Go to the staking page and pick ADA from the list. Some exchanges, such as Coinbase, will show a list of stake pools to delegate your ADA, while others, such as Binance, stake on their own.

- You will have to choose the amount of ADA to stake, the lock-up period, and review other conditions. Some exchanges offer the “auto restake” option to compound rewards.

#2 Join a Cardano ADA Staking Pool

Another way to stake Cardano (ADA) is to join a stake pool operator (SPO). There are thousands of SPOs, and you can choose based on their interest rate (reward), saturation, fees, and past performance. You can explore SPOs on ADAPools.

Here are the general steps to stake ADA with SPOs:

- Choose a stake pool after doing some research.

- Get a Cardano decentralized wallet. The most popular options supporting Cardano are Yoroi or Daedalus wallet, but each pool lists the supported wallets.

- Move ADA from your existing wallet to the supported wallet.

- Delegate your ADA by following the instructions from the supported wallet and start earning rewards.

Staking with an SPO gives you more independence compared to staking with a crypto exchange, as you own the private keys. Also, there is no lock-up period, as is often the case with exchanges.

#3 Staking Cardano ADA Through a Wallet

You can also stake ADA directly from a wallet by picking a stake pool from the dashboard. Yoroi wallet is the most popular option. It is a self-custody wallet that gives you full control over ADA during the staking process.

For maximum security, you can connect Yoroi with a hardware wallet like Ledger, which maintains private keys offline.

The wallet is in the form of a browser extension or mobile app.

Once you set the software wallet, you can choose from the listed stake pools directly from the app and start delegating ADA.

Cardano Staking: Facts and Figures

As of today, there are almost 3,000 pools with stake, hosting more than 1.3 million delegators all over the world.

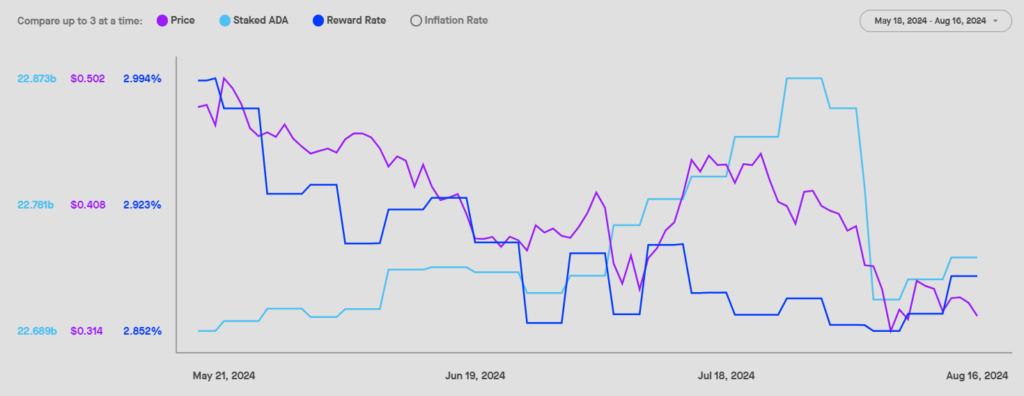

As of mid-August 2024, almost 22.7 billion ADA is staked, accounting for about 65% of the circulating supply. This is more than three times higher than Ethereum’s 22% staked share of supply. Part of this is explained by the fact that ADA stakers don’t have to lock their holdings.

Source: StakingRewards

As we can see above, staking rewards vary according to different pools.

Anatol Antonovici

6+ years of experience writing for crypto brands and blockchain firms, including Coindesk, Cointelegraph, Bitcoinist, CryptoPotato, Algorand, and OTCTrade.com

Cardano Staking FAQs

The safest way to stake ADA is to use a self-custody wallet like Yoroi or Daedalus. For maximum security, you can connect with a hardware wallet.

There is no minimum amount required for staking Cardano, but SPOs or crypto exchanges might require at least 5 or 10 ADA, which is $2 or less.

Most Cardano stake pools don’t require users to lock their ADA tokens, so there is no need to consider joining a liquid staking platform like Lido for ether (ETH). Nevertheless, some decentralized finance (DeFi) Web3 Apps, such as Indigo, offer liquid staking with ADA.

The staking reward of ADA ranges from 2% to 4%, but the return on investment (ROI) can be affected by the price. For example, the price of ADA has continually declined from its ATH at over $3 and is currently trading at $0.32 in August of 2024, making the annual percentage yield (APY) less relevant during such bearish markets.

Anatol Antonovici

6+ years of experience writing for crypto brands and blockchain firms, including Coindesk, Cointelegraph, Bitcoinist, CryptoPotato, Algorand, and OTCTrade.com

🍒 tasty reads

The Core Blockchain and DeFi Ecosystem: What You Need to Know

7 Best DePIN Crypto Projects

What Is Symbiotic and How Does It Work in 2024?

Ethereum vs Ethereum ETFs – 5 Major Differences