📕 Non-Fungible Token Definition: An NFT (Non-Fungible Token) represents unique ownership of a specific digital item saved on a blockchain.

Written by: Mike Martin | Updated June 14, 2024

Reviewed by: Ryan Grace

Fact checked by: Laurence Willows

An NFT is a non-interchangeable, representative digital asset that is stored on a blockchain network that can not be copied. The use cases of these unique digital assets goes far beyond art. Learn about NFTs here!

🍒 tasty takeaways

NFT stands for non-fungible token.

Fungible means interchangeable, like US currency

Non-fungible means non-interchangeable, like art.

The value of an NFT is usually representative of a difference asset.

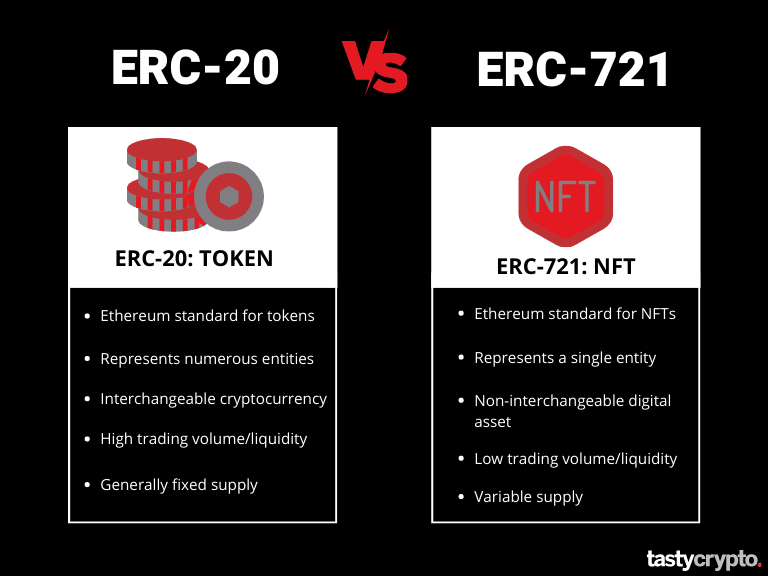

ERC-20 is the standard for fungible tokens on Ethereum while ERC-721 is the standard for non-fungible tokens on Ethereum.

The most popular marketplaces for NFTs are OpenSea, Blur, Magic Eden.

What Are NFTs?

NFT stands for ‘non-fungible token’. NFTs are revolutionizing the way the world holds, buys, and sells both physical and non-physical assets.

In order to understand what ‘non’ fungible means, it will help to first understand what fungible means.

Fungible simply means interchangeable. A US dollar, for example, is a fungible asset because any one US dollar is as good as the next. Most commodities, too, are fungible. Oil, gold, corn – all of these commodities (as long as they are in the proper class) can be exchanged freely.

Fungible Assets:

Currency

Commodities

Cryptocurrency coins

In other words, fungibility implies something is not unique.

Non-fungible, therefore, means something is indeed unique, and therefore must be valued independently. Two different works of art by Cezanne, for example, will have two different values – they are non-fungible. Baseball cards too are considered non-fungible because they are valued independently.

📕 Read: The Future of NFTs

Non-Fungible Assets:

Vintage automobiles

Sports cards

Artwork

An NFT is a non-fungible token that is stored on a blockchain network.

NFTs can represent unique digital assets such as art, sports clips, and even real estate. What makes NFTs unique is that they can not be subdivided or plagiarized. This is because they are stored on blockchain technology, which is immutable.

Generally speaking, the value of NFTs is representative, meaning these digital assets represents something else.

The assets NFTs represent can be either tangible or non-tangible. Let’s compare physical (tangible) to non-physical (non-tangible) NFTs next!

Physical vs Non-Physical NFTs

Physical NFTs are digital assets that link real-world assets to a digital file (NFT). If you own the NFT, you own the underlying asset. NFTs make the process of buying and selling illiquid assets much easier. A few examples of physical NFTs include:

Event tickets

Real estate deeds

Physical artwork

Non-physical NFTs represent something in the digital world. Popular non-physical NFTs include:

Digital artwork

Video game avatars

Music

ERC-20 vs ERC-721 Tokens

NFTs are not cryptocurrencies because cryptocurrencies are interchangeable. Crypto coins like bitcoin (BTC) and ether (ETH) as well as tokens like Chainlink (LINK) and Uniswap (UNI) are fungible.

There’s a difference, however, between coins and tokens.

A crypto coin is native to a blockchain network. Ether, for example, is the medium of exchange for the Ethereum blockchain network.

The Ethereum network, however, has thousands of different decentralized applications (dApps) that run under it.

These applications (protocols) leveraging the power and security of an underlying blockchain network all have their own unique cryptocurrencies. In order for the cryptocurrencies of these different applications to be interchangeable, they must be programmed in a certain way.

On the Ethereum ecosystem (the most popular network for NFTs and DeFi), all fungible tokens are built using the “ERC-20” standard.

All non-fungible tokens on the Ethereum network are built according to the “ERC-721” standard.

Using this token standard makes it possible for users to freely buy and sell ERC-721 NFTs across all Ethereum NFT marketplaces.

Are NFTs Dead?

As of June of 2024, NFTs have been able to return to their 2021 glory. So are they dead? We at tastycrypto think not. Check out this video from Ryan Grace to see why!

How Can I Buy and Sell NFTs?

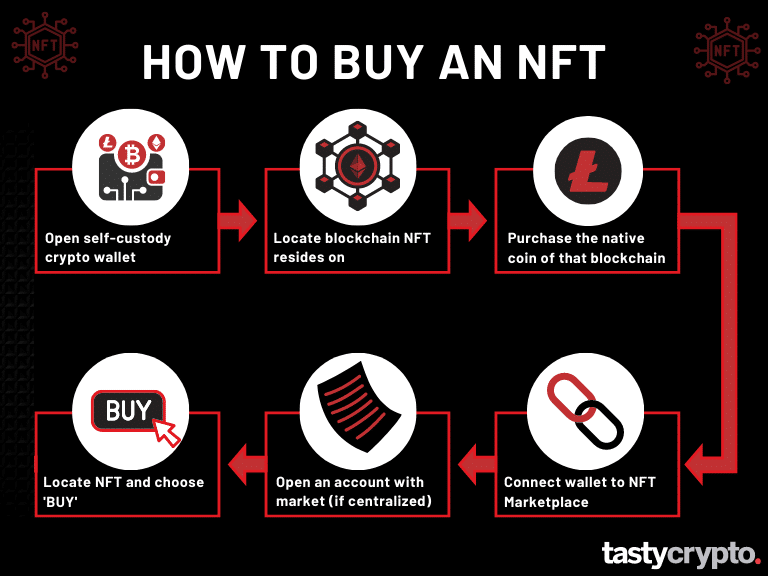

If you’re interested in buying (or selling) already minted NFTs with a self-custody crypto wallet, follow these steps.

Steps to Buy an NFT

Open a self-custody wallet.

Discover which blockchain network the NFT you want to purchase resides on.

Purchase the native coin of that network on a decentralized crypto exchange (DEX).

Connect your wallet to the NFT marketplace on which the NFT is located.

Open an account with that marketplace (if centralized).

Locate your NFT and choose ‘Buy’

To sell an NFT on an NFT marketplace, follow these steps:

Steps to Sell an NFT

Login or create an account with the marketplace you wish to sell your NFT.

Connect your self-custody crypto wallet to the marketplace.

Choose the NFT you wish to sell.

Click ‘Sell’.

Choose the sale price and decide whether to accept offers.

Set the duration you want the NFT listed for.

Choose whether you want to only sell to a certain buyer.

List your NFT for sale.

Where Can I Buy NFTs?

NFT marketplaces can be both centralized and decentralized. The majority of NFT marketplaces are currently centralized in 2023. Here are the most popular centralized NFT marketplaces.

Supported networks: Ethereum · Arbitrum · Klatyn · Optimism · Polygon· Solana

Fees: 2.5% of sale price

Supported networks: Solana · Ethereum

Fees: 2% of all transactions

Supported networks: Ethereum · Polygon · Solana · Flow · Tezos

Fees: 1% on both buyer and seller side

Supported networks: Ethereum

Fees: Varies (expensive!)

Supported networks: Ethereum · Binance Smart Chain

Fees: 1% + additional fees.

Supported Networks: Ethereum

Fees: 0 trading fees; 0.5% NFT royalty fee for the creator

Most Popular NFT Collections

In 2024, NFTs are still a big business. For example, the floor price of a ‘CryptoPunks’ NFT digital collectible is currently 28 ether (ETH). With ETH currently trading at $3,500, that means the cheapest CryptoPunk you can currently buy is bid at $97,200.

Here are some of the top NFT collections. All of the below NFTs represent either digital art or real estate in the metaverse.

Market Cap: 498,413 ETH

Network: Ethereum

Average Sale Price: $109,800

Market Cap: 108,900 ETH

Network: Ethereum, Polygon

Average Sale Price: $110,000

Market Cap: 36,321 ETH

Network: Ethereum

Average Sale Price: $20,440

Market Cap: 34 million SOL

Network: Solana

Average Sale Price: $7,600

Market Cap: 37,700 ETH

Network: Ethereum, zkSync Era

Average Sale Price:$22,500

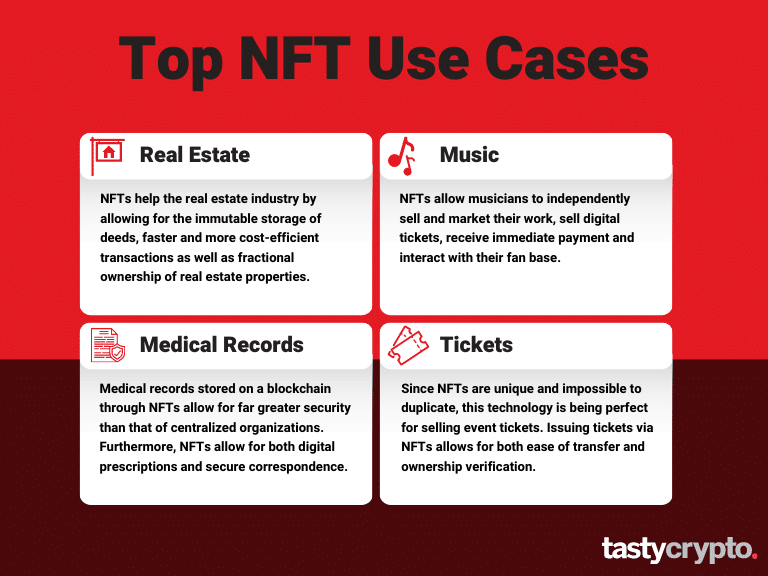

NFT Real-World Use Cases

There are some other use cases for NFTs aside from ridiculously expensive digital art (the digital artist Beeple once an NFT for $69 million at Christie’s).

Let’s start by looking at how NFTs are upgrading the archaic real estate industry.

1. NFTs and Real Estate

NFTs are stored on immutable blockchain networks. This means that what goes into a blockchain can never be altered or tampered with. The exception to this rule is the 51% attack, which implies that if one participant gains more than 50% of a network’s coins, they could change the way a network operates. This outcome is unlikely for larger blockchains, such as Bitcoin and Ethereum.

Immutable ledgers (blockchains) are revolutionizing the way the world buys and sells real estate.

In third-world countries, it is not uncommon for new regimes to seize the property of residents. If the deeds of people were instead saved on a blockchain, it would be very difficult for a regime to commandeer property assets.

In addition to providing a secure way to store property deeds, NFTs in real estate allows for:

-

Fractional ownership of property.

-

Faster and more cost-efficient transfers.

-

Properties to be ‘tokenized’, which increases liquidity.

-

Crowdfunding real estate projects globally.

2. NFTs and the Music Industry

NFTs are giving musicians greater control over their art. In addition to giving a musician complete control over their own artistic work, NFTs allow artists to:

-

Receive immediate payment.

-

Distribute their work for prices they determine.

-

Publish work for unsigned artists.

-

Interact more personally with a fan base.

-

Sell digital tickets to concerts.

-

Proof of ownership.

3. NFTs and Medical Records

NFTs are also currently being used to store medical records. NFTs are reshaping this industry by:

-

Securely storing medical records via digital files.

-

Securing the correspondence between patient and provider.

-

Providing digital prescriptions.

-

Creating an immutable, hack-proof way of storing birth certificates and death records.

4. Other NFT Use Cases

Another interesting NFT project is NBA Top Shot, which allows for the buying and selling of digital moments in basketball history. You could own the rights to a Michael Jordan dunk!

Nike is also in the NFT market, using the Polygon network to mint NFTs that represent sneakers, some of which sell for over 130K!

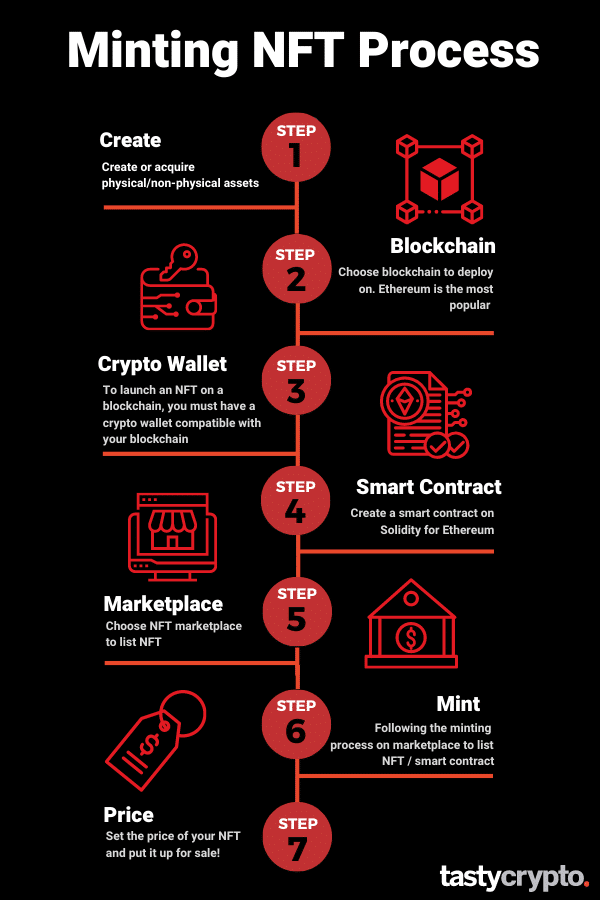

How Are NFTs Made? Minting an NFT

Before investing in an NFT, it may be wise to actually understand how these unique digital assets are created. Here is how you would go about creating and minting an NFT.

Create physical/non-physical non-tangible assets.

Choose blockchain

NFTs can be deployed on numerous blockchain networks. Ethereum is the most popular network for NFTs, but in 2023 Solana and Polygon are fast catching up.

Open self-custody wallet

In order to launch an NFT on a blockchain, you must have a self-custody crypto wallet compatible with that network. The tastycrypto wallet, for example, is compatible with the Ethereum network.

Construct smart contract

This step is a little complicated. Read this article form Alchemy to learn more about developing an NFT on Solidity (Ethereum’s programming language).

Choose NFT marketplace

Next up, you need to choose your NFT marketplace. Think of this as an art showroom. Some marketplaces cost more than others to list NFTs, but these costs could be offset by more participants. Usually, marketplaces take a portion of your profit from a sale. 2.5% of the sale price is standard.

Mint your NFT

Now you have to actually mint your NFT, which writes your NFT into a blockchain network. This process involves uploading your NFT with its representative smart contract to a blockchain via a marketplace. To mint on OpenSea, you simply click ‘create’ and upload your NFT file and fill out the relevant information including metadata.

Set your price

The last step in creating an NFT is to list the price of your digital asset.

Final Word

Let’s now review what we have learned about NFTs.

NFT are digital assets that are stored on a blockchain.

NFTs can not be copied (plagiarized) or divided.

Physical NFTs represent real-world assets, like art or real estate.

Non-physical NFTs represent digital assets, such as digital art and sports clips.

All NFTs on the Ethereum network are created using the ERC-721 standard.

For a deeper dive into the mechanics of NFTs, check out this great article by Wikipedia.

FAQs

NFTs are not cryptocurrencies, and therefore they do not work like cryptocurrencies. However, there are some similarities between cryptocurrencies and NFTs. Both are considered digital assets and both are stored on and secured by a blockchain network.

The future of NFTs is unknown. In early 2023, NFT sales plunged more than 90% from their height a year before. If the broader crypto market begins to recover, there is a good chance NFTs will rise in price with it.

There are numerous types of NFTs. Determining if NFTs are a good investment will depend on an investor’s risk tolerance and their convictions about an NFT project.

🍒 tasty reads

Crypto Burning Guide: What It Means and How It Works

Crypto Coin vs Token: What’s The Difference?

Leverage in Crypto Trading: 6 Key Examples

What Is Slippage in Crypto? Beginners Guide

Mike Martin

Mike Martin formerly served as the Head of Content for tastycrypto. Before joining tastycrypto, Michael worked in the active trader divisions of thinkorswim, TD Ameritrade, and Charles Schwab. He also served as a writer and editor for projectfinance.

Michael has been active in the crypto community since 2017. He holds certifications from Duke University in decentralized finance (DeFi) and blockchain technology.