Cryptocurrency, a form of digital currency like Bitcoin (BTC), is used for decentralized payments and investments. Crypto is secured by cryptography to prevent counterfeiting and double-spending. Beginners interested in trading crypto should start small with affordable amounts, as crypto involves risks.

Written by: Anatol Antonovici | Updated January 24, 2024

Reviewed by: Mike Martin

Fact checked by: Ryan Grace

This guide streamlines the journey into cryptocurrency investing, detailing fundamental steps for beginners to acquire digital assets. Let’s go! 🏃

🍒 tasty takeaways

- Invest in cryptocurrencies with a large market capitalization, high trading volume and liquidity, robust infrastructure, and relevant use cases.

- Cryptocurrencies offer high growth potential, but they also entail considerable risks due to their high volatility.

- Most crypto assets tend to follow the price of Bitcoin, which should account for the largest portion of a beginner’s portfolio.

- Non-custodial wallets, also known as self-custody wallets, offer the most secure storage for cryptocurrencies.

Summary

| Step | Key Points |

|---|---|

| Investing in Crypto | High growth potential with high volatility. Majority follow Bitcoin's price trend. Use non-custodial wallets for security. |

| Why Invest? | Innovative blockchain technology, lower correlation with traditional finance, high potential for gains, but with risks like volatility and security concerns. |

| How Much to Invest | Invest only what you can afford to lose, suggested 1-5% of portfolio. |

| Choose Cryptos | Start with Bitcoin, then explore altcoins. Understand different types like crypto coins, utility tokens, stablecoins, and DeFi tokens. |

| Crypto Wallet | Choose between custodial and non-custodial wallets. Non-custodial like tastycrypto recommended for security. |

| Select an Exchange | Register with a CEX for fiat transactions or a DEX for more security. |

| Buying Crypto | Purchase through CEX, then transfer to a non-custodial wallet. Consider stablecoin strategy. |

| Manage Investment | Align management with strategy. Hold diverse assets long-term, rebalance portfolio. |

How Much Should I Invest in Crypto?

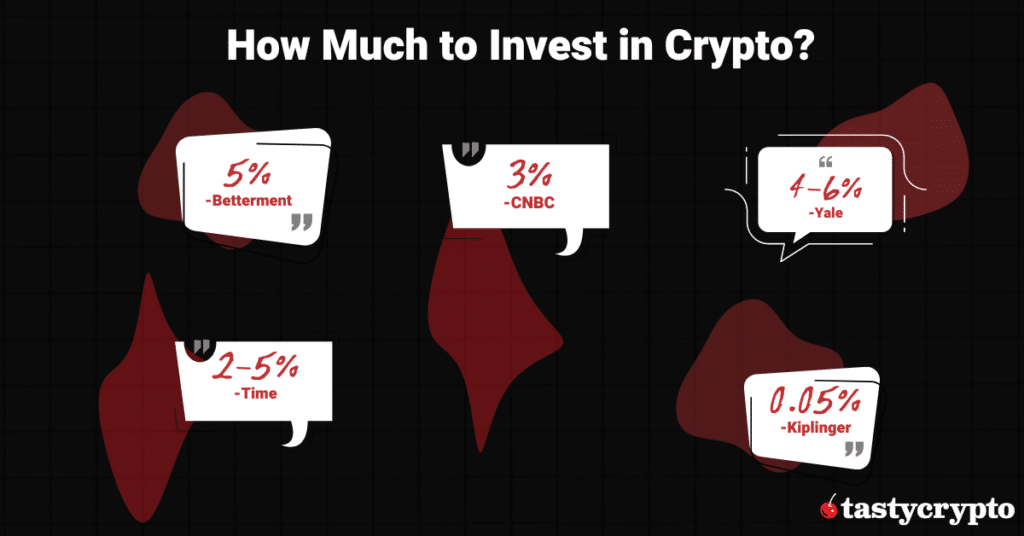

A fundamental rule of investing is never to risk more than you can afford to lose.

Most experts recommend that investors allocate between 1% and 5% of their portfolio to crypto assets.

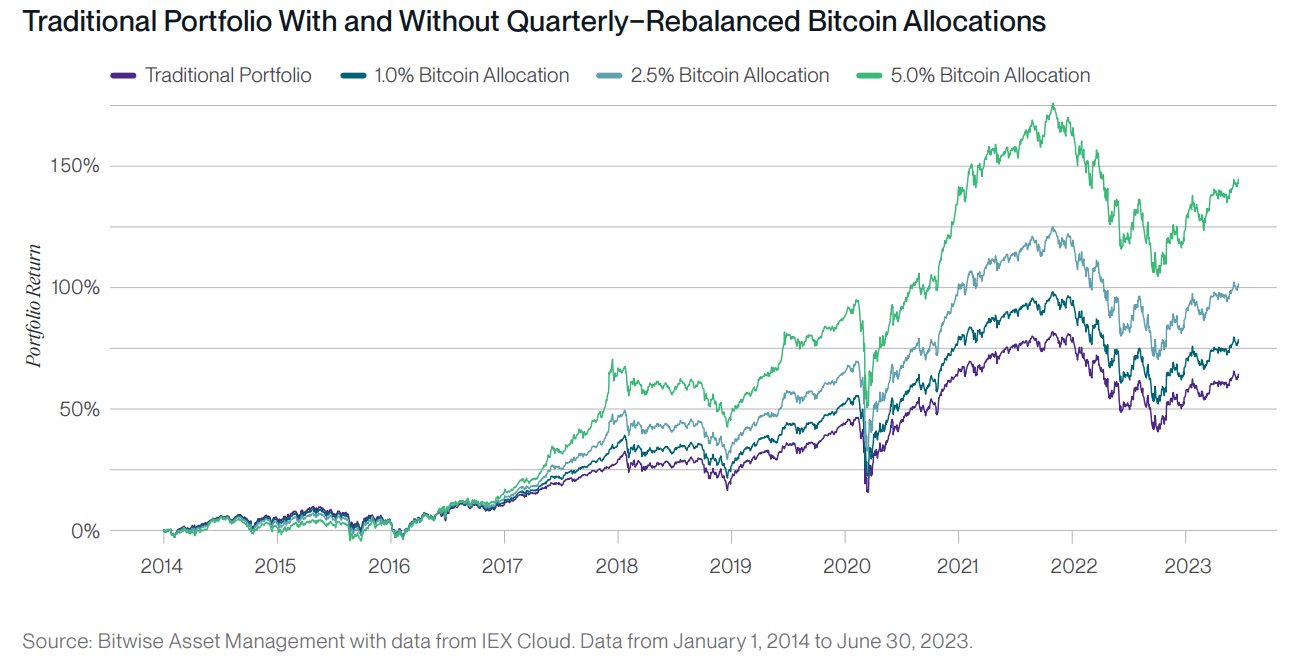

According to a Bitwise report, from 2014 to 2023, Bitcoin (BTC) positively impacted the returns of a traditional investment portfolio. Specifically, BTC enhanced portfolio performance in 70% of cases over 1-year periods, 94% over 2-year periods, and in every instance during 3-year periods.

Furthermore, allocating just 2.5% of a portfolio to Bitcoin resulted in a 12% increase in its 3-year returns.

Source: BitWiseInvestments

If you haven’t yet ventured into cryptocurrency investments, let’s briefly go over the key steps to get started.

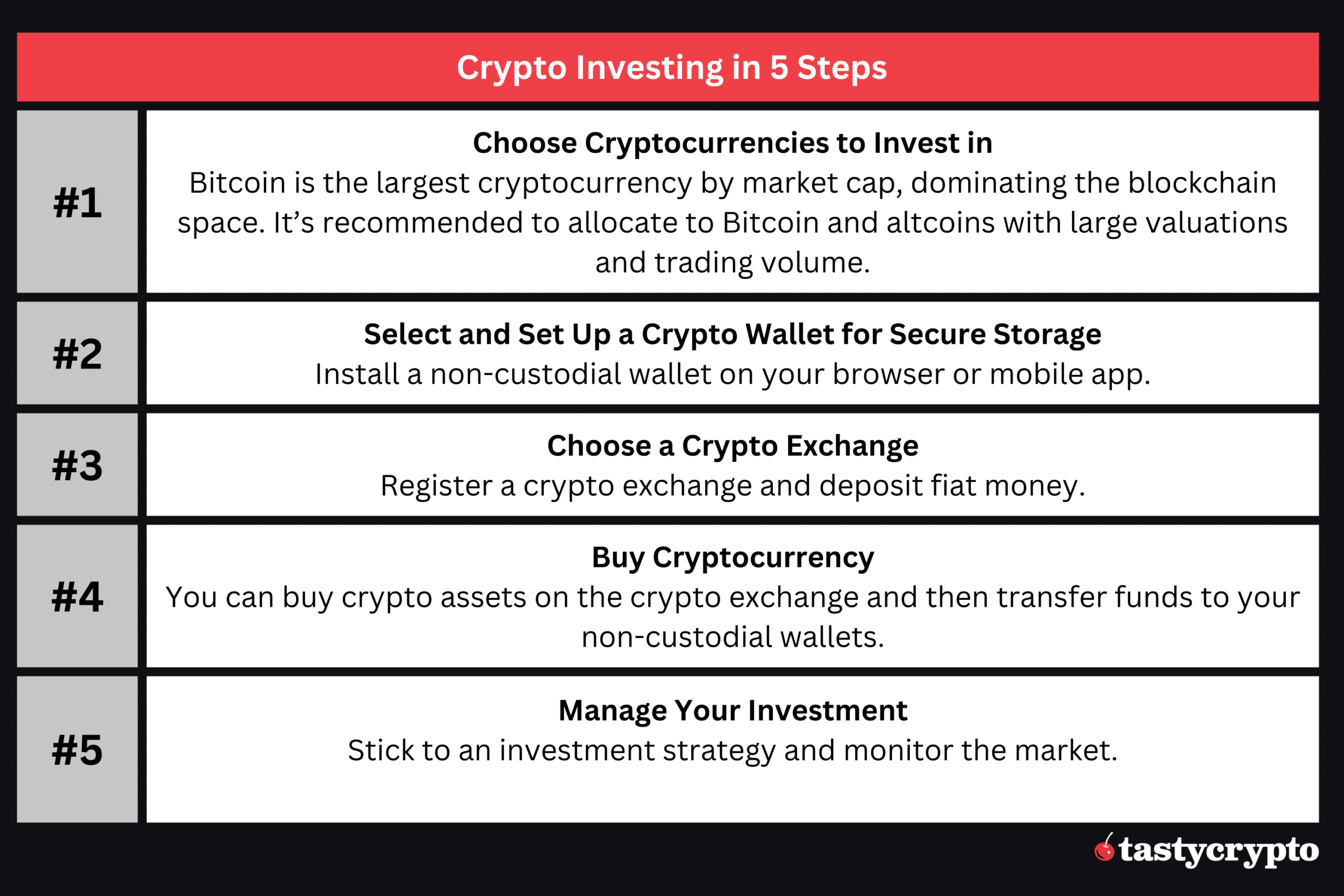

1. Choose Cryptocurrencies to Invest in

Before exploring the various types of digital assets, it’s important to note that the crypto market largely mirrors the trends of Bitcoin (BTC), which represents approximately 50% of the total market cap. With this in mind, beginners are often recommended to start their crypto journey with Bitcoin, and then gradually diversify into altcoins (alternative coins).

That being said, here are the primary categories of cryptocurrencies that you should be familiar with:

- Crypto coins – these are cryptocurrencies that have their own blockchain, e.g., Bitcoin (BTC), Ethereum (ETH), Solana (SOL), or Cardano (ADA).

- Utility tokens – crypto tokens are digital assets that are built on top of an existing blockchain supporting the smart contract feature. These tokens hold value within specific ecosystems. Examples include Chainlink’s LINK and Polygon’s MATIC, both of which are developed on the Ethereum blockchain.

- Stablecoins – these are tokens pegged to traditional assets, predominantly the US dollar. The best-known stablecoins are USDC, USDT & DAI. Beginners may use stablecoins as a gateway to the crypto world.

- DeFi tokens – decentralized finance (DeFi) is a huge sector in blockchain. You should keep an eye on the utility and governance tokens of DeFi apps, such as Uniswap’s UNI and MakerDAO’s MKR.

This guide will omit non-fungible tokens (NFTs) due to their complexity and higher risk for beginners.

Here are a few listicles we made to get you started!

🍒 9 best cryptos for beginners

2. Select a Crypto Wallet for Secure Storage

You should have a digital wallet where you can store cryptocurrencies after purchasing them. There are custodial wallets offered by centralized crypto exchanges (in which case you could skip this step for now) and non-custodial wallets that give you full control over the stored digital assets.

🍒 CEX vs DEX: How Crypto Exchanges Differ

While custodial hot wallets are more user-friendly, it’s recommended to opt for a self-custody wallet solution for the safety of your crypto. tastycrypto is a great non-custodial wallet that can store thousands of digital assets. Its mobile app and browser extension have an intuitive interface and multiple features.

3. Select a Crypto Exchange: CEX or DEX?

To purchase your first crypto, you should register a centralized cryptocurrency exchange (CEX) like tastytrade, Coinbase, or Binance, and deposit fiat money via ACH/wire transfer from your bank account or through a credit/debit card. Be ready to pass through a KYC (know your customer) verification process by sharing an ID document.

Unlike CEXs, decentralized exchanges (DEXs) don’t require registration and are safer because they don’t store your crypto. On these exchanges, you maintain full control over your private key/seed phrase, so no one but you will ever have access to your crypto. However, DEXs don’t let you buy crypto with fiat currency.

4. Buying Crypto

With money in your crypto-supporting CEX balance, you can easily purchase digital assets.

The newly acquired crypto funds will automatically go to a hot custodial wallet managed by the exchange platform. Remember, with hot wallets, you have to trust the exchange is holding your crypto 1×1 (remember FTX?).

For better security, you can transfer crypto to your non-custodial wallet by initiating a crypto withdrawal operation.

Here is the stablecoin approach many crypto investors follow:

- Buy stablecoins like USDC or USDT through a CEX.

- Move the stablecoins to your self-custody wallet.

- Buy any crypto by connecting your self-custody wallet to a decentralized exchange (DEX) like Uniswap.

If you move the stablecoins from the CEX to your tastycrypto wallet, you can exchange them for any crypto inside the app.

Regardless of your chosen approach, we congratulate you on your first purchased crypto!

5. Manage Your Investment

Managing your crypto investments, rather than purchasing them, can be the most challenging part of the process.

Your approach to handling crypto assets should align with your investment strategy and objectives. Given the high volatility of cryptocurrencies, impulsive reactions can be detrimental.

Ideally, you want to hold a variety of major crypto assets for the long term and regularly rebalance your portfolio.

You can apply crypto technical analysis and fundamental analysis to monitor your assets.

Here is a recap of our 5 steps of crypto investing for beginners:

FAQs

Cryptocurrencies are digital assets that have no central authority to rule over them. They are highly volatile and unpredictable. You shouldn’t invest more than you can afford to lose.

There are five main steps to invest in crypto assets:

- Choose a cryptocurrency.

- Select and install a non-custodial crypto wallet on your mobile phone or browser.

- Register with a centralized exchange and deposit fiat money.

- Buy cryptocurrencies and move them to your non-custodial wallet for better security.

- Manage your investments by constantly monitoring the market.

Bitcoin dominates the crypto space and it should account for the lion’s share of your crypto portfolio. Besides that, you should look for cryptocurrencies with a large market capitalization, high trading volume and liquidity, robust infrastructure, and relevant use cases.

You can get exposure to cryptocurrencies without owning them by trading derivatives. For example, tastytrade acts as a brokerage trading platform that offers several financial products, including crypto futures. Margin trading can be used to augment potential returns, but be ready for higher risks.

🍒 tasty reads

The Core Blockchain and DeFi Ecosystem: What You Need to Know

7 Best DePIN Crypto Projects

What Is Symbiotic and How Does It Work in 2024?

Ethereum vs Ethereum ETFs – 5 Major Differences

Anatol Antonovici

6+ years of experience writing for crypto brands and blockchain firms, including Coindesk, Cointelegraph, Bitcoinist, CryptoPotato, Algorand, and OTCTrade.com