Some great ways to make money with crypto include trading, investing, staking, mining, DEX liquidity provision, lending, and DeFi yield farming.

Written by: Anatol Antonovici | Updated May 14, 2024

Reviewed by: Mike Martin

Fact checked by: Ryan Grace

Even though Bitcoin and other large-cap coins are saturated, the crypto market offers many great opportunities to make money. In this article, we’ll tell you the best ways to make money with your crypto!

Table of Contents

🍒 tasty takeaways

Crypto trading and investing (hodling) are the most straightforward ways to get exposure to digital assets.

The DeFi sector provides various yield opportunities, including liquidity mining, crypto lending, liquid staking, and yield farming.

Passive income opportunities, like PoS staking, lending, or DeFi liquidity mining, offer APY figures ranging from 0.05% to over 50%.

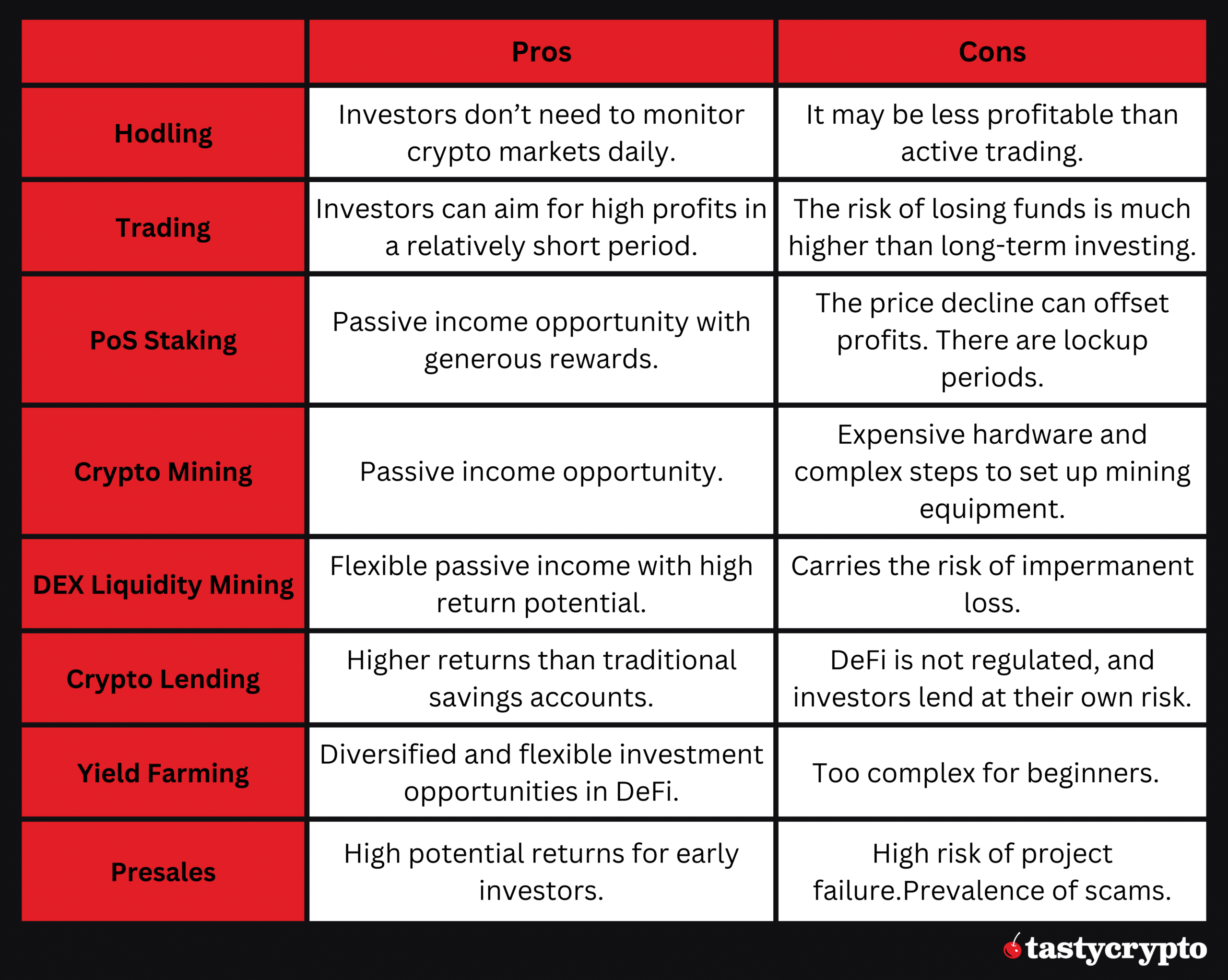

Make Money With Crypto Summary

| Method | Description |

|---|---|

| Trading & Investing | Buy and trade digital assets on exchanges; "hodl" for long-term gains. |

| PoS Staking | Lock up crypto to support network operations and earn rewards. |

| Mining | Use hardware to process transactions and secure crypto like Bitcoin. |

| DEX Liquidity Provision | Provide liquidity to DEXs and earn fees from trading activities. |

| Lending | Lend crypto on DeFi platforms to earn interest. |

| Yield Farming | Engage in complex strategies to earn higher returns in DeFi. |

| Presales | Invest early in new crypto projects and potentially reap large gains. |

1. Investing & Trading

Getting direct exposure to crypto assets is one of the most straightforward ways to make money with crypto. However, digital assets are highly volatile, and active trading requires robust risk management techniques.

There are two main approaches:

- Trading cryptocurrency: Active trading involves opening short-term positions on crypto exchanges and speculating on price fluctuations. Day trading is the most popular style of trading, although this is a risky business due to market volatility. To increase the chances of profit, traders use technical and fundamental analysis tools to assess market trends.

- Hodling: This is a long-term investment style in which you buy crypto assets and hold them for months or years, hoping they become more valuable. The best approach for hodling is to build a diversified crypto portfolio, with Bitcoin accounting for the most significant portion. A crypto investment portfolio can also include non-fungible tokens (NFTs).

2. PoS Staking

Staking is a passive income opportunity where crypto holders participate in securing a Proof of Stake (PoS) network. Popular PoS blockchains offering staking include Ethereum, Solana, Avalanche, Cardano, Near, BNB Chain, Ton, and Cosmos.

With staking, you typically need to lock up a specific amount of the native cryptocurrency in a designated self-custody wallet to earn rewards. It’s important to note that not all participants in staking are required to validate new blocks; some may simply delegate their coins to validators who perform the actual validation work.

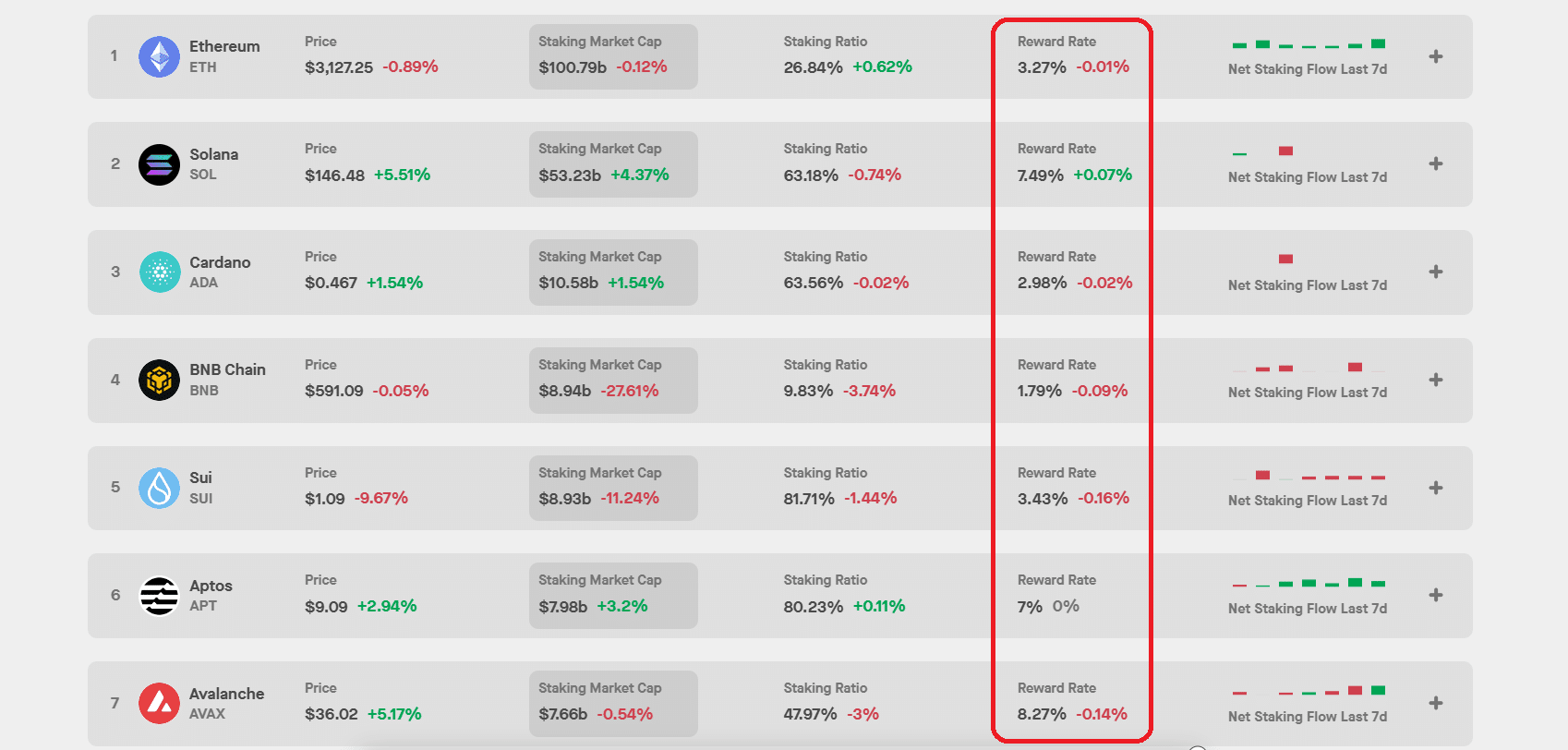

The reward rates for crypto staking range from 1.8% to 20%.

Source: Staking Rewards

The most popular cryptocurrency for staking is Ethereum (ETH). The coin has an entire staking industry built around it, which includes liquid staking and restaking protocols to boost potential rewards.

3. Mining

Mining is a passive income opportunity associated with cryptocurrencies that use the Proof of Work (PoW) consensus mechanism. Miners use hardware like GPU or ASIC devices to crack hashes.

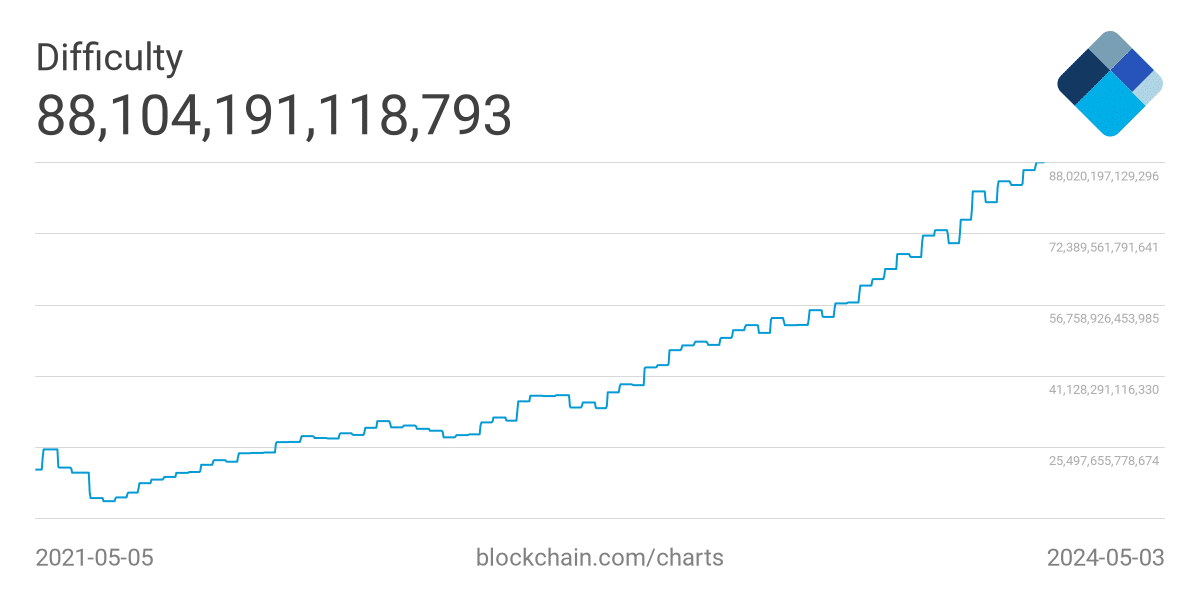

Bitcoin is the most popular cryptocurrency for mining, although individual mining isn’t possible anymore. Following April’s halving event, which happens once every three or four years, the mining reward was reduced by 50% to 3.075 BTC. The difficulty of mining has reached a record high of 88.1 trillion.

Source: Blockchain.com

The best way to mine Bitcoin is to join a mining pool and connect your hardware. Miners benefit when the price of Bitcoin is increasing.

Other cryptocurrencies may be more profitable to mine, including Litecoin, Monero, and Dogecoin.

4. DEX Liquidity Provision

Liquidity provision on decentralized exchanges (DEXs)—referred to as liquidity mining (which is unrelated to crypto mining)—is a passive income strategy in decentralized finance (DeFi). Crypto holders can become liquidity providers (LPs) by locking up digital currencies in DEX liquidity pools for rewards from trading fees.

For DEXs, on-chain liquidity is imperative because they don’t operate order books like regular crypto exchanges, e.g., Coinbase or Binance. Instead, they rely on pools with two or more assets against which traders can swap their tokens.

How to Join a Liquidity Pool 👇

To join a liquidity pool, you must connect your self-custody wallet and add an equal value of two digital assets to a pool. As traders buy and sell from this pool, you earn a portion of the fees they pay.

The most popular DEXs are Uniswap, PancakeSwap, Curve, and Balancer. As of this writing, these four DEXs have a total value locked (TVL) of $10.5 billion.

Liquidity pools generate an annual percentage yield (APY) ranging between 0.05% for popular stablecoins to over 50% for riskier assets.

5. Crypto Lending

Decentralized lending protocols represent another primary use case in DeFi. Crypto projects like Aave and Compound connect lenders with borrowers in a trustless environment, with all rules enforced by code (smart contracts).

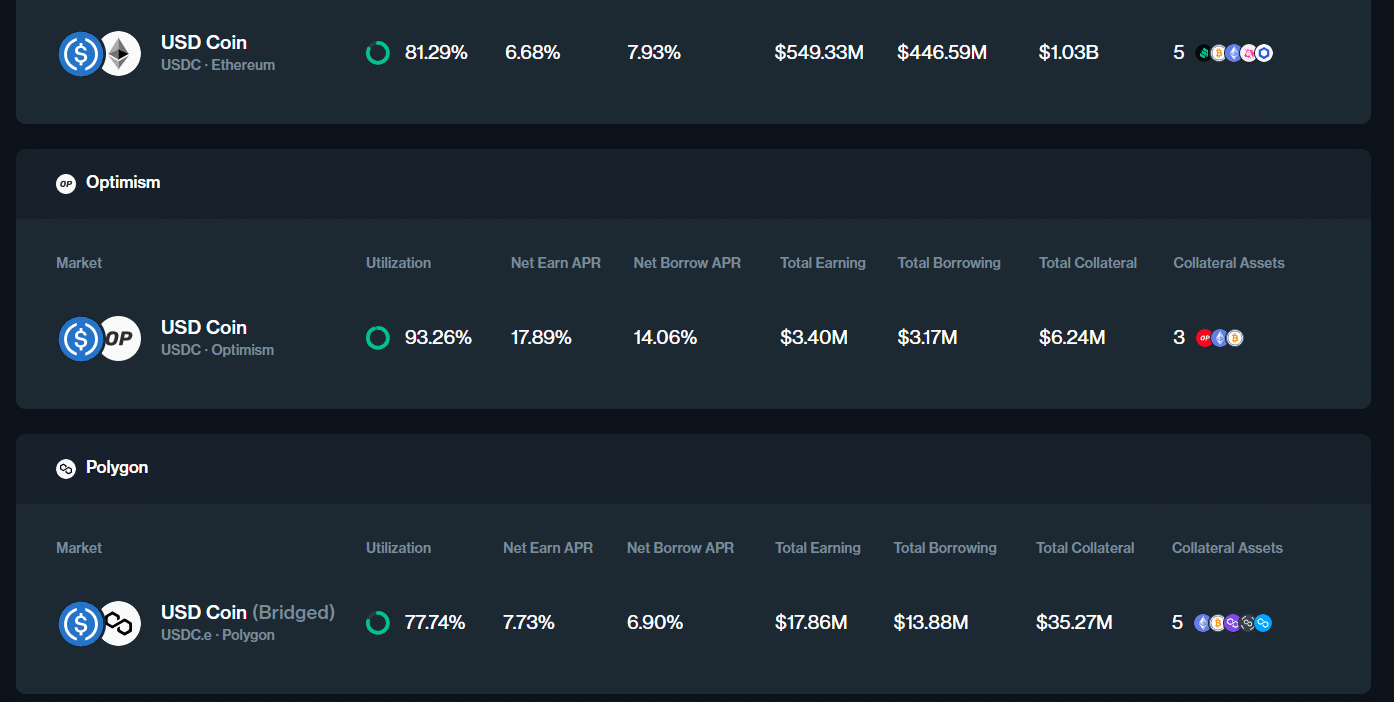

Crypto holders can lend to these platforms and earn interest rates ranging from 0.01% to over 15%.

For example, lending platforms like Aave and Compound currently pay an APY of over 6.6% for USDC deposits. Elsewhere, traditional high-yield savings accounts pay up to 5.25% APY. Compound offers even higher APY figures for USDC tokens on other chains, such as Cosmos or Near.

Source: Compound

6. DeFi Yield Farming

Yield farming is an umbrella term covering all DeFi sector yield opportunities. It includes lending and liquidity mining on DEXs, but there is more to it.

Yield farming is a DeFi strategy aiming for the best market yields across multiple decentralized apps (dapps). Typically, yield farming involves depositing tokens on DeFi apps, including yield protocols, lending apps, and DEXs, and earning rewards in governance or other types of tokens.

Some DeFi apps, such as Convex, Pendle, Yearn Finance, or Aura, specialize in yield opportunities. These apps pay users rewards for staking or locking tokens on their platforms.

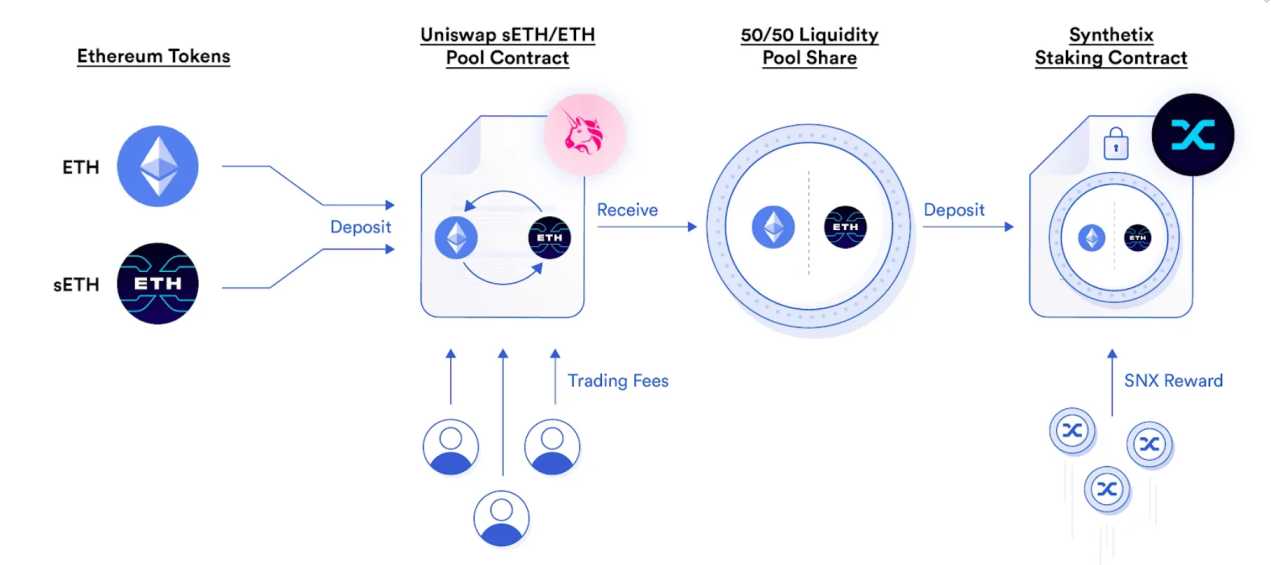

Some dapps, like Synthetix, pay rewards for staking LP tokens of other dapps on their smart contracts.

Source: ChainLink

You can combine various yield strategies in DeFi for potentially more significant returns. For example, you can use a liquid restaking platform like Ether.fi to maximize PoS staking while using liquid restaking tokens to explore additional yield opportunities.

7. Presales

Crypto holders can become early investors in new projects by participating in their presale events. If you have a strong intuition, you can browse multiple fresh crypto projects and invest in them before their tokens become public.

There is a chance that these new coins will see their prices rise once they’re listed on major exchanges, but that’s not always the case. Only a handful of tokens succeed, and you must do due diligence to filter the best crypto projects because there are many scams.

You can search for new presales on social media channels like X, Discord, or Reddit and on dedicated crypto launchpads. Coinlaunch has a decent dashboard to track upcoming and active sales, but you should do your own research.

Recap

Let’s review what we have learned!

FAQs

Can you actually make money from crypto?

Yes, there are several ways to make money from cryptocurrency. These include investing, trading, staking, mining, and yield farming.

How do you make money with crypto?

The most straightforward approach to making money with crypto is to buy digital assets on centralized exchanges and profit from their price appreciation, although you should consider their extreme volatility. The safest way to generate a return is to lend stablecoins for interest.

How can beginners generate returns with crypto?

Beginners can generate returns with crypto by starting with lower-risk activities like staking, which offers rewards for securing a network, or hodling, which involves buying and holding crypto assets long-term. It’s recommended that beginners invest an amount they can afford to lose, irrespective of the investment strategy.

Are there low-risk crypto passive income opportunities?

There are lower-risk crypto passive income opportunities, such as staking or lending on decentralized platforms. Depending on the asset and platform, these offer interest returns with varying degrees of risk.

🍒 tasty reads

Aerodrome (AERO) For Beginners: The Ultimate 2024 Guide

Here’s How DEXTools (DEXT) Works in 2024

What Is Jasmy Coin and How Does It Work in 2024?

5 Best Crypto Arbitrage Scanners of 2024

Anatol Antonovici

6+ years of experience writing for crypto brands and blockchain firms, including Coindesk, Cointelegraph, Bitcoinist, CryptoPotato, Algorand, and OTCTrade.com