In this guide, we’ll review the best 9 cryptos to stake in 2024. A few great cryptocurrencies to stake include Ethereum (ETH), Cardano (ADA), Solana (SOL), Avalanche (AVAX) and Injective (INJ).

Written by: Anatol Antonovici | Updated December 28, 2023

Reviewed by: Mike Martin

Fact checked by: Ryan Grace

Staking refers to locking up cryptocurrencies to help secure a blockchain. In return for staking eligible coins, participants earn rewards in the form of APR.

Table of Contents

🍒 tasty takeaways

Staking is a feature unique to Proof of Stake blockchains. Stakers help networks achieve decentralization and maintain security.

The most popular cryptocurrencies for staking are Ethereum, Solana, and Cardano, with an aggregate staking market cap of $97 billion.

The annual percentage yield (APY) of the top staking coins ranges between 3% and 20%.

- To get the best staking rates, stake through DeFi with the tastycrypto wallet. tastycrypto offers self-custody wallets in the form of mobile apps and a browser extension.

Summary

| Name (Symbol) | Market Cap Rank | Amount Staked | APR Range |

|---|---|---|---|

| Ethereum (ETH) | #1 | $60 billion | 3.50% - 4% |

| Cardano (ADA) | #8 | $23.9 billion | >3% |

| Solana (SOL) | #6 | $4.6 billion | ~7% |

| Avalanche (AVAX) | #13 | $4.5 billion | 8.5% |

| Injective (INJ) | #46 | $44 million | ~19% |

| Kava (KAVA) | #69 | $103 million | >20% |

| Polkadot (DOT) | #15 | $3.88 billion | >14% |

| Cosmos (ATOM) | #20 | $2.32 billion | 14.5% |

| Near Protocol (NEAR) | #33 | $1.17 billion | 8% |

What Is Crypto Staking?

Staking offers a passive income opportunity for cryptocurrency holders. It applies to blockchain networks using the Proof of Stake (PoS) consensus mechanism, which validates transactions in a decentralized way. PoS emerged as an alternative to Bitcoin’s Proof of Work (PoW) model, where miners expend significant computing power to solve complex puzzles for block validation and earning rewards.

When staking, you typically lock a certain amount of the native cryptocurrency in a crypto wallet for a specified period. This process is similar to depositing funds in a high-yield savings account. However, in the context of a PoS blockchain, staking plays a crucial role in supporting the network’s operations and ensuring its security.

How Much Can You Earn Staking Crypto?

Staking can generate an annual percentage rate (APR) ranging between 1.5% and 30%. Staking Rewards is a good resource to monitor the reward rates of each PoS cryptocurrency.

However, the net profits are influenced by the price fluctuation of the native coin, which can go either way during the staking process.

How Do You Stake Crypto?

There are three primary ways to stake cryptocurrency:

1. Run a Node

You can seek higher rewards by becoming a full validator and operating a node, but this requires some technical knowledge.

2. Stake Through a CEX

If you hold cryptocurrency on a CEX like Coinbase, Binance, or Kraken, you can stake some coins directly through their platforms.

3. Stake in DeFi

If you have a self-custody wallet like tastycrypto, you can stake your cryptocurrency directly through a decentralized finance (DeFi) protocol by joining a staking pool. Some popular staking protocols include Lido, Rocket Pool, and StakeWise.

Staking rewards and conditions differ from case to case, and it’s recommended to do some research before building a staking portfolio.

Top Cryptocurrencies for Staking

Here are the most popular and reliable cryptocurrencies for staking:

1. Ethereum

- Symbol: ETH

- Market Cap Rank: #1

- Total Staked: $60 billion

After switching from a PoW to a PoS algorithm, Ethereum has become the most popular cryptocurrency for staking. At the time of writing, over $60 billion worth of ETH is locked for staking, translating into 23% of the entire supply.

The network requires full validators to lock at least 32 ETH to stake, which is the equivalent of $69,000 in today’s prices. However, this is not a problem since you can stake with pools and pay a small fee.

Decentralized liquid staking pools, such as Lido, are a popular alternative for many as very little crypto is needed to stake. These pools allow users to lock in their ETH in exchange for an equivalent amount of derivative tokens.

These derivative tokens, known as Liquid Staking Tokens (LSTs), can later be utilized within the decentralized finance (DeFi) ecosystem to access further yield-generating opportunities, potentially leading to additional returns.

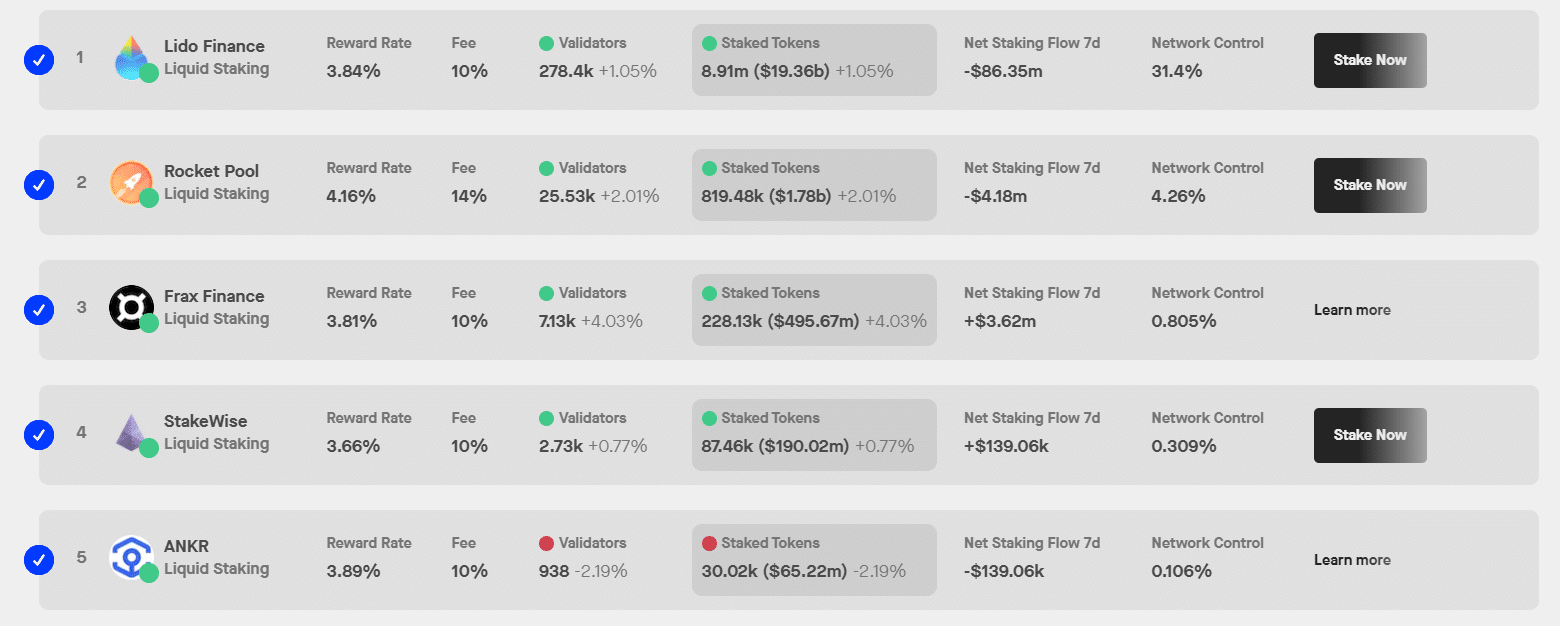

Lido is the largest ETH pool and DeFi protocol, with about $20 billion worth of ETH currently being staked. Rocket Pool comes in second.

Source: StakingRewards

Today, you can expect an APR of 3.50% to 4% for staking ether (ETH).

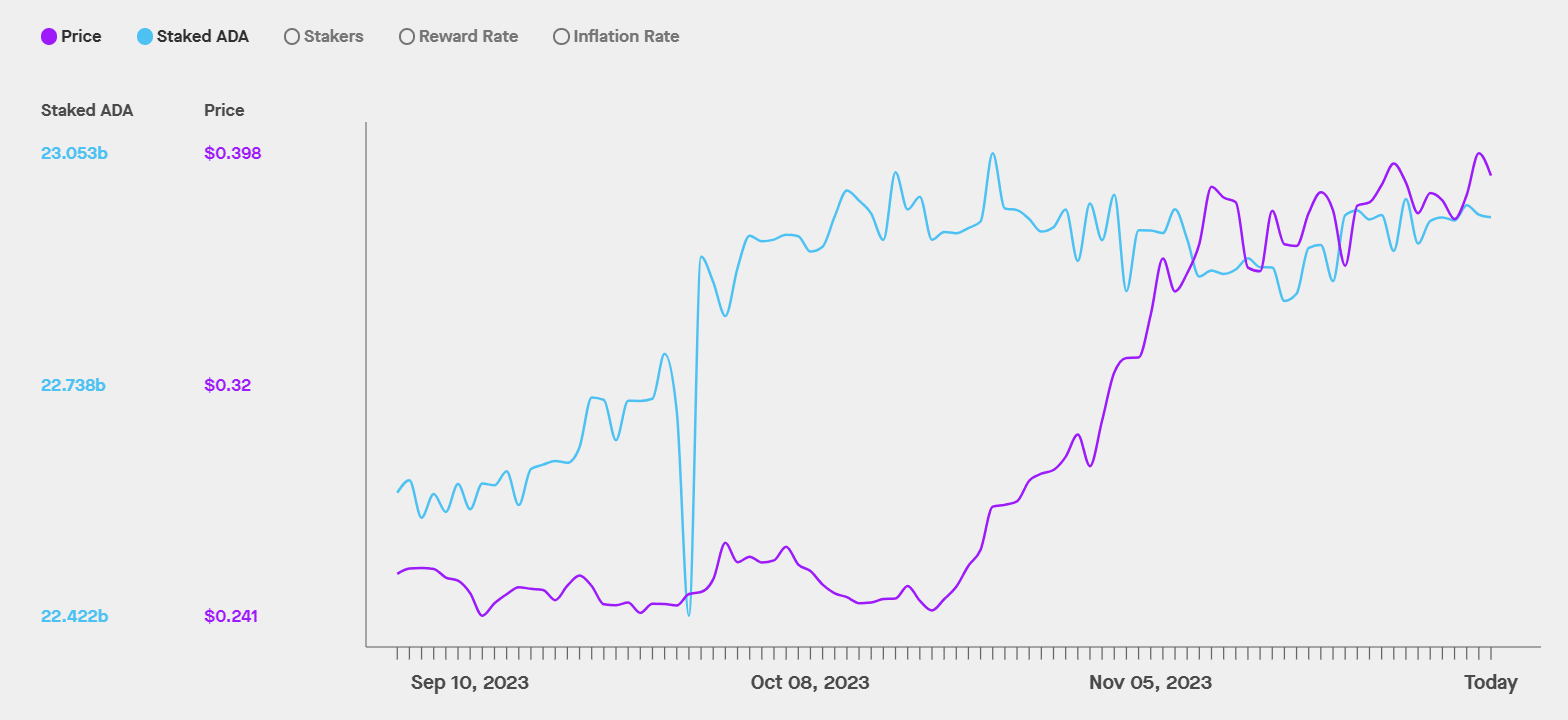

2. Cardano

- Symbol: ADA

- Market Cap Rank: #8

- Total Staked: $23.9 billion

Cardano is a popular staking option because it doesn’t require ADA holders to lock their crypto. You can stake ADA by choosing one of more than 5,000 pools and earn rewards of over 3%.

Thanks to the generous conditions and ADA’s relatively stable price, over 65% of ADA’s supply is currently staked. The staking ratio is more than three times higher than that of Ethereum.

Source: StakingRewards

3. Solana

- Symbol: SOL

- Market Cap Rank: #6

- Total Staked: $4.6 billion

Solana is a popular PoS blockchain built for efficiency and high-speed transactions. The minimum required amount for staking is only 0.01 SOL.

Solana’s almost 70% staking ratio is even higher than Cardano’s, with stakers targeting a generous return rate of about 7%.

4. Avalanche

- Symbol: AVAX

- Market Cap Rank: #13

- Total Staked: $4.5 billion

Avalanche is a scalable PoS network that relies on a unique infrastructure consisting of three different chains. Staking occurs on the so-called Platform Chain (P-Chain), which is responsible for coordinating validators and managing subnetworks.

AVAX stakers can expect an APR of over 8.5%. This generous return explains Avalanche’s staking ratio of over 55%, as more than $5 billion worth of AVAX is locked on P-Chain.

5. Injective

- Symbol: INJ

- Market Cap Rank: #46

- Total Staked: $44 million

Injective is a layer 1 chain that lets users build DeFi Web3 apps. By leveraging artificial intelligence (AI) and auto-executing smart contracts, it offers unique DeFi products directly on-chain, including cross-chain margin trading.

The network relies on a Delegated Proof of Stake (DPoS) algorithm that offers a generous reward rate of over 19%.

6. Kava

- Symbol: KAVA

- Market Cap Rank: #69

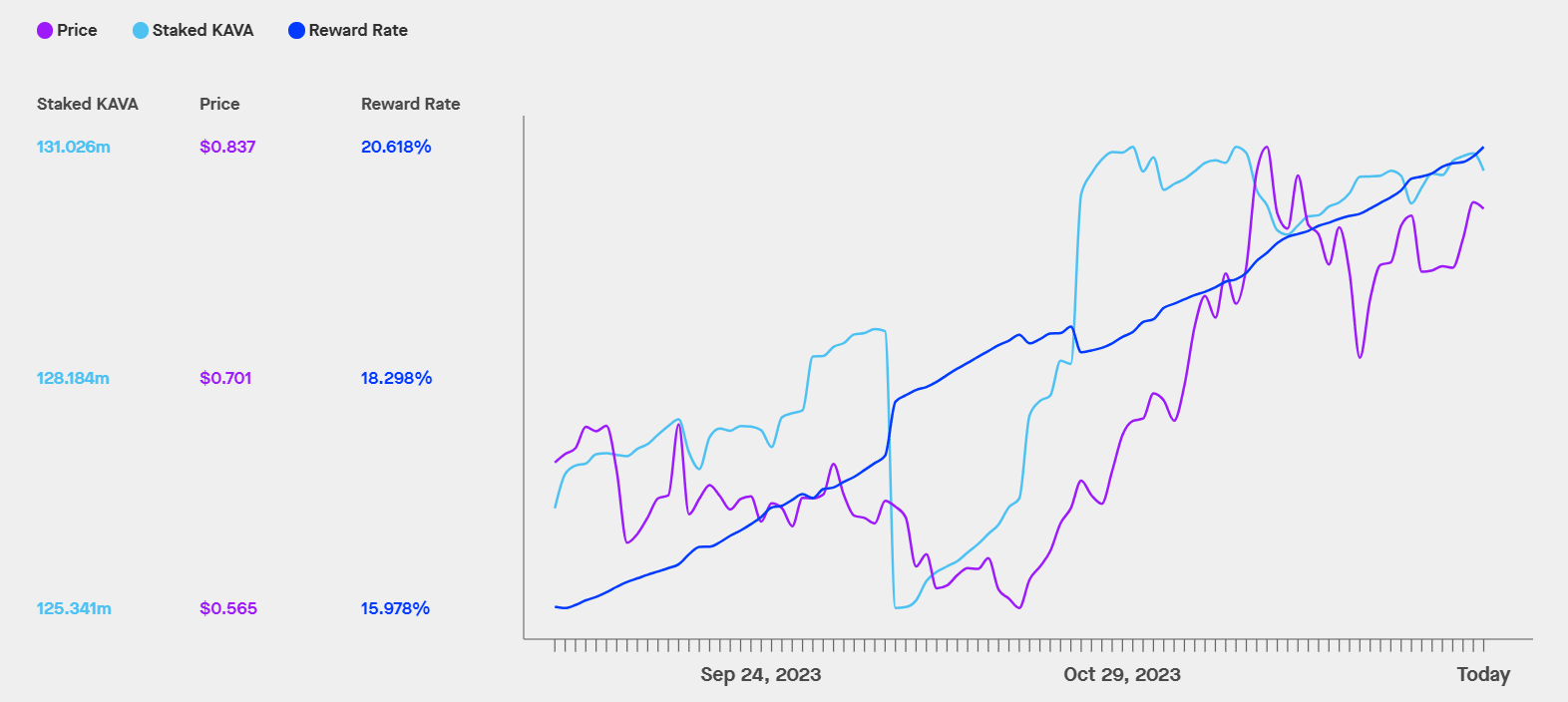

- Total Staked: $103 million

KAVA is a small-cap cryptocurrency supporting the DeFi-oriented Kava Chain – a layer-1 solution built with the Cosmos SDK and compatible with Ethereum.

KAVA staking has risen in popularity, offering rewards that exceed 20%. This is further appealing due to the coin’s 23% price increase in the last three months. However, to receive these rewards, KAVA must be staked for 365 days.

Source: StakingRewards

7. Polkadot

- Symbol: DOT

- Market Cap Rank: $15

- Total Staked: $3.88 billion

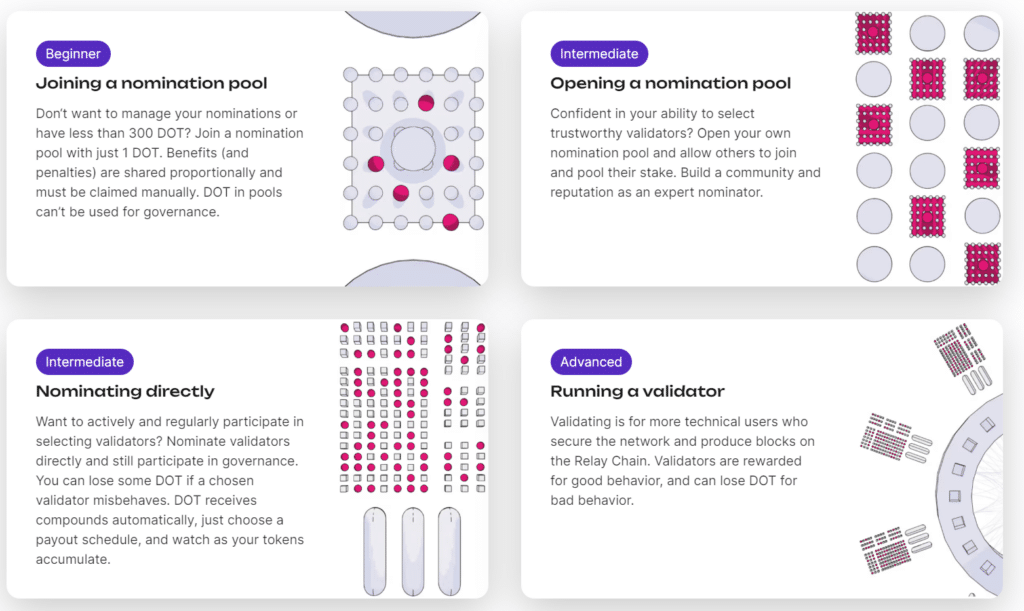

Polkadot is a blockchain that uses Nominated Proof of Stake (NPoS), which relies on nominators and validators to secure the network. It was built to achieve interoperability, enabling users to create their own chains on top of it.

About half of DOT tokens, or $3.85 billion, are currently staked. The APR of DOT staking exceeds 14%.

There are four ways to stake DOT:

- Joining a nomination pool

- Opening a nomination pool

- Nominating validators directly

- Running a validating node.

Cosmos is another blockchain ecosystem built for interoperability. It represents a decentralized network of independent parallel chains that empower DeFi and Web3 apps. It also offers an open-source framework to build layer 1 chains. For example, Injective and Kava have been built using Cosmos SDK tools.

The Cosmos Hub is the native chain of the Cosmos ecosystem. It uses the native ATOM coins to reward stakers. Cosmos offers an attractive reward rate of over 14.5%.

9. Near Protocol

- Symbol: NEAR

- Market Cap Rank: #33

- Total Staked: $1.17 billion

Near Protocol is an Ethereum-like blockchain that focuses on scalability and user-friendliness. It uses a sharded architecture to achieve higher transaction speeds and throughput.

NEAR stakers aim for an APR of 8%, which makes it even more attractive after the coin’s 100% price increase since October.

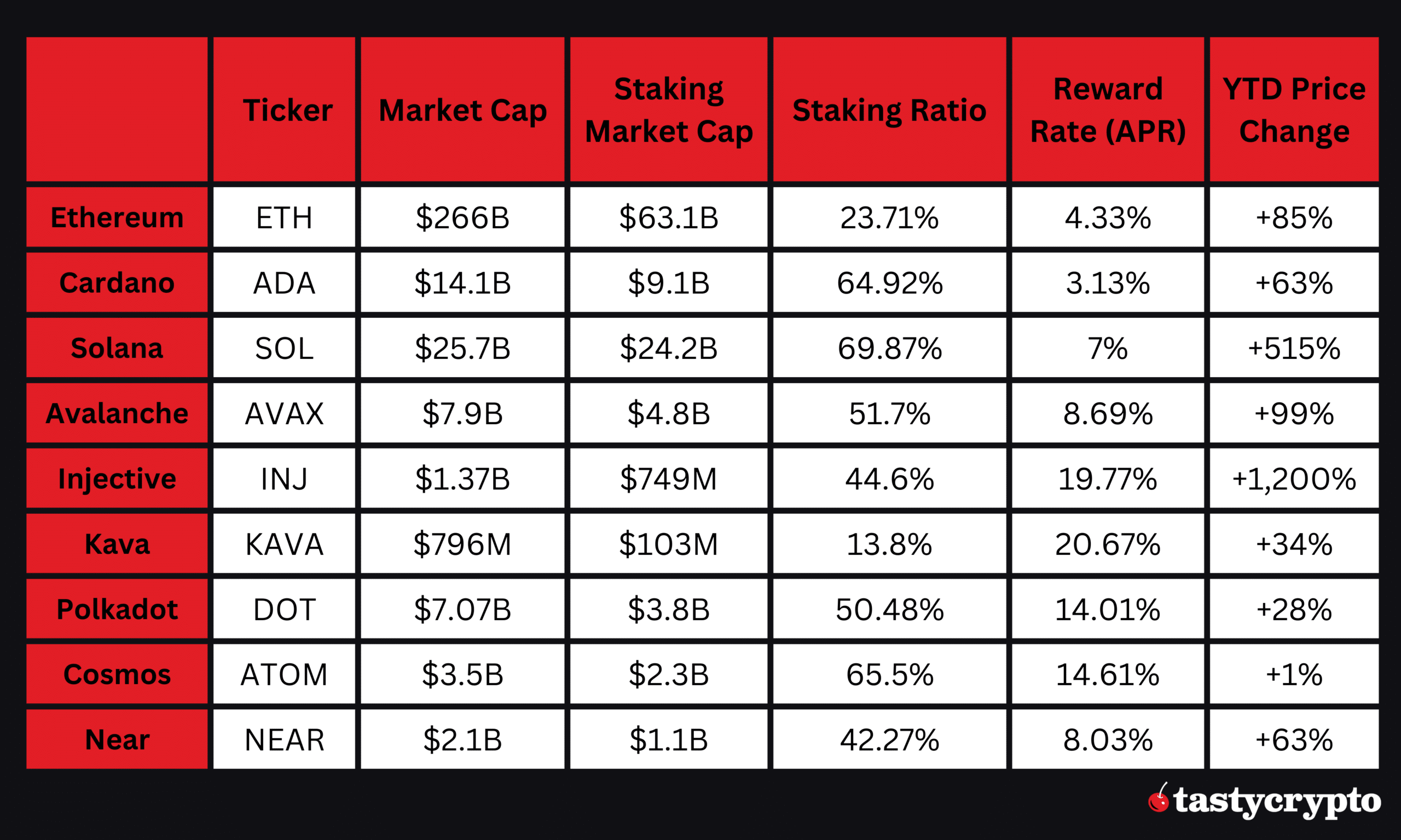

Best Cryptos for Staking: Comparison

Here is a quick comparison of the best crypto coins for staking:

Stake Your Crypto With Self-Custody

When you stake your crypto in a self-custody wallet, you don’t have to trust that an exchange is acting in your best interest. This is because you are the only party privy to your private key, or seed phrase.

Here are some additional benefits you get when you choose to self-custody your digital assets with tastycrypto:

- In-App Swap: Trade BTC, ETH, and 1,000+ tokens

- Generate Yield in DeFi: Stake, lend, and become your own market maker

- NFTs: Buy, sell, and view NFTs in-app

tastycrypto offers both iOS and Android self-custody wallets – download yours today! 👇

FAQs

Staking is a passive income opportunity offered by Proof of Stake (PoS) blockchains. Stakers lock an amount of the native cryptocurrency for a certain period to earn rewards. Staking helps to secure a blockchain.

It’s recommended to look for large-cap and medium-cap staking cryptocurrencies with high trading volumes. Generally speaking, coins that offer the highest staking rewards are also the most volatile.

Some of the best staking coins are Ethereum, Solana, and Cardano. They represent large markets and offer considerable staking returns.

For beginners, the easiest way to stake cryptocurrencies is to stake in DeFi through staking protocols with self-custody wallets like tastycrypto or stake on crypto exchanges like Coinbase and Binance.

🍒 tasty reads

The Core Blockchain and DeFi Ecosystem: What You Need to Know

7 Best DePIN Crypto Projects

What Is Symbiotic and How Does It Work in 2024?

Ethereum vs Ethereum ETFs – 5 Major Differences

Anatol Antonovici

6+ years of experience writing for crypto brands and blockchain firms, including Coindesk, Cointelegraph, Bitcoinist, CryptoPotato, Algorand, and OTCTrade.com