The best crypto arbitrage scanners of 2024 are Cryptohopper, Arbitragescanner.io, Coinrule, Bitsgap, and Algory.io. These tools help traders find price discrepancies across exchanges, making arbitrage trading more efficient.

Written by: Anatol Antonovici | Updated June 17, 2024

Reviewed by: Mike Martin

Fact checked by: Ryan Grace

Crypto arbitrage is one of the few active trading strategies that minimizes volatility risks. In this post, we discuss the 5 best arbitrage scanners that greatly improve arbitrage trading.

Table of Contents

🍒 tasty takeaways

Crypto arbitrage is a strategy where traders buy low on one exchange and sell high on another to profit from price discrepancies

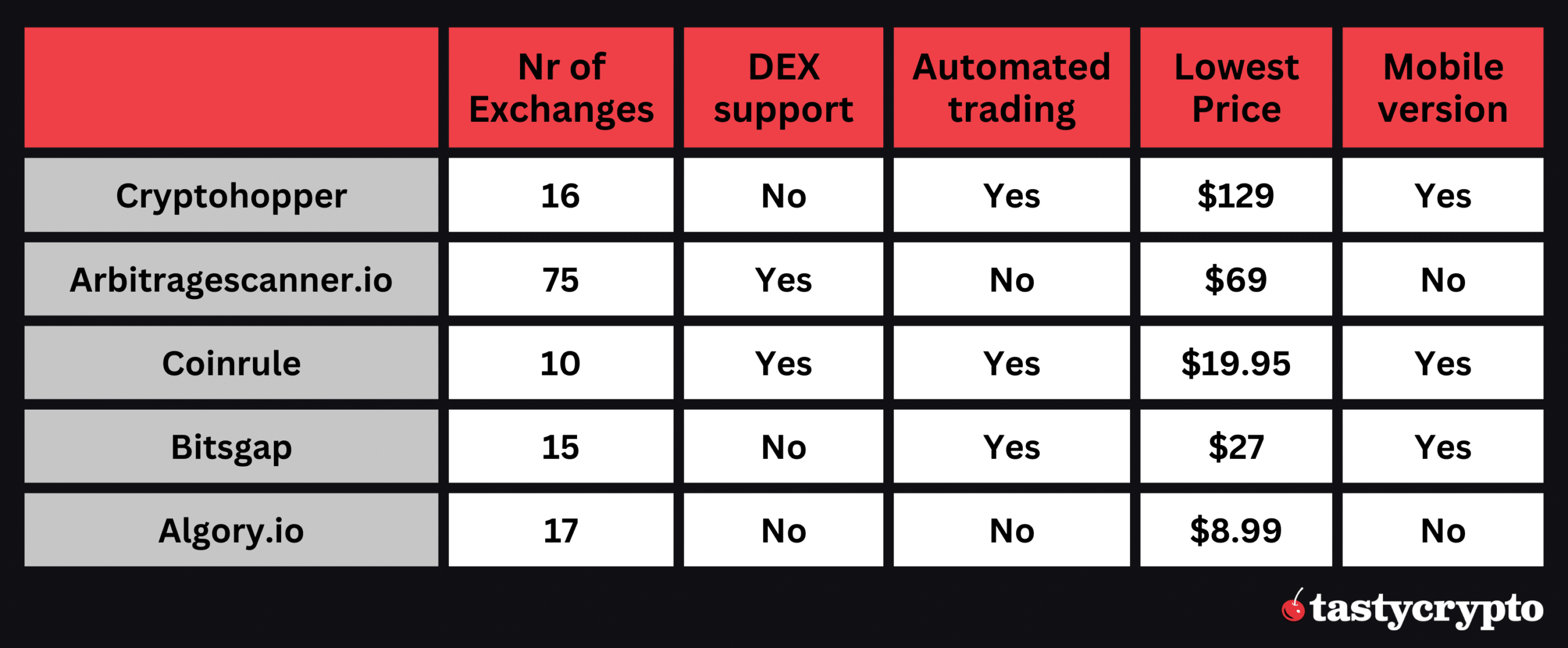

Today’s best crypto arbitrage scanners are Cryptohopper, Arbitragescanner.io, Coinrule, Bitsgap, and Algory.io.

Some of these tools, such as Cryptohopper, offer automated trading bots.

Summary

| Protocol | Details |

|---|---|

| Cryptohopper | Popular trading bot offering arbitrage strategies, supports 16 major exchanges, includes AI-powered bots. |

| Arbitragescanner.io | Specialized tool for arbitrage opportunities, supports 75 exchanges and 20 blockchain networks. |

| Coinrule | Automated strategy platform with advanced trading bots, supports major exchanges, offers demo trading. |

| Bitsgap | Trading bot platform with algorithmic orders and portfolio management, supports 15 crypto exchanges. |

| Algory.io | Crypto scanning tool for analyzing markets, supports 17 exchanges, offers custom scanners with 100 filters. |

What Is Arbitrage in Crypto?

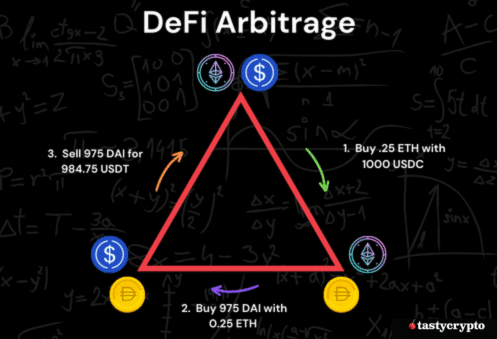

Arbitrage is an old method of making profits from price discrepancies across different marketplaces, and this technique has been brought to the crypto market.

Any major cryptocurrency, such as Bitcoin (BTC) or Ether (ETH), can be traded on multiple crypto exchanges, and its price slightly differs from platform to platform, opening the door to arbitrage opportunities.

Traders can buy crypto on one exchange and immediately sell it for a higher price on another exchange, making a profit without exposing themselves to volatility risks.

Since price discrepancies are usually very small, arbitrage trading is suitable for experienced traders with hefty deposits.

What Are Crypto Arbitrage Scanners?

Crypto arbitrage scanners are software apps programmed to monitor crypto exchanges in real-time and identify significant price differences. They can either provide notifications for traders or implement arbitrage strategies on their own based on complex algorithms.

Some apps streamline arbitrage trading, eliminating manual operations and seeking the highest potential returns. Traders don’t have to open accounts on multiple exchanges and can conduct cryptocurrency trading from one place.

Here are the best cryptocurrency arbitrage apps you should check out in 2024:

1. Cryptohopper

Cryptohopper is a popular crypto trading bot that offers arbitrage strategies.

It supports 16 major centralized crypto exchange (CEX) platforms, including Binance, OKX, Coinbase Advanced, and Kraken.

Cryptohopper’s arbitrage scanner tool enables users to seek arbitrage opportunities by selecting exchanges, trading pairs, and profit targets.

The platform supports different types of arbitrage strategies, including triangular arbitrage and cross-chain exchange trading.

The most expensive subscription, ‘Hero’, costs $129 monthly.

Features

- Connects to 16 crypto exchanges, including Binance, Bybit, KuCoin, OKX, Coinbase Advanced, and Kraken.

- Offers AI-powered trading bots.

- Users can create trading bots manually or copy bots.

- Trading terminal and portfolio management solution.

2. Arbitragescanner.io

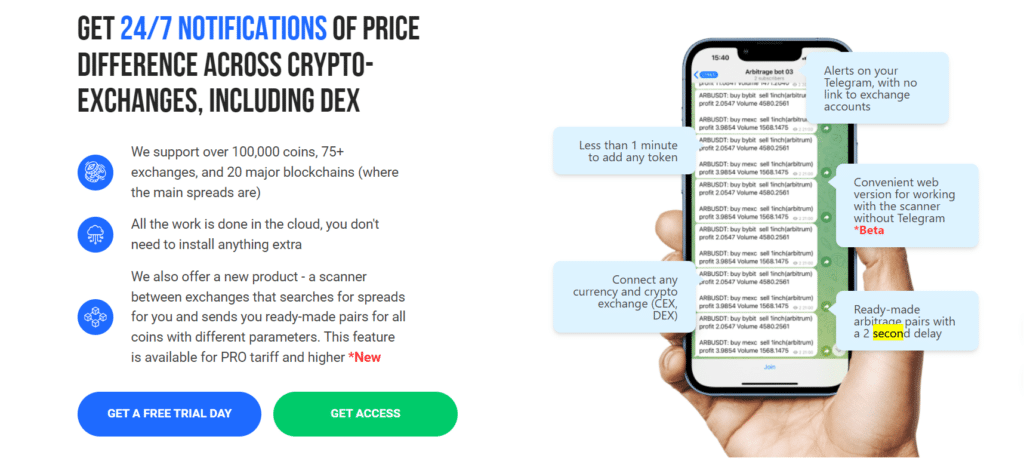

Unlike Cryptohopper, Arbitragescanner is a specialized tool focusing exclusively on exploring arbitrage opportunities.

The platform supports about 75 crypto exchanges, including decentralized exchanges (DEXs) like Uniswap. It also scans data on 20 blockchain networks, including Ethereum, BNB Chain, Arbitrum, Optimism, and Avalanche. This is a key feature, given that many tokens are hosted on multiple chains and behave differently in the short term.

Arbitragescanners claims to support over 100,000 tokens, digital wallets and non-fungible tokens (NFTs).

Source: Arbitragescanner.io

Additionally, the platform offers ArbitrageScanner Message, a service that monitors Telegram and Twitter chats to search for insider information.

Arbitragescanner works as a scanner that notifies users every 4 seconds, although it doesn’t offer automated trading functionality.

Prices start at $69 per month for the basic subscription.

Features

- Connects to 75 crypto exchanges, including DEXs. It also supports 20 chains, digital wallets, and NFTs.

- Provides notifications every 4 seconds.

- Offers guidance for beginners.

3. Coinrule

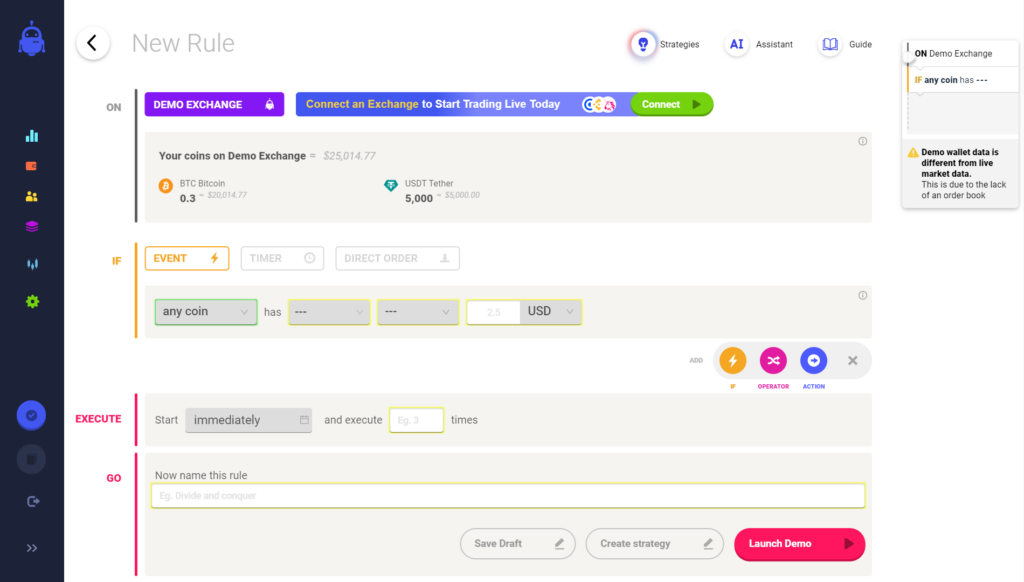

Coinrule is an automated strategy platform offering arbitrage tools. It lets users buy and sell crypto assets on cryptocurrency exchanges through its advanced trading bots.

Users can create bot strategies and configure rules that use “if this, then that” logic” to trigger predetermined actions when certain events occur. Users can run demo trades to test their trading strategies.

Source: CoinRule

Prices start at $19.95 monthly for 7 live rules, 40 template strategies, and 3 connected exchanges.

Features

- Supports major exchanges like Binance, Coinbase, Crypto.com, KuCoin, and OKX.

- Enables users to build automated trading bots by defining multiple rules.

- Demo account for testing strategies.

4. Bitsgap

Bitsgap is a crypto trading bot platform offering algorithmic orders, portfolio management, and demo trading.

While Bitsgap doesn’t offer specialized arbitrage bots, users can easily switch between 15 crypto exchanges, scan prices, and open orders from a single terminal.

Bitsgap is used by over 600,000 traders worldwide, processing almost $660 billion in trading volume.

Prices start at $27 per month for the basic plan.

Features

- Supports 15 crypto trading platforms, including Binance, Bitget, Coinbase, Crypto.com, KuCoin, OKX, and Huobi.

- Enables users to build automated trading bots, including GRID and DCA bots.

- Demo account for testing strategies.

5. Algory.io

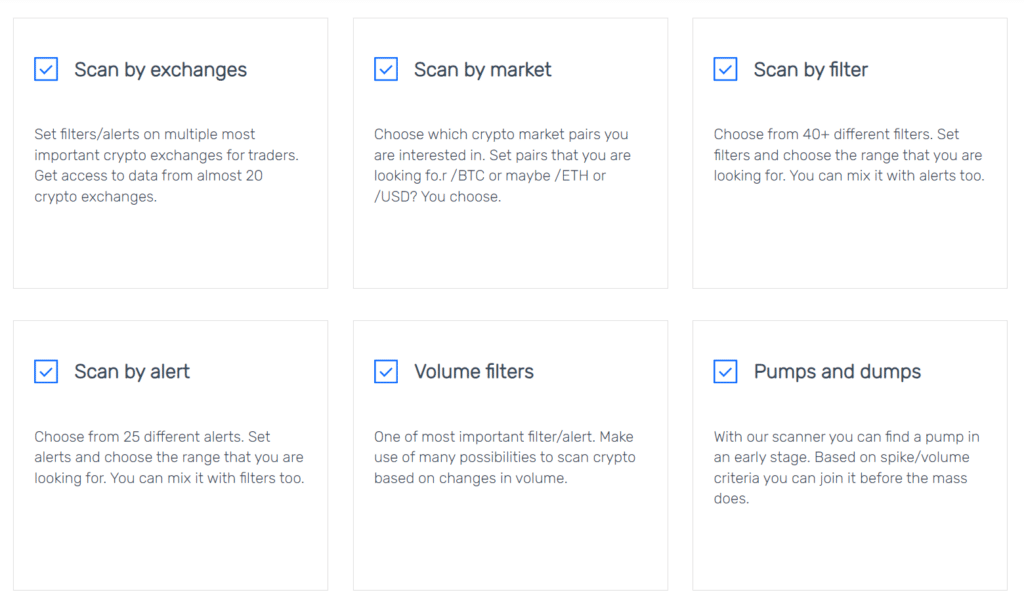

Algory is a crypto scanning tool that analyzes the crypto market from different perspectives. Arbitrage traders can use it to scan prices across multiple crypto exchanges, but they must open positions manually on each exchange.

Users can build custom scanners across 17 crypto exchanges, using 100 different filters and alerts on metrics like volume, volatility, or liquidity. The scanners can monitor cryptocurrency markets in real-time.

Source: Algory

The basic subscription costs only $8.99 per month.

Features

- Supports 17 crypto exchanges and over 1,000 digital assets.

- The news streamer feature monitors thousands of news and social media sources.

- Users can create custom scanners with over 100 filters.

Arbitrage Scanner Summary

FAQs

What is crypto arbitrage?

Crypto arbitrage is a trading strategy that leverages price discrepancies on different exchanges. Traders buy crypto on one exchange and immediately sell it on another exchange with higher prices.

What are crypto arbitrage scanners?

Crypto arbitrage scanners are software tools that monitor multiple cryptocurrency exchanges in real time to identify and notify traders of price discrepancies that can be exploited for arbitrage opportunities.

What are the best crypto arbitrage scanners?

The best crypto arbitrage scanners of 2024 include Cryptohopper, Arbitragescanner.io, Coinrule, Bitsgap, and Algory.io.

Does crypto arbitrage work?

Crypto arbitrage works mainly during periods of high volatility, but traders should be ready to offset gas fees and potential price slippage.

🍒 tasty reads

The Core Blockchain and DeFi Ecosystem: What You Need to Know

7 Best DePIN Crypto Projects

What Is Symbiotic and How Does It Work in 2024?

Ethereum vs Ethereum ETFs – 5 Major Differences

Anatol Antonovici

6+ years of experience writing for crypto brands and blockchain firms, including Coindesk, Cointelegraph, Bitcoinist, CryptoPotato, Algorand, and OTCTrade.com