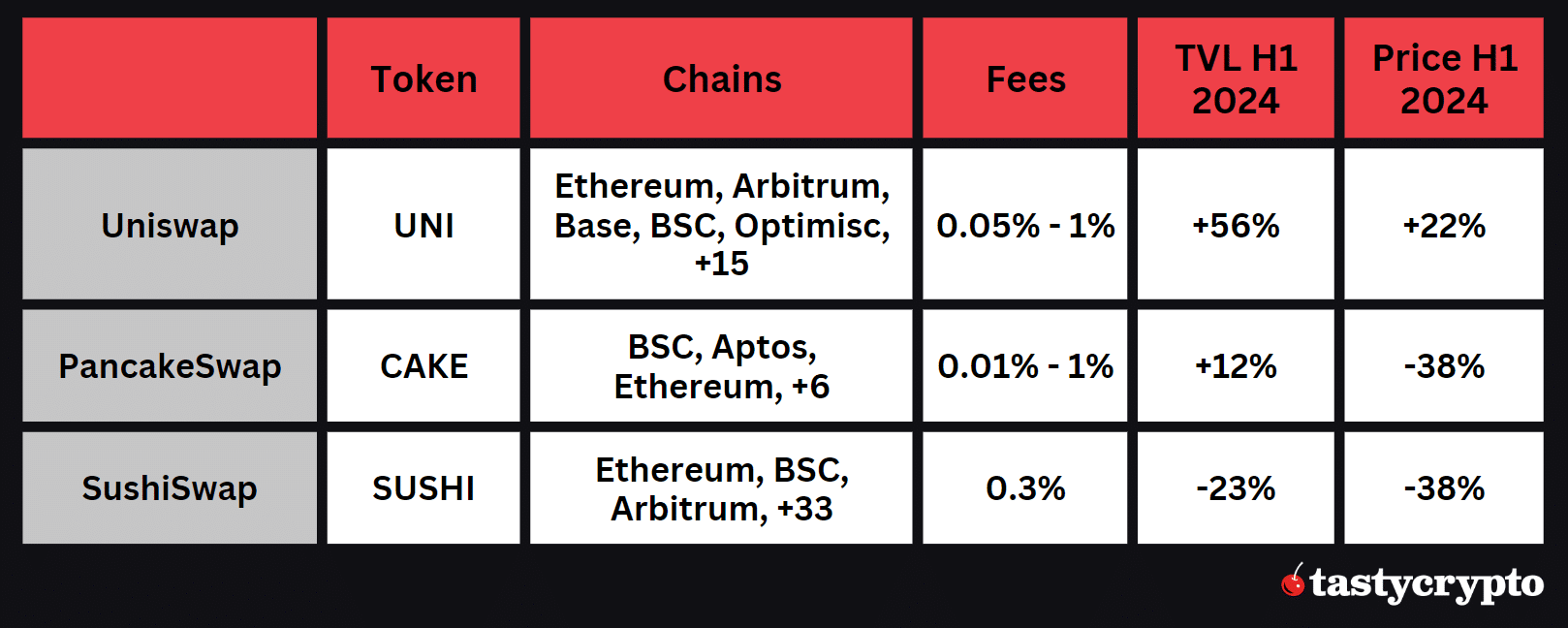

Uniswap is the largest overall DEX while PancakeSwap is the most popular DEX for the Binance blockchain. SushiSwap allows trading on more than 20 blockchains.

Written by: Siyu Ren Heinrich | Updated June 28 2024

Reviewed by: Mike Martin

Fact checked by: Ryan Grace

Uniswap, SushiSwap, or PancakeSwap: which is best for you? In this article, we’ll stack these DEX juggernauts side-by-side!

Decentralized exchanges (DEXs) operating as Automated Market Makers (AMMs) are the most significant decentralized finance (DeFi) platforms in existence. In this article, we examine what makes three of the most popular DEXs (Uniswap, SushiSwap, and PancakeSwap) special and compare their key features.

🍒 tasty takeaways

Uniswap is the leading DEX in terms of various metrics such as market cap, TVL, and monthly volume.

SushiSwap and PancakeSwap offer many innovations and create their own ecosystems.

All three protocols are considered safe and trustworthy – although SushiSwap has had some questionable activity in the past.

The swapping fees vary from 0.05% to 1%; users also need to pay gas fees for the blockchain network they use.

Summary

| Platform | Description | Key Features | Security | Token |

|---|---|---|---|---|

| Uniswap | Decentralized cryptocurrency exchange for exchanging ERC-20 Tokens on the Ethereum blockchain. Also runs on Arbitrum, Optimism, and Polygon blockchains. | Swap feature, Trade NFTs, Liquidity pools. | Publicly viewed core smart contracts, multiple security audits, internal code reviews, bug bounty program. | $UNI token: Governance token for the platform. Introduced in 2020. Max supply capped at 1 billion tokens. |

| SushiSwap | Fork of UniSwap enabling users to trade over 400 tokens on more than twenty blockchains. Also provides lending, borrowing, and leverage services. | Swapping of crypto assets, Kashi, Onsen, Miso, Trident, Furo. | Open-source, community-driven, multiple audits and reviews. | $SUSHI token: ERC-20 governance token. Can be bought or earned on the platform. Max supply capped at 250 million tokens. |

| PancakeSwap | Largest DEX on BNB Smart Chain with varying fee tiers. | Spot trading, Yield farming, Syrup Pools, Prediction market, Lottery, Perpetual futures trading, Initial farm offering (IFO), NFTs trading. | Public code and smart contracts, multiple security audits, contracts verified on BscScan. | $CAKE token: BEP20, ERC-20, and Aptos Mainnet token. Max supply capped at 750 million tokens. |

What is Uniswap?

Launched in 2018, Uniswap is the leading decentralized cryptocurrency exchange for exchanging ERC-20 Tokens on the Ethereum blockchain. Uniswap also runs on the Arbitrum, Optimism, Base, Avalanche, BSC, Polygon, and 13 other blockchains.

📚 Read: Arbitrum vs Optimism vs Polygon: Which is Best?

This protocol has undergone numerous updates since it was created and is currently in version V3. Uniswap charges users fees between 0.05% and 1%.

Uniswap Key Features

Swap feature: enables users to buy and sell crypto assets on multiple blockchains.

Trade NFTs: Uniswap aggregates NFTs from several marketplaces which users can buy and sell.

Liquidity pools: Uniswap allows users to choose from a list of existing pools as well as create new pools. Users can select the fees and set price ranges to concentrate capital where they believe it will generate the highest return.

Uniswap Security

All of Uniswap’s core smart contracts can be publicly viewed in the Uniswap V3 Github.

The Uniswap platform undertakes internal code reviews and has had multiple security audits facilitated by external companies – the most recent one we are able to find was from March 2021. Mostly minor issues were found. Uniswap also has a bug bounty program which helped solve some critical issues in the past.

Uniswap Token $UNI

The $UNI token is an ERC-20 token that acts as a governance token for the platform and gives token holders the right to vote on developments and changes to the platform, including the DEX’s fee structure. $UNI was introduced in 2020 in an effort to prevent users from migrating to SushiSwap. Hard capped at 1 billion tokens, the max supply of UNI will be reached in late 2024.

What is SushiSwap?

SushiSwap is a fork of UniSwap that enables users to buy and sell over 400 tokens on more than twenty different blockchains. Next to trading, users can also use SushiSwap to earn, stack yields, lend, borrow, and leverage. SushiSwap’s trading fee is 0.3%, and users also need to pay network transaction fees (gas fees).

SushiSwap Key Features

Swapping of crypto assets through an automated market maker.

Kashi: a decentralized lending market that enables users to borrow and lend into already existing pairs or to create their own.

Onsen: lets users earn fees and rewards by staking their assets.

Miso: a collection of open-source smart contracts that enable users to launch new projects on SushiSwap.

Trident: an automated market maker framework for creating custom AMMs.

Furo: a solution for the automated distribution of tokens over a set amount of time with the ability to vest and withdraw tokens.

SushiSwap Security

SushiSwap is very community driven and open-source with all code being accessible on SushiSwap’s Github.

The SushiSwap DEX works with various crypto security platforms to conduct audits and reviews. Examples are Quantstamp’s security review (the original page is gone but there is a saved version on archive.org), a PeckShield audit, and a Certik review. In general, these reviews are positive. Some issues were found, but no critical ones. However, it should be noted that all of these audits took place in 2020 and 2021 respectively.

In this context, an episode from SushiSwap’s past should also be briefly mentioned.

In September 2020, one of the anonymous developers stole several million USD in $SUSHI tokens from development funds, only to transfer them back a few weeks later after an outcry from the community. However, this incident brought about an improvement. The users then chose nine representatives to be the keyholders for a multi-sig wallet for SushiSwap’s funds.

SushiSwap Token $SUSHI

SushiSwap’s token $SUSHI is an ERC-20 token used to govern the protocol. Token holders can vote on future platform developments.

$SUSHI can be bought on the open market or earned on the platform by providing liquidity. The token can also be staked to earn additional rewards. $SUSHI is hard capped at 250 million with the max supply to be reached by November 2023.

SushiSwap Misc

SushiSwap introduced SushiSwap Academy which serves as a guide where users can learn about the protocol and DeFi in general. It’s a great starting point to get a better understanding of the platform and its various functions. In addition, there is a roadmap for Sushi 2.0 in which the developers present their plans for future features and developments in detail.

What is PancakeSwap?

PancakeSwap is one of the largest decentralized exchanges on BNB Smart Chain. The platform has four fee tiers: 0.01%, 0.05%, 0.25%, and 1%.

PancakeSwap Key Features

Spot trading through an AMM.

Yield farming: users earn rewards in the form of $CAKE tokens by becoming liquidity providers for liquidity pools.

Syrup Pools: enable users to pick between flexible and locked staking to earn $CAKE and and other tokens.

Prediction market: users can earn rewards by correctly predicting the next movements of $BNB and $CAKE.

Lottery: users can buy lottery tickets to win prizes.

Perpetual futures trading through PancakeSwaps’s cooperation with ApolloX Finance. The service can be used without a KYC process.

Initial farm offering (IFO): allows users to buy new tokens launching on BNB Smart Chain.

NFTs trading: buying and selling whitelisted and PancakeSwap’s own NFT collections on Binance Smart Chain.

PancakeSwap Security

The code and smart contracts for this DEX are publicly available on PancakeSwap’s Github. The DEX’s contracts are verified on BscScan.

The platform has a page that lists all PancakeSwap security audits undertaken by companies such as Certik. The reviews are very promising – currently, only a few issues are identified and these are not critical.

Another plus: based on the listed audits, the security history of the platform can be understood very well, as reviews are represented from the start of the DEX in 2020 to May 2023.

PancakeSwap Token: $CAKE

The PancakeSwap token $CAKE is a BEP20 (BNB Smart Chain), ERC-20, and Aptos Mainnet token. The max supply is capped at 750 million and is expected to be reached in 2025. According to their Litepaper, this should give the developers of the protocol enough time and resources to achieve the announced goals.

The $CAKE token has different use cases such as voting for proposals, minting NFTs, and participating in lotteries. It can be earned in a variety of ways – such as PancakeSwap’s Yield Farms or Syrup Pools.

Uniswap, SushiSwap & PancakeSwap Metrics

Let’s begin our crypto fundamental analysis with a look at the following key metrics – market cap, total value locked (TVL) in USD, monthly volume in USD, and token price performance.

Market Cap

As of the end of June 2024, the three protocols have the following market caps:

UniSwap: $5.6 billion

SushiSwap: $222 million

PancakeSwap: $573 million.

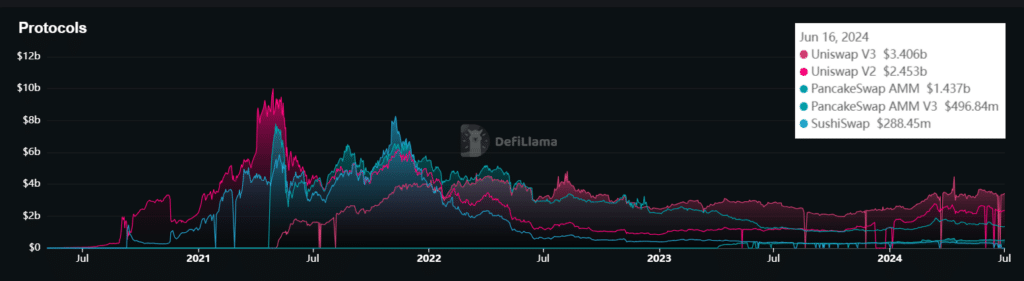

Total Value Locked (TVL)

Total value locked (TVL) represents the sum of all assets deposited in DeFi protocols and thus serves as a gauge of a platform’s fundamental value.

Looking at the last 12 months, the following details stand out:

In general, the DEX TVL has recovered over the last 12 months – from a total of around $15 billion to over $19 billion.

SushiSwap has seen the biggest decline relative to the others.

Uniswap has maintained its leadership position.

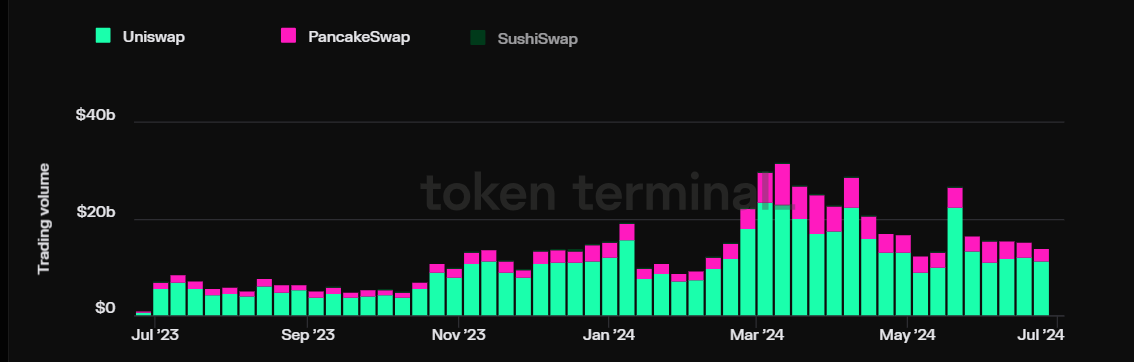

Monthly Trading Volume

Monthly trading volume is an indicator of the health of a decentralized exchange, as it indirectly allows conclusions to be drawn about the number of users and their activities on the platform.

The analysis of the last 12 months allows the following conclusions:

With a combined monthly volume of nearly $122billion in March 2024, Uniswap, SushiSwap, and PancakeSwap surpassed their May 2022 high.

Uniswap’s volume is consistently the highest, while SushiSwap’s volume has corrected so much that it’s not visible on the chart.

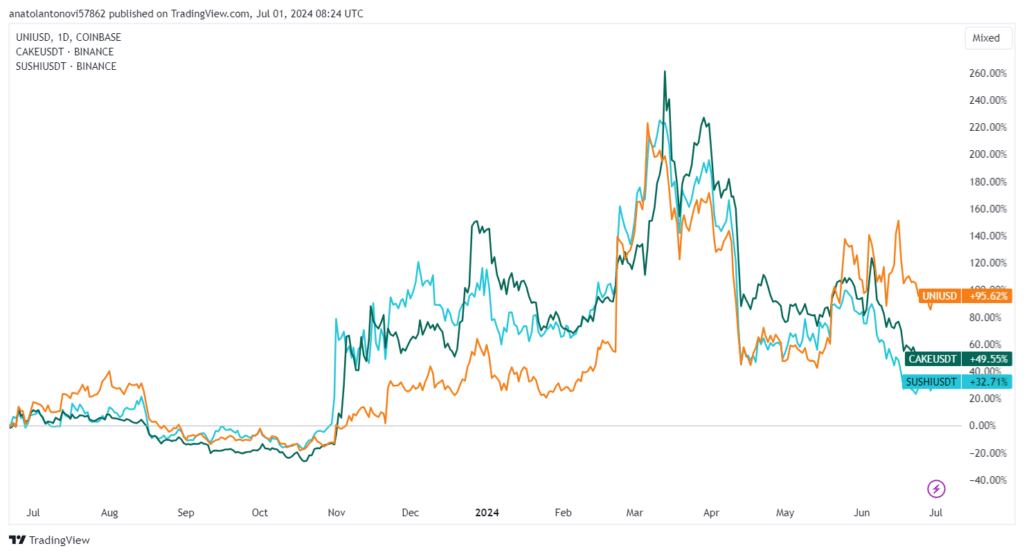

Token Price Performance

The tokens of the three DEXs $UNI, $SUSHI, and $CAKE show an almost identical picture in the last 12 months, although UNI has been the best performed, doubling in price.

Source: TradingView

From the beginning of the end of 2023, all three DEX tokens recorded a sustained price increase that peaked in March 2024.

Uniswap vs. SushiSwap vs. PancakeSwap – Which Should You Pick?

Let’s summarize our findings to see which of the three platforms is the best choice.

In principle, all three platforms are great decentralized exchanges.

As one of the oldest DEXs, Uniswap has the largest market share and a high level of trust from users on Ethereum-based blockchains. It potentially offers the lowest fees and has a straightforward user interface which benefits the user experience. On the downside, Uniswap only offers basic functions such as swapping via an AMM and liquidity pool farming.

SushiSwap and PancakeSwap have shown to be very innovative, offering a broad range of different features. PancakeSwap has proven to be the leading DEX on Binance Smart Chain. SushiSwap, on the other hand, is a true multi-chain solution that serves both Ethereum-based blockchains and other networks such as BSC and Fantom.

So which of the three DEXs is best for you? This will depend mainly on which features you want to use and on which blockchains you want to trade tokens. Before you decide on one, you should also do your own research, as important aspects such as functions and fees can change.

FAQs

Both decentralized and centralized crypto exchanges offer their own advantages and disadvantages. In general, decentralized platforms offer advantages when it comes to questions of anonymity (no KYC process) and the security of user assets. Centralized exchanges such as Binance and Coinbase, on the other hand, often score with the lowest fees and simple use.

The type and number of supported dApps (decentralized applications) and wallets vary depending on the decentralized exchange. In general, all protocols support the most common wallets such as MetaMask or Trust Wallet. Uniswap supports a broad range of different DeFi dApps, integrations, and tools in its ecosystem.

In general, no statements can be made about the future performance of the native tokens of the DEXs. However, a look at the price development over the past few years shows that traders can expect good performance in a positive market environment.

Yes. Thanks to liquidity pools, liquidity providers can generate passive income on DeFi protocols.

Siyu Ren Heinrich

5 years of experience in crypto research of writing practical blockchain and crypto analysis on Medium.

MSc in Computer Science, BSc in Smart Engineering, and BSc in Economics and Statistics.

Michael has been active in the crypto community since 2017. He holds certifications from Duke University in decentralized finance (DeFi) and blockchain technology.

🍒 tasty reads

The Core Blockchain and DeFi Ecosystem: What You Need to Know

7 Best DePIN Crypto Projects

What Is Symbiotic and How Does It Work in 2024?

Ethereum vs Ethereum ETFs – 5 Major Differences