Long-term cryptocurrency investing offers several key advantages over short-term investing. These include the power of compounding returns, lower transaction costs, significant tax benefits, and a reduced emotional impact on decision-making.

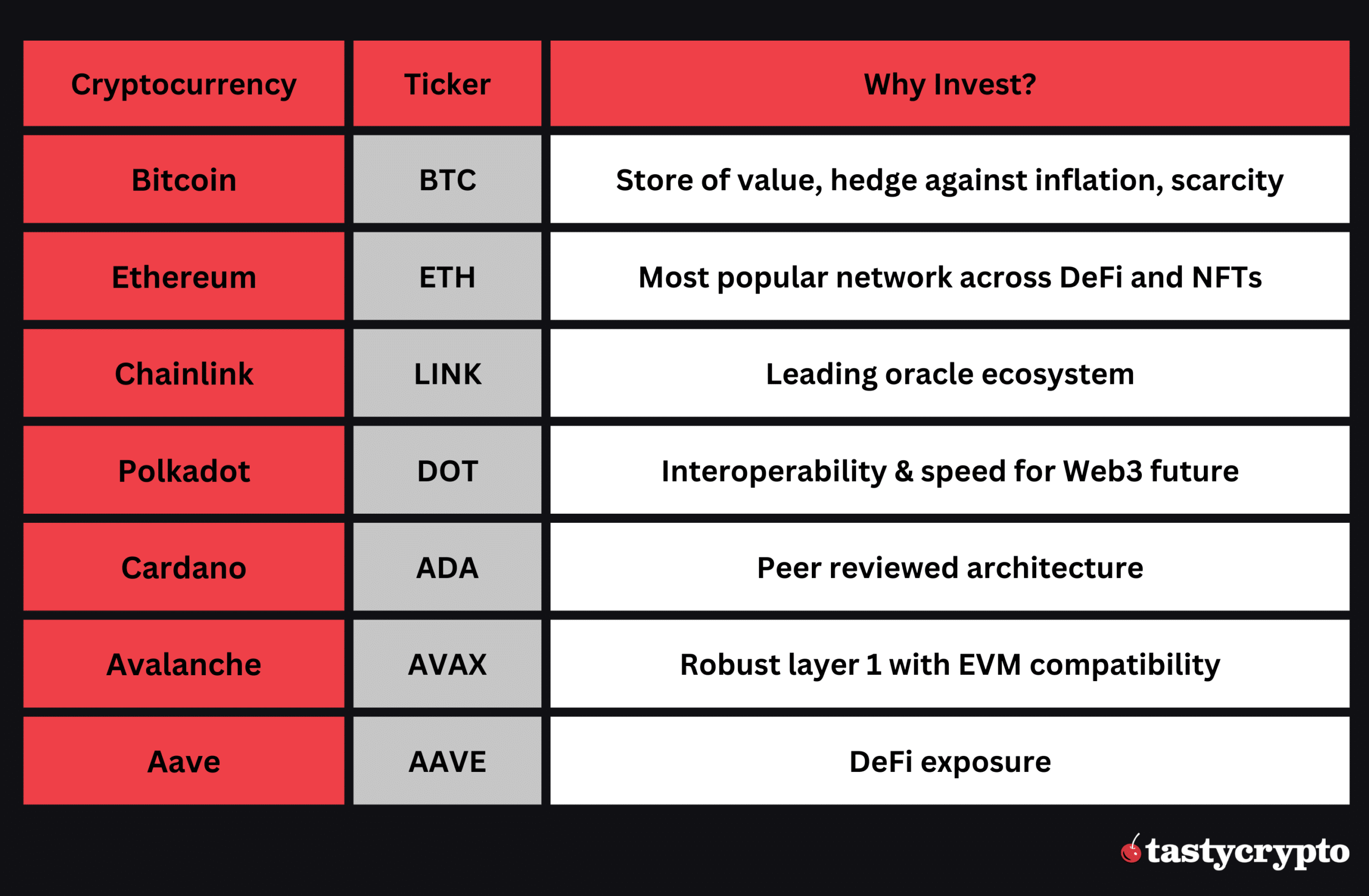

In this guide, we’ll highlight 7 great ‘set-it-and-forget-it’ cryptos to hold in your portfolio over the long-term.

Written by: Anatol Antonovici | Updated January 12, 2023

Reviewed by: Mike Martin

Fact checked by: Ryan Grace

Despite the high volatility of cryptocurrencies, certain digital assets have consistently dominated the crypto market over the years, demonstrating their potential for long-term viability.

Table of Contents

🍒 tasty takeaways

Bitcoin is the best crypto investment with a long-term goal due to its scarcity, unmatched security, high liquidity, and adoption.

The Ethereum network is the leading blockchain for DeFi apps and NFTs.

Other crypto projects with great long-term potential are Chainlink, Polkadot, Cardano, Avalanche, and Aave.

- Criteria for choosing long-term crypto investments include liquidity, market cap, real-world use cases, tokenomics, security, and level of decentralization.

Summary

| Cryptocurrency | Token | Purpose |

|---|---|---|

| Bitcoin | BTC | Blockchain for Digital Gold / SOV Asset |

| Ethereum | ETH | Blockchain for DeFi and NFTs |

| Chainlink | LINK | Oracle Network Protocol |

| Polkadot | DOT | Connectivity and Interoperability Protocol |

| Cardano | ADA | Blockchain for Sustainable Development |

| Avalanche | AVAX | Layer 1 Blockchain Network |

| Aave | AAVE | DeFi Lending Protocol |

1. Bitcoin

- Token: BTC

- Purpose: Blockchain for Digital Gold / SOV Asset

Launched in 2009 by an anonymous entity known as Satoshi Nakamoto, Bitcoin (BTC) is the oldest and most popular cryptocurrency. Bitcoin also dominates more than 50% of the entire cryptocurrency market cap. This network was the first application of blockchain technology, introducing an innovative method for conducting transactions in a decentralized way.

Initially launched as a decentralized monetary system, Bitcoin has evolved into a store of value (SOV) asset, often dubbed ‘digital gold.’ Because of its limited supply and established infrastructure, most crypto investors are interested in holding it long-term rather than trading it short-term.

Due to events like the possible introduction of a bitcoin ETF and the network’s upcoming halving event, many analysts are currently bullish on Bitcoin.

Bitcoin Pros

- Scarcity – Bitcoin’s total supply is capped at 21 million coins, with 19.58 million currently in circulation. This deflationary approach is supporting the long-term price increase, which is driven by demand.

- Security – Bitcoin’s Proof of Work (PoW) has passed the test of time. With millions of nodes dispersed around the world, it is the most decentralized and safe cryptocurrency.

Bitcoin Cons

- No dapps – since it doesn’t support smart contracts, Bitcoin cannot host decentralized applications (dapps). Still, the recent boom in Bitcoin ordinals has brought some interesting use cases built on top of its mainnet.

2. Ethereum

- Token: ETH

- Purpose: Blockchain for DeFi and NFTs

Ethereum (ETH) is the second-largest cryptocurrency by market cap and the largest blockchain network offering the smart contract feature. This means decentralized versions of popular Web2 apps today can be built on Ethereum. These are called Web3 apps.

Ethereum has dominated the decentralized finance (DeFi) space since its emergence and is the preferred network for non-fungible tokens (NFTs).

Following its recent upgrade to the Proof of Stake (PoS) algorithm, Ethereum has become more efficient and flexible.

Ether (ETH) is the native cryptocurrency of Ethereum.

Ethereum Pros

- DeFi and NFTs – Ethereum is the go-to blockchain network to build dapps and mint NFTs. It has dominated the DeFi space from day one.

- Layer 2 scaling – many layer 2 networks are built on top of Ethereum to scale it, including Arbitrum, Optimism, and Polygon.

Ethereum Cons

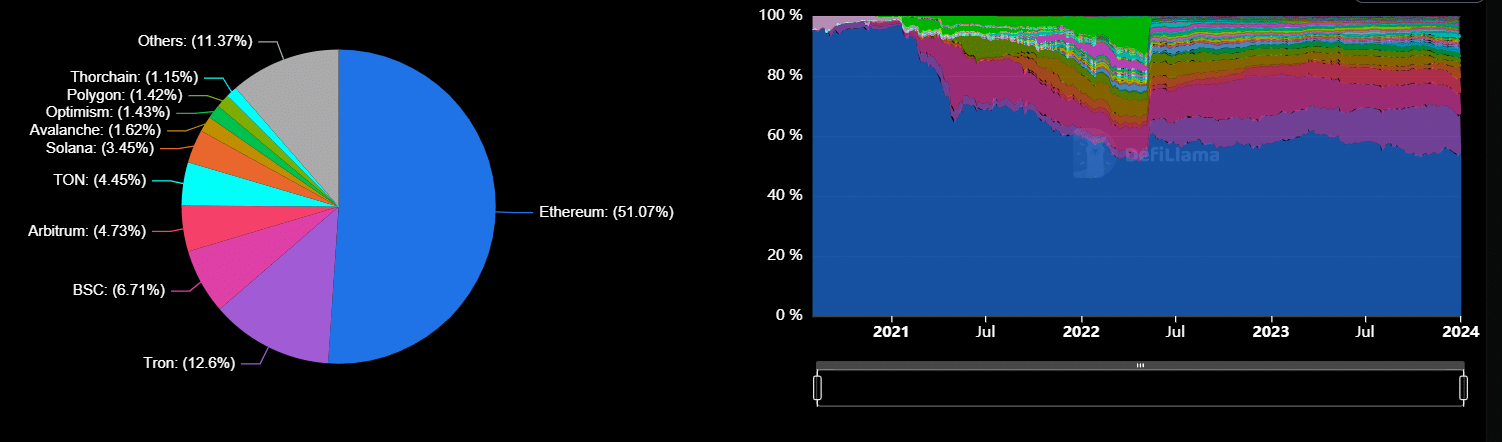

- Competition – while the Ethereum blockchain is still leading the DeFi space, it is facing competition from fast-growing PoS networks, including Solana, Cardano, Avalanche, and Binance’s BNB Chain. Its DeFi dominance level has dropped from over 93% in 2020 to 51% as of January 2024.

Ethereum TVL, Source: DeFiLlama

3. Chainlink

- Token: LINK

- Purpose: Oracle Network Protocol

Chainlink is the largest decentralized oracle network. Unlike Bitcoin and Ethereum, Chainlink is a protocol. Protocols run atop existing blockchains. Chainlink was built on the Ethereum network. Blockchains issue coins while protocols issue tokens. LINK, therefore, is a token.

🍒 Coins vs Tokens: How They Differ

Chainlink helps blockchains get accurate data from the real world, as well as communicate with other decentralized networks. Oracles can be used to verify ID’s on blockchains, monitor prices of real-world and crypto assets, manage supply chains, or bet on sports events directly on-chain.

More importantly, oracles play a major role in tokenization, which is expected to become one of the biggest trends in blockchain.

🍒 Watch the video below to learn more about tokenization!

Chainlink Pros

- Use case – Chainlink is part of a niche market in blockchain, and it doesn’t directly compete with big players like Ethereum, Bitcoin, or Solana. It has a unique use case that ensures a high demand in the years to come.

- Partnerships – Chainlink has partnered with high-profile institutions, being trusted by traditional finance (TradFi) giants like SWIFT.

Chainlink Cons

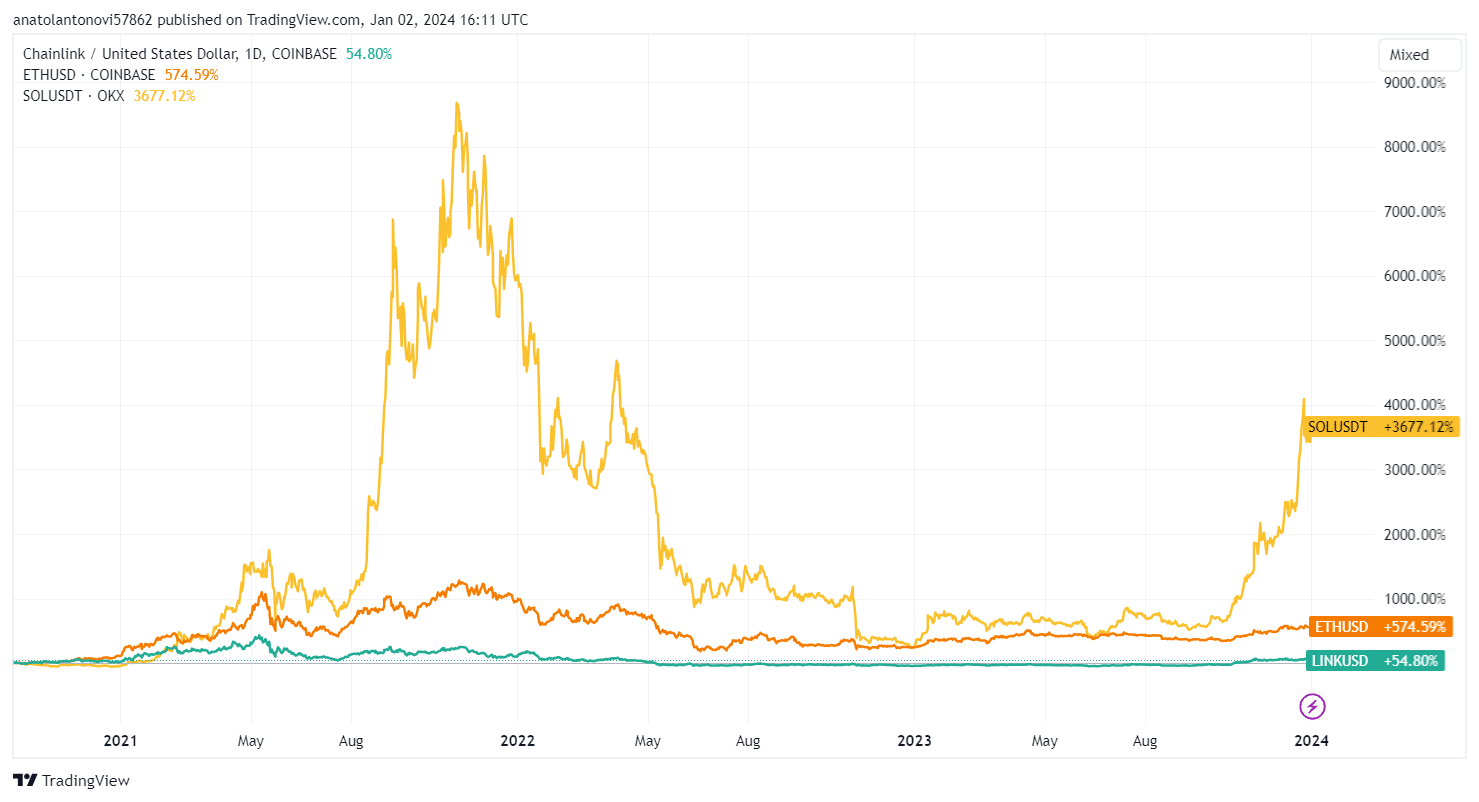

- Performance – despite its success, LINK has underperformed other leading projects, including Ethereum and Solana.

4. Polkadot

- Token: DOT

- Purpose: Connectivity and Interoperability Protocol

Polkadot (DOT) serves as a decentralized blockchain-as-a-service network, enabling users to build customizable decentralized networks called parachains.

The main goal of Polkadot is to bring interoperability to the blockchain industry by enabling parachains to interact with each other. Many believe that Polkadot will become a leading player in a Web3-oriented multi-chain future.

Polkadot Pros

- Use case – as in the case of Chainlink, Polkadot’s interoperability is a unique use case that may secure demand in the years to come. Besides its closed ecosystem, Polkadot chains can connect with external networks through bridges.

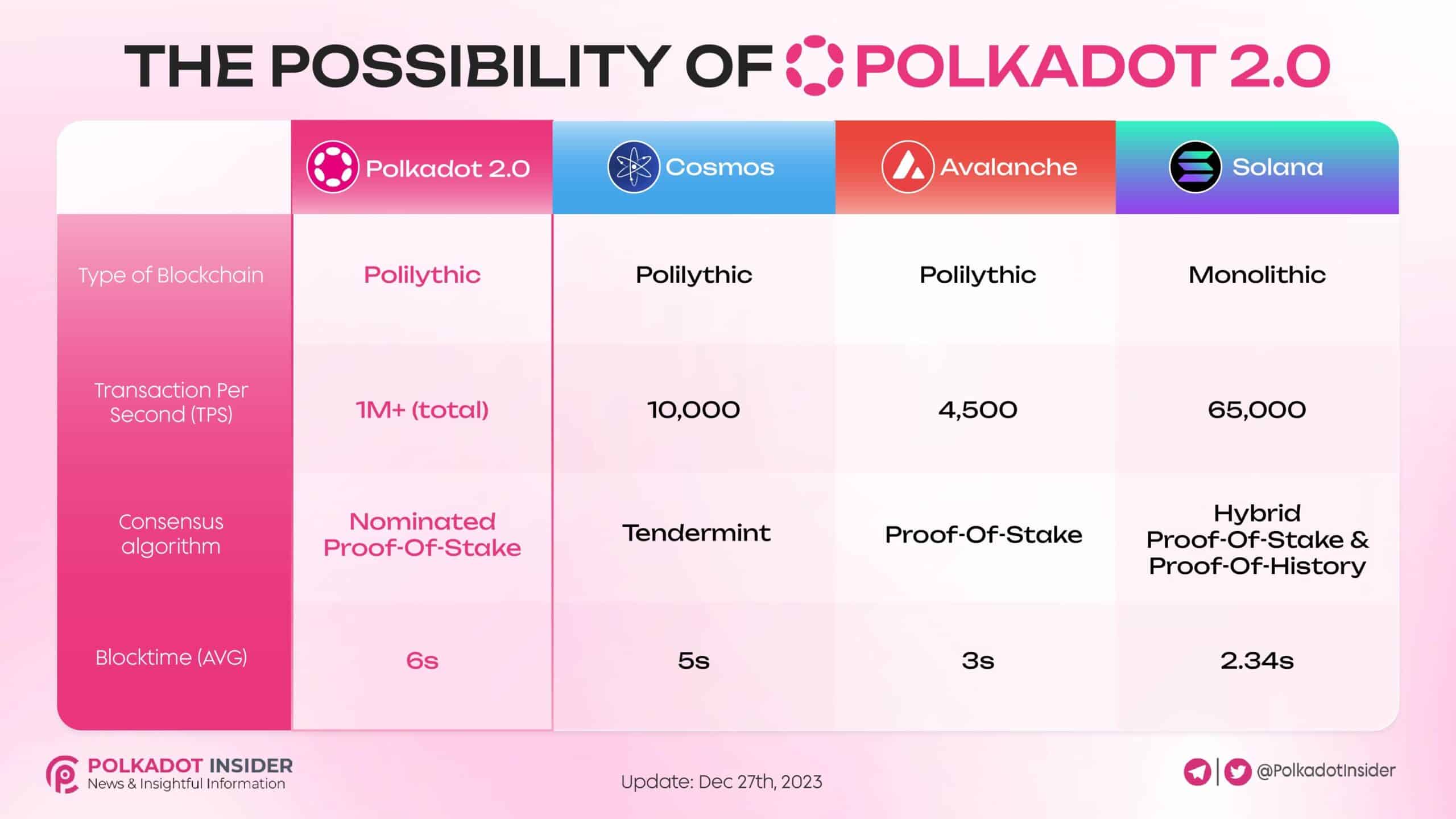

- Speed – Polkadot is one of the fastest blockchains out there, being capable of handling over 1,000 transactions per second (tps). It plans to boost the transaction speed to 1 million after major upgrades.

Source: Polkaverse

Polkadot Cons

High inflation – DOT is an inflationary cryptocurrency, with the circulating supply increasing by over 10% per year. The new tokens are distributed as staking rewards.

5. Cardano

- Token: ADA

- Purpose: Blockchain for Sustainable Development

Cardano (ADA) emerged as one of the earliest significant competitors to Ethereum. While supporting dApps and NFTs, Cardano‘s achievements have been modest, with its ecosystem being relatively small compared to Ethereum.

Despite that, ADA has ranked among the top 10 largest coins for years, and the most exciting part is yet to come, as Cardano is currently at the final stage of its gradual development.

Cardano Pros

- Peer reviewed – Cardano is known for its robust academic background, being developed through peer-reviewed research.

- Efficiency – unlike Ethereum and other PoS chains, the tokens and NFTs built on Cardano don’t use smart contracts. Instead, they leverage the same layer 1 infrastructure, eliminating gas fees and additional smart contract-related costs.

Cardano Cons

- Competition – Cardano faces fierce competition from multiple PoS chains, including Ethereum, Solana, Avalanche, Near, and others.

- Slow upgrading – the academic rigor of Cardano leads to a slower development and deployment process.

6. Avalanche

- Token: AVAX

- Purpose: Layer 1 Blockchain Network

Avalanche (AVAX) is one of the most important competitors of Ethereum. It is one of the most well-balanced layer 1 networks, directly competing with Solana for Ethereum’s market share. Solana (SOL) is currently outperforming Avalanche, being the 4th largest cryptocurrency by market cap and having a 3.45% share in DeFi versus Avalanche’s 1.6%.

However, Avalanche‘s greater decentralization and its Ethereum compatibility may provide it with a long-term advantage.

Avalanche Pros

- Robust ecosystem – Avalanche is growing as a leading player in the DeFi and NFT ecosystem, and its EVM compatibility makes it easy to bring assets from Ethereum.

- Well-balanced layer 1 – the network has a complex architecture that ensures high-speed transactions, instant finality, and low trading fees compared to Ethereum.

Avalanche Cons

- Competition – again, as one of many proof-of-stake chains, Avalanche faces serious competition, and Solana is experiencing a higher adoption rate at the moment due to its faster tps and lower fees.

7. Aave

- Token: AAVE

- Purpose: DeFi Lending Protocol

Aave (AAVE) is an Ethereum-based token that fuels Aave – a leading DeFi lending protocol with over $7 billion worth of crypto locked as collateral.

As a leading DeFi project, the native token is expected to maintain its position in the years to come, making it a good long-term investment for those who want to get exposure to DeFi.

AAVE Pros

- DeFi exposure – Aave is one of the most popular DeFi projects.

- Governance – Aave acts as a governance token for the Aave ecosystem.

AAVE Cons

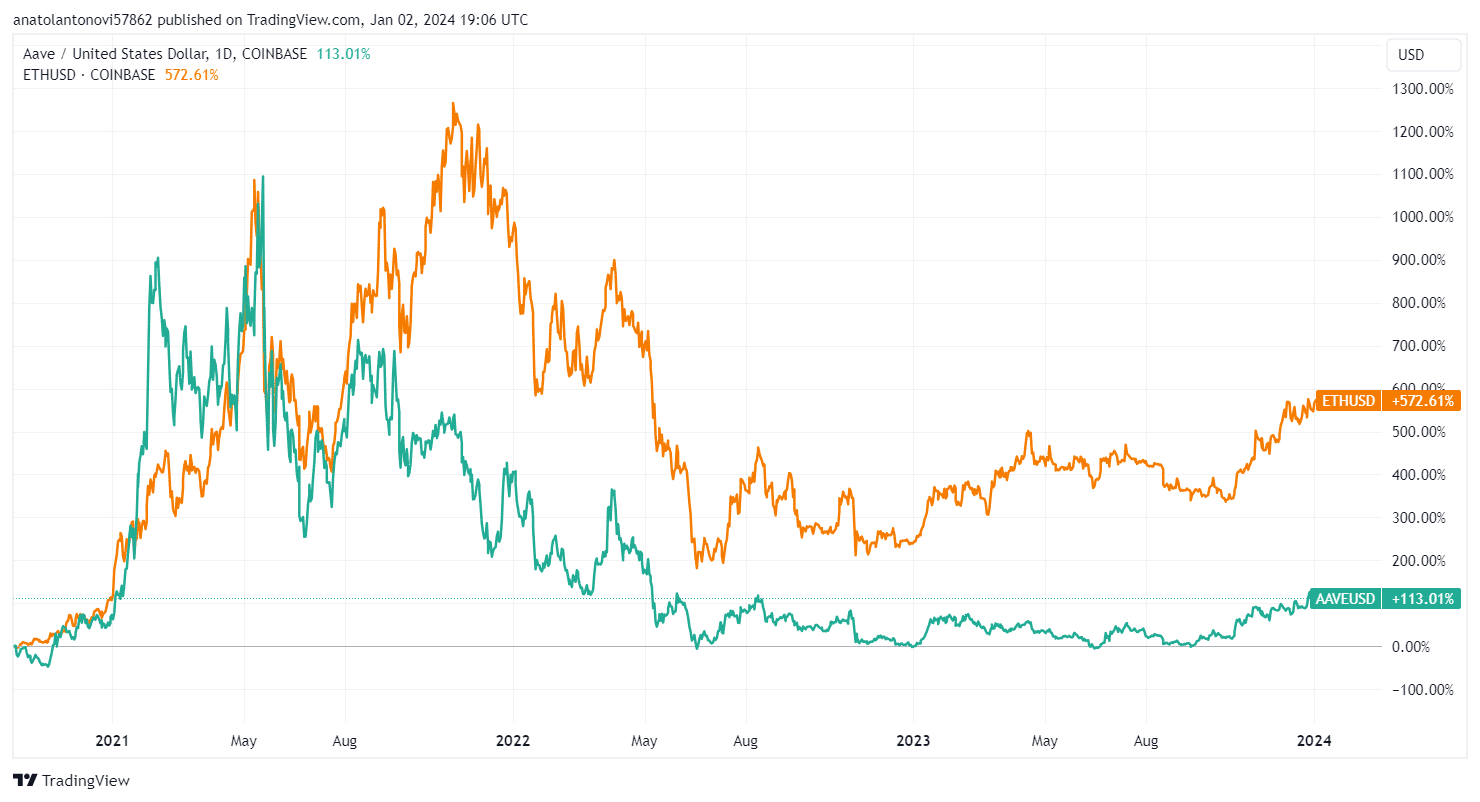

- Performance – the token has underperformed Ethereum since its launch in 2020.

Coin Comparison

FAQs

Bitcoin is widely regarded as the top choice for long-term investment. Its reputation as digital gold, capped supply, and established track record of security position it as a favored choice among investors seeking a store-of-value asset in the cryptocurrency arena.

You can buy digital currencies on crypto exchanges like tastytrade, or decentralized exchanges (DEXs). It’s better to opt for platforms with high trading volumes and robust security. Some exchanges enable users to buy cryptos with fiat currencies, such as USD, by paying with a credit card. DEXs don’t offer the fiat option, but you can buy stablecoins like Tether’s USDT to access DeFi.

Predicting the future of cryptocurrencies remains challenging. However, those projects that showcase strong use cases, robust technology, sophisticated functionality, and expanding ecosystems – like Bitcoin, Ethereum, Chainlink, and Polkadot – are considered to have considerable long-term potential.

For those aiming to create a long-term crypto portfolio, Bitcoin is often suggested as a #1 choice because of its pioneering role and established presence in the cryptocurrency world.

To enhance their portfolio, investors are advised to consider diversifying with other promising altcoins such as Ethereum, Chainlink, Polkadot, Cardano, Avalanche, and Aave.

🚩 Before investing in crypto, know the risks.

🍒 tasty reads

The Core Blockchain and DeFi Ecosystem: What You Need to Know

7 Best DePIN Crypto Projects

What Is Symbiotic and How Does It Work in 2024?

Ethereum vs Ethereum ETFs – 5 Major Differences

Anatol Antonovici

6+ years of experience writing for crypto brands and blockchain firms, including Coindesk, Cointelegraph, Bitcoinist, CryptoPotato, Algorand, and OTCTrade.com