Tokenization converts physical and digital assets into digital tokens on a blockchain, representing anything of value, from real estate to content rights.

Written by: Anatol Antonovici | Updated January 29, 2024

Reviewed by: Mike Martin

Fact checked by: Ryan Grace

Tokenization involves the conversion of traditional assets into digital assets hosted by blockchain networks. In this guide, you’ll learn the prerequisites for tokenization and discover the main steps involved in this process.

Table of Contents

🍒 tasty takeaways

Various traditional assets can be tokenized, including fiat currencies, company shares, bonds, real estate, art, luxury goods, and investment funds.

Centralized tokenization platforms offer comprehensive solutions for users to deploy compliant security tokens.

Decentralized finance (DeFi) platforms facilitate the issuance of tokenized assets across decentralized marketplaces.

- Tokenization, expected to grow to a multi-trillion dollar market by 2030, enhances asset liquidity and transparency, offering benefits like efficient transactions and broader accessibility.

Summary

| Description | |

|---|---|

| Tokenization | Converting assets into blockchain tokens |

| Assets | Includes fiat, shares, bonds, real estate, art, etc. |

| Platforms | Centralized platforms for compliant tokens |

| DeFi Platforms | Decentralized issuance of tokenized assets |

| Market Potential | Expected to grow to $10-$16 trillion by 2030 |

| Benefits | Efficiency, transparency, accessibility |

| Asset Types | Stablecoins, security tokens, asset-backed tokens |

| Blockchain Types | Permissioned and permissionless chains |

| Token Standards | Ethereum ERC standards and others |

| Tokenization Process | Ecosystem assembly, token configuration, compliance, deployment |

What Is Tokenization in Blockchain?

Tokenization refers to the minting of blockchain-based digital tokens (cryptocurrencies) that represent ownership of real-world assets (RWAs), such as company stocks, corporate or government bonds, commodities, real estate, and more. Fiat-backed stablecoins, such as USDC and USDT, also fall under the umbrella term of tokenized assets. Wrapped cryptocurrencies are also tokenized version of digital assets.

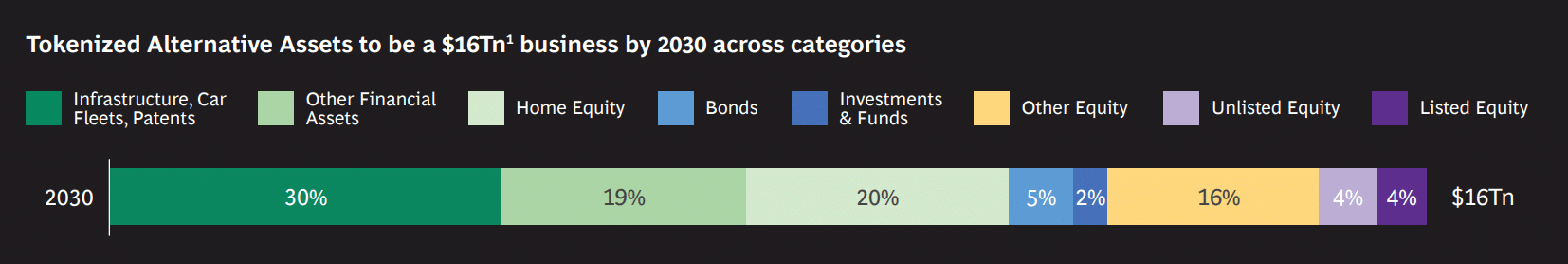

Tokenization is expected to grow substantially in the next decade, with some analysts anticipating this trend to grow to over $10 trillion by 2030.

Boston Consulting Group (BCG) released an even bolder outlook for the same period – it expects tokenization to become a $16 trillion market!

Source: MediaPublications

Benefits of Tokenization

Traditional assets can benefit from tokenization thanks to the unique features of blockchain technology, achieving:

- Efficiency – scalable decentralized networks enable higher transaction speed at lower cost compared to traditional finance (TradFi) brokers. Also, blockchains encourage better price discovery of illiquid assets.

- Transparency – blockchains record all transaction data on an immutable ledger, offering an unprecedented level of transparency.

- Accessibility – companies and other entities can raise capital from larger investor pools. Additionally, blockchain’s fractional ownership feature brings liquidity to illiquid assets.

Types of Tokenized Assets

There are several types of tokenized assets, and each works differently:

- Stablecoins – stablecoins are in a league of their own, accounting for over 90% of the total value of tokenized assets. Fiat-backed stablecoins, predominantly pegged to the US dollar, are issued by centralized financial institutions maintaining equivalent USD reserves in bank accounts.

Reserve funds must always match the circulating token supply, with issuers minting new tokens during demand and burning tokens upon user sales. - Security tokens – these tokens represent traditional securities like company shares and bonds. They are different from utility tokens due to their legal status as securities. In most jurisdictions, they have to be registered with a securities watchdog, e.g., the Securities and Exchange Commission (SEC) for US-based issuers.

- Asset-backed tokens – these tokens provide holders with ownership rights of any type of real-world assets (RWAs), including physical assets like real estate, fine art, commodities, or luxury goods. Intangible assets like intellectual property can also be tokenized.

- Tokenized funds – these tokens represent a share in an investment fund consisting of various RWAs or a mix of RWAs and crypto assets. Tokenizing financial instruments like hedge funds or exchange-traded funds (ETFs) enables asset management on-chain.

The specific type of tokenized asset determines the blockchain used (public or permissioned), the token standard, and the required level of regulatory compliance.

Types of Blockchains & Token Standards

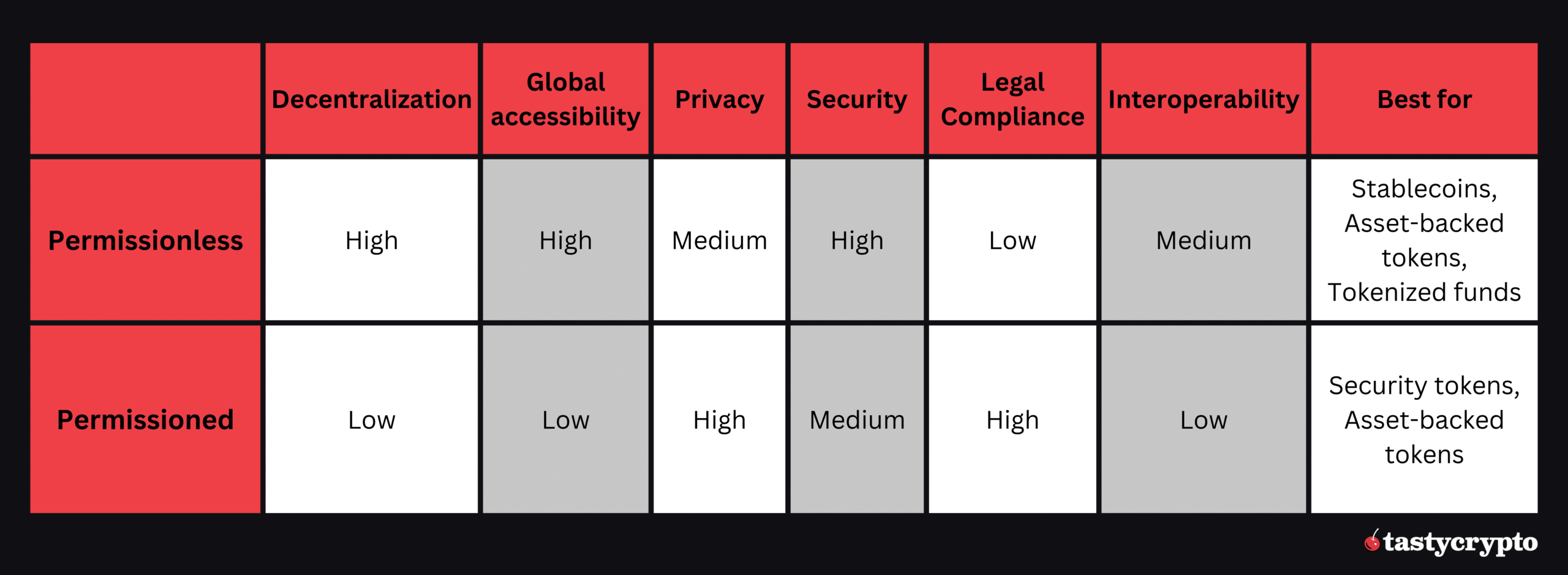

Token issuers can pick from two main types of blockchain networks:

- Permissioned chains – private networks that enable approved entities to participate in consensus validation. It is partially decentralized, being distributed across approved entities.

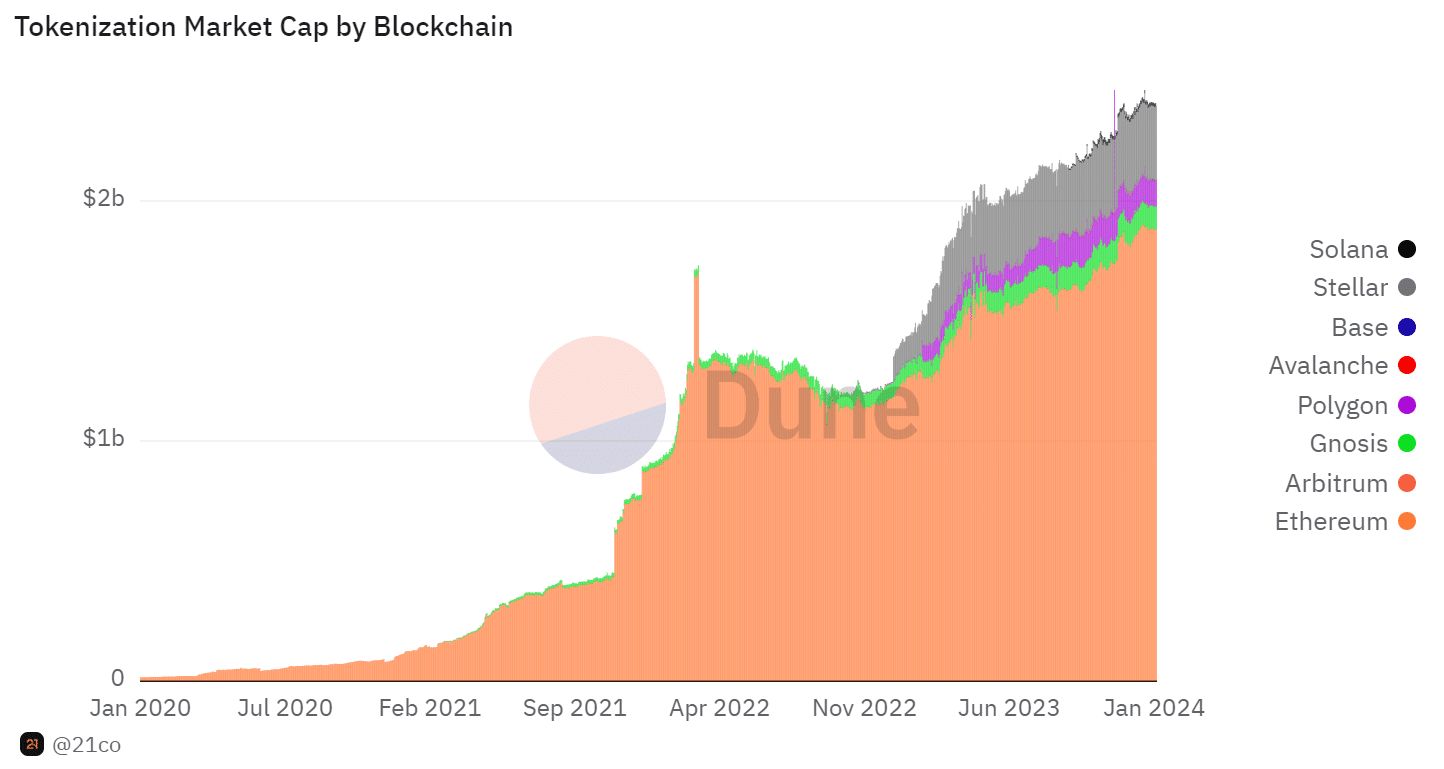

- Permissionless chains – public networks with open-source code and fully decentralized. Anyone can participate in consensus validation. The best example is Ethereum, which hosts 80% of all tokenized asset value.

Permissionless Blockchains

Source: Dune Analytics

Here are the main differences permissioned and permissionless blockchains:

Secure Your Crypto With Self-Custody

When you store your crypto in a self-custody wallet, you don’t have to trust that an exchange is acting in your best interest. This is because you are the only party privy to your private key, or seed phrase.

Here are some additional benefits you get when you choose to self-custody your digital assets with tastycrypto:

- In-App Swap: Trade BTC, ETH, and 1,000+ tokens

- Generate Yield in DeFi: Stake, lend, and become your own market maker

- NFTs: Buy, sell, and view NFTs in-app

tastycrypto offers both iOS and Android self-custody wallets – download yours today! 👇

Ethereum Token Standards

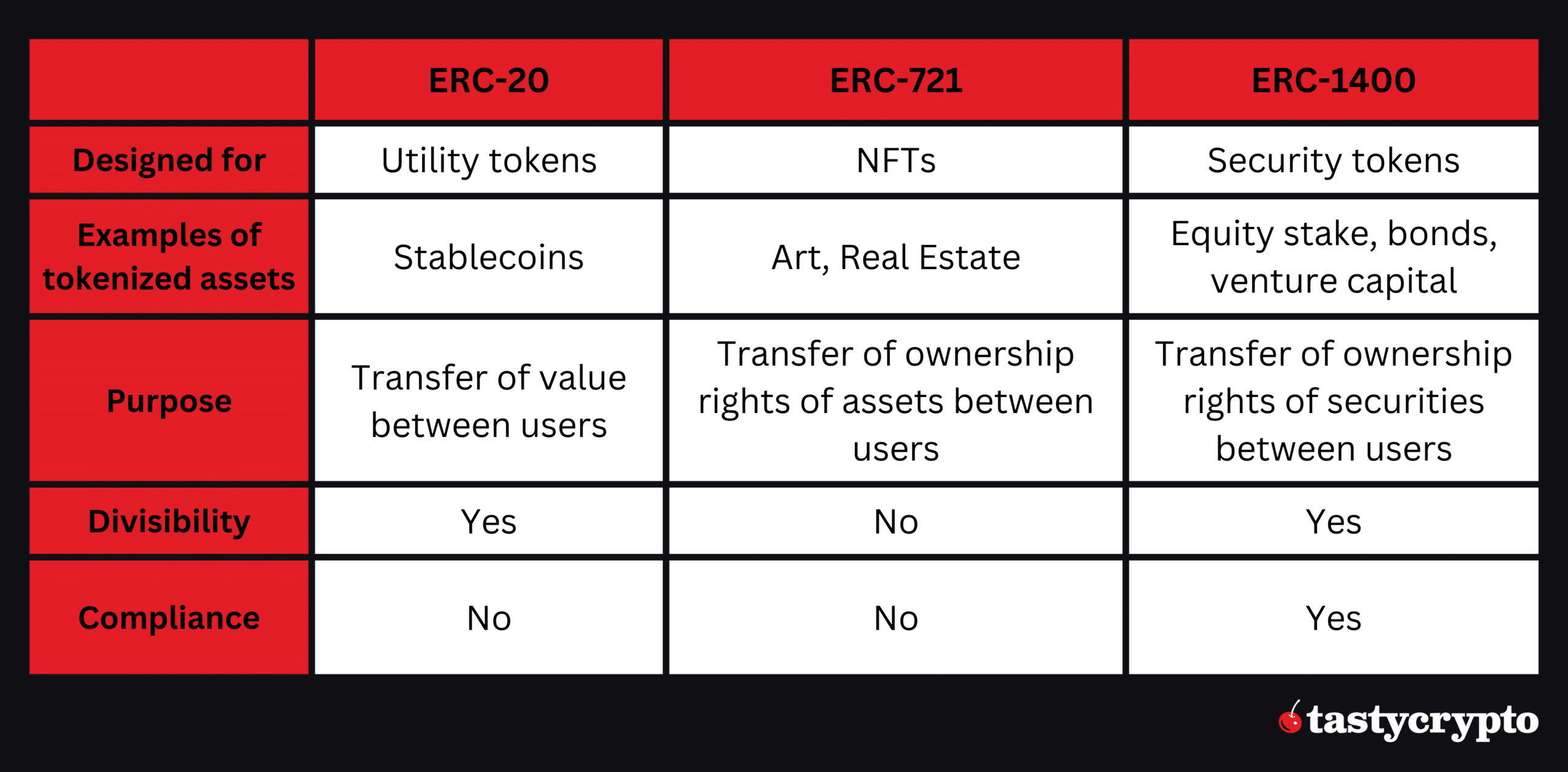

Blockchains offering the smart contract feature may support multiple token standards to enable the development of utility tokens, non-fungible tokens (NFTs), and security tokens.

In the case of Ethereum, which accounts for the lion’s share of tokenized assets, there are three main ‘ERC’ standards, as seen below:

Ethereum also supports other frameworks aimed at tokenized assets. For example, tokenization platform Tokeny launched the ERC-3643 standard for more compliant security tokens.

Additionally, Web3 software provider Enjin launched ERC-1155, which supports both fungible and non-fungible tokens.

Fungible assets, like the US Dollar, are all the same. Non-fungible assets, however, represent assets that are unique and special. Unlike fungible assets, non-fungible assets are not interchangeable. Art is an example of a non-fungible asset class.

How Does Crypto Tokenization Work?

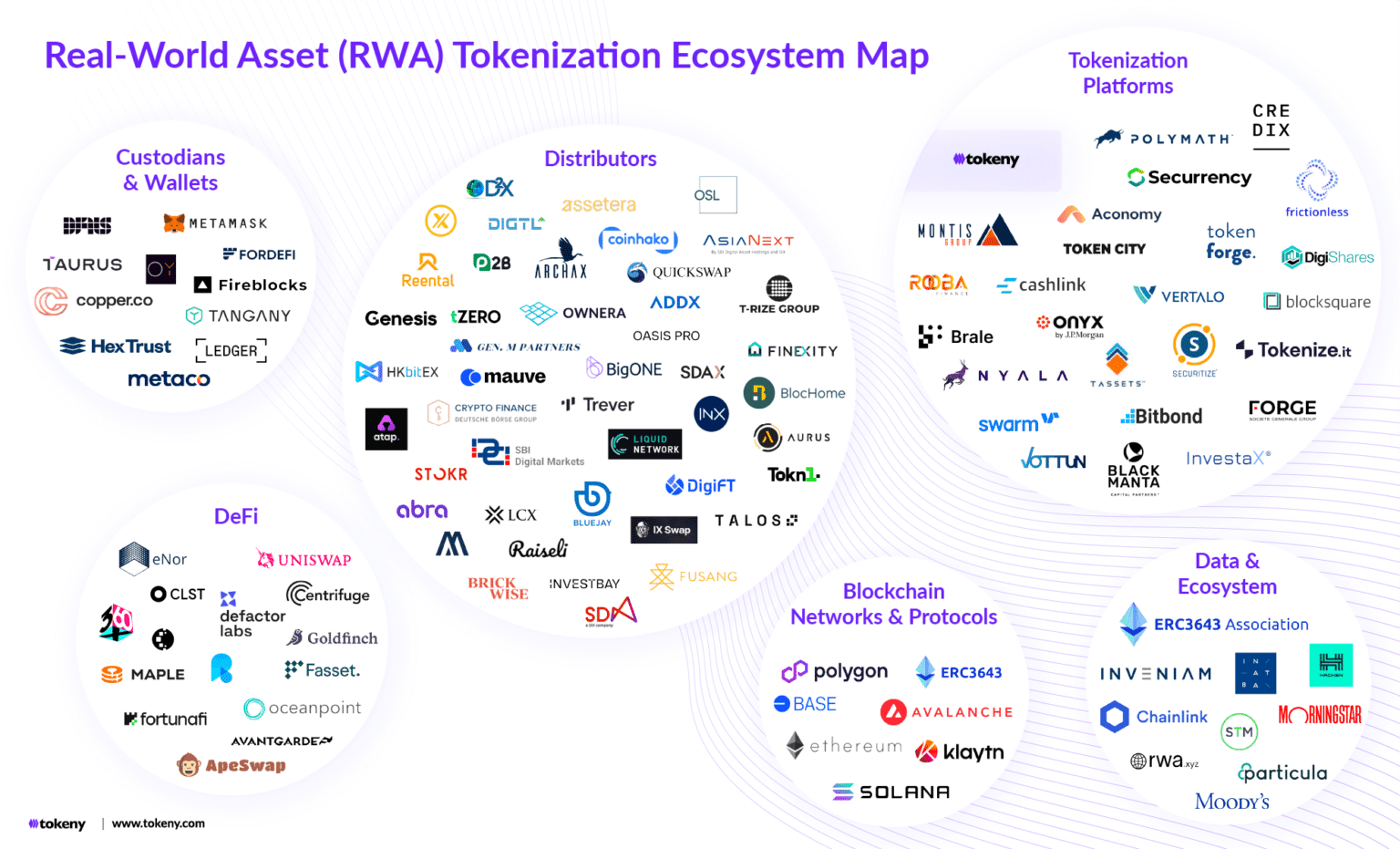

In order to understand how crypto tokenization works, you must first be acquainted with the intricate ecosystem of tokenization, which encompasses various components:

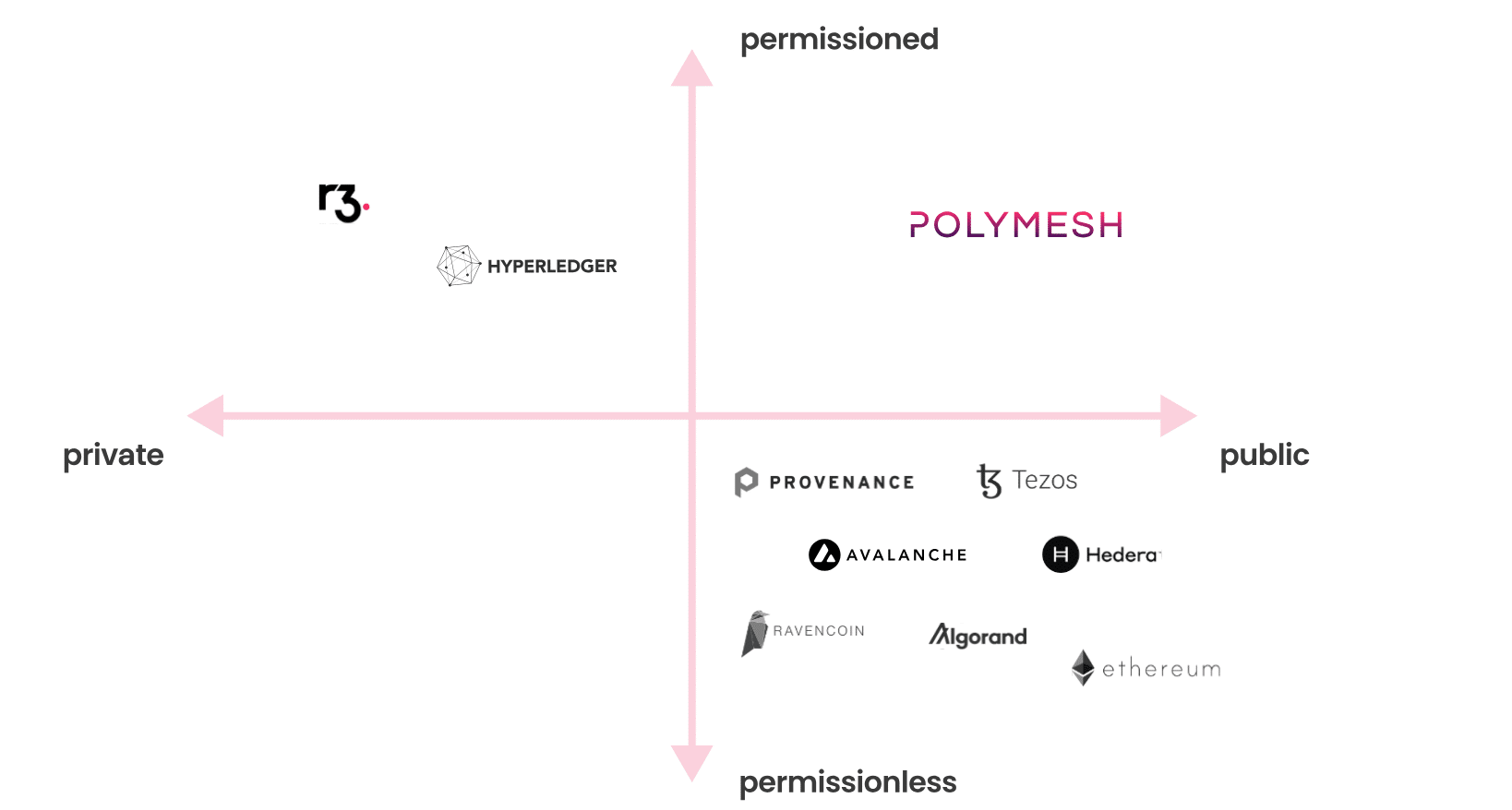

- Blockchain networks – Ethereum, Solana, Avalanche, Polygon, Base, Polymesh.

- Tokenization platforms – Polymath, Tokeny, Securitize, Tokensoft.

- DeFi RWA platforms – Centrifuge, Maple, Goldfinch.

- Digital wallets – tastycrypto, Metamask, Ledger, Fireblocks, Hex Trust.

Here is a tokenization ecosystem overview provided by Tokeny:

Source: Tokeny

If you want to tokenize assets, e.g., the equity of your business, or sell your real estate property, you can hire a specialized tokenization platform to tokenize your assets.

Additionally, can borrow against tokenized assets on a permissionless ecosystem by exploring the decentralized finance (DeFi) ecosystem.

Centralized Tokenization Platforms

Tokenization platforms, like Tokeny, Polymath, and Securitize, focus on the issuance of security tokens and do all the behind-the-scenes work for you or your business.

These platforms typically involve multiple steps in the tokenization process.

- Assemble ecosystem – start by determining the asset you want to tokenize and start building an ecosystem that may include custodians, KYC/AML providers, legal services, tax services, advisory services, marketing, and exchange platforms for secondary market sales.

- Configure the token – next, configure the token by selecting a blockchain network and a token standard. You must classify the token, assign a name and symbol, and set its divisibility and other characteristics. Also, you can create a tokenomics model tailored to your needs.

- Set compliance rules – you can create the smart contract by setting the main token rules, including compliance rules. You can impose KYC/AML verification, set ownership and transfer restrictions by jurisdiction or behavior, enable voting rights, and automate enforcement, among others.

- Deploy, distribute, and manage the tokens – it’s now time to deploy the token by setting the price, minting it on-chain, and distributing it to stakeholders. You can organize a fundraising event like STO or IDO to distribute the token to secondary markets like token exchanges. You can manage your assets by minting, burning, pausing, freezing, and recovering tokens.

- Execute corporate actions – you can track investors, token operations, and report to tax authorities and regulators by extracting blockchain data.

DeFi Tokenization Platforms

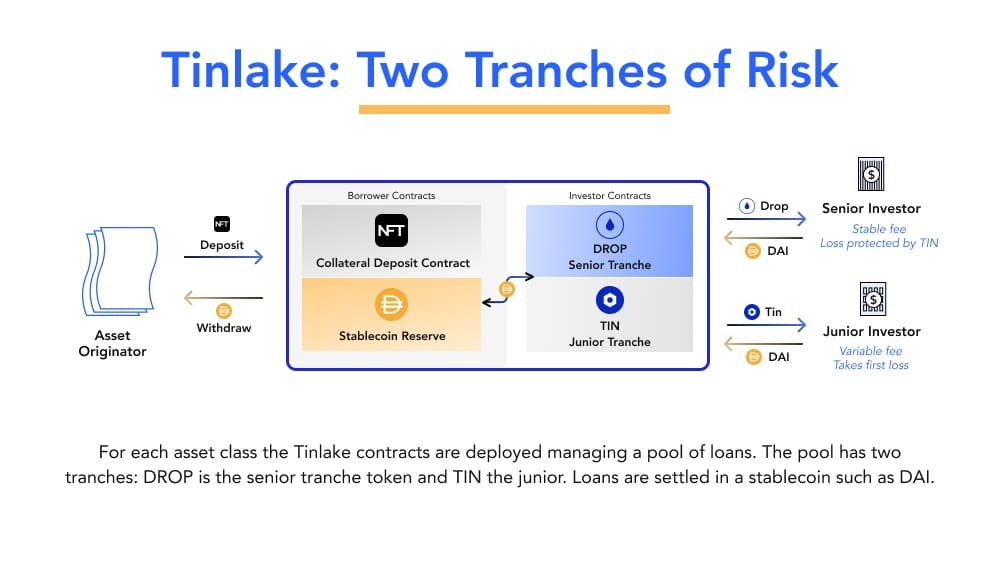

Individuals and entities can also deploy tokenized assets on a DeFi (decentralized finance) platform. Centrifuge currently offers the most comprehensive ecosystem for deploying tokens.

Centrifuge offers a decentralized application (dapp) known as Tinlake. Tinlake acts as an open marketplace and investment venue for tokenized assets. Through Tinlake, anyone can tokenize assets by turning them into NFTs. Examples include invoices, real estate, and royalties.

Eventually, these NFTs can be used as collateral in dedicated Centrifuge pools to borrow crypto like Bitcoin (BTC) or USDC.

Source: Aave

The Centrifuge Credit Group, which comprises 9 members, provides risk analysis on all pools before they launch.

Tokenization, a rapidly expanding trend in the cryptocurrency world, unlocks a multitude of potential applications.

FAQs

Tokenization in blockchain is the process of creating tokens that represent ownership of real-world assets (RWAs) like company stocks, bonds, commodities, and real estate, among others.

The main types of tokenized assets include stablecoins (fiat-backed), security tokens (representing traditional securities like shares and bonds), asset-backed tokens (backed by various RWAs), and tokenized funds (shares in investment funds).

You can use a tokenization platform like Tokeny, Securitize, or Polymath, which helps users with the entire tokenization process, from token configuration and compliance settings to distribution and management.

Tokenization can be done on various decentralized networks, including permissionless chains like Ethereum, Solana, and Avalanche, as well as permissioned chains like Polymesh.

🍒 tasty reads

The Core Blockchain and DeFi Ecosystem: What You Need to Know

7 Best DePIN Crypto Projects

What Is Symbiotic and How Does It Work in 2024?

Ethereum vs Ethereum ETFs – 5 Major Differences

Anatol Antonovici

6+ years of experience writing for crypto brands and blockchain firms, including Coindesk, Cointelegraph, Bitcoinist, CryptoPotato, Algorand, and OTCTrade.com