Tokenization is the conversion of ownership rights for real-world assets into digital tokens on a blockchain.

Written by: Anatol Antonovici | Updated May 7, 2024

Reviewed by: Mike Martin

Fact checked by: Ryan Grace

Tokenization is a rapidly growing trend in the crypto market, with analysts predicting that tokenized assets will comprise an impressive 10% of global GDP by 2030. In this article, we show you how to get exposure to this trend by sharing the top 7 crypto tokenization projects.

Table of Contents

🍒 tasty takeaways

Tokenization refers to the issuance of digital tokens representing real-world assets like stocks, bonds, real estate, and art.

The most sought-after tokenization platforms are Securitize, Tokensoft, and Tokeny, although they don’t offer utility tokens.

RWA projects that offer utility tokens include Centrifuge, Maple, Polymesh, and LCX.

| Project | Token | Category |

|---|---|---|

| Centrifuge | CFG | DeFi & NFTs |

| Maple Finance | MPL | DeFi Lending |

| Polymesh | POLYX | Security Tokens |

| Pendle Finance | PENDLE | Yield Tokenization |

| AllianceBlock Nexera | NXRA | Security Tokens |

| CreditCoin | CTC | Loan Protocol |

| LCX | LCX | Tokenized Securities |

What Is Tokenization?

-

Core Concept: Tokenization creates blockchain-based digital assets representing traditional financial assets like stocks, bonds, and commodities.

-

Beyond Fiat: Initially focused on stablecoins like USDT and USDC, tokenization now includes a variety of assets like real estate and art.

-

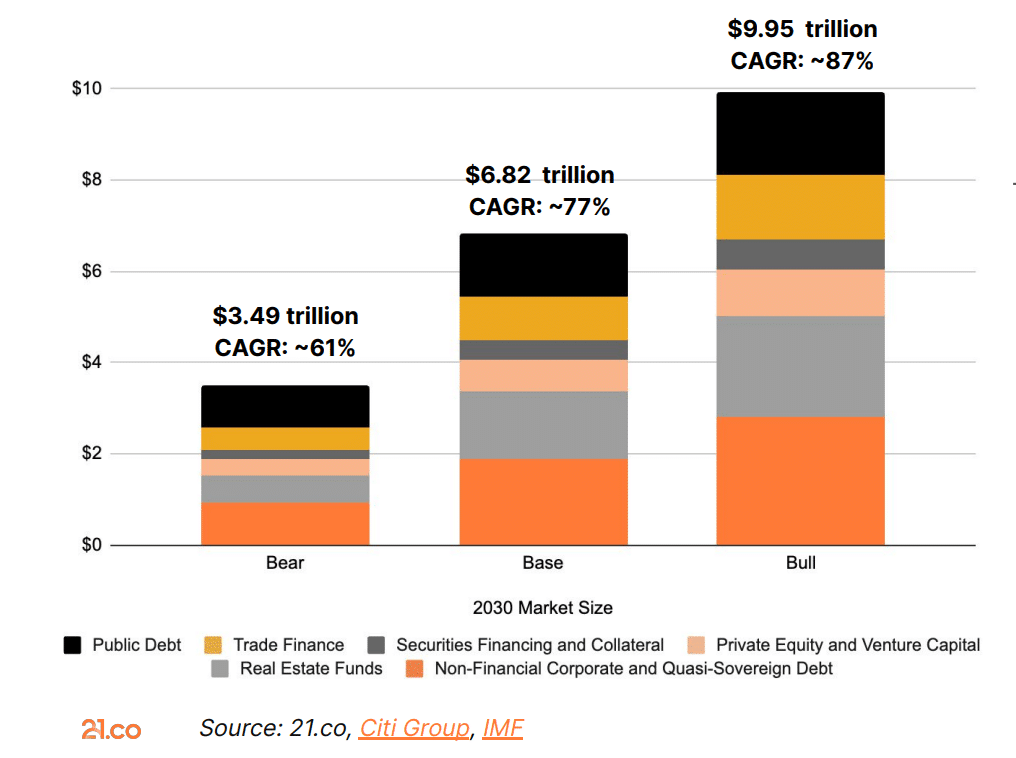

Rapid Growth: A rapidly growing sector, tokenization is projected to reach a market value of up to $10 trillion by 2030.

Tokenization is the issuance of blockchain-based digital assets representing financial assets from traditional markets, such as company shares, government bonds, and commodities. Tokenizing real-world assets (RWAs) can transform financial markets thanks to benefits like faster settlement, greater liquidity, and fractional ownership for illiquid assets.

Popular stablecoins, such as USDT and USDC, can also be regarded as an example of tokenization, although they have become a league of their own. Today, stablecoins account for about 97% of all tokenized assets.

Excluding fiat currencies, tokenization refers to tradable assets like stocks, real estate, bonds, and art.

Tokenization is one of the fastest-growing blockchain sectors today. Analysts expect it to grow into the trillions within the next few years

Digital asset management firm 21.co expects the market value of tokenized assets to reach up to $10 trillion by 2030.

Source: Assets-Global

What Types of Tokenization Projects Are There?

There are several types of tokenization projects.

Popular projects include centralized platforms that offer an entire package of tokenization solutions to enterprise clients. Some examples include:

- Securitize

- Polymath

- Tokensoft

- Tokeny

- ConsenSys

- Codefi

These platforms help financial institutions and other entities with the issuance of asset-backed tokens on a blockchain like Ethereum (bitcoin doesn’t offer the smart contract feature). However, these projects don’t offer utility tokens.

🍒Tokens vs Coins: Here’s How They Differ

Investors who want to get exposure to the tokenization trend may consider centralized and decentralized tokenization and RWA projects offering utility tokens.

In this article, we discuss 7 of the best RWA projects in 2024:

1. Centrifuge

- Symbol: CFG

- Category: DeFi & NFTs

Centrifgure is currently the largest decentralized finance (DeFi) project bringing RWAs on-chain. It uses non-fungible tokens (NFTs) and DeFi tools to let users tokenize assets.

Centrifuge’s decentralized application (dapp), called Tinlake, represents an open marketplace and investment venue for tokenized assets. Through Tinlake, users can tokenize assets like real estate, invoices, and royalties, transforming them into NFTs. These NFTs can be used as collateral in their Centrifuge pool to borrow from investors.

The native CFG token is used to pay for transactions and participate in governance. As of mid-May 2024, CFG is a $349 million market.

Centrifuge demonstrates interoperability with Polkadot’s parachains, and its NFTs adhere to Ethereum‘s ERC-721 token standard.

2. Maple Finance

- Symbol: MPL

- Category: DeFi Lending

Maple is a DeFi lending protocol that introduced RWA liquidity pools in 2023.

The platform offers uncollateralized loans for institutional borrowers as well as income opportunities for both institutional and individual lenders.

Maple is available on Ethereum and Solana.

Through a partnership with blockchain credit risk management firm Cicada Partners, Maple offers the Osprey Total Return Pool, which is the first actively managed investment-grade credit portfolio on blockchain. It includes RWAs like treasury bills, asset-backed securities, and loans. At the time of writing, the pools offer an APY of about 6%.

The ecosystem is fueled by the MPL token, which has a market cap of over $60 million in May of 2024.

3. Polymesh

- Symbol: POLYX

- Category: Security Tokens

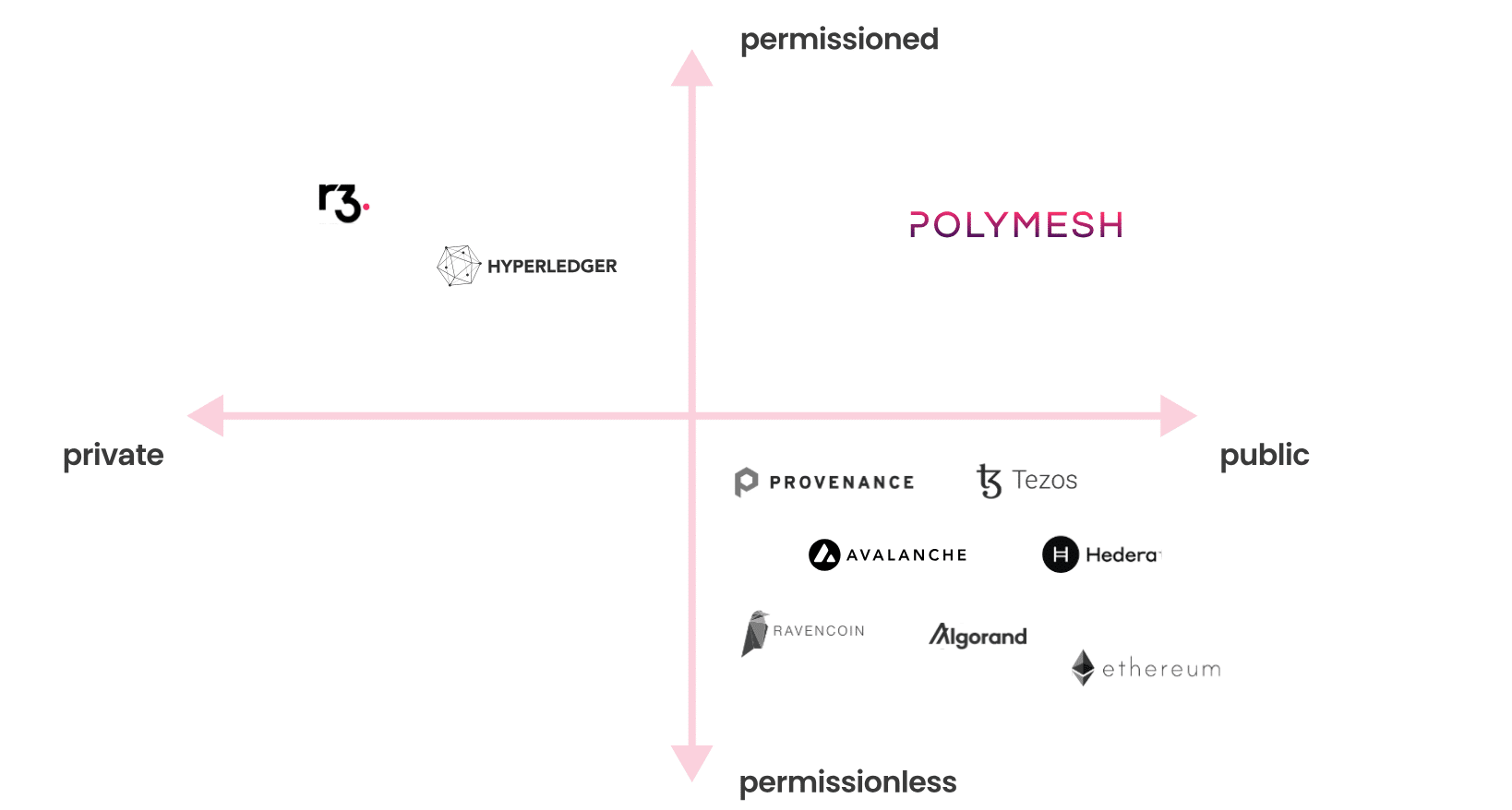

Polymesh is a security token-oriented blockchain network launched by Polymath, one of the most popular tokenization platforms.

Security tokens are regulated digital assets backed by securities, predominantly company shares. While residing on a blockchain, security tokens are recognized by regulators and treated the same as traditional securities.

Polymesh is a public permissioned chain, meaning that it requires users to pass through a KYC verification, given that the assets it hosts are regulated.

🍒 Go In Depth: Polymath Explained

Source: Polymesh

The blockchain network is used for the issuance, management, and trade of security tokens and other RWAs.

The native coin is POLYX, which is used to pay fees and participate in governance. POLYX has a market cap of $340 million in May of 2024.

4. Pendle

- Symbol: PENDLE

- Category: Yield Tokenization

Pendle Finance is a DeFi protocol that lets users tokenize future yields from DeFi assets and transform them into tradable tokens. In this way, DeFi investors can improve their yield strategies and speculate on the yield of DeFi assets.

The platform enables the tokenization of yield-bearing DeFi assets as well as their trading by acting as an Automated Market Making (AMM). Pendle is similar to interest rate derivative markets in traditional finance (TradFi).

In 2023, Pendle introduced the support for RWA products. It uses MakerDAO’s Boosted Dai Savings (sDAI) and Flux Finance’s fUSDC – both stablecoins generate yields from traditional finance sectors.

Pendle assets function like bonds, each with its own specified maturity date.

The protocol’s native token is PENDLE, with a market cap of over $1B in May of 2024.

5. AllianceBlock Nexera

- Symbol: NXRA

- Category: Security Tokens

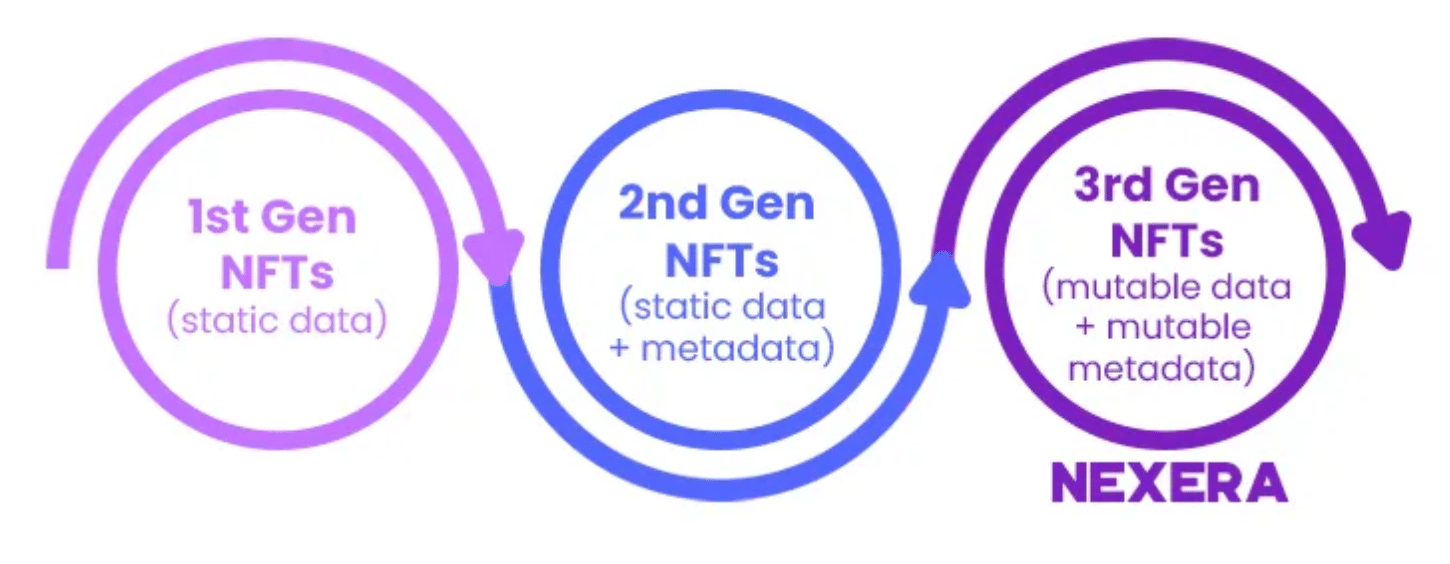

The Nexera Protocol is a blockchain initiative launched by AllianceBlock, which offers tokenization infrastructure for businesses and institutions looking to issue security tokens and other RWAs.

Like Polymath developed Polymesh, AllianceBlock has built its blockchain network for its ecosystem.

Nexera supports composable NFTs, called MetaNFTs, which contain both mutable data and metadata.

Source: Nexera

Nexera’s native token is NXRA and has a market cap of $99 million.

6. CreditCoin

- Symbol: CTC

- Category: Loan Protocol

CreditCoin is a blockchain loan protocol. It connects lenders with borrowers that register matching loan condition requirements.

The protocol eliminates the hurdles and cost of verification by offering a native chain to record credit transaction events. Lenders can easily access credit history and monitor the risk of potential borrowers.

In August 2023, CreditCoin partnered with SubWallet to help users bridge RWAs to the blockchain.

The CTC token is used to pay fees on the network and receive rewards. CTC has a market cap of $243 million as of today.

7. LCX

- Symbol: LCX

- Category: Tokenized Securities

LCX is a security token and crypto exchange regulated by Liechtenstein’s financial watchdog.

Besides its trading platform, it provides blockchain infrastructure to help companies tokenize securities. LCX.com is the tech arm that offers solutions for a regulatory-compliant security token offering (STO) for issuing and managing tokenized securities and digital assets.

LCX is a member of the World Economic Forum’s Center for the Fourth Industrial Revolution (C4IR).

The centralized ecosystem is powered by the LCX token, which has a valuation of $184 million.

How To Invest In Tokenization Projets

To buy and sell tokenization coins, you must first have a self-custody crypto wallet. The tastycrypto wallet connects to dozens of decentralized exchanges through WalletConnect.

tastycrypto offers both iOS and Android self-custody wallets – download yours instantly! 👇

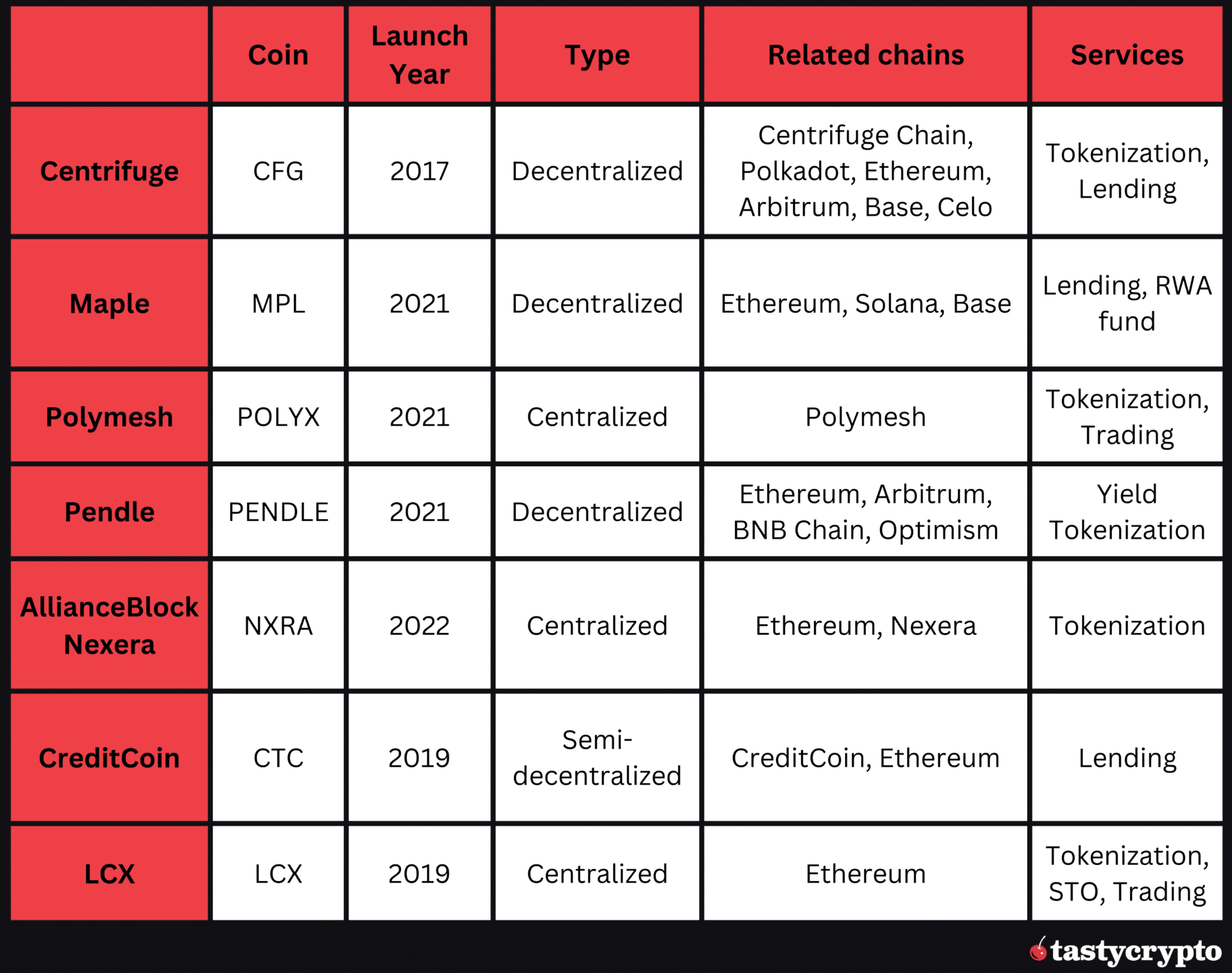

Comparing Top Tokenization Projects

The below table compares all of the tokenization projects we listed in this article.

Watch: Tokenization In Action

FAQs

Tokenization refers to the issuance of blockchain-based tokens representing real-world assets, such as company shares, bonds, real estate, art, money, and even physical assets.

Tokenization platforms help users with the entire process of issuing tokens backed by real-world assets (RWAs). RWA projects offer tokenization solutions or other services for tokenized assets, such as trading, lending, or asset management.

You can invest in this fast-growing market by purchasing the utility tokens of tokenization and RWA projects. Some of these represent decentralized finance (DeFi) investment opportunities. Most tokenization projects are built on Ethereum (bitcoin does not allow for the smart contract feature).

At the time of writing, some of the best RWA cryptocurrencies are CFG, MPL, POLYX, PENDLE, NXRA, CTC, and LCX.

🍒 tasty reads

The Core Blockchain and DeFi Ecosystem: What You Need to Know

7 Best DePIN Crypto Projects

What Is Symbiotic and How Does It Work in 2024?

Ethereum vs Ethereum ETFs – 5 Major Differences

🚩 Before investing in crypto, know the risks.

Anatol Antonovici

6+ years of experience writing for crypto brands and blockchain firms, including Coindesk, Cointelegraph, Bitcoinist, CryptoPotato, Algorand, and OTCTrade.com