Diversify your crypto by investing in a variety of coins and tokens across different projects, sectors, and market capitalizations.

Written by: Mike Martin | Updated September 5, 2024

Reviewed by: Ryan Grace

Fact checked by: Laurence Willows

In 2024, there are over 20,000 cryptocurrencies in existence. Knowing which of these crypto assets to invest in and how much is a daunting task indeed.

In this guide, we’ll help you to simplify the process of diversifying your crypto investments.

🍒 tasty takeaways

Diversification is the process of spreading investments across different assets to reduce risk.

Diversification only works if the assets within a portfolio are not correlated.

Since cryptocurrencies are only mildly correlated, crypto portfolios should be diversified.

Crypto coins generally have higher market capitalizations and lower volatility than crypto tokens.

Investors can diversify their digital assets between crypto use cases, market cap, crypto ETFs, and crypto stock ETFs

DeFi (decentralized finance) allows investors to earn a yield on their crypto and should be considered when diversifying a crypto portfolio.

🚨 New to crypto? Check out our Guide: What is Cryptocurrency and How Does it Work?

Is Crypto Diversification Important?

Diversification is the process of varying the asset allocations within a portfolio so as to reduce the portfolio’s overall risk.

Diversification only works if the various investments in a portfolio are non-correlated.

For example, if every single stock in the US moved the same percentage amount day after day, why not just buy one stock?

But we know that stocks do indeed move at different prices, which is the reason for our retirement accounts being invested in several different stocks as well as several different sectors and categories (small cap, mid cap, large cap, etc.)

So since we diversify our equity investments, must we diversify our digital asset investments?

Well, that depends – are cryptocurrencies correlated, or non-correlated? If they are correlated, we can just buy bitcoin (BTC) or ether (ETH) and call it a day.

Let’s find out!

📚 Read: 23 Free Crypto Research Tools

Are Cryptocurrencies Correlated Together?

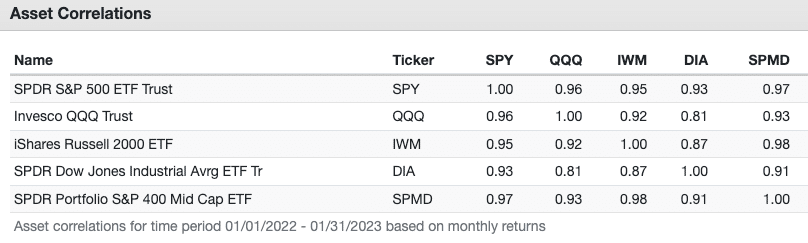

In order to put our study into perspective, let’s first examine the correlations between five major US stock market indices

Stock Correlations (1-Year)

S&P 500 (SPY)

Nasdaq (QQQ)

Russell 2000 (IWM)

Dow Jones (DIA)

S&P MidCap 400 Index (SPMD)

As we can see, major us stock market indices are closely correlated, within about 10%.

Now, let’s jump over to the crypto market and look at the correlations of the ten largest cryptocurrencies (not counting stablecoins)

Crypto Correlations (1-Year)

Bitcoin (BTC)

Ethereum (ETH)

Binance Coin (BNB)

Cardano (ADA)

Dogecoin (DOGE)

Polygon (MATIC)

Solana (SOL)

Polkadot (DOT)

Shiba INU (SHIB)

The above visual shows us that, when stacked side-by-side, the world’s largest cryptocurrencies are even less correlated than major US stock market indices.

Therefore, diversification in crypto as an investment strategy does make sense.

🍒 Is Dogecoin Dead? Find out here!

6 Ways to Diversify Your Crypto Portfolio

Let’s now take a look at a few different ways investors can create a well-balanced cryptocurrency portfolio.

Note: Altcoins is the term used to describe every cryptocurrency that is not bitcoin (BTC).

1. Diversify by Coins and Tokens

Cryptocurrencies can be divided into two categories: coins and tokens.

A cryptocurrency coin is the medium of payment for a blockchain network. There is only one crypto coin per network. For example, the Bitcoin network’s native currency is bitcoin (BTC) while Ethereum is ether (ETH).

A cryptocurrency token is created by a protocol that operates under a blockchain. There can be an infinite number of cryptocurrency tokens per blockchain. Crypto protocols are like ‘apps’ that run on the internet. However, in blockchain, there are several different ‘internets’, or blockchains. Crypto tokens have a variety of purposes, ranging from stablecoins (which track another asset), governance tokens (which give owners the right to vote on changes to a protocol), and utility tokens (which allow a user to interact with a protocol).

Cryptocurrency tokens are (not counting stablecoins) mostly riskier than cryptocurrency coins. The vast majority of the cryptos in our previous correlation study are ‘coins’.

In crypto, the greater the market cap, the less volatility. Again, this is a generality that tends to stay true.

However, it is worth noting that during bull markets, cryptos with lower market caps (like many tokens) tend to outperform larger coins.

Here are a few popular crypto tokens that reside on the Ethereum blockchain, which is the most robust of all blockchains for Web3 tokens.

Note: On the Ethereum network, all utility tokens are created under the ERC-20 standard.

Popular Crypto Tokens

Uniswap (UNI)

Chainlink (LINK)

Lido DAO Token (LDO)

ApeCoin (APE) Cronos (CRO)

Decentraland (MANA)

Axie Infinity (AXS)

Popular Crypto Coins

Bitcoin (BTC)

Ethereum (ETH)

Binance (BNB)

Solana (SOL)

Cardano (ADA)

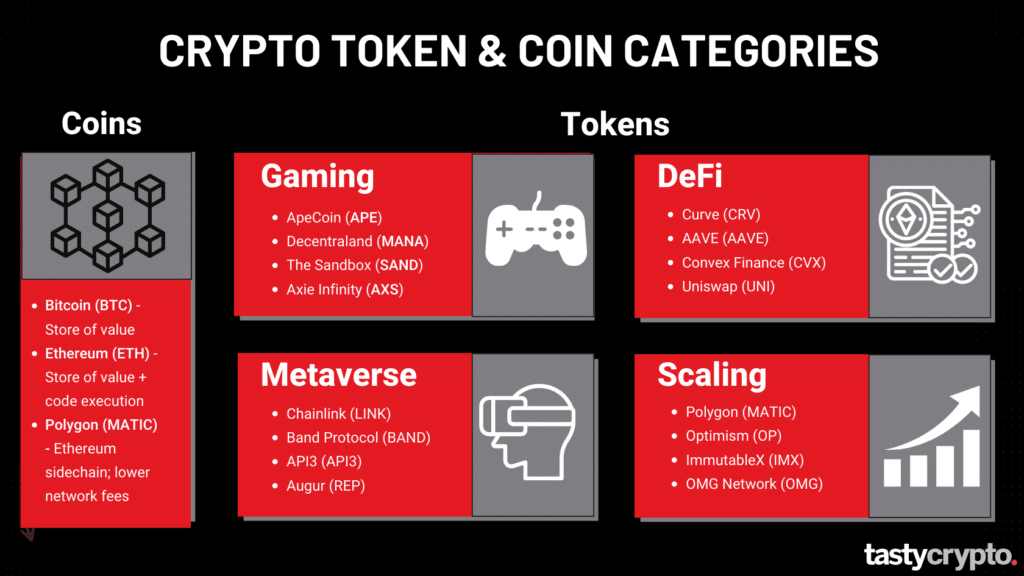

2. Diversify by Segment and Use Cases

Another great way to diversify crypto is by use cases.

Although we are mainly talking about crypto tokens when we talk about various use cases, crypto coins (or blockchains) offer different use cases as well.

Crypto Coins and Their Use Cases

Bitcoin (BTC) – Store of value

Ethereum (ETH) – Store of value + code execution (smart contracts) to build decentralized applications (dapps)

Polygon (MATIC) – Ethereum sidechain; lower network fees.

📚 Read! Bitcoin is a Legit Store of Value. Here’s Why.

Crypto Tokens and Their Use Cases

All of the below tokens are created by decentralized applications or dApps. You can interact with the interfaces of these protocols by connecting a self-custody wallet.

*This is by no means an exhaustive list of crypto token use cases.

Gaming

ApeCoin (APE)

Decentraland (MANA)

The Sandbox (SAND)Axie Infinity (AXS)

DeFi

Lido (LIDO)

Curve (CRV)

AAVE (AAVE)

Convex Finance (CVX)

Uniswap (UNI)

Oracles

Chainlink (LINK)

Band Protocol (BAND)

API3 (API3)

Augur (REP)

Scaling

Polygon (MATIC)

Optimism (OP)

ImmutableX (IMX)

OMG Network (OMG)

3. Diversify by Market Cap

According to Altcoininvestor, cryptocurrencies can be divided into 8 different market caps:

Mega >$200 Billion

Large $10B – $200B

Mid Market $1B – $10B

Small Market $100M – $1B

Micro Market $10M – $100M

Nano Market $1M – $10M

Pico Market $100K – $1M

Femto Market <$100,000

The smaller the market cap, the greater the risk. Investing in any tokens below the micro market cap level is extremely high-risk and not too different from buying a lottery ticket.

The exception to this rule is if you have conviction in a project, or know the industry well.

For example, I have worked for almost 20 years in the options trading industry. When I learned that Ribbon Finance was creating options trading vaults that mimicked popular strategies such as the covered call and collar, my interest was piqued.

After reading Ribbon’s ‘white paper’, I bought some tokens.

A white paper details the scope and ambitions of a project. It is always best to read the protocols white paper before investing.

4. Diversify with Crypto ETFs

Decentralized organizations like “Index Coop” have created tokens that track crypto indices, kind of like how ETFs or mutual funds track various stock market segments.

For example, if you want exposure to DeFi (decentralized finance), but don’t know which tokens to buy, you could purchase Index Coop’s DeFi Pulse token (DPI), which gives inventors exposure to ten dominant tokens in the DeFi space.

Let’s take a closer look at DPI, as well as a few other products offered by Index Coop.

Defi Pulse Index (DPI)

“The DeFi Pulse Index (DPI) is a capitalization-weighted index that tracks the performance of decentralized financial assets across the market.”

Metaverse Index (MVI)

“The Metaverse Index (MVI) is designed to capture the trend of entertainment, sports, and business shifting to take place in virtual environments.”

Web3 Data Economy Index (DATA)

“Web3 enables a new data economy. The Web3 Data Economy Index is an ecosystem of data-centric protocols and applications disrupting the data monopolies built in Big Tech.”

Bankless DeFi Innovation Index (GMI)

“The Bankless DeFi Innovation Index is a simple composite index that focuses on high-growth, early-stage DeFi projects which are not yet considered ‘blue chip.’”

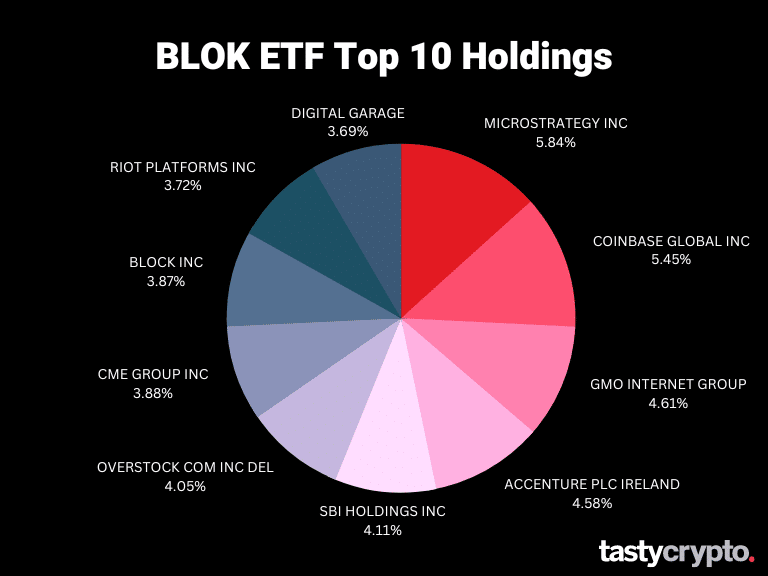

5. Diversify with Crypto Stock ETFs

Another great way to diversify your crypto investments is by purchasing the stocks of US companies embracing blockchain technology. You can diversify these investments further by purchasing blockchain ETFs.

Two popular blockchain ETFs you can buy with your online broker include ‘BLCN’ and ‘BLOK.

6. Diversify with DeFi

Decentralized finance (DeFi) is rebuilding the traditional finance sector in a peer-to-peer ecosystem.

DeFi expands the world of crypto beyond buying and selling by offering investors numerous ways to earn yield.

Additionally, you can interact in DeFi with US Dollar Stablecoins. US Dollar stablecoins are pegged to and (most of the time) backed by US Dollar reserves. Stablecoins can also represent other fiat currencies as well as commodities.

Using US Dollar stablecoins like USDC and Tether (USDT) all but eliminates the underlying volatility present in most crypto assets.

📚 Read: What is DeFi and How Does it Work?

Ways to Earn Yield in DeFi

Liquidity providing

Lending crypto

📚 Read! 3 Ways to Earn Yield in DeFi

In addition to DeFi, investors can further diversify their crypto by investing in non-fungible tokens, or ‘NFTs’.

📚 Read!: Best DeFi Coins to Invest In: 2023

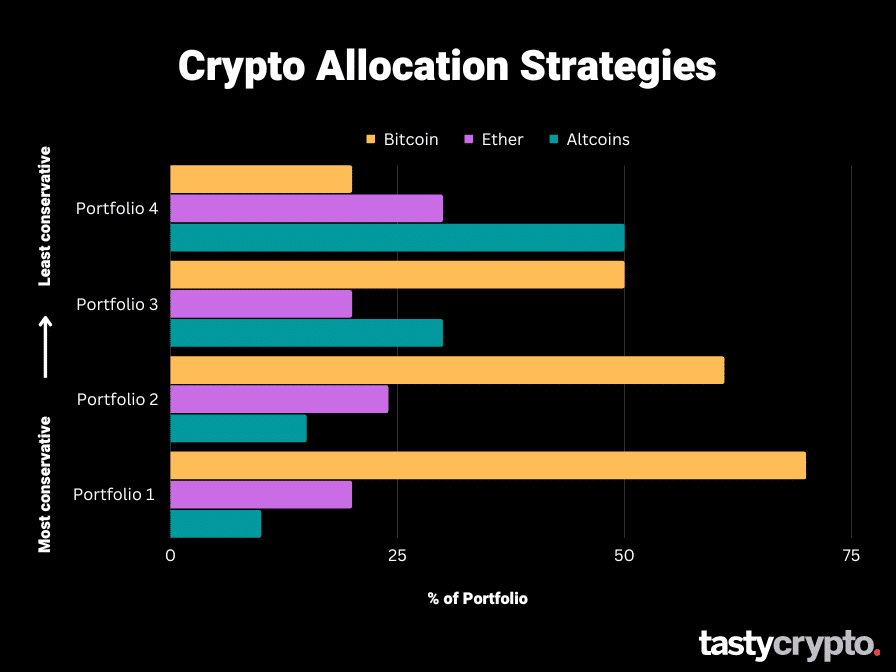

Crypto Allocation Examples

Generally speaking, the more bitcoin you have in your portfolio, the more conservative your portfolio will be.

However, conservative is not synonymous with low risk. Modern portfolio theory tells us that owning uncorrelated assets can actually reduce risk.

“Diversifying sufficiently among uncorrelated risks can reduce portfolio risk toward zero”

— Harry Markowitz

With that being said, let’s look at a few random crypto portfolios in terms of conservativeness. Bear in mind that ‘altcoins’ here represent a basket of many various cryptocurrencies that have some degree of real-world utility.

How Often Should I Rebalance by Crypto Portfolio?

Determining how often you rebalance your crypto portfolio depends on a few factors.

Economic landscape

During bear markets, cryptocurrencies with smaller market caps tend to underperform larger cryptocurrencies, like bitcoin (BTC)

New investments

Whenever you add new investments to your crypto portfolio, you should see how these investments change the overall risk of your portfolio and make the appropriate changes.

Volatility

In volatile markets, crypto prices can move dramatically. For example, if you own a micro-cap token that shoots up 75% in value in a week, it may be wise to take some profits, thus rebalancing your portfolio to reduce your micro-cap exposure.

Final Word

We hope this article was a helpful guide for you to get started on your crypto portfolio diversification journey.

Let’s review what we learned:

Diversification helps to reduce the risk of uncorrelated assets.

Since cryptocurrencies are only mildly correlated, diversification makes sense in this sector.

In addition to buying crypto directly, investors can invest in crypto stock ETFs like BLOK and BLCN, which highlight companies employing blockchain technology.

Crypto tokens generally have greater risk than coins.

DeFi allows investors to earn yield in crypto.

Before investing in any crypto, it is important for investors to have an understanding of both their investment goals and unique risk tolerance. For more information on the risks of crypto assets, read this article from investor.gov.

FAQs

The ideal crypto portfolio depends upon an investor’s risk tolerance. Generally speaking, younger investors have a greater risk tolerance for higher volatility cryptos.

An example of a diversified crypto portfolio would include 50% bitcoin (BTC) 30% ether (ETH) and 20% other altcoins.

A few factors that go into diversifying a crypto portfolio include market cap, use cases, geography, community size, and liquidity.

Some benefits of diversifying a crypto portfolio include exposure to a wider range of assets, higher returns, and lower risk.

Since bitcoin is not directly correlated with altcoins, modern portfolio theory suggests that investing in both bitcoin (BTC) and altcoins would both increase portfolio returns and reduce risk.

Some popular cryptocurrencies investors choose to diversify their digital assets include bitcoin (BTC), ether (ETH), Binance (BNB), Uniswap (UNI), Chainlink (LINK), and Cardano (ADA).

🍒 tasty reads

What Is a Crypto Whitepaper? 5 Things to Look For

Crypto Fundamentals to Pick Winning Trades

Here’s How to Diversify a Crypto Portfolio

Mike Martin

Mike Martin formerly served as the Head of Content for tastycrypto. Before joining tastycrypto, Michael worked in the active trader divisions of thinkorswim, TD Ameritrade, and Charles Schwab. He also served as a writer and editor for projectfinance.

Michael has been active in the crypto community since 2017. He holds certifications from Duke University in decentralized finance (DeFi) and blockchain technology.