PYUSD is PayPal’s USD-backed stablecoin on the Ethereum blockchain, issued by Paxos. PYUSD offers integration with the PayPal ecosystem and Web3 applications and has swiftly achieved a market cap of $150 million

Written by: Anatol Antonovici | Updated August 25, 2024

Reviewed by: Mike Martin

Fact checked by: Ryan Grace

In this guide, we will explore the unique features of PayPal’s PYUSD, compare it to other stablecoins, and examine its potential impact within the cryptocurrency ecosystem.

🍒 tasty takeaways

- PYUSD is pegged to the USD based on a 1:1 ratio and is backed by short-term US treasuries and US dollar deposits.

- In only a few weeks, PYUSD’s market cap has surged to $150 million. As of August 2024, it has a market cap of $1 billion, ranking 66th on Coinmarketcap.

- PYUSD holders can use the token within the PayPal ecosystem as well as in DeFi and Web3.

What Is a Stablecoin?

A stablecoin is a blockchain-based digital currency pegged to the value of a traditional asset, typically a fiat currency like the US dollar. A 1:1 price peg ensures that the coin’s value remains stable at any time, thus eliminating the extreme volatility typical for cryptocurrencies like Bitcoin (BTC) or Ethereum (ETH).

The main goal of stablecoins is to provide stability. Their first use case was to act as a gateway to the crypto ecosystem. Eventually, stablecoins have extended their reach. For example, they play a key role in decentralized finance (DeFi) – a blockchain sector offering financial services on decentralized, community-driven platforms.

Stablecoins are unique because they combine the stability and liquidity of fiat money with blockchain features like decentralization, transparency, speed, security, and efficiency.

What is PayPal?

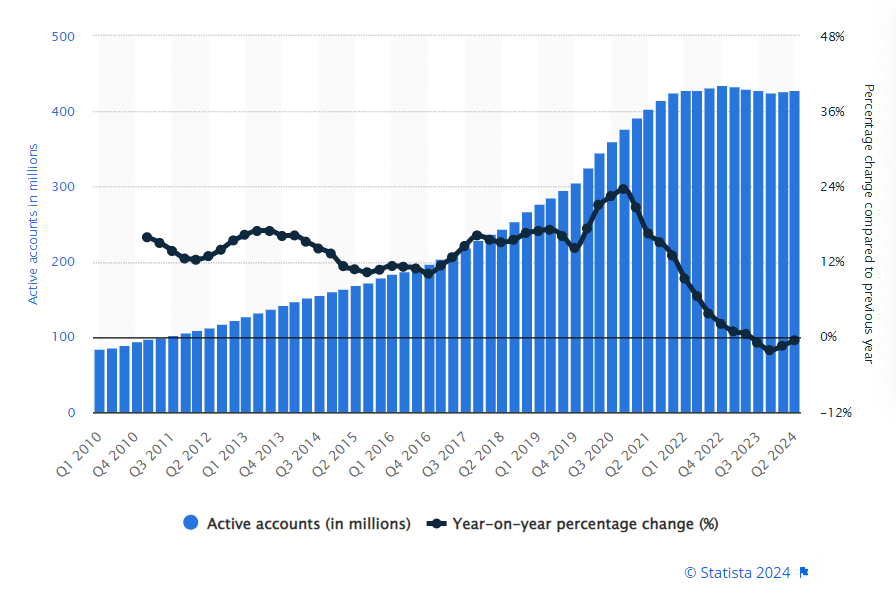

PayPal is an online payment system operated by PayPal Holding Inc., a US-based multinational company with a market cap of $55 billion as of October 2023.

The platform supports the majority of countries and enables users to transfer money online. Users can link their PayPal account with their bank account or credit/debit card to deposit and withdraw funds.

With a market share of 41%, PayPal is the world’s most popular payment app. It has over 400 million users worldwide and the annual payment volume exceeds $1.2 trillion.

Source: Statista

In August 2023, PayPal announced the launch of its own stablecoin – PayPal USD, with the ticker PYUSD. The stablecoin is offered in partnership with Paxos Trust Company, which operates a blockchain infrastructure platform and acts as the issuer of PYUSD.

PayPal’s stablecoin is based on the Ethereum blockchain and uses the ERC20 token standard, making it compatible with DeFi and Web3 applications.

PYUSD is regulated by the New York State Department of Financial Services.

It is available for PayPal users residing in the US and will soon be available on Venmo, a US-oriented payment app operated by PayPal.

🍒 Other popular stablecoins include USDT, USDC, and DAI – Read how they work here!

How Does PYUSD Work?

PayPal is a fiat-backed stablecoin, fully backed by USD deposits, short-term US Treasuries, and similar cash equivalents. When users buy PYUSD by depositing US dollars, Paxos issues new tokens on Ethereum, increasing the stablecoin supply to maintain the peg. When users sell PYUSD and redeem fiat, the sold tokens are burnt.

This mechanism is employed by other stablecoins in this category, including Circle’s USDC and Tether’s USDT. Paxos itself operates a proprietary USD-backed token – USDP.

PayPal USD is available to PayPal users (US clients only at the moment), merchants, and developers to seamlessly connect fiat and digital currencies.

Why Does PayPal Need a Stablecoin?

The launch of PYUSD is one of the very few examples of when an established brand in traditional finance (TradFi) offers a crypto product. Facebook had similar plans, but it postponed these plans due to pressure from governments.

This is not the first time PayPal has promoted crypto use cases. In 2020, it launched support for cryptocurrencies like Bitcoin, Ethereum, Litecoin, and Bitcoin Cash, enabling users to buy and sell crypto directly on the app.

The new stablecoin is meant to open the door to Web3 use cases and be integrated into blockchain applications.

What Can You Do With PYUSD?

Today, eligible users can:

- Transfer PYUSD between PayPal and supported Web3 wallets. Tastycrypto will integrate PYUSD in the coming weeks.

- Send and receive PYUSD with no fees within the PayPal ecosystem.

- Fund purchases by selecting PYUSD at checkout.

- Convert any digital assets supported on PayPal to and from PYUSD.

PYUSD may facilitate global payments, leveraging the platform’s existing network of 29 million merchants.

The stablecoin is also programmable, offering developers a functional digital currency that can be integrated into public blockchains and Web3 apps.

PYUSD Total Supply and Reserves

As of August 2024, the PYUSD’s market cap is over $1 billion, gaining over $700 million in about three weeks.

Source: CoinMarketCap

This means that over 148 million tokens are issued in the contract address on Ethereum. Unlike other fiat-backed stablecoins, PYUSD is backed by USD deposits and other cash equivalents, ensuring more stability compared to tokens backed by commercial paper or commodities.

Paxos releases a reserve report and an attention report on a monthly basis to provide proof of reserves.

How to Trade and Stake PYUSD

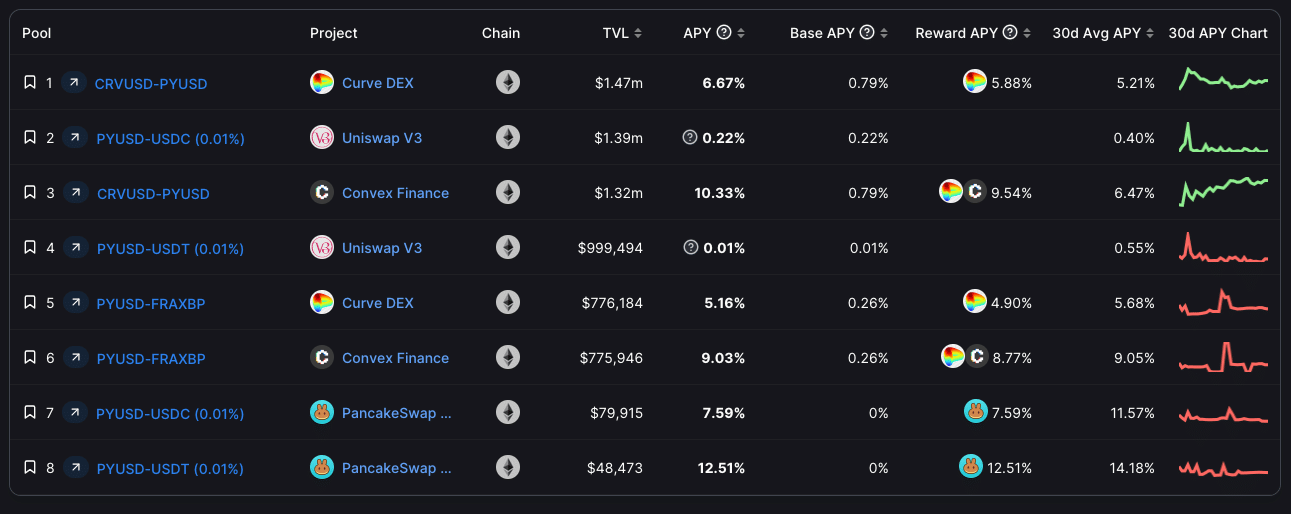

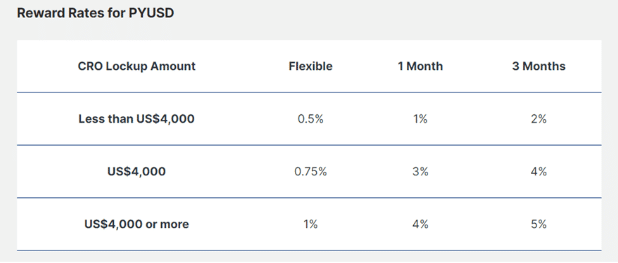

PYUSD is a token that can be traded and used by eligible US residents within the PayPal system. However, it’s not just limited to PayPal; PYUSD token is listed on numerous cryptocurrency exchanges. This includes both centralized exchanges like Coinbase, Kraken, Kucoin, Bitstamp, and Crypto.com, and decentralized exchanges (DEXs) such as Uniswap, PancakeSwap, and Curve.

You can become a liquidity provider on DEXs by depositing PYUSD in pools, most of which contain another stablecoin. The base APY starts from 0.1%, while the annual reward APY can exceed 10% on PancakeSwap or Convex.

Source: DeFiLlama

PYUSD holders can also stake the token on centralized platforms. For example, Crypto.com’s Crypto Earn program offers rewards ranging from 0.5% to 5%.

Buy PYUSD with tastycrypto

You can currently buy PYUSD for no transaction fees with the tastycrypto self-custody wallet. Gas fees, however, still apply.

Here are some additional benefits you get when you choose to self-custody your digital assets with tastycrypto:

- In-App Swap: Trade BTC, ETH, and 1,000+ tokens

- Generate Yield in DeFi: Stake, lend, and become your own market maker

- NFTs: Buy, sell, and view NFTs in-app

tastycrypto offers both iOS and Android self-custody wallets – download yours today! 👇

PYUSD vs USDC vs USDT

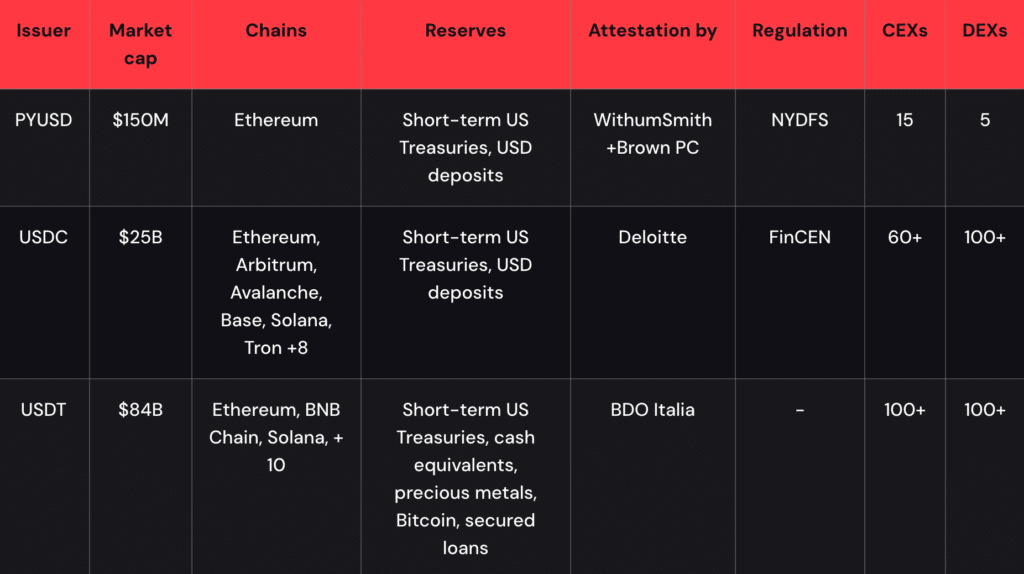

PYUSD is very similar to its direct competitors: USDT and USDC, which are the third and the sixth-largest cryptocurrencies by market cap. However, PYUSD stands out thanks to the brand recognition of PayPal and the tighter regulatory oversight.

Here is a brief comparison between the three:

| Issuer | Market cap | Chains | Reserves | Attestation by | Regulation | CEXs | DEXs |

|---|---|---|---|---|---|---|---|

| PYUSD | $150M | Ethereum | Short-term US Treasuries, USD deposits | WithumSmith +Brown PC | NYDFS | 15 | 5 |

| USDC | $25B | Ethereum, Arbitrum, Avalanche, Base, Solana, Tron +8 | Short-term US Treasuries, USD deposits | Deloitte | FinCEN | 60+ | 100+ |

| USDT | $84B | Ethereum, BNB Chain, Solana, + 10 | Short-term US Treasuries, cash equivalents, precious metals, Bitcoin, secured loans | BDO Italia | - | 100+ | 100+ |

FAQs

PYUSD is a stablecoin launched by PayPal and issued by its partner Paxos on Ethereum.

PYUSD is a cryptocurrency supported by US dollar assets. It strives to keep its value steady at $1, although minor price variations can occur. Currently, its trading value is $0.999.

For US users, PYUSD can be purchased directly on the PayPal app. The token is also available to everyone as it’s listed on several major crypto exchanges.

PYUSD can be used within the PayPal ecosystem for transfers, conversions, and payments. It can also be transferred to compatible external wallets. Additionally, it can be used in DeFi and Web3 as any other stablecoin.

🍒 tasty reads

The Core Blockchain and DeFi Ecosystem: What You Need to Know

7 Best DePIN Crypto Projects

What Is Symbiotic and How Does It Work in 2024?

Ethereum vs Ethereum ETFs – 5 Major Differences

Anatol Antonovici

6+ years of experience writing for crypto brands and blockchain firms, including Coindesk, Cointelegraph, Bitcoinist, CryptoPotato, Algorand, and OTCTrade.com