Koinly is a popular and user-friendly crypto tax software tool that helps users track transactions across hundreds of crypto exchanges and wallets.

Written by: Mike Martin | Updated August 25, 2024

Reviewed by: Ryan Grace

Fact checked by: Laurence Willows

Koinly Quick Summary

| Product | Koinly 2023 Review: Free Crypto Tax Software Made Easy |

| Features |

- Supports over 20,000 tokens - Integrates with 400+ crypto exchanges and 100+ wallets - Generates specialized tax forms for 10+ countries |

| Overview | Koinly is a user-friendly crypto tax software that simplifies cryptocurrency tax reporting. It helps users track transactions, calculate taxes, and generate tax reports. |

| How It Works |

1. Registration with country and base currency selection 2. Data import from exchanges and wallets 3. Review and verification of imported data 4. Generation of detailed tax reports |

In this article, we’ll tell you all about Koinly, a crypto tax reporting tool that simplifies the process of doing your cryptocurrency taxes.

🍒 tasty takeaways

- Koinly supports over 20,000 tokens and can be integrated with more than 500 crypto exchanges and over 200 wallets.

- The platform can generate specialized tax forms for more than 10 countries, including the USA, the UK, Canada, Germany, and Australia.

- Koinly offers a free version with limited features as well as paid plans.

More than a decade after the launch of Bitcoin, cryptocurrency transactions have become taxable events in most developed and developing countries.

Crypto tax obligations can be a complex web. A crypto tax software tool updated with the latest crypto tax rules in major jurisdictions can be of great help. Here is why such a tool is needed for crypto users:

- An intuitive crypto tax tool can simplify crypto tax responsibilities by automatically determining the tax implications for every kind of transaction, including trading, staking, lending, and mining.

- Crypto tax software tools are often updated with the latest guidelines in many jurisdictions.

- They can help users avoid human errors and save more time thanks to automation and the generation of ready-to-sign tax reports suited to specific jurisdictions, such as Schedule D, FIFO, LIFO, etc.

What is Koinly?

Koinly is one of the most popular cryptocurrency tax software solutions. It was launched in 2018 and is headquartered in London, UK.

The tool has been designed to help crypto users calculate and report on their crypto-related taxes. Koinly is aimed at crypto investors and accountants alike. It can distinguish between crypto activities like trading, staking, mining, and airdrops.

Thanks to a series of API keys, Koinly users can simply connect the tool to their crypto exchanges and wallets, enabling automated transaction imports. The platform can easily calculate market prices during crypto trades, match intra-wallet transfers to avoid unnecessary taxation, and evaluate gains and losses.

How Does Koinly Work?

Koinly works very much like an enhanced Excel sheet, streamlining operations related to crypto taxation, tax calculations, and tax filing.

To use the tool, follow the following steps:

- Registration – you can sign up directly or with your Google or Coinbase account. You will have to specify your country, base currency, and desired plan.

Koinly can be used in any jurisdiction that uses universal accountancy methods like First In First Out (FIFO), Last In First Out (LIFO), Highest Cost First Out (HIFO), and Average Cost Basis (ACB). - Data Importation – after registration, link to crypto exchanges, wallets, and blockchains by either auto-syncing (like with Ethereum-based wallets) or manually entering API keys, which are encrypted for security. Alternatively, you can upload CSV files from your exchanges and self-custody wallets.

- Review & Verification – make sure that all data has been imported correctly. Note that Koinly also acts as a crypto portfolio tracker, examining transaction histories, determining cost basis, fair market values, and calculating gains. A summarized tax report is provided for free.

- Generate Tax Reports – after verification, you can export detailed tax reports. They can be exported to tax software like TurboTax and sent directly to accountants. Koinly’s paid plans enable users to generate IRS-ready forms like Form 8949 and Schedule D.

Koinly Features

Koinly has multiple features to help crypto holders better manage their transactions and streamline tax reporting. Here are a few.

- Portfolio tracking – Koinly offers a dedicated crypto portfolio tracker tool that can easily track your crypto assets and taxes. It helps users monitor total holdings and portfolio growth over time across all wallets.

- Data import – thanks to this feature, crypto users have all their transactions across multiple wallets in one place. If you hold crypto across multiple exchanges, such as Coinbase or Binance, you can easily sync to Koinly and automatically import transaction data.

- Integration – The platform can also integrate with futures, options, and margin trading services like BitMEX and Binance Futures, DeFi protocols like Derive (formerly known as Lyra) and Compound, and lending platforms like Nexo.

- Monitor – Koinly uses AI to monitor transactions within your wallets to avoid double taxation.

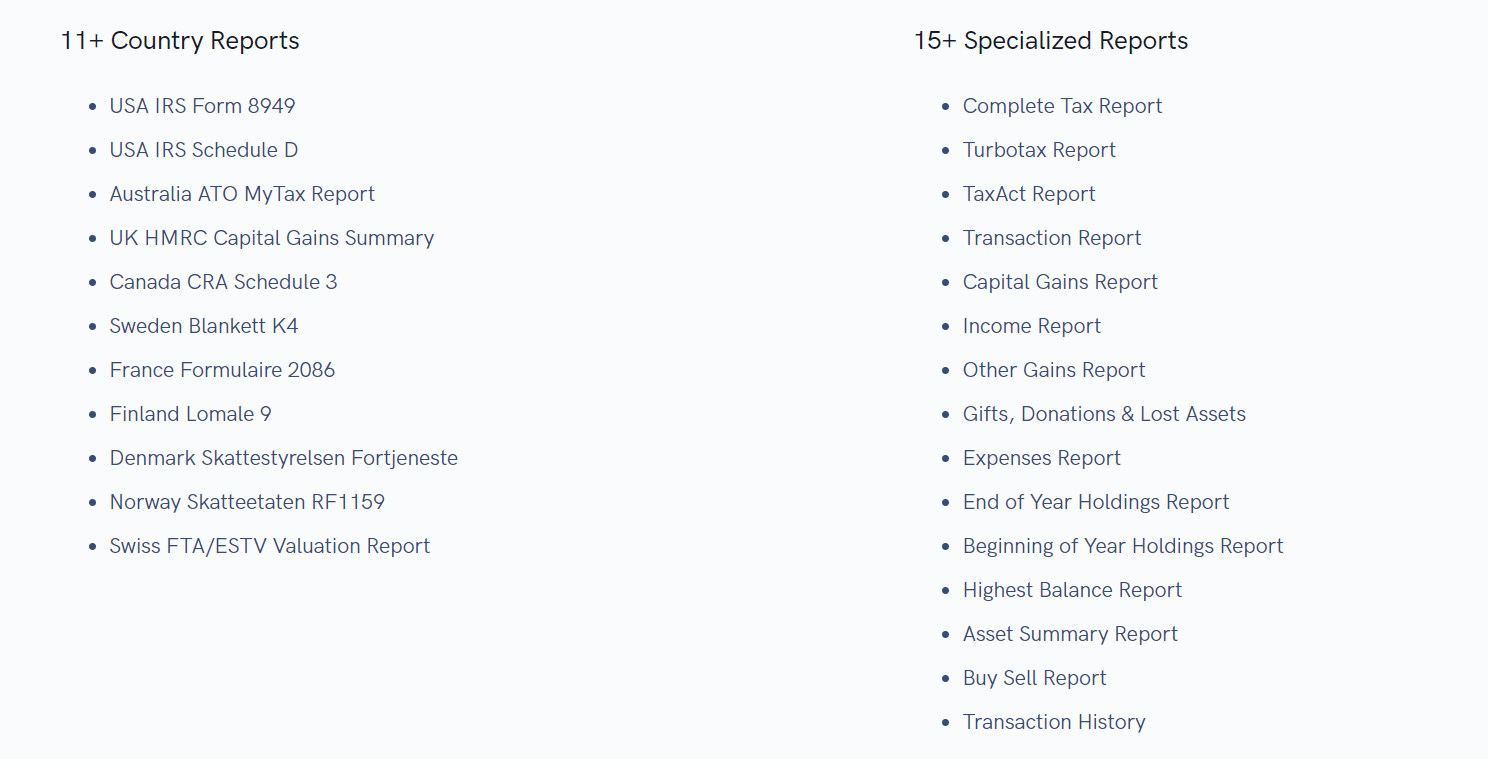

- Crypto tax reports – Koinly provides US residents with reliable crypto tax reports, such as Form 8949 and Schedule D. It can generate international tax reports for dozens of countries, including the UK, Germany, Sweden, and Australia.

- Integration – The integration with tax software TurboTax, TaxAct, and H&R enables Koinly users to easily export the reports to accountants.

- Error reconciliation – Koinly users can detect and fix issues with their crypto transactions.

Koinly Pricing and Fees

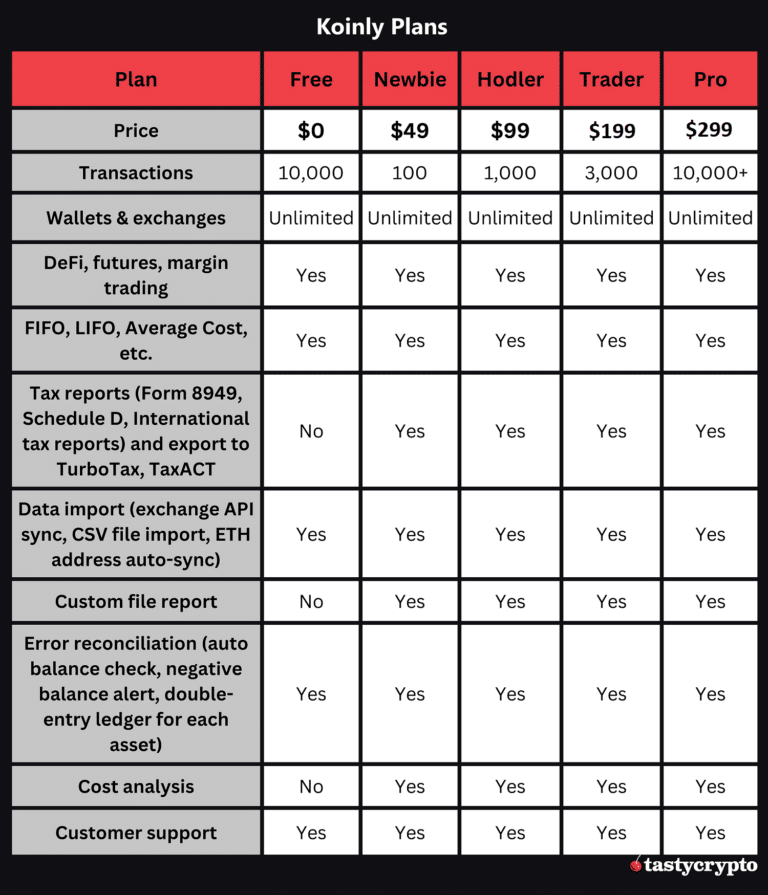

Koinly offers a free plan with limited features, enabling users to track up to 10,000 transactions across all supported exchanges and wallets. However, the free plan doesn’t support tax reports. Here are Koinly’s plans and prices:

Supported Exchanges, Wallets, Chains

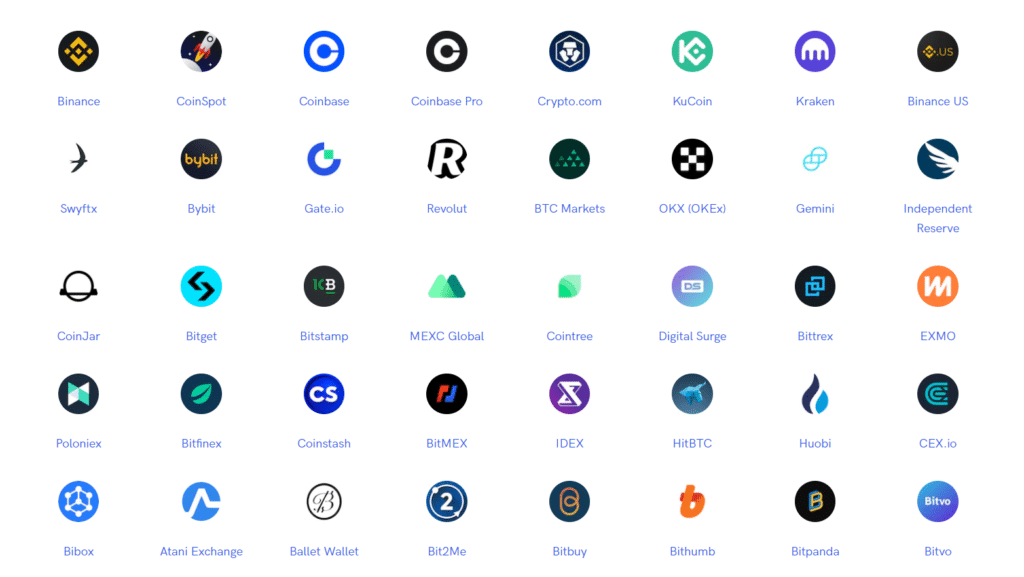

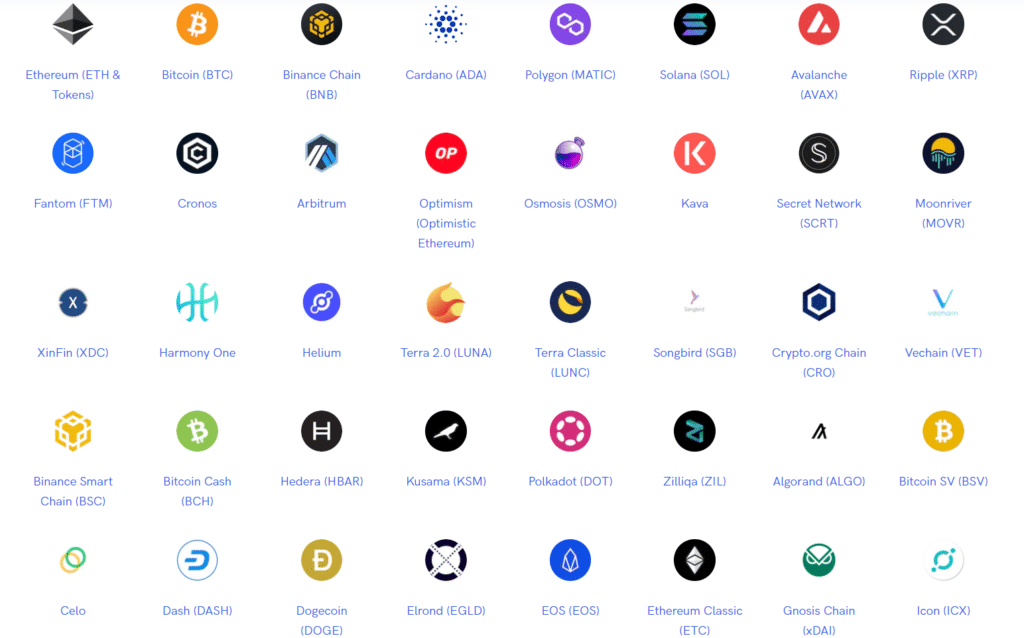

Koinly supports over 400 centralized crypto exchanges and trading platforms.

Supported Exchanges

- Binance

- Coinbase

- Kraken

- Crypto.com

- Gemini

- OKX

- Bitstamp

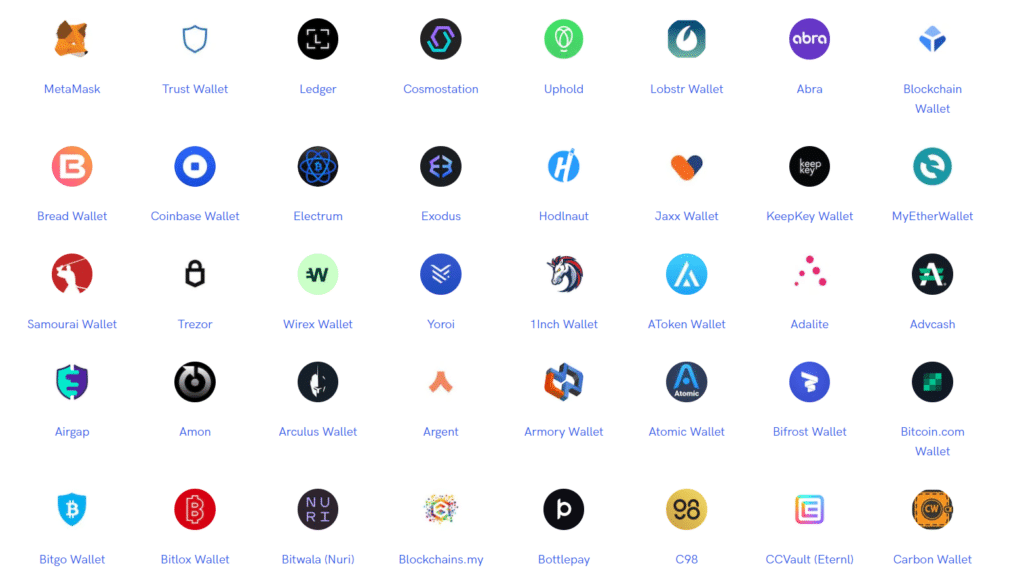

Wallet Support

Koinly also supports over 100 crypto wallets, including self-custody. Some examples include:

- tastycrypto

- MetaMask

- Trust Wallet

- Trezor

- Ledger

- Coinbase Wallet

- Exodus

- Bitgo

- Yoroi

Koinly Supported Wallets

Source: Koinly

Source: Koinly

Supported DeFi platforms

Koinly supports dozens of lending platforms and Web3 platforms, such as Nexo, Compound, and OpenSea.

In total, Koinly supports over 20,000 tokens.

Koinly Pros and Cons

Pros:

- Koinly integrates with hundreds of exchanges and wallets, supporting over 20,000 tokens.

- User-friendly interface.

- The tax software has many features that can automatically import data, track your portfolio, and export reports to tax apps.

- The free version supports up to 10,000 transactions.

- Generates tax reports for dozens of jurisdictions, including Schedule D.

Cons:

- The automated data import doesn’t work for all supported exchanges and wallets.

- It can be expensive for high-volume traders.

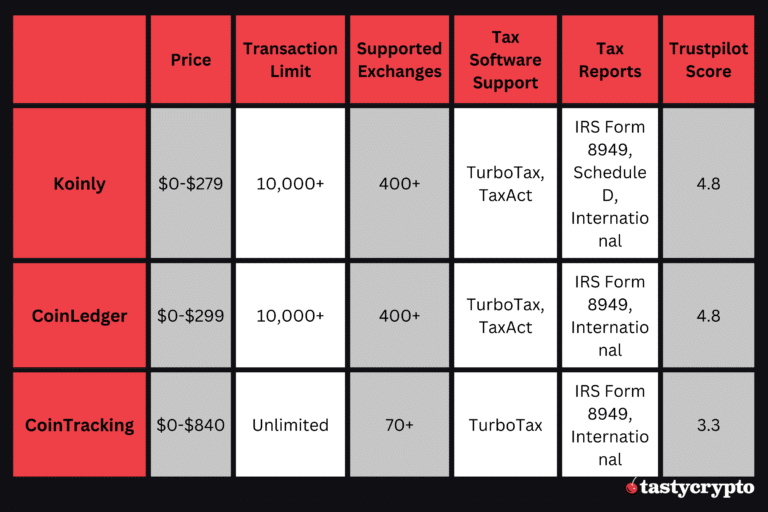

Koinly vs Other Tax Reporting Software

Koinly is one of the most widely-used crypto tax tools, competing with services like CoinLedger or CoinTracking. Here is how it compares with competitors:

FAQs

Yes – Koinly implements numerous security measures such as data encryption and robust SSL to ensure user data is managed securely. With a rating of 4.8 on TrustPilot, Koinly is one of the most trusted crypto tax software systems.

Yes – Koinly has a dedicated help page and a blog section. Users can reach the customer support team via email at support@koinly.io or via the live chat option on the site.

Koinly is mostly suitable for individuals and teams that are active traders and handle multiple crypto transactions throughout the year. However, beginners can also use the tool, especially the free version.

Syncing an account on a crypto exchange or wallet usually takes 15 minutes.

Additional Reading

Anatol Antonovici

6+ years of experience writing for crypto brands and blockchain firms, including Coindesk, Cointelegraph, Bitcoinist, CryptoPotato, Algorand, and OTCTrade.com

🍒 tasty reads

The Core Blockchain and DeFi Ecosystem: What You Need to Know

7 Best DePIN Crypto Projects

What Is Symbiotic and How Does It Work in 2024?

Ethereum vs Ethereum ETFs – 5 Major Differences