MEV bots are software tools built to monitor the Ethereum blockchain, identify profitable opportunities, and automatically execute those transactions for their user.

Written by: Anatol Antonovici | Updated August 25, 2024

Reviewed by: Mike Martin

Fact checked by: Ryan Grace

In Decentralized Finance (DeFi), MEV bots are software programs that profit by front-running or sandwiching transactions on a decentralized crypto exchange. In this guide, we’ll show you how they work!

🍒 tasty takeaways

- Maximal Extractable Value (MEV) is the profit that miners or validators can earn by ordering transactions based on the fees paid by initiators.

- MEV bots are software tools that analyze arbitrage opportunities across DeFi and automatically implement MEV-based strategies.

- Since Ethereum’s move to PoS, MEV bots have become available to wider communities. MEV strategies are not relevant to Bitcoin since this network doesn’t have the smart contract feature.

- MEV bot strategies include arbitrage, frontrunning, sandwiching, flash loans, and liquidation.

- In January of 2024, a MEV bot run by 2Fast extracted $1.9 million from a single transaction on Solana.

Summary

| Description | |

|---|---|

| What Is MEV? | MEV allows block creators to profit from transaction order manipulation in DeFi. |

| MEV Bots Operation | Automated tools identifying and executing profitable Ethereum blockchain transactions. |

| MEV and Ethereum's PoS Transition | Post-PoS, Ethereum's smart contracts enable wider MEV strategies beyond Bitcoin's capabilities. |

| MEV Bot Strategies | Includes arbitrage for price discrepancies and frontrunning to preempt large transactions. |

| Understanding MEV Arbitrage | Traders profit from price differences across exchanges, leveraging the mempool’s public nature. |

| Real-Time Data and MEV Searchers | MEV searchers use real-time mempool data to identify and complete arbitrage within one block. |

What is MEV?

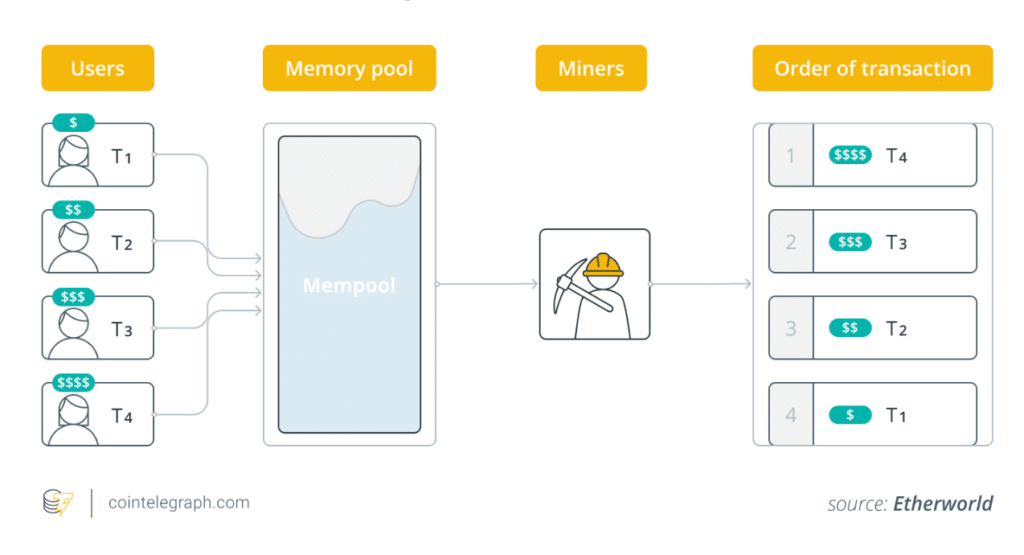

Source: Cointelegraph

Maximal Extractable Value (MEV), previously known as Miner Extractable Value, refers to the potential gain block creators can make by strategically ordering or managing transactions within a blockchain block.

The first destination of all transactions on a blockchain is the ‘mempool’ – a public place from which miners or validators select and arrange transactions in a certain order to be added to the next block. The transactions with the highest gas fees attached are picked first to be validated.

As a rule, block validators make profits from block rewards and transaction fees, but the emergence of decentralized finance (DeFi) and Web3 apps has led to a new revenue stream that has to do with the order in which transactions are added in a block.

Since miners and validators have full control over transaction ordering, they have unique opportunities to extract additional profits through strategic formation and ordering of transactions, a phenomenon that we call MEV.

MEV on Ethereum

While MEV is relevant for all blockchains, we usually discuss it in the context of Ethereum, which dominates the DeFi space and is the largest blockchain with smart contract capabilities.

Before 2023, Ethereum operated on the Proof of Work (PoW) algorithm, enabling a select group of participants, mainly miners crafting the blocks, to profit from MEV extraction. With the shift to the Proof of Stake (PoS) consensus mechanism, anyone can now serve as a block validator and capitalize on MEV prospects.

The Ethereum upgrade promotes the role of ‘searchers,’ which are individuals who use advanced algorithms to spot profitable opportunities on the blockchain. Searchers deploy MEV bots to send these lucrative transactions to validators.

In this setup, searchers pay higher gas fees to prioritize their transactions, earning profits in return, while validators benefit from the increased fees. It’s a mutually beneficial arrangement.

What Are MEV Bots and How Do They Operate?

MEV bots are sophisticated algorithms mostly run by specialized teams. They have been developed to monitor mempools with pending transactions, identify MEV opportunities, and then execute strategies such as frontrunning automatically.

MEV bots, while introducing profit opportunities and intensifying competition in the MEV sector, also introduce significant concerns. Many consider MEV as an ‘invisible tax’ on regular users as it leads to network congestion on Ethereum.

Main Types of MEV Bot Strategies

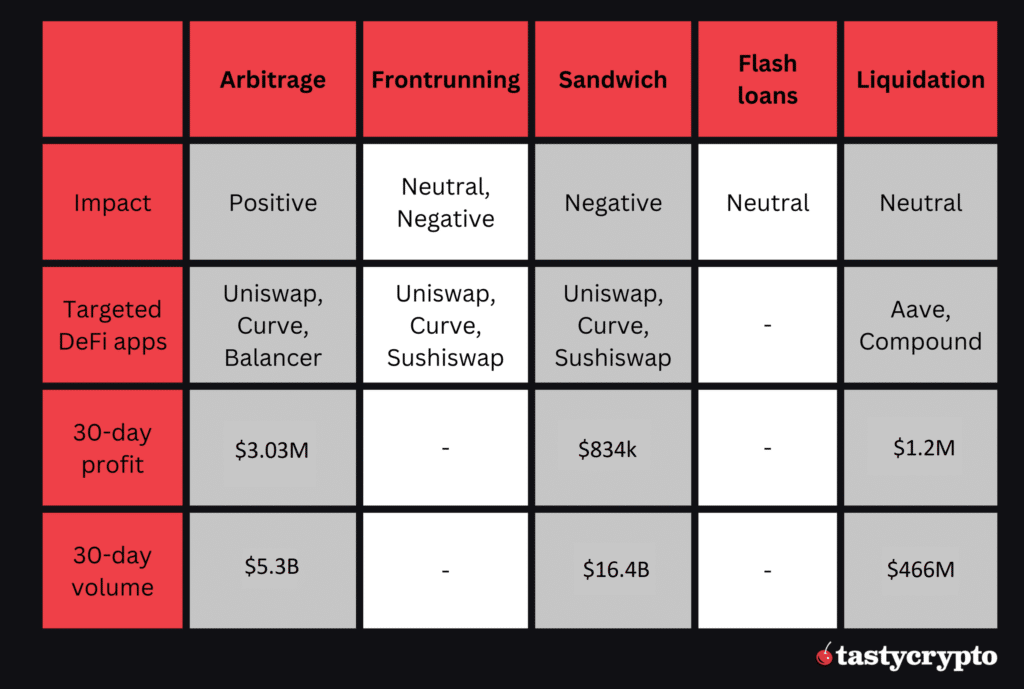

Here are the main types of MEV bots based on their strategies:

Arbitrage bots

These bots identify noticeable price differences for the same asset across different decentralized exchanges (DEXs) and capitalize on these gaps through trading. For instance, if a token’s price on Uniswap is less than on Sushiswap – two popular DEXs – the arbitrage bot would buy it from Uniswap and then sell it on Sushiswap, yielding a profit.

🍒 5 DeFi Arbitrage Strategies in Crypto to Know

Frontrunning bots

These bots analyze the mempool for significant or promising transactions, intending to perform similar trades before their validation by offering a higher fee, ensuring they get into the next block sooner.

For example, let’s say a bot spots a sizable buy order for a token on Uniswap. It would then attempt to purchase that same token ahead of the initial order and resell at an elevated price once the initial order amplifies the token’s demand and price as a result of slippage.

Sandwiching bots

These algorithms integrate both frontrunning and backrunning strategies to encapsulate a targeted transaction.

In a scenario where a bot identifies a significant pending buy order for a token on a DEX, it aims to purchase the token right before the main order is processed (frontrunning) and eventually resell it at a higher price immediately after the pending order is executed by the unsuspecting trader (backrunning). This is usually a malicious strategy that involves three transactions:

- MEV bot places a buy order, pumping the token price.

- MEV victim purchases the token at a higher price.

- MEV bot sells the token on the DEX, benefitting from the price difference.

Flash loan bots

These bots utilize flash loans – quick loans settled within a single block – to conduct advanced trades demanding significant capital. For example, a bot could employ a flash loan to borrow a large amount of ether (ETH), exchange it for a different token on a DEX, swap again for ETH on a different DEX, and then settle the loan plus interest, all within a single block’s duration.

Liquidation bots

DeFi lending protocols like Aave, Compound, or JustLend require users to put up cryptocurrency as collateral, which can be liquidated if the user can’t repay the loan. The protocol enables anyone to liquidate the collateral and earn a liquidation fee. MEV bots can identify which borrowers can be liquidated and then collect these fees.

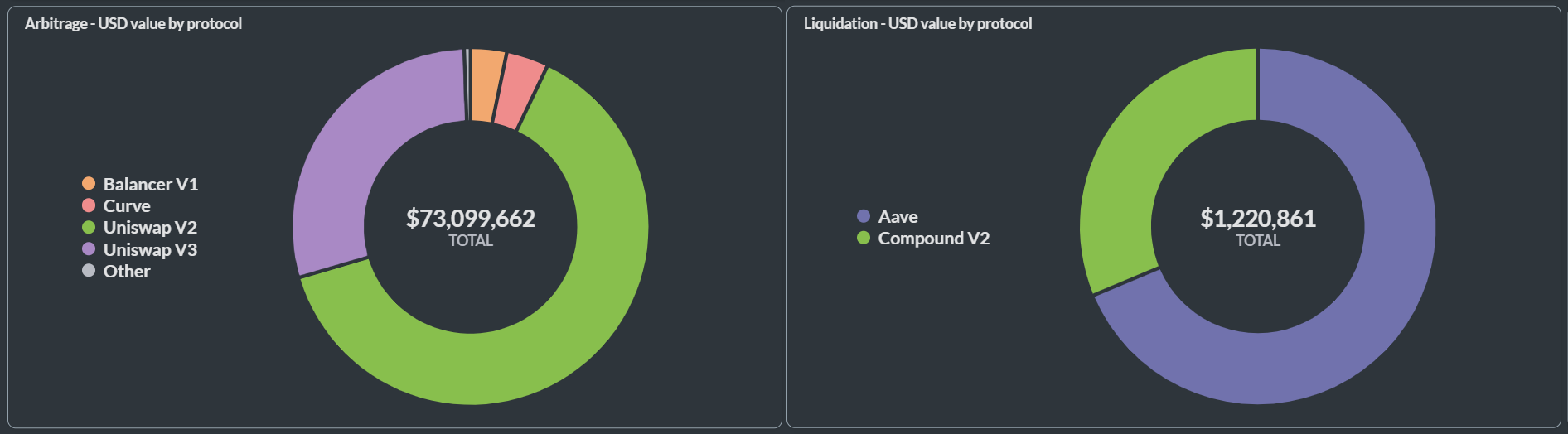

Data from EigenPhi

Pros and Cons of MEV Bots

Let’s now look at the pros and cons of MEV bots:

Advantages of MEV Bots:

- MEV isn’t limited to miners, widening the scope for Ethereum users to tap into profitable on-chain opportunities.

- User-friendly tools allow non-tech-savvy participants to pool liquidity and earn from the profits.

- Arbitrage-focused MEV bots increase market efficiency by correcting price differences across decentralized exchanges (DEXs).

Disadvantages of MEV Bots:

- Potential to compromise blockchain transparency and fairness, favoring those with more resources and influence.

- Can introduce unpredictable market fluctuations, catching traders unaware and triggering their stop losses.

- Attractive tools for deceitful activities, enabling malicious actors to exploit smart contract vulnerabilities.

- Inherent risks involved; unsuccessful strategies could result in financial losses.

Even when used fairly, you should know that MEV bots may be a risky business. If the strategies fail, users can lose money.

Examples of MEV Bots

There are examples of MEV bots making millions, although many of them use unethical methods that don’t benefit regular traders.

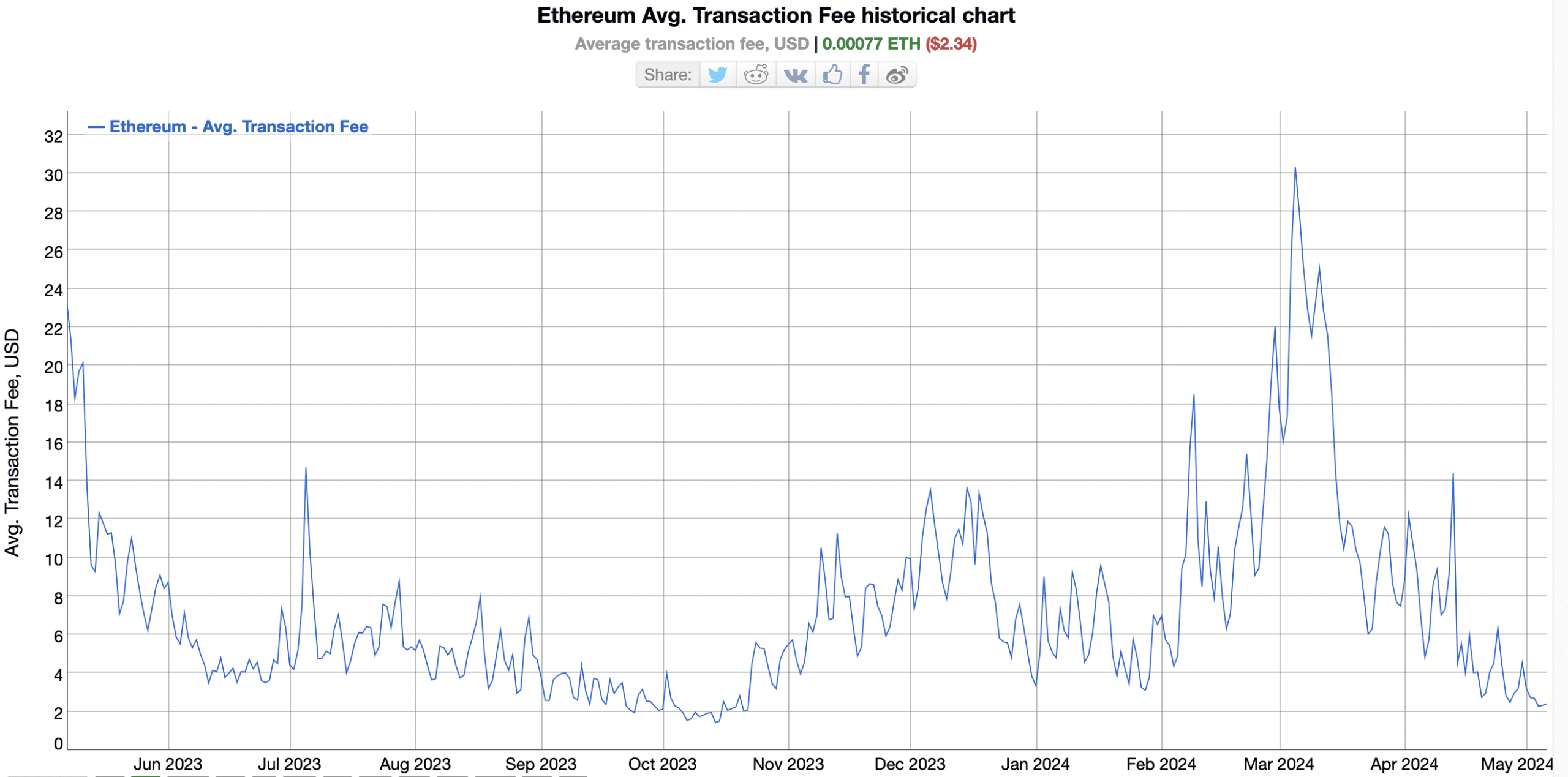

In the first half of 2023, an Ethereum bot made about $34 million in three months by using sandwich attacks and arbitrage strategies. The bot was very active, causing a significant increase in Ethereum’s transaction fees that exceeded $25 in May.

Source: Bitinfocharts

Last year, a MEV bot called 0xbad conducted an arbitrage transaction that yielded 800 ETH, which was valued at over $1 million at the time. Ultimately, a hacker outsmarted the bot by leveraging a flaw in its code, leading to the loss of all its profits and an extra 300 ETH from the crypto wallet.

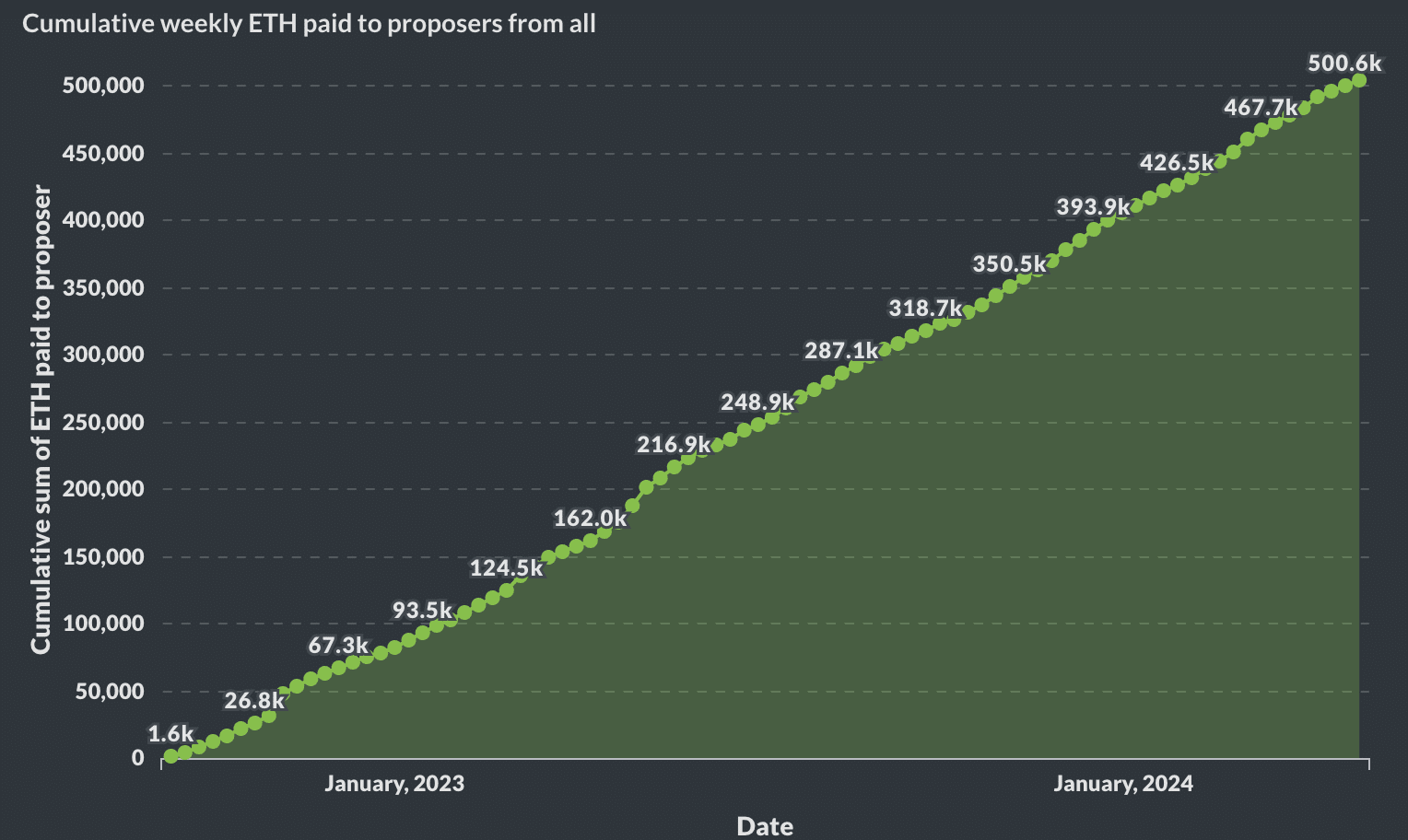

According to data from Flashbots, the total Realized Extractable Value (REV) since Ethereum’s PoS upgrade has exceeded 416k ETH, which translates into more than $500 million in today’s prices!

Source: transparency.flashbots.net

It’s worth noting that the overwhelming majority of arbitrage opportunities are associated with Uniswap, while the vast majority of liquidation frontrunnings occur on Aave and Compound.

Source: transparency.flashbots.net

MEV Bot in Action: $1.9 Million Solana Profit

MEV tips in SOL are given to Solana validators running the Jito client.

In January of 2023, a MEV bot run by 2Fast extracted $1.9 million from a single transaction on the Solana blockchain. Here’s how it happened:

Strategy Implementation: 2Fast, a bot operator, used a back-running strategy on the dogwifhat (WIF) trades.

Profit Generation: The bot transformed 703 SOL (about $70,000) into 19,035 SOL (roughly $1.9 million) in 20 seconds.

Tip to Validator: A part of the profit, 890 SOL, was tipped to Figment, a network validator.

Exploiting Mistake: The gains were due to a trader’s error in a low-liquidity pool, leading to buying WIF at a highly inflated price.

Technology Use: Jito Labs’ tool enabled MEV discovery and transaction bidding on Solana, similar to Ethereum’s Flashbots.

FAQs

In theory, anyone can use MEV bots to explore arbitrage and other opportunities in DeFi. However, this is usually for tech-savvy crypto holders. There are guides to create your own MEV bot, although it requires some programming knowledge and understanding of blockchain.

MEV bots can negatively impact regular traders and DeFi users. To avoid MEV bot influence, you should be aware of their potential, monitor MEV trends, and use Layer 2 solutions, such as Polygon or Arbitrum.

There is an organization that has been working to democratize the MEV space and make it more transparent and inclusive. Known as Flashbots, the ecosystem offers a permissionless system for MEV extraction. Its flagship product is MEV-Boost, which enables validators to sell blockspace to an open market of Ethereum block builders who can then use the space for some MEV strategies.

Anatol Antonovici

6+ years of experience writing for crypto brands and blockchain firms, including Coindesk, Cointelegraph, Bitcoinist, CryptoPotato, Algorand, and OTCTrade.com

🍒 tasty reads

What Is Ether.fi? Liquid Staking Reinvented

What Is Wrapped Ether? Complete wETH Guide

Impermanent Loss in DeFi: The Complete Guide

What is GMX? DeFi Perpetual Exchange 2024 Guide

What Is Defi Liquidity Mining and How Does It Work?