Written by: Mike Martin | Updated September 5, 2024

Reviewed by: Ryan Grace

Fact checked by: Laurence Willows

In this glossary, we’ll review all of the important concepts and terms in both cryptocurrency and blockchain technology.

🍒 New to crypto? Master the concepts with our Learn Center.

Definition: A 51% attack occurs when a miner or group of miners controls more than 50% of a network’s hashing, or computational, power.

What This Means: When a blockchain participant controls more than 50% of a network’s computing power, that participant could change the way a network operates. This bad actor may prevent the issuance of new coins as well as reverse previous transactions. The 51% attack is less of a threat to established coins (bitcoin and ether) than smaller coins with fewer participants. The more participants a coin has in its network, the harder it is to gain control over the network

Additional Reading: Bitcoin Gold Blockchain Hit by 51% Attack

Address

Definition: In blockchain technology, an address is an alphanumeric character identifier used to either send or receive cryptocurrencies on a specific blockchain network.

What This Means: In blockchain, an address is a set of 26 – 36 alphanumeric characters. This address serves as a virtual location for the sending and receiving of cryptocurrency. You can think of your wallet address as your account number. However, unlike your bank account number, cryptocurrency addresses are constantly changing. You can generate as many addresses as you’d like as often as you’d like for different coin networks. To better understand addresses, it may help to have an understanding of both private keys and public keys.

Definition: In cryptocurrencies, “airdropping” refers to a marketing campaign in which free tokens or cryptocurrencies are distributed. This is often done in an unsolicited fashion.

What This Means: An “airdrop” is simply a distribution of tokens from one wallet address to another. Choosing who gets these free tokens and why is left to the party who is gifting the token. Sometimes, airdrops require the receiver to first promote a coin via social media. Other times, tokens are simply handed out to the largest holders of a certain cryptocurrency. Since they are promotional in nature, airdrops are typically done near a token’s initial coin offering (ICO).

Note: ICOs typically involve tokens, not coins.

Additional Reading: PulseChain Airdrop – The Biggest Blockchain Airdrop in History

Definition: In cryptocurrency, altcoins refer to all cryptocurrency coins and tokens that are not bitcoin (BTC).

What This Means: There are over hundreds of blockchain networks in existence today and tens of thousands of tokens. Every single one of these digital assets aside from bitcoin falls under the “altcoin” category. Even Ethereum (ETH), with a market cap well above 100B, is considered an altcoin.

Additional Reading: 10 Important Cryptocurrencies Other Than Bitcoin – Investopedia

Definition: Algorithmic (Algo) Stablecoins are backed solely by manipulating algorithms.

What This Means: Unlike most stablecoins, algorithmic stablecoins are NOT backed by a fiat currency, cryptocurrency, or anything for that matter. These coins are “backed” by math. In theory, this math keeps the coin’s value close to its peg price by manipulating supply. Some stablecoins are “fractional-algorithmic”, meaning their backing is divided between math and fiat currency or another crypto coin

So, do algo coins work? The dramatic de-pegging of the TerraUSD (UST) algo coin in May of 2022 showed us the great vulnerabilities inherent in algo coins.

Additional Reading: How $60 Billion in Terra Coins Went Up in Algorithmic Smoke

Definition: Cryptocurrencies are said to be in a bear market when prices fall 20% from their highs for a prolonged period.

What This Means: Like all securities, cryptocurrencies have and will continue to experience bear markets. The last crypto winter lasted for about 3 years, from January 2018 to December 2020. In 2023, the crypto market is currently bearish.

So why are they called bear markets? When bears attack, they “pull down” their prey with their claws. Bulls, on the other hand, attack by thrusting their horns upward.

Definition: Bitcoin is a decentralized digital currency that operates independently of a central authority.

What This Means: On the tail of the financial crisis of 2008, Satoshi Nakamoto wanted to create a currency that would operate independently of a centralized financial system. He called his creation Bitcoin. Bitcoin succeeded because it solved the double spending problem in crypto. Bitcoin is both the oldest and largest cryptocurrency in existence. Unlike traditional banks, bitcoin is governed via a peer-to-peer system. To replace the trust of traditional banks, Bitcoin uses cryptographic proof to verify transactions. The Bitcoin ecosystem creates its own monetary policy independent of any government or institution.

The coin associated with Bitcoin is also called bitcoin, but with a lowercase “b”. Bitcoin miners are rewarded in bitcoin for verifying transactions. To accomplish this, intense computations must be performed.

Definition: In cryptocurrency, a block is a digital location that contains a recent quantity of transactions made across a protocol.

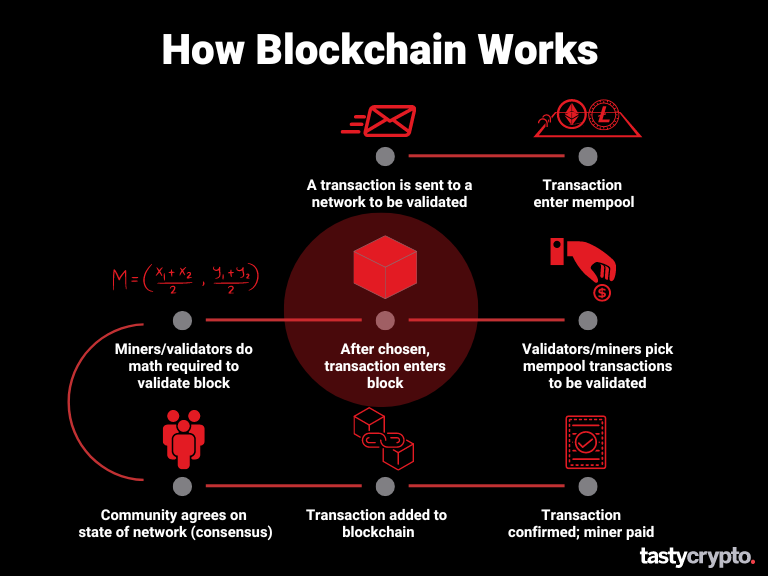

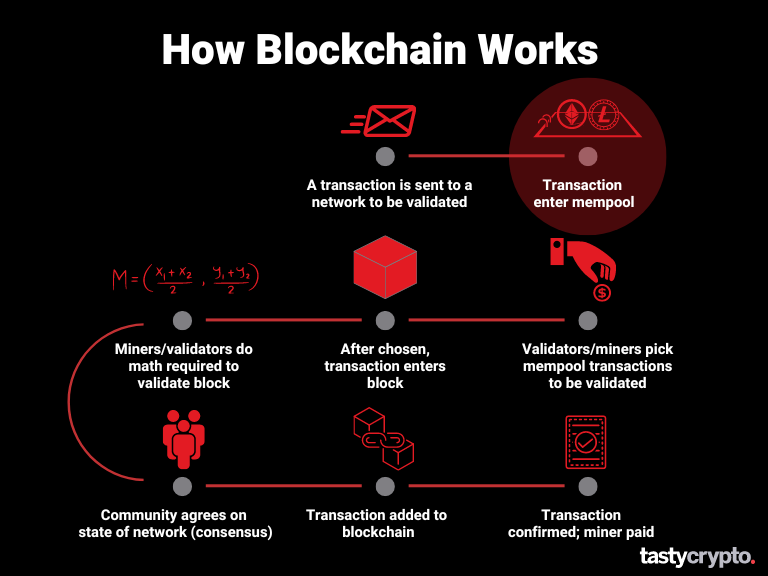

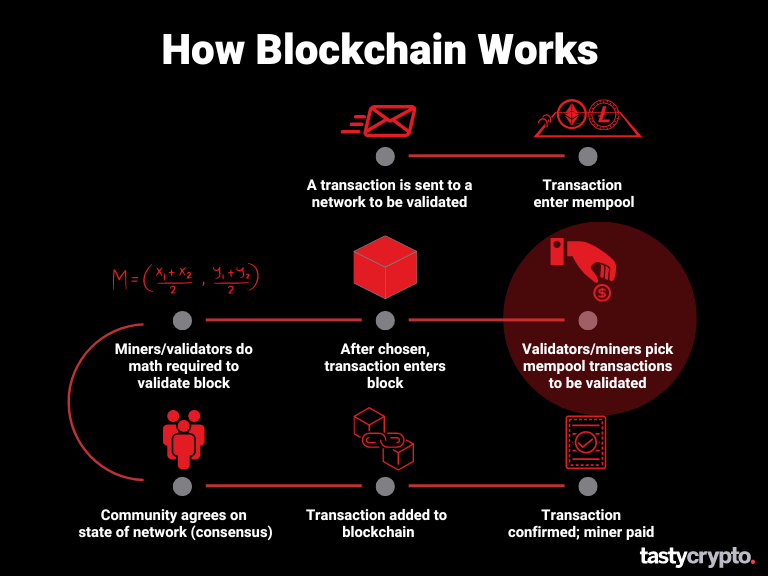

What This Means: Whenever you buy, sell, or transfer crypto, these transactions are first recorded in a network mempool, which acts as a waiting area. For the transactions in this waiting pool to get verified, miners place them into a coin’s block. Once all the transactions in a particular block are verified, this block will then get “chained” to the previous block – hence the phrase blockchain. A block also contains other information, such as the previous block’s hash and a timestamp.

Additional Reading: What Is a Block in the Blockchain?

Definition: A block explorer is an online tool that displays the transactional history of a particular protocol.

What This Means: Blockchain is built on a peer-to-peer system. This means that all information is public. Whenever someone sends or receives crypto, this transaction is ultimately put into a block. Block explorers pull this information into a database. Among other uses, block explorers allow everyone to view the transactional history of a specific crypto wallet address and discover what miner mined what coin at what time.

Want to see how an Ethereum block explorer works? Check it out below.

Additional Reading: Etherscan Block Explorer

Definition: Block height represents the current total number of blocks that have been mined in the history of a network.

What This Means: The very first block mined for network is called the genesis block. Block height simply represents the total number of coins that have been mined in a protocol since the genesis block. The current block height for bitcoin is 740791.

Definition: The block reward is the number of coins distributed to a miner after having successfully mined a block.

What This Means: In proof-of-work networks like Bitcoin, miners are constantly using computational power to find the “golden nonce”. Once found, this nonce chains the current block to the previous one, verifying all of the transactions within the block in the process. As a reward for their work, the miner who finds this nonce will receive a certain number of coins. In the Bitcoin protocol, this number halves about every four years. Currently, the Bitcoin reward is 6.25 bitcoin (BTC).

Definition: Blockchain is a permissionless, digital ledger shared via a peer-to-peer system that uses cryptography to secure transactions within a coin’s network.

What This Means: A blockchain is a series of digital blocks containing data. Simply put, a blockchain is a ledger. What makes blockchain unique is that this ledger is shared and controlled via a peer-to-peer system. This is unlike traditional ledgers, which are stored and controlled by a central authority. Additionally, blockchain is “immutable”, which means all the past transactions in a coin’s block are written in stone – they cannot be altered.

Definition: Blockchain 1.0 is the first and simplest blockchain version.

What This Means: Blockchain 1.0 was the first itineration of blockchain and is concerned widely with Bitcoin. The founder of Bitcoin, Satoshi Nakamoto, had a narrow goal for his cryptocurrency, “a purely peer-to-peer version of electronic cash would allow online payments to be sent directly from one party to another without going through a financial institution.”

Definition: Blockchain 2.0 expanded upon the foundation of blockchain 1.0 to include smart contracts.

What This Means: While blockchain 1.0 is credited to Nakamoto, Vitalik Buterin paved the way for blockchain’s next iteration: blockchain 2.0. Buterin, who invented Ethereum, saw blockchain’s utility far beyond a store of value. He envisioned a world where, through functions and logic, blockchain could automate the execution of agreements and contracts without the need for an intermediary.

Definition: Cryptocurrencies are said to be in a bull market when market prices continuously rise over an extended period.

What This Means: Bull markets are defined by strong demand and weak supply. In cryptocurrencies, bull markets tend to be fast and furious. The natural state for many coins such as Bitcoin and Ethereum is bearish. Historically, investors who buy before the market reaches a strong demand/low supply cycle perform the best. The term “bull” or “bullish” comes from the way in which a bull attacks, which is an upward thrusting of its horns.

Definition: Cardano is a proof-of-stake decentralized blockchain protocol.

What This Means: Cardano has a lot in common with Ethereum – both protocols can be used to run smart contracts and build programs. Though Cardano has some great features in comparison to Ethereum, it is not as widely adopted, and therefore it is currently less attractive to both investors and blockchain developers.

Definition: Central ledgers are physical or digital records of an organization maintained by a central, controlling authority.

What This Means: In a centralized ledger, one entity maintains complete control over all transactions within the ledger. If this central authority, e.g. a bank or government, is compromised, the records within a ledger may be compromised as well.

For example, if a new regime takes control of a government, that regime could, in theory, transfer property deeds out of citizens’ hands into their own. Blockchain, instead, uses a decentralized ledger. This immutable system gives control to not one authority, but every party participating in the network.

Definition: In blockchain, a “coin” is a cryptocurrency derived from a particular blockchain’s protocols consensus mechanism (proof-of-work and proof-of-stake).

What This Means: There are a lot of different cryptocurrencies in existence, but there aren’t as many true “coins” in existence. For example, the Ethereum protocol uses “ether” as its coin while Bitcoin uses “bitcoin” (lowercase b) as its coin. Tokens (smart contracts) are not actually coins, but digital assets created by applications that are built on a native coin. For example, the Tether (USDT) token is built on the Ethereum platform, and therefore uses ether as its native currency.

Definition: A cold wallet is an offline wallet where cryptocurrency data is stored.

What This Means: Cryptocurrency wallets can be either stored online or offline. When stored online, wallets are said to be “hot”. With hot wallets, there is always the risk of being hacked. For those crypto participants worried about security, “cold” wallets are a great alternative. These wallets, sometimes called hardware wallets, typically store private keys on USB flash drives offline. Of course, there are risks here as well. What if you misplace the hard drive? For a real horror story on cold wallets, check out the below article!

Definition: In blockchain, a consensus protocol guarantees the stability of a network (coin) by helping the various nodes in a network come to an agreement on the validity of new blocks added

What This Means: Four generals want to attack a castle. If most of these generals act together, they will win. If they act independently of each other, they will likely fail. How can they trust each other? How do they now know whether one party is a spy for the castle, aka a bad actor? In this scenario, there can still be a bad actor and the majority can still win – if they have a consensus.

This model, known as the “Byzantine Fault Tolerance”, is at the heart of Bitcoin’s proof-of-work consensus. As long as the majority of the nodes (participants) agree that a new block is added to the chain is not malicious, the block will be added. Some bad actors may try to say a malicious block is indeed not malicious. But this does not matter – if ⅔ of the nodes agree (or disagree) on the validity of a new block, the network will remain secure. This creates a trustless system. You don’t have to trust other people in the network if the majority of the nodes want it to succeed.

Additional Reading: A (Short) Guide to Blockchain Consensus Protocols

Definition: A cryptocurrency is a digitalized and encrypted medium of exchange.

What This Means: When one hears “cryptocurrency”, bitcoin or perhaps ether comes to mind. However, cryptocurrencies encompass a sweeping variety of digital products. Most cryptocurrency ecosystems grow from under a native protocol, particularly Ethereum. NFTs and utility tokens are examples of the different sub-sectors of cryptocurrency. Although these currencies are traded independently of a protocol, these coins still rely on a native coin’s technology.

Definition: In blockchain, cryptography refers to the enciphering and deciphering of data to secure information.

What This Means: Cryptography is the backbone of blockchain. For a peer-to-peer system to be trustless, security is of utmost importance. To ensure all transactions on a coin’s ledger are secure, blockchain employs cryptography. Some of these cryptographic methods include symmetric encryption cryptography, asymmetric encryption cryptography, and hashing.

Additional Reading: Explaining the Crypto in Cryptocurrency

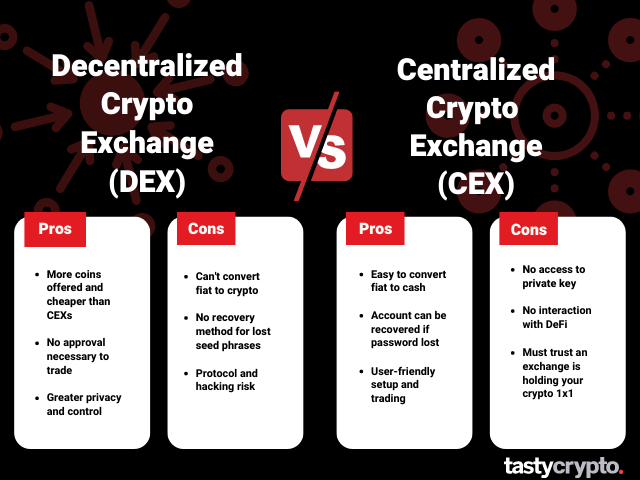

Definition: A platform that facilitates the buying and selling of various cryptocurrencies.

What This Means: Traditional cryptocurrency exchanges, such as the ones offered by Binance, Coinbase, and Kraken, allow investors to purchase, sell and exchange cryptocurrency. There are also decentralized exchanges (DEXs), such as Uniswap, which self-custody wallets interact with.

Definition: DAOs (decentralized autonomous organizations) are organizations run on smart contracts that automate decision-making.

What This Means: DAOs are organizations that are built on smart contracts made to run devoid of a central authority.

Chances are, you work at an organization that follows a set of protocols. For example, payroll will review your hours worked during a period before they mail you a paycheck. Couldn’t these simple processes be automated via blockchain technology?

DAOs take this idea and apply it to a larger level. What if a DAO was created to replace Uber with automated cars? If these cars could drive themselves, fill up their own tanks, and perform their own maintenance, what need would there be for a central authority?

DAOs are members-owned communities that can operate without any governance at all.

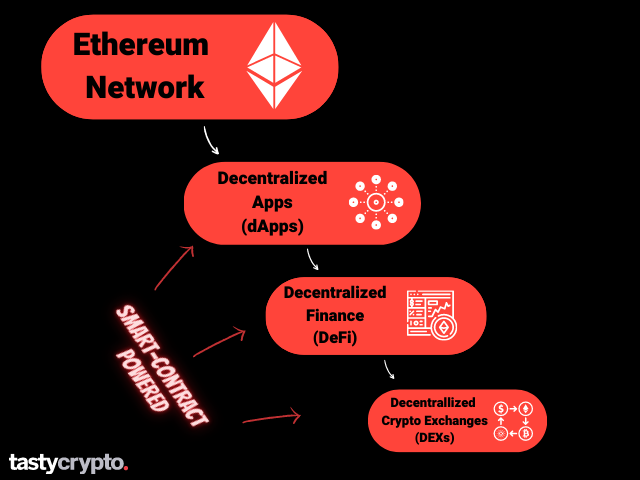

Definition: DApps (decentralized applications) are applications built with smart contracts designed to run autonomously.

What This Means: DApps take smart contracts and combine them with an interface. This interface allows participants to interact with a DApp.

On traditional applications (like Twitter), users must interact with a central server via an API. The DApp “Steemit” is a potential blockchain replacement for Twitter. In this decentralized app, information is not loaded from a server, but from a blockchain. The data on Steemit is stored on the Steemit blockchain, which is controlled by its participants.

Definition: Defi, short for decentralized finance, is an umbrella term used to describe all DApps that aim to replace current, centralized financial institutions.

What This Means: In the future, blockchain will most certainly have an influence on the way the world interacts with money. DeFi is the broad term used to describe all the current initiatives aimed to move finance away from central authorities and into a peer-to-peer managed ledger. How could this work?

Let’s say you’re getting 1% interest in your bank account today. Your bank lends this money, your money, to someone else for a higher rate – say 3%. They pocket the 2% difference. With Defi, you would loan your money directly to the third party, keeping the majority of the 3% yield.

Additional Reading: DeFi Self-Custody Wallet FAQs

Definition: A DEXs (decentralized trading protocol) is a decentralized exchange that runs completely on a blockchain.

What This Means: A centralized exchange (CEX) is a trading platform that acts as an intermediary between buyers and sellers of digital assets. CEXs hold the assets of their users in a central location. On CEXs, users must trust that an exchange is holding their assets 1×1.

Decentralized exchanges (DEXs) are being created on blockchains to replace these institutions. Self-custody wallets connect to DEXs only when transacting. A DEX, therefore, doesn’t have custody over crypto. DEXs use automated market makers (AMMs) and liquidity pools instead of traditional market makers.

Definition: Digital currency refers to any currency that exists in a purely digital state.

What This Means: All cryptocurrencies are digital currencies. These purely digital currencies can be created through both the proof-of-work and proof-of-stake systems. Tokens, also digital currencies, are created using the blockchain network of a specific coin. For example, ether is the coin behind Ethereum, and Chainlink (LINK) is a token built upon the Ethereum protocol. Ether is a coin; Chainlink is a token, but they are both digital currencies.

Definition: In a distributed ledger, data is stored and secured across a network of computers, or “nodes”.

What This Means: Unlike a traditional central ledger, the data within a distributed ledger is stored in many places. In blockchain, these places are the computers of those who participate in a blockchain. Distributed ledgers allow for the peer-to-peer interaction that makes blockchain so secure and unique.

Definition: Dogecoin is a peer-to-peer open-sourced meme coin.

What This Means: When Billy Markus and Jackson Palmer created Dogecoin in 2013, it was supposed to be a joke. In the crypto crazy of 2021, however, that joke was taken very seriously. Dogecoin, invented in imitation of Litecoin and considered a meme coin, skyrocketed in value. Why? Not because of its utility, but because of its loyal community of followers.

Definition: Ether is the native currency of the Ethereum blockchain.

What This Means: Blockchains need a native currency for participants in that blockchain to interact and make transactions. Ether is the native currency of the Ethereum protocol. Following bitcoin, ether is the second most popular cryptocurrency in the world.

Definition: Ethereum is a distributed, open-source blockchain protocol that relies upon the proof-of-stake consensus mechanism.

What This Means: Ethereum, invented by Vitalik Buterin in 2013, expanded upon the technology behind Bitcoin to allow developers in its ecosystem to build applications and write smart contracts. While Bitcoin is mainly used as a secure store of value, Ethereum provides far-reaching utility. Most tokens are created on the Ethereum network. Ethereum’s ERC20 standard token allows for interoperability in the Ethereum ecosystem.

Definition: A government-issued currency that is not backed by a commodity.

What This Means: So if a fiat currency is not backed by a commodity, what is it backed by? Nothing! Nothing tangible, anyway. In the US, fiat currency means all bills and coins. All those dollars in your wallet and bank account (as well as all those dollars you owe people) are backed solely by the good faith of the US government. In Latin, the term fiat means, “it shall be”. Fiat currency exists because governments said, “it shall be”, and we believe them.

Fiat currencies must be issued by a government. Therefore, bitcoin and other cryptocurrencies are not fiat currencies.

Definition: A blockchain fork occurs when disagreement in a blockchain community results in the need for a fundamental change in the foundational protocol.

What This Means: Sometimes, the participants of a blockchain disagree on how a coin should be run. One example of this would be technology. As time passes, new technologies are invented. This technology can offer opportunities not present when a coin was invented.

To update a protocol, a “fork” must occur. After this fork, an old version remains on a network while a new version forks off. Forks can be either “hard” or “soft”. Hard forks create brand-new coins (as a hard fork created bitcoin gold) while soft forks do not. Both outcomes are covered in this glossary.

For example, PulseX is a fork of Ethereum.

Definition: On the Ethereum protocol, gas fees are the fees nodes (participants) pay miners to validate transactions.

What This Means: Verifying transactions on a blockchain requires computing power. Computing power is not free. To compensate miners on the Ethereum blockchain for verifying your transaction, you must pay them a fee. The higher the fee you pay, the faster your transaction will be settled. The recommended gas fees (calculated in gwei’s) are in constant flux with the market – the faster the market, the higher the fees.

Definition: The first block of data mined and validated on any blockchain is called the genesis block.

What This Means: For all blockchains, there is a first block – the genesis block. The genesis block, called block 0, is unique in that there is no previous block (previous hash) linked to it. The creator of a blockchain usually mines the first coin themself. Satoshi Nakamoto, Bitcoin’s inventor, mined the first coin on the Bitcoin protocol.

Definition: Governance tokens allow the participants of a protocol to influence a coin’s future.

What This Means: In blockchain, governance tokens give the participants of a protocol the power to shape the future direction of a coin by allowing nodes to vote on future events. New products, innovations, and integrations are all voted on using governance tokens. For example, UNI tokens allow participants to vote on changes in the Uniswap decentralized exchange. A current proposal is, “Should the Uniswap community participate in the Protocol Guild Pilot?”

Additional Reading: Uniswap Governance

Definition: In blockchain, halving refers to the rate of reduction in which new coins are created.

What This Means: Halfling pertains to the supply side of a coin. Some coins, like the Ethereum protocol, have no defined monetary supply which dictates the rate at which new coins are minted. Bitcoin does indeed have a supply monetary system. Under this protocol, the number of bitcoins released is halved every 4 years or every 210,000 blocks. The current bitcoin reward for mining a new block is 6.25 bitcoins. In 2024, this number will fall to 3.125.

Definition: In cryptocurrency, a hash function allows transactions to be conducted anonymously.

What This Means: In blockchain, a hash is like a fingerprint. Blocks within a blockchain all have their own unique hash and (except for the genesis block) the hash of the previously mined coin within them. You cannot change a previous hash without affecting the entire protocol. Hash’s help to secure a network.

Definition: In cryptocurrency, the hash rate is the number of calculations that are performed every second.

What This Means: For proof or work networks, hash rate is a good measure of a coin’s security. The more computational power that is utilized to solve a chain’s cryptographic puzzle, the more secure that network will be. When there are a small number of participants mining in a protocol, the odds of malicious participants taking control increase. This could potentially lead to a 51% attack.

Definition: Hashing power represents the computational power of a miner(s) mining in a protocol.

What This Means: The goal for miners in a proof of work protocol is to find the nonce, which is below the current target of the network. Discovering this golden nonce takes a whole lot of guesses. Computers or hard drives with the greatest computing power have the highest hashing power and therefore are at an advantage of finding the golden nonce. This discovery will earn them the fees within the block and the blockchain reward.

Definition: A hard fork occurs in a blockchain when disagreement causes a protocol to be split, creating two separate coins

What This Means: Two kinds of forks can occur in blockchain: hard forks and soft forks. The latter does not result in the creation of a new coin; the former (hard fork) does. Let’s look at a hard fork that happened with Bitcoin.

In 2017, there was disagreement in the Bitcoin community regarding whether to increase the size of the blocks mined to increase transaction speed. Some bitcoiners were on board; others were not. This resulted in the forking of Bitcoin. Bitcoin cash (BCH) miners followed the updated protocol, while Bitcoin Standard (BTC) did not. All nodes in the network received the new coin while also keeping the old coin.

Additional Reading: A History of Bitcoin Hard Forks

Definition: HD (hierarchically deterministic) wallets generate new keys from a master key for each transaction.

What This Means: In blockchain, security is of utmost importance. Bad actors can sometimes spot patterns in a wallets transactions and use this information to act maliciously. One way to heighten security is to create new private keys for every transaction. But this becomes tedious.

HD wallets enable another layer of security by constantly generating new keys from a master key. Generating these new keys is accomplished by the hash system. HD wallets are also ideal for companies utilizing blockchains, as they can make keys for all employees accessing the blockchain.

Definition: In cryptocurrency, a hot wallet is any wallet that is connected to the internet.

What This Means: Unlike a “cold” wallet (a USB drive), a “hot” wallet is a digital currency wallet that is always connected to the internet. This connectivity implies that hot wallets are constantly vulnerable to attack. Most cryptocurrency traders, however, prefer hot wallets because they make transacting easier.

Definition: An ICO (initial coin offering) represents the first issuance of a coin or token to a marketplace.

What This Means: In the stock market, they are called IPOs (initial public offerings). In cryptocurrency, they are called ICOs. Both IPOs and ICOs have one goal: to raise capital. However, there are some key differences.

Stock market participants who buy into a company’s IPO get things such as shares, control, and dividends. Participants in ICOs get none of these benefits. They simply are hopeful the tokens they purchase will increase in value.

Tokens and not coins? Yes. The term “ICO” can be a bit misleading – though technically this term stands for “initial coin offering” tokens are usually the cryptos released under this acronym.

Definition: In cryptocurrency, liquidity refers to the ease at which digital assets can be bought, sold, or transferred.

What This Means: For any market to operate efficiently, liquidity must be present. Liquidity, which means how easily an asset can be transferred to cash, is highest in markets with numerous participants. In addition to market participants, market makers are often employed to boost liquidity. Market makers buy the bid and sell the ask to satisfy the market, pocketing the difference, or the spread, as their profit. In DeFi, DEXs (decentralized exchanges) use smart contracts and liquidity pools to replace traditional market makers.

Liquid staking allows users access to their staked cryptocurrency through liquidity tokens. Lido is an example of a liquid staking protocol in DeFi.

Definition: Market cap (market capitalization) refers to the total current value of a digital asset(s).

What This Means: The current market cap of a coin or token tells us that digital currencies total current market value. Market cap is equated by multiplying the number of coins/tokens currently in circulation by the current trading price of the coin/token.

Currently, the market cap of bitcoin is $390,940,222,019. To view the market of popular cryptocurrencies, visit CoinMarketCap.

Definition: In cryptocurrency mining, the mempool is the point of entry for all digital transactions.

What This Means: Whenever you conduct a transaction on a network, that transaction goes directly into a mempool. The mempool is a staging area for miners. Miners pick and choose which transactions to include in a block from the mempool.

So what transactions are chosen? The ones with the highest fees attached. Therefore, if you want a transaction to get verified quickly on a public blockchain, you must pay a reasonable fee.

Definition: The metaverse is an open-sourced digital world that participants access via a headset.

What This Means: Living in the real world comes brings with it a lot of inefficiencies. For example, if you want to go to a concert, you must get in a car, pay for the gas, park, attend the show, and then find your way home. The metaverse aims to make all this much easier.

If this concert was in the metaverse, all you’d have to do is lean back on your couch and put on your headset. Your friends can even join you in this augmented reality. What else can you do in the metaverse? Buy real estate, learn a new language, and practice for that upcoming heart transplant operation. Blockchain is an integral component of the metaverse due to its open-sourced capabilities.

Definition: In cryptocurrency, a mnemonic phrase is a (typically) 12-word phrase used to recover a Bitcoin wallet.

What This Means: Mnemonic phrases are associated with HD (hierarchical deterministic) wallets. With HD wallets, numerous “private keys” are distributed from a single “master seed”. This master seed, or the controlling seed, can access all the various private keys that fall under it with a single mnemonic phrase. A mnemonic phrase is simply a string of 12 unrelated and unique words.

Accordion

Definition: In proof of work protocols, new blocks are added to the blockchain via mining, a computationally heavy process that validates transactions.

What This Means: Blockchain produces an incredibly secure place for people to transact. The process of securing these transactions, however, is not free. For blocks to be added to a chain, the transactions within these blocks must first be validated. Mining is the process of validating transactions. To successfully mine a block, miners must solve a cryptographic puzzle. The miner who succeeds will win both coins directly from the protocol and receive the fees users paid to have their transactions validated.

Definition: A mining pool is a group of individual miners who pool together their computing power to increase their odds of winning a block.

What This Means: Anyone can mine for bitcoin. You can mine for bitcoin on your laptop right now if you wanted to. However, your chances of actually solving the cryptographic puzzle are almost zero. Why? Your competition is just too great. A normal CPU can process 10 million hashes/per second. A modern ASIC “rig” used by professional miners can process 1 trillion hashes per second.

A mining pool makes individual miners more competitive by pooling together resources. Mining pools do so in a very strategic way so redundant work is not an issue. Mining pools give anyone with a PC the ability to mine. Antpool is currently the world’s largest mining pool.

Additional Reading: A Look at the Top Bitcoin Mining Pools

Definition: Satoshi Nakamoto is credited for the creation of the Bitcoin protocol.

What This Means: The name Satoshi Nakamoto is veiled in mystery. Nobody knows who he/she is because the name is likely a pseudonym. There could be one party behind the pseudonym, or perhaps dozens. All we do know for certain is that, on October 28th, 2008, the technology and intent behind bitcoin were published in a whitepaper released be Nakamoto. On January 3rd of the next year, bitcoin went live.

Additional Reading: Who is Satoshi Nakamoto?

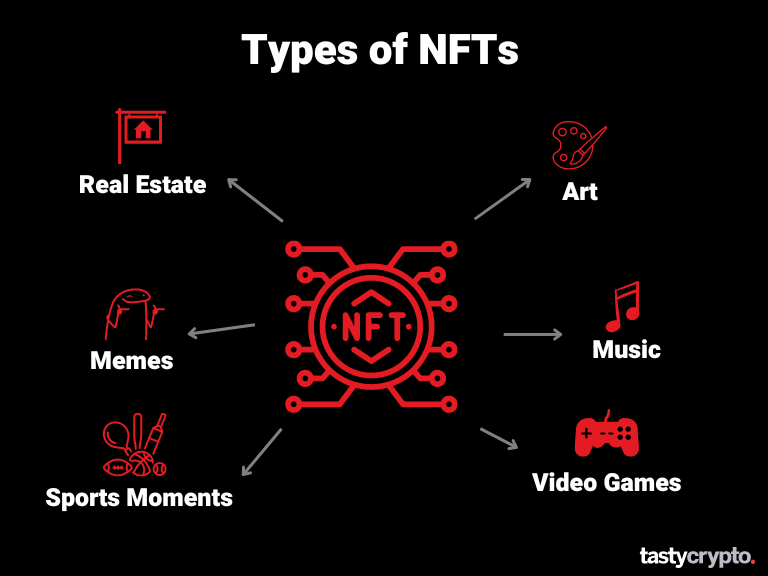

Definition: A NFT (non-fungible token) is a unique representative digital asset that is stored on a blockchain.

What This Means: NFTs can be thought of as 21st-century collectibles. Instead of hoarding basketball cards, for example, an NFT could allow you to actually purchase the digital rights to a specific digital clip out of basketball history.

What makes NFTs special is their “non-fungible” status. If something is fungible (like bitcoin) it can be traded and exchanged freely. Non-fungible assets have unique characteristics, like snowflakes. One dollar bill is fungible because it is as good as the next, but not all diamonds are the same; they all have their own uniqueness and therefore they cannot be interchanged. Therefore, they are non-fungible.

Definition: In blockchain, a “node” is a computer that is connected to a blockchain protocol.

What This Means: The term “node” can mean a few things in blockchain, but generally, a node is a computer owned by a blockchain participant. Nodes play a very important role in keeping a network safe. Whenever a new block is minted, the nodes on a network verify its validity to determine whether or not it should be added to a blockchain via a process called consensus.

Definition: A “nonce” is a component of a blockchain’s block that gives variability to the hash.

What This Means: Proof of work miners must find the nonce that brings the hash below the target set by the protocol in order to validate transactions and add a block to the blockchain. The hash of a block can only be varied by changing the nonce. Miners engage in intense computations to determine this “golden nonce”. Their reward is coins and transaction fees.

Definition: In blockchain, off-chain governance refers to the process of discussing and proposing changes to a network on social media, online forums, and other ex-network mediums.

What This Means: Before changes to a blockchain network are put into motion, they are discussed expansively. Off-chain governance refers to the way in which these proposed changes are both discussed and promoted via social media, conferences, blogs, and online forums. Off-chain governance can act a lot like politics in that the participants are generally trying to promote an outcome that is favorable to them.

Definition: On-chain governance allows participants in a blockchain network to vote directly on any and all changes within a protocol.

What This Means: One advantage of centralized organizations is their agility to make changes within a network. In a decentralized blockchain network, every participant in the chain has a say. So how does a protocol decide on what changes, if any, need to be made? By voting.

On-chain governance is a system built within a protocol that allows participants to vote on proposed changes. These changes are discussed in more detail via off-chain governance.

Definition: In blockchain, oracles allow protocols to connect to external entities.

What This Means: Ethereum has advantages over Bitcoin in that Ethereum allows for smart contracts to be run and stored on its chain.

Oracles connect Ethereum protocols to external systems by allowing these external systems to add live, real-world data to a protocol. For example, an oracle could be used to pay a truck driver the moment their GPS hits a specified location. Chainlink is a popular decentralized oracle that facilitates smart contracts like these.

Definition: A private key is used by blockchain participants in tandem with an algorithm to both encrypt and decrypt sensitive data.

What This Means: All self-custody wallet users are assigned a private key (seed phrase). Reveal this key to no one. This private key in turn generates a public key, which is mathematically linked to the private key. Why two keys? If everybody had access to your private key, they could do whatever they wanted with your cryptocurrency.

Public keys can be compared to a mailbox, in that anyone can send mail to any mailbox address. However, the private key acts as the mailbox key, which can only be opened by the possessor of this key.

Definition: Proof of stake refers to blockchain networks that verify transactions by validators who stake their own coins.

What This Means: Proof of stake is much more efficient than proof of work for verifying transactions in a blockchain. Unlike proof of work, which uses intense computations to verify the transactions within a block, proof of stake validates transactions by coin owners, or “validators” staking their own coins.

These “validators” earn crypto in the form of rewards. These rewards are often viewed as “interest” received for staking. Once two-thirds of the validators in a coins ecosystem attest to the validity of a new block, that block will be added to the chain and the rewards will be released to the staker.

Definition: In blockchain, proof of work refers to all networks that use mining to validate blocks of transactions.

What This Means: Cryptocurrency transactions can either be validated via proof of work or proof of stake (among other methods). In proof of work protocols like Bitcoin, transactions are verified via miners using computers to solve mathematical puzzles. After the transactions within a block are validated, they are added to the chain.

Proof of work is generally more secure than proof of stake, but proof of stake networks run faster and use less energy.

Definition: A public key is a long string of characters and digits that represents a user’s address on the blockchain. This key is used to receive cryptocurrency and can be shared publicly without compromising the security of the user’s funds.

What This Means: A public key is created from a private key using a cryptographic hashing function. A private key is a secret key that is used to both sign and authorize transactions. A public key is an address to which the cryptocurrency is sent.

Additional Reading: A Beginner’s Guide: Private and Public Key Cryptography Deciphered

Definition: A self-custody wallet gives users complete control over their private keys.

What This Means: Unlike custodial wallets (Coinbase), self-custody wallets give users complete control over their public keys. Users are responsible for maintaining a record of their seed phrases in this type of wallet. If you lose your seed phrase, you will lose access to your crypto.

Unlike custodial wallets, self-custody wallets allow users to interact with decentralized applications (DApps).

Definition: Sharding refers to the process of breaking down a blockchain network into smaller, latent-free pieces.

What This Means: Sharding takes the “smaller is better” approach and applies it to blockchain technology. Sometimes, a blockchain network can become too large. When this happens, inefficiencies arise. An example of this would be slow transaction speeds. To make a protocol run more efficiently, networks are sometimes partitioned off into smaller pieces via sharding.

Definition: Smart contracts are developer-built programs run on a blockchain that automatically execute when a certain set of criteria is met.

What This Means: Smart contracts are like any other type of real-world contracts in that are designed to carry out a set of instructions, such as insurance contracts. Smart contracts differ from traditional contracts in that they are executed on the blockchain via code. This means that transactions completed cannot be changed – they are “immutable” or set in stone.

Smart contracts allow developers to utilize blockchains’ immutable nature in whatever specialized way they see fit. For example, let’s say you prefer your coffee is Colombian. How can you guarantee that the grounds you buy do indeed come from Colombia? We simply trust the label. To truly verify the origin of the coffee, a smart contract could be developed that tracks the coffee from the farm right to your table by scanning the coffee through various checkpoints. This smart contract would introduce transparency in the supply chain of your coffee.

Additional Reading: What are Smart Contracts and How Do They Work?

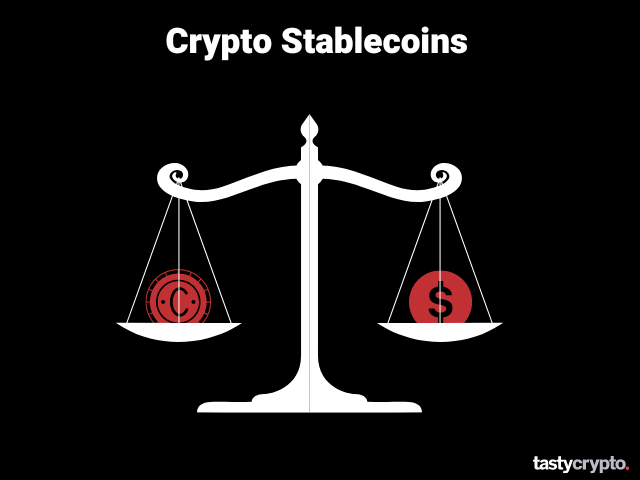

Definition: A stablecoin is a cryptocurrency that pegs its price to an underlying currency or commodity.

What This Means: Unlike most cryptocurrencies, which fluctuate in price based on supply and demand, stablecoins aim to stabilize their price by attaching it to an underlying value, typically a currency like the dollar or euro. The most popular stablecoins are Tether (USDT), USD Coin (USDC), and Binance USD (BUSD). All three of these coins are pegged to the US dollar.

So, what are stablecoins backed by? Typically, stablecoins are backed by the asset to which they are pegged. A US dollar stablecoin is therefore backed by the US dollar. A great risk of stablecoins is that they are not fully backed by the assets to which they are pegged.

Algorithmic (algo) stablecoins are backed not by assets, but math. The TerraUSD (UST) algo stablecoin lost its peg and is presently nearly worthless.

Definition: Staking is the process of using one’s own coins in a proof of stake protocol to validate the transactions within a block.

What This Means: In proof of work coins, like bitcoin, transactions are validated by mining. The miner who solves the mathematical problem first validates a block and then wins the reward, which mostly consists of bitcoin. In proof of stake protocols, like Ethereum, transactions are not validated via mining, but by staking.

Stacking is the process of lending one’s own coins to a network. The blockchain network randomly chooses one of these stakers computers to do the math required to process the transactions within a block. The more coins you are willing to stake to be chosen for validation, the greater odds you have of being selected to validate a block. If chosen, validators receive the transaction fees within a block for payment.

Definition: The Solana network is an open-sourced, proof of history blockchain with smart contract compatibility.

What This Means: When Anatoly Yakovenko invented the proof of history concept in 2017, he fixed a major problem inherent in proof of work and proof of stake systems: time. Before Solana was invented, there was no such thing as a standardized time stamp on messages – it took the stamp from whatever time zone the sending party was in. Miners would then have to agree that time had indeed passed to verify messages. This created desynchronization across the network.

The proof of time system solves this by automatically proving that time has passed – no more need for discussion. Solana encompasses two verification methods: proof of stake to verify transactions and proof of history to timestamp transactions.

Solana has a lot in common with Ethereum in that they both support smart contracts. However, since the Ethereum network was launched first, its ecosystem is much larger than Solana’s. Solana is at an advantage when it comes to efficiency in that it can verify transactions much faster than Ethereum.

Sam Bankman Fried was a large investor in Solana. The network has recently suffered greatly following the fall of FTX.

Additional Reading: Proof of History: A Clock for Blockchain

Definition: Solidity is a programming language used on the Ethereum network that allows developers to build smart contracts based on the network.

What This Means: Many blockchains incorporate programming languages to allow developers to use the power of the network to create their own smart contracts. Solana, for example, uses “Rust”. The Ethereum network uses “solidity”.

After contracts are written in the solidity language, they are sent to the Ethereum Virtual Machine (EVM) via opcodes to be executed.

Additional Reading: Solidity Programming Language

Definition: Tether (USDT) is a popular stablecoin that pegs its price to the US dollar.

What This Means: Tether is currently the largest stablecoin in existence. This US dollar pegged cryptocurrency currently has a market cap of 67B. There has been some skepticism around Tether’s backing, which encompasses numerous debt instruments. In May of 2022, Tether briefly lost its peg, falling to $0.95 in value.

Additional Reading: Tether Loses $1 Peg, Bitcoin Drops to 2020 Levels of Near $24K

Definition: The DAO refers to a specific DAO (decentralized autonomous organization) that was created in 2016.

What This Means: The DAO (not to be confused with DAOs in general) was the very first decentralized autonomous organization to launch. The DAO acted like a decentralized venture capital fund. The blockchain nature of the fund created more transparency and fewer costs than traditional venture capital funds. But there was a flaw.

In June of 2016, a hacker founds a fault in the code of The DAO which allowed him to transfer out 3.6 million ether. The Ethereum network created a hard fork in response, which allowed participants, in a roundabout way, to get their money back.

Definition: Tokens are a kind of cryptocurrency that reside on a specific blockchain.

What This Means: While both tokens and coins act as stores of value, they are structured very differently. Coins are the direct byproducts that come from verifying transactions in a protocol. Tokens are assets that are built under a protocol.

Hierarchically speaking, the native coin must come first. Once a blockchain is built, developers in some networks like Ethereum can build specialized applications on top of a blockchain framework. To create a currency within their applications, tokens are often used. Common tokens include those designed for security, utility, and governance.

Definition: Tokenomics explores the monetary side of a coin, such as supply and demand.

What This Means: Most networks and tokens have built within their networks a schedule for releasing new coins. This algorithmically determined schedule is constant and steady. This is unlike government-run monetary policy, which alters the quantity of money to match current economic needs. When a government prints a lot of money, the existing money can fall in value. When compared to traditional monetary policy, a blockchain’s automatic system allows for more trust and stability.

Definition: Trustless refers to a system where participants do not have to rely on a third party for the success of an entity.

Definition: Trustless refers to a system where participants do not have to rely on a third party for the success of an entity.

What This Means: The best part about blockchain is that its participants do not have to trust one another for a cryptocurrency to be successful. Through a process called consensus, all nodes in a network must attest to the validity of a block of transactions for that block to get added to the chain. Blockchains decentralized, peer-to-peer nature allows room for some bad actors to operate, but the majority, who want the coin to succeed, will vote them down.

Additional Reading: How ‘Trustless’ is Bitcoin, Really?

Definition: Uniswap is an automated cryptocurrency exchange that uses automated market makers (smart contracts).

What This Means: As far as volume goes, Uniswap is currently the world’s largest decentralized crypto exchange. However, centralized exchanges currently do more volume than Uniswap, with Coinbase and Binance leading the pack in this space.

So why trade on a decentralized exchange? For one, security. If you’re trading with a traditional exchange, your account can be hacked or the exchange can spend your crypto for personal gains (FTX). If you’re trading on Uniswap out of a self-custody wallet, your main security risk is that you forget your private key. Additionally, self-custody wallets can be hacked as well.

Another downside of using decentralized exchanges is liquidity – traditional, centralized crypto exchanges currently offer superior liquidity.

Definition: A validator is a node that plays a crucial role in a blockchain by verifying the validity of new transactions.

What This Means: Before a transaction gets added to a blockchain, it must first be validated. In proof of stake networks, like Ethereum, this validating is done by stakers. After a staker (validator) confirms the authenticity of a block’s transactions, the block is passed on to the entire blockchain community for further verification.

Definition: In cryptocurrency, volatility refers to the degree of variance in a coin or token over a specific period.

What This Means: Volatility simply means how much the price of an asset moves over a specific time frame. It is not uncommon for bitcoin to move 20% over the course of a few days. Bitcoin is, therefore, a high-volatility product. A value stock, like JNJ, rarely moves much over any time duration and is therefore a relatively low volatility asset. Cryptocurrency is a very, very volatile market segment.

Definition: In blockchain, a wallet is either a program (hot wallet) or device (cold storage wallet) that allows its owner to both store and transact with cryptocurrencies.

What This Means: To send, receive or store cryptocurrencies, you’ll first need a wallet. Wallets safeguard both your private keys.

There are two varieties of wallets – hot and cold. Hot wallets are accessed via the internet. This makes transacting in cryptocurrencies relatively easy but leaves your wallet constantly vulnerable to attack. Cold wallets are offline wallets. These wallets store their keys on hardware, such as a flash USB drive. Though highly secure, cold wallets are not practical for those regularly engaged in cryptocurrency transactions.

Definition: A whale is a participant in a cryptocurrency who holds a considerable amount of a coin or token.

What This Means: Generally speaking, a whale holds more than 5% of a specific networks cryptocurrency. With that much at stake, whales control a large portion of a coins governance and price.

Additional Reading: Here Is Who Owns The Most Bitcoin

Definition: In blockchain, a whitepaper is a document created by an inventor(s) of a cryptocurrency project that outlines the projects scope and specifications.

What This Means: Whitepapers generally precede the release of a new coin or token. These documents inform future and current investors what their product is, how it will operate, the technology behind it, and its reason for existence.

Perhaps the most important whitepaper in crypto history was released by Satoshi Nakamoto in 2008. This whitepaper, titled “Bitcoin: A Peer-to-Peer Electronic Cash System” informed the world of the Bitcoin network.

Additional Reading: Bitcoin: A Peer-to-Peer Electronic Cash System

Definition: Wrapped tokens are representational tokens that track the value of a cryptocurrency belonging to a network other than the token’s native network.

What This Means: All cryptocurrencies operate under the ecosystem of native a blockchain. For example, tokens on the Ethereum network can be easily exchanged with one another because they all operate under the same network. But what if you wanted to own bitcoin on the Ethereum network?

This is where wrapped tokens come in handy. Wrapped tokens track the performance of a non-native token. For example, wrapped bitcoin (wBTC) is a token on the Ethereum network that tracks the price of bitcoin. Wrapped ether is popular in DeFI.

Want to learn more DeFi terms? Check out our DeFi glossary!

Mike Martin

Mike Martin formerly served as the Head of Content for tastycrypto. Before joining tastycrypto, Michael worked in the active trader divisions of thinkorswim, TD Ameritrade, and Charles Schwab. He also served as a writer and editor for projectfinance.

Michael has been active in the crypto community since 2017. He holds certifications from Duke University in decentralized finance (DeFi) and blockchain technology.