Optimistic rollups prioritize user experience and market presence, while ZK rollups focus on security and privacy but are complex and less adopted.

Written by: Anatol Antonovici | Updated May 2, 2024

Reviewed by: Mike Martin

Fact checked by: Ryan Grace

Optimistic rollups and ZK rollups are the two main types of scaling solutions for Ethereum. In this article, we show you how they differ.

Table of Contents

🍒 tasty takeaways

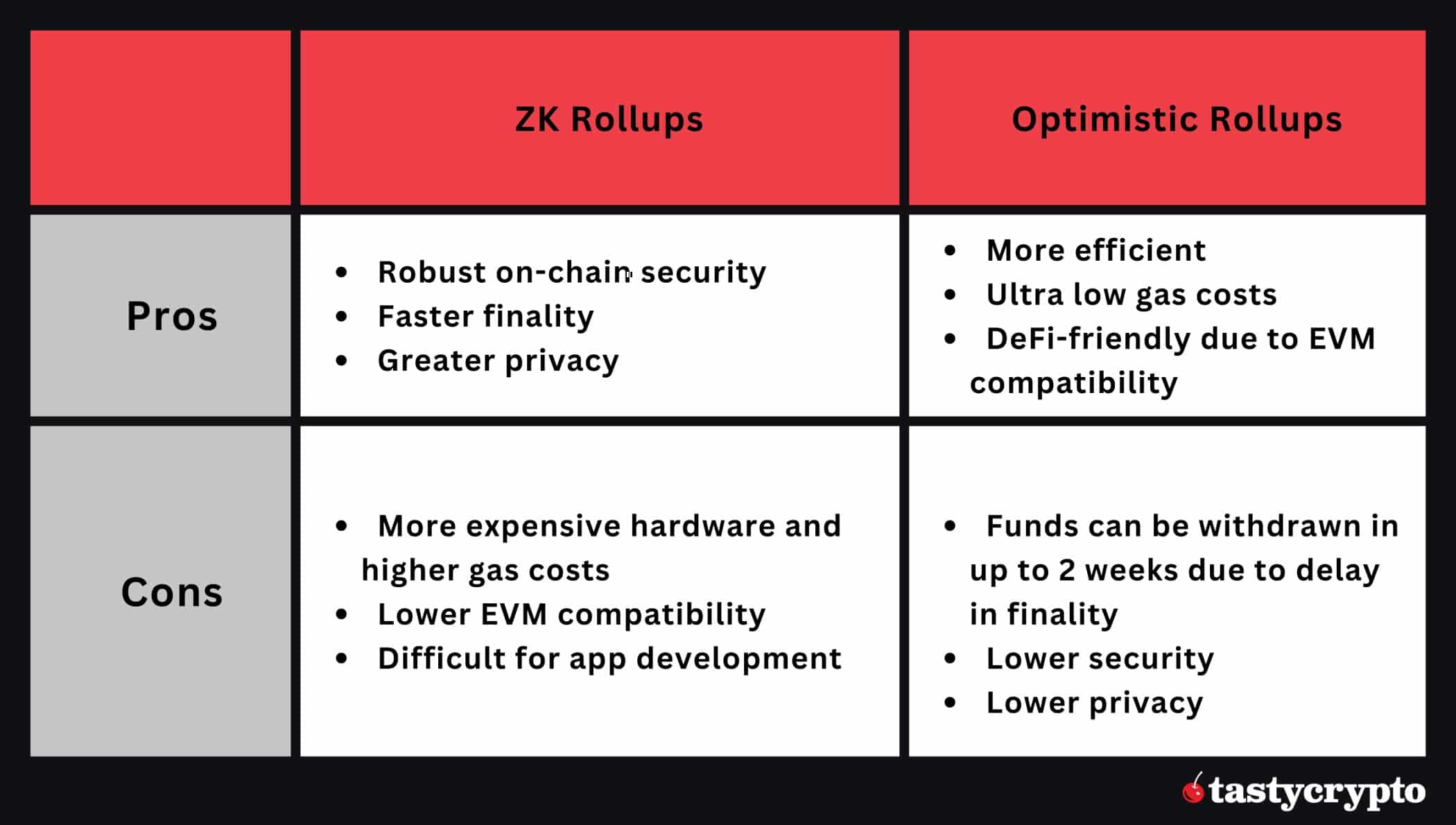

Optimistic rollups are efficient, cost-effective, and user-friendly, though they only reach true finality after 7 days and are more vulnerable to various risks.

ZK rollups focus on privacy and security, but their complexity hinders adoption.

Optimistic rollups dominate the layer 2 space, having a market share of over 85%.

What Are Blockchain Rollups?

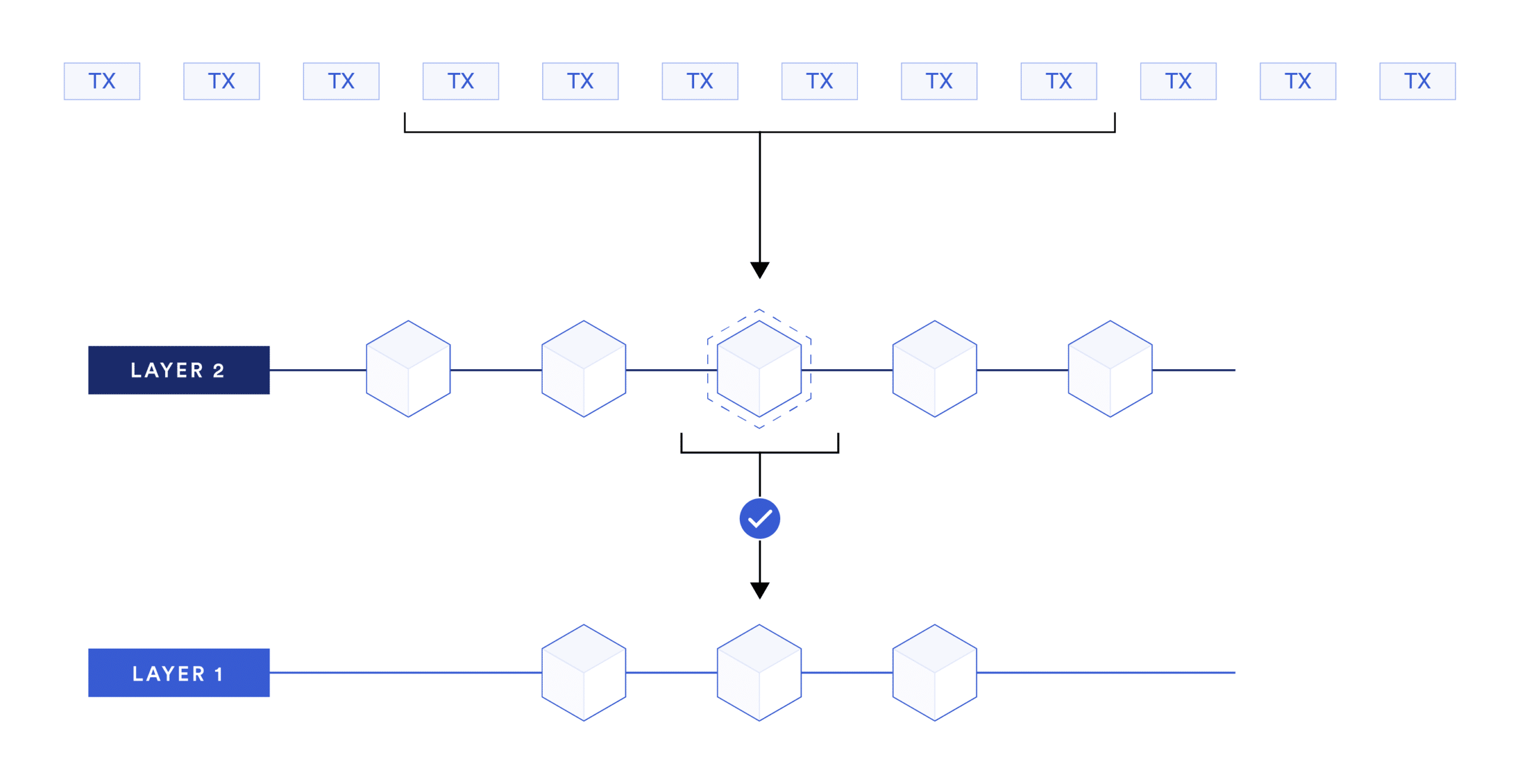

Rollups are layer 2 solutions that help blockchain networks improve scalability. Most layer 2s are designed for Ethereum to make the network more efficient and help it maintain its relevance in the decentralized finance (DeFi) and Web3 sectors.

The layer 2 networks built for the Ethereum chain greatly improve its transaction speed and reduce gas fees while benefiting from the mainnet’s security and smart contract compatibility.

The two main types of layer 2s are zero-knowledge (ZK) rollups and optimistic rollups. They differ in the way transactions are verified and how disputes are addressed.

How Do ZK Rollups Work?

ZK rollups use advanced cryptographic methods to validate transactions without revealing details. This method assumes that all transactions are false until approved by validators through zero-knowledge proofs.

After verification, validators bundle all approved transactions into rolls and submit them to Ethereum.

ZK rollups offer an additional layer of privacy and can process transactions quickly without waiting for extensive validation.

However, they use complex technology, which may create difficulties for crypto developers.

How Do Optimistic Rollups Work?

Unlike ZK rollups, optimistic rollups assume all transactions are valid unless proven false.

They bundle all Ethereum transactions in batches, send compressed data to the main chain, and then use a fraud-proof mechanism to update transactions that are challenged over seven days.

Since Optimistic rollups skip initial verification, they can be more efficient. However, true finality is reached only after the seven-day challenge period, during which transactions can be disputed.

Nevertheless, more developers prefer this rollup type due to its ease of use and compatibility with Ethereum tools.

ZK Rollups vs Optimistic Rollups: Comparison

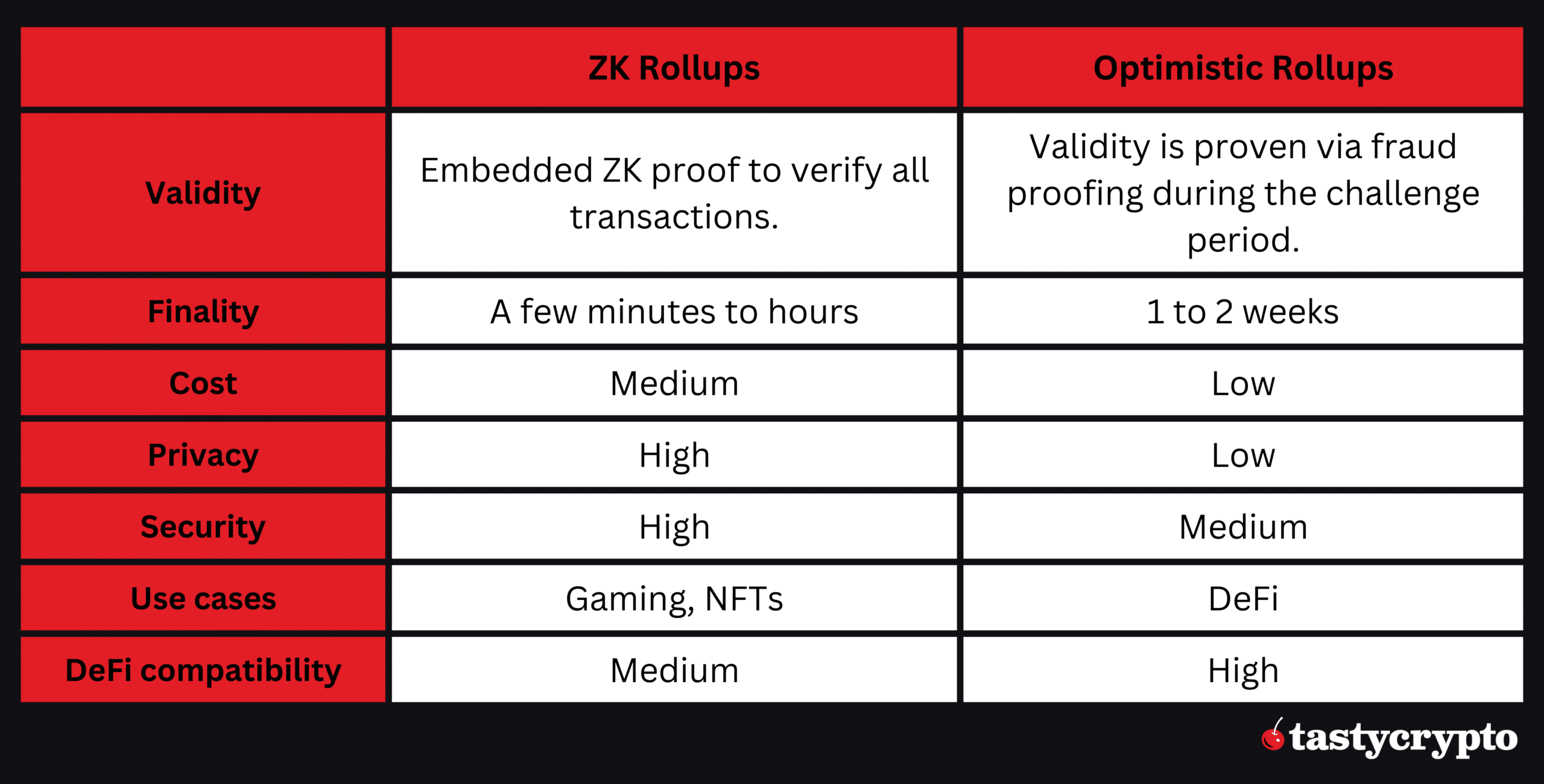

Let’s now compare ZK rollups and Optimistic rollups across several key aspects.

| Aspect | Description |

|---|---|

| Validity proof | Optimistic rollups use fraud proofs challenged within seven days. ZK rollups use zero-knowledge proofs requiring more computation. |

| Finality | Optimistic rollups reach finality in about 7 days; ZK-rollups in a few minutes. |

| Cost | Lower transaction costs for Optimistic rollups. ZK rollups require costly hardware for proof verification. |

| Privacy | ZK rollups offer high privacy using ZK-proof technology. Optimistic rollups reveal more on-chain details. |

| Security | ZK rollups resist censorship and are immune to fraud. Optimistic rollups are less secure and vulnerable to censorship. |

| Use cases | ZK rollups are suitable for gaming and NFTs; Optimistic rollups are best for DeFi apps. |

| DeFi use | Optimistic rollups excel in DeFi applications due to compatibility with Ethereum tools; ZK rollups are not EVM-compatible. |

Examples of ZK Rollups & Optimistic Rollups

The most popular Optimistic rollups are:

- Arbitrum has a market share of over 40% among layer 2s in DeFi and a total value locked (TVL) of over $15 billion as of the end of April 2024.

- OP Mainnet, formerly Optimism, provides the underlying technology for many other layer 2s, such as Base, Blast, and Mantle.

The most popular ZK rollups are:

- zkSync Era is a fast-growing ZK rollup solution launched in 2023.

- The Starknet ecosystem includes decentralized applications (dapps) across multiple use cases, including DeFi, gaming, NFTs, digital ID, and payments.

Polygon, a popular Ethereum scaling solution that acts as a sidechain, offers Polygon zkEVM, which enables developers to build EVM-compatible smart contracts.

ZK Rollups vs Optimistic Rollups: Performance and Adoption

While ZK rollups offer a higher degree of privacy and security, Optimistic rollups experience a much higher adoption rate as they focus on user experience.

Data from L2Beat shows that the top 5 largest layer 2s by TVL are Optimistic rollups, which have a market share of about 83%.

Source: L2Beat

Optimistic rollups have more daily active addresses, with Base showing the most activity since March 2024

👇.

Source: growthepie

FAQs

What Are Blockchain Rollups?

Rollups are layer 2 scaling solutions that improve the efficiency of blockchain networks like Ethereum by settling transactions off-chain, merging them into batches, and then submitting them to layer 1.

How do ZK rollups and Optimistic rollups work?

ZK rollups use cryptographic proofs to verify all transactions without revealing their details, ensuring privacy and faster finality. Optimistic rollups assume transactions are valid unless challenged, relying on a fraud-proof mechanism that works during a dispute period.

Which of the two rollup types performs better?

ZK rollups are complex but offer better privacy, higher security, and faster finality. Optimistic rollups are more user-friendly due to faster-perceived transaction finality and lower costs.

What are some examples of Optimistic rollups and ZK rollups?

The most popular Optimistic rollups are Arbitrum, OP Mainnet, and Base. Some examples of ZK rollups are zkSync Era, Starknet, and Polygon zkEVM.

🍒 tasty reads

The Core Blockchain and DeFi Ecosystem: What You Need to Know

7 Best DePIN Crypto Projects

What Is Symbiotic and How Does It Work in 2024?

Ethereum vs Ethereum ETFs – 5 Major Differences

Anatol Antonovici

6+ years of experience writing for crypto brands and blockchain firms, including Coindesk, Cointelegraph, Bitcoinist, CryptoPotato, Algorand, and OTCTrade.com