Cryptocurrencies function on decentralized ledgers without the need for an intermediary; DeFi encompasses all financial platforms that operate on top of pre-existing blockchains.

Written by: Mike Martin | Updated August 28, 2023

Reviewed by: Ryan Grace

Fact checked by: Laurence Willows

Without crypto, there would be no DeFi. In this guide, we’ll show you the relationship between crypto and decentralized finance, or ‘DeFi’.

🍒 tasty takeaways

Cryptocurrencies are digital securities that operate on decentralized ledgers while DeFi represents all financial platforms that run on top of existing blockchains.

Cryptocurrency coins are primarily used as a medium of exchange and are created to reward miners or validators for adding transactions into a blockchain network.

Cryptocurrency tokens are created by decentralized applications or dApps and can be used as a means of payment, voting, and incentives to participate in a protocol.

DeFi represents all decentralized finance-related protocols (think applications) that operate under a blockchain network. DeFi platforms include staking dApps, borrowing and lending dApps, decentralized exchange dApps, and derivative dApps.

Crypto vs DeFi Summary

| Category | Description |

|---|---|

| Cryptocurrencies | Function on decentralized ledgers without intermediaries. |

| DeFi | Financial platforms operating on pre-existing blockchains. |

| Crypto Coins | Used as a medium of exchange and created as rewards for miners or validators. |

| Crypto Tokens | Created by dApps and can be used for payment, voting, and protocol incentives. |

| Blockchain | A decentralized digital ledger ensuring security through chained blocks. |

| dApps | Decentralized applications operating on blockchains, primarily Ethereum. |

Cryptocurrency Coins Explained

Crypto (cryptocurrency) is a digital currency primarily used as a medium of exchange.

Cryptocurrency coins are created to reward miners (Bitcoin network) or validators (Ethereum network) for adding transactions into a blockchain network. This is the origin of all crypto coins. From here, these coins get bought and sold on exchanges.

How Cryptocurrency Works

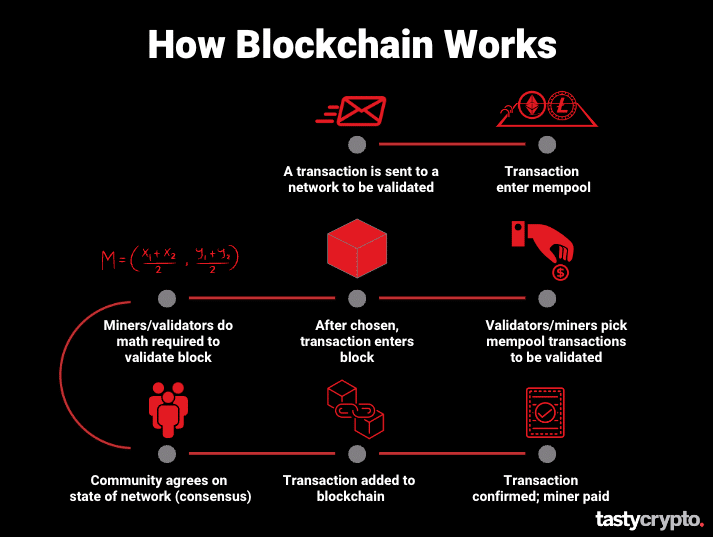

A blockchain is simply a digital ledger. What makes blockchain technology unique is that it is decentralized (no third parties or intermediaries required), trustless, transparent, open-source, and set in stone.

You can easily manipulate a traditional ledger, but in order to change a blockchain ledger, you must change all the previous blocks to which that transaction is attached – a virtually impossible task for large networks like Bitcoin and Ethereum.

Cryptocurrency coins have value because of the aforementioned security.

📚 Read: Crypto for Beginners: What It Is and How It Works

5 Most Popular Cryptocurrency Coins

Here are a few of the more popular crypto coins to invest in during 2023 (excluding stablecoins).

Bitcoin (BTC)

Ethereum (ETH)

BNB (BNB)

Cardano (ADA)

Cryptocurrency Tokens Explained

Cryptocurrency tokens are a little bit different than cryptocurrency coins. These cryptocurrencies are created by decentralized applications or dApps.

dApps operate on top of a blockchain network in order to leverage that great security we spoke of before.

Why would a dApp create a brand new blockchain if they could simply attach their platform to a preexisting blockchain? It’s all about safety in numbers – the more participants a blockchain has, the greater the security it has.

Though there can be only one cryptocurrency coin per blockchain, a single blockchain can support an infinite number of protocols. An example of a protocol would be Uniswap, which is a decentralized crypto exchange (DEX) in DeFi (more on this later!)

The vast majority of dApps operate under the Ethereum ecosystem.

Unlike Bitcoin, Ethereum can store transactions and code within its blocks. This code (smart contracts) can be used to create completely decentralized versions of the Web2 apps we use today (think Facebook and Twitter).

Cryptocurrency tokens can be thought of as tickets to a ride in a carnival. We will call this carnival “Ethereum”. Once you enter Ethereum, there are many different types of rides. In order to ride one of these attractions, you need to buy a special ticket.

Just like these tickets, you usually need to own the native cryptocurrency of a dApp in order to interact with it. Tokens can be used as a means of payment, as a way to vote (governance tokens), and as incentives to get people to participate in a protocol.

Tokens and coins – these represent all cryptocurrencies in existence.

📚 Read: What Are Stablecoin Tokens?

What is DeFi and How Does it Work?

DeFi is short for decentralized finance. DeFi simply represents all decentralized applications that fall under the category of finance. DeFi protocols replace traditional intermediaries, such as banks, with smart contracts that execute transactions when conditions are met. Compared to traditional financial institutions, DeFi is more efficient, has higher security, and requires no trust.

Top DeFi Activities

Popular DeFi activities include:

Borrowing and Lending dApps

Decentralzied exchange dApps

Derivative dApps

Top DeFi Protocols

DeFi platforms with a high total value locked (TVL) include:

If you have a self-custody crypto wallet, you can connect it to any dApp you wish and participate in whatever activity they offer.

You do not necessarily need to own the native token of a protocol in order to interact with it. For example, you can lend crypto on Aave (DeFi lending dApp) without actually owning the AAVE token. Other lending platforms include JustLend and Compound.

However, you can invest in the native token of a DeFi network if you believe in its future.

📚 Read: What is DeFi And How Does It Work?

Crypto vs DeFi

Cryptocurrencies can be either coins or tokens. Cryptocurrencies can be bought and sold through both centralized exchanges (CEXs) and decentralized exchanges (DEXs).

🍒 Read: CEX vs DEX – Crypto Exchange Fees Comparison

DeFi (decentralized finance) represents all finance-related protocols that operate under a blockchain network. DeFi applications can be thought of as Web2 apps rebuilt in a decentralized environment (Web3).

FAQs

Cryptocurrencies are fungible, meaning they can be freely interchanged, like US dollars. Non-fungible tokens (NFTs) are unique and can’t be replicated. Digital art, sports clips, and even real estate can be NFTs.

DeFi may very well be the future of crypto. However, future regulations will dictate whether or not this is the case.

The downsides of DeFi include hacking risks, volatility risks, no regulation, liquidity risks, and complexity.

Bitcoin is not under DeFi as this blockchain can not store smart contracts, which are the building blocks of DeFi. The Ethereum blockchain is the go-to network for DeFi.

Yes, in order to participate in DeFi, you will need to own a quantity of cryptocurrency (digital assets) to both interact with a dApp and pay gas fees.

DeFi (Decentralized Finance) has been around since 2017 but did not enter the mainstream until 2020.

Bitcoin is a decentralized blockchain network while DeFi represents protocols that run on top of a blockchain network, mostly Ethereum.

Mike Martin

Mike Martin formerly served as the Head of Content for tastycrypto. Before joining tastycrypto, Michael worked in the active trader divisions of thinkorswim, TD Ameritrade, and Charles Schwab. He also served as a writer and editor for projectfinance.

Michael has been active in the crypto community since 2017. He holds certifications from Duke University in decentralized finance (DeFi) and blockchain technology.

🍒 tasty reads

The Core Blockchain and DeFi Ecosystem: What You Need to Know

7 Best DePIN Crypto Projects

What Is Symbiotic and How Does It Work in 2024?

Ethereum vs Ethereum ETFs – 5 Major Differences