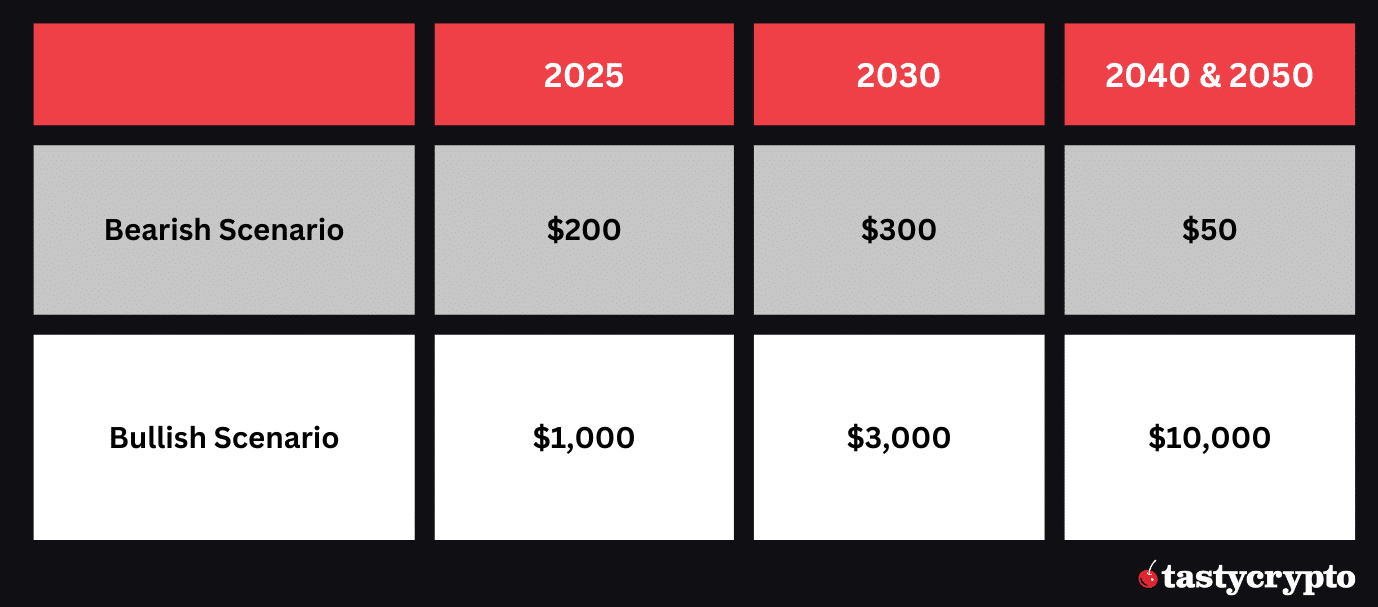

tastycrypto’s Bittensor (TAO) price predictions are as follows: by 2025, it may range from $200 in a bearish scenario to $1,000 in a bullish scenario. By 2030, the price could be between $300 and $3,000. For 2040 and 2050, predictions range from $50 in a bearish scenario to $10,000 in a bullish scenario.

Written by: Anatol Antonovici | Updated May 21, 2024

Reviewed by: Mike Martin

Fact checked by: Ryan Grace

Bittensor has been in a bearish market since its record peak of over $750, but it has a realistic chance of reaching a new high in the near term and exploding in price as we look ahead to 2050.

Table of Contents

🍒 tasty takeaways

The TAO coin has a deflationary model and is part of the fast-growing AI market.

Bittensor may reach a new high in 2025 but will likely trade below $1,000 next year.

TAO may hit $2,000 by 2030.

Summary

| Year | Bearish Scenario | Bullish Scenario |

|---|---|---|

| 2025 | $200 | $1,000 |

| 2030 | $300 | $3,000 |

| 2040 & 2050 | $50 | $10,000 |

Bittensor is a decentralized ecosystem for creating, training, and trading artificial intelligence (AI) and machine learning (ML) models. The AI models leverage a blockchain-powered peer-to-peer (P2P) network, which enables them to form a global neural network.

The ecosystem comprises multiple decentralized subnets, each focusing on a topic, such as text prompting, image creation, data analysis, etc. Subnets use incentive-based mechanisms to drive miner competition.

For example, the text prompting subnet rewards miners for generating high-quality text responses to prompts issued by subnet validators.

What Makes Bittensor Unique?

Currently, AI systems operate in a vacuum. There are dozens of different AI platforms out there, but they are stand-alone silos and learn nothing from each other. This is, of course, the definition of centralization.

Bittensor operates numerous AI systems, each under its own ‘subnet,’ yet all are interconnected and operate under a unified umbrella.

Think of Bittensor as a tree: each branch is a subnet connected to the same trunk. Every branch independently grows its leaves, but all rely on the same root system, integrating their growth into one cohesive tree.

TAO TOKEN

The ecosystem is fueled by TAO, a cryptocurrency built on Bittensor’s proprietary chain, Nakamoto. It relies on the Yuma Consensus algorithm, which combines Proof of Work and Proof of Stake elements. TAO is used to incentivize subnet participation, pay transaction fees, and stake.

Read our dedicated post on Bittensor to learn more about this project.

What Drives TAO’s Price?

As with any other asset, the TAO price is determined by the ratio between its supply and demand. Increasing demand drives the price, which shares an inverse relationship with supply.

The current price of TAO is $342 as of mid-May 2024, down 43% compared to the previous month. Bittensor’s market capitalization is $2.3 billion. The AI coin hit an all-time high of over $757 on March 7.

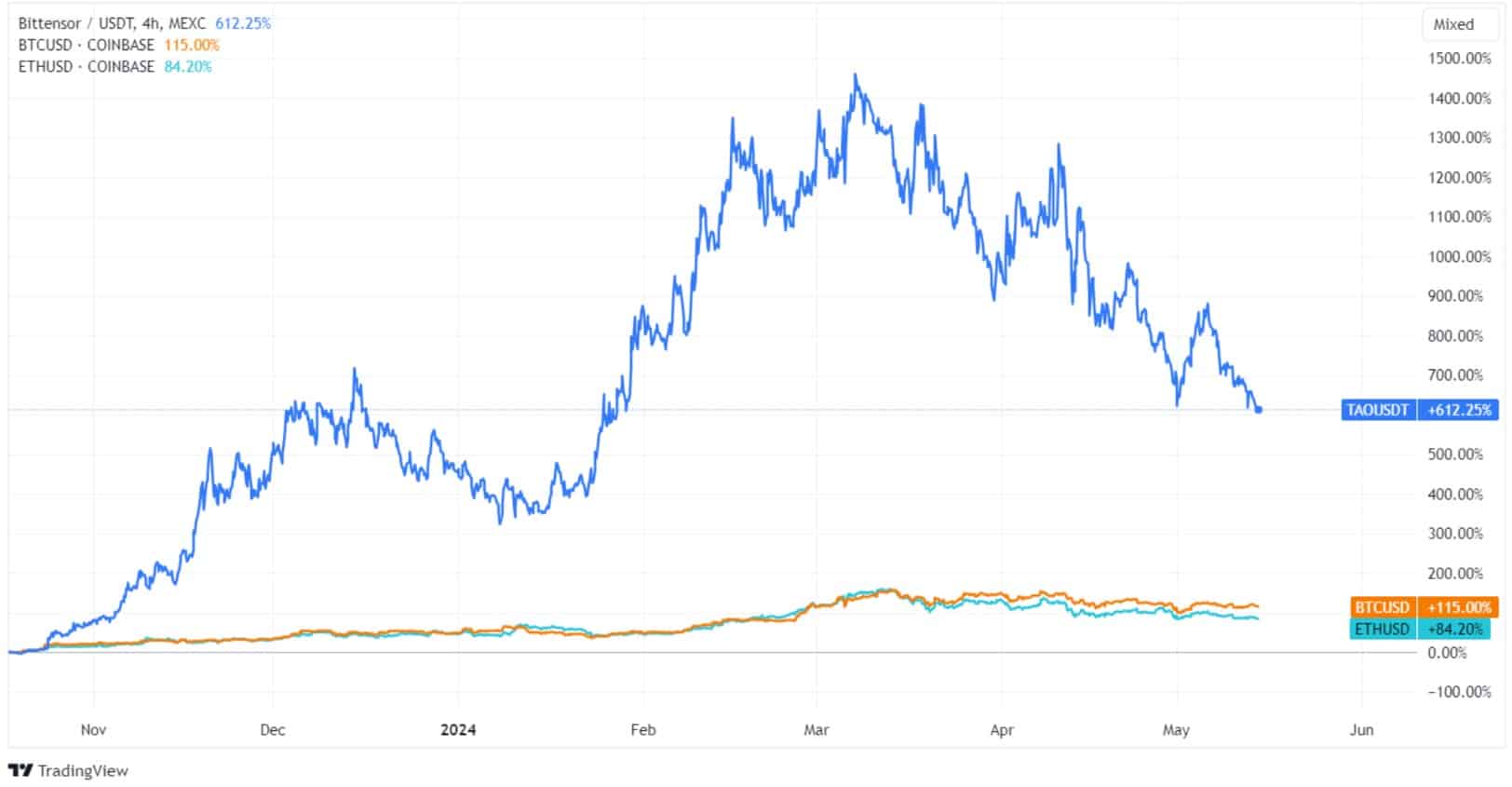

Despite losing over 50% of its value since the recent all-time high, Bittensor’s price has performed better than Bitcoin (BTC) or Ethereum (ETH) since the AI crypto trend took off at the end of 2023.

Source: TradingView

Now, let’s examine TAO’s supply and demand dynamics more closely to provide a more accurate Bittensor price prediction.

🍒 AI Crypto Coin Prediction: FET, TAO, RNDR, NEAR INJ & More

TAO Supply

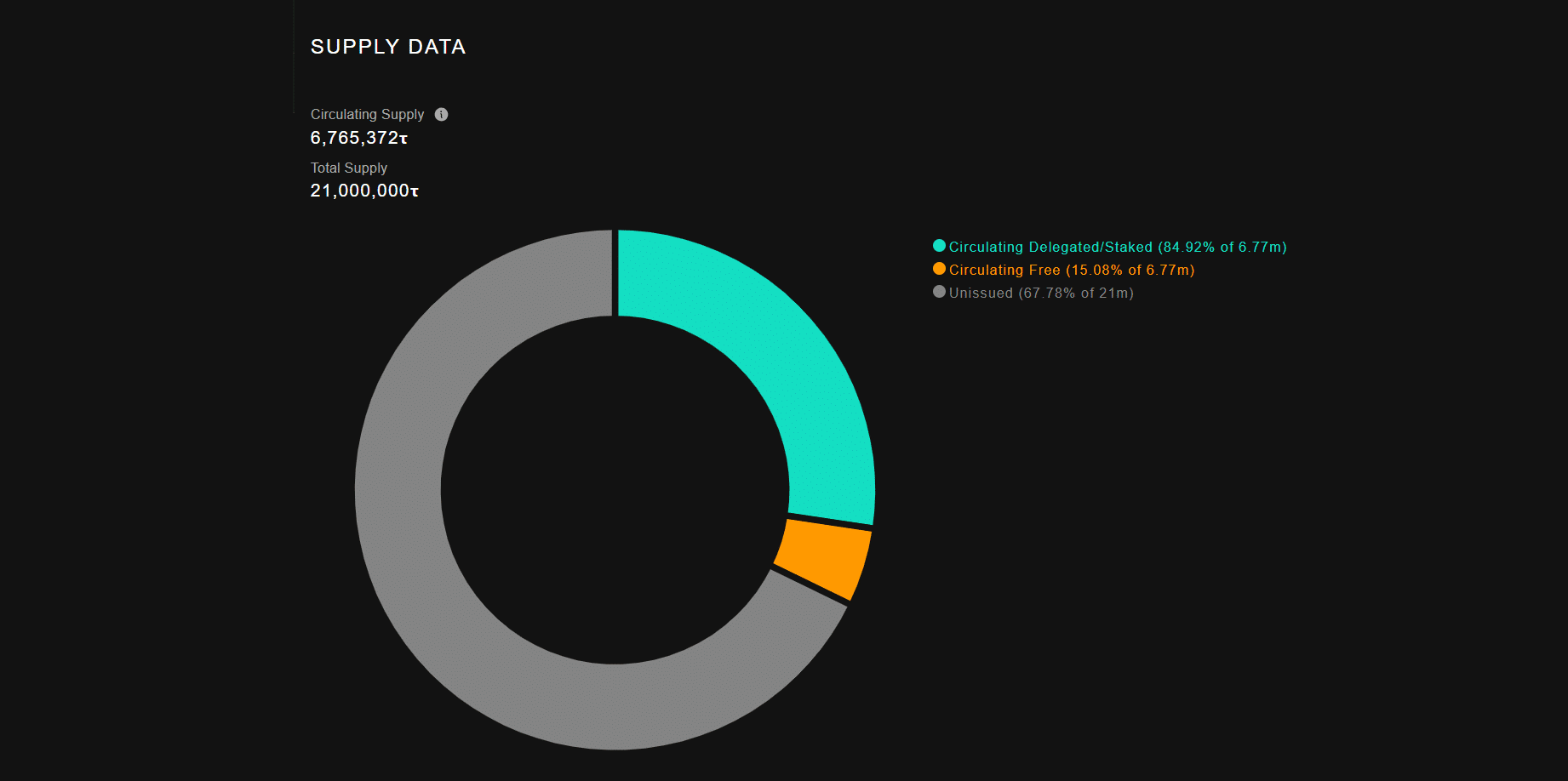

TAO uses a deflationary model inspired by Bitcoin, with a limited supply of 21 million coins. For investors, this is the best-case scenario, as they can focus on demand fluctuations when assessing the fair price. This means that the project’s success is reflected in the coin value straightforwardly.

Unlike Bitcoin, whose circulating supply is about 94%, TAO’s circulating supply is only 6.7 million coins, or 32%, as of this writing. This leaves room for dilution until the majority of coins are unlocked. Currently, 85% of the circulating supply is locked for staking.

Source: TAO Stats

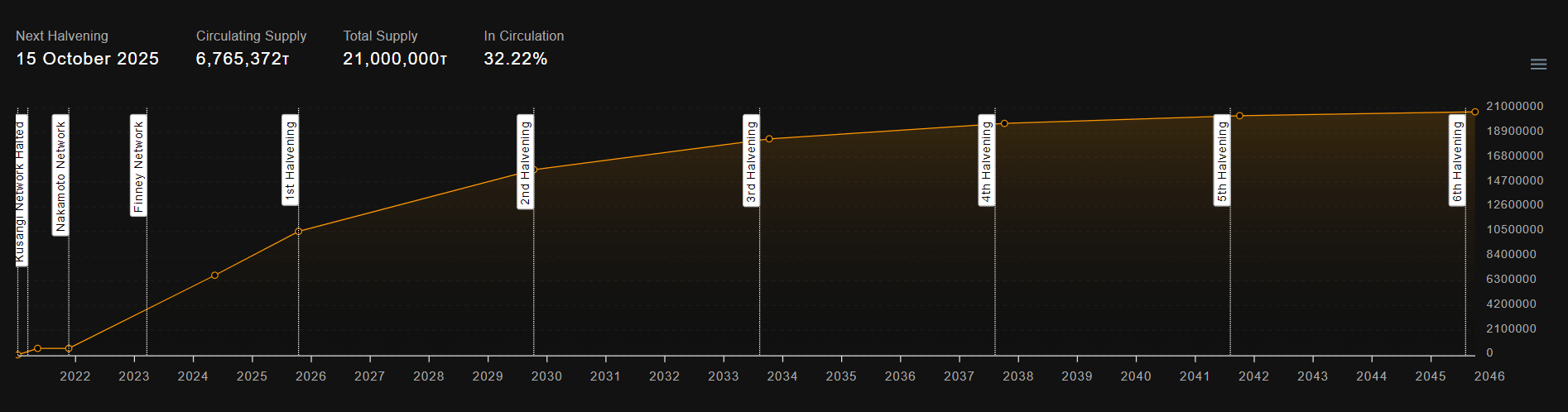

Another great aspect of TAO’s tokenomics model is that its supply issuance is pre-programmed, which makes it easier for investors to factor in the supply increase. Interestingly, Bittensor also implements halving, gradually reducing the reward size.

Source: TAO Stats

TAO Demand

Bittensor was launched in 2023 and is still in an early stage of development. The network is in an experimental phase, which makes long-term price forecasts impossible due to a lack of historical data.

Nevertheless, the demand side holds the key to TAO’s potential.

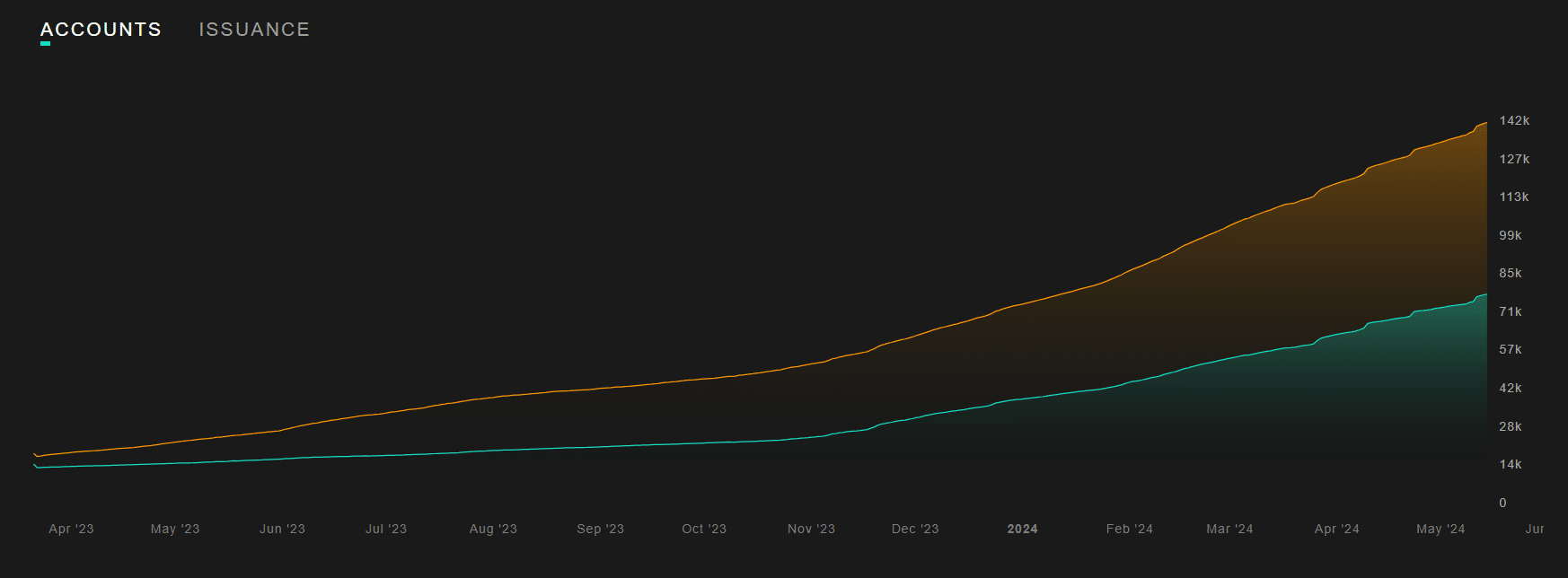

So far, Bittensor’s adoption rate is promising. As of this writing, the number of accounts has doubled since the start of the year to over 141,000.

Source: X – TAO Stats

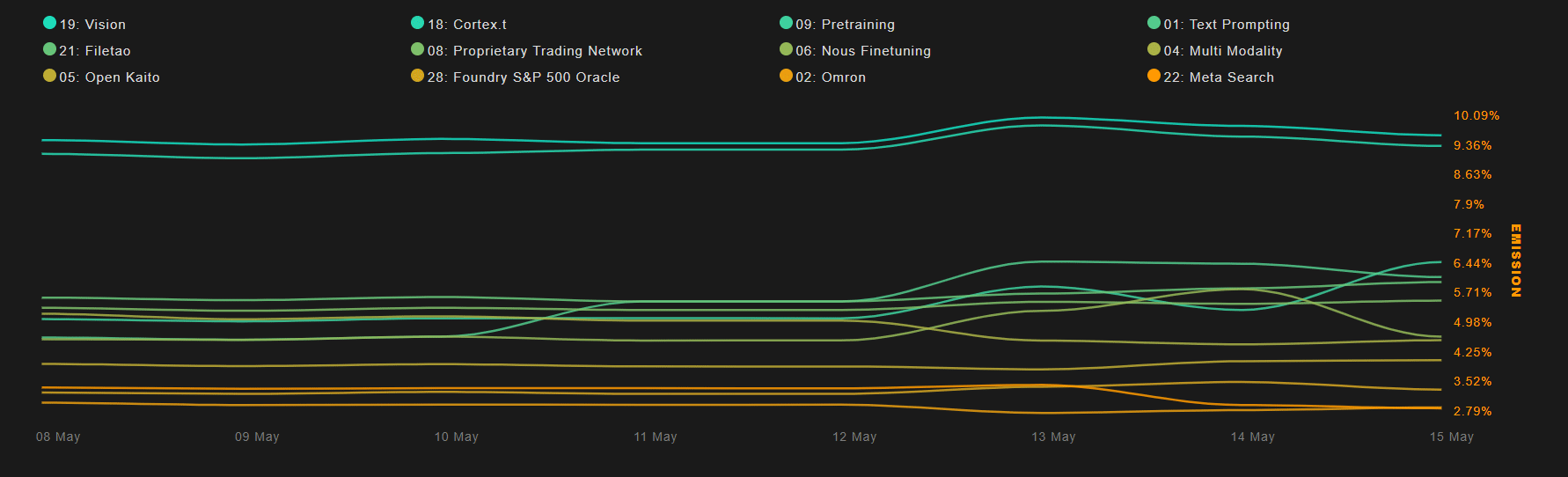

The largest subnets by TAO emissions are ‘vision’ and cortex.t.’

Source: X – TAO Stats

In the future, AI models developed on Bittensor can be used for various use cases, such as:

- Finance – AI models for portfolio management, risk analysis, and market forecasting.

- Healthcare – AI models for drug discovery, diagnosis, and personalized treatment plans.

- Automation – operations optimization, process automation, and data analysis.

If Bittensor’s AI models can secure even a small portion of the AI market dominated by companies like OpenAI, the coin’s price may skyrocket in the years ahead.

TAO: Bullish Factors

- TAO has a deflationary model and a pre-programmed issuance rate.

- Generative AI is expected to become a $1.3 trillion market by 2032.

- Bittensor is backed by reputable VCs. For example, Polychain holds about $200 million in TAO.

- TAO has utility within the Bittensor’s subnet ecosystem, which is used for payments, rewards, and staking.

TAO Bearish Factors

- Bittensor is in an experimental phase, and it’s still not clear whether it will be able to survive AI competition.

- TAO’s value may be distorted by disproportionate reactions and hype surrounding AI.

TAO Price Prediction: 2025

Let’s start with more realistic short-term predictions and implement basic technical analysis tools.

The TAO price is correcting today, and basic technical indicators like moving averages suggest that the downtrend may continue in the coming months. The price may find support near $210. If it fails to bounce back at that level, TAO may continue to trade below $500 next year.

Suppose TAO manages to recover before hitting the support level. In that case, the coin will have the chance to consolidate above the resistance level at $390 and potentially reach a new ATH next year.

Source: TradingView

Interestingly, oscillators like the Relative Strength Index (RSI) form a divergence with the TAO price, which is a bearish signal.

Source: TradingView

TAO Price Prediction: 2030

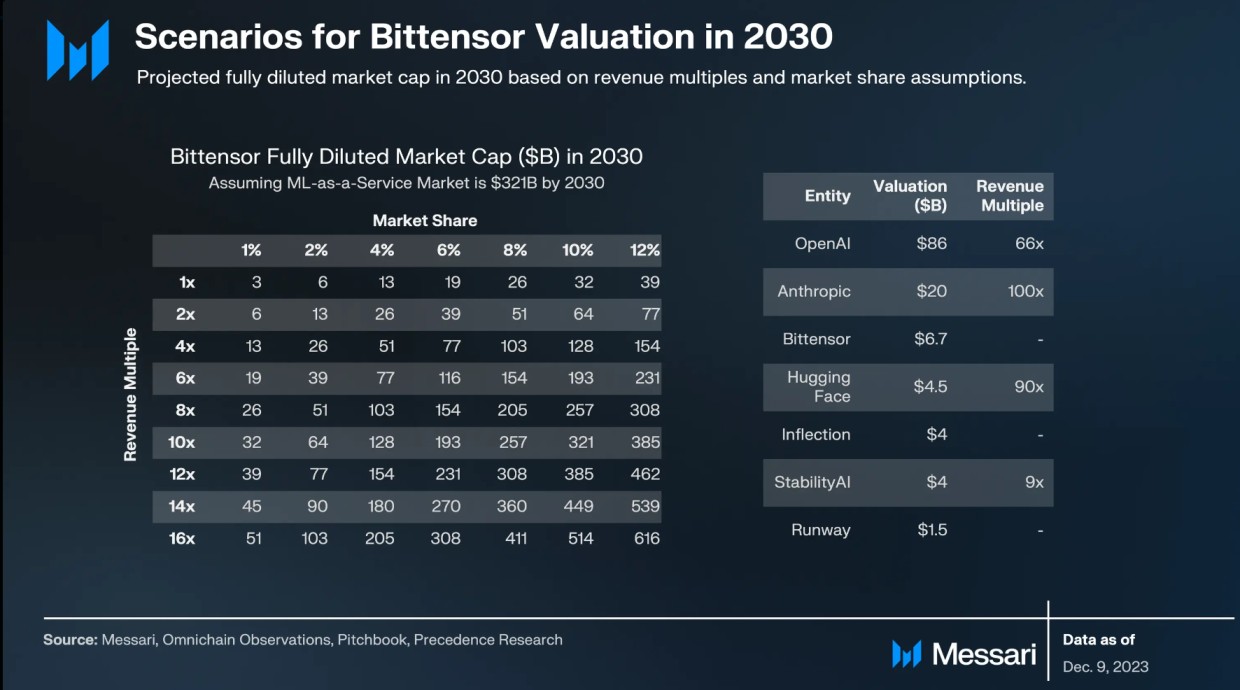

Suppose Bittensor’s subnets offer real utility to AI models and power AI applications. In that case, the network can capture a visible market share of the ML as a service sector, expected to reach $320 billion by 2030.

If the decentralized network learns to adapt to fast-growing AI market needs by scaling and building an ecosystem with many revenue-generating Web3 dapps, TAO can reach a fully diluted valuation ranging between $25 billion and $50 billion, provided that it secures about 2% of the ML as a service market. The neutral scenario suggests a price of over $2,000, which considers the increase in supply.

Here is the full spectrum of possible market cap figures by 2030 based on Bittensor’s potential market share and revenue increase.

Source: Messari

TAO Price Prediction 2040 & 2050

Providing an accurate Bittensor price forecast over such a large time frame is impossible, as the AI industry itself is very young.

In the best-case scenario, Bittensor competes with centralized AI solutions and secures a visible market share. Suppose TAO follows the growth rate of the crypto market and maintains its current 0.1% share. In that case, it can reach a valuation of over $50 billion, provided that the crypto space becomes a $50+ trillion market by then.

FAQs

Can you give an accurate long-term Bittensor price prediction?

Long-term price predictions for Bittensor are challenging due to its early stage of development and market volatility.

What will be the average price of TAO in 2025?

The price of TAO in 2025 may range between $210 and $1,000, depending on market trends and recovery potential.

How much will TAO cost in 2030?

In 2030, TAO could reach over $1,500 if Bittensor captures a significant share of the AI market.

How high will Bittensor go by 2040 & 2050?

Predicting TAO’s price in 2040 and 2050 is highly speculative. Still, it could potentially exceed $50 billion in valuation if it keeps its 0.1% market share and the cryptocurrency market continues to grow significantly.

🍒 tasty reads

The Core Blockchain and DeFi Ecosystem: What You Need to Know

7 Best DePIN Crypto Projects

What Is Symbiotic and How Does It Work in 2024?

Ethereum vs Ethereum ETFs – 5 Major Differences

Anatol Antonovici

6+ years of experience writing for crypto brands and blockchain firms, including Coindesk, Cointelegraph, Bitcoinist, CryptoPotato, Algorand, and OTCTrade.com