Future Solana (SOL) upgrades could elevate the cryptocurrency to $260 in the near term. It has the potential to rise to $3,000 by 2030 and reach over $6,000 by 2050.

Written by: Anatol Antonovici | Updated June 6, 2024

Reviewed by: Mike Martin

Fact checked by: Ryan Grace

Solana (SOL) might hit a new all-time high of $260 either this year or next, contingent on the success of the Firedancer upgrade, marking a pivotal ‘all-or-nothing’ moment for the cryptocurrency.

Table of Contents

🍒 tasty takeaways

Solana (SOL) has been the fastest-growing chain since the end of 2022, overcoming Bitcoin (BTC) and Ethereum (ETH).

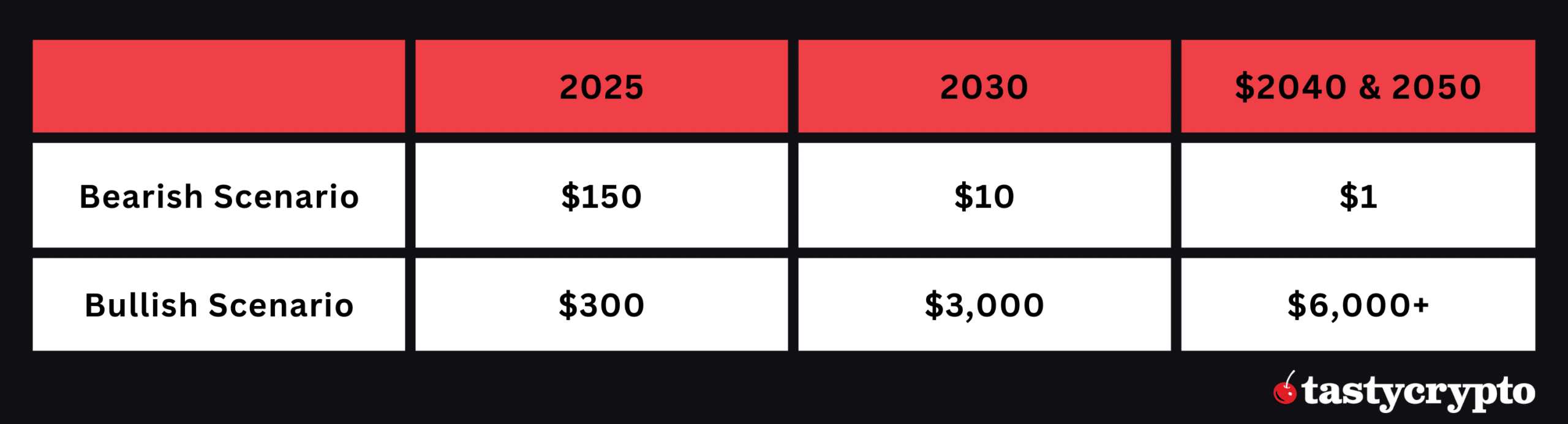

2025 Forecast: Solana (SOL) could surpass its current all-time high, reaching $260 in the near term due to the Firedancer upgrade, with a potential to stabilize above $300.

2030 Forecast: With continuous technological advancements and ecosystem diversification, SOL might explode to $3,000, facing a crucial ‘all-or-nothing’ scenario.

2040 & 2050 Forecast: If Solana expands to account for 10% of a $30 trillion cryptocurrency market, the SOL price can trade over $6,000.

VanEck analysts estimated that SOL can explode to $3,000 by 2030.

Summary

| Year | Price Prediction | Key Factors |

|---|---|---|

| 2025 | $260 - $300+ | Firedancer upgrade success |

| 2030 | Up to $3,000 | Technological advancements and market adaptation |

| 2040 & 2050 | Over $6,000 | Competing with Ethereum, capturing 10% of crypto market |

What Determines Solana’s Price?

The price of any asset, crypto and Solana included, is shaped by supply and demand dynamics.

Supply and price share an inverse relationship, while demand directly correlates with price. For investors, an optimal situation arises when supply alterations are programmatic, enabling the market to factor in these dynamics ahead of their occurrence.

Let’s start by exploring Solana’s basic tokenomics.

Solana Supply

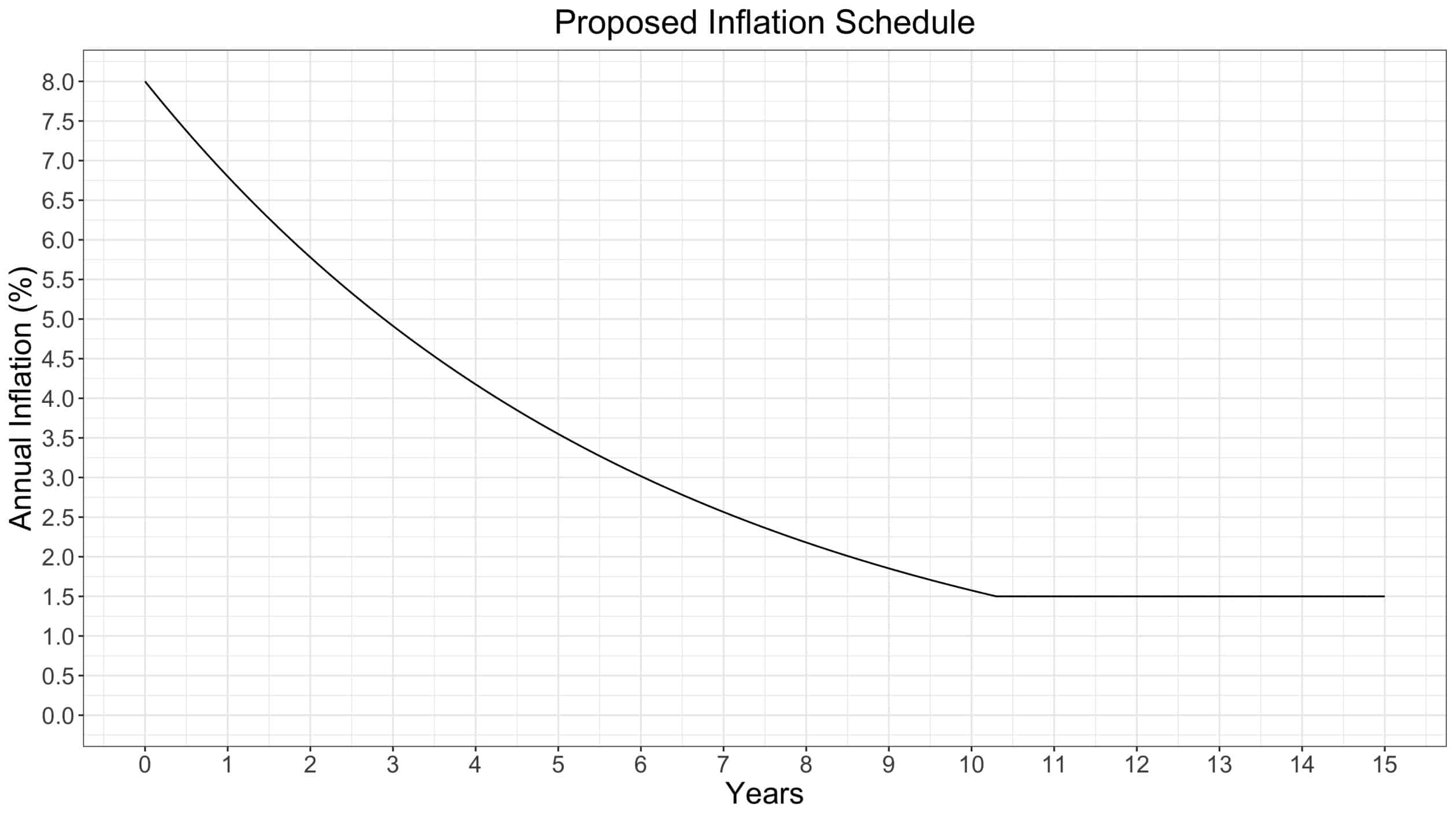

The Solana blockchain operates on a Proof of Stake (PoS) consensus mechanism, rewarding validators with newly minted coins. It follows a predefined inflation schedule to release new SOL annually, distributed among validators to support ecosystem growth.

Without a cap on maximum supply, Solana’s inflation rate is designed to decrease over time, aiming for long-term sustainability.

Source: Solana.com

The Solana inflation rate is 5.2%, much higher than Bitcoin’s 0.84% and Ethereum’s 0.4%. However, surging demand has offset inflation, supporting the SOL price.

The protocol can burn SOL under certain circumstances, but this measure has never been implemented.

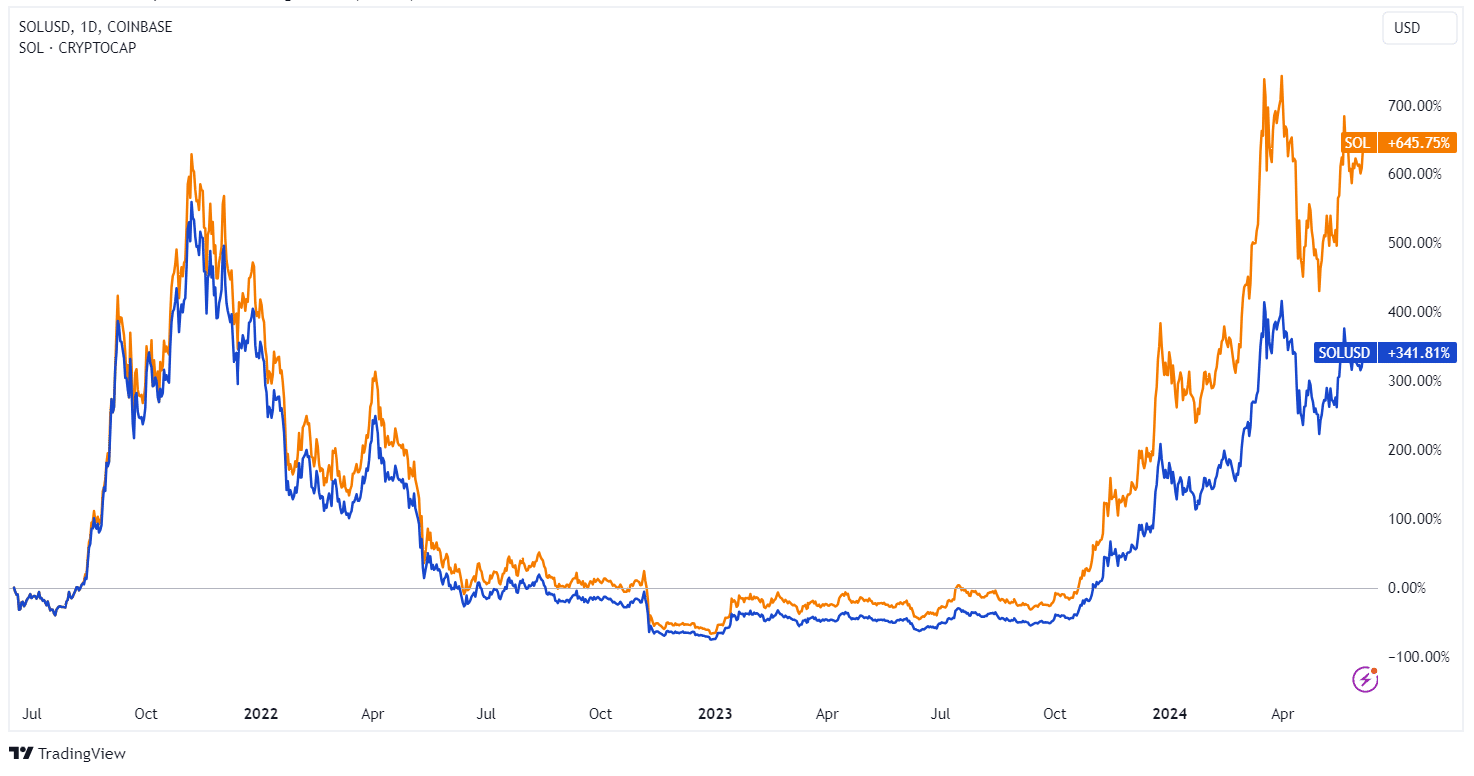

Due to the gradual disinflation, Solana’s market cap has reached a new record high at the end of March 2024, even though the price hasn’t been able to break the all-time high (ATH) set at the end of 2021.

Source: TradingView

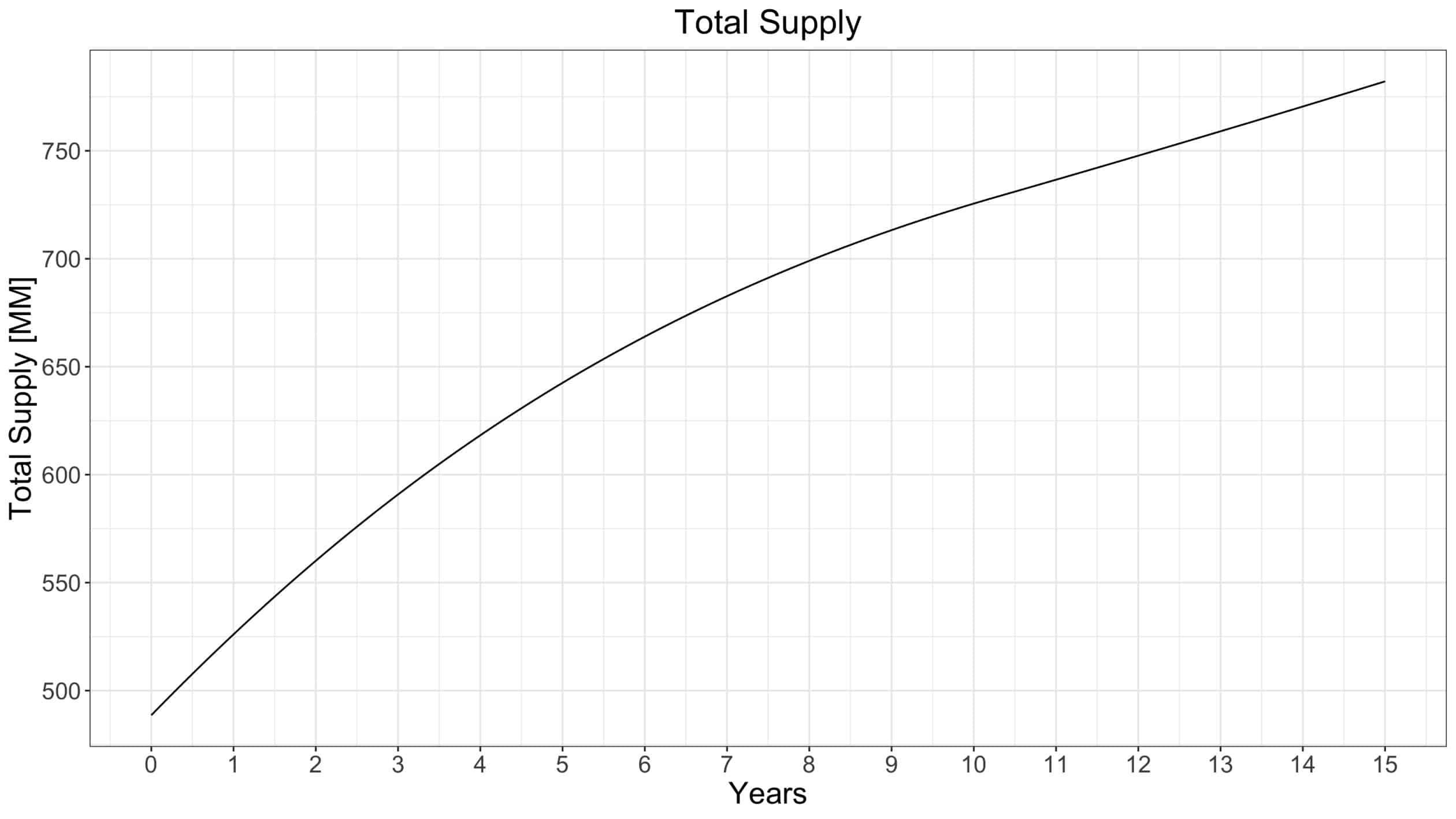

As per Coinmarketcap, Solana’s total supply currently is 577.5 million SOL, while the circulating supply is over 459.9 million. Here is how much the supply is expected to grow in the future (note that Solana launched in 2020):

Source: Solana.com

Solana Demand

Despite a high inflation rate, SOL has been the best-performing coin among major chains since 2023, mainly due to surging demand. SOL has overtaken blockchain projects that previously showed big promises, including Cardano (ADA) and Ripple (XRP).

While Bitcoin is used to preserve wealth, SOL acts as the utility coin for the Solana chain, which competes with Ethereum to attract crypto projects, such as decentralized finance (DeFi) applications, non-fungible tokens (NFTs), and Web3 services.

Ethereum dominates the DeFi sector, but Solana is catching up on the NFT and Web3 fronts. Enterprises looking to integrate blockchain solutions also prefer Solana due to its high speed and low fees.

Read our head-to-head comparison between Solana and Ethereum to understand how the two differ.

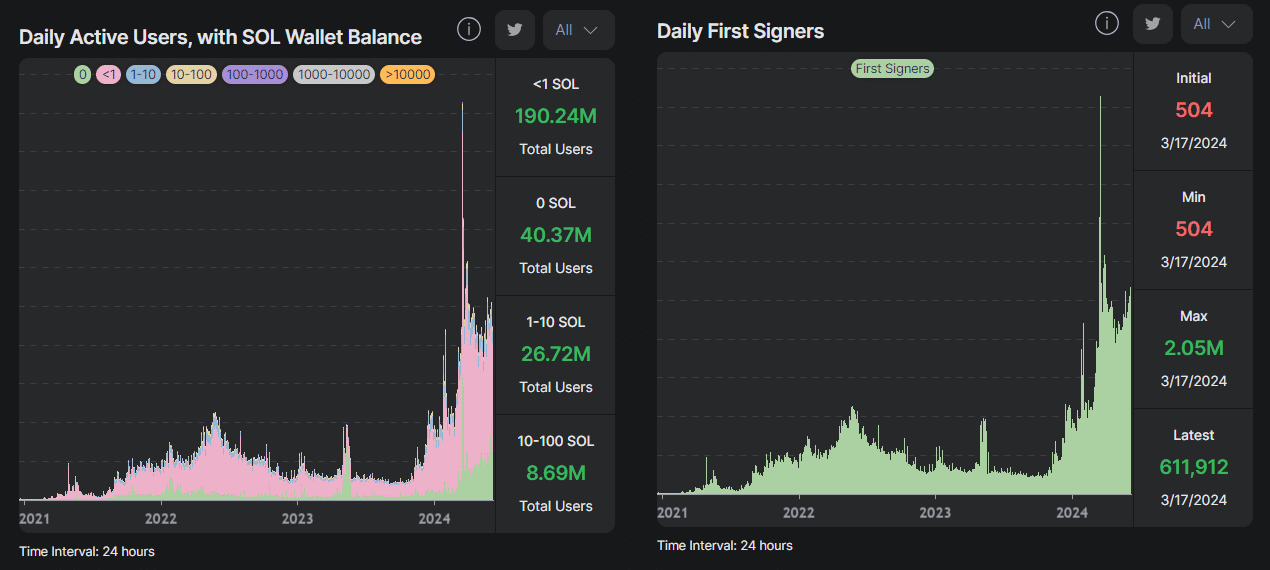

The rapid increase in active users and new signers reflects the surging demand for Solana.

Source: Hello Moon

The high adoption rate may continue in the coming years, as Solana is preferred by many enterprises (such as payments and banking solutions), gaming projects, NFTs, and meme coins like dogwifhat (WIF).

Solana’s Unique Position

Solana has been the best-performing layer 1 due to its impressive performance capabilities.

For example, it can handle 65,000 transactions per second (tps) with almost instant finality at infinitesimal fees. By comparison, Ethereum can process up to 30 tps at an average fee of $5 per transaction.

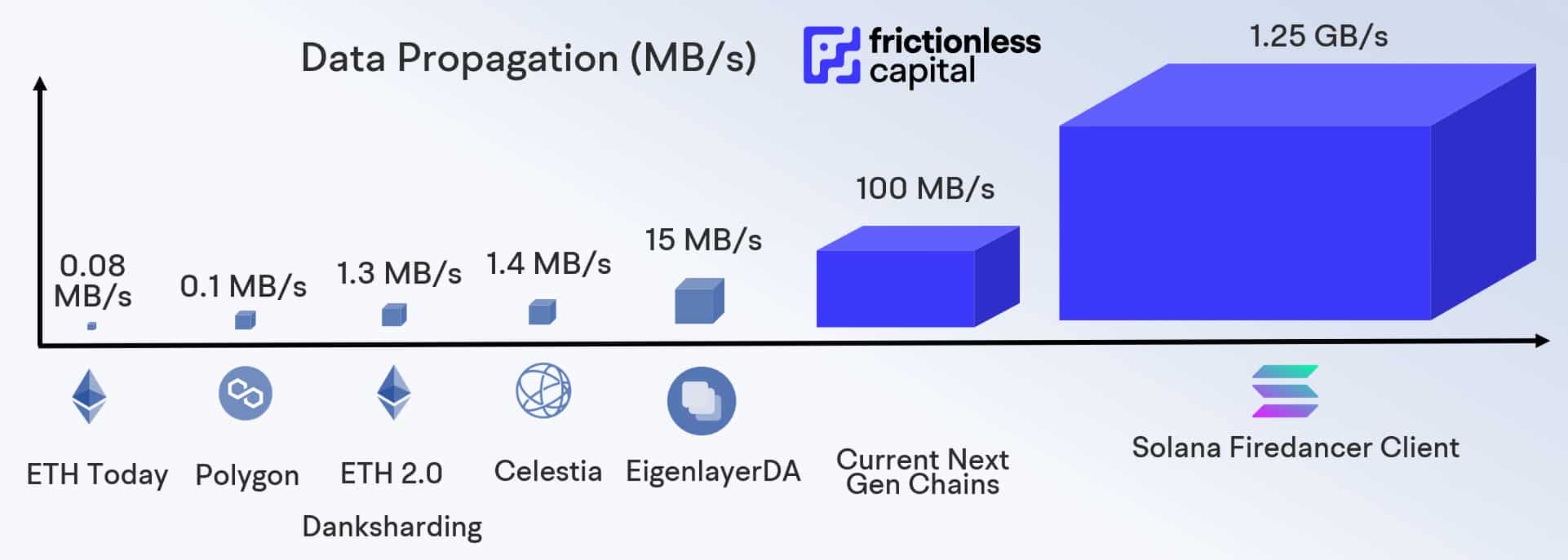

Solana already has the highest throughput at 100 MB/s.

The summer of 2024 is a major milestone for Solana, as it will be hosted by the Firedancer validator—a third-party node meant to increase Solana’s efficiency. The upgrade is expected to increase the throughput to over 1 GB/s.

Source: frictionless capital

Solana Risks and Challenges

With such impressive performance, Solana could have already dethroned Ethereum. Still, a big obstacle exists: Solana loses on the decentralization side, an important aspect of a resilient crypto infrastructure.

Solana’s monolithic construction leads to centralization, i.e., few large nodes control the system. The network depends on its validators’ hardware performance, suggesting that higher throughput is achieved by more expensive and potent hardware.

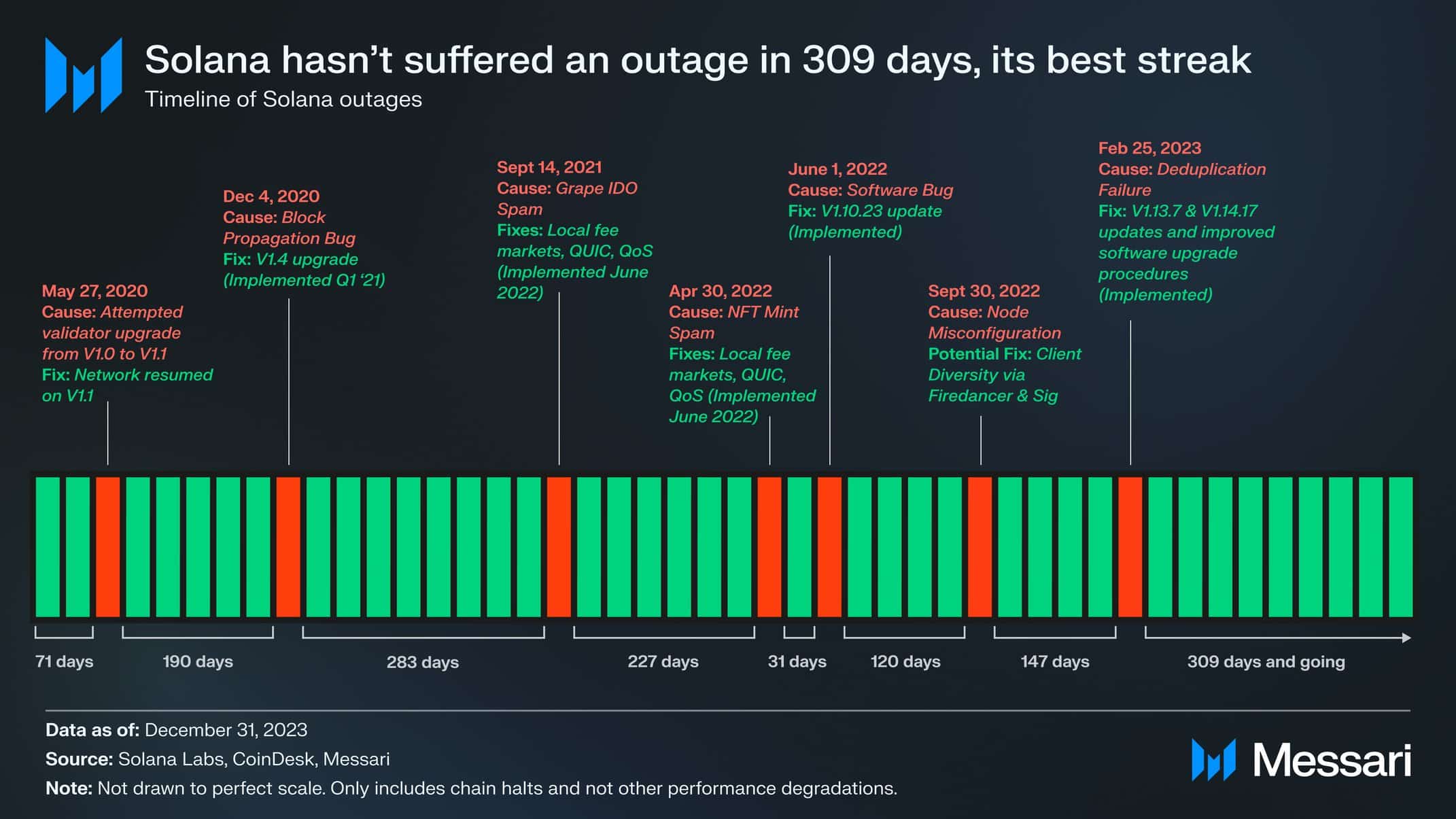

The surging demand has occasionally caused outages and problems. The latest one occurred in February 2024, after a record streak of no outages for over 300 days.

Source: Solan Floor – Twitter

The Firedancer upgrade is expected to end these outages.

Complex Design

Another challenge for Solana is the complexity of its design, including its virtual machine (SVM), which attracts fewer developers to its ecosystem.

Developers must use Rust to build on Solana, and the programming language is estimated to have only 2.8 million active developers compared to 17.4 million JavaScript developers who can build on Ethereum.

Solana Price Prediction for 2025

Solana has been the best-performing chain since 2023, but it still represents only 20% of Ethereum’s market cap, so there is more room for growth.

The current price of SOL is $172.9, which may break the previous record at $260 this or next year. Much depends on how the market reacts to the Firedancer upgrade, which could make DeFi perform similarly to centralized platforms.

The upgrade is a major catalyst that could help Solana to consolidate above $300 next year.

Solana Price Prediction for 2030

Solana has existed for only four years; by 2030, we may see another layer 1 showing even better performance. Solana must constantly improve its technology and build a diverse ecosystem to succeed in the long term.

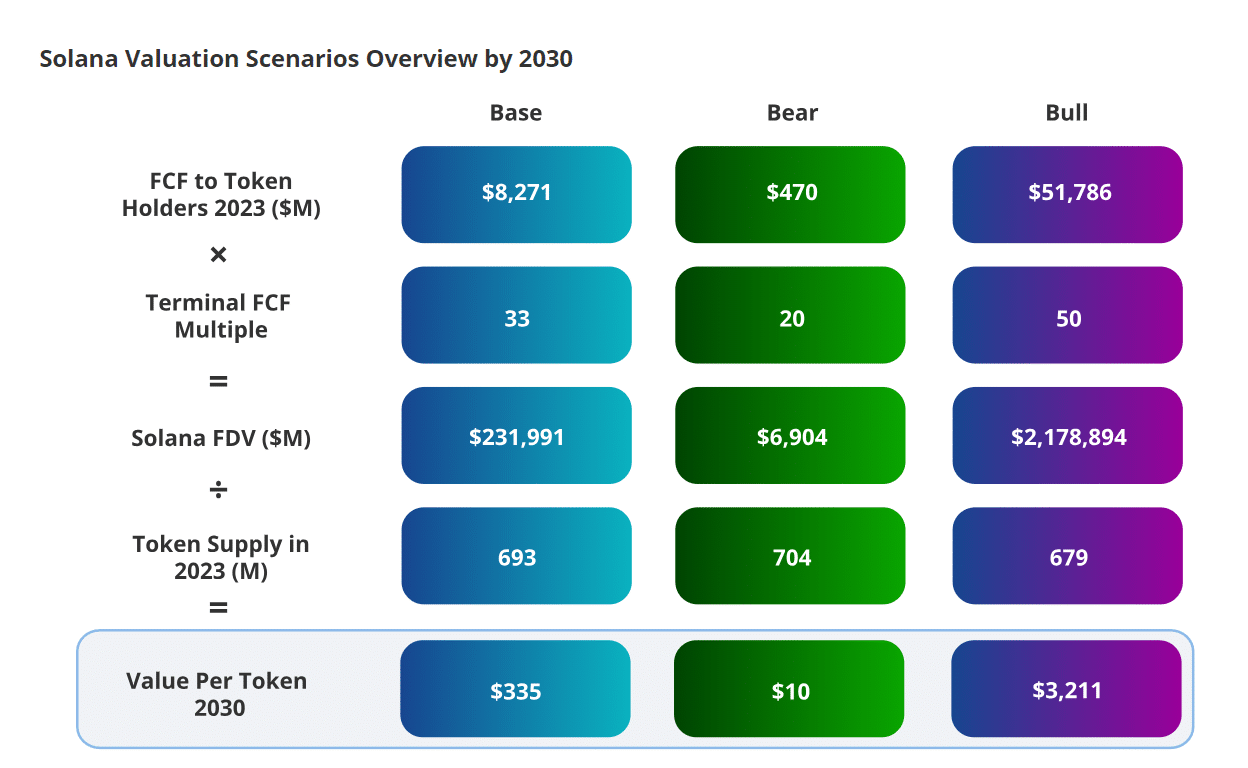

According to VanEck analysts, SOL can break above $3,000 by 2030. However, if it fails to adapt to market conditions and generate significant revenue, it can lose market share and trade at only $10. Therefore, it’s the ‘everything or nothing’ scenario for Solana.

Source: Vaneck

Solana Forecast: 2040 & 2050

Predicting the price of SOL over such a large time frame is impossible, as many things can change by then.

In the best-case scenario, if Solana overtakes or at least competes with Ethereum and accounts for 10% of the total crypto space, it can become a $3+ trillion market, considering the Ark Invest CEO Cathie Wood’s estimation that the crypto market capitalization will explode to $25 trillion by 2030. This will suggest a price of $6,000 for SOL.

FAQs

Can you give accurate Solana price forecasts?

SOL is a digital currency with extreme volatility, and predicting its price is difficult. Unlike Bitcoin, Solana and many altcoins don’t have a valuation and forecasting model, and long-term outlooks depend on exogenous factors.

How can I predict the price of Solana?

Technical analysis may work only for short-term predictions. The best approach is to monitor market sentiment regularly by browsing crypto news and monitoring price movements and major upgrades.

What will the price of SOL be in 2025?

Much depends on the Firedancer upgrade scheduled for 2024, but SOL can potentially update a record high at $260 and consolidate above $300 by 2025.

How much will Solana cost in 2030?

It’s an all-or-nothing game, with the bullish case suggesting a price of $3,000. However, if it fails to secure revenue, the bearish scenario points to a decline to $10.

How far will Solana reach in 2040 & 2050?

No price analysis method can provide an outlook for such large time frames. If Solana expands to account for 10% of a $30 trillion cryptocurrency market, the SOL price can trade over $6,000.

🍒 tasty reads

Aerodrome (AERO) For Beginners: The Ultimate 2024 Guide

Here’s How DEXTools (DEXT) Works in 2024

What Is Jasmy Coin and How Does It Work in 2024?

5 Best Crypto Arbitrage Scanners of 2024

Anatol Antonovici

6+ years of experience writing for crypto brands and blockchain firms, including Coindesk, Cointelegraph, Bitcoinist, CryptoPotato, Algorand, and OTCTrade.com